PROSPECTUS SUPPLEMENT

(To general prospectus supplement

and prospectus dated March 31, 2006)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-132911

Subject to Completion

Preliminary Prospectus Supplement dated February 13, 2007

| PROSPECTUS SUPPLEMENT (To general prospectus supplement and prospectus dated March 31, 2006) |

|

Units

Merrill Lynch & Co., Inc.

PROtected Covered Call EnhancED Income NoteSSM

Linked to the World Equity PROCEEDS Index

due April , 2012

(the “PROCEEDSSM”)

$10 principal amount per unit

Investing in the PROCEEDS involves risks that are described in the “ Risk Factors” section beginning on page PS-10 of this prospectus supplement.

| Per Unit | Total | |||

| Public offering price (1) |

$10.00 | $ | ||

| Underwriting discount (1) |

$.30 | $ | ||

| Proceeds, before expenses, to Merrill Lynch & Co., Inc. |

$9.70 | $ |

| (1) | The public offering price and the underwriting discount for any single transaction to purchase between 100,000 and 299,999 units will be $9.95 per unit and $.25 per unit, respectively, for any single transaction to purchase between 300,000 to 499,999 units will be $9.90 per unit and $.20 per unit, respectively, and for any single transaction to purchase 500,000 units or more will be $9.85 per unit and $.15 per unit respectively. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying general prospectus supplement or prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Merrill Lynch & Co.

The date of this prospectus supplement is March , 2007.

“PROtected Covered Call EnhancED Income NoteS” and “PROCEEDS” are service marks of Merrill Lynch & Co., Inc.

“Standard & Poor’s®”, “Standard & Poor’s 500”, “S&P 500®” and S&P® are trademarks of The McGraw Hill Companies, Inc. and have been licensed for use by Merrill Lynch, Pierce, Fenner & Smith Incorporated and Merrill Lynch & Co., Inc. is an authorized sublicensee. Nikkei-225® is a service mark of Nikkei Inc., and has been authorized for use by Merrill Lynch & Co., Inc. The “Dow Jones EURO STOXX 50SM” is proprietary and copyrighted material. The Dow Jones EURO STOXX 50SM and the related trademarks have been licensed for certain purposes by Merrill Lynch & Co., Inc and its subsidiaries. Neither STOXX Limited nor Dow Jones & Company, Inc. sponsors, endorses or promotes the PROCEEDS based on the Dow Jones EURO STOXX 50SM.

Prospectus Supplement

| PS-3 | ||

| PS-10 | ||

| RISK FACTORS RELATING TO THE PROCEEDS AND THE REFERENCE INDEX |

PS-10 | |

| PS-13 | ||

| PS-16 | ||

| PS-21 | ||

| PS-22 | ||

| PS-38 | ||

| PS-57 | ||

| PS-61 | ||

| PS-62 | ||

| PS-62 | ||

| PS-62 | ||

| PS-63 | ||

| PS-63 | ||

| PS-64 |

Debt Securities, Warrants, Preferred Stock,

Depositary Shares and Common Stock Prospectus Supplement

(the “general prospectus supplement”)

| MERRILL LYNCH & CO., INC |

S-3 | |

| USE OF PROCEEDS |

S-3 | |

| RATIO OF EARNINGS TO FIXED CHARGES AND RATIO OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS |

S-4 | |

| THE SECURITIES |

S-4 | |

| DESCRIPTION OF DEBT SECURITIES |

S-5 | |

| DESCRIPTION OF DEBT WARRANTS |

S-16 | |

| DESCRIPTION OF CURRENCY WARRANTS |

S-18 | |

| DESCRIPTION OF INDEX WARRANTS |

S-20 | |

| DESCRIPTION OF PREFERRED STOCK |

S-25 | |

| DESCRIPTION OF DEPOSITARY SHARES |

S-32 | |

| DESCRIPTION OF PREFERRED STOCK WARRANTS |

S-36 | |

| DESCRIPTION OF COMMON STOCK |

S-38 | |

| DESCRIPTION OF COMMON STOCK WARRANTS |

S-42 | |

| PLAN OF DISTRIBUTION |

S-44 | |

| WHERE YOU CAN FIND MORE INFORMATION |

S-45 | |

| INCORPORATION OF INFORMATION WE FILE WITH THE SEC |

S-46 | |

| EXPERTS |

S-46 |

Prospectus

| WHERE YOU CAN FIND MORE INFORMATION |

2 | |

| INCORPORATION OF INFORMATION WE FILE WITH THE SEC |

2 | |

| EXPERTS |

2 |

PS-2

This summary includes questions and answers that highlight selected information from this prospectus supplement and the accompanying general prospectus supplement and prospectus to help you understand the PROtected Covered Call EnhancED Income NoteSSM Linked to the World Equity PROCEEDS Index (the “Reference Index”) due April , 2012. You should carefully read this prospectus supplement, the accompanying general prospectus supplement and prospectus to fully understand the terms of the PROCEEDS, the Reference Index and the tax and other considerations that are important to you in making a decision about whether to invest in the PROCEEDS. You should carefully review the “Risk Factors” section, which highlights certain risks associated with an investment in the PROCEEDS, to determine whether an investment in the PROCEEDS is appropriate for you.

References in this prospectus supplement to “ML&Co.”, “we”, “us” and “our” are to Merrill Lynch & Co., Inc. References to “MLPF&S” are to Merrill Lynch, Pierce, Fenner & Smith Incorporated. References to “MLI” are to Merrill Lynch International.

What are the PROCEEDS?

The PROCEEDS will be a series of senior debt securities issued by ML&Co. and will not be secured by collateral. The PROCEEDS will rank equally with all of our other unsecured and unsubordinated debt. The PROCEEDS will mature on April , 2012. We cannot redeem the PROCEEDS at an earlier date. We will make variable monthly interest payments only under the circumstances described in this prospectus supplement. Depending on the date the PROCEEDS are priced for initial sale to the public (the “Pricing Date”), which may be in March or April, the settlement date may occur in March instead of April and the maturity date may occur in March instead of April. Any reference in this prospectus supplement to the month in which the settlement date or maturity date will occur is subject to change as specified above.

Each unit of the PROCEEDS represents $10 principal amount of PROCEEDS. You may transfer the PROCEEDS only in whole units. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the PROCEEDS in the form of a global certificate, which will be held by The Depository Trust Company (“DTC”) or its nominee. Direct and indirect participants in DTC will record your ownership of the PROCEEDS. You should refer to the section entitled “Description of the Debt Securities—Depositary” in the accompanying general prospectus supplement.

Are there any risks associated with my investment?

Yes. An investment in the PROCEEDS is subject to risks, including the risk that the PROCEEDS will only return their principal amount on the maturity date, resulting in a substantial economic opportunity loss to you. Please refer to the section entitled “Risk Factors” in this prospectus supplement.

Who publishes the Reference Index and what does the Reference Index measure?

The daily closing values of the Reference Index, the Basket Units and the Zero Coupon Bond Units determined as of 4:00 p.m. (New York City time) will be published on each business day on Reuters Page MEREDUS15 (or any successor page for the purpose of displaying those closing values as identified by MLI, as the Reference Index calculation agent (the “Calculation Agent”)).

The Reference Index is a composite index that will track the performance of hypothetical investments in two assets, the Basket Units and the Zero Coupon Bond Units, and one liability, the Leverage Units (each an “Index Component,” and together the “Index Components”). Generally, the level of the Reference Index at any time will equal the sum of the values of the Basket Units and the Zero Coupon Bond Units, less the value of Leverage Units and reduced by a pro rata portion of the Index Adjustment Factor of 1.15% per annum as described below. The level of the Reference Index will be set to 97 on the Pricing Date.

The initial allocations of hypothetical funds to the Index Components will be set on the Pricing Date and will be between 95% and 105% in Basket Units, between 0% and 5% in Zero Coupon Bond Units and between 0% and 5% in Leverage Units. We expect the allocations among the Index Components to change upon an Allocation Determination Event, as described in the section entitled “The World Equity PROCEEDS Index” in this prospectus supplement.

The formula will not allocate more than 150% of the hypothetical funds to the Basket Units. The relative allocations among each Index Component will be determined by the Calculation Agent based upon the formula described herein.

The PROCEEDS are debt securities of ML&Co. An investment in the PROCEEDS does not entitle you to any dividends, voting rights, option premiums or any other ownership interest in the securities included in the Reference Index.

PS-3

What hypothetical investment does each Index Component track?

The Index Components are defined as follows:

A “Basket Unit” will track the value of an initial US$100 hypothetical investment in the Index Basket. The “Index Basket” is a hypothetical investment in a “covered call” strategy in which (i) an investment in United States dollars in each of the indices in the Index Basket (the “Basket Indices”) is purchased and (ii) call options on the Basket Indices are sold in United States dollars on a monthly basis for a one month term. The Basket Indices will be the Dow Jones EURO STOXX 50 Index, which is denominated in European Union euros, the Nikkei 225 Index, which is denominated in Japanese yen, and the S&P 500 Index, which is denominated in United States dollars. The Basket Indices will initially be equally weighted as of the Pricing Date based upon the United States dollar equivalent of their respective levels and will be rebalanced annually so that they are equally weighted based upon the United States dollar equivalent of their respective levels on the date of such rebalancing as described in this prospectus supplement. The Basket Indices are described in the section entitled “Description of the Index Basket” in this prospectus supplement.

A “Zero Coupon Bond Unit” will track the value of a US$100 face value hypothetical investment in a hypothetical zero coupon bond maturing on the scheduled Valuation Date, as described below, with a yield equal to the applicable zero coupon yield based upon USD swap rates as published on Bloomberg Page EDS. The applicable zero coupon yield will be estimated from the USD swap rate yields corresponding to the published maturities closest in time to the scheduled Valuation Date. The Calculation Agent may, when necessary, estimate the applicable zero coupon yield by interpolating the appropriate USD swap rate yields based on those published maturities. The Zero Coupon Bond Units will not yield any return after the scheduled Valuation Date.

A “Leverage Unit” will track the value of US$1 of hypothetical borrowings used to increase the exposure to the Basket Units. To the extent that exposure to the Basket Units is leveraged (i.e., increased with borrowed funds) through the use of Leverage Units, the number of Leverage Units will be increased daily by an amount equal to the Daily Leverage Charge (see the section entitled “Fees, Deductions and Charges—Daily Leverage Charge” in this prospectus supplement). The Daily Leverage Charge will reduce the level of the Reference Index.

What will I receive on the maturity date of the PROCEEDS?

We have designed the PROCEEDS for investors who want to protect their investment by receiving at least the principal amount of their investment on the maturity date and who also want to participate in possible periodic interest payments and, to the extent provided herein, in possible increases in the level of the Reference Index (after the deduction of certain fees, deductions and charges). On the maturity date, you will receive a cash payment, in addition to any interest payment due, on the PROCEEDS equal to the sum of two amounts: the “principal amount” and the “Supplemental Redemption Amount”, if any.

Principal Amount

The “principal amount” per unit is $10.

Supplemental Redemption Amount

The “Supplemental Redemption Amount” per unit will be denominated in United States dollars and will equal:

| $10 × |

(

|

Ending Value – Threshold Value | )

|

; | ||||||||

| Threshold Value |

provided, however, that in no event will the Supplemental Redemption Amount be less than zero.

The “Ending Value” will be determined by the Calculation Agent and will equal the level of the Reference Index at the close of the market on the Valuation Date.

The “Threshold Value” equals 100.

The “Valuation Date” will be the seventh scheduled global business day before the maturity date, or on an alternate date shortly thereafter as described in the section entitled “Description of the PROCEEDS—Payment on the maturity date” in this prospectus supplement.

The “Starting Value” will be set to 97 on the Pricing Date.

Because the Starting Value will be set to 97, which is less than the Threshold Value, we will pay you a Supplemental Redemption Amount only if the Ending Value is 3.09% greater than the Starting Value on the Valuation Date. If the Ending Value is less than or equal to the Threshold Value, the Supplemental Redemption Amount will be zero. We will pay you the principal amount of your PROCEEDS regardless of whether any Supplemental Redemption Amount is payable.

For more specific information about the Supplemental Redemption Amount, please see the section entitled “Description of the PROCEEDS” in this prospectus supplement.

PS-4

Examples

Here are three examples of Supplemental Redemption Amount calculations:

Example 1—On the maturity date, the Reference Index is below the Starting Value:

| Starting Value: 97 | ||||||||||||

| Threshold Value: 100 | ||||||||||||

| Hypothetical Ending Value: 90 | ||||||||||||

| Supplemental Redemption Amount (per unit) = $10 × | (

|

90 – 100 | )

|

= $0 | (Supplemental Redemption Amount cannot be less than zero) | |||||||

| 100 | ||||||||||||

| Total payment on the maturity date (per unit) = $10 + $0 = $10 | ||||||||||||

Example 2—On the maturity date, the Reference Index is above the Starting Value but below the Threshold Value:

| Starting Value: 97 | ||||||||||||

| Threshold Value: 100 | ||||||||||||

| Hypothetical Ending Value: 99 | ||||||||||||

| Supplemental Redemption Amount (per unit) = $10 × | (

|

99 – 100 | )

|

= $0 | (Supplemental Redemption Amount cannot be less than zero) | |||||||

| 100 | ||||||||||||

| Total payment on the maturity date (per unit) = $10 + $0 = $10 | ||||||||||||

Example 3—On the maturity date, the Reference Index is above the Threshold Value:

| Starting Value: 97 | ||||||||||||

| Threshold Value: 100 | ||||||||||||

| Hypothetical Ending Value: 105 | ||||||||||||

| Supplemental Redemption Amount (per unit) = $10 × | (

|

105 – 100 | )

|

= $.50 | ||||||||

| 100 | ||||||||||||

| Total payment on the maturity date (per unit) = $10 + $.50 = $10.50 | ||||||||||||

Will I receive interest payments on the PROCEEDS?

The interest payable on the PROCEEDS will vary and may be zero. We expect to pay interest, if any, in cash monthly on the dates described under “Description of the PROCEEDS—Interest” in this prospectus supplement.

The interest payments, if any, on the PROCEEDS will depend on the hypothetical income of the Basket Units (the “Basket Unit Income”) held in the Reference Index over each monthly calculation period and the level of the Reference Index at the end of that period. The Basket Unit Income will be based on the United States dollar value of the cash dividends in respect of the stocks included in the Basket Indices and the value of the premiums in respect of call options on the Basket Indices. See “Description of the Index Basket—Calculation of the Value of the Index Basket” in this prospectus supplement. If the level of the Reference Index (less any Basket Unit Income) falls below certain thresholds relative to the Floor Level described in this prospectus supplement during any monthly calculation period, you will not receive any interest payment for that monthly calculation period and, in certain circumstances, you will not receive any interest payments for the

PS-5

remaining term of the PROCEEDS. See “Description of the PROCEEDS—Interest” in this prospectus supplement.

What are the costs associated with an investment in the PROCEEDS?

Your return on the PROCEEDS will reflect the deduction of the following costs over the term of the PROCEEDS:

Index Adjustment Factor: The level of the Reference Index will reflect a 1.15% per annum reduction (the “Index Adjustment Factor”) that will be applied and accrue daily on the daily closing level of the Reference Index to the benefit of the Calculation Agent on the basis of a 365-day year from the date the PROCEEDS are issued to the public through the Valuation Date. The Index Adjustment Factor will remain at 1.15% per annum for as long as any hypothetical funds are allocated to Basket Units. If at any time that allocation is zero, the Index Adjustment Factor will not apply.

Daily Leverage Charge: To the extent that the hypothetical investment in the Basket Units is leveraged (i.e., increased with hypothetical borrowed funds) through the use of Leverage Units, the number of Leverage Units will be increased daily by an amount equal to the interest expense deemed to have been incurred on those funds (the “Daily Leverage Charge”). The Daily Leverage Charge will equal the number of Leverage Units outstanding on the applicable day multiplied by the Federal Funds rate on the applicable day plus 0.5%, divided by 360. This deemed interest expense will reduce the level of the Reference Index on each day that the Reference Index includes Leverage Units.

Implicit sales charge: An implicit sales charge is paid to MLPF&S upon the purchase of the PROCEEDS because the Starting Value will be set to 97, while the Threshold Value equals 100. In order for you to receive a Supplemental Redemption Amount on the maturity date, the Ending Value must exceed 100 on the Valuation Date. Therefore, the level of the Reference Index must increase by more than 3.09% for you to receive an amount in excess of $10 per unit of the PROCEEDS. This is analogous to paying an up front sales charge of 3% per unit of the PROCEEDS.

Basket Adjustment Factor: The value of the Index Basket will reflect a 1.00% per annum reduction (the “Basket Adjustment Factor”) that will be applied and accrue daily based on the value of the Index Basket at the end of the previous day on the basis of a 365-day year and will be subtracted from the Basket Unit Income on the Index Basket at the end of each day prior to effecting any reallocation that day. The value of the Basket Adjustment Factor for any monthly calculation period will not exceed the value of the Basket Unit Income on the Index Basket for that monthly calculation period. The Basket Adjustment Factor will accrue to the benefit of the Calculation Agent. Because the Basket Adjustment Factor reduces the value of the Index Basket, the return on an investment in the “covered call” strategy (as described in the section entitled “Description of the Index Basket” in this prospectus supplement) represented by the Index Basket, and therefore the Reference Index and the PROCEEDS, will be less than a return on a “covered call” strategy on the Index Basket that did not include the Basket Adjustment Factor.

What does the “formula” do and when will the Reference Index undergo reallocations among the Index Components?

The formula determines the allocation of hypothetical funds to the Basket Units (the “Targeted Exposure”), and the consequent allocations to the Zero Coupon Bond Units and the Leverage Units. The formula will cause these allocations to vary over the term of the PROCEEDS in order to participate in any appreciation of the Basket Units, but only to the extent consistent with the objective that the Reference Index level on the scheduled Valuation Date is at least 100.

An “Allocation Determination Event” will occur and a reallocation will be effected if the absolute value of the difference in (i) the closing value of the Basket Units in the Reference Index divided by the closing level of the Reference Index on any business day and (ii) the Targeted Exposure is greater than 5% of the Targeted Exposure. In addition, if at any time during any index business day the level of any Basket Index has declined from its closing level on the previous index business day by 10% or more, an Allocation Determination Event will have been deemed to have occurred.

In general, the Targeted Exposure may increase following increases in the value of the Basket Units or decreases in the Floor Level (due to interest rate increases). Using Leverage Units, the Targeted Exposure may equal up to 150%. In general, the Targeted Exposure may decrease following decreases in the value of the Basket Units or increases in the Floor Level (due to interest rate decreases).

In some circumstances, the amount of hypothetical funds allocated to the Basket Units may be reduced to zero, which will result in the hypothetical funds allocated to the Basket Units remaining at zero for the remaining term of the PROCEEDS. You should refer to the section entitled “Risk Factors—Risk Factors Relating to the PROCEEDS and the Reference Index— Less than 100%, and possibly none, of the hypothetical funds

PS-6

allocated to the Index Components may be allocated to the Basket Units” in this prospectus supplement.

For a detailed description of the formula and the Targeted Exposure, see the section entitled “The World Equity PROCEEDS Index— Reallocation of hypothetical funds allocated to the Index Components” in this prospectus supplement.

When would the formula allocate none of the hypothetical funds to the Basket Units, and what happens in that event?

If the “Cushion”, a ratio which reflects the level of the Reference Index relative to the value of the Floor Level, is less than 1% on any business day (a “Defeasance Event”), the formula will not allocate any hypothetical funds to the Basket Units. The “Floor Level” for any date will equal the value of a hypothetical zero coupon bond maturing on the scheduled Valuation Date with a yield equal to the applicable zero coupon rate based upon USD swap rates, plus the Fee Protection Factor (as described under “The World Equity PROCEEDS Index— Reallocation of hypothetical funds allocated to the Index Components —Allocation Determination Events” in this prospectus supplement), if any.

Because the amount of the interest payments on the PROCEEDS will depend on the performance of the Basket Units in the Reference Index, no interest will be paid for the remaining term of the PROCEEDS after the occurrence of a Defeasance Event. In addition, the Reference Index will not participate in any subsequent increase in the value of the Basket Units and your payment on the maturity date will be limited to the $10 principal amount per unit (except as described under “The World Equity PROCEEDS Index —Defeasance Events” in this prospectus supplement). This means that, while a holder of Basket Units would benefit from a subsequent increase in the value of the Basket Units, a holder of PROCEEDS would not.

What is “leveraging” and how are the Leverage Units used?

The Leverage Units represent hypothetical borrowing that permits the Targeted Exposure to exceed 100%, subject to a maximum of 150%. When required by the formula, the Calculation Agent will use Leverage Units to increase the allocation of hypothetical funds to the Basket Units above 100%. The use of hypothetical borrowed funds will increase the Reference Index’s exposure to movements in the value of the Basket Units and will therefore make the Reference Index more volatile than the Index Basket. Accordingly, if the value of the Basket Units increases when Leverage Units are outstanding, the level of the Reference Index may increase by a greater amount than will the value of the Basket Units. Conversely, if the value of the Basket Units decreases when Leverage Units are outstanding, the level of the Reference Index may decrease by a greater amount than will the value of the Basket Units. For risks associated with the use of hypothetical borrowed funds, see “Risk Factors—Risk Factors Relating to the PROCEEDS and the Reference Index—The use of leverage may adversely affect the Supplemental Redemption Amount” in this prospectus supplement.

How has the Reference Index performed historically?

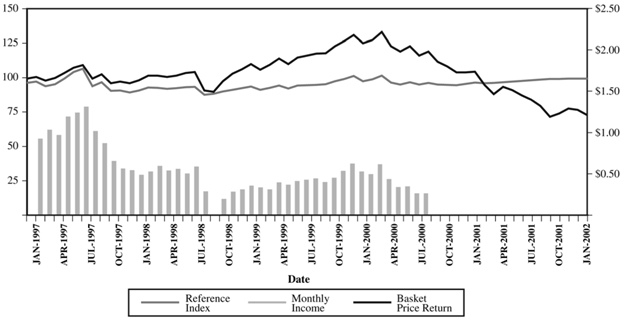

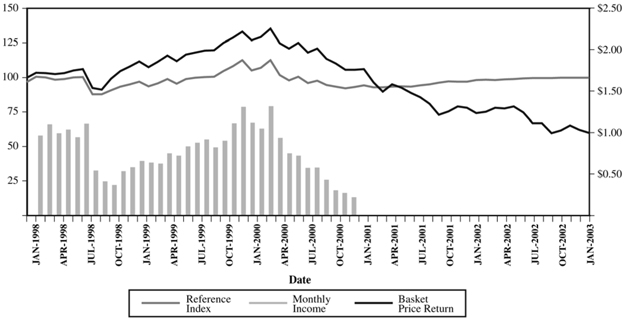

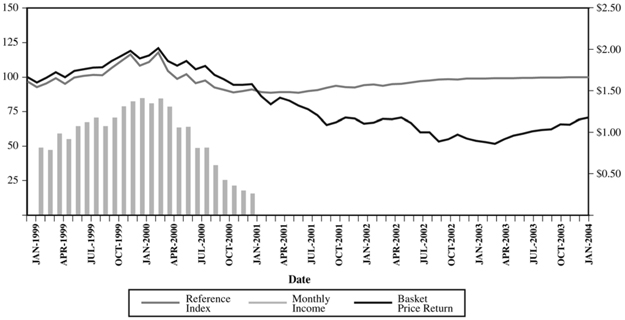

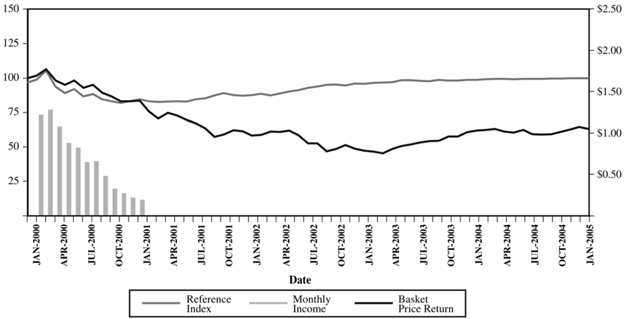

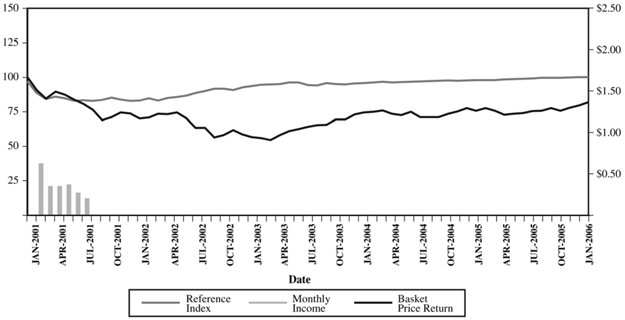

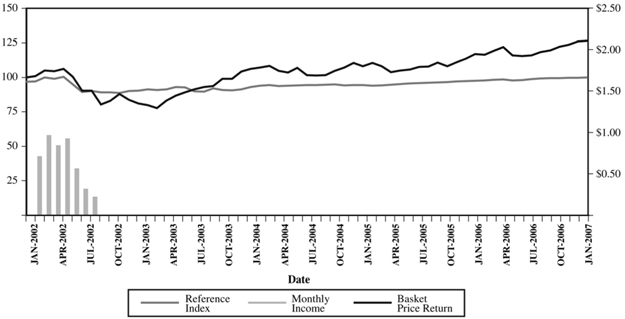

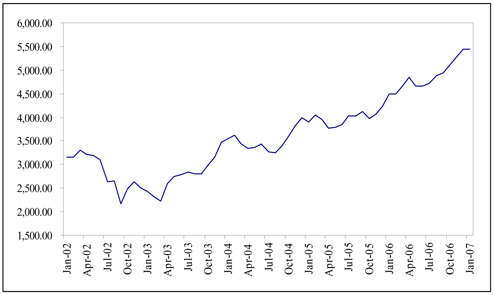

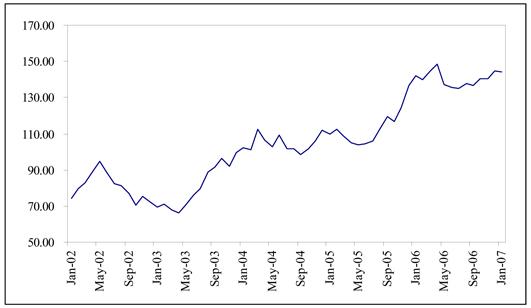

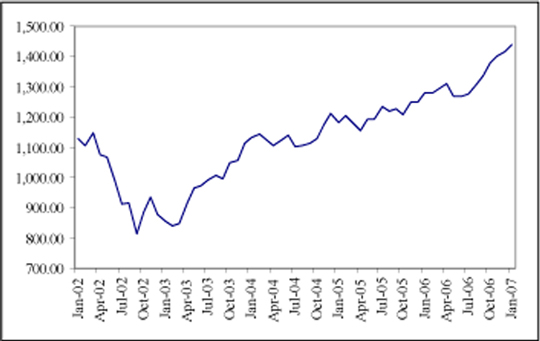

The Reference Index did not exist until the Pricing Date. However, we have included tables and graphs showing the hypothetical month-end closing level of the Reference Index during six different 60 month periods beginning on the last Global Business Day in January in 1997, 1998, 1999, 2000, 2001 and 2002. These hypothetical closing levels have been calculated on the same basis that the Reference Index will be calculated. However, the calculations used to determine these levels contain assumptions and necessary estimates and approximations that will not be reflected in the calculation of the level of the Reference Index and interest payments over the term of the PROCEEDS. For further details on the calculation of these hypothetical levels, please refer to the section entitled “The World Equity PROCEEDS Index—Hypothetical Data on the Reference Index” in this prospectus supplement. We have also included tables for each Basket Index showing the historical month-end levels of that Basket Index from January 2002 through January 2007. In addition, we have included tables showing the historical exchange rate of the United States dollar against the currency in which that Basket Index (except with respect to the S&P 500 Index) is denominated (each, an “Index Currency”) for those months and graphs showing the United States dollar equivalent of the level of that Basket Index for those months. The tables and graphs for the Basket Indices are included in the section entitled “Description of the Index Basket” in this prospectus supplement.

We have provided this information to help you evaluate the hypothetical past performance of the Reference Index and the historical performance of the Basket Indices, including the behavior of the United States dollar relative to the Index Currencies, in various economic environments; however, this hypothetical past performance and past performance, as applicable, is not indicative of how the Reference Index or the Basket Indices (expressed in United States dollars) will perform in the future.

PS-7

What is the “Index Basket” and what does it measure?

The Index Basket is designed to track the performance of a hypothetical “covered call” strategy for the Basket Indices. A “covered call” strategy on an index is an investment strategy in which an investor:

| • | buys an investment in the index; and |

| • | sells call options on the index with exercise prices higher than the level of the index when the options are priced. |

A “covered call” strategy provides income from option premiums, or the value of the option when it is priced, helping, to a limited extent, to offset losses if there is a decline in the level of the index to which the options relate. However, the strategy limits participation in the appreciation of the index beyond the option’s exercise price. Thus, in a period of significant stock market increases, a “covered call” strategy will tend to produce lower returns than ownership of an investment in the related index. See “Risk Factors— Risk Factors Relating to the Basket Units—The appreciation of the Index Basket will be capped due to the “covered call” strategy” in this prospectus supplement.

The value of the Index Basket is based on hypothetical purchases of investments in the Basket Indices, including the United States dollar value of the dividends on the stocks included in the Basket Indices, and hypothetical premiums on call options sold on each of those Basket Indices, as reduced by a pro rata portion of the Basket Adjustment Factor.

An investment in the PROCEEDS does not entitle you to any dividends, voting rights, option premiums or any other ownership interest in respect of the securities included in the Index Basket.

How will the Calculation Agent determine the value of hypothetical call options included in the Index Basket?

The mark-to-market value of each hypothetical call option will be determined by the Calculation Agent in accordance with an option pricing formula and using prevailing market parameters as described in the section entitled “Description of the Index Basket—Hypothetical Call Options—Valuation of Hypothetical Call Options” in this prospectus supplement.

What about taxes?

Each year, you will be required to pay taxes on ordinary income from the PROCEEDS over their term based upon an estimated yield for the PROCEEDS, even though you may not receive any variable monthly interest payments or any other cash payments from us prior to the maturity date. We have determined this estimated yield, in accordance with regulations issued by the U.S. Treasury Department, solely in order for you to calculate the amount of taxes that you will owe each year as a result of owning a PROCEEDS. This estimated yield is neither a prediction nor a guarantee of what either the actual monthly interest payments or the actual Supplemental Redemption Amount will be, or that either the actual monthly interest payments or the actual Supplemental Redemption Amount will even exceed zero. We have determined that this estimated yield will equal % per annum, compounded monthly.

For further information, see “United States Federal Income Taxation” in this prospectus supplement.

Will the PROCEEDS be listed on a securities exchange?

The PROCEEDS will not be listed on any securities exchange and we do not expect a trading market for the PROCEEDS to develop, which may affect the price you receive for your PROCEEDS upon any sale prior to the maturity date. You should review the section entitled “Risk Factors—A trading market for the PROCEEDS is not expected to develop and if trading does develop, the market price you may receive or be quoted for your PROCEEDS on a date prior to the stated maturity date will be affected by this and other important factors including our costs of developing, hedging and distributing the PROCEEDS” in this prospectus supplement.

What price can I expect to receive if I sell the PROCEEDS prior to the stated maturity date?

In determining the economic terms of the PROCEEDS, and consequently the potential return on the PROCEEDS to you, a number of factors are taken into account. Among these factors are certain costs associated with creating, hedging and offering the PROCEEDS. In structuring the economic terms of the PROCEEDS, we seek to provide investors with what we believe to be commercially reasonable terms and to provide MLPF&S with compensation for its services in developing the PROCEEDS.

If you sell your PROCEEDS prior to the stated maturity date, you will receive a price determined by market conditions for the security. This price may be influenced by many factors, such as interest rates, volatility and the current level of the Reference Index. In addition, the price, if any, at which you could sell your PROCEEDS in a secondary market transaction is expected to be affected by the factors that we considered in setting the economic terms of the PROCEEDS, namely the underwriting discount paid in respect of the PROCEEDS, and compensation for developing and hedging the product.

PS-8

Depending on the impact of these factors, you may receive significantly less than the principal amount of your PROCEEDS if sold before the stated maturity date.

In a situation where there had been no movement in the level of the Reference Index and no changes in the market conditions from those existing on the date of this prospectus supplement, the price, if any, at which you could sell your PROCEEDS in a secondary market transaction is expected to be lower than the original issue price. This is due to, among other things, our costs of developing, hedging and distributing the PROCEEDS. Any potential purchasers of your PROCEEDS in the secondary market are unlikely to consider these factors.

What is the role of MLPF&S?

Our subsidiary MLPF&S is the underwriter for the offering and sale of the PROCEEDS. After the initial offering, MLPF&S intends to buy and sell the PROCEEDS to create a secondary market for holders of the PROCEEDS, and may stabilize or maintain the market price of the PROCEEDS during their initial distribution. However, MLPF&S will not be obligated to engage in any of these market activities or continue them once it has started.

What is ML&Co.?

Merrill Lynch & Co., Inc. is a holding company with various subsidiary and affiliated companies that provide investment, financing, insurance and related services on a global basis. For information about ML&Co. see the section entitled “Merrill Lynch & Co., Inc.” in the accompanying general prospectus supplement. You should also read the other documents we have filed with the Securities and Exchange Commission, which you can find by referring to the section entitled “Where You Can Find More Information” in this prospectus supplement.

What is the role of Merrill Lynch International?

MLI, as the Calculation Agent, will be our agent for purposes of determining, among other things, the level of the Reference Index, the value of the Basket Units and the call options, the occurrence of an Allocation Determination Event, any reallocations of hypothetical funds, the Ending Value and the Supplemental Redemption Amount. Under certain circumstances, MLI’s role as Calculation Agent, its other business activities or its affiliation to ML&Co. could give rise to conflicts of interest. MLI is required to carry out its duties as Calculation Agent in good faith and using its reasonable judgment.

PS-9

Investment in the PROCEEDS involves risks, which include, but are not limited to, the risks referred to below. The level of the Reference Index may decrease as well as increase. If you receive only the principal amount of the PROCEEDS on the maturity date, you will have incurred a significant loss of opportunity to otherwise profit from the amount invested. In addition, the PROCEEDS are illiquid and if you sell the PROCEEDS prior to the maturity date, your sale price may be substantially less than the principal amount of the PROCEEDS.

You should consult your financial and legal advisors concerning risks associated with an investment in the PROCEEDS and the suitability of investing in the PROCEEDS in light of your particular circumstances. In addition, you should consult your tax advisors concerning the characterization of the PROCEEDS as contingent payment debt instruments for United States federal income tax purposes.

RISK FACTORS RELATING TO THE PROCEEDS AND THE REFERENCE INDEX

Less than 100%, and possibly none, of the hypothetical funds allocated to the Index Components may be allocated to the Basket Units

The formula that determines the Index Component allocations is designed so that the level of the Reference Index should equal at least 100 on the scheduled Valuation Date, even upon the occurrence of a Defeasance Event. The formula will allocate hypothetical funds to the Basket Units, but only to the extent consistent with the objective that the Reference Index level on the scheduled Valuation Date equal at least 100. Certain economic or market factors, such as low interest rates or insufficient gains by the Basket Units (including as a result of an increase in the value of the United States dollar relative to the other Index Currencies) to offset the costs embedded in the Reference Index, will cause the allocation in the Zero Coupon Bond Units to be increased.

Any allocation of hypothetical funds to Zero Coupon Bond Units will reduce the probability that the Reference Index will reflect any increases in the value of the Basket Units, which is the primary Index Component likely to result in appreciation in the Reference Index level. If the Reference Index level does not exceed 100 on the Valuation Date, the PROCEEDS will only return their principal amount on the maturity date, and you will have incurred substantial economic opportunity losses. Initially, between 0% and 5% of the hypothetical funds will be allocated to the Zero Coupon Bond Units.

The performance of the Basket Units may exceed the performance of the Reference Index

The Calculation Agent will adjust the allocations of hypothetical funds among the Index Components systematically using the formula. Accordingly, the performance of the Reference Index will likely differ significantly from the performance of each of the Index Components.

Initially, between 0% and 5% of the hypothetical funds will be allocated to the Zero Coupon Bond Units. However, the percentage of hypothetical funds represented by Zero Coupon Bond Units may increase or decrease during the term of the PROCEEDS, depending upon the performance of the Basket Units (including as a result of any change in the value of the United States dollar relative to the other Index Currencies), the effect of any Leverage Units and the then-current interest rate environment. Changes in economic conditions may cause a change in the allocations of hypothetical funds among the Index Components as determined by the formula. The timing of any rebalancing, and the magnitude of the reallocations, may result in less than full participation in the increases, if any, in the value of the Basket Units, which would in turn affect the level of the Reference Index, and as a result the Supplemental Redemption Amount.

Because the formula is designed so that the level of the Reference Index should equal at least 100 on the scheduled Valuation Date, the allocation of hypothetical funds to the Zero Coupon Bond Units may increase during the term of the PROCEEDS depending upon the performance of the Basket Units and interest rates. Should the allocation of hypothetical funds to the Basket Units be reduced to zero, that allocation will remain at zero for the remaining term of the PROCEEDS and, except as described under “The World Equity PROCEEDS Index— Defeasance Events” in this prospectus supplement, your payment on the maturity date will be limited to the $10 principal amount per unit. This means that, while a holder of Basket Units would benefit from a subsequent increase in the value of the Basket Units, a holder of PROCEEDS would not.

PS-10

The level of the Reference Index will not increase or decrease directly in proportion with increases or decreases in the value of the Basket Units due to the allocation of the Reference Index’s hypothetical funds to other Index Components. The Basket Units may increase in value substantially over the duration of the PROCEEDS, but the Supplemental Redemption Amount of the PROCEEDS may reflect little, if any, of that increase. The Supplemental Redemption Amount of the PROCEEDS may represent a yield less than the yield you would earn if you invested directly in the Basket Units or their equivalent or in the Zero Coupon Bond Units or their equivalent.

Certain other similar investments offered by our affiliates have lost all potential for appreciation

Our affiliates have offered indexed investments based upon rebalancing formulas similar to the PROCEEDS, certain of which have, in fact, terminated all exposure to the instruments equivalent to the Basket Units, which has resulted in a loss of the opportunity to profit from the amount invested.

The use of leverage may adversely affect the Supplemental Redemption Amount

The Targeted Exposure may be as much as 150% pursuant to the formula. Exposure above 100% would reflect the use of leverage, as represented by the allocation to Leverage Units. This leverage offers the potential for increases in the level of the Reference Index greater than any corresponding increase in the value of the Basket Units, but also entails a high degree of risk, including the risk of decreases in the level of the Reference Index greater than any corresponding decrease in the value of the Basket Units. In addition, the deemed interest expense associated with the allocation to Leverage Units will reduce the level of the Reference Index daily, which will result in a reduction in the Ending Value.

Reference Index rebalancing procedures may adversely impact the Supplemental Redemption Amount

The Reference Index tracks the performance of a hypothetical investment in the Index Components whose allocations of hypothetical funds will be rebalanced from time to time according to the rebalancing procedures described in this prospectus supplement. The timing and magnitude of any change in the allocations among the Index Components will be based on certain threshold values used in the formula as described herein. For example, under the rebalancing procedures, we expect the allocation to the Basket Units to increase as the level of the Reference Index increases or the Floor Level decreases and to decrease as the level of the Reference Index decreases or the Floor Level increases. This may expose the Reference Index to a higher risk of decreases (and a higher possibility of increases) if, for example, the Leverage Units are used to obtain more exposure to the Basket Units. In addition, certain market conditions, such as high volatility of the Basket Units (which may result from high volatility of the Basket Indices, the Index Currencies or both) or low interest rates, may result in larger reallocations among the Index Components. The timing and frequency of the reallocations among the Index Components may affect the level of the Reference Index on the Valuation Date, which in turn could affect the Supplemental Redemption Amount.

Fees, deductions and charges will reduce the Supplemental Redemption Amount

Your return on the PROCEEDS will reflect the deduction of certain fees, deductions and charges. These fees, deductions and charges include explicit charges that will be deducted from the level of the Reference Index over the term of the PROCEEDS, namely the Index Adjustment Factor and the Daily Leverage Charge. Also, there is an implicit sales charge paid upon the purchase of the PROCEEDS because the Starting Value will be set below the Threshold Value on the Pricing Date. In addition, the value of the Index Basket will reflect the reduction of the Basket Adjustment Factor which, if the Reference Index includes Basket Units, will reduce the level of the Reference Index over the term of the PROCEEDS by reducing the value of the Basket Units. See “Fees, Deductions and Charges” in this prospectus supplement. The net effect of these fees, deductions and charges will be to decrease the level of the Reference Index on the Valuation Date, thereby reducing the Ending Value. Accordingly, the Supplemental Redemption Amount payable to you on the maturity date will be less than it would have been absent these fees, deductions and charges.

Potential conflicts of interest could arise

The Calculation Agent is responsible for the calculation of the Reference Index pursuant to the formula. While the application of the formula is largely objective, there are certain situations where the Calculation Agent will exercise judgment

PS-11

in its capacity as the Calculation Agent. The Calculation Agent will also be responsible for calculating the value of the Basket Units.

The Calculation Agent for the PROCEEDS is MLI, our affiliate. Under certain circumstances, MLI as our subsidiary and its responsibilities as Calculation Agent for the PROCEEDS could give rise to conflicts of interest. MLI is required to carry out its duties as calculation agent in good faith and using its reasonable judgment. However, because we control MLI, potential conflicts of interest could arise.

We have entered into an arrangement with one of our subsidiaries to hedge the market risks associated with our obligations in connection with the PROCEEDS. This subsidiary expects to make a profit in connection with this arrangement. We did not seek competitive bids for this arrangement from unaffiliated third parties.

In addition to the compensation paid at the time of the original sale of the PROCEEDS, MLPF&S will pay an additional amount on each anniversary of the Pricing Date in 2008 through 2011 to brokers whose clients purchased the units in the initial distribution and who continue to hold their PROCEEDS. This additional amount will accrue at an annualized rate of 0.5% per unit for each day that hypothetical funds are allocated to Basket Units based on the amount payable on the maturity date of the PROCEEDS calculated as if the applicable compensation payment date is the maturity date and the Ending Value is equal to the closing level of the Reference Index on that date. Also, MLPF&S may from time to time pay additional amounts to brokers whose clients purchased PROCEEDS in the secondary market and continue to hold those PROCEEDS. As a result of these payments, your broker will receive a financial benefit each year you retain your investment in the PROCEEDS.

The level of the Reference Index on the Valuation Date must be more than 3.09% higher than the Starting Value for you to receive a Supplemental Redemption Amount on the maturity date

The Starting Value will be set to 97. As a result, the level of the Reference Index must increase by more than 3.09% as of the Valuation Date in order for you to receive a Supplemental Redemption Amount. If the level of the Reference Index declines, or does not increase sufficiently, you will receive only the principal amount of your investment, in addition to any interest payment due, on the maturity date, which could represent a significant loss of opportunity to otherwise profit from the amount invested in the PROCEEDS.

The interest payable on the PROCEEDS, if any, will vary

The interest payments, if any, on the PROCEEDS will depend on the Basket Unit Income in the Reference Index over each monthly calculation period and the level of the Reference Index at the end of that period. If the level of the Reference Index (less any Basket Unit Income) falls below certain thresholds relative to the Floor Level described in this prospectus supplement during any monthly calculation period (except the last monthly calculation period before the maturity date), you will not receive any interest payment for that monthly calculation period and, in certain circumstances, you will not receive any interest payments for the remaining term of the PROCEEDS. See “Description of the PROCEEDS—Interest” in this prospectus supplement.

The yield on the PROCEEDS may be lower than the yield on other debt securities of comparable maturity

Even if payment on the PROCEEDS on the maturity date exceeds the principal amount of the PROCEEDS, this payment may represent a yield less than the yield you would have earned if you had bought a traditional interest bearing debt security of ML&Co. with the same stated maturity date.

A trading market for the PROCEEDS is not expected to develop and if trading does develop, the market price you may receive or be quoted for your PROCEEDS on a date prior to the stated maturity date will be affected by this and other important factors including our costs of developing, hedging and distributing the PROCEEDS

The PROCEEDS will not be listed on any securities exchange and we do not expect a trading market for the PROCEEDS to develop. Although our affiliate MLPF&S has indicated that it currently expects to bid for PROCEEDS offered for sale to it by holders of the PROCEEDS, it is not required to do so and may cease making those bids at any time. The limited trading market for your PROCEEDS may affect the price that you receive for your PROCEEDS if you do not wish to hold your investment until the maturity date.

PS-12

If MLPF&S makes a market in the PROCEEDS, the price it quotes would reflect any changes in market conditions and other relevant factors. In addition, the price, if any, at which you could sell your PROCEEDS in a secondary market transaction is expected to be affected by the factors that we considered in setting the economic terms of the PROCEEDS, namely the underwriting discount paid in respect of the PROCEEDS and other costs associated with the PROCEEDS, including compensation for developing and hedging the product. This quoted price could be higher or lower than the $10 principal amount. Furthermore, there is no assurance that MLPF&S or any other party will be willing to buy the PROCEEDS. MLPF&S is not obligated to make a market in the PROCEEDS.

Assuming there is no change in the level of the Reference Index and no change in market conditions or any other relevant factors, the price, if any, at which MLPF&S or another purchaser might be willing to purchase your PROCEEDS in a secondary market transaction is expected to be lower than the $10 principal amount. This is due to, among other things, the fact that the $10 principal amount included, and secondary market prices are likely to exclude, underwriting discount paid with respect to, and the developing and hedging costs associated with, the PROCEEDS.

Ownership of the PROCEEDS does not entitle you to any rights with respect to any securities tracked by the Index Components

You will not own or have any beneficial or other legal interest in, and will not be entitled to any rights with respect to, any of the Index Components or the stocks included in any of the Basket Indices.

Changes in our credit ratings may affect the value of the PROCEEDS

Our credit ratings are an assessment of our ability to pay our obligations. Consequently, real or anticipated changes in our credit ratings may affect the trading value of the PROCEEDS. However, because your return on the PROCEEDS is dependent upon factors in addition to our ability to pay our obligations under the PROCEEDS, such as the percentage increase, if any, in the level of the Reference Index on the Valuation Date, an improvement in our credit ratings will not reduce the other investment risks related to the PROCEEDS.

An investment in the PROCEEDS will have tax consequences

You should consider the tax consequences of investing in the PROCEEDS. See the section entitled “United States Federal Income Taxation” in this prospectus supplement.

RISK FACTORS RELATING TO THE BASKET UNITS

Your return may be affected by factors affecting international securities markets

The Basket Indices are computed by reference to the value of the stocks of companies listed on various U.S., European and Asian exchanges. The return on the PROCEEDS will be affected by factors affecting the value of stocks in these markets. The European and Asian securities markets may be more volatile than U.S. or other securities markets and may be affected by market developments in different ways than U.S. or other securities markets. Direct or indirect government intervention to stabilize a particular securities market and cross-shareholdings in companies on these markets may affect prices and the volume of trading on those markets. Also, there is generally less publicly available information about European and Asian companies than about companies that are subject to the reporting requirements of U.S. securities regulatory authorities. Additionally, accounting, auditing and financial reporting standards and requirements in Europe and Asia differ from one another and from those applicable to U.S. reporting companies.

The prices and performance of securities of companies in the U.S., Europe and Asia may be affected by political, economic, financial and social factors in those regions. In addition, recent or future changes in a country’s government, economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions, and possible fluctuations in the rate of exchange between currencies, are factors that could negatively affect international securities markets. Moreover, the relevant European and Asian economies may differ favorably or unfavorably from the U.S. economy in economic factors such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency.

PS-13

The value of the Basket Indices will be influenced by changes in the exchange rates between the United States dollar and the Index Currencies

The value of any currency, including the Index Currencies, may be affected by complex political and economic factors. The exchange rate of each relevant Index Currency in terms of the United States dollar is at any moment a result of the supply and demand for the two currencies, and changes in the exchange rate result over time from the interaction of many factors directly or indirectly affecting economic and political conditions in the originating country of each Index Currency, including economic and political developments in other countries. Of particular importance are the relative rates of inflation, interest rate levels, the balance of payments and the extent of governmental surpluses or deficits in those countries and in the United States, all of which are in turn sensitive to the monetary, fiscal and trade policies pursued by the governments of those countries and other countries important to international trade and finance.

Currency exchange rates can either be fixed by sovereign governments or floating. Currency exchange rates of most economically developed nations, including those issuing the European Union euro, the British pound and the Japanese yen, are permitted to fluctuate in value relative to the United States dollar. However, governments may use a variety of techniques, such as intervention by their central bank or imposition of regulatory controls or taxes, to affect the exchange rates of their respective currencies. They may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by devaluation or revaluation of a currency. Thus, a special risk in purchasing the PROCEEDS is that their liquidity, trading value and Supplemental Redemption Amount could be affected by the actions of sovereign governments which could change or interfere with theretofore freely determined currency valuation, fluctuations in response to other market forces and the movement of currencies across borders. There will be no adjustment or change in the terms of the PROCEEDS in the event that currency exchange rates should become fixed, or in the event of any devaluation or revaluation or imposition of exchange or other regulatory controls or taxes, or in the event of the issuance of a replacement currency or in the event of other developments affecting the Index Currencies, the United States dollar specifically or any other currency.

Volatility of the markets and foreign currency exchange rates may adversely affect the value of the Basket Units

Movements in the United States dollar equivalent of the levels of the Basket Indices may be volatile from month to month. High volatility of the Basket Units will increase the likelihood of larger allocation changes among the Index Components upon an Allocation Determination Event (as described in the section entitled “The World Equity PROCEEDS Index—Reallocation of the Hypothetical Funds—Allocation Determination Events” in this prospectus supplement). A rebalancing may result in reallocation from the Basket Units to the Zero Coupon Bond Units, thus reducing or eliminating the possibility of future increases in the level of the Reference Index. A rebalancing may also result in hypothetical selling or buying of Basket Units at a time when prices for those sales or purchases are unfavorable due to prevailing market conditions or currency exchange rates.

There may be delays between the determination of an Allocation Determination Event and reallocation of hypothetical funds which could affect the level of the Reference Index

The Calculation Agent will determine whether an Allocation Determination Event has occurred and, if so, the Targeted Exposure at the beginning of a Business Day based on the values of the Reference Index, the Basket Units and the Cushion at the close of business on the previous Business Day, but any necessary reallocation will be effected at the close of business on the Business Day on which the occurrence of the Allocation Determination Event is determined. As a result:

| • | the Calculation Agent may determine that an Allocation Determination Event has occurred even if the values of the Reference Index, the Index Basket and the Floor Level at the time the reallocation is effected would not result in an Allocation Determination Event; |

| • | the Reference Index may be exposed to a greater extent to losses on the Basket Units between the determination of the occurrence of an Allocation Determination Event and the resulting reallocation than would be the case if a reallocation were effected immediately following determination of the Targeted Exposure; |

PS-14

| • | the Reference Index may not as fully participate in any appreciation of the Basket Units that occurs between the determination of the occurrence of an Allocation Determination Event and the resulting reallocation as it would if a reallocation were effected immediately following determination of the Targeted Exposure; and |

| • | the Calculation Agent may effect a greater or lesser allocation of the level of the Reference Index to the Basket Units than otherwise would be required if the occurrence of an Allocation Determination Event were determined by the Calculation Agent at the end of that Business Day. |

The valuation of hypothetical call options for purposes of determining the occurrence of an Allocation Determination Event will be different than the valuation of hypothetical call options for purposes of effecting a reallocation

For purposes of determining the occurrence of an Allocation Determination Event, the value of hypothetical call options in the Index Basket will be determined using mid-market implied volatility (or the arithmetic mean of bid-side and offered-side implied volatility). However, reallocations will be effected through:

| • | deemed purchases of Basket Units at prices that reflect the value of call options determined using bid-side implied volatility, which will result in Basket Units being purchased at a higher price than will be subsequently reflected in the level of the Reference Index; and |

| • | deemed sales of Basket Units at prices that reflect the value of call options determined using offered-side implied volatility, which will result in Basket Units being sold at a price lower than was previously reflected in the level of the Reference Index. |

As a result, the level of the Reference Index will be reduced following each reallocation. See the section entitled “Description of the Index Basket—Hypothetical Call Options—Valuation of Call Options” in this prospectus supplement.

The appreciation of the Index Basket will be capped due to the “covered call” strategy

Because the exercise price of each hypothetical call option limits the portion of any appreciation in the level of each Basket Index to the amount by which the exercise price exceeds the level of the Basket Index at the time the call option is priced, the Index Basket will not participate as fully in the appreciation of the Basket Indices as would a direct investment in the Basket Indices. If the level of a Basket Index increases by an amount greater than the amount by which the exercise price exceeds the level of that Basket Index at the time the call option is priced, the value of the Index Basket will be less than it would be if it reflected a direct investment in that Basket Index.

The use of Basket Unit Income to make interest payments will reduce the value of the Basket Units at the end of each monthly calculation period and may cause an Allocation Determination Event

The value of Basket Unit Income will be removed from the value of the Index Basket on the last day of each monthly calculation period. The deduction of the value of the Basket Unit Income will reduce the value of the Basket Units and may cause an Allocation Determination Event in which the allocation of hypothetical funds to the Basket Units is reduced, even if the levels of the Basket Indices have not fallen. This Allocation Determination Event may reduce the allocation of the Reference Index to the Basket Units, possibly to zero, in which case it would remain at zero for the remaining term of the PROCEEDS. See “—Risk Factors Relating to the PROCEEDS and the Reference Index— Less than 100%, and possibly none, of the hypothetical funds allocated to the Index Components may be allocated to the Basket Units” above.

The ability of the Calculation Agent to effect a reallocation upon a 10% decline in the level of any Basket Index may not prevent significant losses in the value of the Basket Units

If at any time during any Index Business Day the level of any Basket Index declines from its closing level on the previous Index Business Day by 10% or more, the Calculation Agent, as soon as reasonably practicable, will determine the Targeted Exposure and reallocate hypothetical funds among the Index Components so that the percentage of the Reference Index hypothetically invested in the Basket Units is as close as is reasonably practicable to the Targeted Exposure. However, the ability of the Calculation Agent to effect this reallocation may not prevent losses in the value of the Basket Units because of potential delays in effecting the reallocation pursuant to the formula under the market conditions at that time.

PS-15

ML&Co. will issue the PROCEEDS as a series of senior debt securities under the 1983 Indenture, which is more fully described in the accompanying general prospectus supplement. The Bank of New York has succeeded JPMorgan Chase Bank, N.A. as the trustee under such indenture. The PROCEEDS will mature on April , 2012.

The PROCEEDS will not be subject to redemption by ML&Co. or at the option of any holder of the PROCEEDS before the maturity date.

ML&Co. will issue the PROCEEDS in denominations of whole units, each with a principal amount of $10 per unit. You may transfer the PROCEEDS only in whole units. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the PROCEEDS in the form of a global certificate, which will be held by The Depository Trust Company, also known as DTC, or its nominee. Direct and indirect participants in DTC will record your ownership of the PROCEEDS. You should refer to the section entitled “Description of the Debt Securities—Depositary” in the accompanying general prospectus supplement.

The PROCEEDS will not have the benefit of any sinking fund.

Payment on the maturity date

On the maturity date, a holder of a PROCEEDS will be entitled to receive the principal amount of, in addition to any interest payment due on, that PROCEEDS plus a Supplemental Redemption Amount, if any, all as provided below. If the Ending Value does not exceed the Threshold Value, a holder will be entitled to receive only the principal amount, in addition to any interest payment due, of the PROCEEDS.

The “Supplemental Redemption Amount” for a PROCEEDS will be denominated in United States dollars, will be determined by the Calculation Agent and will equal:

| principal amount of each PROCEEDS ($10 per unit) |

× |

(

|

Ending Value –Threshold Value | )

|

; | |||||||

| Threshold Value |

provided, however, that in no event will the Supplemental Redemption Amount be less than zero.

The “Ending Value” will be determined by the Calculation Agent and will equal the closing level of the Reference Index determined on the Valuation Date.

The “Threshold Value” equals 100.

The “Starting Value” will be set to 97 on the date the PROCEEDS are priced for initial sale to the public (the “Pricing Date”).

The “Valuation Date” will be the seventh scheduled Global Business Day before the maturity date, or if that day is not a Global Business Day, the next Global Business Day; provided, however, that if no Global Business Days occur between the seventh scheduled Global Business Day before the maturity date and the second scheduled Global Business Day before the maturity date, the Valuation Date will be the second scheduled Global Business Day before the maturity date, regardless of the occurrence of a Market Disruption Event.

A “Global Business Day” means any day on which the EURO STOXX 50 Index, the Nikkei 225 Index, the S&P 500 Index, the Hang Seng Index and the FTSE 100 Index, or any respective successor index, is calculated and published. Please note, however, that neither the FTSE 100 Index nor the Hang Seng Index is a Basket Index.

An “Index Business Day” means, for each Basket Index, a day on which that Basket Index or any successor index is calculated and published.

PS-16

Because the Starting Value will be set to 97, which is less than the Threshold Value, we will pay you a Supplemental Redemption Amount only if the Ending Value is 3.09% greater than the Starting Value on the Valuation Date. If the Ending Value is less than or equal to the Threshold Value, the Supplemental Redemption Amount will be zero. We will pay you the principal amount of your PROCEEDS, in addition to any interest payment due, regardless of whether any Supplemental Redemption Amount is payable.

Interest

The interest payable on the PROCEEDS will vary and may be zero. We will pay interest, if any, in cash monthly on the third Banking Business Day following each Commencement Date and on the maturity date. A “Commencement Date” is the Global Business Day following the Interest Determination Date for each month, beginning April , 2007. An “Interest Determination Date” for any month is the last Global Business Day of that month; provided, however, that if the next succeeding day that is a Monday, Tuesday, Wednesday, Thursday or Friday is not a scheduled Global Business Day, the Interest Determination Date for that month will be the first Global Business Day of the following month from which the next succeeding day that is a Monday, Tuesday, Wednesday, Thursday or Friday is a scheduled Global Business Day. If an interest payment date falls on a day that is not a Banking Business Day, the interest payment, if any, to be made on that interest payment date will be made on the next succeeding Banking Business Day with the same force and effect as if made on that interest payment date, and no additional interest will be paid as a result of the delayed payment. A “Banking Business Day” means any day other than a Saturday or Sunday that is not a day on which banking institutions in The City of New York are authorized or required by law, regulation or executive order to close.

The interest payments, if any, on the PROCEEDS will depend on the income, if any, deemed to be derived from the Basket Units held in the Reference Index over each monthly calculation period, and the level of the Reference Index at the end of that period as described in the next paragraph. This hypothetical income from the Basket Units (the “Basket Unit Income”) will be determined on the Interest Determination Date for that monthly calculation period and will be based on the United States dollar value of the cash dividends in respect of the stocks included in each of the Basket Indices and the value of premiums in respect of call options on the Basket Indices. See “Description of the Index Basket—Calculation of the Value of the Index Basket” in this prospectus supplement. The Zero Coupon Bond Units and the Leverage Units will not produce hypothetical income for purposes of the interest payments on the PROCEEDS.

The interest payment on the PROCEEDS, if any, for any monthly calculation period will be based on figures determined on the Interest Determination Date and will equal:

Number of Basket Units × Adjusted Monthly Income

provided the Calculation Agent determines that the level of the Reference Index (less any Basket Unit Income) is greater than 105% of the Floor Level at the close of business on the Interest Determination Date of any monthly calculation period, except the last monthly calculation period before the maturity date, for which any interest payment will be paid in addition to the Supplemental Redemption Amount. For a description of how the Adjusted Monthly Income is calculated, see “Description of the Index Basket—Calculation of the Value of the Index Basket” in this prospectus supplement.

Interest will be calculated from, and including, each Commencement Date to, but excluding, the next Commencement Date, provided that the initial monthly calculation period will commence on, and include, April , 2007 and the final monthly calculation period will extend to, and include, the Valuation Date. No interest will accrue on the PROCEEDS after the Valuation Date. The interest payment date related to any monthly calculation period with respect to which interest is paid will be the interest payment date following the Interest Determination Date of the applicable monthly calculation period or, with respect to the final monthly calculation period, the stated maturity date. The Calculation Agent will notify the indenture trustee of the amount of interest payable on or before the second Banking Business Day immediately following the Interest Determination Date of the applicable monthly calculation period. Interest will be payable to the persons in whose names the PROCEEDS are registered at the close of business on the Commencement Date.

As described above, the interest, if any, on the PROCEEDS will depend on the allocation of hypothetical funds to the Basket Units and on the Basket Unit Income. However, if at the close of business on the Interest Determination Date of any monthly calculation period (except the last monthly calculation period before the maturity date), the Calculation Agent determines that the level of the Reference Index (less any Basket Unit Income) is less than 105% of the Floor Level, the Basket Unit Income relating to that monthly calculation period will be deemed invested in the Basket Units at the close of business on

PS-17

the next Commencement Date (by increasing the number of Basket Units included in the Reference Index) and no interest will be payable on the PROCEEDS on the interest payment date relating to that monthly calculation period. See “The World Equity PROCEEDS Index—Calculation of The Reference Index—Reinvestment of the Basket Unit Income” in this prospectus supplement.

If the amount allocated to the Basket Units is zero at any time during the term of the PROCEEDS (either following a Allocation Determination Event or a Defeasance Event), it will remain zero for the remaining term of the PROCEEDS and no interest will be paid for the remaining term of the PROCEEDS. See “Risk Factors—Risk Factors Relating to the PROCEEDS and the Reference Index— Less than 100%, and possibly none, of the hypothetical funds allocated to the Index Components may be allocated to the Basket Units” in this prospectus supplement.

Adjustments to the Reference Index; Market Disruption Events

If the value (including a closing value) of any component of the Reference Index is unavailable on any Business Day because of a Market Disruption Event or otherwise, unless deferred by the Calculation Agent as described below, the Calculation Agent will determine the value of each Index Component for which no value is available as follows:

| • | the level of any Basket Index for which no level is available will be the arithmetic mean, as determined by the Calculation Agent, of the level of that Basket Index obtained from as many dealers in equity securities (which may include MLPF&S or any of our other subsidiaries or affiliates), but not exceeding three of those dealers, as will make that level available to the Calculation Agent; |

| • | the value of any hypothetical call option related to a Basket Index for which no value is available will be the arithmetic mean, as determined by the Calculation Agent, of the offer prices of that option obtained from as many dealers in options (which may include MLPF&S or any of our other subsidiaries or affiliates), but not exceeding three of those dealers, as will make that value available to the Calculation Agent; |

| • | the value of the Zero Coupon Bond Units will be the arithmetic mean, as determined by the Calculation Agent, of the value of the hypothetical bond tracked by the Zero Coupon Bond Units obtained from as many dealers in fixed-income securities (which may include MLPF&S or any of our other subsidiaries or affiliates), but not exceeding three of those dealers, as will make that value available to the Calculation Agent; and |

| • | the value, if any, of the Leverage Units will be calculated as described in the section entitled “The World Equity PROCEEDS Index” in this prospectus supplement. |

The Calculation Agent will use the levels of the Basket Indices and the related hypothetical call options to determine the value of the Basket Units. The Calculation Agent will then calculate the level of the Reference Index and, if earlier than the Valuation Date, will determine whether an Allocation Determination Event has occurred. If the Calculation Agent determines that an Allocation Determination Event has occurred, it will reallocate hypothetical funds as described in the section entitled “The World Equity PROCEEDS Index—Reallocation of hypothetical funds allocated to the Index Components” in this prospectus supplement.

The determination of any of the above values or of an Allocation Determination Event by the Calculation Agent in the event any of those values is unavailable may be deferred by the Calculation Agent for up to ten consecutive Business Days on which Market Disruption Events are occurring. Following this period, the Calculation Agent will determine the relevant values in consultation with ML&Co. No reallocation of the level of the Reference Index will occur on any day the determination of any of the above values is so deferred.

A “Business Day” means any day on which the New York Stock Exchange (the “NYSE”), the American Stock Exchange (the “AMEX”) and The Nasdaq Stock Market (the “Nasdaq”) are open for trading.

“Market Disruption Event” means either of the following events as determined by the Calculation Agent:

PS-18

| (A) | the suspension of or material limitation on trading for more than two hours of trading, or during the one-half hour period preceding the close of trading, on the applicable exchange (without taking into account any extended or after-hours trading session), in 20% or more of the stocks which then comprise a Basket Index or any successor index; or |

| (B) | the suspension of or material limitation on trading for more than two hours of trading, or during the one-half hour period preceding the close of trading, on the applicable exchange (without taking into account any extended or after-hours trading session), whether by reason of movements in price otherwise exceeding levels permitted by the applicable exchange or otherwise, in option contracts or futures contracts related to a Basket Index or any successor index. |

For the purpose of determining whether a Market Disruption Event has occurred:

| (1) | a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular business hours of the applicable exchange; |

| (2) | a limitation on trading imposed during the course of a day by reason of movements in price otherwise exceeding levels permitted by the applicable exchange will constitute a Market Disruption Event; |

| (3) | a decision to permanently discontinue trading in the relevant futures or option contracts related to the applicable Basket Index, or any successor index, will not constitute a Market Disruption Event; |

| (4) | a suspension in trading in a futures or option contract on the applicable Basket Index, or any successor index, by a major securities market by reason of (a) a price change violating limits set by that securities market, (b) an imbalance of orders relating to those contracts or (c) a disparity in bid and ask quotes relating to those contracts will constitute a suspension or material limitation of trading in futures or option contracts related to that Basket Index; |

| (5) | an absence of trading on the applicable exchange will not include any time when that exchange is closed for trading under ordinary circumstances; and |

| (6) | for the purpose of clause (A) above, any limitations on trading during significant market fluctuations under NYSE Rule 80B, or any applicable rule or regulation enacted or promulgated by the NYSE or any other self regulatory organization or the Securities and Exchange Commission of similar scope as determined by the calculation agent, will be considered “material”. |

The occurrence of a Market Disruption Event could affect the calculation of the payment you may receive on the maturity date. See “—Payment on the maturity date” above.

All determinations made by the Calculation Agent are required to be made in good faith and in a commercially reasonable manner and, absent a determination of a manifest error, will be conclusive for all purposes and binding on ML&Co. and the holders and beneficial owners of the PROCEEDS.

Events of Default and Acceleration