FILED PURSUANT TO RULE 424(b)(5)

REGISTRATION NO. 333-83374

| Subject to Completion Preliminary Prospectus Supplement Dated August 14, 2002 |

| PROSPECTUS SUPPLEMENT (To prospectus dated April 1,

2002) |

1,000,000 Units

Merrill Lynch & Co., Inc.

Market Index Target-Term Securities®

Linked

to the USD/EUR Exchange Rate due August , 2005

“MITTS® Securities”

$10 principal amount

per unit

| The MITTS Securities: • 100% principal protection at maturity. • No payments before the maturity date. • Linked to the value of the U.S. Dollar/Euro exchange rate, a rate which expresses the number of U.S. Dollars that can be exchanged for one Euro. • Senior unsecured debt securities of Merrill Lynch & Co., Inc. • We have applied to have the MITTS Securities listed on the American Stock Exchange under the trading symbol

“EUF”. • Expected settlement date: August

, 2002.

|

|

Payment on the MITTS Securities: • On the maturity date, for each unit of the MITTS Securities that you own, we will pay you an amount equal to the sum of the principal amount of each unit and an additional

amount based on the percentage increase, if any, in the value of the U.S. Dollar/Euro exchange rate, i.e. the appreciation of the Euro, multiplied by a participation rate expected to be between 190% and 210%. However, in no event will the

amount payable exceed a maximum payment expected to be between $11.90 and $12.10 per MITTS Security. The actual participation rate and maximum payment will be determined on the date the MITTS Securities are priced for initial sale to the public and

will appear in the final prospectus supplement. • At maturity, you will

receive no less than the principal amount of your MITTS Securities. |

Investing in the MITTS

Securities involves risks that are described in the “Risk Factors” section beginning on page S-8 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

|

Per Unit

|

|

Total

|

| Public offering price (1) |

|

$10.00 |

|

$10,000,000 |

| Underwriting discount |

|

$ |

|

$ |

| Proceeds, before expenses, to Merrill Lynch & Co., Inc. |

|

$ |

|

$ |

| |

(1) |

The public offering price and the underwriting discount for any single transaction to purchase 100,000 units or more will be

$ per unit and $ per unit, respectively. |

Merrill Lynch & Co.

The date of this prospectus supplement is August , 2002.

“MITTS” and “Market Index Target-Term Securities” are registered service marks and “Protected Growth” is a service mark of

Merrill Lynch & Co., Inc.

Prospectus Supplement

| |

|

Page

|

| |

|

S-4 |

| What are the MITTS Securities? |

|

S-4 |

| What will I receive on the stated maturity date of the MITTS Securities? |

|

S-4 |

| Will I receive interest payments on the MITTS Securities? |

|

S-6 |

| What is the Euro? |

|

S-6 |

| What does the USD/EUR Rate reflect? |

|

S-6 |

| How has the USD/EUR Rate performed historically? |

|

S-6 |

| What about taxes? |

|

S-6 |

| Will the MITTS Securities be listed on a stock exchange? |

|

S-6 |

| What is the role of MLPF&S? |

|

S-7 |

| What is ML&Co.? |

|

S-7 |

| Are there any risks associated with an investment in the MITTS Securities? |

|

S-7 |

| |

|

S-8 |

| You may not earn a return on your investment |

|

S-8 |

| Your return may be limited |

|

S-8 |

| Your yield may be lower than the yield on a standard debt security of comparable maturity |

|

S-8 |

| The value of the MITTS Securities is closely related to changes in the value of the Euro relative to the U.S.

Dollar |

|

S-8 |

| There may be an uncertain trading market for the MITTS Securities |

|

S-9 |

| Even though currency trades around-the-clock, your MITTS Securities will trade on the AMEX only during regular trading

hours |

|

S-9 |

| Many factors affect the trading value of the MITTS Securities; these factors interrelate in complex ways and the effect

of any one factor may offset or magnify the effect of another factor |

|

S-9 |

| Potential conflicts |

|

S-10 |

| Tax consequences |

|

S-11 |

| |

|

S-12 |

| Payment at maturity |

|

S-12 |

| Hypothetical returns |

|

S-14 |

| Events of Default and Acceleration |

|

S-14 |

| Depositary |

|

S-15 |

| Same-Day Settlement and Payment |

|

S-17 |

| |

|

S-17 |

| |

|

S-20 |

| General |

|

S-20 |

| U.S. Holders |

|

S-21 |

| Non-U.S. Holders |

|

S-22 |

| Backup withholding |

|

S-22 |

| |

|

S-23 |

| |

|

S-24 |

| |

|

S-24 |

| |

|

S-24 |

| |

|

S-25 |

| |

|

S-25 |

| |

|

S-26 |

S-2

Prospectus

| |

|

Page

|

| MERRILL LYNCH & CO., INC |

|

2 |

| USE OF PROCEEDS |

|

2 |

| RATIO OF EARNINGS TO FIXED CHARGES AND RATIOS OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK

DIVIDENDS |

|

3 |

| THE SECURITIES |

|

3 |

| DESCRIPTION OF DEBT SECURITIES |

|

4 |

| DESCRIPTION OF DEBT WARRANTS |

|

10 |

| DESCRIPTION OF CURRENCY WARRANTS |

|

12 |

| DESCRIPTION OF INDEX WARRANTS |

|

14 |

| DESCRIPTION OF PREFERRED STOCK |

|

19 |

| DESCRIPTION OF DEPOSITARY SHARES |

|

24 |

| DESCRIPTION OF PREFERRED STOCK WARRANTS |

|

28 |

| DESCRIPTION OF COMMON STOCK |

|

30 |

| DESCRIPTION OF COMMON STOCK WARRANTS |

|

34 |

| PLAN OF DISTRIBUTION |

|

36 |

| WHERE YOU CAN FIND MORE INFORMATION |

|

37 |

| INCORPORATION OF INFORMATION WE FILE WITH THE SEC |

|

37 |

| EXPERTS |

|

38 |

S-3

This summary includes questions and answers that highlight selected information from

this prospectus supplement and the accompanying prospectus to help you understand the Market Index Target-Term Securities® Linked to the USD/EUR Exchange Rate due August , 2005 (the “MITTS Securities”). You should carefully read this prospectus supplement and the accompanying prospectus to fully understand

the terms of the MITTS Securities, as well as the tax and other considerations that are important to you in making a decision about whether to invest in the MITTS Securities. You should carefully review the “Risk Factors” section, which

highlights certain risks, to determine whether an investment in the MITTS Securities is appropriate for you.

References in this prospectus supplement to “ML&Co.”, “we”, “us” and “our” are to Merrill Lynch & Co., Inc., and references to “MLPF&S” are to Merrill Lynch, Pierce,

Fenner & Smith Incorporated.

In this prospectus supplement and the accompanying prospectus, unless otherwise

specified or unless the context otherwise requires, references to “Euro” or “EUR” are to the lawful currency of the member states of the European Union that adopt the single currency in accordance with the treaty establishing the

European Community (the “EC”) as amended by the Treaty on European Union, and references to “Dollars”, “$”, “U.S.$” or “USD” are to the lawful currency of the United States.

What are the MITTS Securities?

The MITTS Securities will be a series of senior debt securities issued by ML&Co. and will not be secured by collateral. The MITTS Securities will rank equally with all of our other unsecured and unsubordinated debt. The MITTS

Securities will mature on August , 2005. We cannot redeem the MITTS Securities at an earlier date. We will not make any payments on the MITTS Securities until maturity. We have designed the MITTS Securities for investors who

want to protect their investment by receiving at least the principal amount of their investment at maturity and who also want to participate in the possible appreciation of the Euro relative to the U.S. Dollar.

Each unit of MITTS Securities represents $10 principal amount of MITTS Securities. You may transfer the MITTS Securities only in whole

units. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the MITTS Securities in the form of a global certificate, which will be held by The Depository

Trust Company, also known as DTC, or its nominee. Direct and indirect participants in DTC will record your ownership of the MITTS Securities. You should refer to the section “Description of the MITTS Securities—Depositary” in this

prospectus supplement.

What will I receive on the stated maturity date of the MITTS Securities?

On the stated maturity date, you will receive a cash payment on the MITTS Securities equal to the sum of two amounts: the

“principal amount” and the “Supplemental Redemption Amount”, if any.

Principal Amount

The “principal amount” per unit is $10.

Supplemental Redemption Amount

The “Supplemental Redemption Amount” per unit will equal:

| $10 x |

|

( |

|

Ending Value – Starting Value

Starting Value |

|

) |

|

x |

|

Participation

Rate |

but will not be less than zero nor greater than an amount expected to be between $1.90 and

$2.10 per MITTS Security (the “Capped Value”). We will determine the Capped Value on the date the MITTS Securities are priced for initial sale to the public (the “Pricing Date”) and it will be disclosed in the final prospectus

supplement delivered in connection with sales of the MITTS Securities.

S-4

The “Starting Value” will be equal to the U.S.

Dollar/Euro exchange rate (the “USD/EUR Rate”) in the interbank market as reported by Reuters Group PLC (“Reuters”) on page 1FED at approximately 10:00 a.m. New York City time on the Pricing Date. We will disclose the

Starting Value to you in the final prospectus supplement delivered in connection with sales of the MITTS Securities.

The “Ending Value” will be equal to the USD/EUR Rate in the interbank market as reported by Reuters on page 1FED, or any substitute page thereto, at approximately 10:00 a.m. New York City time, on the fifth scheduled

Business Day prior to the stated maturity date of the MITTS Securities. If the USD/EUR Rate is not so quoted by Reuters on page 1FED, or any substitute page thereto, then the USD/EUR Rate will be determined in accordance with the procedures

described in this prospectus supplement. If such day is not a Business Day, then the USD/EUR Rate will be determined on the immediately succeeding Business Day.

The “Participation Rate” means a factor expected to be between 190% and 210%. We will determine the Participation Rate on the Pricing Date and it will be disclosed in the final

prospectus supplement delivered in connection with sales of the MITTS Securities.

For more specific information

about the Supplemental Redemption Amount, please see the section “Description of the MITTS Securities” in this prospectus supplement.

We will pay you a Supplemental Redemption Amount only if the Ending Value is

Examples

Set forth below are three examples of Supplemental Redemption Amount calculations assuming a Participation Rate of 200% and a Capped Value of $2.00:

Example 1—The Euro has depreciated versus the U.S. Dollar (i.e., the USD/EUR Rate has decreased):

Hypothetical Starting Value: 0.9864

Hypothetical

Ending Value: 0.8878

| Supplemental Redemption Amount (per unit) = $10 × |

( |

0.8878 – 0.9864

0.9864 |

) |

x 200% = $0.00 |

|

(Supplemental

Redemption

Amount cannot

be less than zero) |

Total payment

at maturity = $10.00 + $0.00 = $10.00

Example 2—The Euro has moderately appreciated versus the U.S. Dollar (i.e., the USD/EUR Rate has

slightly increased):

Hypothetical Starting Value: 0.9864

Hypothetical

Ending Value: 1.0259

| Supplemental Redemption Amount (per unit) = $10 × |

( |

1.0259 – 0.9864

0.9864 |

) |

x 200% = $0.80 |

|

|

Total payment at maturity (per unit) = $10.00 + $0.80 = $10.80

Example 3—The Euro has shown strong appreciation versus the U.S. Dollar (i.e., the USD/EUR Rate has greatly increased):

Hypothetical Starting Value: 0.9864

Hypothetical Ending Value: 1.1245

| Supplemental Redemption Amount (per unit) = $10 × |

( |

1.1245 – 0.9864

0.9864 |

) |

x 200% = $2.00 |

|

(Supplemental

Redemption

Amount cannot

be greater than Capped Value) |

Total amount payable at maturity = $10.00 + $2.00 = $12.00

S-5

greater than the Starting Value. If the Ending Value is less than, or equal to, the Starting Value, the Supplemental Redemption Amount will be zero. We will pay you the principal amount of

your MITTS Securities regardless of whether any Supplemental Redemption Amount is payable.

For more information

about risks associated with the MITTS Securities, please see the section entitled “Risk Factors” in this prospectus supplement.

Will I receive interest payments on the MITTS Securities?

You will not receive any

interest payments on the MITTS Securities, but will instead receive the principal amount plus the Supplemental Redemption Amount, if any, at maturity. We have designed the MITTS Securities for investors who are willing to forego market interest

payments on the MITTS Securities, such as floating interest rates paid on standard senior non-callable debt securities, in exchange for the ability to participate in the possible appreciation of the Euro versus the U.S. Dollar.

What is the Euro?

The Euro is the official currency of the member states of the European Economic and Monetary Union.

It was introduced in January 1999 and replaced the national currencies of the then 11 participating countries. The Euro is the official currency of the member states of the European Economic and Monetary Union that adopted the single

currency in accordance with the treaty establishing the EC, as amended by the Treaty on European Union. The following 12 countries currently use the Euro as their official currency: Germany, Belgium, Greece, Luxembourg, Spain, France, Ireland,

Italy, the Netherlands, Austria, Portugal and Finland. There is a possibility that in the future other EC countries may adopt the Euro as their official currency.

What does the USD/EUR Rate reflect?

The USD/EUR Rate is a

foreign exchange spot rate that measures the relative value of two currencies, the Euro and the U.S. Dollar. The rate is expressed as the number of U.S. Dollars that can be exchanged for one Euro. The USD/EUR Rate increases when the Euro appreciates

relative to the U.S. Dollar and decreases when the Euro depreciates relative to the U.S. Dollar. On August 14, 2002, the USD/EUR Rate was equal to 0.9864, which was the rate in the interbank market as reported by Reuters on page 1FED at

approximately 10:00 a.m. New York City time.

How has the USD/EUR Rate performed historically?

We have provided a table showing the monthly high, low and month-end levels of the USD/EUR Rate for each month from January 1999 to July

2002, as obtained from Bloomberg L.P. You can find this table in the section entitled “USD/EUR Rate” in this prospectus supplement. We have provided this historical information to help you evaluate the behavior of the USD/EUR Rate in

various economic environments; however, past performance of the USD/EUR Rate is not indicative of how the USD/EUR Rate will perform in the future.

What about taxes?

You generally should only be required to recognize income, gain, or loss

on the maturity date or upon a sale or exchange of a MITTS Security prior to the maturity date. You should review the discussion under the section entitled “United States Federal Income Taxation”.

Will the MITTS Securities be listed on a stock exchange?

We have applied to have the MITTS Securities listed on the AMEX under the symbol “EUF”. You should be aware that the listing of the MITTS Securities on the AMEX will not necessarily ensure

that a liquid trading market will be available for the MITTS Securities. You should review the section entitled “Risk Factors—There may be an uncertain trading market for the MITTS Securities” in this prospectus supplement.

S-6

What is the role of MLPF&S?

MLPF&S, our subsidiary, is the underwriter for the offering and sale of the MITTS Securities. After the initial offering, MLPF&S intends to buy and sell MITTS

Securities to create a secondary market for holders of the MITTS Securities, and may stabilize or maintain the market price of the MITTS Securities during the initial distribution. However, MLPF&S will not be obligated to engage in any of these

market activities or to continue them once it has started.

MLPF&S also will be our agent for purposes of

calculating, among other things, the USD/EUR Rate and the Supplemental Redemption Amount . Under certain circumstances, these duties could result in a conflict of interest between MLPF&S’s status as our subsidiary and its responsibilities

as calculation agent.

What is ML&Co.?

Merrill Lynch & Co., Inc. is a holding company with various subsidiaries and affiliated companies that provide investment, financing, insurance and related services on a global basis. For

information about ML&Co., please see the section entitled “Merrill Lynch & Co., Inc.” in the accompanying prospectus. You should also read the other documents we have filed with the SEC, which you can find by referring to the

section entitled “Where You Can Find More Information” in this prospectus supplement.

Are there any risks associated with

an investment in the MITTS Securities?

Yes, an investment in the MITTS Securities is subject to certain

risks. Please refer to the section entitled “Risk Factors” in this prospectus supplement.

S-7

Your investment in the MITTS Securities will involve certain risks. You

should consider carefully the following discussion of risks before you decide that an investment in the MITTS Securities is suitable for you.

You may not earn a return on your investment

You should be aware that if, at maturity, the

Ending Value does not exceed the Starting Value, i.e. the Euro has not appreciated versus the U.S. Dollar, the Supplemental Redemption Amount will be zero. This will be true even if the USD/EUR Rate was higher than the Starting Value at some time

during the life of the MITTS Securities but later falls below the Starting Value. If the Supplemental Redemption Amount is zero, we will pay you only the principal amount of your MITTS Securities.

Your return may be limited

Although you will receive the principal amount of $10.00 per unit of your MITTS Securities at maturity, in no event will the Supplemental Redemption Amount be greater than the Capped Value, an amount expected to be between $1.90 and

$2.10 per unit. We will determine the Capped Value on the Pricing Date and disclose this value in the final prospectus supplement delivered in connection with sales of the MITTS Securities.

Your yield may be lower than the yield on a standard debt security of comparable maturity

The amount we pay you at maturity may be less than the return you could earn on other investments. Your yield may be less than the yield you would earn if you bought a standard senior non-callable debt

security of ML&Co. with the same stated maturity date. Your investment may not reflect the full opportunity cost to you when you take into account factors that affect the time value of money.

The value of the MITTS Securities is closely related to changes in the value of the Euro relative to the U.S. Dollar

The value of any currency, including the Euro and the U.S. Dollar, may be affected by complex political and economic factors. The exchange rate of the Euro in terms of the

U.S. Dollar is at any moment a result of the supply and demand for the two currencies, and changes in the exchange rate result over time from the interaction of many factors directly or indirectly affecting economic and political conditions in the

European Union and the United States, including economic and political developments in other countries. Of particular importance are the relative rates of inflation, interest rate levels, the balance of payments and the extent of governmental

surpluses or deficits in the European Union and in the United States, all of which are in turn sensitive to the monetary, fiscal and trade policies pursued by the European Union, the governments of the European Union, the United States and other

countries important to international trade and finance.

Foreign exchange rates can either be fixed by sovereign

governments or floating. Exchange rates of most economically developed nations, including the European Union, are permitted to fluctuate in value relative to the U.S. Dollar. However, governments sometimes do not allow their currencies to float

freely in response to economic forces. Governments, including the European Union, use a variety of techniques, such as intervention by their central bank or imposition of regulatory controls or taxes, to affect the exchange rates of their respective

currencies. They may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by devaluation or revaluation of a currency. Thus, a special risk in purchasing the MITTS Securities is

that their liquidity, trading value and amounts payable could be affected by the actions of sovereign governments or the European Union which could change or interfere with theretofore freely determined currency valuation, fluctuations in response

to other market forces and the movement of currencies across borders. There will be no adjustment or change in the terms of the MITTS Securities in the event that exchange rates should become fixed, or in the event of any devaluation or revaluation

or imposition of exchange or other regulatory controls or taxes, or in the event of the issuance of a replacement currency or in the event of other developments affecting the Euro, the U.S. Dollar or any other currency.

S-8

There may be an uncertain trading market for the MITTS Securities

We have applied to have the MITTS Securities listed on the American Stock Exchange under the symbol “EUF”. While there have been

a number of issuances of series of Market Index Target-Term Securities, trading volumes have varied historically from one series to another and it is therefore impossible to predict how the MITTS Securities will trade. You cannot assume that a

trading market will develop for the MITTS Securities. If a trading market does develop, there can be no assurance that there will be liquidity in the trading market. The development of a trading market for the MITTS Securities will depend on our

financial performance, and other factors such as the appreciation, if any, in the value of the Euro relative to the U.S. Dollar.

If the trading market for the MITTS Securities is limited, there may be a limited number of buyers for your MITTS Securities if you do not wish to hold your investment until maturity. This may affect the price you receive.

Even though currency trades around-the-clock, your MITTS Securities will trade on the AMEX only during regular trading hours

The interbank market in foreign currencies is a global, around-the-clock market. Therefore, the hours of

trading for the MITTS Securities will not conform to the hours during which the Euro and U.S. Dollar are traded. To the extent that the AMEX is closed while the markets for the Euro remain open, significant price and rate movements may take place in

the underlying foreign exchange markets that will not be reflected immediately in the price of a MITTS Security on such exchange. The possibility of these movements should be taken into account in relating closing prices on the AMEX for the MITTS

Securities to those in the underlying foreign exchange markets.

There is no systematic reporting of last-sale

information for foreign currencies. Reasonably current bid and offer information is available in certain brokers’ offices, in bank foreign currency trading offices, and to others who wish to subscribe for this information, but this information

will not necessarily reflect the USD/EUR Rate used to calculate the Supplemental Redemption Amount, if any. There is no regulatory requirement that those quotations be firm or revised on a timely basis. The absence of last-sale information and the

limited availability of quotations to individual investors may make it difficult for many investors to obtain timely, accurate data about the state of the underlying foreign exchange markets.

Many factors affect the trading value of the MITTS Securities; these factors interrelate in complex ways and the effect of any one factor may offset or magnify the effect of another

factor

The trading value of the MITTS Securities will be affected by factors that interrelate in complex

ways. It is important for you to understand that the effect of one factor may offset the increase in the trading value of the MITTS Securities caused by another factor, and that the effect of one factor may exacerbate the decrease in the trading

value of the MITTS Securities caused by another factor. For example, a decrease in USD/EUR Rate volatility may offset some or all of any increase in the trading value of the MITTS Securities attributable to another factor, such as any increase in

the USD/EUR Rate. The following paragraphs describe the expected impact on the trading value of the MITTS Securities given a change in a specific factor, assuming all other conditions remain constant.

The value of the USD/EUR Rate is expected to affect the trading value of the MITTS Securities. We

expect that the market value of the MITTS Securities will depend substantially on the amount by which the Euro appreciates versus the U.S. Dollar over the term of the MITTS Securities. If you choose to sell your MITTS Securities when the USD/EUR

Rate exceeds the Starting Value, you may receive substantially less than the amount that would be payable at maturity based on that value because of the expectation that the USD/EUR Rate will continue to fluctuate until the Ending Value is

determined. If you choose to sell your MITTS Securities when the USD/EUR Rate is below, or not sufficiently above, the Starting Value, you may receive less than the $10 principal amount per unit of MITTS Securities.

S-9

Changes in the levels of interest rates are expected to affect the trading

value of the MITTS Securities. We expect that interest rates will affect the trading value of the MITTS Securities. In general, if U.S. interest rates increase, we expect that the trading value of the MITTS Securities

will decrease and, conversely, if U.S. interest rates decrease, we expect that the trading value of the MITTS Securities will increase. In general, if Euro interest rates increase, we expect that the trading value of the MITTS Securities will

increase and, conversely, if Euro interest rates decrease, we expect that the trading value of the MITTS Securities will decrease. Interest rates may also affect the economies of the member countries of the European Union or the United States, and,

in turn, the USD/EUR Rate.

Changes in volatility of the USD/EUR Rate are expected to affect the trading

value of the MITTS Securities. Volatility is the term used to describe the size and frequency of price and/or market fluctuations. If the volatility of the USD/EUR Rate increases or decreases, the trading value of the

MITTS Securities may be adversely effected.

As the time remaining to maturity of the MITTS Securities

decreases, the “time premium” associated with the MITTS Securities will decrease. We anticipate that before their maturity, the MITTS Securities may trade at a value above that which would be expected based

on the level of the USD/EUR Rate. This difference will reflect a “time premium” due to expectations concerning the value of the Euro relative to the U.S. Dollar prior to the maturity of the MITTS Securities. However, as the time remaining

to the maturity of the MITTS Securities decreases, we expect that this time premium will decrease, lowering the trading value of the MITTS Securities.

Changes in our credit ratings may affect the trading value of the MITTS Securities. Our credit ratings are an assessment of our ability to pay our obligations.

Consequently, real or anticipated changes in our credit ratings may affect the trading value of the MITTS Securities. However, because the return on your MITTS Securities is dependent upon factors in addition to our ability to pay our obligations

under the MITTS Securities, such as any fluctuations in the USD/EUR Rate, an improvement in our credit ratings will not reduce other investment risks related to MITTS Securities.

In general, assuming all relevant factors are held constant, we expect that the effect on the trading value of the MITTS Securities of a given change in most of the factors

listed above will be less if it occurs later in the term of the MITTS Securities than if it occurs earlier in the term of the MITTS Securities. However, we expect that the effect on the trading value of the MITTS Securities of a given increase in

the USD/EUR Rate will be greater if it occurs later in the term of the MITTS Securities than if it occurs earlier in the term of the MITTS Securities.

Potential conflicts

The calculation agent for the MITTS Securities is MLPF&S, our

subsidiary. Under certain circumstances, MLPF&S’ role as our subsidiary and its responsibilities as calculation agent for the MITTS Securities could give rise to conflicts of interests. MLPF&S is required to carry out its duties as

calculation agent in good faith and using its reasonable judgment. However, you should be aware that because we control MLPF&S, potential conflicts of interest could arise.

At any given time, we and our affiliates may be engaging in foreign exchange or currency derivative transactions and expect to enter into such transactions in connection

with hedging our obligations under the MITTS Securities. These transactions could affect the value of the USD/EUR Rate in a manner that would be adverse to your investment in the MITTS Securities.

We have entered into an arrangement with one of our subsidiaries to hedge the market risks associated with our obligations in connection

with the MITTS Securities. This subsidiary expects to make a profit in connection with this arrangement. We did not seek competitive bids for this arrangement from unaffiliated parties.

S-10

ML&Co. or its affiliates may from time to time publish research reports on

the foreign exchange markets, exchange rates and other matters that may have an influence on the USD/EUR Rate. These reports may express opinions or provide recommendations that are inconsistent with an investment in the MITTS Securities. Any

prospective purchaser of the MITTS Securities should make an independent investigation of the foreign currency markets as in their judgement is appropriate to make an informed decision regarding an investment in the MITTS Securities and its

suitability for them in the light of their particular circumstances.

Tax consequences

You should consider the tax consequences of investing in the MITTS Securities. See the section entitled “United States Federal Income

Taxation” in this prospectus supplement.

S-11

DESCRIPTION OF THE MITTS SECURITIES

ML&Co. will issue the MITTS Securities as a

series of senior debt securities under the 1983 Indenture, which is more fully described in the accompanying prospectus. The MITTS Securities will mature on August , 2005.

While at maturity a beneficial owner of a MITTS Security will receive the sum of the principal amount of the MITTS Security plus the Supplemental Redemption Amount, if

any, there will be no other payment of interest, periodic or otherwise. See “—Payment at maturity”.

The MITTS Securities will not be subject to redemption by ML&Co. or at the option of any beneficial owner before maturity. If an Event of Default occurs with respect to the MITTS Securities, holders of the MITTS Securities

may accelerate the maturity of the MITTS Securities, as described under “—Events of Default and Acceleration” in this prospectus supplement and “Description of Debt Securities—Events of Default” in the accompanying

prospectus.

ML&Co. will issue the MITTS Securities in denominations of whole units each with a principal

amount of $10.00 per unit.

The MITTS Securities will not have the benefit of any sinking fund.

Payment at maturity

At maturity, a beneficial owner of a MITTS Security will be entitled to receive the principal amount of that MITTS Security plus a Supplemental Redemption Amount, if any, all as provided below. If the Ending Value does not exceed the

Starting Value, a beneficial owner will be entitled to receive only the principal amount of the MITTS Security.

The “Supplemental Redemption Amount” for a MITTS Security will be determined by the calculation agent and will equal:

| principal amount of each MITTS Security ($10 per unit) x |

|

( |

|

Ending Value - Starting Value

Starting Value |

|

) |

|

x |

|

Participation Rate |

| |

|

|

|

|

provided, however, that in no event will the Supplemental Redemption Amount be less

than zero nor greater than the Capped Value, expected to be between $1.90 and $2.10 per MITTS Security.

The

“Starting Value” will be equal to the USD/EUR Rate in the interbank market as reported by Reuters Group PLC (“Reuters”) on page 1FED at approximately 10:00 a.m. New York City time on the Pricing Date. We will disclose the

Starting Value to you in the final prospectus supplement delivered in connection with sales of the MITTS Securities.

The “Ending Value” will be equal to the USD/EUR Rate in the interbank market as reported by Reuters on page 1FED, or any substitute page thereto, at approximately 10:00 a.m. New York City time, on the fifth

scheduled Business Day prior to the stated maturity date of the MITTS Securities. However, if the USD/EUR Rate is not so quoted by Reuters on page 1FED, or any substitute page thereto, then the USD/EUR Rate will be calculated on the basis of the

arithmetic mean of the applicable spot quotations received by the calculation agent at approximately 10:00 a.m. New York City time on such date for the purchase or sale by the Reference Dealers of the Reference Amount for settlement two Business

Days later. If fewer than two Reference Dealers provide such spot quotations, then the USD/EUR Rate will be calculated on the basis of the arithmetic mean of the applicable spot quotations received by the calculation agent at approximately 10:00

a.m. New York

S-12

City time on such date from three leading commercial banks in New York (selected in the sole discretion of the calculation agent), for the sale by such banks of the Reference Amount for

settlement two Business Days later. If these spot quotations are available from fewer than three banks, then the calculation agent, in its sole discretion, shall determine which spot rate is available and reasonable to be used. If no such spot

quotation is available, then the USD/EUR Rate will be the rate the calculation agent, in its sole discretion, determines to be fair and reasonable under the circumstances at approximately 10:00 a.m. New York City time on such date. If the fifth

scheduled Business Day prior to the stated maturity date is not a Business Day, the USD/EUR Rate will be determined on the immediately succeeding Business Day.

The “Participation Rate” means a factor expected to be between 190% and 210%. We will determine the Participation Rate on the Pricing Date and it will be disclosed in the final

prospectus supplement delivered in connection with sales of the MITTS Securities.

“Business Day”

means any day other than a Saturday or Sunday that is neither a legal holiday nor a day on which banking institutions in The City of New York or the member states of the European Union which use the Euro as their official currency are authorized or

required by law, regulation or executive order to close and such banks are open for dealing in a foreign exchange and foreign currency deposits.

The “Reference Amount” equals 1,000,000 Euros.

“Reference Dealers” as used herein, means Citibank, N.A., Deutsche Bank A.G. and JPMorgan Chase Bank, or their successors.

S-13

Hypothetical returns

The following table illustrates, for a hypothetical Starting Value and a range of hypothetical Ending Values of the USD/EUR Rate:

| |

• |

the percentage change from the hypothetical Starting Value to the hypothetical Ending Value, |

| |

• |

the total amount payable at maturity for each unit of MITTS Securities, |

| |

• |

the total rate of return to beneficial owners of the MITTS Securities, and |

| |

• |

the pretax annualized rate of return to beneficial owners of MITTS Securities. |

The following table also assumes a Participation Rate of 200% and a Capped Value equal to $2.00.

| Hypothetical Ending Value of USD/EUR Rate

|

|

Percentage change from

the hypothetical Starting Value to

the hypothetical Ending Value

|

|

Total amount payable

at maturity per unit of the MITTS Securities

|

|

Total rate of return on

the MITTS Securities

|

|

Pretax annualized rate of return

on the MITTS Securities(1)

|

| 0.8483 |

|

– 14% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.8680 |

|

– 12% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.8878 |

|

– 10% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.9075 |

|

– 8% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.9272 |

|

– 6% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.9469 |

|

– 4% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.9667 |

|

– 2% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 0.9864(2) |

|

– 0% |

|

$10.00 |

|

0.00% |

|

0.00% |

| 1.0061 |

|

2% |

|

$10.40 |

|

4.00% |

|

1.31% |

| 1.0259 |

|

4% |

|

$10.80 |

|

8.00% |

|

2.58% |

| 1.0456 |

|

6% |

|

$11.20 |

|

12.00% |

|

3.81% |

| 1.0653 |

|

8% |

|

$11.60 |

|

16.00% |

|

5.00% |

| 1.0850 |

|

10% |

|

$12.00 |

|

20.00% |

|

6.16% |

| 1.1048 |

|

12% |

|

$12.00 |

|

20.00% |

|

6.16% |

| 1.1245 |

|

14% |

|

$12.00 |

|

20.00% |

|

6.16% |

(1) |

The annualized rates of return specified in the preceding table are calculated on a semiannual bond equivalent basis. |

(2) |

This is the hypothetical Starting Value for purposes of this table. |

The above figures are for purposes of illustration only. The actual Supplemental Redemption Amount, received by you, if any, and the resulting total and pretax annualized

rate of return will depend on the actual Starting Value and Ending Value determined by the calculation agent as described in this prospectus supplement.

Events of Default and Acceleration

In case an Event of Default with respect to any MITTS

Securities has occurred and is continuing, the amount payable to a beneficial owner of a MITTS Security upon any acceleration permitted by the MITTS Securities, with respect to each MITTS Security, will be equal to the principal amount and the

Supplemental Redemption Amount, if any, calculated as though the date of early repayment were the stated maturity date of the MITTS Securities. See “—Payment at maturity” in this prospectus supplement. If a bankruptcy proceeding is

commenced in respect of ML&Co., the claim of the holder of a MITTS Security may be limited, under Section 502(b)(2) of Title 11 of the United States Code, to the principal amount of the MITTS Security plus an

S-14

additional amount of contingent interest calculated as though the date of the commencement of the proceeding were the maturity date of the MITTS Securities.

In case of default in payment of the MITTS Securities, whether at the stated maturity date or upon acceleration, from and after that date

the MITTS Securities will bear interest, payable upon demand of their holders, at the rate of % per annum, to the extent that payment of any interest is legally enforceable on the unpaid amount due and payable on that date in

accordance with the terms of the MITTS Securities to the date payment of that amount has been made or duly provided for.

Depositary

Description of the Global Securities

Upon issuance, all MITTS Securities will be represented by one or more fully registered global securities. Each global security will be deposited with, or on behalf of, DTC

(DTC, together with any successor, being a “depositary“), as depositary, registered in the name of Cede & Co., DTC’s partnership nominee. Unless and until it is exchanged in whole or in part for MITTS Securities in definitive

form, no global security may be transferred except as a whole by the depositary to a nominee of the depositary or by a nominee of the depositary to the depositary or another nominee of the depositary or by the depositary or any nominee to a

successor of the depositary or a nominee of that successor.

So long as DTC, or its nominee, is a registered owner

of a global security, DTC or its nominee, as the case may be, will be considered the sole owner or holder of the MITTS Securities represented by the global security for all purposes under the 1983 Indenture. Except as provided below, the beneficial

owners of the MITTS Securities represented by a global security will not be entitled to have the MITTS Securities represented by a global security registered in their names, will not receive or be entitled to receive physical delivery of the MITTS

Securities in definitive form and will not be considered the owners or holders of the MITTS Securities including for purposes of receiving any reports delivered by ML&Co. or the trustee under the 1983 Indenture. Accordingly, each person owning a

beneficial interest in a global security must rely on the procedures of DTC and, if that person is not a participant of DTC, on the procedures of the participant through which that person owns its interest, to exercise any rights of a holder under

the 1983 Indenture. ML&Co. understands that under existing industry practices, in the event that ML&Co. requests any action of holders or that an owner of a beneficial interest in a global security desires to give or take any action which a

holder is entitled to give or take under the 1983 Indenture, DTC would authorize the participants holding the relevant beneficial interests to give or take that action, and those participants would authorize beneficial owners owning through those

participants to give or take that action or would otherwise act upon the instructions of beneficial owners. Conveyance of notices and other communications by DTC to participants, by participants to indirect participants and by participants and

indirect participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

DTC Procedures

The

following is based on information furnished by DTC:

DTC will act as securities depositary for the MITTS

Securities. The MITTS Securities will be issued as fully registered securities registered in the name of Cede & Co., DTC’s partnership nominee. One or more fully registered global securities will be issued for the MITTS Securities in the

aggregate principal amount of such issue, and will be deposited with DTC.

DTC is a limited-purpose trust company

organized under the New York Banking Law, a “banking organization” within the meaning of the New York Banking Law, a member, of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform

Commercial Code, and a “clearing agency”

S-15

registered pursuant to the provisions of Section 17A of the Securities Exchange Act of 1934, as amended. DTC holds securities that its participants deposit with DTC. DTC also facilitates the

settlement among participants of securities transactions, such as transfers and pledges, in deposited securities through electronic computerized book-entry changes in participants’ accounts, thereby eliminating the need for physical movement of

securities certificates. Direct participants of DTC include securities brokers and dealers, banks, trust companies, clearing corporations and certain other organizations. DTC is owned by a number of its direct participants and by the NYSE, the AMEX,

and the National Association of Securities Dealers, Inc. Access to DTC’s system is also available to others such as securities brokers and dealers, banks and trust companies that clear through or maintain a custodial relationship with a direct

participant, either directly or indirectly. The rules applicable to DTC and its participants are on file with the SEC.

Purchases of the MITTS Securities under DTC’s system must be made by or through direct participants, which will receive a credit for the MITTS Securities on DTC’s records. The ownership interest of each beneficial owner is

in turn to be recorded on the records of direct and indirect participants. Beneficial owners will not receive written confirmation from DTC of their purchase; but beneficial owners are expected to receive written confirmations providing details of

the transaction, as well as periodic statements of their holdings, from the direct or indirect participants through which the beneficial owner entered into the transaction. Transfers of ownership interests in the MITTS Securities are to be made by

entries on the books of participants acting on behalf of beneficial owners.

To facilitate subsequent transfers,

all MITTS Securities deposited with DTC are registered in the name of DTC’s partnership nominee, Cede & Co. The deposit of MITTS Securities with DTC and their registration in the name of Cede & Co. effect no change in beneficial

ownership. DTC has no knowledge of the actual beneficial owners of the MITTS Securities; DTC’s records reflect only the identity of the direct participants to whose accounts the MITTS Securities are credited, which may or may not be the

beneficial owners. The participants will remain responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by DTC to direct participants, by direct participants to indirect participants, and by direct participants and indirect participants to beneficial owners will be governed by arrangements

among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Neither

DTC nor Cede & Co. will consent or vote with respect to the MITTS Securities. Under its usual procedures, DTC mails an omnibus proxy to ML&Co. as soon as possible after the applicable record date. The omnibus proxy assigns Cede &

Co.’s consenting or voting rights to those direct participants identified in a listing attached to the omnibus proxy to whose accounts the MITTS Securities are credited on the record date.

Principal, premium, if any, and/or interest, if any, payments made in cash on the MITTS Securities will be made in immediately available funds to DTC. DTC’s

practice is to credit direct participants’ accounts on the applicable payment date in accordance with their respective holdings shown on the depositary’s records unless DTC has reason to believe that it will not receive payment on that

date. Payments by participants to beneficial owners will be governed by standing instructions and customary practices, as is the case with securities held for the accounts of customers in bearer form or registered in “street name”, and

will be the responsibility of that participant and not of DTC, the trustee or ML&Co., subject to any statutory or regulatory requirements as may be in effect from time to time. Payment of principal, premium, if any, and/or interest, if any, to

DTC is the responsibility of ML&Co. or the trustee, disbursement of those payments to direct participants will be the responsibility of DTC, and disbursement of those payment will be the responsibility of direct participants and indirect

participants.

S-16

Exchange for Certificated Securities

If:

| |

• |

the depositary is at any time unwilling or unable to continue as depositary and a successor depositary is not appointed by ML&Co. within 60 days,

|

| |

• |

ML&Co. executes and delivers to the trustee a company order to the effect that the global securities shall be exchangeable, or

|

| |

• |

an Event of Default under the 1983 Indenture has occurred and is continuing with respect to the MITTS Securities, |

the global securities will be exchangeable for MITTS Securities in definitive form of like tenor and of an equal aggregate principal amount, in denominations of

$10 and integral multiples of $10. The definitive MITTS Securities will be registered in the name or names as the depositary shall instruct the trustee. It is expected that instructions may be based upon directions received by the depositary from

participants with respect to ownership of beneficial interests in the global securities.

DTC may discontinue

providing its services as securities depositary with respect to the MITTS Securities at any time by giving reasonable notice to ML&Co. or the trustee. Under these circumstances, in the event that a successor securities depositary is not

obtained, MITTS Security certificates are required to be printed and delivered.

ML&Co. may decide to

discontinue use of the system of book-entry transfers through DTC or a successor securities depositary. In that event, MITTS Security certificates will be printed and delivered.

The information in this section concerning DTC and DTC’s system has been obtained from sources that ML&Co. believes to be reliable, but ML&Co. takes no

responsibility for its accuracy.

Same-Day Settlement and Payment

Settlement for the MITTS Securities will be made by the underwriter in immediately available funds. ML&Co. will make all payments of principal and the Supplemental

Redemption Amount, if any, in immediately available funds so long as the MITTS Securities are maintained in book-entry form.

The USD/EUR Rate is a foreign exchange spot rate that measures the

relative values of two currencies, the Euro and the U.S. Dollar. The USD/EUR Rate increases when the Euro appreciates relative to the U.S. Dollar and decreases when the Euro depreciates relative to the U.S. Dollar. The USD/EUR Rate is expressed as a

rate that reflects the amount of U.S. Dollars that can be exchanged for one Euro. A USD/EUR Rate equal to 0.9864 thus indicates that 98.64 U.S. cents can be exchanged for 1 Euro.

The following table sets forth the monthly high, low and month-end levels in the interbank market of the USD/EUR Rate from the inception of the Euro in January 1999 through

July 2002 as obtained from Bloomberg L.P. The historical performance of USD/EUR Rates should not be taken as an indication of future performance. Any historical upward or downward trend in the USD/EUR Rate during any period set forth below is not

any indication that the USD/EUR Rate is more or less likely to increase or decrease at any time during the term of the MITTS Securities.

S-17

| Year

|

|

High

|

|

Low

|

|

Month End

|

| 1999: |

|

|

|

|

|

|

| January |

|

1.1899 |

|

1.1340 |

|

1.1362 |

| February |

|

1.1398 |

|

1.0926 |

|

1.1028 |

| March |

|

1.1070 |

|

1.0680 |

|

1.0762 |

| April |

|

1.0880 |

|

1.0530 |

|

1.0570 |

| May |

|

1.0841 |

|

1.0396 |

|

1.0420 |

| June |

|

1.0558 |

|

1.0258 |

|

1.0351 |

| July |

|

1.0743 |

|

1.0108 |

|

1.0711 |

| August |

|

1.0825 |

|

1.0393 |

|

1.0566 |

| September |

|

1.0728 |

|

1.0285 |

|

1.0684 |

| October |

|

1.0912 |

|

1.0438 |

|

1.0549 |

| November |

|

1.0591 |

|

1.0036 |

|

1.0093 |

| December |

|

1.0297 |

|

0.9990 |

|

1.0062 |

| |

| 2000: |

|

|

|

|

|

|

| January |

|

1.0414 |

|

0.9668 |

|

0.9707 |

| February |

|

1.0090 |

|

0.9390 |

|

0.9642 |

| March |

|

0.9795 |

|

0.9483 |

|

0.9553 |

| April |

|

0.9750 |

|

0.9033 |

|

0.9119 |

| May |

|

0.9410 |

|

0.8850 |

|

0.9380 |

| June |

|

0.9700 |

|

0.9283 |

|

0.9525 |

| July |

|

0.9595 |

|

0.9194 |

|

0.9266 |

| August |

|

0.9286 |

|

0.8837 |

|

0.8878 |

| September |

|

0.9035 |

|

0.8443 |

|

0.8827 |

| October |

|

0.8856 |

|

0.8230 |

|

0.8489 |

| November |

|

0.8787 |

|

0.8371 |

|

0.8729 |

| December |

|

0.9431 |

|

0.8700 |

|

0.9427 |

| |

| 2001: |

|

|

|

|

|

|

| January |

|

0.9594 |

|

0.9120 |

|

0.9366 |

| February |

|

0.9444 |

|

0.9017 |

|

0.9236 |

| March |

|

0.9380 |

|

0.8751 |

|

0.8767 |

| April |

|

0.9088 |

|

0.8699 |

|

0.8891 |

| May |

|

0.9004 |

|

0.8446 |

|

0.8453 |

| June |

|

0.8670 |

|

0.8413 |

|

0.8490 |

| July |

|

0.8823 |

|

0.8352 |

|

0.8764 |

| August |

|

0.9240 |

|

0.8741 |

|

0.9123 |

| September |

|

0.9331 |

|

0.8826 |

|

0.9114 |

| October |

|

0.9240 |

|

0.8870 |

|

0.9005 |

| November |

|

0.9118 |

|

0.8737 |

|

0.8964 |

| December |

|

0.9081 |

|

0.8743 |

|

0.8895 |

| |

| 2002: |

|

|

|

|

|

|

| January |

|

0.9064 |

|

0.8574 |

|

0.8593 |

| February |

|

0.8799 |

|

0.8565 |

|

0.8693 |

| March |

|

0.8868 |

|

0.8633 |

|

0.8717 |

| April |

|

0.9044 |

|

0.8713 |

|

0.9005 |

| May |

|

0.9416 |

|

0.8989 |

|

0.9342 |

| June |

|

0.9988 |

|

0.9304 |

|

0.9914 |

| July |

|

1.0212 |

|

0.9716 |

|

0.9776 |

S-18

The following table sets forth the intraday high and low levels in the interbank

market of the USD/EUR Rate from August 1, 2002 through August 13, 2002.

| |

|

High

|

|

Low

|

| August 1st |

|

0.9856 |

|

0.9728 |

| August 2nd |

|

0.9915 |

|

0.9835 |

| August 5th |

|

0.9873 |

|

0.9800 |

| August 6th |

|

0.9811 |

|

0.9624 |

| August 7th |

|

0.9757 |

|

0.9643 |

| August 8th |

|

0.9772 |

|

0.9642 |

| August 9th |

|

0.9740 |

|

0.9653 |

| August 12th |

|

0.9798 |

|

0.9689 |

| August 13th |

|

0.9844 |

|

0.9757 |

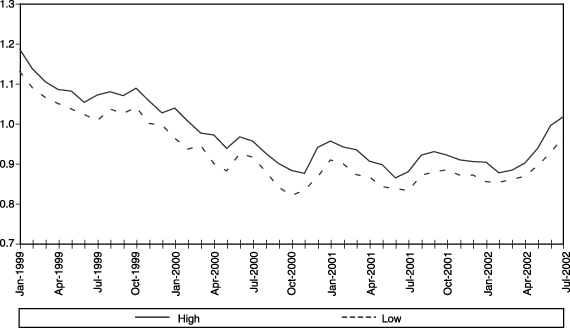

The following graph sets forth the monthly high and low levels in

the interbank market of the USD/EUR Rate from January 1999 through July 2002 set forth in the table above. The historical performance of USD/EUR Rates should not be taken as an indication of future performance.

On August 14, 2002 the USD/EUR Rate, as reported by Reuters on page 1FED at

approximately 10:00 a.m. New York City time, was equal to 0.9864.

The information presented in this prospectus

supplement relating to the exchange rates of the U.S. Dollar relative to the Euro is furnished as a matter of information only. The fluctuations in the USD/EUR Rate that have occurred in the past are not indicative of fluctuations in that rate which

may occur over the term of the MITTS Securities.

S-19

UNITED STATES FEDERAL INCOME TAXATION

Set forth in full below is the opinion of

Sidley Austin Brown & Wood LLP, tax counsel to ML&Co., as to certain United States Federal income tax consequences of the purchase, ownership and disposition of the MITTS Securities. This opinion is based upon laws,

regulations, rulings and decisions now in effect, all of which are subject to change (including retroactive changes in effective dates) or possible differing interpretations. The discussion below deals only with MITTS Securities held as capital

assets and does not purport to deal with persons in special tax situations, such as financial institutions, insurance companies, regulated investment companies, dealers in securities or currencies, traders in securities that elect to mark to market,

tax-exempt entities, persons holding MITTS Securities in a tax-deferred or tax-advantaged account, or persons holding MITTS Securities as a hedge against currency risks, as a position in a “straddle” or as part of a “hedging” or

“conversion” transaction for tax purposes. It also does not deal with holders other than original purchasers (except where otherwise specifically noted in this prospectus supplement). The following discussion also assumes that the issue

price of the MITTS Securities, as determined for United States Federal income tax purposes, equals the principal amount thereof. Persons considering the purchase of the MITTS Securities should consult their own tax advisors concerning the

application of the United States Federal income tax laws to their particular situations as well as any consequences of the purchase, ownership and disposition of the MITTS Securities arising under the laws of any other taxing jurisdiction.

As used in this prospectus supplement, the term “U.S. Holder” means a beneficial owner of a MITTS

Security that is for United States Federal income tax purposes (a) a citizen or resident of the United States, (b) a corporation, partnership or other entity treated as a corporation or a partnership created or organized in or under the laws of the

United States, any state thereof or the District of Columbia (other than a partnership that is not treated as a United States person under any applicable Treasury regulations), (c) an estate the income of which is subject to United States Federal

income taxation regardless of its source, (d) a trust if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all

substantial decisions of the trust, or (e) any other person whose income or gain in respect of a MITTS Security is effectively connected with the conduct of a United States trade or business. Notwithstanding clause (d) of the preceding sentence, to

the extent provided in Treasury regulations, certain trusts in existence on August 20, 1996, and treated as United States persons prior to that date that elect to continue to be treated as United States persons also will be U.S. Holders. As used

herein, the term “non-U.S. Holder” means a beneficial owner of a MITTS Security that is not a U.S. Holder.

General

There are no statutory provisions, regulations, published rulings or judicial decisions addressing or

involving the characterization, for United States Federal income tax purposes, of the MITTS Securities or securities with terms substantially the same as the MITTS Securities. However, although the matter is not free from doubt, under current law,

each MITTS Security should be treated as a debt instrument of ML&Co. for United States Federal income tax purposes. ML&Co. currently intends to treat each MITTS Security as a debt instrument of ML&Co. for United States Federal income tax

purposes and, where required, intends to file information returns with the Internal Revenue Service (the “IRS”) in accordance with this treatment, in the absence of any change or clarification in the law, by regulation or otherwise,

requiring a different characterization of the MITTS Securities. Prospective investors in the MITTS Securities should be aware, however, that the IRS is not bound by ML&Co.’s characterization of the MITTS Securities as indebtedness, and the

IRS could possibly take a different position as to the proper characterization of the MITTS Securities for United States Federal income tax purposes. The following discussion of the principal United States Federal income tax consequences of the

purchase, ownership and disposition of the MITTS Securities is based upon the assumption that each MITTS Security will be treated as a debt instrument of ML&Co. for United States Federal income tax purposes. If the MITTS Securities are not in

fact treated as debt instruments of ML&Co. for United

S-20

States Federal income tax purposes, then the United States Federal income tax treatment of the purchase, ownership and disposition of the MITTS Securities could differ from the treatment

discussed below with the result that the timing and character of income, gain or loss recognized in respect of a MITTS Security could differ from the timing and character of income, gain or loss recognized in respect of a MITTS Security had the

MITTS Securities in fact been treated as debt instruments of ML&Co. for United States Federal income tax purposes.

U.S. Holders

On June 11, 1996, the Treasury Department issued final regulations (the “CPDI Regulations”)

concerning the proper United States Federal income tax treatment of contingent payment debt instruments, which apply to debt instruments issued on or after August 13, 1996. In general, the CPDI Regulations cause the timing and character of income,

gain or loss reported on a contingent payment debt instrument to substantially differ from the timing and character of income, gain or loss reported on a contingent payment debt instrument under general principles of prior United States Federal

income tax law. However, debt instruments that are subject to the rules regarding foreign currency gain or loss (the “Foreign Currency Rules”) are generally exempt from the timing and character rules provided by the CPDI Regulations. Since

the amount payable at maturity with respect to the MITTS Securities in excess of the principal amount of the MITTS Securities (i.e., the Supplemental Redemption Amount) will be determined by reference to the value of the USD/EUR Rate, the MITTS

Securities generally should be subject to the Foreign Currency Rules and should not be subject to the CPDI Regulations. However, the Foreign Currency Rules do not set forth specific rules for determining the amount of income, gain or loss realized

by a taxpayer from holding a debt instrument that provides for one or more contingent payments, similar to the MITTS Securities. In the absence of any specific provision in the Foreign Currency Rules, the United States Federal income tax

consequences of the purchase, ownership and disposition of the MITTS Securities should be governed by a combination of both the general principles contained in the Foreign Currency Rules and general principles of United States Federal income tax

law.

Under general principles of United States Federal income tax law, payments of interest on a debt instrument

generally will be taxable to a U.S. Holder as ordinary interest income at the time such payments are accrued or are received (in accordance with the U.S. Holder’s regular method of tax accounting). Under these principles, the amount payable at

maturity with respect to a MITTS Security in excess of the principal amount thereof (i.e., the Supplemental Redemption Amount), if any, would be treated as contingent interest and generally would be includible in income by a U.S. Holder as ordinary

interest on the date that the Supplemental Redemption Amount is accrued (i.e., generally when the Supplemental Redemption Amount becomes fixed in amount and becomes unconditionally payable) or when such amount is received, in accordance with the

U.S. Holder’s regular method of tax accounting.

Upon the sale or exchange of a MITTS Security prior to

maturity, a U.S. Holder generally would recognize taxable gain or loss in an amount equal to the difference, if any, between the amount realized on the sale or exchange and such U.S. Holder’s adjusted tax basis in the MITTS Security. A U.S.

Holder’s adjusted tax basis in a MITTS Security generally will equal such U.S. Holder’s initial investment in the MITTS Security. Any portion of such gain or loss that is attributable to changes in the value of the USD/EUR Rate should

constitute exchange gain or loss which will be characterized as ordinary income or loss. Any such gain or loss in excess of the portion of such gain or loss that constitutes exchange gain or loss generally should be capital gain or loss and should

be long-term capital gain or loss if the MITTS Security has been held by the U.S. Holder for more than one year. It is possible, however, that the IRS could assert that all or any portion of the amounts realized upon the sale or exchange of a MITTS

Security prior to its maturity in excess of the principal amount thereof constitutes ordinary interest income. In addition, U.S. Holders purchasing a MITTS Security at a price that differs from the adjusted issue price of the MITTS Security as of

the purchase date (e.g., subsequent purchasers) may be subject to rules providing for certain adjustments to the foregoing rules and these U.S. Holders should consult their own tax advisors concerning these rules.

S-21

Non-U.S. Holders

A non-U.S. Holder will not be subject to United States Federal income taxes on payments of principal, premium (if any) or interest (including original issue discount, if

any) on a MITTS Security, unless such non-U.S. Holder is a direct or indirect 10% or greater shareholder of ML&Co., a controlled foreign corporation related to ML&Co. or a bank receiving interest described in section 881(c)(3)(A) of the

Internal Revenue Code of 1986, as amended. However, income allocable to non-U.S. Holders will generally be subject to annual tax reporting on IRS Form 1042-S. For a non-U.S. Holder to qualify for the exemption from taxation, any person, U.S. or

foreign, that has control, receipt or custody of an amount subject to withholding, or who can disburse or make payments of an amount subject to withholding (the “Withholding Agent”) must have received a statement that (a) is signed by the

beneficial owner of the MITTS Security under penalties of perjury, (b) certifies that such owner is a non-U.S. Holder and (c) provides the name and address of the beneficial owner. The statement may generally be made on IRS Form W-8BEN (or other

applicable form) or a substantially similar form, and the beneficial owner must inform the Withholding Agent of any change in the information on the statement within 30 days of that change by filing a new IRS Form W-8BEN (or other applicable form).

Generally, a Form W-8BEN provided without a U.S. taxpayer identification number will remain in effect for a period starting on the date the form is signed and ending on the last day of the third succeeding calendar year, unless a change in

circumstances makes any information on the form incorrect. If a MITTS Security is held through a securities clearing organization or certain other financial institutions, the organization or institution may provide a signed statement to the

Withholding Agent. Under certain circumstances, the signed statement must be accompanied by a copy of the applicable IRS Form W-8BEN (or other applicable form) or the substitute form provided by the beneficial owner to the organization or

institution.

Under current law, a MITTS Security will not be includible in the estate of a non-U.S. Holder unless

the individual is a direct or indirect 10% or greater shareholder of ML&Co. or, at the time of such individual’s death, payments in respect of such MITTS Security would have been effectively connected with the conduct by such individual of

a trade or business in the United States.

Backup withholding

Backup withholding at the applicable statutory rate of United States Federal income tax may apply to payments made in respect of the MITTS Securities to registered owners

who are not “exempt recipients” and who fail to provide certain identifying information (such as the registered owner’s taxpayer identification number) in the required manner. Generally, individuals are not exempt recipients, whereas

corporations and certain other entities generally are exempt recipients. Payments made in respect of the MITTS Securities to a U.S. Holder must be reported to the IRS, unless the U.S. Holder is an exempt recipient or establishes an exemption.

Compliance with the identification procedures described in the preceding section would establish an exemption from backup withholding for those non-U.S. Holders who are not exempt recipients.

In addition, upon the sale of a MITTS Security to (or through) a broker, the broker must withhold on the entire purchase price, unless either (a) the broker determines

that the seller is a corporation or other exempt recipient or (b) the seller provides, in the required manner, certain identifying information (e.g., an IRS Form W-9) and, in the case of a non-U.S. Holder, certifies that such seller is a

non-U.S. Holder (and certain other conditions are met). Such a sale must also be reported by the broker to the IRS, unless either (a) the broker determines that the seller is an exempt recipient or (b) the seller certifies its non-U.S. status (and

certain other conditions are met). Certification of the registered owner’s non-U.S. status would be made normally on an IRS Form W-8BEN (or other applicable form) under penalties of perjury, although in certain cases it may be possible to

submit other documentary evidence.

Any amounts withheld under the backup withholding rules from a payment to a

beneficial owner would be allowed as a refund or a credit against such beneficial owner’s United States Federal income tax provided the required information is furnished to the IRS.

S-22

Each fiduciary of a pension, profit-sharing or other employee

benefit plan (a “plan”) subject to the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), should consider the fiduciary standards of ERISA in the context of the plan’s particular circumstances before

authorizing an investment in the Notes. Accordingly, among other factors, the fiduciary should consider whether the investment would satisfy the prudence and diversification requirements of ERISA and would be consistent with the documents and

instruments governing the plan, and whether the investment would involve a prohibited transaction under Section 406 of ERISA or Section 4975 of the Internal Revenue Code (the “Code”).

Section 406 of ERISA and Section 4975 of the Code prohibit plans, as well as individual retirement accounts and Keogh plans subject to

Section 4975 of the Internal Revenue Code (also “plans”) from engaging in certain transactions involving “plan assets” with persons who are “parties in interest” under ERISA or “disqualified persons” under the

Code (“parties in interest”) with respect to the plan or account. A violation of these prohibited transaction rules may result in civil penalties or other liabilities under ERISA and/or an excise tax under Section 4975 of the Code for

those persons, unless exemptive relief is available under an applicable statutory, regulatory or administrative exemption. Certain employee benefit plans and arrangements including those that are governmental plans (as defined in Section 3(32) of

ERISA), certain church plans (as defined in Section 3(33) of ERISA) and foreign plans (as described in Section 4(b)(4) of ERISA) (“non-ERISA arrangements”) are not subject to the requirements of ERISA or Section 4975 of the Code but may be

subject to similar provisions under applicable federal, state, local, foreign or other regulations, rules or laws (“similar laws”).

The acquisition of the Notes by a plan with respect to which we, MLPF&S, or certain of our affiliates is or becomes a party in interest may constitute or result in a prohibited transaction under

ERISA or Section 4975 of the Code, unless those Notes are acquired pursuant to and in accordance with an applicable exemption. The U.S. Department of Labor has issued five prohibited transaction class exemptions, or “PTCEs”, that may

provide exemptive relief if required for direct or indirect prohibited transactions that may arise from the purchase or holding of the Notes. These exemptions are:

| |

(1) |

PTCE 84-14, an exemption for certain transactions determined by independent qualified professional asset managers; |

| |

(2) |

PTCE 90-1, an exemption for certain transactions involving insurance company pooled separate accounts; |

| |

(3) |

PTCE 91-38, an exemption for certain transactions involving bank collective investment funds; |

| |

(4) |

PTCE 95-60, an exemption for transactions involving certain insurance company general accounts; or |

| |

(5) |

PTCE 96-23, an exemption for plan asset transactions managed by in-house asset managers. |

The Notes may not be purchased or held by (1) any plan, (2) any entity whose underlying assets include “plan assets” by reason

of any plan’s investment in the entity (a “plan asset entity”) or (3) any person investing “plan assets” of any plan, unless in each case the purchaser or holder is eligible for the exemptive relief available under any of

the PTCEs listed above or another applicable similar exemption. Any purchaser or holder of the Notes or any interest in the Notes will be deemed to have represented by its purchase and holding of the Notes that it either (1) is not a plan or a plan

asset entity and is not purchasing those Notes on behalf of or with “plan assets” of any plan or plan asset entity or (2) with respect to the purchase or holding, is eligible for the exemptive relief available under any of the PTCEs listed

above or another applicable exemption. In addition, any purchaser or holder of the Notes or any interest in the Notes which is a non-ERISA arrangement will be deemed to have represented by its purchase and holding of the Notes that its purchase and

holding will not violate the provisions of any similar law.

S-23