| PROSPECTUS SUPPLEMENT

|

|

Filed Pursuant to Rule 424(b)(5) Registration No. 333-83374

|

| (To prospectus dated April 1, 2002)

|

1,500,000 Units

Merrill Lynch & Co., Inc.

Strategic Return NotesSM

Linked to the

Industrial 15 Index due August 30, 2007

(the “Notes”)

$10 original public offering price per Unit

| The Notes: Ÿ Senior unsecured debt securities of Merrill Lynch & Co., Inc. Ÿ Exchangeable at your option for a cash payment during a specified period in August of each year from 2003 through 2006, as described in this prospectus

supplement. Ÿ No payments prior to maturity unless

exchanged. Ÿ Linked to the value of the Industrial

15 Index (index symbol “IXD”). Ÿ The

Notes have been approved for listing on the American Stock Exchange under the trading symbol “DCV”, subject to official notice of issuance. Ÿ Expected closing date: August 30, 2002. |

|

|

|

Payment at maturity or upon exchange: Ÿ At maturity or upon exchange, you will receive a cash amount based upon the percentage change in the value of the Industrial 15 Index, which reflects the

total return of fifteen of the top dividend yielding stocks, reconstituted annually, in Standard & Poor’s Industrial Index less an annual index adjustment factor of 1.5%. Ÿ At maturity or upon exchange, the amount you receive will depend on the value of the Industrial 15 Index.

The value of the Industrial 15 Index must increase in order for you to receive at least the original public offering price of $10 per Note upon exchange or at maturity. If the value of the Industrial 15 Index has declined or has not increased

sufficiently, you will receive less, and possibly significantly less, than the original public offering price of $10 per Note. |

Investing in the Notes involves risks that are described in the “Risk Factors” section

beginning on page S-8 of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

| |

|

Per Unit

|

|

|

Total

|

| Public offering price |

|

$10.00 |

|

|

$15,000,000 |

| Underwriting fee |

|

$.20 |

|

|

$300,000 |

| Proceeds, before expenses, to Merrill Lynch & Co., Inc. |

|

$9.90 |

* |

|

$14,850,000 |

| |

* |

$.10 per Unit of the underwriting fee will be paid to the underwriter by a subsidiary of Merrill Lynch & Co., Inc. For a description of this payment, please

see the section entitled “Underwriting” in this prospectus supplement. |

Merrill Lynch & Co.

The date of this prospectus supplement is August 27, 2002.

“Strategic Return Notes” is a service mark of Merrill Lynch & Co., Inc.

Prospectus Supplement

| |

|

Page

|

| |

|

S-4 |

| What are the Notes? |

|

S-4 |

| What will I receive upon maturity of the Notes? |

|

S-4 |

| How does the exchange feature work? |

|

S-5 |

| Who publishes the Industrial 15 Index and what does the Industrial 15 Index measure? |

|

S-5 |

| How has the Industrial 15 Index performed historically? |

|

S-6 |

| Will I receive interest payments on the Notes? |

|

S-6 |

| What about taxes? |

|

S-6 |

| Will the Notes be listed on a stock exchange? |

|

S-6 |

| What is the role of MLPF&S? |

|

S-6 |

| What is ML&Co.? |

|

S-6 |

| Are there any risks associated with my investment? |

|

S-7 |

| |

|

S-8 |

| Your investment may result in a loss |

|

S-8 |

| Your return will not reflect the return of owning the Industrial 15 Stocks |

|

S-8 |

| The value of the Industrial 15 Index is expected to affect the trading value of the Notes |

|

S-8 |

| Changes in our credit ratings may affect the trading value of the Notes |

|

S-8 |

| Your investment may become concentrated |

|

S-8 |

| Your yield may be lower than the yield on other debt securities of comparable maturity |

|

S-9 |

| There may be an uncertain trading market for the Notes |

|

S-9 |

| Risk factors specific to companies included in the Industrial 15 Index |

|

S-9 |

| Amounts payable on the Notes may be limited by state law |

|

S-10 |

| Purchases and sales by us and our affiliates may affect your return |

|

S-10 |

| Potential conflicts |

|

S-10 |

| Uncertain tax consequences |

|

S-11 |

| |

|

S-12 |

| Payment at maturity |

|

S-12 |

| Exchange of the Notes prior to maturity |

|

S-13 |

| Hypothetical returns |

|

S-13 |

| Adjustments to the Industrial 15 Index; Market Disruption Events |

|

S-14 |

| Discontinuance of the Industrial 15 Index |

|

S-15 |

| Events of Default and Acceleration |

|

S-16 |

| Depositary |

|

S-16 |

| Same-Day Settlement and Payment |

|

S-19 |

| |

|

S-19 |

| Industrial 15 Index |

|

S-19 |

| Dividends |

|

S-21 |

| Adjustments to the Share Multiplier and Industrial 15 Portfolio |

|

S-21 |

| Hypothetical and Historical Data on the Industrial 15 Index |

|

S-23 |

| |

|

S-24 |

| General |

|

S-24 |

| Tax Treatment of the Notes |

|

S-25 |

| Possible Alternative Tax Treatments of an Investment in the Notes |

|

S-25 |

| Non-U.S. Holders |

|

S-25 |

| Backup Withholding and Information Reporting |

|

S-26 |

| |

|

S-26 |

| |

|

S-27 |

| |

|

S-27 |

| |

|

S-28 |

| |

|

S-29 |

| |

|

S-29 |

| |

|

S-30 |

| |

|

A-1 |

S-2

Prospectus

| |

|

Page

|

| MERRILL LYNCH & CO., INC |

|

2 |

| USE OF PROCEEDS |

|

2 |

| RATIO OF EARNINGS TO FIXED CHARGES AND RATIOS OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK

DIVIDENDS |

|

3 |

| THE SECURITIES |

|

3 |

| DESCRIPTION OF DEBT SECURITIES |

|

4 |

| DESCRIPTION OF DEBT WARRANTS |

|

10 |

| DESCRIPTION OF CURRENCY WARRANTS |

|

12 |

| DESCRIPTION OF INDEX WARRANTS |

|

14 |

| DESCRIPTION OF PREFERRED STOCK |

|

19 |

| DESCRIPTION OF DEPOSITARY SHARES |

|

24 |

| DESCRIPTION OF PREFERRED STOCK WARRANTS |

|

28 |

| DESCRIPTION OF COMMON STOCK |

|

30 |

| DESCRIPTION OF COMMON STOCK WARRANTS |

|

34 |

| PLAN OF DISTRIBUTION |

|

36 |

| WHERE YOU CAN FIND MORE INFORMATION |

|

37 |

| INCORPORATION OF INFORMATION WE FILE WITH THE SEC |

|

37 |

| EXPERTS |

|

38 |

S-3

This summary includes questions and answers that

highlight selected information from this prospectus supplement and the accompanying prospectus to help you understand the Strategic Return NotesSM Linked to the Industrial 15 Index due August 30, 2007 (the “Notes”). You should carefully read this prospectus supplement and the accompanying prospectus to fully understand the

terms of the Notes, the Industrial 15 Index and the tax and other considerations that are important to you in making a decision about whether to invest in the Notes. You should carefully review the “Risk Factors” section, which highlights

certain risks associated with an investment in the Notes, to determine whether an investment in the Notes is appropriate for you.

References in this prospectus supplement to “ML&Co.”, “we”, “us” and “our” are to Merrill Lynch & Co., Inc., and references to “MLPF&S” are to Merrill Lynch, Pierce,

Fenner & Smith Incorporated.

What are the Notes?

The Notes will be a series of senior debt securities issued by ML&Co. and will not be secured by collateral. The Notes will rank equally with all of our other unsecured

and unsubordinated debt. The Notes will mature on August 30, 2007 unless exchanged by you as described in this prospectus supplement.

A Unit will represent a single Note with an original public offering price of $10.00 (a “Unit”). You may transfer the Notes only in whole Units. You will not have the right to receive physical certificates

evidencing your ownership except under limited circumstances. Instead, we will issue the Notes in the form of a global certificate, which will be held by The Depository Trust Company, also known as DTC, or its nominee. Direct and indirect

participants in DTC will record your ownership of the Notes. You should refer to the section entitled “Description of the Notes—Depositary” in this prospectus supplement.

What will I receive upon maturity of the Notes?

At maturity, if you have not previously exchanged your Notes, you will receive a cash payment on the Notes equal to the “Redemption Amount”.

The “Redemption Amount” per Unit will equal:

| |

|

( |

Ending Value |

) |

| $9.90 × |

|

|

| |

|

Starting Value |

The Industrial 15 Index must increase in order for you to receive a

Redemption Amount equal to or greater than the original public offering price, and, if the value of the Industrial 15 Index declines or has not increased sufficiently, you will receive less than the original public offering price of the Notes.

The “Starting Value” equals 104.97, the closing value of the Industrial 15 Index on August 27,

2002, the date the Notes were priced for initial sale to the public (the “Pricing Date”).

For purposes

of determining the Redemption Amount, the “Ending Value” means the average, arithmetic mean, of the values of the Industrial 15 Index at the close of the market on five business days shortly before the maturity of the Notes. We may

calculate the Ending Value by reference to fewer than five or even a single day’s closing value if, during the period shortly before the maturity date of the Notes, there is a disruption in the trading of a stock included in the Industrial 15

Index (an “Industrial 15 Stock”) or certain futures or options contracts relating to an Industrial 15 Stock.

For more specific information about the Redemption Amount, please see the section entitled “Description of the Notes” in this prospectus supplement.

S-4

Examples

Here are two examples of Redemption Amount calculations:

Example 1—The Industrial 15 Index at maturity is below the Starting Value:

Starting Value: 104.97

Hypothetical Ending Value: 20.99

| |

( |

20.99 |

) |

|

| Redemption Amount (per Unit) = $9.90 × |

|

= $1.98 |

| |

104.97 |

|

Total payment at maturity (per Unit) = $1.98

Example 2—The Industrial 15 Index at maturity is above the Starting Value:

Starting Value: 104.97

Hypothetical Ending Value: 188.95

| |

( |

188.95 |

) |

|

| Redemption Amount (per Unit) = $9.90 × |

|

= $17.82 |

| |

104.97 |

|

Total payment at maturity (per Unit) = $17.82

How does the exchange feature work?

You may elect to exchange all or a portion of your Notes during a specified period in the month of August in the years 2003 through 2006 by giving notice to the depositary or trustee of the Notes, as the case may be, as

described in this prospectus supplement. The amount of the cash payment you receive upon exchange (the “Exchange Amount”) will be equal to the Redemption Amount, calculated as if the Exchange Date, as defined in this prospectus supplement,

were the stated maturity date, except that the Ending Value will be equal to the closing value of the Industrial 15 Index on the Exchange Date. The Exchange Amount will be paid three Business Days following the Exchange Date. If you elect to

exchange your Notes, you will receive only the Exchange Amount and you will not receive the Redemption Amount at maturity. The Exchange Amount you receive may be greater than or less than the Redemption Amount at maturity depending upon the

performance of the Industrial 15 Index during the period from the Exchange Date until the stated maturity date. In addition, if the value of the Industrial 15 Index has not increased sufficiently above the Starting Value, the Exchange Amount will be

less than the original public offering price.

For more specific information about the exchange feature, please

see the section entitled “Description of the Notes—Exchange of the Notes prior to maturity” in this prospectus supplement.

Who publishes the Industrial 15 Index and what does the Industrial 15 Index measure?

The

Industrial 15 Index is calculated and disseminated by the American Stock Exchange under the index symbol “IXD”. The Industrial 15 Index is an index which reflects the price changes and dividends of the top fifteen dividend yielding stocks

from a group of certain stocks in Standard & Poor’s Industrial Index (the “S&P Industrial Index”) less an annual index adjustment factor of 1.5% applied daily (the “Index Adjustment Factor”). The Industrial 15 Index

has been calculated and disseminated since June 26, 2001. The Industrial 15 Index is reconstituted on June 26th of each year, the anniversary of the date the Industrial 15 Index was originally calculated and disseminated or, under certain circumstances, on a day shortly after the anniversary date, as described in this prospectus

supplement. For more specific information about the Industrial 15 Index and its reconstitution, and the Index Adjustment Factor, please see the section entitled “The Industrial 15 Index” in this prospectus supplement.

The Notes are debt obligations of ML&Co., and an investment in the Notes does not entitle you to any ownership interest in

the Industrial 15 Stocks.

S-5

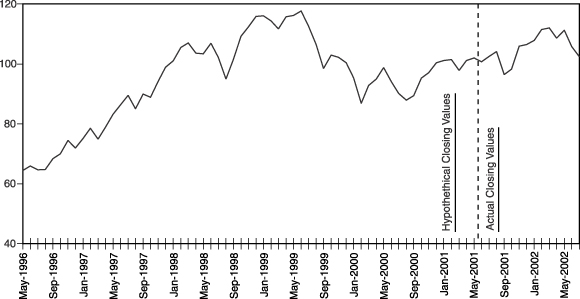

How has the Industrial 15 Index performed historically?

The value of the Industrial 15 Index was set to 100 on June 26, 2001, the date the Industrial 15 Index was initially calculated. On August

27, 2002, the closing value of the Industrial 15 Index was 104.97. While there is currently little historical information about the Industrial 15 Index, we have provided a table and a graph showing the hypothetical month-end closing values of the

Industrial 15 Index from May 1996 through May 2001. These closing values have been calculated hypothetically on the same basis that the Industrial 15 Index is currently calculated. We have provided this information to illustrate how the Industrial

15 Index would have performed from May 1996 through May 2001. For further details on the calculation of these hypothetical closing values please refer to the section entitled “The Industrial 15 Index—Historical Data on the Industrial 15

Index” in this prospectus supplement. We have also provided the actual month-end closing values of the Industrial 15 Index from June 2001 through July 2002. Any historical upward or downward trend in the level of the Industrial 15 Index during

the periods presented is not an indication that the Industrial 15 Index is more or less likely to increase or decrease at any time during the term of the Notes.

Will I receive interest payments on the Notes?

You will not receive any interest

payments on the Notes, but you will receive the Exchange Amount following the exercise of your exchange option or the Redemption Amount at maturity. We have designed the Notes for investors who are willing to forego market interest payments on the

Notes, such as fixed or floating interest rates paid on standard senior non-callable debt securities, in exchange for the Exchange Amount or the Redemption Amount.

What about taxes?

The U.S. federal income tax consequences

of an investment in the Notes are complex and uncertain. By purchasing a Note, you and ML&Co. hereby agree, in the absence of an administrative or judicial ruling to the contrary, to characterize a Note for all tax purposes as a pre-paid

cash-settled forward contract linked to the value of the Industrial 15 Index. Under this characterization of the Notes, you should be required to recognize gain or loss to the extent that you receive cash on the maturity date or upon a sale or

exchange of a Note prior to the maturity date. You should review the discussion under the section entitled “United States Federal Income Taxation” in this prospectus supplement.

Will the Notes be listed on a stock exchange?

The Notes have been approved for listing on the AMEX under the symbol “DCV”, subject to official notice of issuance. You should be aware that the listing of the Notes on the AMEX will not necessarily ensure that a liquid

trading market will be available for the Notes. You should review the section entitled “Risk Factors—There may be an uncertain trading market for the Notes” in this prospectus supplement.

What is the role of MLPF&S?

Our subsidiary, MLPF&S, is the underwriter for the offering and sale of the Notes. After the initial offering, MLPF&S intends to buy and sell Notes to create a secondary market for holders of the Notes, and may stabilize or

maintain the market price of the Notes during their initial distribution. However, MLPF&S will not be obligated to engage in any of these market activities or continue them once it has started.

MLPF&S will also be our agent for purposes of calculating, among other things, the Ending Value, Redemption Amount and Exchange

Amounts. Under certain circumstances, these duties could result in a conflict of interest between the status of MLPF&S as our subsidiary and its responsibilities as calculation agent.

What is ML&Co.?

Merrill Lynch & Co.,

Inc. is a holding company with various subsidiary and affiliated companies that provide investment, financing, insurance and related services on a global basis.

S-6

For information about ML&Co., see the section entitled “Merrill Lynch

& Co., Inc.” in the accompanying prospectus. You should also read other documents we have filed with the SEC, which you can find by referring to the section entitled “Where You Can Find More Information” in this prospectus

supplement.

Are there any risks associated with my investment?

Yes, an investment in the Notes is subject to risks. Please refer to the section entitled “Risk Factors” in this prospectus

supplement.

S-7

Your investment in the Notes will involve risks. An investment in the

Notes involves credit risks which are identical to those related to investments in any other debt obligations of ML&Co., and additional risks which are similar to investing in each of the Industrial 15 Stocks. You should carefully consider the

following discussion of risks before deciding whether an investment in the Notes is suitable for you.

Your investment may result in a

loss

We will not repay you a fixed amount of principal on the Notes at maturity or upon exchange. The payment

on the Notes will depend on the change in the value of the Industrial 15 Index. Because the value of the Industrial 15 Index is subject to market fluctuations, the amount of cash you receive may be more or less than the original public offering

price of your Notes. If the applicable Ending Value, at maturity or at the time you exchange your Notes, is less than or not sufficiently above the Starting Value, then the amount you receive will be less than the original public offering price of

each Note, in which case your investment in the Notes will result in a loss to you. The original public offering price of $10 per Unit exceeds the $9.90 per Unit amount used to calculate the Redemption Amount and therefore the Industrial 15 Index

must increase in order for you to receive a Redemption Amount or Exchange Amount equal to the original public offering price.

Your

return will not reflect the return of owning the Industrial 15 Stocks

While the Industrial 15 Index does

reflect the payment of dividends on the Industrial 15 Stocks as described in more detail below, the yield to the maturity of the Notes will not produce the same yield as if the Industrial 15 Stocks were purchased and held for a similar period. At

the end of each calendar quarter, the dividends accrued on the Industrial 15 Stocks will be incorporated into the Industrial 15 Index by adjusting the Share Multipliers of the stocks and the amounts will thereafter be subject to the price movements

of the stocks. In addition, at the end of each day, the Industrial 15 Index will be reduced by a pro rata portion of the annual Index Adjustment Factor of 1.5%. Due to the effect of the annual Index Adjustment Factor and to the matters discussed

above under “Your investment may result in a loss”, the return on an investment in the Notes will be less than the return on a similar investment in the Industrial 15 Stocks, assuming transaction costs and taxes are not taken into account.

The trading value of the Notes and final return on the Notes may also differ from the results of the Industrial 15 Index for the reasons discussed below under “Changes in our credit ratings may affect the trading value of the Notes”.

The value of the Industrial 15 Index is expected to affect the trading value of the Notes

The market value of the Notes will depend substantially on the amount by which the Industrial 15 Index exceeds or does not exceed the

Starting Value. The value of the Notes is related to the Industrial 15 Index, and consequently, a sale of the Notes may result in a loss. Additionally, because the trading value and perhaps final return on your Notes are dependent on factors in

addition to the Industrial 15 Index, such as our credit rating, an increase in the value of the Industrial 15 Index will not reduce the other investment risks related to the Notes.

Changes in our credit ratings may affect the trading value of the Notes

Our credit ratings are an assessment of our ability to pay our obligations. Consequently, real or anticipated changes in our credit ratings may affect the trading value of the Notes. However, because the return on your Notes is

dependent upon factors in addition to our ability to pay our obligations under the Notes, such as the value of the Industrial 15 Index at maturity, an improvement in our credit ratings will not reduce the other investment risks related to the Notes.

Your investment may become concentrated

As a result of market fluctuations and/or reconstitution events, an investment in the Notes may carry risks similar to a concentrated investment in one or more industries.

S-8

Your yield may be lower than the yield on other debt securities of comparable maturity

The amount we pay you at maturity or upon exchange may be less than the return you could earn on other

investments. Your yield may be less than the yield you would earn if you bought other senior non-callable debt securities of ML&Co. with the same stated maturity date. Your investment may not reflect the full opportunity cost to you when you

take into account factors that affect the time value of money.

There may be an uncertain trading market for the Notes

The Notes have been approved for listing on the AMEX under the trading symbol “DCV”, subject to

official notice of issuance. However, you cannot assume that a trading market will develop for the Notes. If a trading market does develop, there can be no assurance that there will be liquidity in the trading market. The development of a trading

market for the Notes will depend on our financial performance and other factors such as the change in the value of the Industrial 15 Index.

If the trading market for the Notes is limited, there may be a limited number of buyers for your Notes if you do not wish to hold your investment until maturity. This may affect the price you receive.

Risk factors specific to companies included in the Industrial 15 Index

The Industrial 15 Index is an index which reflects the price changes and dividends of the top fifteen dividend yielding Qualifying Stocks in the S&P Industrial Index

less an annual Index Adjustment Factor. The stock prices of some of the companies included in the Industrial 15 Index (the “Industrial 15 Companies”) have been and may continue to be volatile. These stock prices could be subject to wide

fluctuations in response to a variety of factors, including the following:

| |

Ÿ |

general market fluctuations; |

| |

Ÿ |

actual or anticipated variations in the quarterly operating results of the Industrial 15 Companies; |

| |

Ÿ |

announcements of technological innovations or new services offered by competitors of the Industrial 15 Companies; |

| |

Ÿ |

changes in financial estimates by securities analysts; |

| |

Ÿ |

regulatory or legal developments, including significant litigation matters, affecting the Industrial 15 Companies or in the industries in which they operate;

|

| |

Ÿ |

announcements by competitors of the Industrial 15 Companies of significant acquisitions, strategic partnerships, joint ventures or capital commitments; and

|

| |

Ÿ |

departures of key personnel of the Industrial 15 Companies. |

The international operations of some of the Industrial 15 Companies expose them to risks inherent to international business. The risks of international business that these

companies are exposed to include the following:

| |

Ÿ |

general economic, social and political conditions in the countries where they operate; |

| |

Ÿ |

the difficulty of enforcing intellectual property rights, agreements and collecting receivables through certain foreign legal systems;

|

| |

Ÿ |

differing tax rates, tariffs, exchange controls or other similar restrictions; |

| |

Ÿ |

currency exchange rate fluctuations; and |

S-9

| |

Ÿ |

changes in, and compliance with, domestic and foreign laws and regulations which impose a range of restrictions on operations, trade practices, foreign trade

and international investment decisions. |

Amounts payable on the Notes may be limited by state law

New York State law governs the 1983 Indenture under which the Notes will be issued. New York has usury laws that limit the

amount of interest that can be charged and paid on loans, which includes debt securities like the Notes. Under present New York law, the maximum rate of interest is 25% per annum on a simple interest basis. This limit may not apply to debt

securities in which $2,500,000 or more has been invested.

While we believe that New York law would be given

effect by a state or Federal court sitting outside of New York, many other states also have laws that regulate the amount of interest that may be charged to and paid by a borrower. We will promise, for the benefit of the Note holders, to the extent

permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest.

Purchases and sales by us

and our affiliates may affect your return

We and our affiliates may from time to time buy or sell the

Industrial 15 Stocks or futures or options contracts on the Industrial 15 Index or the Industrial 15 Stocks for our own accounts for business reasons and expect to enter into such transactions in connection with hedging our obligations under the

Notes. These transactions could affect the price of Industrial 15 Stocks and, in turn, the value of the Industrial 15 Index in a manner that would be adverse to your investment in the Notes. Any purchases by us, our affiliates or others on our

behalf on or before the Pricing Date may temporarily increase the prices of the Industrial 15 Stocks. Temporary increases in the market prices of the Industrial 15 Stocks may also occur as a result of the purchasing activities of other market

participants. Consequently, the prices of the Industrial 15 Stocks may decline subsequent to the Pricing Date reducing the value of the Industrial 15 Index and therefore the market value of the Notes.

Potential conflicts

Our subsidiary MLPF&S is our agent for the purposes of calculating the Ending Value, Redemption Amount and Exchange Amounts. Under certain circumstances, MLPF&S’ role as our subsidiary and its responsibilities as

calculation agent for the Notes could give rise to conflicts of interest. These conflicts could occur, for instance, in connection with its determination as to whether the value of the Industrial 15 Index can be calculated on a particular trading

day, or in connection with judgments that it would be required to make in the event of a discontinuance of the Industrial 15 Index. See the sections entitled “Description of the Notes—Adjustments to the Industrial 15 Index; Market

Disruption Events” and “—Discontinuance of the Industrial 15 Index” in this prospectus supplement. MLPF&S is required to carry out its duties as calculation agent in good faith and using its reasonable judgment. However, you

should be aware that because we control MLPF&S, potential conflicts of interest could arise. MLPF&S, the underwriter, will pay an additional amount on each anniversary of the Pricing Date in 2003 through 2006 to brokers whose client accounts

purchased their Notes in the initial distribution and continue to hold the Notes. In addition, MLPF&S may from time to time pay additional amounts to brokers whose clients purchased Notes in the secondary market and continue to hold the Notes.

You should understand that as a result of this additional payment, your broker receives a financial benefit each year you retain your investment in the Notes. Please see the section entitled “Underwriting” in this prospectus supplement.

We have entered into an arrangement with one of our subsidiaries to hedge the market risks associated with our

obligation to pay amounts due at maturity on the Notes. This subsidiary expects to make a profit in connection with this arrangement. We did not seek competitive bids for this arrangement from unaffiliated parties.

S-10

ML&Co. or its affiliates may presently or from time to time engage in

business with one or more of the Industrial 15 Companies including extending loans to, or making equity investments in, the Industrial 15 Companies or providing advisory services to the Industrial 15 Companies, including merger and acquisition

advisory services. In the course of business, ML&Co. or its affiliates may acquire non-public information relating to the Industrial 15 Companies and, in addition, one or more affiliates of ML&Co. may publish research reports about the

Industrial 15 Companies. ML&Co. does not make any representation to any purchasers of the Notes regarding any matters whatsoever relating to the Industrial 15 Companies. Any prospective purchaser of the Notes should undertake an independent

investigation of the Industrial 15 Companies as in its judgment is appropriate to make an informed decision with respect to an investment in the Notes. The composition of the Industrial 15 Index does not reflect any investment or sell

recommendations of ML&Co. or its affiliates.

Uncertain tax consequences

You should consider the tax consequences of investing in the Notes, aspects of which are uncertain. See the section entitled “United States Federal Income

Taxation” in this prospectus supplement.

S-11

ML&Co. will issue the Notes as a series of senior debt

securities under the 1983 Indenture, which is more fully described in the accompanying prospectus. Unless exchanged by you, the Notes will mature on August 30, 2007.

While at maturity or upon exchange a beneficial owner of a Note will receive an amount equal to the Redemption Amount or the Exchange Amount, as the case may be, there will

be no other payment of interest, periodic or otherwise. See the section entitled “—Payment at maturity” and “—Exchange of the Notes prior to maturity” in this prospectus supplement.

The Notes may be exchanged by you during an Exchange Notice Period, but are not subject to redemption by ML&Co. before maturity. If an

Event of Default occurs with respect to the Notes, beneficial owners of the Notes may accelerate the maturity of the Notes, as described under “—Events of Default and Acceleration” in this prospectus supplement and “Description

of Debt Securities—Events of Default” in the accompanying prospectus.

ML&Co. will issue the Notes

in denominations of whole Units each with an original public offering price of $10 per Unit.

The Notes will not

have the benefit of any sinking fund.

Payment at maturity

For each Note that has not been exchanged prior to maturity, the holder will be entitled to receive the Redemption Amount, as provided below.

Determination of the Redemption Amount

The “Redemption Amount” per Unit will be determined by the calculation agent and will equal:

| $9.90 × |

( |

Ending Value

Starting Value |

) |

|

|

The “Starting Value” equals 104.97, the closing

value of the Industrial 15 Index on the Pricing Date.

For the purpose of determining the Redemption Amount, the

“Ending Value” will be determined by the calculation agent and will equal the average, arithmetic mean, of the closing values of the Industrial 15 Index determined on each of the first five Calculation Days during the Calculation

Period. If there are fewer than five Calculation Days during the Calculation Period, then the Ending Value will equal the average, arithmetic mean, of the closing values of the Industrial 15 Index on those Calculation Days. If there is only one

Calculation Day during the Calculation Period, then the Ending Value will equal the closing value of the Industrial 15 Index on that Calculation Day. If no Calculation Days occur during the Calculation Period, then the Ending Value will equal the

closing value of the Industrial 15 Index determined on the last scheduled Index Business Day in the Calculation Period, regardless of the occurrence of a Market Disruption Event on that day.

The “Calculation Period” means the period from and including the seventh scheduled Index Business Day prior to the maturity date to and including the

second scheduled Index Business Day prior to the maturity date.

A “Calculation Day” means any

Index Business Day during the Calculation Period on which a Market Disruption Event has not occurred.

S-12

An “Index Business Day” means a day on which the New York Stock Exchange and the AMEX are open for

trading and the Industrial 15 Index or any successor index is calculated and published.

All determinations made

by the calculation agent shall be at the sole discretion of the calculation agent and, absent a determination by the calculation agent of a manifest error, shall be conclusive for all purposes and binding on ML&Co. and the holders and beneficial

owners of the Notes.

Exchange of the Notes prior to maturity

You may elect to exchange all or a portion of the Notes you own during any Exchange Notice Period by giving notice as described below. An “Exchange Notice Period”

means any Business Day from and including the first calendar day of the month of August to and including 12:00 noon in The City of New York on the fifteenth calendar day during the month of August in the years 2003, 2004, 2005 and 2006. If the

fifteenth calendar day of the applicable month of August is not a Business Day, then the Exchange Notice Period will be extended to 12:00 noon in The City of New York on the next succeeding Business Day. The amount of the cash payment you receive

upon exchange (the “Exchange Amount”) will be equal to the Redemption Amount, calculated as if the Exchange Date were the stated maturity date, except that the Ending Value will be equal to the closing value of the Industrial 15 Index on

the Exchange Date. An “Exchange Date” will be the second Index Business Day following the end of the applicable Exchange Notice Period. If a Market Disruption Event occurs on the second Index Business Day following an Exchange Notice

Period, the Exchange Date for that year will be the next succeeding Index Business Day on which a Market Disruption Event does not occur. The Exchange Amount will be paid three Business Days after the Exchange Date.

The Notes will be issued in registered global form and will remain on deposit with the depositary as described in this prospectus

supplement. Therefore, you must exercise the option to exchange your Notes through the depositary. To make your exchange election effective, you must make certain that your notice is delivered to the depositary during the applicable Exchange Notice

Period. To ensure that the depositary will receive timely notice of your election to exchange all or a portion of your Notes, you must instruct the direct or indirect participant through which you hold an interest in the Notes to notify the

depositary of your election to exchange your Notes prior to 12:00 noon in The City of New York on the last day of the applicable Exchange Notice Period, in accordance with the then applicable operating procedures of the depositary. Different firms

have different deadlines for accepting instructions from their customers. You should consult the direct or indirect participant through which you hold an interest in the Notes to ascertain the deadline for ensuring that timely notice will be

delivered to the depositary.

If at any time the global securities are exchanged for Notes in definitive form,

from and after that time notice of your election to exchange must be delivered to JPMorgan Chase Bank, as trustee under the 1983 Indenture, through the procedures required by the trustee by 12:00 noon in The City of New York on the last day of the

applicable Exchange Notice Period.

Hypothetical returns

The following tables illustrate, for the Starting Value and a range of hypothetical Ending Values of the Industrial 15 Index:

| |

Ÿ |

the total amount payable at maturity of the Notes, and the total amount payable on an investment in the Industrial 15 Stocks, |

| |

Ÿ |

the total rate of return to beneficial owners of the Notes, and the total return on an investment in the Industrial 15 Stocks, and

|

| |

Ÿ |

the pretax annualized rate of return to beneficial owners of the Notes, and the pretax annualized rate of return on an investment in the Industrial 15 Stocks.

|

S-13

The tables below assume an initial investment of $10 in the Notes and an initial investment of $10 in the Industrial 15

Stocks.

| Hypothetical Returns Related to Strategic Return Notes

based on the Industrial 15 Index

|

|

Hypothetical Returns Related to an Investment

in the Industrial 15 Stocks

|

| Hypothetical Ending

Value of the

Industrial 15 Index(1)

|

|

|

Total

Amount Payable at Maturity

Per Note

|

|

Total

Rate of

Return on

the Notes

|

|

Pretax Annualized Rate of Return on the Notes(2)

|

|

Hypothetical Ending Value of an Investment in the Industrial 15 Stocks(3)

|

|

Total

Amount Payable at Maturity

|

|

Total

Rate of Return on the Industrial 15 Stocks

|

|

Pretax Annualized Rate of

Return on

the Industrial 15 Stocks(2)

|

| 20.00 |

|

|

$ 1.89 |

|

–81.14% |

|

–30.71% |

|

21.56 |

|

$ 2.05 |

|

–79.46% |

|

–29.26% |

| 40.00 |

|

|

$ 3.77 |

|

–62.27% |

|

–18.57% |

|

43.12 |

|

$ 4.11 |

|

–58.92% |

|

–17.02% |

| 60.00 |

|

|

$ 5.66 |

|

–43.41% |

|

–11.06% |

|

64.68 |

|

$ 6.16 |

|

–38.39% |

|

–9.45% |

| 80.00 |

|

|

$ 7.55 |

|

–24.55% |

|

–5.55% |

|

86.23 |

|

$ 8.22 |

|

–17.85% |

|

–3.89% |

| 100.00 |

|

|

$ 9.43 |

|

–5.69% |

|

–1.17% |

|

107.79 |

|

$10.27 |

|

2.69% |

|

0.53% |

| 104.97 |

(4) |

|

$ 9.90 |

|

–1.00% |

|

–0.20% |

|

113.15 |

|

$10.78 |

|

7.79% |

|

1.51% |

| 120.00 |

|

|

$11.32 |

|

13.18% |

|

2.49% |

|

129.35 |

|

$12.32 |

|

23.23% |

|

4.22% |

| 140.00 |

|

|

$13.20 |

|

32.04% |

|

5.63% |

|

150.91 |

|

$14.38 |

|

43.77% |

|

7.39% |

| 160.00 |

|

|

$15.09 |

|

50.90% |

|

8.40% |

|

172.47 |

|

$16.43 |

|

64.30% |

|

10.18% |

| 180.00 |

|

|

$16.98 |

|

69.76% |

|

10.86% |

|

194.03 |

|

$18.48 |

|

84.84% |

|

12.66% |

| 200.00 |

|

|

$18.86 |

|

88.63% |

|

13.10% |

|

215.59 |

|

$20.54 |

|

105.38% |

|

14.92% |

| 220.00 |

|

|

$20.75 |

|

107.49% |

|

15.14% |

|

237.14 |

|

$22.59 |

|

125.92% |

|

16.97% |

| 240.00 |

|

|

$22.64 |

|

126.35% |

|

17.01% |

|

258.70 |

|

$24.65 |

|

146.45% |

|

18.87% |

| 260.00 |

|

|

$24.52 |

|

145.21% |

|

18.76% |

|

280.26 |

|

$26.70 |

|

166.99% |

|

20.63% |

| 280.00 |

|

|

$26.41 |

|

164.08% |

|

20.38% |

|

301.82 |

|

$28.75 |

|

187.53% |

|

22.27% |

(1) |

The Industrial 15 Index reflects the total return of the top fifteen dividend yielding Qualifying Stocks in the S&P Industrial Index less an annual Index

Adjustment Factor of 1.5%. |

(2) |

The annualized rates of return are calculated on a semiannual bond equivalent basis and assume an investment term from August 30, 2002 to August 30, 2007.

|

(3) |

An investment in the Industrial 15 Stocks is assumed to be the equivalent to an investment in the Industrial 15 Index, including the method and timing of

reinvesting dividends, except that the Industrial 15 Index is reduced daily by the pro rata portion of the annual Index Adjustment Factor of 1.5%. The hypothetical investment in the Industrial 15 Stocks presented in this column does not take into

account transaction costs and taxes. |

(4) |

This is the Starting Value. |

The above figures are for purposes of illustration only. The actual Redemption Amount received by investors in the Notes and the resulting total and pretax annualized rates of return will depend on the actual Ending Value

and term of your investment.

Adjustments to the Industrial 15 Index; Market Disruption Events

If at any time the AMEX changes its method of calculating the Industrial 15 Index, or the value of the Industrial 15 Index changes, in any

material respect, or if the Industrial 15 Index is in any other way modified so that the Industrial 15 Index does not, in the opinion of the calculation agent, fairly represent the value of the Industrial 15 Index had those changes or modifications

not been made, then, from and after that time, the calculation agent shall, at the close of business in New York, New York, on each date that the closing value of the Industrial 15 Index is to be calculated, make those adjustments as, in the good

faith judgment of the calculation agent, may be necessary in order to arrive at a calculation of a value of a stock index comparable to the Industrial 15 Index as if those changes or modifications had not been made, and calculate the closing value

with reference to the Industrial 15 Index, as so adjusted. Accordingly, if the method of calculating the Industrial

S-14

15 Index is modified so that the value of the Industrial 15 Index is a fraction or a multiple of what it would have been if it had not been modified, e.g., due to a split, then the calculation

agent shall adjust the Industrial 15 Index in order to arrive at a value of the Industrial 15 Index as if it had not been modified, e.g., as if a split had not occurred.

“Market Disruption Event” means either of the following events as determined by the calculation agent:

| |

(A) |

the suspension of or material limitation on trading for more than two hours of trading, or during the one-half hour period preceding the close of trading, on

the applicable exchange, in one or more of the Industrial 15 Stocks (without taking into account any extended or after-hours trading session), or one or more of the stocks included in any successor index; or |

| |

(B) |

the suspension of or material limitation on trading, in each case, for more than two hours of trading, or during the one-half hour period preceding the close of

trading, on the applicable exchange (without taking into account any extended or after-hours trading session), whether by reason of movements in price otherwise exceeding levels permitted by the relevant exchange or otherwise, in option contracts or

futures contracts related to the Industrial 15 Stocks, or the stocks included in any successor index, which are traded on any major U.S. exchange. |

For the purpose of the above definition:

| |

(1) |

a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change

in the regular business hours of the relevant exchange, and |

| |

(2) |

for the purpose of clause (A) above, any limitations on trading during significant market fluctuations under NYSE Rule 80A, or any applicable rule or regulation

enacted or promulgated by the NYSE or any other self regulatory organization or the SEC of similar scope as determined by the calculation agent, will be considered “material”. |

As a result of the terrorist attacks in Manhattan and Washington, D.C., the financial markets were closed from September 11, 2001 through

September 14, 2001 and values of the Industrial 15 Index are not available for such dates. Such market closures would have constituted Market Disruption Events.

Discontinuance of the Industrial 15 Index

If the AMEX discontinues publication of

the Industrial 15 Index and the AMEX or another entity publishes a successor or substitute index that the calculation agent determines, in its sole discretion, to be comparable to the Industrial 15 Index (a “successor index”), then, upon

the calculation agent’s notification of any determination to the trustee and ML&Co., the calculation agent will substitute the successor index as calculated by the AMEX or any other entity for the Industrial 15 Index and calculate the

closing value as described above under “—Payment at maturity”. Upon any selection by the calculation agent of a successor index, ML&Co. shall cause notice to be given to holders of the Notes.

In the event that the AMEX discontinues publication of the Industrial 15 Index and:

| |

Ÿ |

the calculation agent does not select a successor index, or |

| |

Ÿ |

the successor index is no longer published on any of the Calculation Days, |

the calculation agent will compute a substitute value for the Industrial 15 Index in accordance with the procedures last used to calculate the Industrial 15 Index before any discontinuance. If a

successor index is selected or the calculation agent calculates a value as a substitute for the Industrial 15 Index as described below,

S-15

the successor index or value will be used as a substitute for the Industrial 15 Index for all purposes, including for purposes of determining whether a Market Disruption Event exists.

If the AMEX discontinues publication of the Industrial 15 Index before the period during which the Redemption

Amount is to be determined and the calculation agent determines that no successor index is available at that time, then on each Business Day until the earlier to occur of:

| |

Ÿ |

the determination of the Ending Value, or |

| |

Ÿ |

a determination by the calculation agent that a successor index is available, |

the calculation agent will determine the value that would be used in computing the Redemption Amount as described in the preceding paragraph as if that day were a Calculation Day. The

calculation agent will cause notice of each value to be published not less often than once each month in The Wall Street Journal (the “WSJ”) or another newspaper of general circulation, and arrange for information with respect to

these values to be made available by telephone.

A “Business Day” is any day on which the NYSE

and the AMEX are open for trading.

Notwithstanding these alternative arrangements, discontinuance of the

publication of the Industrial 15 Index may adversely affect trading in the Notes.

Events of Default and Acceleration

In case an Event of Default with respect to any Notes has occurred and is continuing, the amount payable to a

beneficial owner of a Note upon any acceleration permitted by the Notes, with respect to each Unit, will be equal to the Redemption Amount, if any, calculated as though the date of early repayment were the stated maturity date of the Notes. See the

section entitled “—Payment at maturity” in this prospectus supplement. If a bankruptcy proceeding is commenced in respect of ML&Co., the claim of the beneficial owner of a Note may be limited, under Section 502(b)(2) of Title 11

of the United States Code, to the original public offering price of the Note plus an additional amount of contingent interest calculated as though the date of the commencement of the proceeding was the maturity date of the Notes.

In case of default in payment of the Notes, whether at their stated maturity or upon exchange or acceleration, from and after

that date the Notes will bear interest, payable upon demand of their beneficial owners, at the rate of 2.10% per year to the extent that payment of any interest is legally enforceable on the unpaid amount due and payable on that date in accordance

with the terms of the Notes to the date payment of that amount has been made or duly provided for.

Depositary

Description of the Global Securities

Upon issuance, all Notes will be represented by one or more fully registered global securities. Each global security will be deposited with, or on behalf of, DTC (DTC,

together with any successor, being a “depositary”), as depositary, registered in the name of Cede & Co., DTC’s partnership nominee. Unless and until it is exchanged in whole or in part for Notes in definitive form, no global

security may be transferred except as a whole by the depositary to a nominee of the depositary or by a nominee of the depositary to the depositary or another nominee of the depositary or by the depositary or any nominee to a successor of the

depositary or a nominee of that successor.

So long as DTC, or its nominee, is a registered owner of a global

security, DTC or its nominee, as the case may be, will be considered the sole owner or holder of the Notes represented by the global security for all

S-16

purposes under the 1983 Indenture. Except as provided below, the beneficial owners of the Notes represented by a global security will not be entitled to have the Notes represented by a global

security registered in their names, will not receive or be entitled to receive physical delivery of the Notes in definitive form and will not be considered the owners or holders of the Notes including for purposes of receiving any reports delivered

by ML&Co. or the trustee under the 1983 Indenture. Accordingly, each person owning a beneficial interest in a global security must rely on the procedures of DTC and, if that person is not a participant of DTC, on the procedures of the

participant through which that person owns its interest, to exercise any rights of a holder under the 1983 Indenture. ML&Co. understands that under existing industry practices, in the event that ML&Co. requests any action of holders or that

an owner of a beneficial interest in a global security desires to give or take any action which a holder is entitled to give or take under the 1983 Indenture, DTC would authorize the participants holding the relevant beneficial interests to give or

take that action, and those participants would authorize beneficial owners owning through those participants to give or take that action or would otherwise act upon the instructions of beneficial owners. Conveyance of notices and other

communications by DTC to participants, by participants to indirect participants and by participants and indirect participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as

may be in effect from time to time.

DTC Procedures

The following is based on information furnished by DTC:

DTC will act as securities depositary for the Notes. The Notes will be issued as fully registered securities registered in the name of Cede & Co. (DTC’s

partnership nominee). One or more fully registered global securities will be issued for the Notes in the aggregate original public offering price of such issue, and will be deposited with DTC.

DTC is a limited-purpose trust company organized under the New York Banking Law, a “banking organization” within the meaning of the New York Banking Law, a

member of the Federal Reserve System, a “clearing corporation” within the meaning of the New York Uniform Commercial Code, and a “clearing agency” registered pursuant to the provisions of Section 17A of the Securities Exchange

Act of 1934, as amended. DTC holds securities that its participants deposit with DTC. DTC also facilitates the settlement among participants of securities transactions, such as transfers and pledges, in deposited securities through electronic

computerized book-entry changes in participants’ accounts, thereby eliminating the need for physical movement of securities certificates. Direct participants of DTC include securities brokers and dealers, banks, trust companies, clearing

corporations and certain other organizations. DTC is owned by a number of its direct participants and by the NYSE, the AMEX, and the National Association of Securities Dealers, Inc. Access to DTC’s system is also available to others such as

securities brokers and dealers, banks and trust companies that clear through or maintain a custodial relationship with a direct participant, either directly or indirectly. The rules applicable to DTC and its participants are on file with the SEC.

Purchases of Notes under DTC’s system must be made by or through direct participants, which will receive a

credit for the Notes on DTC’s records. The ownership interest of each beneficial owner is in turn to be recorded on the records of direct and indirect participants. Beneficial owners will not receive written confirmation from DTC of their

purchase, but beneficial owners are expected to receive written confirmations providing details of the transaction, as well as periodic statements of their holdings, from the direct or indirect participants through which the beneficial owner entered

into the transaction. Transfers of ownership interests in the Notes are to be made by entries on the books of participants acting on behalf of beneficial owners.

To facilitate subsequent transfers, all Notes deposited with DTC are registered in the name of DTC’s partnership nominee, Cede & Co. The deposit of Notes with DTC and their registration in the

name of Cede & Co. effect no change in beneficial ownership. DTC has no knowledge of the actual beneficial owners of the Notes; DTC’s records reflect only the identity of the direct participants to whose accounts such Notes are credited,

which

S-17

may or may not be the beneficial owners. The participants will remain responsible for keeping account of their holdings on behalf of their customers.

Conveyance of notices and other communications by DTC to direct participants, by direct participants to indirect participants, and by

direct participants and indirect participants to beneficial owners will be governed by arrangements among them, subject to any statutory or regulatory requirements as may be in effect from time to time.

Neither DTC nor Cede & Co. will consent or vote with respect to the Notes. Under its usual procedures, DTC mails an omnibus proxy to

ML&Co. as soon as possible after the applicable record date. The omnibus proxy assigns Cede & Co.’s consenting or voting rights to those direct participants identified in a listing attached to the omnibus proxy to whose accounts the

Notes are credited on the record date.

Principal, premium, if any, and/or interest, if any, payments made in cash

on the Notes will be made in immediately available funds to DTC. DTC’s practice is to credit direct participants’ accounts on the applicable payment date in accordance with their respective holdings shown on the depositary’s records

unless DTC has reason to believe that it will not receive payment on that date. Payments by participants to beneficial owners will be governed by standing instructions and customary practices, as is the case with securities held for the accounts of

customers in bearer form or registered in “street name”, and will be the responsibility of that participant and not of DTC, the trustee or ML&Co., subject to any statutory or regulatory requirements as may be in effect from time to

time. Payment of principal, premium, if any, and/or interest, if any, to DTC is the responsibility of ML&Co. or the trustee, disbursement of those payments to direct participants shall be the responsibility of DTC, and disbursement of any

payments to the beneficial owners will be the responsibility of direct participants and indirect participants.

Exchange for Certificated Securities

If:

| |

Ÿ |

the depositary is at any time unwilling or unable to continue as depositary and a successor depositary is not appointed by ML&Co. within 60 days,

|

| |

Ÿ |

ML&Co. executes and delivers to the trustee a company order to the effect that the global securities shall be exchangeable, or

|

| |

Ÿ |

an Event of Default under the 1983 Indenture has occurred and is continuing with respect to the Notes, |

the global securities will be exchangeable for Notes in definitive form of like tenor in whole Units and multiples of Units. The definitive Notes will be

registered in the name or names as the depositary shall instruct the trustee. It is expected that instructions may be based upon directions received by the depositary from participants with respect to ownership of beneficial interests in the global

securities.

DTC may discontinue providing its services as securities depositary with respect to the Notes at any

time by giving reasonable notice to ML&Co. or the trustee. Under these circumstances, in the event that a successor securities depositary is not obtained, Notes are required to be printed and delivered.

ML&Co. may decide to discontinue use of the system of book-entry transfers through DTC or a successor securities depositary. In that

event, Notes will be printed and delivered.

The information in this section concerning DTC and DTC’s system

has been obtained from sources that ML&Co. believes to be reliable, but ML&Co. takes no responsibility for its accuracy.

S-18

Same-Day Settlement and Payment

Settlement for the Notes will be made by the underwriter in immediately available funds. ML&Co. will make all payments in immediately available funds so long as the

Notes are maintained in book-entry form.

Industrial 15 Index

The value of the Industrial 15 Index is calculated and disseminated by the AMEX under the symbol “IXD”. On any Business Day, the value of the Industrial 15

Index equals (i) the sum of the products of the current market price for each of the Industrial 15 Stocks and the applicable share multiplier (the sum equals the “Industrial 15 Portfolio Value”), plus (ii) an amount reflecting Current

Quarter Dividends (as defined below), and less (iii) a pro rata portion of the annual Index Adjustment Factor. The Index Adjustment Factor is 1.5% per annum and reduces the value of the Industrial 15 Index each day by the pro rata amount. The AMEX

currently uses an index divisor to represent the application of the pro rata portion of the Index Adjustment Factor to the Industrial 15 Index. As a result, the value of the Industrial 15 Index is obtained by adding the Industrial 15 Portfolio Value

to the value of any Current Quarter Dividends, as described above, and dividing by the current index divisor. On August 27, 2002, the index divisor for the Industrial 15 Index was 1.01770318. The AMEX generally calculates and disseminates the value

of the Industrial 15 Index based on the most recently reported prices of the Industrial 15 Stocks (as reported by the exchange or trading system on which the Industrial 15 Stocks are listed or traded), at approximately 15-second intervals during the

AMEX’s business hours and at the end of each Index Business Day via the Consolidated Tape Association’s Network B.

Initial Determination of Industrial 15 Portfolio

At any time the “Industrial

15 Portfolio” consists of the then current Industrial 15 Stocks. The stocks currently included in the Industrial 15 Portfolio and their respective Dividend Yields are shown below. The stocks included in the Industrial 15 Portfolio have been

determined by the AMEX to be the fifteen Qualifying Stocks in the S&P Industrial Index having the highest Dividend Yield on June 24, 2002. A “Qualifying Stock” is any stock from the S&P Industrial Index that is in the top 75% of

the stocks, as measured by market capitalization, after the elimination of (i) stocks included in the Dow Jones Industrial Average and (ii) stocks that do not have an S&P Common Stock Ranking of A or A+. We have included a brief description of

each of the Industrial 15 Companies and historical stock price information for the Industrial 15 Stocks in Annex A to this prospectus supplement. “Dividend Yield” for each common stock is determined by annualizing the last quarterly or

semi-annual ordinary cash dividend for which the ex-dividend date has occurred, excluding any extraordinary dividend, and dividing the result by the last available sale price for each stock on its primary exchange on the date that Dividend Yield is

to be determined.

| Company

|

|

Dividend Yield(1)

|

|

|

Share Multiplier(1)

|

| Abbott Laboratories |

|

2.31 |

% |

|

0.18747 |

| Albertson’s, Inc. |

|

2.70 |

% |

|

0.23326 |

| ALLTEL Corporation |

|

3.10 |

% |

|

0.15290 |

| Avery Dennison Corporation |

|

2.04 |

% |

|

0.11199 |

| Avon Products, Inc. |

|

1.68 |

% |

|

0.13880 |

| Bristol-Myers Squibb Company |

|

4.43 |

% |

|

0.27544 |

| The Clorox Company |

|

2.03 |

% |

|

0.17132 |

| ConAgra Foods, Inc. |

|

3.50 |

% |

|

0.27196 |

| Emerson Electric Co. |

|

3.15 |

% |

|

0.13110 |

| Johnson Controls, Inc. |

|

1.53 |

% |

|

0.09221 |

| The May Department Stores Company |

|

3.22 |

% |

|

0.22157 |

| Omnicom Group Inc. |

|

1.31 |

% |

|

0.14577 |

| Pitney Bowes Inc. |

|

3.22 |

% |

|

0.17989 |

| Rohm and Haas Company |

|

2.23 |

% |

|

0.18034 |

| Schering-Plough Corporation |

|

2.96 |

% |

|

0.28863 |

(1) |

As of August 27, 2002. |

S-19

The dividend yield on the Industrial 15 Index as of August 27, 2002 was 2.58%.

The Share Multipliers indicated above were calculated by the AMEX on June 26, 2002, the anniversary of the date the Industrial 15 Index was originally calculated and disseminated. Each Share Multiplier equaled the number of shares of that Industrial

15 Stock, or portion thereof, based upon the closing market price of that stock on June 26, 2002, so that each stock represented approximately an equal percentage of the Industrial 15 Index as of June 26, 2002. Each Share Multiplier remains constant

until adjusted for certain corporate events, quarterly dividend adjustments and annual reconstitutions as described below. The last adjustment to the Share Multipliers took place on June 26, 2002.

Annual Industrial 15 Portfolio Reconstitution

As of the close of business on each Anniversary Date through the Anniversary Date in 2006, the Industrial 15 Portfolio shall be reconstituted to include the fifteen

Qualifying Stocks in the S&P Industrial Index having the highest Dividend Yield (the “New Stocks”) on the second scheduled Index Business Day prior to the applicable Anniversary Date (the “Annual Determination Date”).

“Anniversary Date” shall mean June 26th of each year, which is the anniversary of the date the Industrial 15 Index was originally calculated and disseminated; provided, however, that if the date is not an Index Business Day or a Market

Disruption Event occurs on that date, then the Anniversary Date for that year shall mean the immediately succeeding Index Business Day on which a Market Disruption Event does not occur. The AMEX will only add a stock having characteristics as of the

applicable Annual Determination Date that will permit the Industrial 15 Index to remain within the criteria specified in the rules of the AMEX and within the applicable rules of the Securities and Exchange Commission. The criteria and rules will

apply only on an Annual Determination Date to exclude a proposed New Stock. If a proposed New Stock does not meet these criteria or rules, the AMEX will replace it with the Qualifying Stock with the next highest Dividend Yield which meets the rules

and criteria. These criteria currently provide, among other things, (1) that each component stock must have a minimum market value of at least $75 million, except that up to 10% of the component securities in the Industrial 15 Index may have a

market value of $50 million; (2) that each component stock must have an average monthly trading volume in the preceding six months of not less than 1,000,000 shares, except that up to 10% of the component stocks in the Industrial 15 Index may have

an average monthly trading volume of 500,000 shares or more in the last six months; (3) 90% of the Industrial 15 Index’s numerical index value and at least 80% of the total number of component stocks will meet the then current criteria for

standardized option trading set forth in the rules of the AMEX and (4) all component stocks will either be listed on the AMEX, the NYSE, or traded through the facilities of the National Association of Securities Dealers Automated Quotation System

and reported as National Market System Securities.

The “Share Multiplier” for each New Stock will be

determined by the AMEX and will equal the number of shares of each New Stock, based upon the closing market price of that New Stock on the Anniversary Date, so that each New Stock represents approximately an equal percentage of a value equal to the

Industrial 15 Index in effect at the close of business on the applicable Anniversary Date. As an example, if the Industrial 15 Index in effect at the close of business on an Anniversary Date equaled 150, then each of the fifteen New Stocks would be

allocated a portion of the value of the Industrial 15 Index equal to 10 and if, the closing market price of a New Stock on the Anniversary Date was 20, the applicable Share Multiplier would be 0.5. If the Industrial 15 Index equaled 60, then each of

the fifteen New Stocks would be allocated a portion of the value of the Industrial 15 Index equal to 4 and if the closing market price of a New Stock on the Anniversary Date was 20, the applicable Share Multiplier would be 0.2.

S&P Industrial Index

The S&P Industrial Index is a subset of the S&P 500 Index made up of the companies in the S&P 500 Index that are considered industrial companies. The S&P 500 Index is published by

Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. and is intended to provide an indication of the pattern of common stock price movement. The value of the S&P 500 Index is based on the relative value of the aggregate

market value of

S-20

the common stocks of 500 companies as of a particular time compared to the aggregate average market value of the common stocks of 500 similar companies during the base period of the years 1941

through 1943. Companies included in the S&P 500 Index are classified as one of four different types of companies: utility, transportation, financial or industrial.

Dividends

As described above, the value of the Industrial

15 Index will include an amount reflecting Current Quarter Dividends. “Current Quarter Dividends” for any day will be determined by the Index Calculation Agent and will equal the sum of the products for each Industrial 15 Stock of the cash

dividend paid by an issuer on one share of stock during the Current Quarter multiplied by the Share Multiplier applicable to such stock on the ex-dividend date. “Current Quarter” shall mean the calendar quarter containing the day for which

the applicable Current Quarter Dividends are being determined. As of August 27, 2002, Current Quarter Dividends amounted to $0.485666. This amount, along with any other Current Quarter Dividends accumulated through and including September 30, 2002,

will be allocated to the Industrial 15 Stocks prior to the opening of trading on October 1, 2002, as described below.

As of the first day of the start of each calendar quarter, the AMEX will allocate the Current Quarter Dividends as of the end of the immediately preceding calendar quarter to each then outstanding Industrial 15 Stock. The amount of

the Current Quarter Dividends allocated to each Industrial 15 Stock will equal the percentage of the value of each Industrial 15 Stock contained in the Industrial 15 Portfolio relative to the value of the entire Industrial 15 Portfolio based on the

closing market price on the last Index Business Day in the immediately preceding calendar quarter. The Share Multiplier of each such outstanding Industrial 15 Stock will be increased to reflect the number of shares, or portion of a share, that the

amount of the Current Quarter Dividend allocated to such Industrial 15 Stock can purchase of each such Industrial 15 Stock based on the closing market price on the last Index Business Day in the immediately preceding calendar quarter.

Adjustments to the Share Multiplier and Industrial 15 Portfolio

The Share Multiplier for any Industrial 15 Stock and the Industrial 15 Portfolio will be adjusted as follows:

1. If an Industrial 15 Stock is subject to a stock split or reverse stock split, then once the split has become effective, the Share Multiplier for

that Industrial 15 Stock will be adjusted to equal the product of the number of shares issued with respect to one such share of that Industrial 15 Stock and the prior multiplier.

2. If an Industrial 15 Stock is subject to a stock dividend, issuance of additional shares of the Industrial 15 Stock, that is given equally to all

holders of shares of the issuer of that Industrial 15 Stock, then once the dividend has become effective and that Industrial 15 Stock is trading ex-dividend, the Share Multiplier will be adjusted so that the new Share Multiplier shall equal the

former Share Multiplier plus the product of the number of shares of that Industrial 15 Stock issued with respect to one such share of that Industrial 15 Stock and the prior multiplier.

3. If an Industrial 15 Company is being liquidated or is subject to a proceeding under any applicable bankruptcy, insolvency or other similar law,

that Industrial 15 Stock will continue to be included in the Industrial 15 Portfolio so long as a market price for that Industrial 15 Stock is available. If a market price is no longer available for an Industrial 15 Stock for whatever reason,

including the liquidation of the issuer of the Industrial 15 Stock or the subjection of the issuer of the Industrial 15 Stock to a proceeding under any applicable bankruptcy, insolvency or other similar law, then the value of that Industrial 15

Stock will equal zero in connection with calculating the Industrial 15 Portfolio Value for so long as no market price is available, and no attempt will be made to immediately find a replacement stock or increase the value of the Industrial 15

Portfolio to compensate for the deletion of such Industrial 15 Stock. If a market price is no longer available for a Industrial

S-21

15 Stock as described above, the Industrial 15 Portfolio Value will be computed based on the remaining Industrial 15 Stocks for which market prices are available and no new stock will be added to

the Industrial 15 Portfolio until the annual reconstitution of the Industrial 15 Portfolio. As a result, there may be periods during which the Industrial 15 Portfolio contains fewer than fifteen Industrial 15 Stocks.

4. If an Industrial 15 Company has been subject to a merger or consolidation and is not the surviving entity or is

nationalized, then a value for that Industrial 15 Stock will be determined at the time the issuer is merged or consolidated or nationalized and will equal the last available market price for that Industrial 15 Stock and that value will be constant

until the Industrial 15 Portfolio is reconstituted. At that time, no adjustment will be made to the Share Multiplier of the relevant Industrial 15 Stock.

5. If an Industrial 15 Company issues to all of its shareholders equity securities that are publicly traded of an issuer other than the Industrial 15 Company, or a tracking stock

is issued by an Industrial 15 Company to all of its shareholders, then the new equity securities will be added to the Industrial 15 Portfolio as a new Industrial 15 Stock. The Share Multiplier for the new Industrial 15 Stock will equal the product

of the original Share Multiplier with respect to the Industrial 15 Stock for which the new Industrial 15 Stock is being issued (the “Original Industrial 15 Stock”) and the number of shares of the new Industrial 15 Stock issued with respect

to one share of the Original Industrial 15 Stock.

No adjustments of any Share Multiplier of an Industrial 15

Stock will be required unless the adjustment would require a change of at least 1% in the Share Multiplier then in effect. The Share Multiplier resulting from any of the adjustments specified above will be rounded to the nearest ten-thousandth with

five hundred-thousandths being rounded upward.

The AMEX expects that no adjustments to the Share Multiplier of

any Industrial 15 Stock or to the Industrial 15 Portfolio will be made other than those specified above, however, the AMEX may at its discretion make adjustments to maintain the value of the Industrial 15 Index if certain events would otherwise

alter the value of the Industrial 15 Index despite no change in the market prices of the Industrial 15 Stocks.

S-22

Hypothetical and Historical Data on the Industrial 15 Index

The following table sets forth the hypothetical level of the Industrial 15 Index at the end of each month, in the period from May 1996 through May 2001 calculated as if the

Industrial 15 Index had existed during that period and the actual month-end closing values of the Industrial 15 Index from June 2001 through July 2002. All hypothetical historical data presented in the following table were calculated by the AMEX and