Filed Pursuant to Rule 424(b)(5)

Registration No. 333-112708

Pricing Supplement No. 422

(To Prospectus dated April 14, 2004

and Prospectus Supplement dated April 15, 2004)

August 28, 2007

$5,000,000

STrategic Equity Exposure Performance Linked Securities™ “STEEPLS™,” due

December 1, 2008, Linked to the Nasdaq-100 Index®

| • | STEEPLS are our unsecured senior notes. |

| • | STEEPLS are not principal protected. |

| • | We will not pay interest on STEEPLS. |

| • | The STEEPLS will mature on December 1, 2008. |

| • |

At maturity, you will receive a cash payment based upon the percentage change in the level of the Nasdaq-100 Index®. |

| • |

If the level of the Nasdaq-100 Index® has increased over the term of the STEEPLS, at maturity you will receive a payment per STEEPLS based on double the percentage increase of the Nasdaq-100 Index®, not to exceed a maximum return of 20.00%. We describe how this payment will be determined beginning on page PS-4. |

| • |

If the level of the Nasdaq-100 Index® has decreased over the term of the STEEPLS, at maturity you will receive a payment per STEEPLS based upon that percentage decrease. As a result, you may receive less than the original public offering price of $1,000 per STEEPLS. We describe how this payment will be determined beginning on page PS-4. |

| • | STEEPLS are issued in $1,000 denominations. |

| • | STEEPLS will not be listed on any securities exchange. |

| Per STEEPLS | Total | |||||

| Public offering price |

100.00 | % | $ | 5,000,000 | ||

| Selling Agents’ commissions |

1.25 | % | 62,500 | |||

| Proceeds (before expenses) |

98.75 | % | $ | 4,937,500 | ||

STEEPLS are unsecured and are not savings accounts, deposits, or other obligations of a bank. STEEPLS are not guaranteed by Bank of America, N.A. or any other bank, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and involve investment risks. Potential purchasers of STEEPLS should consider the information in “ Risk Factors” beginning on page PS-11. You may lose some or all of your investment in the STEEPLS.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this pricing supplement, the accompanying prospectus supplement, or the accompanying prospectus. Any representation to the contrary is a criminal offense.

We will deliver STEEPLS in book-entry form only through The Depository Trust Company on or about August 31, 2007 against payment in immediately available funds.

| Banc of America Securities LLC | Banc of America Investment Services, Inc. |

Selling Agents

| Page | ||

| PS-3 | ||

| PS-11 | ||

| PS-17 | ||

| PS-18 | ||

| PS-22 | ||

| PS-28 | ||

| PS-28 | ||

| PS-29 | ||

| PS-32 | ||

STEEPLS™ and STrategic Equity Exposure Performance Linked Securities™ are our trademarks.

“Nasdaq®,” “Nasdaq-100 Index®,” and “Nasdaq-100®” are trade or service marks of The Nasdaq Stock Market, Inc. (with its affiliates, “Nasdaq®”) and have been licensed for use by us. The STEEPLS have not been passed on by Nasdaq® as to their legality or suitability. The STEEPLS are not sponsored, endorsed, sold, or promoted by Nasdaq®. Nasdaq® makes no representation regarding the advisability of investing in the STEEPLS.

PS-2

This pricing supplement relates only to STEEPLS and does not relate to the securities of any of the companies comprising the Nasdaq-100 Index®. This summary includes questions and answers that highlight selected information from the accompanying prospectus, prospectus supplement, and this pricing supplement to help you understand STEEPLS. You should read carefully the entire prospectus, prospectus supplement, and pricing supplement to understand fully the terms of STEEPLS, as well as the tax and other considerations important to you in making a decision about whether to invest in STEEPLS. In particular, you should review carefully the section in this pricing supplement entitled “Risk Factors,” which highlights a number of risks of an investment in STEEPLS, to determine whether an investment in STEEPLS is appropriate for you. If information in this pricing supplement is inconsistent with the prospectus or prospectus supplement, this pricing supplement will supersede those documents.

Certain capitalized terms used and not defined in this pricing supplement have the meanings ascribed to them in the prospectus supplement and prospectus.

In light of the complexity of the transaction described in this pricing supplement, you are urged to consult with your own attorneys and business and tax advisors before making a decision to purchase any STEEPLS.

The information in this “Summary” section is qualified in its entirety by the more detailed explanation set forth elsewhere in this pricing supplement and the accompanying prospectus supplement and prospectus. You should rely only on the information contained in this pricing supplement, the accompanying prospectus supplement, and the prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor any of the selling agents is making an offer to sell STEEPLS in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this pricing supplement, the accompanying prospectus supplement, and prospectus is accurate only as of the date on their respective front covers.

What are STEEPLS?

STEEPLS are senior debt securities issued by Bank of America Corporation, and are not secured by collateral. STEEPLS rank equally with all of our other unsecured senior indebtedness from time to time outstanding. STEEPLS will mature on December 1, 2008. We cannot redeem STEEPLS at any earlier date. We will not make any payments on STEEPLS until maturity. STEEPLS are not principal protected.

Are STEEPLS equity or debt securities?

STEEPLS are our senior debt securities. However, STEEPLS differ from traditional debt securities in that they contain a derivative component, they are not principal protected, and you will not receive interest payments. At maturity, instead of receiving the face amount, you may receive an amount that is greater or less than the face amount, depending upon the average of the closing levels of the Nasdaq-100 Index® during a period of three trading days (as defined below) occurring prior to the end of the term of STEEPLS. We describe below how this amount is determined. STEEPLS have been designed for investors who are willing to forgo market interest rates on their investment, such as fixed interest rates paid on conventional non-callable debt securities.

PS-3

Is it possible for you to lose some or all of your investment in STEEPLS?

Yes. If the Ending Level (as defined below) is less than the Starting Level (as defined below), then at maturity you will receive a cash amount that is less than the face amount of STEEPLS, determined in proportion to the decrease in the level of the Nasdaq-100 Index®. As a result, you may lose a substantial portion of the amount that you invested to purchase STEEPLS.

How is the payment at maturity calculated?

At maturity, you will receive a cash payment for each $1,000 face amount of STEEPLS that you hold. This payment will be calculated as follows:

Payment at maturity = $1,000 × (1 + Index Return)

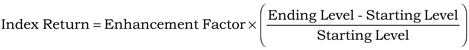

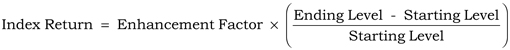

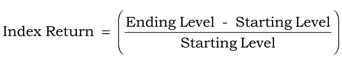

The “Index Return” will be calculated as follows:

| • | If the Ending Level is greater than the Starting Level: |

| • | If the Ending Level is equal to or less than the Starting Level: |

The Index Return will be rounded to the nearest ten-thousandth and then expressed as a percentage.

In no event will the Index Return exceed 20.00%, which we call the “Maximum Return.” We set the Maximum Return on the pricing date. As a result of this limitation on the Index Return, the cash payment that you will receive at maturity for each $1,000 face amount of STEEPLS will not exceed $1,200.00.

The “Starting Level” is 1,899.24, which is equal to the closing level of the Nasdaq-100 Index® on the pricing date. The calculation agent will determine the “Ending Level,” which is the average of the closing levels of the Nasdaq-100 Index® during the Maturity Valuation Period.

“Maturity Valuation Period” means the period of three trading days from, and including, the sixth scheduled trading day immediately preceding the maturity date to, and including, the fourth scheduled trading day immediately preceding the maturity date.

“Trading day” means any day, as determined by the calculation agent, that is not a day on which the principal securities market (or markets) on which the constituent stocks of the Nasdaq-100 Index® are traded is closed.

The “Enhancement Factor” is 2. The Enhancement Factor represents the extent to which the upside performance of STEEPLS is affected by the upside price performance of the Nasdaq-100 Index®, as limited by the Maximum Return.

PS-4

Is the return on STEEPLS limited in any way?

Yes. Your investment return is limited to 20.00%, which we refer to as the “Maximum Return.” Because you will not receive more than the Maximum Return, you will realize the maximum effect of the Enhancement Factor if the Ending Level exceeds the Starting Level by 10.00%. See “—Hypothetical Payments on STEEPLS at Maturity,” and “—Hypothetical Returns.”

PS-5

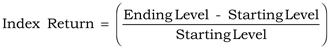

Hypothetical Payments on STEEPLS at Maturity

The following graph illustrates the Nasdaq-100 Index® and STEEPLS percentage returns for a range of hypothetical Nasdaq-100 Index® returns. The graph is for purposes of illustration only. The percentage returns for STEEPLS and the Nasdaq-100 Index® set forth in the graph may not reflect the actual returns. The graph is based on the Maximum Return of 20.00%, and the Enhancement Factor of 2.

Because you will not receive more than the Maximum Return, the following graph illustrates that you will realize the maximum effect of the Enhancement Factor when the Ending Level exceeds the Starting Level by 10.00.

PS-6

Examples: Below are three hypothetical examples of the calculation of the payment to be received at maturity for STEEPLS with a principal amount of $1,000. In each case, the examples assume the Starting Level of 1,899.24, the Enhancement Factor of 2, and the Maximum Return of 20.00%.

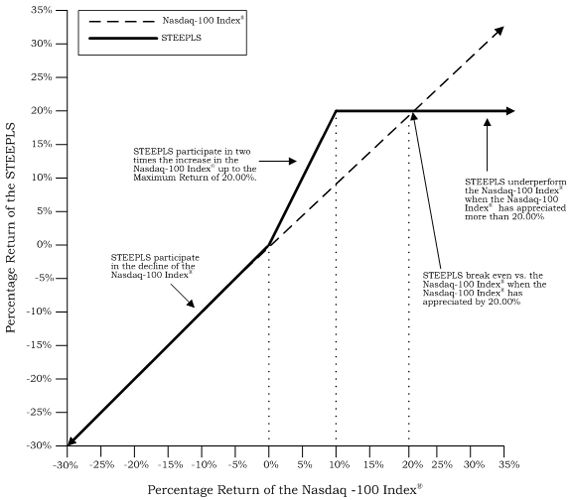

Example 1- The hypothetical Ending Level is less than the Starting Level:

Starting Level: 1,899.24

Ending Level: 949.62

Payment at maturity = $1,000 × (1 + (– 50.00%)) = $500.00

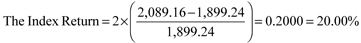

Example 2- The hypothetical Ending Level is greater than the Starting Level by 10.00%:

Starting Level: 1,899.24

Ending Level: 2,089.16

Payment at maturity is $1,000 × (1 + 20.00%) = $1,200.00

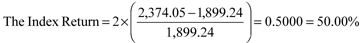

Example 3- The hypothetical Ending Level is greater than the Starting Level by 25.00%:

Starting Level: 1,899.24

Ending Level: 2,374.05

The Index Return cannot be greater than the Maximum Return of 20.00%; therefore, the Index Return will equal 20.00%.

Payment at maturity is $1,000 × (1 + 20.00%) = $1,200.00

PS-7

Hypothetical Returns

The following table is based upon the Starting Level of 1,899.24, the Maximum Return of 20.00%, the Enhancement Factor of 2, and a range of hypothetical Ending Levels. The table illustrates:

| • | the percentage change from the Starting Level to the hypothetical Ending Level; |

| • | the hypothetical Index Return (subject to the Maximum Return); and |

| • | the hypothetical payment at maturity per $1,000 of STEEPLS. |

The amounts in the table are for purposes of illustration only. The actual cash payment you will receive at maturity will depend on the actual Ending Level.

| Hypothetical |

Percentage Change from the Starting Level to Ending Level |

Hypothetical Index Return (subject to Maximum Return) |

Hypothetical Payment at Maturity per $1,000 of STEEPLS | |||

| 949.62 |

-50.00% | -50.00% | $500.00 | |||

| 1,044.58 |

-45.00% | -45.00% | $550.00 | |||

| 1,139.54 |

-40.00% | -40.00% | $600.00 | |||

| 1,234.51 |

-35.00% | -35.00% | $650.00 | |||

| 1,329.47 |

-30.00% | -30.00% | $700.00 | |||

| 1,424.43 |

-25.00% | -25.00% | $750.00 | |||

| 1,519.39 |

-20.00% | -20.00% | $800.00 | |||

| 1,614.35 |

-15.00% | -15.00% | $850.00 | |||

| 1,709.32 |

-10.00% | -10.00% | $900.00 | |||

| 1,804.28 |

-5.00% | -5.00% | $950.00 | |||

| 1,899.24 |

0.00% | 0.00% | $1,000.00 | |||

| 1,918.23 |

1.00% | 2.00% | $1,020.00 | |||

| 1,937.22 |

2.00% | 4.00% | $1,040.00 | |||

| 1,956.22 |

3.00% | 6.00% | $1,060.00 | |||

| 1,975.21 |

4.00% | 8.00% | $1,080.00 | |||

| 1,994.20 |

5.00% | 10.00% | $1,100.00 | |||

| 2,013.19 |

6.00% | 12.00% | $1,120.00 | |||

| 2,032.19 |

7.00% | 14.00% | $1,140.00 | |||

| 2,051.18 |

8.00% | 16.00% | $1,160.00 | |||

| 2,070.17 |

9.00% | 18.00% | $1,180.00 | |||

| 2,089.16 |

10.00% | 20.00% | $1,200.00 | |||

| 2,127.15 |

12.00% | 20.00% | $1,200.00 | |||

| 2,165.13 |

14.00% | 20.00% | $1,200.00 | |||

| 2,203.12 |

16.00% | 20.00% | $1,200.00 | |||

| 2,241.10 |

18.00% | 20.00% | $1,200.00 | |||

| 2,279.09 |

20.00% | 20.00% | $1,200.00 | |||

| 2,317.07 |

22.00% | 20.00% | $1,200.00 | |||

| 2,374.05 |

25.00% | 20.00% | $1,200.00 | |||

| 2,469.01 |

30.00% | 20.00% | $1,200.00 | |||

| 2,563.97 |

35.00% | 20.00% | $1,200.00 | |||

| 2,658.94 |

40.00% | 20.00% | $1,200.00 | |||

| 2,753.90 |

45.00% | 20.00% | $1,200.00 | |||

| 2,848.86 |

50.00% | 20.00% | $1,200.00 |

PS-8

Who will determine the amount to be paid at maturity?

A calculation agent will make all the calculations associated with determining the amount to be paid on STEEPLS at maturity. We have appointed our affiliate, Banc of America Securities LLC, or “BAS,” to act as calculation agent. See the section entitled “Description of STEEPLS—Role of the Calculation Agent.”

Who publishes the Nasdaq-100 Index® and what does it measure?

The Nasdaq-100 Index® is a modified capitalization-weighted index of 100 of the largest and most actively traded stocks of non-financial companies listed on The Nasdaq Global Market tier of the Nasdaq Market System. The Nasdaq-100 Index® was first published in January 1985 and includes companies across a variety of major industry groups. The Nasdaq-100 Index® is determined, comprised, and calculated by The Nasdaq Stock Market, Inc. without regard to the notes. The Nasdaq-100 Index® is described further in the section entitled “The Nasdaq-100 Index®.”

How has the Nasdaq-100 Index® performed historically?

There has been significant volatility in the Nasdaq-100 Index®. The table on page PS-26 shows the quarterly performance of the Nasdaq-100 Index® since the first calendar quarter of 2003. However, it is not possible to accurately predict how the Nasdaq-100 Index® or the notes will perform in the future. Past performance of the Nasdaq-100 Index® is not necessarily indicative of future results for any other period.

How will you be able to find the Nasdaq-100 Index® level?

You can obtain the Nasdaq-100 Index® level from the Bloomberg Financial® service under the symbol “NDX,” the Nasdaq website, www.nasdaq.com, as well as from The New York Times, The Wall Street Journal, and the Financial Times.

Will you have an ownership interest in the stocks that are included in the Nasdaq-100 Index®?

No. An investment in STEEPLS does not entitle you to any ownership interest, including any voting rights, dividends paid, or other distributions, in the stocks of the companies included in the Nasdaq-100 Index®.

Who are the selling agents for STEEPLS?

Our affiliates, BAS and Banc of America Investment Services, Inc., or “BAI,” are acting as our selling agents in connection with this offering and will receive a commission based on the total principal amount of STEEPLS sold. In this capacity, neither of the selling agents is your fiduciary or advisor, and you should not rely upon any communication from either of them in connection with STEEPLS as investment advice or a recommendation to purchase STEEPLS. You should make your own investment decision regarding STEEPLS after consulting with your legal, tax, and other advisors.

How are STEEPLS being offered?

BAS and BAI are offering STEEPLS, as selling agents, to selected investors on a best efforts basis. We have registered STEEPLS with the SEC in the United States. However, we are not registering STEEPLS for public distribution in any jurisdiction other than the United States. The selling agents may solicit offers to purchase STEEPLS from non-United States

PS-9

investors in reliance on available private placement exemptions. See the section entitled “Notices for Certain Non-United States Investors.”

Are STEEPLS exchange-traded funds?

No. STEEPLS are not part of an exchange-traded fund. The value of STEEPLS will not rise or fall at the same rate, or in the same manner, as the Nasdaq-100 Index®. We do not expect STEEPLS to trade with the same volume or liquidity as certain exchange-traded funds.

Will STEEPLS be listed on an exchange?

No. STEEPLS will not be listed on any securities exchange, and a market for them may never develop.

Can the maturity date be postponed if a Market Disruption Event occurs?

No. See the section entitled “Description of STEEPLS – Market Disruption.”

Does ERISA impose any limitations on purchases of STEEPLS?

Yes. An employee benefit plan subject to the fiduciary responsibility provisions of the Employee Retirement Income Security Act of 1974 (commonly referred to as “ERISA”) or a plan that is subject to Section 4975 of the Internal Revenue Code, or the “Code,” including individual retirement accounts, individual retirement annuities, or Keogh plans, or any entity the assets of which are deemed to be “plan assets” under the ERISA regulations, should not purchase, hold, and dispose of STEEPLS unless that plan or entity has determined that its purchase, holding, and disposition of STEEPLS will not constitute a prohibited transaction under ERISA or Section 4975 of the Code.

Any plan or entity purchasing STEEPLS will be deemed to be representing that it has made that determination, or that a prohibited transaction class exemption (“PTCE”) exists.

Are there any risks associated with your investment?

Yes. An investment in STEEPLS is subject to risk. STEEPLS are not principal protected. Please refer to the section entitled “Risk Factors” on page PS-11 of this pricing supplement and page S-3 of the attached prospectus supplement.

PS-10

Your investment in STEEPLS entails significant risks. Your decision to purchase STEEPLS should be made only after carefully considering the risks of an investment in STEEPLS, including those discussed below, with your advisors in light of your particular circumstances. STEEPLS are not an appropriate investment for you if you are not knowledgeable about significant elements of STEEPLS or financial matters in general.

Your investment may result in a loss; there is no guaranteed return of principal. STEEPLS are not principal protected and do not pay interest. There is no fixed repayment amount of principal on STEEPLS at maturity. The payment at maturity on STEEPLS will depend on the change in the level of the Nasdaq-100 Index®. If the Ending Level is less than the Starting Level, as a result of a decrease in the level of the Nasdaq-100 Index®, your return at maturity will be an amount in cash that reflects that index decline and that is less than the face amount of your STEEPLS. As a result, you may lose a substantial portion of your investment. See “Summary—Hypothetical Payments on STEEPLS at Maturity” and “—Hypothetical Returns.”

Your yield may be less than the yield on a conventional debt security of comparable maturity. There will be no periodic interest payments on STEEPLS as there would be on a conventional fixed-rate or floating-rate debt security having the same maturity. Any yield that you receive on STEEPLS, which could be negative, may be less than the return you would earn if you purchased a conventional debt security with the same maturity date. As a result, your investment in STEEPLS may not reflect the full opportunity cost to you when you consider factors that affect the time value of money. Additionally, although any positive return on STEEPLS is based on double the amount of the percentage increase in the Nasdaq-100 Index®, in no event will your return at maturity be greater than the Maximum Return.

Your investment return may be less than a comparable investment in a Nasdaq-100 Index® fund or the Nasdaq-100 Index® stocks directly. The appreciation potential of STEEPLS is limited by the Maximum Return. Because you will not receive more than the Maximum Return, the effect of the Enhancement Factor will be reduced once the Ending Level exceeds the Starting Level by 10.00%. In contrast, a direct investment in a Nasdaq-100 Index® fund or the stocks comprising the Nasdaq-100 Index® would allow you to receive the full benefit of any appreciation in the price of those shares. In addition, your return on the STEEPLS will not reflect the return you would realize if you actually owned the stocks and received the dividends paid or distributions made on those stocks, because the Index Return will be calculated without taking into consideration the value of dividends paid or distributions made on those stocks, or any other rights with respect to those stocks.

We cannot assure you that a trading market for the STEEPLS will ever develop or be maintained. We will not list the STEEPLS on any securities exchange. We cannot predict how STEEPLS will trade in the secondary market, or whether that market will be liquid or illiquid. The number of potential buyers of STEEPLS in any secondary market may be limited. BAS currently intends to act as a market-maker for the STEEPLS, but it is not required to do so. BAS may discontinue its market-making activities at any time.

To the extent that BAS engages in any market-making activities, it may bid for or offer STEEPLS. Any price at which BAS may bid for, offer, purchase, or sell any STEEPLS may differ from the values determined by pricing models that may be used by BAS, whether as a result of dealer discounts, mark-ups, or other transaction costs. These bids, offers, or completed transactions may affect the prices, if any, at which STEEPLS might otherwise trade in the market.

PS-11

In addition, if at any time BAS were to cease acting as a market-maker, it is likely that there would be significantly less liquidity in the secondary market, in which case the price at which STEEPLS could be sold likely would be lower than if an active market existed.

If you attempt to sell STEEPLS prior to maturity, the market value of STEEPLS, if any, may be less than the principal amount of STEEPLS. Unlike savings accounts, certificates of deposit, and other similar investment products, you have no right to redeem STEEPLS prior to maturity. If you wish to liquidate your investment in STEEPLS prior to maturity, your only option would be to sell them. At that time, there may be a very illiquid market for STEEPLS or no market at all. Even if you were able to sell your STEEPLS, there are many factors outside of our control that may affect their market value, some of which, but not all, are stated below. Some of these factors are interrelated in complex ways. As a result, the effect of any one factor may be offset or magnified by the effect of another factor. The following paragraphs describe the expected impact on the market value of STEEPLS from a change in a specific factor, assuming all other conditions remain constant.

| • |

The Nasdaq-100 Index®. Because the total amount payable at maturity is tied to the closing levels of the Nasdaq-100 Index® on the pricing date and during the Maturity Valuation Period, the market value of the STEEPLS at any time will depend on the closing levels of the Nasdaq-100 Index®. The Nasdaq-100 Index® is influenced by the operational results, creditworthiness, and dividend rates, if any, of the companies represented by the component stocks of that index, and by complex and interrelated political, economic, financial, and other factors that affect the capital markets generally, the markets on which these stocks are traded, and the market segments of which the companies represented by these stocks are a part. The policies of Nasdaq® concerning additions, deletions, and substitutions of the stocks underlying the Nasdaq-100 Index® and the manner in which the Nasdaq-100 Index® takes account of certain changes affecting these stocks may affect the value of the Nasdaq-100 Index®. The policies of Nasdaq® with respect to the calculation of the Nasdaq-100 Index® also could affect the level of the Nasdaq-100 Index®. Nasdaq® may discontinue or suspend the calculation or dissemination of the Nasdaq-100 Index®. Any of these actions could affect the value of the STEEPLS. See the section entitled “Nasdaq-100 Index®.” It is impossible to predict whether the level of the Nasdaq-100 Index® will rise or fall. |

| • |

Impact of the Nasdaq-100 Index® on the Value of the STEEPLS. We anticipate that the market value of the STEEPLS, if any, will depend substantially on the level of the Nasdaq-100 Index®. Even if the level of the Nasdaq-100 Index® increases after the pricing date, if you are able to sell your STEEPLS before the maturity date, you may receive substantially less than the amount that would be payable at maturity based on that value because of the anticipation that the Nasdaq-100 Index® will continue to fluctuate until the Ending Level is determined. If you sell your STEEPLS when the level of the Nasdaq-100 Index® is less than, or not sufficiently above, its closing level as of the pricing date, you may receive less than the principal amount of your STEEPLS. In general, the market value of the STEEPLS will decrease as the level of the Nasdaq-100 Index® decreases, and increase as the level of the Nasdaq-100 Index® increases. It is impossible to predict whether the level of the Nasdaq-100 Index® will rise or fall. Trading prices of the Nasdaq-100 Index® stocks also may be influenced if we, our affiliates, or any other entity issues securities or other instruments with terms similar to the STEEPLS or transfers shares of the Nasdaq-100 Index® stocks. In addition, the market price of the Nasdaq-100 Index® stocks could become more volatile and could be affected by hedging or arbitrage trading activity that may develop involving the STEEPLS or shares of the Nasdaq-100 Index® stocks. However, as the market value of the Nasdaq-100 Index® stocks increases or decreases, the market value of the STEEPLS is not expected to increase or decrease at the same rate as that change in market value of the Nasdaq-100 Index® stocks. |

PS-12

| • |

Volatility of the Nasdaq-100 Index®. Volatility is the term used to describe the size and frequency of market fluctuations. Volatility of the Nasdaq-100 Index® may affect the market value of the STEEPLS. The volatility of the Nasdaq-100 Index® during the term of the STEEPLS may vary. This volatility may increase the risk that the level of the Nasdaq-100 Index® will decline, which would negatively affect the market value of STEEPLS and your yield. |

| • | Economic and Other Conditions Generally. The general economic conditions of the capital markets, as well as geopolitical conditions and other financial, political, regulatory, and judicial events that affect stock markets generally, may affect the value of STEEPLS. |

| • |

Interest Rates. We expect that changes in interest rates will affect the trading value of STEEPLS. In general, if United States interest rates increase, we expect that the trading value of STEEPLS will decrease and, conversely, if United States interest rates decrease, we expect that the trading value of STEEPLS will increase. The level of prevailing interest rates also may affect the United States economy, and, in turn, the level of the Nasdaq-100 Index®. |

| • |

Dividend Yields. In general, if dividend yields on the stocks included in the Nasdaq-100 Index® increase, we anticipate that the market value of the STEEPLS will decrease and, conversely, if dividend yields on the stocks included in the Nasdaq-100 Index® decrease, we anticipate that the market value of the STEEPLS will increase. |

| • |

Time to Maturity. As the time remaining to maturity of STEEPLS decreases, the “time premium” associated with STEEPLS will decrease. We anticipate that before maturity, STEEPLS may have a market value above that which would be expected based on the levels of market interest rates and the level of the Nasdaq-100 Index®. This difference will reflect a “time premium” due to expectations concerning the level of the Nasdaq-100 Index® during the period before the maturity date of STEEPLS. In general, as the time remaining to maturity decreases, the value of STEEPLS will approach the amount that would be payable at maturity based on the then-current level of the Nasdaq-100 Index®. As a result, as the time remaining to maturity decreases, any premium attributed to the time value of STEEPLS will diminish, decreasing the value of STEEPLS. |

In general, assuming all relevant factors are held constant, we anticipate that the effect on the market value of STEEPLS based on a given change in most of the factors listed above will be less if it occurs later in the term of STEEPLS than if it occurs earlier in their term.

Your payment at maturity will not be affected by all developments relating to the Nasdaq-100 Index®. Changes in the Nasdaq-100 Index® during the term of the STEEPLS before the Maturity Valuation Period will not be reflected in the calculation of your payment at maturity. The calculation agent will calculate your payment at maturity by comparing only the Ending Level to the Starting Level. No other levels of the Nasdaq-100 Index® will be taken into account. As a result, you may lose some or most of your investment even if the Nasdaq-100 Index® has risen at certain times during the term of the STEEPLS before decreasing to a level below the Starting Level during the Maturity Valuation Period.

Changes in our credit ratings are expected to affect the value of STEEPLS. Our credit ratings are an assessment by ratings agencies of our ability to pay our obligations. Consequently, actual or anticipated changes in our credit ratings prior to the maturity date may affect the trading value of STEEPLS. However, because your return on STEEPLS depends upon factors in addition to our ability to pay our obligations, such as the level of the Nasdaq-

PS-13

100 Index®, an improvement in our credit ratings will not reduce the other investment risks related to STEEPLS.

Hedging activities may affect the amounts to be paid at maturity and the market value of STEEPLS. Hedging activities we or one or more of our affiliates, including the selling agents, may engage in may affect the level of the Nasdaq-100 Index®. Accordingly, our hedging activities may increase or decrease the market value of STEEPLS prior to maturity and the payment that you may receive at maturity. In addition, we or one or more of our affiliates, including the selling agents, may purchase or otherwise acquire a long or short position in STEEPLS. We or one of our affiliates, including the selling agents, may hold or resell STEEPLS. Although we have no reason to believe that any of those activities will have a material impact on the level of the Nasdaq-100 Index®, we cannot assure you that these activities will not affect that level and the market value of STEEPLS prior to maturity or the payment you will receive at maturity.

You have no shareholder rights, no rights to receive any shares of the Nasdaq-100 Index® stocks, and are not entitled to dividends or other distributions on the Nasdaq-100 Index® stocks. STEEPLS are our debt securities. They are not equity instruments or shares of stock. Investing in STEEPLS will not make you a holder of any of the Nasdaq-100 Index® stocks. You will not have any voting rights, any rights to receive dividends or other distributions, or any other rights with respect to the Nasdaq-100 Index® stocks. As a result, the return on your STEEPLS may not reflect the return you would realize if you actually owned these stocks and received the dividends paid or other distributions made in connection with them. Your STEEPLS will be paid in cash and you have no right to receive delivery of any Nasdaq-100 Index® stocks.

We are not affiliated with any Nasdaq-100 Index® company and are not responsible for any disclosure made by any Nasdaq-100 Index® company. Neither we nor any of our affiliates, including the selling agents, assume any responsibility for the adequacy or accuracy of any publicly available information about any other companies represented by constituent stocks of the Nasdaq-100 Index® or the calculation of the Nasdaq-100 Index®. You should make your own investigation into the Nasdaq-100 Index® and the companies represented by its constituent stocks. See the section entitled “Nasdaq-100 Index®” below for additional information about the Nasdaq-100 Index®.

None of Nasdaq® or any of its affiliates, or any Nasdaq-100 Index® company is involved in this offering of STEEPLS or has any obligation of any sort with respect to STEEPLS. As a result, none of those companies has any obligation to take your interests into consideration for any reason, including taking any corporate actions that might affect the value of STEEPLS.

Our trading and hedging activities may create conflicts of interest with you. We or one or more of our affiliates, including the selling agents, may engage in trading activities related to the Nasdaq-100 Index® and the Nasdaq-100 Index® stocks that are not for your account or on your behalf. We and our affiliates from time to time may buy or sell the stocks included in the Nasdaq-100 Index® or futures or options contracts on the Nasdaq-100 Index® for our own accounts, for business reasons, or in connection with hedging our obligations under STEEPLS. We also may issue, or our affiliates may underwrite, other financial instruments with returns based upon the Nasdaq-100 Index®. These trading and underwriting activities could affect the level of the Nasdaq-100 Index® in a manner that would be adverse to your investment in the STEEPLS.

In addition, we expect to enter into an arrangement or arrangements with one or more of our affiliates to hedge the market risks associated with our obligation to pay the amounts due under STEEPLS. Our affiliates expect to make a profit in connection with this

PS-14

arrangement. We do not intend to seek competitive bids for this arrangement from unaffiliated parties.

We or our affiliates may enter into these transactions on or prior to the pricing date, in order to hedge some or all of our anticipated obligations under the STEEPLS. This hedging activity could increase the Starting Level. If this occurs, you would be less likely to receive more than the principal amount of your STEEPLS on the maturity date.

In addition, from time to time during the term of the STEEPLS and in connection with their maturity, we or our affiliates may enter into additional hedging transactions or adjust or close out existing hedging transactions. We or our affiliates also may enter into hedging transactions relating to other notes or instruments that we issue, some of which may have returns calculated in a manner related to that of the STEEPLS described in this pricing supplement. We or our affiliates will price these hedging transactions with the intent to realize a profit, considering the risks inherent in these hedging activities, whether the value of STEEPLS increases or decreases. However, these hedging activities may result in a profit that is more or less than initially expected, or could result in a loss.

These trading activities may present a conflict of interest between your interest in STEEPLS and the interests we and our affiliates may have in our proprietary accounts, in facilitating transactions, including block trades, for our other customers, and in accounts under our management. These trading activities, if they influence the level of the Nasdaq-100 Index® or secondary trading activity in the STEEPLS, could be adverse to your interests as a beneficial owner of STEEPLS.

Our business activities may create conflicts of interest with you. We and our affiliates, including the selling agents, at present or in the future, may engage in business with Nasdaq-100 Index® companies, including making loans to, equity investments in, or providing investment banking, asset management, or other services to those companies, their affiliates, and their competitors. In connection with these activities, we may receive information about those companies that we will not divulge to you or other third parties. One or more of our affiliates have published, and in the future may publish, research reports on one or more of the Nasdaq-100 Index® companies. This research is modified from time to time without notice and may express opinions or provide recommendations that are inconsistent with purchasing or holding STEEPLS. Any of these activities may affect the market value of STEEPLS.

Secondary market prices of STEEPLS may be affected adversely by the inclusion in the original issue price of STEEPLS of the selling agents’ commissions and costs of hedging our obligations under STEEPLS. Assuming no change in market conditions or any other relevant factors, the market price, if any, at which a party may be willing to purchase STEEPLS in secondary market transactions likely will be lower than the original issue price. This is because the original issue price included, and secondary market prices are likely to exclude, commissions paid for STEEPLS and the potential profit included in the cost of hedging our obligations under STEEPLS. The price of hedging our obligations was determined by our affiliates with the intention of realizing a profit. However, because hedging our obligations entails risks and may be influenced by market forces beyond our control or our affiliates’ control, these hedging activities may result in a profit that is more or less than initially expected, or could result in a loss.

There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. Our subsidiary, BAS, is the calculation agent for STEEPLS and, as such, will determine the Ending Level, the Index Return, and the amount of the cash payment you will receive at maturity. Under some circumstances, these duties could result in a conflict of interest between BAS’s status as our subsidiary and its responsibilities as calculation agent. These conflicts could occur, for

PS-15

instance, in connection with the calculation agent’s determination as to whether a “Market Disruption Event” has occurred, or in connection with judgments that it would be required to make if the publication of the Nasdaq-100 Index® is discontinued. See the sections entitled “Description of STEEPLS—Market Disruption” and “—Discontinuance of the Nasdaq-100 Index®; Alteration of Method of Calculation.”

The United States federal income tax consequences of STEEPLS are uncertain. No statutory, judicial, or administrative authority directly addresses the characterization of STEEPLS or securities similar to STEEPLS for United States federal income tax purposes. As a result, significant aspects of the United States federal income tax consequences of an investment in STEEPLS are not certain. Under the terms of STEEPLS, you will have agreed with us to treat STEEPLS as a single financial contract, as described under “United States Federal Income Taxation—General.” If the Internal Revenue Service (the “IRS”) were successful in asserting an alternative characterization for STEEPLS, the timing and character of income or loss with respect to STEEPLS may differ. No ruling is being requested from the IRS with respect to STEEPLS and no assurance can be given that the IRS will agree with the statements made in the section entitled “United States Federal Income Tax Summary.”

You are urged to consult with your own tax advisor regarding all aspects of the United States federal income tax consequences of investing in STEEPLS.

Bank of America employees who purchase STEEPLS must comply with policies that limit their ability to trade the STEEPLS, and that may affect the value of their STEEPLS. If you are our employee or an employee of one of our affiliates, including one of the selling agents, you may only acquire STEEPLS for investment purposes and you must comply with all of our internal policies and procedures. Because these policies and procedures limit the dates and times that you may effect the transactions in STEEPLS, you may not be able to purchase any of the STEEPLS from us and your ability to trade or sell any of the STEEPLS in any secondary market for STEEPLS may be limited.

PS-16

We will use the net proceeds we receive from the sale of STEEPLS for the purposes described in the accompanying prospectus under “Use of Proceeds.” In addition, we expect that we or our affiliates will use a portion of the net proceeds to hedge our obligations under STEEPLS.

PS-17

General

STEEPLS are part of a series of medium-term notes entitled “Medium-Term Notes, Series K” issued under the Senior Indenture, as amended and supplemented from time to time. The Senior Indenture is described more fully in the accompanying prospectus and prospectus supplement. The following description of STEEPLS supplements the description of the general terms and provisions of the notes and debt securities set forth under the headings “Description of the Notes” in the prospectus supplement and “Description of Debt Securities” in the prospectus.

The aggregate principal amount of STEEPLS is $5,000,000. STEEPLS are issued in $1,000 denominations. The STEEPLS will mature on December 1, 2008.

We will not pay interest on STEEPLS.

STEEPLS are not principal protected.

Prior to maturity, STEEPLS are not redeemable by us or repayable at the option of any holder. STEEPLS are not subject to any sinking fund.

STEEPLS will be issued in book-entry form only. The CUSIP number for the STEEPLS is 06050 MHS9.

Payment at Maturity

At maturity, you will receive a cash payment for each $1,000 face amount of STEEPLS that you hold. This amount will be calculated as follows:

Payment at maturity = $1,000 × (1 + Index Return)

The Index Return will be calculated as follows:

| • | If the Ending Level is greater than the Starting Level: |

| • | If the Ending Level is equal to or less than the Starting Level: |

The Index Return will be rounded to the nearest ten-thousandth and then expressed as a percentage.

In no event will the Index Return exceed 20.00%, which we call the “Maximum Return.” We set the Maximum Return on the pricing date. As a result of this limitation on the Index Return, the cash payment you will receive at maturity for each $1,000 face amount of STEEPLS will not exceed $1,200.00.

PS-18

The Starting Level is 1,899.24, which is equal to the closing level of the Nasdaq-100 Index® on the pricing date. The calculation agent will determine the Ending Level based upon the average of the closing levels of the Nasdaq-100 Index® during the Maturity Valuation Period.

The Enhancement Factor is 2. The Enhancement Factor represents the extent to which the upside performance of STEEPLS is affected by the upside price performance of the Nasdaq-100 Index®, limited by the Maximum Return.

“Business day” means a business day of the kind described in the accompanying prospectus supplement, but that is not a day on which the principal securities market (or markets) on which the constituent stocks of the Nasdaq-100 Index® are traded is closed.

“Calculation day” means any trading day during the Maturity Valuation Period on which a Market Disruption Event has not occurred.

For purposes of determining the average closing levels of the Nasdaq-100 Index® during the Maturity Valuation Period:

(i) if any trading day during the Maturity Valuation Period is not a calculation day and a later trading day during the Maturity Valuation Period is a calculation day, then the closing level for that non-calculation day will be the same as the closing level for the next calculation day that occurs during the Maturity Valuation Period (for example, if the first and second days in the Maturity Valuation Period are not calculation days, but the third day is a calculation day, then the closing level for that third day will also be the closing level for the first and second days);

(ii) if the final trading day during the Maturity Valuation Period is not a calculation day, then the calculation agent will determine the closing level for that day by applying the procedures described below for use when a Market Disruption Event has occurred; and

(iii) if the closing level for the final trading day during the Maturity Valuation Period is determined in accordance with clause (ii) of this sentence, then that day will be treated as a calculation day for purposes of clause (i) of this sentence.

Market Disruption

Each of the following will be a “Market Disruption Event” if, in the sole opinion of the calculation agent, that event materially affects the Nasdaq-100 Index®:

| • |

the suspension, material limitation, or absence of the trading of a material number of stocks included in the Nasdaq-100 Index®; |

| • |

the suspension or material limitation of the trading of stocks on one or more stock exchanges on which stocks included in the Nasdaq-100 Index® are quoted; |

| • |

a breakdown or failure in the price and trade reporting systems of the respective primary markets on which the stocks included in the Nasdaq-100 Index® are quoted, as a result of which the reported trading prices for the affected stocks, during the last one-half hour before the close of trading in that market, are materially inaccurate; or |

| • |

the suspension or material limitation of the trading of (a) options or futures relating to the Nasdaq-100 Index® on any options or futures exchanges or (b) options or futures generally. |

PS-19

For purposes of determining whether a Market Disruption Event has occurred:

| • | a limitation on the number of hours or days of trading will not be a Market Disruption Event if it results from an announced change in the regular business hours of the relevant exchange; |

| • | a limitation on trading imposed by reason of the movements in price exceeding the levels permitted by any relevant exchange will be a Market Disruption Event; |

| • | a decision to permanently discontinue trading in the relevant futures or options contracts will not constitute a Market Disruption Event; and |

| • | an absence of trading on a securities exchange or quotation system will not include any time when that exchange or quotation system is closed for trading under ordinary circumstances. |

If on the last trading day of the Maturity Valuation Period, a Market Disruption Event has occurred, then the calculation agent will make a good faith estimate of the closing level of the Nasdaq-100 Index® based on its assessment, made in its sole discretion, of the level of the Nasdaq-100 Index® at that time.

Discontinuance of the Nasdaq-100 Index®; Alteration of Method of Calculation

If Nasdaq® discontinues publication of the Nasdaq-100 Index®, and Nasdaq® or another entity publishes a successor or substitute index that the calculation agent determines, in its sole discretion, is comparable to the discontinued Nasdaq-100 Index® (the new index being referred to as a “Successor Index”), then the relevant closing levels will be determined by reference to the closing level of the Successor Index.

If the calculation agent selects a Successor Index, the calculation agent immediately will notify us and the trustee of the Senior Indenture, and the trustee will provide written notice of a change to the holders of the STEEPLS within three business days of that selection.

If Nasdaq® discontinues publication of the Nasdaq-100 Index® or a Successor Index is discontinued, and the calculation agent determines that no Successor Index is available, then the calculation agent will notify us and the trustee of the Senior Indenture, and will calculate the appropriate closing levels. These calculations by the calculation agent will be in accordance with the formula for and method of calculating the Nasdaq-100 Index® last in effect prior to that discontinuance. If a Successor Index is selected or the calculation agent calculates a level as a substitute for the Nasdaq-100 Index®, that Successor Index or level will be substituted for the Nasdaq-100 Index® for all purposes.

If at any time the method of calculating the Nasdaq-100 Index® or a Successor Index, or the level of that index, is changed in a material respect, or if the Nasdaq-100 Index® or a Successor Index in any other way is modified so that it does not, in the opinion of the calculation agent, fairly represent the level of the Nasdaq-100 Index® or that Successor Index had those changes or modifications not been made, then, from and after that time, the calculation agent will notify us and the trustee of the Senior Indenture. The calculation agent will make those calculations and adjustments as, in the good faith judgment of the calculation agent, may be necessary in order to arrive at a level of a stock index comparable to the Nasdaq-100 Index® or that Successor Index, as the case may be, as if those changes or modifications had not been made, and calculate the closing levels with reference to the Nasdaq-100 Index® or

PS-20

that Successor Index, as adjusted. Accordingly, if the method of calculating the Nasdaq-100 Index® or a Successor Index is modified so that the level of that index is a fraction of what it would have been if it had not been modified (e.g., due to a split in the index), then the calculation agent will adjust that index in order to arrive at a level of the Nasdaq-100 Index® or that Successor Index as if it had not been modified (e.g., as if the split had not occurred). The calculation agent also may determine that no adjustment is required by the modification of the method of calculation.

Role of the Calculation Agent

The calculation agent has the sole discretion to make all determinations regarding STEEPLS, including determinations regarding the Ending Level, the Index Return, the payment at maturity, any Market Disruption Events, a Successor Index, trading days, business days, and calculation days. Absent manifest error, all determinations of the calculation agent will be final and binding on you and us, without any liability on the part of the calculation agent.

We have initially appointed our affiliate, BAS, as the calculation agent, but we may change the calculation agent at any time without notifying you.

Same-Day Settlement and Payment

STEEPLS will be delivered in book-entry form only through The Depository Trust Company against payment by purchasers of STEEPLS in immediately available funds. We will make the cash payment due at maturity in immediately available funds so long as the STEEPLS are maintained in book-entry form.

Events of Default and Acceleration

If an event of default, as defined in the Senior Indenture, with respect to STEEPLS shall have occurred and be continuing, the amount payable to a holder of STEEPLS upon any acceleration permitted under the Senior Indenture will be equal to the cash amount described under the caption “—Payment at Maturity,” determined as if (a) STEEPLS matured on the date of acceleration and (b) the Ending Level was determined based upon the closing levels of the Nasdaq-100 Index® during the three trading days prior to that date.

Listing

STEEPLS will not be listed on any securities exchange.

PS-21

We have obtained all information regarding the Nasdaq-100 Index® contained in this pricing supplement, including its make up, method of calculation, and changes in its components, from publicly available information. That information reflects the policies of, and is subject to change by, Nasdaq®, which owns the copyright and all other rights to the Nasdaq-100 Index®. Nasdaq® has no obligation to continue to publish, and may discontinue publication of, the Nasdaq-100 Index®. The consequences of Nasdaq® discontinuing publication of the Nasdaq-100 Index® are discussed in the section entitled “Description of the Notes—Discontinuance of the Nasdaq-100 Index®; Alteration of Method of Calculation.” We do not assume any responsibility for the accuracy or completeness of any information relating to the Nasdaq-100 Index®.

The Nasdaq-100 Index® is a modified capitalization-weighted index of 100 of the largest and most actively traded stocks of domestic and international non-financial companies listed on the Nasdaq Global Select Market tier or the Nasdaq Global Market tier of the Nasdaq®. The Nasdaq-100 Index® was first published in January 1985 and includes companies across a variety of major industry groups. Current information regarding the market value of the Nasdaq-100 Index® is available from Nasdaq® as well as numerous market information services. The Nasdaq-100 Index® is determined, comprised, and calculated by Nasdaq® without regard to the notes.

At any moment in time, the value of the Nasdaq-100 Index® equals the aggregate value of the then-current Nasdaq-100 Index® share weights of each of the Nasdaq-100 Index® securities, which are based on the total shares outstanding of each such Nasdaq-100 Index® security, subject in certain cases to rebalancing, multiplied by each such security’s respective last sale price on The Nasdaq Stock Market, and divided by a scaling factor (the “divisor”), which becomes the basis for the reported Nasdaq-100 Index® value. The divisor serves the purpose of scaling such aggregate value (otherwise in the trillions) to a lower order of magnitude which is more desirable for Nasdaq-100 Index® reporting purposes.

As a result of these calculations, each underlying stock’s influence on the value of the Nasdaq-100 Index® is directly proportional to the value of its Nasdaq-100 Index® share weight.

Computation of the Nasdaq-100 Index®

To be eligible for inclusion in the Nasdaq-100 Index®, a security must be listed on Nasdaq® and meet the following criteria:

| • | the security must be of a non-financial company; |

| • | the security may not be issued by an issuer currently in bankruptcy proceedings; |

| • |

the security must have average daily trading volume on Nasdaq® of at least 200,000 shares per day; |

| • | if the security is of a foreign issuer, it must have listed options or be eligible for listed options trading; |

| • | only one class of security per issuer is allowed; |

PS-22

| • | the issuer of the security may not have entered into a definitive agreement or other arrangement that would result in the security no longer being index-eligible within the next six months; |

| • | the issuer of the security may not have annual financial statements with an audit opinion which the auditor or the company have indicated cannot be currently relied upon; |

| • |

the security must have “seasoned” on Nasdaq® or another recognized market (generally, a company is considered to be seasoned if it has been listed on a market for at least two years; in the case of spin-offs, the operating history of the spin-off will be considered); and |

| • |

if the security would otherwise qualify to be in the top 25% of the securities included in the Nasdaq-100 Index® by market capitalization for the six prior consecutive month ends, then a one-year “seasoning” criteria would apply. |

In addition, to be eligible for continued inclusion in the Nasdaq-100 Index®, the security must have an adjusted market capitalization equal to or exceeding 0.10% of the aggregate adjusted market capitalization of the Index at each month end. In the event a company does not meet this criterion for two consecutive month ends, it will be removed from the Nasdaq-100 Index® effective after the close of trading on the third Friday of the following month.

These Nasdaq-100 Index® eligibility criteria may be revised from time to time by the National Association of Securities Dealers, Inc., the corporate parent of Nasdaq®, without regard to the notes.

The underlying stocks comprising the Nasdaq-100 Index® are evaluated on an annual basis, except under extraordinary circumstances which may result in an interim evaluation (the “Ranking Review”). Securities listed on Nasdaq® which meet the above eligibility criteria are ranked by market value using closing prices as of the end of October and publicly available total shares outstanding as of the end of November. Index-eligible securities which already are in the Nasdaq-100 Index® and which are in the top 100 eligible securities (based on market value) are retained in the Nasdaq-100 Index®. Those securities that are ranked 101 to 125 in the Nasdaq-100 Index® are also retained in the Nasdaq-100 Index® provided that such securities were ranked in the top 100 eligible securities as of the previous Ranking Review or was added to the Nasdaq-100 Index® subsequent to the previous Ranking Review. Securities not meeting such criteria are replaced. The replacement securities chosen are those index-eligible securities not currently in the Nasdaq-100 Index® which have the largest market capitalization. Generally, the list of annual additions and deletions is publicly announced by a press release in the early part of December and replacements are made effective after the close of trading on the third Friday in December. Additionally, Nasdaq® may periodically (ordinarily, several times per quarter) replace one or more component securities in the Nasdaq-100 Index® due to mergers, acquisitions, bankruptcies, or other market conditions, or if the issuers of such component securities fail to meet the criteria for continued inclusion in the Nasdaq-100 Index®. Moreover, if at any time during the year, a Nasdaq-100 Index® security is no longer traded on Nasdaq®, or is otherwise determined by Nasdaq® to become ineligible for continued inclusion in the Nasdaq-100 Index®, the security will be replaced with the largest market capitalization security not currently in the Nasdaq-100 Index® and meeting the Nasdaq-100 Index® eligibility criteria listed above.

In addition to the Ranking Review, the underlying stocks comprising the Nasdaq-100 Index® are monitored every day by Nasdaq® with respect to changes in total shares outstanding arising from secondary offerings, stock repurchases, conversions, or other corporate actions.

PS-23

Nasdaq® has adopted the following quarterly scheduled weight adjustment procedures with respect to such changes. If the change in total shares outstanding arising from such corporate action is greater than or equal to 5.00%, such change is made to the Nasdaq-100 Index® as soon as practical, normally within 10 days of that action. Otherwise, if the change in total shares outstanding is less than 5.00%, then all such changes are accumulated and made effective at one time on a quarterly basis after the close of trading on the third Friday in each of March, June, September, and December. In either case, the Nasdaq-100 Index® share weights for such underlying stocks are adjusted by the same percentage amount by which the total shares outstanding have changed in such Nasdaq-100 Index® securities. Ordinarily, whenever there is a change in the Nasdaq-100 Index® share weights or a change in a component security included in the Nasdaq-100 Index®, Nasdaq® adjusts the divisor to assure that there is no discontinuity in the value of the Nasdaq-100 Index® which might otherwise be caused by any such change.

Rebalancing of the Nasdaq-100 Index®

The Nasdaq-100 Index® is calculated under a “modified capitalization-weighted” methodology, which is a hybrid between equal weighting and conventional capitalization weighting. This methodology is expected to: (1) retain in general the economic attributes of capitalization weighting; (2) promote portfolio weight diversification (thereby limiting domination of the Nasdaq-100 Index® by a few large stocks); (3) reduce Nasdaq-100 Index® performance distortion by preserving the capitalization ranking of companies; and (4) reduce market impact on the smallest Nasdaq-100 Index® securities from necessary weight rebalancings.

Under the methodology employed, on a quarterly basis coinciding with Nasdaq’s® quarterly scheduled weight adjustment procedures, the underlying stocks comprising the Nasdaq-100 Index® are categorized as either “Large Stocks” or “Small Stocks” depending on whether their current percentage weights (after taking into account such scheduled weight adjustments due to stock repurchases, secondary offerings, or other corporate actions) are greater than, or less than, or equal to, the average percentage weight in the Nasdaq-100 Index® (i.e., as a 100-stock index, the average percentage weight in the Nasdaq-100 Index® is 1.00%).

Such quarterly examination will result in a Nasdaq-100 Index® rebalancing if either one or both of the following two weight distribution requirements are not met: (1) the current weight of the single largest market capitalization Nasdaq-100 Index® security must be less than or equal to 24.00% and (2) the “collective weight” of those Nasdaq-100 Index® securities whose individual current weights are in excess of 4.50%, when added together, must be less than or equal to 48.00%. In addition, Nasdaq® may conduct a special rebalancing if it is determined necessary to maintain the integrity of the Nasdaq-100 Index®.

If either one or both of these weight distribution requirements are not met upon quarterly review, or if Nasdaq® determines that a special rebalancing is required, a weight rebalancing will be performed. First, relating to weight distribution requirement (1) above, if the current weight of the single largest Nasdaq-100 Index® security exceeds 24.00%, then the weights of all Large Stocks will be scaled down proportionately towards 1.00% by enough for the adjusted weight of the single largest Nasdaq-100 Index® security to be set to 20.00%. Second, relating to weight distribution requirement (2) above, for those Nasdaq-100 Index® securities whose individual current weights or adjusted weights in accordance with the preceding step are in excess of 4.50%, if their “collective weight” exceeds 48.00%, then the weights of all Large Stocks will be scaled down proportionately towards 1.00% by just enough for the “collective weight,” so adjusted, to be set to 40.00%.

The aggregate weight reduction among the Large Stocks resulting from either or both of the above rescalings will then be redistributed to the Small Stocks in the following iterative

PS-24

manner. In the first iteration, the weight of the largest Small Stock will be scaled upwards by a factor which sets it equal to the average Nasdaq-100 Index® weight of 1.00%. The weights of each of the smaller remaining Small Stocks will be scaled up by the same factor reduced in relation to each stock’s relative ranking among the Small Stocks such that the smaller the Nasdaq-100 Index® security in the ranking, the less the scale-up of its weight. This is intended to reduce the market impact of the weight rebalancing on the smallest component securities in the Nasdaq-100 Index®.

In the second iteration, the weight of the second largest Small Stock, already adjusted in the first iteration, will be scaled upwards by a factor which sets it equal to the average index weight of 1.00%. The weights of each of the smaller remaining Small Stocks will be scaled up by this same factor reduced in relation to each stock’s relative ranking among the Small Stocks such that, once again, the smaller the stock in the ranking, the less the scale-up of its weight.

Additional iterations will be performed until the accumulated increase in weight among the Small Stocks exactly equals the aggregate weight reduction among the Large Stocks from rebalancing in accordance with weight distribution requirement (1) and/or weight distribution requirement (2).

Then, to complete the rebalancing procedure, once the final percent weights of each of the Nasdaq-100 Index® securities are set, the Nasdaq-100 Index® share weights will be determined anew based upon the last sale prices and aggregate capitalization of the Nasdaq-100 Index® at the close of trading on the Thursday in the week immediately preceding the week of the third Friday in March, June, September, and December. Changes to the Nasdaq-100 Index® share weights will be made effective after the close of trading on the third Friday in March, June, September, and December and an adjustment to the Index divisor will be made to ensure continuity of the Nasdaq-100 Index®.

Ordinarily, new rebalanced weights will be determined by applying the above procedures to the current Nasdaq-100 Index® share weights. However, Nasdaq® may from time to time determine rebalanced weights, if necessary, by instead applying the above procedure to the actual current market capitalization of the Nasdaq-100 Index® components. In such instances, Nasdaq® would announce the different basis for rebalancing prior to its implementation.

Historical Closing Levels of the Nasdaq-100 Index®

Since its inception, the Nasdaq-100 Index® has experienced significant fluctuations. Any historical upward or downward trend in the level of the Nasdaq-100 Index® during any period shown below is not an indication that the level of the Nasdaq-100 Index® is more or less likely to increase or decrease at any time during the term of the STEEPLS. The historical Nasdaq-100 Index® levels do not give an indication of future performance of the Nasdaq-100 Index®. We cannot assure you that the future performance of the Nasdaq-100 Index® or the constituent stocks of the Nasdaq-100 Index® will result in your receiving an amount greater than the outstanding face amount of the STEEPLS on the maturity date.

The table below sets forth the high, the low, and the last closing levels at the end of each calendar quarter of the Nasdaq-100 Index® since the first quarter of 2003. The closing levels listed in the table below were obtained from the Bloomberg Financial® service, without independent verification.

PS-25

Nasdaq-100 Index® Quarterly Levels

| HIGH | LOW | CLOSE | ||||

| 2003 |

||||||

| First Quarter |

1,094.87 | 951.90 | 1,018.66 | |||

| Second Quarter |

1,247.90 | 1,022.63 | 1,201.69 | |||

| Third Quarter |

1,400.13 | 1,207.28 | 1,303.70 | |||

| Fourth Quarter |

1,470.37 | 1,335.34 | 1,467.92 | |||

| 2004 |

||||||

| First Quarter |

1,553.66 | 1,370.04 | 1,438.41 | |||

| Second Quarter |

1,516.64 | 1,379.90 | 1,516.64 | |||

| Third Quarter |

1,489.57 | 1,304.43 | 1,412.74 | |||

| Fourth Quarter |

1,627.46 | 1,425.21 | 1,621.12 | |||

| 2005 |

||||||

| First Quarter |

1,603.51 | 1,464.34 | 1,482.53 | |||

| Second Quarter |

1,568.96 | 1,406.85 | 1,493.52 | |||

| Third Quarter |

1,627.19 | 1,490.53 | 1,601.66 | |||

| Fourth Quarter |

1,709.10 | 1,521.19 | 1,645.20 | |||

| 2006 |

||||||

| First Quarter |

1,758.24 | 1,645.09 | 1,703.66 | |||

| Second Quarter |

1,739.20 | 1,516.85 | 1,575.23 | |||

| Third Quarter |

1,661.59 | 1,451.88 | 1,654.13 | |||

| Fourth Quarter |

1,819.76 | 1,632.81 | 1,756.90 | |||

| 2007 |

||||||

| First Quarter |

1,846.34 | 1,712.94 | 1,772.36 | |||

| Second Quarter |

1,944.37 | 1,773.33 | 1,934.10 | |||

| Third Quarter (through August 28th) |

2,052.99 | 1,846.09 | 1,899.24 | |||

Before investing in the STEEPLS, you should consult publicly available sources for the levels and trading pattern of the Nasdaq-100 Index®. The generally unsettled international environment and related uncertainties, including the risk of terrorism, may result in financial markets generally and the Nasdaq-100 Index® exhibiting greater volatility than in earlier periods.

License Agreement

We have entered into a non-exclusive license agreement with Nasdaq® providing for the license to us and certain of our affiliated or subsidiary companies, in exchange for a fee, of the right to use indices owned and published by the Nasdaq® (including the Nasdaq-100 Index®) in connection with certain securities, including the STEEPLS.

The license agreement between us and Nasdaq® requires that the following language be stated in this pricing supplement:

The STEEPLS are not sponsored, endorsed, sold, or promoted by Nasdaq®. Nasdaq® has not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the STEEPLS. Nasdaq® makes no representation or warranty, express or implied to the owners of the

PS-26

STEEPLS or any member of the public regarding the advisability of investing in securities generally or in the STEEPLS particularly, or the ability of the Nasdaq-100 Index® to track general stock market performance. Nasdaq®’s only relationship to us is in the licensing of the Nasdaq-100®, Nasdaq-100 Index®, and Nasdaq® trademarks or service marks, and certain trade names of Nasdaq® and the use of the Nasdaq-100 Index®, which is determined, composed, and calculated by Nasdaq® without regard to us or the STEEPLS. Nasdaq® has no obligation to take our needs or your needs into consideration in determining, composing, or calculating the Nasdaq-100 Index®. Nasdaq® is not responsible for and has not participated in the determination of the timing of, prices at, or quantities of the STEEPLS to be issued or in the determination of the amount to be paid on the STEEPLS. Nasdaq® has no liability in connection with the administration, marketing, or trading of the STEEPLS.

NASDAQ® DOES NOT GUARANTEE THE ACCURACY AND/OR UNINTERRUPTED CALCULATION OF THE NASDAQ-100 INDEX® OR ANY DATA INCLUDED THEREIN. NASDAQ® MAKES NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY BANK OF AMERICA CORPORATION, OWNERS OF THE STEEPLS, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE NASDAQ-100 INDEX® OR ANY DATA INCLUDED THEREIN. NASDAQ® MAKES NO EXPRESS OR IMPLIED WARRANTIES AND EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE NASDAQ-100 INDEX® OR ANY DATA INCLUDED THEREIN WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL NASDAQ® HAVE ANY LIABILITY FOR ANY LOST PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

PS-27

SUPPLEMENTAL PLAN OF DISTRIBUTION

Our affiliates, BAS and BAI, have been appointed as our selling agents to solicit offers on a best efforts basis to purchase STEEPLS. The selling agents are parties to the Distribution Agreement described in the “Supplemental Plan of Distribution” on page S-25 of the accompanying prospectus supplement. Each selling agent will receive a commission of 1.25% of the principal amount of STEEPLS sold through its efforts. You must have an account with one of the selling agents in order to purchase STEEPLS.

No selling agent is acting as your fiduciary or advisor, and you should not rely upon any communication from any selling agent in connection with STEEPLS as investment advice or a recommendation to purchase STEEPLS. You should make your own investment decision regarding STEEPLS after consulting with your legal, tax, and other advisors.

BAS and any of our other affiliates, may use this pricing supplement, the accompanying prospectus supplement, and the prospectus in a market-making transaction for any STEEPLS after their initial sale.

NOTICES FOR CERTAIN NON-UNITED STATES INVESTORS

Argentina: We have not made, and will not make, any application to obtain an authorization from the Comisión Nacional de Valores (the “CNV”) for the public offering of STEEPLS in Argentina. The CNV has not approved STEEPLS, the offering, or any document relating to the offering of STEEPLS. The selling agents have not offered or sold, and will not offer or sell, STEEPLS in Argentina, except in transactions that will not constitute a public offering of securities within the meaning of Section 16 of the Argentine Public Offering Law N° 17,811. Argentine pension funds and insurance companies may not purchase STEEPLS.

Brazil: STEEPLS have not been registered in Brazil. The Comissão de Valores Mobiliários of Brazil has not approved STEEPLS, the offering, nor any document relating to the offering of the STEEPLS, including this pricing supplement. Neither STEEPLS nor the offering have been registered with the Comissão de Valores Mobiliários in Brazil. Persons wishing to offer or acquire STEEPLS within Brazil should consult with their own counsel as to the applicability of registration requirements or any exemption therefrom, and such persons are solely responsible for compliance with the requirements of Brazilian law applicable to the remittance of funds outside Brazil in connection with any such transaction, including any applicable tax and exchange control laws. No action should be taken by such persons that would result in the offering of STEEPLS being deemed a public offering under Brazilian law. In addition, any resale of STEEPLS must be made in a manner that will not constitute a public offering in Brazil. This offering is not being made to any Brazilian financial institution, pension fund, insurance company, or capitalization company.

Chile: STEEPLS have not been registered with the Superintendency of Securities and Insurance of Chile, and STEEPLS may not be publicly offered in Chile, within the meaning of Chilean Law.

Mexico: STEEPLS have not been registered under the Mexican Securities Market Law or recorded in the Mexican National Securities Registry. No action may be taken in Mexico that would render the offering of STEEPLS a public offering in Mexico. No Mexican regulatory authority has approved or disapproved of STEEPLS or passed on our solvency. In addition, any resale of STEEPLS must be made in a manner that will not constitute a public offering in Mexico.

Taiwan: STEEPLS may not be issued, sold, or offered in Taiwan. No subscription or other offer to purchase STEEPLS shall be binding on us until received and accepted by us,

PS-28

BAS, or BAI outside of Taiwan (the “Place of Acceptance”), and the purchase/sale contract arising therefrom shall be deemed a contract entered into in the Place of Acceptance.

Uruguay: STEEPLS have not been registered under the Uruguayan Securities Market Law or recorded in the Uruguayan Central Bank. No action may be taken in Uruguay that would render the offering of STEEPLS a public offering in Uruguay. No Uruguayan regulatory authority has approved STEEPLS or passed on our solvency. In addition, any resale of STEEPLS must be made in a manner that will not constitute a public offering in Uruguay.

Venezuela: The STEEPLS have not been registered with the Venezuelan National Commission of Securities and are not being publicly offered in Venezuela. No document related to the offering of the STEEPLS, including this pricing supplement, shall be interpreted to constitute an offer of securities financial instruments or an offer or the rendering of any investment advice or securities brokerage services or banking services rendered within Venezuela. Investors wishing to acquire the STEEPLS may use only funds located outside of Venezuela.

UNITED STATES FEDERAL INCOME TAX SUMMARY

The following summary of certain United States federal income tax consequences of the purchase, ownership, and disposition of STEEPLS is based upon laws, regulations, rulings, and decisions now in effect, all of which are subject to change (including changes in effective dates) or possible differing interpretations. It deals only with initial purchasers of STEEPLS who hold them as capital assets and does not deal with persons in special tax situations, such as financial institutions, insurance companies, regulated investment companies, dealers in securities or currencies, tax-exempt entities, persons holding STEEPLS in a tax-deferred or tax-advantaged account, persons holding STEEPLS as a hedge, a position in a “straddle” or as part of a “conversion” transaction for tax purposes, or persons who are required to mark-to-market for tax purposes. The discussion assumes that STEEPLS constitute a single financial contract with respect to the Nasdaq-100 Index® for United States federal income tax purposes. If STEEPLS did not constitute a single financial contract, the tax consequences described below would be materially different. You must consult your own tax advisors concerning the application of United States federal income tax laws to your particular situation as well as any consequences of the purchase, ownership, and disposition of STEEPLS arising under the laws of any other jurisdiction.