This Settlement Agreement (“Agreement”) is entered into between the United States acting through the United States Department of Justice (“Department of Justice”), along with the States of California, Delaware, Illinois, Maryland, and New York, and the Commonwealth of Kentucky, acting through their respective Attorneys General (collectively, “the States”), and Bank of America Corporation, Bank of America, N.A., and Banc of America Mortgage Securities, as well as their current and former subsidiaries and affiliates (collectively, “Bank of America”). The United States, the States, and Bank of America are collectively referred to herein as “the Parties.” RECITALS A. The United States Attorney’s Offices for the District of New Jersey, the Western District of North Carolina, the Northern District of Georgia, and the Central District of California conducted investigations of the packaging, origination, marketing, sale, structuring, arrangement, and issuance of residential mortgage-backed securities (“RMBS”) and collateralized debt obligations (“CDOs”) by Bank of America; Countrywide Financial Corporation, Countrywide Home Loans, Inc., and Countrywide Securities Corporation, as well as their current and former subsidiaries and affiliates (collectively, “Countrywide”); Merrill Lynch, Pierce, Fenner & Smith, Inc., Merrill Lynch Mortgage Lending, Inc., and Merrill Lynch Mortgage Investors, Inc., as well as their current and former subsidiaries and affiliates (collectively, “Merrill Lynch”); and First Franklin Financial Corporation, as well as its current and former subsidiaries and affiliates (“First Franklin”). Based on these investigations, the United States believes that there are potential legal claims by the United States against Bank of America, Countrywide, Merrill Lynch and First Franklin for violations of federal law. Furthermore, based on its investigation, the United States Attorney’s Office for the Western District of North Carolina filed a civil action,

United States v. Bank of America Corp., et al., No. 13-cv-446-MOC (W.D.N.C.), against Bank of America seeking a civil monetary penalty pursuant to the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (“FIRREA”), 12 U.S.C. § 1833a. B. The States, based on their independent investigations of the same conduct, believe that there are potential legal claims by California, Delaware, Illinois, Maryland, Kentucky, and New York against Bank of America, Countrywide, Merrill Lynch, and First Franklin for state law violations in connection with the packaging, origination, marketing, sale, structuring, arrangement, and issuance of RMBS and CDOs. C. The United States Attorney’s Office for the Southern District of New York has conducted investigations of Countrywide and Bank of America’s origination and sale of defective residential mortgage loans to the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”) (collectively, “government-sponsored enterprises” or “GSEs”), including investigating allegations asserted by: i. Relator, who filed a complaint on or about June 21, 2011, under the qui tam provisions of the False Claims Act, 31 U.S.C. §§ 3729, et seq., against Bank of America, three of its subsidiaries (Countrywide Financial Corporation, Landsafe Appraisal Services, Inc. and U.S. Trust), and another defendant, asserting inter alia, that, from 2004 to 2011, Bank of America and its subsidiaries originated residential mortgage loans using inflated appraisals and fraudulently sold those loans to the GSEs with misrepresentations as to the loans’ quality; ii. Relator, who filed a complaint on or about June 4, 2014, under the qui tam provisions of the False Claims Act against Countrywide and Bank of America, alleging, inter alia, that, from 2009 to 2014, these entities fraudulently sold 2

defective residential mortgage loans originated by Countrywide’s Consumer Markets Division and later Bank of America to the GSEs with misrepresentations as to the loans’ quality; and iii. Relator, who filed a complaint on or about January 14, 2014, under the qui tam provisions of the False Claims Act against Defendants Countrywide, Bank of America, Merrill Lynch, and First Franklin, alleging, inter alia, that, from 2008 to 2013, those entities breached representations and warranties by failing to report thousands of defective loans to the GSEs. Based on these investigations, the United States believes that there are potential legal claims by the United States against Bank of America for violations of federal law. D. The United States Attorney’s Office for the Western District of North Carolina has also conducted an investigation of Bank of America and Countrywide submitting false claims to the Federal Housing Administration (“FHA”), an agency within the United States Department of Housing and Urban Development, including investigating allegations asserted by Mortgage Now, Inc., which filed a complaint on or about June 7, 2012, under the qui tam provisions of the False Claims Act against Bank of America alleging inter alia, that Bank of America and Countrywide submitted claims to FHA for reimbursement of amounts Bank of America and Countrywide already had recovered from third-party correspondent lenders. As part of this investigation, the United States Attorney’s Office for the Western District of North Carolina examined whether Bank of America settled repurchase claims with Freddie Mac and Fannie Mae concerning residential mortgages for which Bank of America or Countrywide received compensation from third party correspondent lenders that Bank of America did not disclose to Freddie Mac and Fannie Mae. 3

E. The United States Attorney’s Office for the Eastern District of New York has conducted an investigation of Bank of America’s origination of loans insured by the FHA from May 1, 2009 through March 31, 2012. F. The United States Department of Housing and Urban Development has conducted an investigation of Bank of America’s performance as Master Subservicer under Contract Number C-OPC-23289 with the Government National Mortgage Association (“Ginnie Mae”). G. Bank of America, Countrywide, Merrill Lynch, and/or certain affiliates thereof have resolved claims filed by the Federal Deposit Insurance Corporation (“FDIC”) as Receiver for 1st Pacific Bank of California, the FDIC as Receiver for Affinity Bank, the FDIC as Receiver for CF Bancorp, the FDIC as Receiver for Citizens National Bank, the FDIC as Receiver for Colonial Bank, the FDIC as Receiver for Eurobank, the FDIC as Receiver for First Banking Center, the FDIC as Receiver for First Dupage Bank, the FDIC as Receiver for Franklin Bank, S.S.B., the FDIC as Receiver for Guaranty Bank, the FDIC as Receiver for Horizon Bank, the FDIC as Receiver for Imperial Capital Bank, the FDIC as Receiver for Independent Bankers Bank, the FDIC as Receiver for Los Padres Bank, the FDIC as Receiver for Palos Bank & Trust Co., the FDIC as Receiver for Prosperan Bank, the FDIC as Receiver for SCB Bank, the FDIC as Receiver for Security Savings Bank, the FDIC as Receiver for ShoreBank, the FDIC as Receiver for Statewide Bank, the FDIC as Receiver for Strategic Capital Bank, the FDIC as Receiver for United Western Bank, F.S.B., the FDIC as Receiver for USA Bank, the FDIC as Receiver for Venture Bank, and the FDIC as Receiver for Warren Bank (the FDIC in its capacity as receiver for each of the Failed Banks referred to as “FDIC-R”), and claims filed by Bank of America, N.A. The terms of the resolution of those claims are memorialized in a separate agreement, attached hereto as Exhibit A. 4

H. Bank of America and Merrill Lynch have reached an agreement in principle to resolve claims by the United States Securities and Exchange Commission (“SEC”). The terms of the resolution of those claims are reflected in separate documents, attached hereto as Exhibit B. I. Bank of America acknowledges the facts set out in the Statement of Facts set forth in Annex 1, attached hereto and hereby incorporated. J. In consideration of the mutual promises and obligations of this Agreement, the Parties agree and covenant as follows: TERMS AND CONDITIONS 1. Payment. Bank of America shall pay a total amount of $9,650,000,000.00 to resolve pending and potential legal claims in connection with the Covered Conduct, as defined below (the “Settlement Amount”), of which $5,020,000,000.00 shall be paid as a civil monetary penalty. As set out in Paragraph 1(A)(i), $5,000,000,000.00 of the Settlement Amount will be paid as a penalty recovered pursuant to FIRREA, 12 U.S.C. § 1833a. The remainder will be paid as set out in Paragraphs 1(A)(ii) to 1(A)(ix) and Paragraphs 1(B) to 1(G) and the Total Tax Relief Payment Amount as set out in Paragraph 2. As set out in the settlement documents attached hereto as Exhibit B, $20,000,000.00 of the Settlement Amount will be paid as a penalty in connection with the claims referenced in Recital Paragraph H. A. Within sixty (60) days of receiving written payment processing instructions from the Department of Justice, Office of the Associate Attorney General, Bank of America shall pay $8,216,840,000.00 of the Settlement Amount by electronic funds transfer to the Department of Justice. 5

i. $5,000,000,000.00, and no other amount, is a civil monetary penalty recovered pursuant to FIRREA, 12 U.S.C. § 1833a. It will be deposited in the General Fund of the United States Treasury. ii. $350,000,000.00, and no other amount, is in settlement of the claims of the United States identified in Recital Paragraph C and United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America. iii. $350,000,000.00, and no other amount, is in settlement of the claims of the United States identified in Recital Paragraph C and United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America. iv. $50,000,000.00, and no other amount, is in settlement of the claims of the United States identified in Recital Paragraph D and United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America. v. $300,000,000.00, and no other amount, is in settlement of the claims of the United States identified in Recital Paragraph C and United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America. vi. $800,000,000.00, and no other amount, is in settlement of Bank of America’s submission of claims through December 31, 2013 for FHA loans originated by Bank of America or Countrywide on or after May 1, 2009. Any amount that FHA receives will be deposited into the Federal Housing Administration’s Capital Reserve Account. vii. $200,000,000.00, and no other amount, is in settlement of potential contractual claims related to Bank of America’s and Countrywide’s performance as Master Subservicer under Contract Number C-OPC-23289 6

with Ginnie Mae. Any amount that Ginnie Mae receives will be deposited into the Government National Mortgage Association’s Financing Account. viii.$1,031,000,000.00, is paid by Bank of America in settlement of the claims of the FDIC identified in Recital Paragraph G, pursuant to the settlement agreement attached hereto as Exhibit A, the terms of which are not altered or affected by this Agreement. ix. $135,840,000.00, and no other amount, is paid by Bank of America in settlement of the claims of the SEC identified in Recital Paragraph H, pursuant to the settlement documents attached hereto as Exhibit B, the terms of which are not altered or affected by this Agreement. B. $300,000,000.00, and no other amount, will be paid by Bank of America to the State of California pursuant to Paragraph 8, below, and the terms of written payment instructions from the State of California, Office of the Attorney General. Payment shall be made by electronic funds transfer within sixty (60) days of receiving written payment processing instructions from the State of California, Office of the Attorney General. C. $45,000,000.00, and no other amount, will be paid by Bank of America to the State of Delaware pursuant to Paragraph 9, below, and the terms of written payment instructions from the State of Delaware, Office of the Attorney General. Payment shall be made by electronic funds transfer within sixty (60) days of receiving written payment processing instructions from the State of Delaware, Office of the Attorney General. D. $200,000,000.00, and no other amount, will be paid by Bank of America to the State of Illinois pursuant to Paragraph 10, below, and the terms of written payment instructions from the State of Illinois, Office of the Attorney General. Payment shall be made by electronic 7

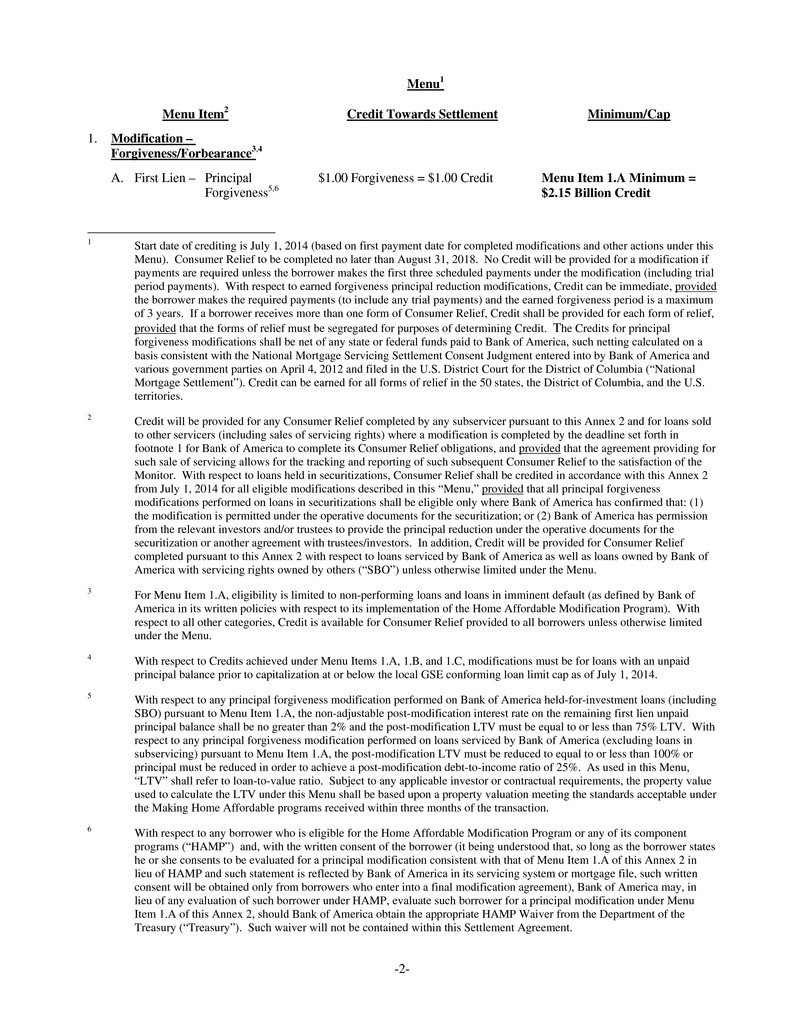

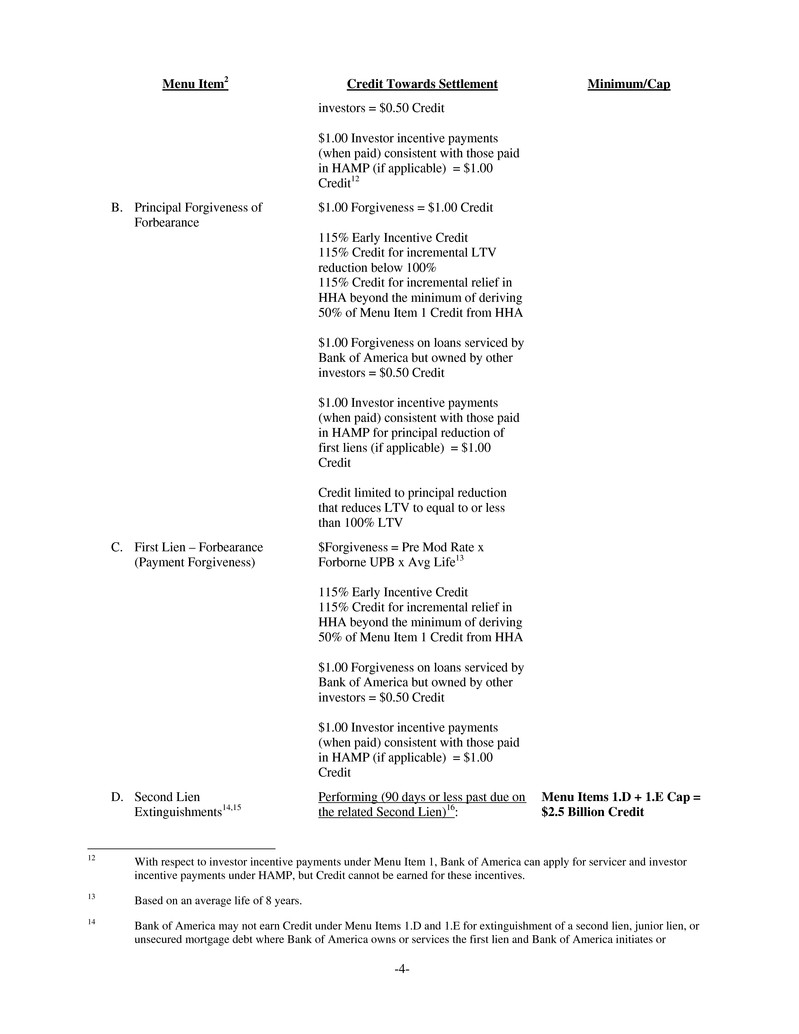

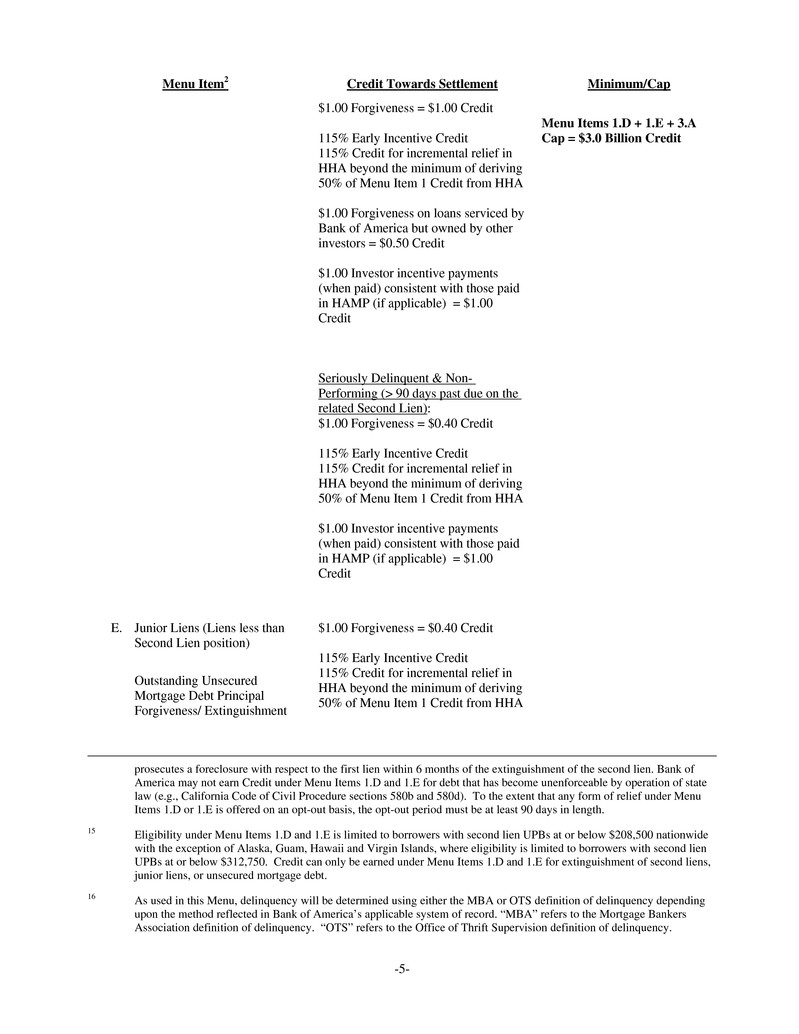

funds transfer within sixty (60) days of receiving written payment processing instructions from the State of Illinois, Office of the Attorney General. E. $23,000,000.00, and no other amount, will be paid by Bank of America to the Commonwealth of Kentucky pursuant to Paragraph 11, below, and the terms of written payment instructions from the Commonwealth of Kentucky, Office of the Attorney General. Payment shall be made by electronic funds transfer within sixty (60) days of receiving written payment processing instructions from the Commonwealth of Kentucky, Office of the Attorney General. F. $75,000,000.00, and no other amount, will be paid by Bank of America to the State of Maryland pursuant to Paragraph 12, below, and the terms of written payment instructions from the State of Maryland, Office of the Attorney General. Payment shall be made by electronic funds transfer within sixty (60) days of receiving written payment processing instructions from the State of Maryland, Office of the Attorney General. G. $300,000,000.00, and no other amount, will be paid by Bank of America to the State of New York pursuant to Paragraph 13, below, and the terms of written payment instructions from the State of New York, Office of the Attorney General. Payment shall be made by electronic funds transfer within sixty (60) days of receiving written payment processing instructions from the State of New York, Office of the Attorney General. 2. Consumer Relief. In addition, Bank of America shall provide $7,000,000,000.00 worth of consumer relief as set forth in Annex 2, attached hereto and hereby incorporated as a term of this Agreement, to remediate harms resulting from the alleged unlawful conduct of Bank of America. The value of consumer relief provided shall be calculated and enforced pursuant to the terms of Annex 2. An independent monitor will determine whether Bank of America has satisfied the obligations contained in Annex 2 (such monitor to be Eric Green), and Bank of 8

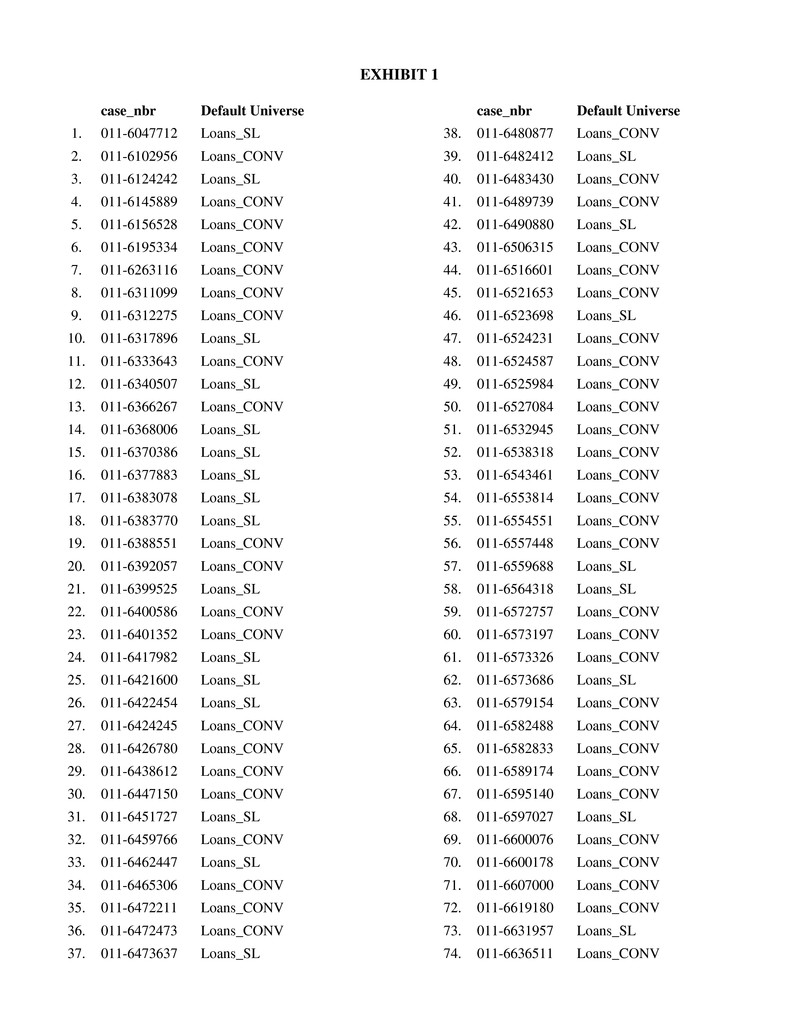

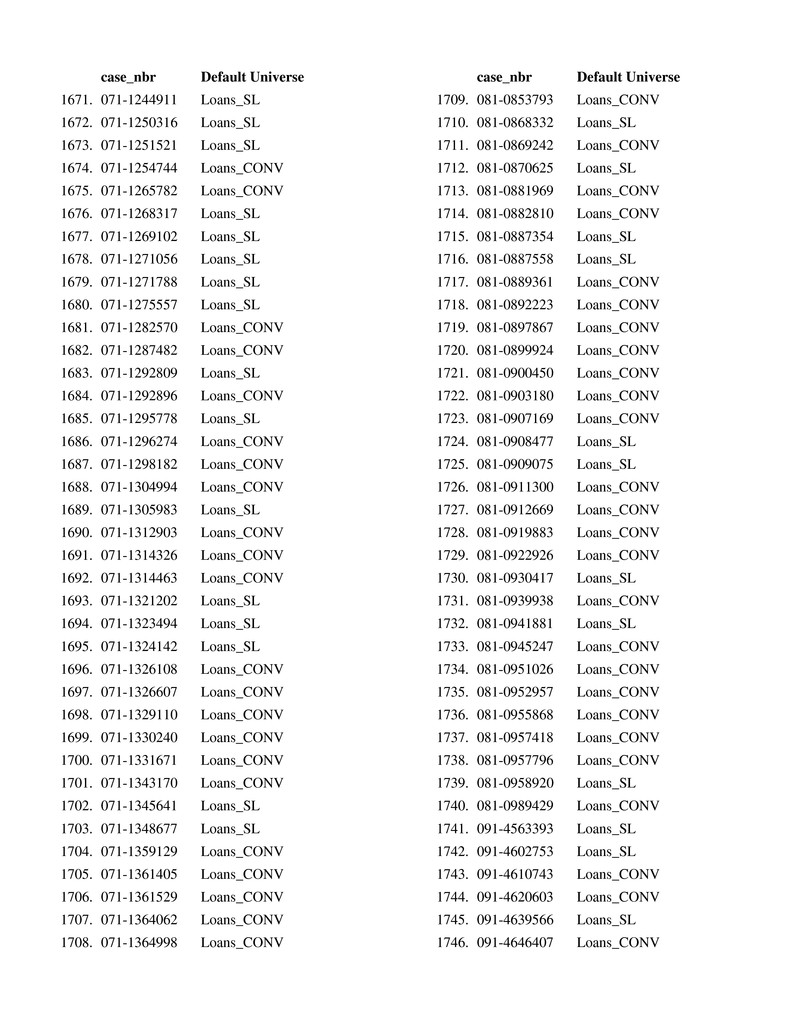

America will provide the Monitor with all documentation the Monitor needs to do so, excluding all privileged information. All costs associated with said Monitor shall be borne solely by Bank of America; notwithstanding the fact that Bank of America bears the costs associated with the Monitor, the Monitor shall be fully independent of Bank of America. Bank of America will refrain from retaining the Monitor to represent Bank of America in any capacity prior to two years after the date upon which Bank of America satisfies the Consumer Relief obligations set forth in Annex 2. Bank of America will also refrain from engaging the Monitor as a mediator in any matter to which Bank of America is a party until Bank of America satisfies the Consumer Relief obligations set forth in Annex 2. Bank of America shall also pay $490,160,000.00 (such amount to be referred to as the “Total Tax Relief Payment Amount”) of the Settlement Amount, in addition to the $7,000,000,000.00 worth of consumer relief, for the payment of consumer tax liability as a result of consumer relief as set forth in Annex 3, attached hereto and incorporated as a term of this Agreement. Such $490,160,000.00 will be deposited into an escrow account (such account to be referred to as the “Tax Relief Payment Account”) that is a Qualified Settlement Fund in accordance with Treasury Regulation 1.468B-1(a), and all aspects of the payments therefrom shall be handled by the Monitor provided for herein and shall not be the responsibility of Bank of America. 3. Covered Conduct. “Covered Conduct” as used herein is defined as: A. The creation, origination, pooling, structuring, arranging, formation, packaging, marketing, underwriting, sale, or issuance prior to January 1, 2009 by the Released Entities (as defined further below) of the RMBS and CDOs identified in Annex 4, attached hereto and hereby incorporated. Covered Conduct includes representations, disclosures, or non-disclosures to RMBS investors about, or made in connection with, the underlying residential mortgage loans, 9

where the representation, disclosure, or non-disclosure involves information about or obtained during the process of originating, acquiring, securitizing, underwriting, or servicing residential mortgage loans in the RMBS identified in Annex 4. Covered Conduct also includes representations, disclosures, or non-disclosures made in connection with the activities set forth above about the CDOs identified in Annex 4, attached hereto and hereby incorporated. Covered Conduct as set forth in this Paragraph 3(A) does not include: (i) representations or non- disclosures made in connection with the trading of RMBS or CDOs, except to the extent that the representations, disclosures, or non-disclosures are in the offering materials for the underlying RMBS or CDOs listed in Annex 4, attached hereto and hereby incorporated; (ii) any conduct where Bank of America, Countrywide, Merrill Lynch, and First Franklin acted only in the role of trustee; or (iii) the servicing of residential mortgage loans, except representations or non- disclosures to investors in the RMBS listed in Annex 4 about servicing, or information obtained in the course of servicing, such loans. B. Covered Conduct includes the administration of RMBS and CDOs identified in Annex 4, attached hereto and hereby incorporated, as of the Execution Date, to the extent such administration relates to any actions or inactions with respect to representation and warranties or the cure, substitution, or repurchase (or failure to do or seek any of the same) of residential mortgage loans. Covered Conduct includes representations, disclosures, or non-disclosures to trustees made in connection with the activities set forth above about the residential mortgage loans included in the RMBS identified in Annex 4, attached hereto and hereby incorporated. C. The underwriting and origination of residential mortgage loans by Bank of America and Countrywide that were sold by Bank of America and Countrywide prior to December 31, 2013 to the GSEs, including the appraisal of properties in connection with the 10

origination of such residential mortgage loans, and representations by Bank of America and Countrywide made prior to December 31, 2013 to the GSEs regarding the underwriting, origination, and quality control with respect to those residential mortgage loans. D. The repurchase, investigation, and reporting obligations of Bank of America, Countrywide, and First Franklin from January 1, 2006 to December 31, 2013, under the representations and warranties contained in the GSE Seller/Servicer Guide with respect to concurrent residential mortgage loans. E. The origination, including the appraisal of properties in connection with the origination of such residential mortgage loans, underwriting, quality control, and endorsement of single-family residential mortgage loans by Bank of America and Countrywide, as set forth more fully in Annex 1, originated on or after May 1, 2009, on which claims were submitted on or before December 31, 2013 to the FHA. F. All claims as alleged in the following actions relating to the Covered Conduct described in Paragraphs 3(A)-3(E), supra: i. United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America ii. United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; iii. United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; and iv. United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America, relating to the submission of claims by Bank of America or Countrywide on or before December 31, 2013 to FHA for residential mortgages that: (i) Bank of America or Countrywide acquired from third 11

party correspondent lenders and (ii) Bank of America or Countrywide received any form of compensation from third party correspondent lenders that was not disclosed to FHA. Covered Conduct relating to this matter also includes Bank of America settling repurchase claims with Freddie Mac and Fannie Mae concerning residential mortgages for which Bank of America or Countrywide received compensation from third party correspondent lenders in connection with actual or anticipated losses on those mortgages that Bank of America did not disclose to Freddie Mac and Fannie Mae. Notwithstanding anything to the contrary, all conduct described in this Paragraph 3(F)(iv) shall be deemed Covered Conduct under this Agreement. G. Bank of America’s and Countrywide’s performance as Master Subservicer under Contract Number C-OPC-23289, with Ginnie Mae for the period March 1, 2009 through August 31, 2014. H. The underwriting and origination of residential mortgage loans, including the appraisal of properties in connection with the origination of such residential mortgage loans, by Bank of America, Countrywide, Merrill Lynch, and First Franklin that were securitized by non- governmental entities in private label securitizations prior to January 1, 2009. 4. Cooperation. Until the date upon which all investigations and any prosecution arising out of the Covered Conduct are concluded by the Department of Justice, whether or not they are concluded within the term of this Agreement, Bank of America shall, subject to applicable laws or regulations: (a) cooperate fully with the Department of Justice (including the Federal Bureau of Investigation) and any other law enforcement agency designated by the Department of Justice 12

regarding matters arising out of the Covered Conduct; (b) assist the Department of Justice in any investigation or prosecution arising out of the Covered Conduct by providing logistical and technical support for any meeting, interview, grand jury proceeding, or any trial or other court proceeding; (c) use its best efforts to secure the attendance and truthful statements or testimony of any officer, director, agent, or employee of any of the entities released in Paragraph 5 at any meeting or interview or before the grand jury or at any trial or other court proceeding regarding matters arising out of the Covered Conduct; and (d) provide the Department of Justice, upon request, all non-privileged information, documents, records, or other tangible evidence regarding matters arising out of the Covered Conduct about which the Department or any designated law enforcement agency inquires. 5. Releases by the United States. Subject to the exceptions in Paragraph 15 (“Excluded Claims”), and conditioned upon Bank of America’s full payment of the Settlement Amount and Bank of America’s agreement, by executing this Agreement, to satisfy the terms in Paragraph 2 (“Consumer Relief”) and Paragraph 4 (“Cooperation”), the United States fully and finally releases Bank of America, Countrywide, Merrill Lynch, and First Franklin, (“Released Entities”) and each of their respective successors and assigns: a. For the Covered Conduct contained in Paragraphs 3(A), 3(B), 3(C), 3(D), 3(E), and 3(F) from any civil claims the United States has for the Covered Conduct arising under FIRREA, 12 U.S.C. § l833a; the False Claims Act, 31 U.S.C. §§ 3729, et seq.; the Program Fraud Civil Remedies Act, 31 U.S.C. §§ 3801, et seq.; the Racketeer Influenced and Corrupt Organizations Act, 18 U.S.C. §§ 1961, et seq.; the Injunctions Against Fraud Act, 18 U.S.C. § 1345; common law theories of negligence, gross negligence, indemnification, payment by mistake, unjust enrichment, money had and 13

received, breach of fiduciary duty, breach of contract, misrepresentation, deceit, fraud, and aiding and abetting any of the foregoing; or that the Civil Division of the Department of Justice has actual and present authority to assert and compromise pursuant to 28 C.F.R. § 0.45. b. For the Covered Conduct contained in Paragraph 3(H) from any civil claims the United States has for the Covered Conduct arising under FIRREA, 12 U.S.C. § 1833a. 6. Releases by the FHA. Subject to the exceptions in Paragraph 15 (“Excluded Claims”), and conditioned upon Bank of America’s full payment of the Settlement Amount relating to the submission of claims to the FHA ($800,000,000.00) and Bank of America’s agreement, by executing this Agreement, to satisfy the terms in Paragraph 2 (“Consumer Relief”) and Paragraph 4 (“Cooperation”), the United States Department of Housing and Urban Development, acting on behalf of FHA, fully and finally releases the Released Entities and their successors and assigns from any monetary administrative claim the FHA has for the Covered Conduct described in Paragraphs 3(E) and 3(F), supra. 7. Releases by the Ginnie Mae. Subject to the exceptions in Paragraph 15 (“Excluded Claims”), and conditioned upon: (i) Bank of America’s full payment of the Settlement Amount relating to Ginnie Mae ($200,000,000.00) and (ii) Bank of America’s agreement, by executing this Agreement, to satisfy the terms in Paragraph 2 (“Consumer Relief”) and Paragraph 4 (“Cooperation), the United States Department of Housing and Urban Development, acting on behalf of Ginnie Mae, fully and finally releases the Released Entities and their successors and assigns from any civil or administrative monetary claim Ginnie Mae has against Bank of 14

America for the Covered Conduct contained in Paragraph 3(G) under the common law theory of breach of contract. 8. Releases by the California Attorney General. Subject to the exceptions in Paragraph 15 (Excluded Claims), and conditioned upon Bank of America’s full payment of the Settlement Amount (of which $300,000,000.00 will be paid to the Office of the California Attorney General, in accordance with written payment instructions from the California Attorney General, to remediate harms to the State, pursuant to California Government Code §§ 12650- 12656 and 12658, allegedly resulting from unlawful conduct of the Released Entities), the California Attorney General fully and finally releases the Released Entities from any civil or administrative claim for the Covered Conduct contained in Paragraph 3(A) only that the California Attorney General has authority to bring, including but not limited to: California Corporate Securities Law of 1968, Cal. Corporations Code § 25000 et seq., California Government Code §§ 12658 and 12660 and California Government Code §§ 12650-12656, common law theories of negligence, payment by mistake, unjust enrichment, money had and received, breach of fiduciary duty, breach of contract, misrepresentation, deceit, fraud and aiding and abetting any of the foregoing. The California Attorney General executes this release in her official capacity and releases only claims that the California Attorney General has the authority to release for the Covered Conduct contained in Paragraph 3(A). The California Attorney General agrees that no portion of the funds in this paragraph is received as a civil penalty or fine, including, but not limited to any civil penalty or fine imposed under California Government Code § 12651. The California Attorney General and Bank of America acknowledge that they have been advised by their attorneys of the contents and effect of Section 1542 of the California 15

Civil Code (“Section 1542”) and hereby expressly waive with respect to this Agreement any and all provisions, rights, and benefits conferred by Section 1542. 9. Releases by the State of Delaware. Subject to the exceptions in Paragraph 15 (Excluded Claims), and conditioned solely upon Bank of America's full payment of the Settlement Amount (of which $45,000,000.00 will be paid to the State of Delaware, in accordance with written payment instructions from the State of Delaware, Office of the Attorney General, to remediate harms to the State allegedly resulting from unlawful conduct of the Released Entities), the Delaware Department of Justice fully and finally releases the Released Entities from any civil or administrative claim for the Covered Conduct contained in Paragraph 3(A) only that it has authority to bring, including but not limited to: 6 Del. C. Chapter 12 (the Delaware False Claims and Reporting Act), 6 Del. C. §§ 2511 et seq. (the Delaware Consumer Fraud Act), 6 Del. C. Chapter 73 (the Delaware Securities Act), and common law theories of negligence, payment by mistake, unjust enrichment, money had and received, breach of fiduciary duty, breach of contract, misrepresentation, deceit, fraud and aiding and abetting any of the foregoing. The payment to the State of Delaware shall be used, to the maximum extent possible, for purposes of providing restitution and remediating harms to the State and its communities allegedly resulting from unlawful conduct of the Released Entities, including efforts to address the mortgage and foreclosure crisis, financial fraud and deception, and housing-related issues. The State of Delaware agrees that no portion of the funds in this paragraph is received as a civil penalty or fine, including, but not limited to any civil penalty or fine imposed under 6 Del. C. § 1201 or § 2522. 10. Releases by the State of Illinois. Subject to the exceptions in Paragraph 15 (Excluded Claims), and conditioned solely upon Bank of America’s full payment of the Settlement Amount 16

(of which $200,000,000.00 will be paid to the State of Illinois, Office of the Attorney General, in accordance with the written payment instructions from the State of Illinois, Office of the Attorney General, to remediate harms to the State allegedly resulting from unlawful conduct of the Released Entities), the Illinois Attorney General of the State of Illinois fully and finally releases the Released Entities from any civil or administrative claim for the Covered Conduct contained in Paragraph 3(A) only that it has authority to bring or compromise, including but not limited to: Illinois Securities Law of 1953, 815 Ill. Comp. Stat. 5/1 et seq., and common law theories of negligence, gross negligence, payment by mistake, unjust enrichment, money had and received, breach of fiduciary duty, breach of contract, misrepresentation, deceit, fraud and aiding and abetting any of the foregoing. The State of Illinois agrees that no portion of the funds in this paragraph is received as a civil penalty or fine. 11. Releases of the Commonwealth of Kentucky. Subject to the exceptions in Paragraph 15 (Excluded Claims), and conditioned solely upon Bank of America’s full payment of the Settlement Amount (of which $23,000,000.00 will be paid to the Commonwealth of Kentucky, in accordance with written payment instructions from the Commonwealth of Kentucky, Office of the Attorney General, to remediate harms to the State allegedly resulting from allegedly unlawful conduct of the Released Entities), the Attorney General of the Commonwealth of Kentucky fully and finally releases the Released Entities from any civil or administrative claim for the Covered Conduct contained in Paragraph 3(A) only that it has the authority to bring or compromise, including but not limited to under: KRS 292.310-292.480 (Kentucky Securities Act), 367.110-367.300 (Kentucky Consumer Protection Act), and common law theories of negligence, gross negligence, recklessness, willful misconduct, payment by mistake, unjust enrichment, money had and received, breach of fiduciary duty, breach of 17

contract, misrepresentation, deceit, fraud, gross negligence, recklessness, willful misconduct, and aiding and abetting or conspiracy regarding any of the foregoing, as well as claims of unfair, abusive, or deceptive practices. The Commonwealth of Kentucky agrees that no portion of the funds in this paragraph is received as a civil penalty or fine. 12. Releases of the State of Maryland. Subject to the exceptions in Paragraph 15 (Excluded Claims), and conditioned solely upon Bank of America’s full payment of the Settlement Amount (of which $75,000,000.00 will be paid to the State of Maryland, in accordance with written payment instructions from the State of Maryland, Office of the Attorney General, to remediate harms to the State allegedly resulting from unlawful conduct of the Released Entities), the Attorney General of the State of Maryland (“Maryland Attorney General”) fully and finally releases the Released Entities from any civil or administrative claim for the Covered Conduct contained in Paragraph 3(A) only that the Maryland Attorney General has authority to bring, including but not limited to: Maryland Securities Act, Md. Code Ann., Corps. & Assn’s, §§ 11-101 et seq., Maryland Consumer Protection Act, Com. Law §§ 13-101 et seq., statutes and regulations in the nature of the False Claims Act or similar Laws, and common law theories of negligence, gross negligence, recklessness, willful misconduct, payment by mistake, unjust enrichment, money had and received, breach of fiduciary duty, breach of contract, misrepresentation, deceit, fraud, indemnification, contribution, restitution, rescission, and aiding and abetting or conspiracy claims regarding any of the foregoing, as well as claims of unfair, abusive, or deceptive practices, but excluding any liability arising under the tax provisions of the Maryland Code and any claims that may arise in any non-enforcement legal action related to any Maryland governmental entity in its capacity as an investor. The Maryland Attorney General executes this release in his official capacity and releases only claims that the Maryland Attorney 18

General has the authority to release for the Covered Conduct. The payment to the State of Maryland shall be made to the Maryland Attorney General, which shall hold the monies and distribute them as directed by the Maryland Attorney General for restitution to certain investors, including state and local governmental entities, and for costs incurred in connection with restitution, with any remaining funds to be credited to the Mortgage Loan Servicing Practices Settlement Fund to be used in accordance with Maryland law. The State of Maryland agrees that no portion of the funds in this paragraph is received as a civil penalty or fine. 13. Releases by the State of New York. Subject to the exceptions in Paragraph 15 (Excluded Claims), and conditioned solely upon Bank of America’s full payment of the Settlement Amount (of which $300,000,000.00 will be paid to the State of New York, in accordance with written payment instructions from the State of New York, Office of the Attorney General, to remediate harms to the State allegedly resulting from unlawful conduct of the Released Entities), the State of New York, by Eric T. Schneiderman, Attorney General of the State of New York, fully and finally releases the Released Entities from any civil or administrative claim for the Covered Conduct contained in Paragraph 3(A) only that it has authority to bring, including but not limited to any such claim under: New York General Business Law Article 23A, New York Executive Law § 63(12), and common law theories of negligence, payment by mistake, unjust enrichment, money had and received, breach of fiduciary duty, breach of contract, misrepresentation, deceit, fraud and aiding and abetting any of the foregoing. The payment to the State of New York shall be used, to the maximum extent possible, for purposes of redeveloping and revitalizing housing and home ownership and rebuilding communities in the State, and for programs intended to avoid preventable foreclosures, to ameliorate the effects of the foreclosure crisis, to provide funding for housing 19

counselors and legal assistance, housing remediation and anti-blight projects, to enhance housing code compliance efforts aimed at addressing blight and disinvestment, and to enhance efforts to remediate the effects of financial fraud or unfair or deceptive acts or practices. The State of New York agrees that no portion of the funds in this paragraph is received as a civil penalty or fine. 14. Releases by the FDIC and the SEC. The release of claims by the FDIC and the SEC are contained in separate settlement documents with Bank of America, attached as Exhibits A and B. Any release of claims by the FDIC and the SEC are governed solely by those separate settlement documents. 15. Excluded Claims. Notwithstanding the releases in Paragraphs 5-14 of this Agreement, or any other term(s) of this Agreement, the following claims are specifically reserved and not released by this Agreement: a. Any criminal liability; b. Any liability of any individual; c. Any liability of any person or entity other than the Released Entities and their successors and assigns; d. Any liability arising under Title 26 of the United States Code (the Internal Revenue Code); e. Any liability arising under Title XI of the Kentucky Revised Statutes. f. Any liability to or claims of the FDIC (in its capacity as a corporation, receiver, or conservator) and the SEC, except as expressly set forth in the separate agreements with those entities; 20

g. Any claim related to compliance with the National Mortgage Settlement (“NMS”), or to compliance with the related agreements reached between the settling banks and individual states; h. Any liability to, or claims brought by, the Federal Reserve Board and its member institutions, and/or by the United States Department of the Treasury; i. Any liability to, or claims brought by, the Department of Veterans Affairs relating to whole loans insured, guaranteed, or purchased by the Department of Veterans Affairs; j. Any liability to, or claims brought by, Fannie Mae or Freddie Mac relating to whole loans insured, guaranteed, or purchased by Fannie Mae or Freddie Mac; k. Any administrative liability, including the suspension and debarment rights of any federal agency, except to the extent expressly released in Paragraphs 6 and 7; l. Any liability based upon obligations created by this Settlement Agreement; m. Any liability for the claims or conduct alleged in the following qui tam actions, and no setoff related to amounts paid under this Agreement shall be applied to any recovery in connection with any of these actions: (i) United States ex rel. O’Donnell v. Bank of America Corp. et al., No. 12-cv- 1422 (S.D.N.Y.); (ii) United States ex rel. Adams, et al. v. Aurora Loan Servs. LLC et al., No. 11-cv-00535 (D. Nev.) & 14-15031 (9th Cir.); (iii) United States, et al. ex rel. Szymoniak v. American Home Mortgage Servicing, Inc., et al., No. 10-cv-01465-JFA (D.S.C.), and United States ex 21

rel. Szymoniak v. ACE Securities Corp., et al., No. 13-cv-464-JFA (D.S.C.), to the extent any claims survive dismissal; (iv) United States ex rel. Fisher v. Bank of America, N.A., No. 13-cv-01913- TPG (S.D.N.Y.); (v) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; (vi) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; (vii) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; (viii) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; (ix) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; (x) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America; (xi) In re [CONFIDENTIAL]; (xii) United States ex rel. Armendariz v. Wiles, et al., No. 14-cv-00551 (D.D.C.); and (xiii) United States ex rel. [Sealed] v. [Sealed], as disclosed to Bank of America, to the extent it alleges any false or fraudulent statements, claims, and/or certifications to United States Department of Housing and Urban Development and/or the GSEs in connection with the reimbursement of costs or expenses incurred in connection with foreclosure-related proceedings anywhere in the United States (including foreclosure proceedings or other proceedings, such as bankruptcy or eviction proceedings, involving claims or issues relating to foreclosure), any failure to comply with, or any false or fraudulent statements, claims, and/or certifications to United States Department of Housing and Urban 22

Development and/or the GSEs concerning compliance with, quality control and/or monitoring requirements applicable to such costs or expenses. n. Any dispute, claim, or defense which may arise between any Relator and Bank of America in the matters identified in Paragraph 3(F) regarding attorneys’ fees, expenses and costs of the Relator under 31 U.S.C. § 3730(d). o. Any liability arising under: the Fair Housing Act; the Equal Credit Opportunity Act; the Home Mortgage Disclosure Act; or any other statute or law that prohibits discrimination because of race, color, national origin, gender, disability, or any other protected status. p. Any claims related to the alleged manipulation of the London Interbank Offered Rate or other currency benchmarks. 16. Releases by Bank of America. Bank of America and any current or former affiliated entity and any of its respective successors and assigns fully and finally releases the United States and the States, and their officers, agents, employees, and servants, from any claims (including attorney’s fees, costs, and expenses of every kind and however denominated) that Bank of America has asserted, could have asserted, or may assert in the future against the United States and the States, and their officers, agents, employees, and servants, related to the Covered Conduct to the extent released hereunder and the investigation and civil prosecution to date thereof. 17. Waiver of Potential FDIC Indemnification Claims by Bank of America. Bank of America hereby irrevocably waives any right that it otherwise might have to seek (and in any event agrees that it shall not seek) any form of indemnification, reimbursement or contribution from the FDIC in any capacity, including the FDIC in its Corporate Capacity or the FDIC in its 23

Receiver Capacity for any payment that is a portion of the Settlement Amount set forth in Paragraph 1 of this Agreement or of the Consumer Relief set forth in Paragraph 2 of this Agreement, including payments to the United States, the States, and the SEC made pursuant to Paragraphs 1 and 2 of this Agreement. 18. Waiver of Potential Defenses by Bank of America. Bank of America and any current or former affiliated entity (to the extent that Bank of America retains liability for the Covered Conduct associated with such affiliated entity) and any of their respective successors and assigns waive and shall not assert any defenses Bank of America may have to any criminal prosecution or administrative action relating to the Covered Conduct that may be based in whole or in part on a contention that, under the Double Jeopardy Clause in the Fifth Amendment of the Constitution, or under the Excessive Fines Clause in the Eighth Amendment of the Constitution, this Agreement bars a remedy sought in such criminal prosecution or administrative action. 19. Unallowable Costs Defined. All costs (as defined in the Federal Acquisition Regulation, 48 C.F.R. § 31.205-47) incurred by or on behalf of Bank of America, and its present or former officers, directors, employees, shareholders, and agents in connection with: a. the matters covered by this Agreement; b. the United States’ audit(s) and civil investigation(s) of the matters covered by this Agreement; c. Bank of America’s investigation, defense, and corrective actions undertaken in response to the United States’ audit(s) and civil and any criminal investigation(s) in connection with the matters covered by this Agreement (including attorney’s fees); d. the negotiation and performance of this Agreement; and 24

e. the payment Bank of America makes to the United States pursuant to this Agreement, are unallowable costs for government contracting purposes (hereinafter referred to as “Unallowable Costs”). 20. Future Treatment of Unallowable Costs. Unallowable Costs will be separately determined and accounted for by Bank of America, and Bank of America shall not charge such Unallowable Costs directly or indirectly to any contract with the United States. 21. Miscellaneous. a. This Agreement is intended to be for the benefit of the Parties only and does not create any third-party rights. b. This Agreement is governed by the laws of the United States. The Parties agree that the exclusive jurisdiction and venue for any dispute relating to this Agreement is the United States District Court for the District of New Jersey. c. The Parties acknowledge that this Agreement is made without any trial or adjudication or finding of any issue of fact or law, and is not a final order of any court or governmental authority. d. Each Party shall bear its own legal and other costs incurred in connection with this matter, including the preparation and performance of this Agreement. e. Each party and signatory to this Agreement represents that it freely and voluntarily enters into this Agreement without any degree of duress or compulsion. f. Nothing in this Agreement in any way alters the terms of the NMS, or Bank of America’s obligations under the NMS. 25

g. Nothing in this Agreement constitutes an agreement by the United States concerning the characterization of the Settlement Amount for the purposes of the Internal Revenue laws, Title 26 of the United States Code. h. For the purposes of construing the Agreement, this Agreement shall be deemed to have been drafted by all Parties and shall not, therefore, be construed against any Party for that reason in any dispute. i. This Agreement, including all Annexes and Exhibits attached hereto, shall not apply to, or be used in, United States ex rel. O’Donnell v. Bank of America Corp., et al., No. 12-cv-1422 (S.D.N.Y.). j. This Agreement constitutes the complete agreement between the Parties. This Agreement may not be amended except by written consent of the Parties. k. The undersigned counsel represent and warrant that they are fully authorized to execute this Agreement on behalf of the persons and entities indicated below. l. This Agreement may be executed in counterparts, each of which constitutes an original and all of which constitute one and the same Agreement. m. This Agreement is binding on Bank of America’s successors, transferees, heirs, and assigns. n. All parties consent to the disclosure to the public of this Agreement by Bank of America, the United States, the States, the FDIC, and the SEC whose separate settlement agreements are referenced herein and attached as exhibits to this Agreement. 26

o. This Agreement is effective on the date of signature of the last signatory to the Agreement (“Effective Date of this Agreement”). Facsimiles of signatures shall constitute acceptable, binding signatures for purposes of this Agreement. 27

8/20/2014 8/20/2014

8/20/2014

For the State of T1linois: LISA MADIGAN Attorney General State of II1inois 500 South Second Street Springfield, IL 62706 Phone: (217) 782-1090 " 1 ~ J / «;/ La \!.,{ADated: "'I - - +-- - - - -

For the State of Maryland: Senter S Commissioner Office of the Attorney General of Maryland, Securities Division 200 St, Paul Place Baltimore, Maryland 21202 Dated Douglas F Attorney General Office of the Attomey General of Maryland 200 St. Paul Place Baltimore, Maryland 21202 Dared: 4t C.øt+ t8,"2ot{ I (

ANNEX 1 Bank of America Corporation Statement of Facts BANK OF AMERICA - RMBS In late 2007 and early 2008, Bank of America structured, offered and sold over $850 million in residential mortgage-backed security (“RMBS”) certificates in a securitization trust known as the BOAMS 2008-A securitization to investors, including federally insured financial institutions. Bank of America marketed these RMBS as backed by Bank-originated, prime mortgages. Bank of America issued these RMBS certificates using a shelf registration statement and other offering documents filed with the U.S. Securities and Exchange Commission (“SEC”) by a Bank of America affiliate, Banc of America Mortgage Securities, Inc. (“BOAMS”). In the BOAMS 2008-A offering documents, Bank of America represented that “each mortgage [backing the securitization] . . . is underwritten in accordance with guidelines established in Bank of America’s Product and Policy Guides.” It further represented that “[a] loan is considered to be underwritten in accordance with a given set of guidelines if, based on an overall qualitative evaluation, the loan is in substantial compliance with such underwriting guidelines.” Bank of America also represented that it “permits [a loan applicant’s debt-to- income ratio] to exceed guidelines when the applicant has documented compensating factors for exceeding ratio guidelines . . . .” At the time Bank of America made these representations, its internal reporting showed that “wholesale” mortgages—that is, loans originated through third-party mortgage brokers—had decreased in performance and were experiencing an increase in underwriting exceptions. Additionally, a report that Bank of America prepared for qualified institutional buyers showed that wholesale loans from an industry lender, on average, experienced a higher Conditional Prepayment Rate (“CPR”) than retail mortgages. These reports were received by Bank of America employees involved in the BOAMS 2008-A securitization prior to its marketing and sale. Bank of America did not disclose this information in the BOAMS 2008-A offering documents. Bank of America also did not disclose in the BOAMS 2008-A offering documents the percentage of wholesale mortgage loans collateralizing the securitization. Over 70 percent of the mortgage loans collateralizing the BOAMS 2008-A securitization consisted of mortgages Bank of America originated through its wholesale channel. Approximately six weeks before the transaction closed, Bank of America disclosed preliminary data relating to the percentage of wholesale mortgage loans collateralizing the BOAMS 2008-A RMBS to certain investors but it did not disclose the percentage to all buyers of the BOAMS 2008-A offering. The preliminary loan tapes containing the information about the wholesale loan percentage that Bank of America provided to certain investors were “ABS informational and computational material” because they were “factual information regarding the pool assets underlying the asset-backed securities, including origination . . . and other factual information concerning the parameters of the asset pool appropriate to the nature of the underlying assets, such as . . . the programs under which the loans were originated.” Bank of America did not 1

publicly file the preliminary loan tapes containing this information with the SEC and only disclosed it to the aforementioned investors, who ultimately invested. Bank of America did not have third-party, loan-level due diligence conducted on the specific mortgage loans collateralizing the BOAMS 2008-A securitization. This was contrary to its past practice. Third-party, loan level due diligence had been conducted on previous BOAMS securitizations that closed in March, April, and August 2007; these diligence reviews revealed that some of the mortgages reviewed did not conform to Bank of America underwriting standards. Third-party due diligence also had revealed data errors in the preliminary loan tapes that Bank of America had provided to investors. Bank of America did not disclose in the BOAMS 2008-A offering documents that third-party, loan-level due diligence was not conducted on the loans collateralizing BOAMS 2008-A. MERRILL LYNCH - RMBS Throughout 2006 and 2007, Merrill Lynch issued approximately 72 RMBS consisting of thousands of subprime mortgage loans. Merrill Lynch acquired some of these loans from third- party originators in whole loan transactions. Merrill Lynch also securitized loans from two originators in which Merrill Lynch had an ownership interest: Ownit Mortgage Solutions, Inc. (“Ownit”) and First Franklin Financial Corporation (“First Franklin”). Merrill Lynch made certain representations in the offering documents it filed with the SEC concerning the loans securitized in these RMBS. Merrill Lynch also submitted information about these RMBS to the ratings agencies. Prior to making these representations, Merrill Lynch received information as part of its due diligence process showing that, for certain loan pools, significant numbers of the loans it was considering for securitization did not conform to the representations made in the offering documents it filed with the SEC. In particular, the offering documents for Merrill Lynch subprime RMBS regularly included representations that “[a]ll of the Mortgage Loans were originated generally in accordance with the [originator’s] Underwriting Guidelines.” The offering documents also regularly represented that exceptions were made to these guidelines on a “case-by-case basis” based on the presence of “compensating factors.” (According to offering documents filed with the SEC, the underwriting guidelines were “primarily intended to assess the ability and willingness of the borrower to repay the debt and to evaluate the adequacy of the mortgaged property as collateral for the mortgage loan.”) The offering documents also represented that the loans securitized by Merrill Lynch conformed to applicable federal, state, and local laws. Prior to making these representations, employees at Merrill Lynch’s Whole Loan Trading Desk conducted due diligence on the loans to be purchased. This due diligence process typically included a review of the files for a sample of the loans from each pool. This review was conducted by a third-party vendor and overseen by Merrill Lynch. The sample would contain randomly selected loans, as well as loans selected using “adverse sampling” techniques designed to identify loans that had particular characteristics that Merrill Lynch believed warranted further review. This loan file review included an evaluation of the loans’ compliance with the 2

originators’ underwriting guidelines (the “credit review”), as well as an evaluation of whether the origination of the loans complied with federal, state, and local laws, rules, and regulations (the “compliance review”). The third-party vendors that performed the credit and compliance reviews assigned grades to each of the loans they reviewed. The vendor graded a loan an “Event Grade 1” loan, or EV1, if it determined that the loan was underwritten according to the originator’s underwriting guidelines and in compliance with relevant rules and regulations. Loans that the vendor determined did not strictly comply with applicable underwriting guidelines, but that had sufficient compensating factors, were rated as an EV2. Vendors graded a loan an EV3 when the loan was not originated in compliance with applicable laws and regulations, the loan did not comply with applicable underwriting guidelines and lacked the sufficient offsetting compensating factors, or the loan file was missing a key piece of documentation. The underwriting and compliance attributes considered by the vendors in grading loans as EV3 included, among other things, loans to borrowers who had recently declared bankruptcy in certain lending programs where bankrupt borrowers were not permitted; “high cost” loans that appeared to violate state lending laws; debt-to-income ratios that did not comply with applicable product guidelines; inadequate or missing documentation of income, assets, and rental or mortgage history for the relevant loan program; and stated incomes the vendors concluded were unreasonable. Merrill Lynch’s subprime due diligence manager received the vendors’ reports and the results of the due diligence reviews throughout the whole loan acquisition process. The vendors’ reports were also available to others in Merrill Lynch’s RMBS business, including those on the trading desk and in the securitization group. These reports showed that some due diligence samples had an EV3 rate as high as 50% of the loans sampled. Merrill Lynch typically did not review the unsampled portion of the loan pools to determine whether they also included loans with material credit or compliance defects. In addition, due diligence personnel and, in certain instances, traders on Merrill Lynch’s Whole Loan Trading Desk, reevaluated certain loans graded EV3 by the vendor and, in certain circumstances, overruled the vendor’s grade and “waived” particular loans into the purchased pool. Merrill Lynch’s contemporaneous records did not in all cases document Merrill Lynch’s reasons for directing the due diligence vendors to re-grade loans. In an internal email that discussed due diligence on one particular pool of loans, a consultant in Merrill Lynch’s due diligence department wrote: “[h]ow much time do you want me to spend looking at these [loans] if [the co-head of Merrill Lynch’s RMBS business] is going to keep them regardless of issues? . . . Makes you wonder why we have due diligence performed other than making sure the loan closed.” In 2006 and 2007, Merrill Lynch’s due diligence vendors provided Merrill Lynch with reports reflecting that the vendors graded certain of the sampled loans as EV3. For some pools, the reports showed that the vendors had graded more than 20 percent of the sampled loans as EV3. The following examples provide the approximate percentages of EV3 loans that were 3

present in the samples taken from particular pools and the approximate percentage of those EV3 loans that were waived in by Merrill Lynch for acquisition: • Sampled loans from five pools of loans originated by ResMAE Mortgage Corporation fed into four securitizations issued by Merrill Lynch Mortgage Investors Trust in 2006: MLMI 2006-RM1, MLMI 2006-RM2, MLMI 2006-RM3 and MLMI 2006- RM5. For one pool, the vendor graded 24% of the due diligence sample EV3, and Merrill Lynch waived into the purchase pool 16% of these loans. For a second pool, the vendor graded 32% of the due diligence sample EV3, and Merrill Lynch waived into the purchase pool 14% of these loans. For a third pool, the vendor graded 22% of the due diligence sample EV3, and Merrill Lynch waived into the purchase pool 27% of these loans. For a fourth pool, the vendor graded 57% of the due diligence sample EV3. Finally, for a fifth pool, the vendor graded 40% of the due diligence sample EV3, and Merrill Lynch waived into the purchase pool 50% of these loans. • Sampled loans from two pools of loans originated by Mortgage Lenders Network USA, Inc. fed into MLMI 2006-MLN1, a securitization issued by Merrill Lynch Mortgage Investors Trust in 2006. Vendors graded 22% and 23% of the due diligence sample EV3 for these two pools. For the latter sample, Merrill Lynch waived into the purchase pool 22% of the loans that had received an EV3 rating. • Sampled loans from two pools of loans originated by WMC Mortgage Corporation fed into two securitizations issued by Merrill Lynch Mortgage Investors Trust in 2006: MLMI 2006-WMC1 and MLMI 2006-WMC2. For these two pools, the vendors graded 22% and 45% of the loans in the due diligence sample EV3. For the latter sample, Merrill Lynch waived into the purchase pool 26% of the loans that had received an EV3 rating. • Sampled loans from a pool of loans originated by Accredited Home Lenders, Inc. fed into MLMI 2006-AHL1, a securitization issued by Merrill Lynch Mortgage Investors Trust in 2006. For this pool, vendors graded 55% of the due diligence sample EV3. Merrill Lynch waived into the purchase pool 31% of the loans that had received an EV3 rating. Merrill Lynch securitized most of the EV3 loans it waived in and acquired in this fashion, typically within a matter of months. These due diligence results are consistent with a “trending report” prepared for client marketing purposes by one of Merrill Lynch’s due diligence vendors (later described by the vendor to be a “beta” or test report) that tracked EV3 and waiver rates in the samples from the Merrill Lynch loan pools that the vendor reviewed from the first quarter of 2006 through the second quarter of 2007. During those six quarters, the vendor reported that it reviewed 55,529 loans for Merrill Lynch. The vendor reported that 12,888 of the loans reviewed, or 23%, received an initial grade of EV3. The report notes that 4,099 loans, or 31.8% of the loans that received an initial EV3 grade, were “waived” into the purchase pools by Merrill Lynch. 4

Through the due diligence process in 2005 and 2006, Merrill Lynch also learned that certain originators were loosening their underwriting guidelines, resulting in Merrill Lynch’s identifying, for example, an increasing number of loans with unreasonable stated incomes. Merrill Lynch’s due diligence manager brought this to the attention of Merrill Lynch’s head of whole loan trading in a memorandum written in November 2005. Merrill Lynch, however, continued to acquire and securitize loans from some of these originators without substantially altering its disclosures to investors. A year later, in December 2006, Merrill Lynch’s due diligence manager again brought the loosening of originator guidelines to the attention of the head of whole loan trading in another memorandum. Merrill Lynch still continued to acquire and securitize loans from some of those originators without substantially altering its disclosures to investors. With its acquisition of originator First Franklin in December 2006, Merrill Lynch vertically integrated all significant aspects of its RMBS business, from origination through securitization. This integration gave Merrill Lynch greater visibility into First Franklin’s loan origination practices. Following its acquisition of First Franklin, Merrill Lynch sometimes reviewed a smaller due diligence sample when securitizing First Franklin loans than it had when acquiring and securitizing loans from First Franklin prior to the acquisition. In an email, one Merrill Lynch employee stated that certain post-acquisition First Franklin loans were being securitized “without the equivalent of a whole loan due diligence” and as a result “valuation and other credit kickouts will not occur” to the same extent as prior to the First Franklin acquisition. Moreover, for a period of time in 2007, Merrill Lynch gave its wholly owned subsidiary First Franklin the authority in certain circumstances to make the final decision about what First Franklin loans should be waived in and securitized. For example, according to a May 2007 report, the due diligence vendor graded 7% of the loans in one sample of First Franklin loans EV3 and 58% of those loans were waived into the purchase pool. Most of these loans were ultimately securitized by Merrill Lynch. The offering documents for Merrill Lynch subprime RMBS also made representations concerning the value of the properties that secured the mortgage loans it securitized. In particular, the offering documents made representations to investors concerning the loan to value (“LTV”) and combined loan to value (“CLTV”) ratios of the securitized loans. Originators generally made their LTV and CLTV determinations by comparing the appraised value of the property at the time of origination or the purchase price of the property (whichever was lower) to the amount of the loan or loans secured by the property. Merrill Lynch hired third-party valuation firms to test the reasonableness of the appraised values of mortgaged properties. These checks were performed through a variety of methods that generated valuation estimates, including (i) “automated valuation models,” or “AVMs,” (ii) desk reviews of the appraisals by licensed appraisers, and (iii) broker price opinions. After reviewing the relevant data, the valuation firm would provide its results to Merrill Lynch. Merrill Lynch had an internal “tolerance” of 10 to 15%. As a result of this practice, Merrill Lynch accepted certain loans for purchase and securitization where the reported appraised value at the time of origination was as much as 10 to 15% higher than the valuation firm’s estimated value of the property. In addition, some of the RMBS issued by Merrill Lynch potentially contained loans 5

with an LTV in excess of 100%, based on valuations obtained from AVMs. The offering documents did not disclose facts about Merrill Lynch’s “tolerance” levels. The conduct described above with respect to Merrill Lynch all occurred prior to Bank of America’s acquisition of Merrill Lynch in January 2009. COUNTRYWIDE - RMBS Between 2005 and 2007, Countrywide Financial Corporation (“CFC”) was the parent corporation of Countrywide Home Loans (“CHL”), Countrywide Bank, FSB (“CB”), and Countrywide Securities Corporation (“CSC”). CHL originated and acquired residential mortgage loans. CB was a federally chartered savings bank, the deposits of which were federally insured. CSC was a registered broker-dealer that was engaged in underwriting RMBS, which were often backed by “pools” of loans originated by CHL. CFC, CHL, CB, and CSC are referred to herein collectively as “Countrywide.” As discussed below, from 2005 to 2007, Countrywide originated an increasing number of loans as exceptions to its Loan Program Guides. At the same time, employees of Countrywide received information indicating that there was an increased risk of poor performance for certain mortgage programs and products that were being included in RMBS. Despite having access to this information, Countrywide’s RMBS offering documents generally did not disclose the extent to which underlying loans were originated as exceptions to its Loan Program Guides. Nor did Countrywide disclose in its RMBS offering documents the results of certain reviews and internal reports related to loan performance. I. Countrywide Business Model Between 2005 and 2007, Countrywide was a diversified financial services company engaged in mortgage lending, banking, mortgage loan servicing, mortgage warehouse lending, securities, and insurance. At this time, Countrywide was among the largest originators of residential mortgage loans in the United States. Countrywide’s SEC filings show that it originated $229 billion in residential mortgage loans in 2005, $243 billion in 2006, and $205 billion in 2007. Countrywide’s business model was to serve as an intermediary between borrowers seeking residential mortgages and investors seeking to purchase loans in the secondary market. As disclosed in Countrywide’s Form 10-K for 2005, most of the mortgage loans Countrywide produced were sold into the secondary mortgage market, primarily in the form of RMBS. From 2005 to 2007, Countrywide sponsored and sold approximately $332 billion of prime, Alt-A, second lien, home equity line of credit, and subprime RMBS backed by loans originated by, among others, CHL. Countrywide employed, among others, a corporate strategy sometimes referred to as the “Supermarket Strategy.” The Supermarket Strategy was developed to create a one-stop shopping experience for borrowers. In addition to offering its own products, Countrywide strove to offer to 6

borrowers every kind of mortgage product that was available from legitimate competing lenders. A component of the Supermarket Strategy, which has sometimes been referred to as the “matching strategy,” was a process by which Countrywide would learn about and evaluate loan product offerings from its competitors and expand its product offering to match or exceed its competitors’ product offerings. II. Countrywide Loan Origination Process CHL originated and acquired residential mortgage loans through a variety of channels, including its own retail branches, mortgage brokers, and a network of third-party correspondent lenders. Countrywide’s retail branches were referred to as the Consumer Markets Division (“CMD”) and the Full Spectrum Lending Division (“FSL”). Countrywide provided its CMD and FSL branch underwriters with sets of lending guidelines, including Loan Program Guides, that listed borrower and loan characteristics, including credit scores and debt-to-income (“DTI”) and LTV ratios, that branch underwriters were to consider when underwriting a potential loan. Branch underwriters had authority to approve loans that fit within the parameters outlined in the Loan Program Guides. When branch underwriters received loan applications that did not meet the program parameters in the Loan Program Guides (e.g., credit score, LTV, loan amount), the branch underwriters were authorized to refer the applications to more experienced underwriters at the relevant divisional “Structured Loan Desk” (“SLD”) for consideration of an “exception.” Underwriters at the SLD were authorized to approve requests to make an “exception” to the Loan Program Guides if the proposed loan and borrower complied with the characteristics described in another set of guidelines, referred to as so-called “Shadow Guidelines,” and the loan contained compensating factors supporting the exception request. The Shadow Guidelines generally permitted loans to be made to borrowers with lower credit scores and allowed for higher LTV ratios than the Loan Program Guides. If the SLD underwriter did not believe that an exception was appropriate as presented, the SLD underwriter either could deny the exception request or could propose a counter-offer to the branch underwriter. A counter-offer was a rejection of the exception request accompanied by a proposal that the loan could be originated under a different set of terms from those originally proposed by the branch underwriter. For example, a counter-offer might propose a different loan product or program or request that the borrower increase the size of a down payment. Countrywide’s policies indicated that after an exception approval or counter-offer was delivered to the branch underwriter, the branch underwriter would then be responsible for deciding whether to approve the loan. If a loan application did not meet the credit standards of the Shadow Guidelines, Structured Loan Desk underwriters were authorized to submit a request to Countrywide’s Secondary Marketing Structured Loan Desk (“SMSLD”), which would then determine whether the requested loan, if originated, could be priced and sold in the secondary market. If a loan could be priced and sold, SMSLD would provide a price for the loan and ultimately it would be returned to the branch underwriter. 7

III. RMBS Securitization Process Countrywide sold the majority of the loans that it originated. Many such loans were sold in the form of RMBS underwritten by CSC. The CHL loans that CSC underwrote in these securitizations were sourced in a variety of ways, including through third-party correspondent lenders. Countrywide structured and securitized these CHL or third-party mortgage loans under its own shelf registrations, such as Countrywide Alternative Loan Trust. Due Diligence When Countrywide securitized loans into RMBS, it would typically engage a third-party due diligence provider to perform due diligence on a sample of the loans. During this process, third-party due diligence providers generally reviewed a sample of the loans to be securitized against underwriting guidelines provided by Countrywide. In certain instances, Countrywide provided the due diligence providers with what were known as “Seller Loan Program Guides,” which were guidelines based on the characteristics of loans that Countrywide had been able to make and sell in the past. Seller Loan Program Guides reflected the credit attributes of the loans that Countrywide had previously made and sold, and as a result they frequently listed lower credit scores or higher DTI and LTV ratios than the applicable Loan Program Guides or the applicable Shadow Guidelines. For example, certain of the Seller Loan Program Guides stated that they allowed DTIs of up to 55% for certain loans. The due diligence providers would then report the results of their review of the loans that were contained in the selected samples, including whether they complied with the underwriting guidelines provided by Countrywide and/or whether exceptions to those guidelines were supported by compensating factors. Offering Document Representations and Disclosures Countrywide prepared and filed with the SEC certain documents in connection with offering RMBS. Those documents included Prospectuses and Prospectus Supplements (together, “Offering Documents”), as well as Pooling and Servicing Agreements that memorialized agreements among Countrywide entities that offered or serviced the RMBS and the trustee for the RMBS once they were issued. Portions of the Pooling and Servicing Agreements were described and/or incorporated by reference in the Offering Documents. In certain of the Offering Documents that were provided to investors in RMBS, Countrywide represented that it maintained an underwriting system that was intended to evaluate residential borrowers’ credit standing and repayment ability. Although the Offering Documents were not uniform, Countrywide typically represented in them that it originated loans substantially in accordance with its credit, appraisal and underwriting standards. For example, Countrywide typically represented that it applied its underwriting standards “to evaluate the borrower’s credit standing and repayment ability” and that “a determination generally is made as to whether the prospective borrower has sufficient monthly income available to meet monthly housing expenses and other financial obligations and to meet the borrower’s monthly obligations on the proposed mortgage loan.” For certain RMBS, Countrywide also generally stated that “exceptions” to CHL’s “underwriting guidelines may be made if compensating factors are demonstrated by a prospective borrower.” 8

In certain of the Offering Documents, Countrywide stated that it originated loans under “Standard Underwriting Guidelines” and “Expanded Underwriting Guidelines.” Countrywide stated that certain Standard Underwriting Guidelines generally permitted DTI ratios based on monthly housing expenses up to 33% and, when based on total debt, up to 38%. Certain Offering Documents disclosed that under Countrywide’s Standard Underwriting Guidelines, loans could be originated pursuant to the “Full,” “Alt,” “Reduced,” “CLUES Plus,” and “Streamlined” documentation programs, and that under certain of these programs, “some underwriting documentation concerning income, employment and asset verification is waived,” that “information relating to a prospective borrower’s income and employment is not verified,” and that therefore DTI for those loans was calculated “based on the information provided by the borrower in the mortgage loan application.” Certain Offering Documents also disclosed that under Countrywide’s Expanded Underwriting Guidelines, loans could be originated under additional documentation programs, namely “Stated Income/Stated Assets,” “No Income/No Assets,” and “No Ratio.” Under the “Stated Income/Stated Asset” program, borrowers stated their incomes on a loan application without providing supporting documentation that could then be verified. The Offering Documents disclosed that in connection with the Stated Income/Stated Assets program, the loan application was reviewed to determine whether the income as stated by the borrower was reasonable for the borrower’s stated employment. The description of the Expanded Underwriting Guidelines also stated that they generally permitted DTI ratios up to 36% on the basis of housing debt and up to 40% on the basis of total debt. Countrywide entities made representations to securitization trustees in Pooling and Servicing Agreements. For example, CHL typically represented that each CHL mortgage loan supporting the subject RMBS was underwritten in all material respects in accordance with CHL’s underwriting guidelines. In certain Pooling and Servicing Agreements, CHL also represented that the mortgage loan pools backing the subject RMBS were “selected from among the . . . portfolios of the Sellers at the Closing Date as to which the representations and warranties [set forth in the Pooling & Servicing Agreement] can be made” and were not “selected in a manner intended to adversely affect the interests of the Certificateholders.” CHL also represented in certain Pooling and Servicing Agreements that, to the best of its knowledge, “there is no material event which, with the passage of time or with notice and the expiration of any grace or cure period, would constitute a default, breach, violation or event of acceleration” as to any mortgage loan serving as collateral for the RMBS. IV. Countrywide Expanded Its Loan Offerings Based on Salability In the early to mid-2000s, mortgage originators across the mortgage lending industry began to offer more types of mortgage products. In furtherance of its goal to obtain a 30% market share and its “Supermarket Strategy,” Countrywide began to offer products that featured more permissive lending criteria. Examples of these more permissive lending criteria included loans with higher combined-loan-to-value ratios or with lower credit scores. Countrywide also began to offer products that required less documentation from borrowers or offered flexible payment options. Examples of these mortgage products included “Stated Income” loans and Pay- Option Adjustable Rate Mortgages (“ARMs”). Stated Income loans did not require borrowers to 9