|

Exhibit 99.2

|

Exhibit C to Indenture Supplement to Indenture

|

SCHEDULE TO MONTHLY NOTEHOLDERS' STATEMENT

BAseries

BA CREDIT CARD TRUST

____________________________________________

MONTHLY PERIOD ENDING December 31, 2023

____________________________________________

Reference is made to the Fifth Amended and Restated Series 2001-D Supplement (the "Series 2001-D Supplement"), dated

as of December 17, 2015, among BA Credit Card Funding, LLC as Transferor, Bank of America, National Association (“BANA”), as Servicer, and The Bank of New York Mellon, as Trustee, the Fourth Amended and Restated Indenture (the “Indenture”), dated as

of December 17, 2015, and the Third Amended and Restated BAseries Indenture Supplement (the "Indenture Supplement"), dated as of December 17, 2015, each between BA Credit Card Trust, as Issuer, and The Bank of New York Mellon, as Indenture Trustee.

Terms used herein and not defined herein have the meanings ascribed to them in the Fifth Amended and Restated 2001-D Supplement, the Fourth Amended and Restated Indenture and the Third Amended and Restated BAseries Indenture Supplement, as

applicable.

The following computations are prepared with respect to the Transfer Date of January 12, 2024 and with respect to the performance of the Trust during the related Monthly Period.

Terms and abbreviations used in this report and not otherwise defined herein have the meanings set forth in the

certain program documents for the BA Master Credit Card Trust II and the BA Credit Card Trust, as certain of such program documents have been amended, as applicable. Each of these agreements and related amendments, as applicable, has been included

as an exhibit to a report on Form 8-K filed by BA Credit Card Funding, LLC, the BA Master Credit Card Trust II and the BA Credit Card Trust, with the Securities and Exchange Commission ("SEC") under File Nos. 0001370238, 0000936988 and 0001128250,

respectively, on October 1, 2014, July 8, 2015 or December 18, 2015.

|

A.

|

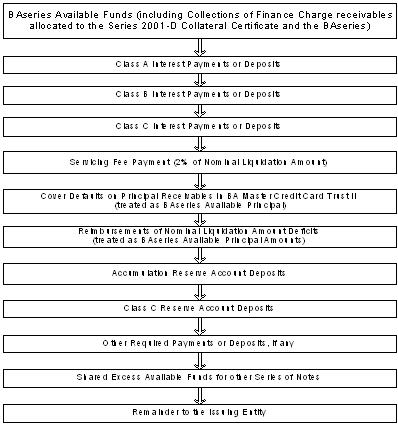

In accordance with Section 3.01 of the Third Amended and Restated BAseries Indenture Supplement dated as of December 17, 2015, between BA Credit

Card Trust and The Bank of New York Mellon, BAseries Available Funds shall be applied in the priority described in the chart below. This chart is only an overview of the application and priority of payments of BAseries Available Funds. For

a more detailed description, please see the Third Amended and Restated BAseries Indenture Supplement as included in Exhibit 4.5 to Registrant's Form 8-K filed with SEC on December 18, 2015.

|

Priority of Payments

BAseries Available Funds

| B. |

Targeted deposits to Interest Funding sub-Accounts:

|

|

Targeted Deposit to Interest Funding sub-Account for applicable Monthly Period

|

Actual Deposit to Interest Funding sub-Account for applicable Monthly Period

|

Shortfall from earlier Monthly Periods

|

Interest Funding sub-account Balance prior to Withdrawals

|

Interest Funding sub-Account Earnings

|

|

|

Class A :

|

|||||

|

Class A (2021-01)

|

$366,666.67

|

$366,666.67

|

$0.00

|

$366,666.67

|

$0.00

|

|

Class A (2022-01)

|

$2,941,666.67

|

$2,941,666.67

|

$0.00

|

$2,941,666.67

|

$0.00

|

|

Class A (2022-02)

|

$5,208,333.33

|

$5,208,333.33

|

$0.00

|

$5,208,333.33

|

$0.00

|

|

Class A (2023-01)

|

$3,991,666.67

|

$3,991,666.67

|

$0.00

|

$3,991,666.67

|

$0.00

|

|

Class A (2023-02)

|

$6,432,500.00

|

$6,432,500.00

|

$0.00

|

$6,432,500.00

|

$0.00

|

|

Class A Total:

|

$18,940,833.34

|

$18,940,833.34

|

$0.00

|

$18,940,833.34

|

$0.00

|

|

Class B :

|

|||||

|

Class B (2010-01)

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Class B Total:

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Class C :

|

|||||

|

Class C (2010-01)

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Class C Total:

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

|

Total:

|

$18,940,833.34

|

$18,940,833.34

|

$0.00

|

$18,940,833.34

|

$0.00

|

|

C.

|

Interest to be paid on the corresponding Payment Date:

|

|

CUSIP Number

|

Interest Payment Date

|

Interest Rate

|

Amount of interest to be paid on corresponding Interest Payment Date

|

|

|

Class A :

|

||||

|

Class A (2021-01)

|

05522RDD7

|

January 16, 2024

|

0.440000%

|

$366,666.67

|

|

Class A (2022-01)

|

05522RDE5

|

January 16, 2024

|

3.530000%

|

$2,941,666.67

|

|

Class A (2022-02)

|

05522RDF2

|

January 16, 2024

|

5.000000%

|

$5,208,333.33

|

|

Class A (2023-01)

|

05522RDG0

|

January 16, 2024

|

4.790000%

|

$3,991,666.67

|

|

Class A (2023-02)

|

05522RDH8

|

January 16, 2024

|

4.980000%

|

$6,432,500.00

|

|

Class A Total:

|

$18,940,833.34

|

|||

|

Total:

|

$18,940,833.34

|

|||

| D. |

Targeted deposits to Class C Reserve sub-Accounts:

|

|

Targeted Deposit to Class C Reserve sub-Account for applicable Monthly Period

|

Actual Deposit to Class C Reserve sub-Account for applicable Monthly Period

|

Class C Reserve sub-Account Balance on Transfer Date prior to withdrawals

|

Class C Reserve sub-Account Earnings

|

Amount of interest to be paid on corresponding Interest Payment Date

|

|

|

NOTHING TO REPORT

|

|||||

|

E.

|

Withdrawals to be made from the Class C Reserve

sub-Accounts on the corresponding Transfer Date:

|

|

Targeted Deposit to Withdrawals for Interest

|

Actual Deposit to Withdrawals for Principal

|

Class C Reserve Class C Reserve sub-Account Balance on Transfer Date after withdrawals

|

|

|

NOTHING TO REPORT

|

|||

|

F.

|

Targeted deposits to Principal Funding sub-Accounts:

|

|

Targeted Deposit to Principal Funding sub-Account for applicable Monthly Period

|

Actual Deposit to Principal Funding sub-Account for applicable Monthly Period

|

Shortfall from earlier Monthly Periods

|

Principal Funding sub-Account Balance on Transfer Date

|

Principal Funding sub-Account Earnings

|

|

|

NOTHING TO REPORT

|

|||||

|

G.

|

Principal to be paid on the corresponding Principal Payment Date:

|

|

CUSIP Number

|

Principal Payment Date

|

Amount of principal to be paid on corresponding Principal Payment Date

|

|

|

NOTHING TO REPORT

|

|||

| H. |

Stated Principal Amount, Outstanding Dollar Principal Amount and Nominal Liquidation Amount for the related Monthly Period:

|

|

Initial Dollar Principal Amount

|

Outstanding Principal Amount

|

Adjusted Outstanding Principal Amount

|

Nominal Liquidation Amount

|

|

|

Class A :

|

||||

|

Class A (2021-01)

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

|

Class A (2022-01)

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

|

Class A (2022-02)

|

$1,250,000,000.00

|

$1,250,000,000.00

|

$1,250,000,000.00

|

$1,250,000,000.00

|

|

Class A (2023-01)

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

$1,000,000,000.00

|

|

Class A (2023-02)

|

$1,500,000,000.00

|

$1,500,000,000.00

|

$1,500,000,000.00

|

$1,500,000,000.00

|

|

Class A Total:

|

$5,750,000,000.00

|

$5,750,000,000.00

|

$5,750,000,000.00

|

$5,750,000,000.00

|

|

Class B :

|

||||

|

Class B (2010-01)

|

$2,350,000,000.00

|

$2,350,000,000.00

|

$2,350,000,000.00

|

$2,350,000,000.00

|

|

Class B Total:

|

$2,350,000,000.00

|

$2,350,000,000.00

|

$2,350,000,000.00

|

$2,350,000,000.00

|

|

Class C :

|

||||

|

Class C (2010-01)

|

$1,225,000,000.00

|

$1,225,000,000.00

|

$1,225,000,000.00

|

$1,225,000,000.00

|

|

Class C Total:

|

$1,225,000,000.00

|

$1,225,000,000.00

|

$1,225,000,000.00

|

$1,225,000,000.00

|

|

Total:

|

$9,325,000,000.00

|

$9,325,000,000.00

|

$9,325,000,000.00

|

$9,325,000,000.00

|

|

I.

|

Class A Usage of Class B and Class C Subordinated

Amounts:

|

|

Class A Usage of Class B Subordinated Amount for this Monthly Period

|

Class A Usage of Class C Subordinated Amount for this Monthly Period

|

Cumulative Class A Usage of Class B Subordinated Amount

|

Cumulative Class A Usage of Class C Subordinated Amount

|

||

|

NOTHING TO REPORT

|

|||||

|

J.

|

Class B Usage of Class C Subordinated Amounts:

|

|

Class B Usage of Class C Subordinated Amount for this Monthly Period

|

Cumulative Class B Usage of Class C Subordinated Amount

|

||||

|

NOTHING TO REPORT

|

|||||

|

K.

|

Nominal Liquidation Amount for Tranches of Notes Outstanding:

|

|

Beginning Nominal Liquidation Amount

|

Increases from accretions on Principal for Discount Notes

|

Increases from amounts withdrawn from the Principal Funding sub-Account in respect of Prefunding Excess Amount

|

Reimbursements from Available Funds

|

Reductions due to reallocations of Available Principal Amounts

|

Reductions due to Investor Charge-Offs

|

Reductions due to amounts on deposit in the Principal Funding sub-Account

|

Ending Nominal Liquidation Amount

|

|

|

Class A :

|

||||||||

|

Class A (2021-01)

|

$1,000,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,000,000,000.00

|

|

Class A (2022-01)

|

$1,000,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,000,000,000.00

|

|

Class A (2022-02)

|

$1,250,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,250,000,000.00

|

|

Class A (2023-01)

|

$1,000,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,000,000,000.00

|

|

Class A (2023-02)

|

$1,500,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,500,000,000.00

|

|

Class A Total:

|

$5,750,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$5,750,000,000.00

|

|

Class B :

|

||||||||

|

Class B (2010-01)

|

$2,350,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$2,350,000,000.00

|

|

Class B Total:

|

$2,350,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$2,350,000,000.00

|

|

Class C :

|

||||||||

|

Class C (2010-01)

|

$1,225,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,225,000,000.00

|

|

Class C Total:

|

$1,225,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$1,225,000,000.00

|

|

Total:

|

$9,325,000,000.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$0.00

|

$9,325,000,000.00

|

|

L.

|

Excess Available Funds and 3 Month Excess Available Funds:

|

|

Excess Available Funds

|

$131,876,200.82

|

|

Is 3 Month Excess Available Funds < 0 ? (Yes/No)

|

No

|

|

M.

|

Other Performance Triggers

|

|

Has a Class C Reserve sub-Account funding trigger occurred? (Yes/No)

|

No

|

N. Repurchase Demand Activity (Rule 15Ga-1)

No Activity to Report

Most Recent Form ABS – 15G

Filed by: BA Credit Card Funding, LLC

CIK#: 0001370238

Filing Date: January 19, 2023

IN WITNESS WHEREOF, the undersigned has duly executed and delivered this Monthly Noteholders' Statement this 8th day of January, 2024.

|

BANK OF AMERICA, NATIONAL ASSOCIATION,

|

|

|

Servicer

|

|

|

By: /S/Joseph L. Lombardi

|

|

|

Name: Joseph L. Lombardi

|

|

|

Title: Director

|

|