|

Exhibit 99.1

|

EXHIBIT C to the Supplement to PSA

|

|

|

CLASS A CUSIP

|

55262TCB7

|

|

|

CLASS B CUSIP

|

55262TCC5

|

|

|

MONTHLY CERTIFICATEHOLDERS' STATEMENT

|

||

|

SERIES 1997-B

|

||

|

BA CREDIT CARD FUNDING, LLC

|

||

|

BA MASTER CREDIT CARD TRUST II

|

||

|

MONTHLY PERIOD ENDING NOVEMBER 30, 2010

|

||

|

The information which is required to be prepared with respect to the Distribution Date of December 15, 2010, and with respect to the performance of the Trust during the month of November, 2010 is set forth below.

|

||

|

Capitalized terms used in this statement have their respective meanings set forth in the Second Amended and Restated Pooling and Servicing Agreement.

|

||

|

Material terms, parties and related abbreviations used herein may be found in the following documents as filed with the Securities and Exchange Commission ("SEC"):

|

||

|

Amended and Restated Series 1997-B Supplement to the Second Amended and Restated Pooling and Servicing Agreement relating to the Collateral Certificate

|

Included in Exhibit 4.1 to BA CREDIT CARD FUNDING, LLC Form 8-K filed with the SEC on March 2, 2009

|

|

Second Amended and Restated Pooling and Servicing Agreement dated as of October 20, 2006

|

Included in BA CREDIT CARD FUNDING, LLC Form 8-K filed with the SEC on October 20, 2006

|

|

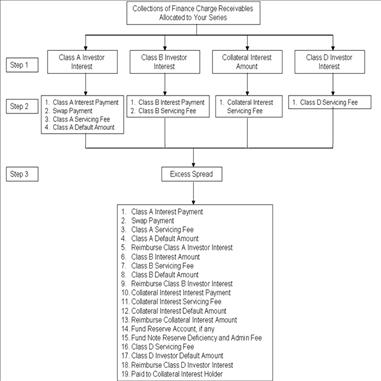

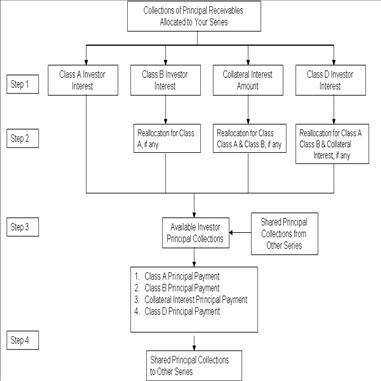

A.In accordance with Article IV of the Second Amended and Restated Pooling and Servicing Agreement, Allocations of Collections of Finance Charge Receivables and Principal Receivables for each Series shall be applied in the priority described in the two charts below. These charts are only an overview of the application and priority of payments of Collections of Finance Charge Receivables and Principal Receivables. For a more detailed description, please see the Second Amended and Restated Pooling and Servicing Agreement and the Amended and Restated Series 1997-B Supplement previously filed by the Registrant with the SEC.

|

Allocations of Collections of Finance Charge Receivables

Allocations of Collections of Principal Receivables

|

B.

|

Information Regarding the Current Monthly Distribution (Stated on the Basis of $1,000 Original Certificate Principal Amount).

|

|||

|

1.

|

The amount of distribution in respect of Class A Monthly Principal

|

$

|

0.000000

|

|

|

2.

|

The amount of distribution in respect of Class B Monthly Principal

|

$

|

0.000000

|

|

|

3.

|

The amount of distribution in respect of Class C Monthly Principal

|

$

|

0.000000

|

|

|

4

|

The amount of distribution in respect of Class D Monthly Principal

|

$

|

0.000000

|

|

|

5.

|

The amount of distribution in respect of Class A Monthly Interest

|

$

|

0.344533

|

|

|

6.

|

The amount of distribution in respect of Class A Deficiency Amounts

|

$

|

0.000000

|

|

|

7.

|

The amount of distribution in respect of Class A Additional Interest

|

$

|

0.000000

|

|

|

8.

|

The amount of distribution in respect of Class B Monthly Interest

|

$

|

0.502867

|

|

|

9.

|

The amount of distribution in respect of Class B Deficiency Amounts

|

$

|

0.000000

|

|

|

10.

|

The amount of distribution in respect of Class B Additional Interest

|

$

|

0.000000

|

|

|

11.

|

The amount of distribution in respect of Class C Monthly Interest

|

$

|

1.002867

|

|

|

12.

|

The amount of distribution in respect of Class C Deficiency Amounts

|

$

|

0.000000

|

|

|

13.

|

The amount of distribution in respect of Class C Additional Interest

|

$

|

0.000000

|

|

|

C.

|

Information Regarding the Performance of the Trust

|

||||

|

1.

|

Collection of Principal Receivables

|

||||

|

(a)

|

The aggregate amount of Collections of Principal Receivables processed during the related Monthly Period which were allocated in respect of the Class A Certificates

|

$

|

116,426,542.44

|

||

|

(b)

|

The aggregate amount of Collections of Principal Receivables processed during the related Monthly Period which were allocated in respect of the Class B Certificates

|

$

|

10,272,932.91

|

||

|

(c)

|

The aggregate amount of Collections of Principal Receivables processed during the related Monthly Period which were allocated in respect of the Class C Interest

|

$

|

10,272,932.91

|

||

|

(d)

|

The aggregate amount of Collections of Principal Receivables processed during the related Monthly Period which were allocated in respect of the Class D Certificates

|

$

|

31,761,158.52

|

||

|

2.

|

Principal Receivables in the Trust

|

||||

|

(a)

|

The aggregate amount of Principal Receivables in the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

74,126,551,711.46

|

||

|

(b)

|

The amount of Principal Receivables in the Trust represented by the Investor Interest of Series 1997-B as of the end of the day on the last day of the related Monthly Period

|

$

|

1,231,880,000.00

|

||

|

(c)

|

The amount of Principal Receivables in the Trust represented by the Adjusted Investor Interest of Series 1997-B as of the end of the day on the last day of the related Monthly Period

|

$

|

1,231,880,000.00

|

||

|

(d)

|

The amount of Principal Receivables in the Trust represented by the Class A Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

850,000,000.00

|

||

|

(e)

|

The amount of Principal Receivables in the Trust represented by the Class A Adjusted Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

850,000,000.00

|

||

|

(f)

|

The amount of Principal Receivables in the Trust represented by the Class B Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

75,000,000.00

|

||

|

(g)

|

The amount of Principal Receivables in the Trust represented by the Class B Adjusted Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

75,000,000.00

|

||

|

(h)

|

The amount of Principal Receivables in the Trust represented by the Class C Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

75,000,000.00

|

||

|

(i)

|

The amount of Principal Receivables in the Trust represented by the Class C Adjusted Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

75,000,000.00

|

||

|

(j)

|

The amount of Principal Receivables in the Trust represented by the Class D Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

231,880,000.00

|

||

|

(k)

|

The amount of Principal Receivables in the Trust represented by the Class D Adjusted Investor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

231,880,000.00

|

||

|

(l)

|

The Floating Investor Percentage with respect to the period:

|

||||

|

November 1, 2010 through November 30, 2010

|

1.66%

|

||||

|

(m)

|

The Class A Floating Allocation with respect to the related Monthly Period

|

0.690

|

|||

|

(n)

|

The Class B Floating Allocation with respect to the related Monthly Period

|

0.061

|

|||

|

(o)

|

The Class C Floating Allocation with respect to the related Monthly Period

|

0.061

|

|||

|

(p)

|

The Class D Floating Allocation with respect to the related Monthly Period

|

0.188

|

|||

|

(q)

|

The Fixed Investor Percentage with respect to the related Monthly Period

|

N/A

|

|||

|

(r)

|

The Class A Fixed Allocation with respect to the related Monthly Period

|

N/A

|

|||

|

(s)

|

The Class B Fixed Allocation with respect to the related Monthly Period

|

N/A

|

|||

|

(t)

|

The Class C Fixed Allocation with respect to the related Monthly Period

|

N/A

|

|||

|

(u)

|

The Class D Fixed Allocation with respect to the related Monthly Period

|

N/A

|

|||

|

3.

|

Shared Principal Collections

|

|||

|

The aggregate amount Shared Principal Collections allocated to:

|

||||

|

Total

|

$

|

0.000.000.000.00

|

||

|

4.

|

Delinquent Balances

|

|

|

The aggregate amount of outstanding balances in the Accounts which were delinquent as of the end of the day on the last day of the related Monthly Period:

|

||

|

Percentage

of Total

Receivables

|

Aggregate

Account

Balance

|

|||||

|

(a)

|

30 - 59 days:

|

1.34%

|

$

|

1,050,951,472.42

|

||

|

(b)

|

60 - 89 days:

|

1.12%

|

$

|

887,641,902.22

|

||

|

(c)

|

90 - 119 days:

|

1.04%

|

$

|

823,054,099.55

|

||

|

(d)

|

120 - 149 days:

|

0.96%

|

$

|

756,723,880.99

|

||

|

(e)

|

150 - 179 days:

|

1.01%

|

$

|

797,638,145.52

|

||

|

(f)

|

180 – or more days:

|

0.00%

|

$

|

551,689.03

|

||

|

Total:

|

5.47%

|

$

|

4,316,561,189.73

|

|

5.

|

Investor Default Amount

|

||||

|

(a)

|

The Aggregate Investor Default Amount for the related Monthly Period

|

$

|

10,954,098.87

|

||

|

(b)

|

The Class A Investor Default Amount for the related Monthly Period

|

$

|

7,558,352.97

|

||

|

(c)

|

The Class B Investor Default Amount for the related Monthly Period

|

$

|

666,913.69

|

||

|

(d)

|

The Class C Default Amount for the related Monthly Period

|

$

|

666,913.69

|

||

|

(e)

|

The Class D Investor Default Amount for the related Monthly Period

|

$

|

2,061,918.52

|

||

|

6.

|

Investor Charge Offs

|

||||

|

(a)

|

The aggregate amount of Class A Investor Charge Offs for the related Monthly Period

|

$

|

0.00

|

||

|

(b)

|

The aggregate amount of Class A Investor Charge Offs set forth in 6 (a) above per $1,000 of original certificate principal amount

|

$

|

0.00

|

||

|

(c)

|

The aggregate amount of Class B Investor Charge Offs for the related Monthly Period

|

$

|

0.00

|

||

|

(d)

|

The aggregate amount of Class B Investor Charge Offs set forth in 6 (c) above per $1,000 of original certificate principal amount

|

$

|

0.00

|

||

|

(e)

|

The aggregate amount of Class C Investor Charge Offs for the related Monthly Period

|

$

|

0.00

|

||

|

(f)

|

The aggregate amount of Class C Investor Charge Offs set forth in 6 (e) above per $1,000 of original certificate principal amount

|

$

|

0.00

|

||

|

(g)

|

The aggregate amount of Class D Investor Charge Offs for the related Monthly Period

|

$

|

0.00

|

||

|

(h)

|

The aggregate amount of Class D Investor Charge Offs set forth in 6 (g) above per $1,000 of original certificate principal amount

|

$

|

0.00

|

||

|

(i)

|

The aggregate amount of Class A Investor Charge Offs reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(j)

|

The aggregate amount of Class A Investor Charge Offs set forth in 6 (i) above per $1,000 original certificate principal amount reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(k)

|

The aggregate amount of Class B Investor Charge Offs reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(l)

|

The aggregate amount of Class B Investor Charge Offs set forth in 6 (k) above per $1,000 original certificate principal amount reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(m)

|

The aggregate amount of Class C Investor Charge Offs reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(n)

|

The aggregate amount of Class C Investor Charge Offs set forth in 6 (m) above per $1,000 original certificate principal amount reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(o)

|

The aggregate amount of Class D Investor Charge Offs reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

(p)

|

The aggregate amount of Class D Investor Charge Offs set forth in 6 (o) above per $1,000 original certificate principal amount reimbursed on the Transfer Date immediately preceding this Distribution Date

|

$

|

0.00

|

||

|

7.

|

Investor Servicing Fee

|

||||

|

(a)

|

The amount of the Class A Servicing Fee payable by the Trust to the Servicer for the related Monthly Period

|

$

|

885,416.66

|

||

|

(b)

|

The amount of the Class B Servicing Fee payable by the Trust to the Servicer for the related Monthly Period

|

$

|

78,125.00

|

||

|

(c)

|

The amount of the Class C Servicing Fee payable by the Trust to the Servicer for the related Monthly Period

|

$

|

78,125.00

|

||

|

(d)

|

The amount of the Class D Servicing Fee payable by the Trust to the Servicer for the related Monthly Period

|

$

|

241,541.67

|

||

|

(e)

|

The amount of Servicer Interchange payable by the Trust to the Servicer for the related Monthly Period

|

$

|

769,925.00

|

||

|

8.

|

Reallocations

|

||||

|

(a)

|

The amount of Reallocated Class D Principal Collections with respect to this Distribution Date

|

$

|

0.00

|

||

|

(b)

|

The amount of Reallocated Class C Principal Collections with respect to this Distribution Date

|

$

|

0.00

|

||

|

(c)

|

The amount of Reallocated Class B Principal Collections with respect to this Distribution Date

|

$

|

0.00

|

||

|

(d)

|

The Class D Investor Interest as of the close of business on this Distribution Date

|

$

|

231,880,000.00

|

||

|

(e)

|

The Class D Adjusted Investor Interest as of the close of business on this Distribution Date

|

$

|

231,880,000.00

|

||

|

(f)

|

The Class C Investor Interest as of the close of business on this Distribution Date

|

$

|

75,000,000.00

|

||

|

(g)

|

The Class C Adjusted Investor Interest as of the close of business on this Distribution Date

|

$

|

75,000,000.00

|

||

|

(h)

|

The Class B Investor Interest as of the close of business on this Distribution Date

|

$

|

75,000,000.00

|

||

|

(i)

|

The Class B Adjusted Investor Interest as of the close of business on this Distribution Date

|

$

|

75,000,000.00

|

||

|

(j)

|

The Class A Investor Interest as of the close of business on this Distribution Date

|

$

|

850,000,000.00

|

||

|

(k)

|

The Class A Adjusted Investor Interest as of the close of business on this Distribution Date

|

$

|

850,000,000.00

|

||

|

9.

|

Principal Funding Account

|

||||

|

(a)

|

The principal amount on deposit in the Principal Funding Account on the related Transfer Date (after taking into account deposits on such date but prior to withdrawals)

|

$

|

0.00

|

||

|

(b)

|

The Accumulation Shortfall with respect to the related Monthly Period

|

$

|

0.00

|

||

|

(c)

|

The Principal Funding Investment Proceeds deposited in the Finance Charge Account on the related Transfer Date to be treated as Class A Available Funds

|

$

|

0.00

|

||

|

(d)

|

The Principal Funding Investment Proceeds deposited in the Finance Charge Account on the related Transfer Date to be treated as Class B Available Funds

|

$

|

0.00

|

||

|

(e)

|

The Principal Funding Investment Proceeds deposited in the Finance Charge Account on the related Transfer Date to be treated as Class C Available Funds

|

$

|

0.00

|

||

|

10.

|

Reserve Account

|

||||

|

(a)

|

The Reserve Draw Amount on the related Transfer Date

|

$

|

0.00

|

||

|

(b)

|

The amount of the Reserve Draw Amount deposited in the Finance Charge Account on the related Transfer Date

|

$

|

0.00

|

||

|

(c)

|

The amount of the Reserve Draw Amount deposited in the Finance Charge Account on the related Transfer Date to be treated as Class A Available Funds

|

$

|

0.00

|

||

|

(d)

|

The amount of the Reserve Draw Amount deposited in the Finance Charge Account on the related Transfer Date to be treated as Class B Available Funds

|

$

|

0.00

|

||

|

(e)

|

The amount of the Reserve Draw Amount deposited in the Finance Charge Account on the related Transfer Date to be treated as Class C Available Funds

|

$

|

0.00

|

||

|

11.

|

Available Funds

|

||||

|

(a)

|

The amount of Class A Available Funds on deposit in the Finance Charge Account on the related Transfer Date

|

$

|

18,757,075.67

|

||

|

(b)

|

The amount of Class B Available Funds on deposit in the Finance Charge Account on the related Transfer Date

|

$

|

1,655,038.15

|

||

|

(c)

|

The amount of Class C Available Funds on deposit in the Finance Charge Account on the related Transfer Date

|

$

|

1,655,038.15

|

||

|

(d)

|

The amount of Class D Available Funds on deposit in the Finance Charge Account on the related Transfer Date

|

$

|

5,116,932.18

|

||

|

12.

|

Collection of Finance Charge Receivables

|

||||

|

(a)

|

The aggregate amount of Collections of Finance Charge Receivables processed during the related Monthly Period, allocated in respect of the Class A Certificates

|

$

|

19,288,325.67

|

||

|

(b)

|

The aggregate amount of Collections of Finance Charge Receivables processed during the related Monthly Period which were allocated in respect of the Class B Certificates

|

$

|

1,701,913.15

|

||

|

(c)

|

The aggregate amount of Collections of Finance Charge Receivables processed during the related Monthly Period which were allocated in respect of the Class C Interests

|

$

|

1,701,913.15

|

||

|

(d)

|

The aggregate amount of Collections of Finance Charge Receivables processed during the related Monthly Period, any Principal Funding Investment Proceeds and amounts if any withdrawn from the Reserve Account and which were allocated in respect of the Class D Certificates

|

$

|

5,261,857.18

|

||

|

13.

|

Portfolio Yield

|

||||

|

(a)

|

The Portfolio Yield for the related Monthly Period

|

16.56%

|

|||

|

(b)

|

The Portfolio Adjusted Yield

|

13.56%

|

|||

|

D.

|

Floating Rate Determinations

|

|||

|

LIBOR rates for the related Interest Period:

|

||||

|

Class A and Class B determination -

|

0.25344%

|

|||

|

E.

|

Supplemental Information

|

||||

|

1.

|

Collections of Trust Receivables and Payment Rates

|

||||

|

(a)

|

The aggregate amount of Collections processed during the related Monthly Period (excluding Interchange)

|

$

|

11,667,266,449.83

|

||

|

(b)

|

The aggregate amount of Principal Collections processed during the related Monthly Period

|

$

|

10,166,680,930.10

|

||

|

(c)

|

Collections of Discount Option Receivables for the related Monthly Period

|

$

|

574,434,952.58

|

||

|

(d)

|

The aggregate amount of Finance Charge Collections processed during the related Monthly Period (excluding Interchange and Collections of Discount Option Receivables)

|

$

|

926,150,567.15

|

||

|

(e)

|

Collections as a percentage of prior month Principal Receivables and Finance Charge Receivables

|

14.70%

|

|||

|

(f)

|

Collections of Principal Receivables as a percentage of prior month Principal Receivables

|

13.70%

|

|||

|

2.

|

Receivables in the Trust

|

||||

|

BA Master Credit Card Trust II

|

|||||

|

(a)

|

The aggregate amount of Receivables in the Trust as of the beginning of the related Monthly Period

|

$

|

79,379,163,566.55

|

||

|

(b)

|

The aggregate amount of Principal Receivables in the Trust as of the beginning of the related Monthly Period

|

$

|

74,224,299,239.95

|

||

|

(c)

|

Discount Option Receivables as of the beginning of the related Monthly Period

|

$

|

4,193,800,517.51

|

||

|

(d)

|

The aggregate amount of Finance Charge Receivables in the Trust as of the beginning of the related Monthly Period (excluding Discount Option Receivables)

|

$

|

961,063,809.09

|

||

|

(e)

|

The aggregate amount of Receivables in the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

78,945,057,934.72

|

||

|

(f)

|

The aggregate amount of Principal Receivables in the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

74,126,551,711.46

|

||

|

(g)

|

Discount Option Receivables as of the end of the day on the last day of the related Monthly Period

|

$

|

3,921,696,624.55

|

||

|

(h)

|

The aggregate amount of Finance Charge Receivables in the Trust as of the end of the day on the last day of the related Monthly Period (excluding Discount Option Receivables)

|

$

|

896,809,598.71

|

||

|

(i)

|

Discounted Percentage for related Monthly Period

|

3.00%

|

|||

|

Transferor’s Interest

|

|||||

|

(j)

|

Aggregate Investor Interest for all outstanding Series of the Trust as of the end of the day on the last day of the related Monthly Period

|

$

|

61,011,944,517.00

|

||

|

(k)

|

Transferor Interest as of the end of the day on the last day of the related Monthly Period

|

$

|

13,114,607,194.46

|

||

|

Series 1997-B

|

|||||

|

(l)

|

The amount of Principal Receivables in the Trust represented by the Investor Interest of Series 1997-B as of the end of the day on the last day of the related Monthly Period

|

$

|

1,231,880,000.00

|

||

|

3.

|

Trust Yields

|

||||

|

Series 1997-B

|

|||||

|

(a)

|

Collections of Finance Charge Receivables (other than Interchange, Recoveries and Collections of Discount Option Receivables but including Interest Funding Account Investment Proceeds) allocated to Series 1997-B for the related Monthly Period

|

$

|

14,601,794.61

|

||

|

(b)

|

Collections of Discount Option Receivables allocated to Series 1997-B

|

$

|

9,533,736.71

|

||

|

(c)

|

Interchange allocated to Series 1997-B

|

$

|

3,044,657.98

|

||

|

(d)

|

Recoveries allocated to Series 1997-B

|

$

|

773,819.85

|

||

|

(e)

|

Total Collections of Finance Charge Receivables, Discount Option Receivables, Interchange and Recoveries (collectively, “Cash Yield”) allocated to Series 1997-B for the related Monthly Period

|

$

|

27,954,009.15

|

||

|

(f)

|

Aggregate Investor Default Amount allocated to Series 1997-B for the related Monthly Period

|

$

|

10,954,098.87

|

||

|

(g)

|

Cash Yield net of Aggregate Investor Default Amount (collectively, “Portfolio Yield”) for Series 1997-B, each for the related Monthly Period

|

$

|

16,999,910.28

|

||

|

(h)

|

Total Cash Yield for the related Monthly Period as a percentage of Series 1997-B Investor Interest

|

27.23%

|

|||

|

(i)

|

Total Cash Yield excluding Recoveries, each for the related Monthly Period, as a percentage of Series 1997-B Investor Interest

|

26.48%

|

|||

|

(j)

|

Aggregate Investor Default Amount for the related Monthly Period as a percentage of Series 1997-B Investor Interest

|

10.67%

|

|||

|

(k)

|

Aggregate Investor Default Amount net of Recoveries, each for the related Monthly Period, as a percentage of Series 1997-B Investor Interest

|

9.92%

|

|||

|

(l)

|

The Portfolio Yield for the related Monthly Period as a percentage of Series 1997-B Investor Interest

|

16.56%

|

|||

|

(m)

|

Base Rate for the related Monthly Period

|

2.40%

|

|||

|

(n)

|

Excess Available Funds Percentage for the related Monthly Period

|

14.16%

|

|||

|

(o)

|

Three Month Average Excess Available Funds Percentage for the related Monthly Period

|

14.06%

|

|||

|

FIA CARD SERVICES, NATIONAL ASSOCIATION,

|

|

|

Servicer

|

|

|

By: /s/Stephanie L. Vincent

|

|

|

Name: Stephanie L. Vincent

|

|

|

Title: Vice President

|

|

|

1997-B

|

|