Subject to Completion

Preliminary Pricing Supplement dated May 30, 2008

| PRICING SUPPLEMENT (To MTN prospectus supplement, general prospectus supplement and prospectus each dated March 31, 2006) Pricing Supplement Number: |

Filed Pursuant to Rule 424(b)(3) Registration No. 333-132911 |

Units

Merrill Lynch & Co., Inc.

Medium-Term Notes, Series C

Notes Linked to the

S&P® Diversified Trends Indicator Price Return Index

due June , 2009

(the “Notes”)

$10,000 original public offering price per unit

Information included in this pricing supplement supersedes information in the accompanying MTN prospectus supplement, general prospectus supplement and prospectus to the extent that it is different from that information.

Investing in the Notes involves risks that are described in the “ Risk Factors” section beginning on page PS-7 of this pricing supplement and beginning on page S-3 of the accompanying MTN prospectus supplement.

In connection with this offering, each of Merrill Lynch, Pierce, Fenner & Smith Incorporated and its broker-dealer affiliate First Republic Securities Company, LLC is acting in its capacity as a principal.

| Per Unit | Total | |||

| Public offering price |

$10,000 | $ | ||

| Underwriting discount |

$0 | $ | ||

| Proceeds, before expenses, to Merrill Lynch & Co., Inc. |

$10,000 | $ |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this pricing supplement or the accompanying MTN prospectus supplement, general prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Merrill Lynch & Co.

The date of this pricing supplement is June , 2008.

“Standard & Poor’s®” and “S&P®”, are trademarks of The McGraw-Hill Companies, Inc. “DTI” is a trademark of Alpha Financial Technologies, LLC. These marks have been licensed for use by Merrill Lynch & Co., Inc. as responsible entity for the Notes. The Notes are not sponsored, endorsed, sold or promoted by Alpha Financial Technologies, LLC or Standard & Poor’s and Alpha Financial Technologies, LLC and Standard & Poor’s make no representation regarding the advisability of investing in the Notes.

Pricing Supplement

| PS-3 | ||

| PS-7 | ||

| PS-12 | ||

| PS-18 | ||

| PS-25 | ||

| PS-30 | ||

| PS-31 | ||

| PS-31 | ||

| PS-31 | ||

| PS-33 | ||

| Medium-Term Notes, Series C Prospectus Supplement (the “MTN prospectus supplement”) | ||

| RISK FACTORS |

S-3 | |

| DESCRIPTION OF THE NOTES |

S-4 | |

| UNITED STATES FEDERAL INCOME TAXATION |

S-22 | |

| PLAN OF DISTRIBUTION |

S-29 | |

| VALIDITY OF THE NOTES |

S-30 | |

| Debt Securities, Warrants, Preferred Stock, Depositary Shares and Common Stock Prospectus Supplement (the “general prospectus supplement”) | ||

| MERRILL LYNCH & CO., INC |

S-3 | |

| USE OF PROCEEDS |

S-3 | |

| RATIO OF EARNINGS TO FIXED CHARGES AND RATIO OF EARNINGS TO COMBINED FIXED CHARGES AND PREFERRED STOCK DIVIDENDS |

S-4 | |

| THE SECURITIES |

S-4 | |

| DESCRIPTION OF DEBT SECURITIES |

S-5 | |

| DESCRIPTION OF DEBT WARRANTS |

S-16 | |

| DESCRIPTION OF CURRENCY WARRANTS |

S-18 | |

| DESCRIPTION OF INDEX WARRANTS |

S-20 | |

| DESCRIPTION OF PREFERRED STOCK |

S-25 | |

| DESCRIPTION OF DEPOSITARY SHARES |

S-32 | |

| DESCRIPTION OF PREFERRED STOCK WARRANTS |

S-36 | |

| DESCRIPTION OF COMMON STOCK |

S-38 | |

| DESCRIPTION OF COMMON STOCK WARRANTS |

S-42 | |

| PLAN OF DISTRIBUTION |

S-44 | |

| WHERE YOU CAN FIND MORE INFORMATION |

S-45 | |

| INCORPORATION OF INFORMATION WE FILE WITH THE SEC |

S-46 | |

| EXPERTS |

S-46 | |

| Prospectus | ||

| WHERE YOU CAN FIND MORE INFORMATION |

2 | |

| INCORPORATION OF INFORMATION WE FILE WITH THE SEC |

2 | |

| EXPERTS |

2 | |

PS-2

This summary includes questions and answers that highlight selected information from this pricing supplement and the accompanying MTN prospectus supplement, general prospectus supplement and prospectus to help you understand the Notes Linked to the S&P® Diversified Trends Indicator Price Return Index due June , 2009 (the “Notes”). You should carefully read this pricing supplement and the accompanying MTN prospectus supplement, general prospectus supplement and prospectus to fully understand the terms of the Notes, the S&P® Diversified Trends Indicator Price Return Index (the “Index”) and the tax and other considerations that are important to you in making a decision about whether to invest in the Notes. You should carefully review the “Risk Factors” sections in this pricing supplement and the accompanying MTN prospectus supplement, which highlight certain risks associated with an investment in the Notes, to determine whether an investment in the Notes is appropriate for you.

References in this pricing supplement to “ML&Co.”, “we”, “us” and “our” are to Merrill Lynch & Co., Inc. and references to “MLPF&S” are to Merrill Lynch, Pierce, Fenner & Smith Incorporated.

What are the Notes?

The Notes will be part of a series of senior debt securities issued by ML&Co. entitled “Medium-Term Notes, Series C” and will not be secured by collateral. The Notes will rank equally with all of our other unsecured and unsubordinated debt. The Notes will mature on June , 2009.

Each unit will represent a single Note with a $10,000 original public offering price. You may transfer the Notes only in whole units. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the Notes in the form of a global certificate, which will be held by The Depository Trust Company, also known as DTC, or its nominee. Direct and indirect participants in DTC will record your ownership of the Notes. You should refer to the section entitled “Description of Debt Securities—Depositary” in the accompanying general prospectus supplement.

Are there any risks associated with my investment?

Yes, an investment in the Notes is subject to risks, including the risk of loss of principal. Please refer to the section entitled “Risk Factors” in this pricing supplement and the accompanying MTN prospectus supplement.

Who publishes the Index and what does the Index measure?

The Index is constructed, calculated and maintained by Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“Standard & Poor’s” or “S&P”) pursuant to a licensing agreement with Alpha Financial Technologies, LLC (“AFT”). Standard & Poor’s has been calculating and maintaining the Index since January 1, 2004. The Index tracks the value of 24 commodities by reference to the prices of the related futures contracts grouped into 14 sectors, including eight financial sectors (the “Financial Index Components”) and six commodity sectors (the “Commodity Index Components” and, together with the Financial Index Components, the “Index Components”). The Index Components are equally divided by weight between Financial Index Components and Commodity Index Components. Each sector is represented on either a “long” or “short” basis, depending on recent price trends of that sector. Such positions are determined by comparing the current sector price to a moving exponential average. The sectors are rebalanced on a monthly basis and the Index Components contained in the sectors are rebalanced annually. For further information regarding the Index, please see the section entitled “The Index”.

An investment in the Notes does not entitle you to any dividends, voting rights or any other ownership interest in the Index Components.

How has the Index performed historically?

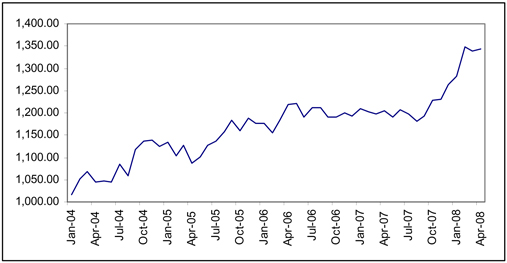

We have included a graph showing the historical month-end closing levels of the Index from January 2004 through April 2008 in the section entitled “The Index—Historical Data on the Index” in this pricing supplement. We have provided this historical information to help you evaluate the behavior of the Index in various economic environments; however, past performance of the Index is not necessarily indicative of how the Index will perform in the future.

PS-3

What will I receive on the maturity date of the Notes?

On the maturity date, you will receive a cash payment per unit equal to the Redemption Amount.

The “Redemption Amount” per unit to which you will be entitled will depend on the direction of and percentage change in the level of the Index and will equal the $10,000 principal amount multiplied by the greater of:

| (A) | 0; and |

| (B) |

[

|

100% + |

(

|

300% × Final Return | )

|

]

|

||||||||

The “Final Return” will equal:

Index Return – Fees

The “Index Return” will equal:

| (

|

Ending Value | )

|

– 1 | |||||||

| Starting Value |

The “Starting Value” will equal the closing level of the Index on the date the Notes are priced for initial sale to the public (the “Pricing Date”).

The “Ending Value” will equal the closing level of the Index on the eighth scheduled Index Business Day prior to the maturity date of the Notes (the “Valuation Date”).

The “Fees” will equal:

| 1.6% × |

(

|

D | )

|

|||||||

| 365 |

where “D” equals the number of days from and including the Pricing Date, to and including the Valuation Date.

In the event that the level of the Index declines from the Starting Value to the Ending Value, or has not increased by an amount at least equal to the Fees, the amount you receive on the maturity date will be proportionately less than the original public offering price of the Notes. As a result, you may receive less, and possibly significantly less, than the $10,000 original public offering price per unit.

For more specific information about the Redemption Amount, please see the section entitled “Description of the Notes” in this pricing supplement.

Will I receive interest payments on the Notes?

Unless earlier redeemed, we will pay interest on the Notes in cash quarterly in arrears on September , 2008, December , 2008, March , 2009 and on the maturity date (the “Interest Payment Dates”). The Notes will accrue interest at a rate equal to the Interest Payment Rate (as defined below) from and including June , 2008, or from and including the most recent Interest Payment Date to which interest has been paid, to but excluding the next succeeding Interest Payment Date, the stated maturity date or Early Redemption Date, as the case may be (each, an “Interest Payment Period”); provided, however, that if an Interest Payment Date falls on a day that is not a Banking Business Day, other than the Interest Payment Date that is also the stated maturity date or Early Redemption Date, that Interest Payment Date will be postponed to the next Banking Business Day except that if such next Banking Business Day is in a different month, then that Interest Payment Date will be the immediately preceding day that is a Banking Business Day.

Interest will accrue quarterly at rate equal to:

| (3-Month LIBOR –0.12%) |

× |

(

|

Days | )

|

||||||||||

| 360 |

where “Days” equals the number of calendar days during such Interest Payment Period (the “Interest Payment Rate”).

“3-Month LIBOR” is the 3-Month London Inter-Bank Offer Rate as of the LIBOR Determination Date for such Interest Payment Period, calculated as described herein under the section entitled “Description of the Notes—Determination of 3-Month LIBOR”.

How does the early redemption feature work?

In the event that the closing level of the Index is equal to or less than 85% of the Starting Value on any Index Business Day (the “Early Redemption Date”) from and including June , 2008, the expected settlement date for the Notes, to but excluding the scheduled Valuation Date, then the Valuation Date shall be accelerated to the next Index Business Day immediately following the Early Redemption Date (the “Early Redemption Valuation Date”) and the maturity date will be accelerated to the fifth scheduled Index Business Day following the Early Redemption Valuation Date.

PS-4

Examples:

Set forth below are three examples of Redemption Amount calculations (subject to rounding), including a hypothetical Starting Value of 1,371.49, the level of the Index on May 27, 2008, assuming a term of one year and a Fee for one year of 1.6%.

Example 1—The hypothetical Ending Value is 90% of the hypothetical Starting Value:

Hypothetical Starting Value: 1,371.49

Hypothetical Ending Value: 1,234.34

| $10,000 × |

[

|

100% + |

(

|

300% × |

[

|

(

|

1,234.34 | )

|

– 1.016 |

]

|

)

|

]

|

= $6,520 | |||||||||||||||||||||||||

| 1,371.49 |

Redemption Amount (per unit) = $6,520

Example 2—The hypothetical Ending Value is 102% of the hypothetical Starting Value:

Hypothetical Starting Value: 1,371.49

Hypothetical Ending Value: 1,398.92

| $10,000 × |

[

|

100% + |

(

|

300% × |

[

|

(

|

1,398.92 | )

|

– 1.016 |

]

|

)

|

]

|

= $10,120 | |||||||||||||||||||||||||

| 1,371.49 |

Redemption Amount (per unit) = $10,120

Example 3—The hypothetical Ending Value is 110% of the hypothetical Starting Value:

Hypothetical Starting Value: 1,371.49

Hypothetical Ending Value: 1,508.64

| $10,000 × |

[

|

100% + |

(

|

300% × |

[

|

(

|

1,508.64 | )

|

– 1.016 |

]

|

)

|

]

|

= $12,520 | |||||||||||||||||||||||||

| 1,371.49 |

Redemption Amount (per unit) = $12,520

What about taxes?

You will be required to pay taxes on ordinary income from the Notes over their term based upon an estimated yield for the Notes. We have established this estimated yield, in accordance with regulations issued by the U.S. Treasury Department, solely in order for you to calculate the amount of taxes that you will owe each year as a result of owning a Note. This estimated yield is neither a prediction nor a guarantee of what the actual yield on the Notes will be. We have determined that this estimated yield will equal % per annum, compounded quarterly. For further information, see “United States Federal Income Taxation” in this pricing supplement.

Will the Notes be listed on a stock exchange?

The Notes will not be listed on any securities exchange and we do not expect a trading market for the Notes to develop, which may affect the price you receive for your Notes upon any sale prior to the maturity date or redemption. You should review the section entitled “Risk Factors—In seeking to provide investors with what we believe to be commercially reasonable terms for the Notes while providing MLPF&S with compensation for its services, we have considered the costs of developing, hedging and distributing the Notes. If a trading market develops for the Notes (and such a market may not develop), these costs are expected to affect the market price you may receive or be quoted for

PS-5

your Notes on a date prior to the stated maturity date” in this pricing supplement.

What price can I expect to receive if I sell the Notes prior to the stated maturity date?

In determining the economic terms of the Notes, and consequently the potential return on the Notes to you, a number of factors are taken into account. Among these factors are certain costs associated with creating, hedging and offering the Notes. In structuring the economic terms of the Notes, we seek to provide investors with what we believe to be commercially reasonable terms and to provide MLPF&S with compensation for its services in developing the Notes.

If you sell your Notes prior to the stated maturity date, you will receive a price determined by market conditions for the Notes. This price may be influenced by many factors, such as interest rates, volatility and the prevailing level of the Index. In addition, the price, if any, at which you could sell your Notes in a secondary market transaction is expected to be affected by the factors that we considered in setting the economic terms of the Notes, namely the underwriting discount paid in respect of the Notes, and compensation for developing and hedging the product. Depending on the impact of these factors, you may receive significantly less than the $10,000 principal amount per unit of your Notes if sold before the stated maturity date.

In a situation where there had been no movement in the level of the Index and no changes in the market conditions from those existing on the date of this pricing supplement, the price, if any, at which you could sell your Notes in a secondary market transaction is expected to be lower than the original issue price. This is due to, among other things, our costs of developing, hedging and distributing the Notes. Any potential purchasers of your Notes in the secondary market are unlikely to consider these factors.

What is the role of MLPF&S?

MLPF&S, our subsidiary, is the underwriter for the offering and sale of the Notes. After the initial offering, MLPF&S intends to buy and sell Notes to create a secondary market for holders of the Notes, and may stabilize or maintain the market price of the Notes during their initial distribution. However, MLPF&S will not be obligated to engage in any of these market activities or continue them once it has started.

What is the role of Merrill Lynch International?

Merrill Lynch International will serve as calculation agent (in such capacity, the “Calculation Agent”) for purposes of determining, among other things, the Final Return, Index Return, Fees and Redemption Amount. Under certain circumstances, these duties could result in a conflict of interest between Merrill Lynch International, as our subsidiary, and its responsibilities as Calculation Agent.

What is ML&Co.?

Merrill Lynch & Co., Inc. is a holding company with various subsidiaries and affiliated companies that provide investment, financing, insurance and related services on a global basis.

For information about ML&Co., see the section entitled “Merrill Lynch & Co., Inc.” in the accompanying general prospectus supplement. You should also read other documents ML&Co. has filed with the Securities and Exchange Commission, which you can find by referring to the sections entitled “Where You Can Find More Information” and “Incorporation of Information We File with the SEC” in the accompanying general prospectus supplement and prospectus.

PS-6

Your investment in the Notes will involve risks. You should carefully consider the following discussion of risks and the discussion of risks included in the accompanying MTN prospectus supplement before deciding whether an investment in the Notes is suitable for you.

Your investment may result in a loss

ML&Co. will not repay you a fixed amount of principal on the Notes on the maturity date or Early Redemption Date, if applicable. The Redemption Amount will depend on the direction of and percentage change in the level of the Index. Because the level of the Index is subject to market fluctuations, the Redemption Amount you receive may be more or less than the principal amount per unit of the Notes and the original offering price per unit of the Notes. If the Ending Value is not greater than the Starting Value by an amount sufficient to offset the Fees, the Redemption Amount will be less than the original offering price per unit. If the Notes become subject to early redemption, you should expect to receive less than the principal amount of your Notes on the Early Redemption Date.

Your yield may be lower than the yield on other debt securities of comparable maturity

The yield that you will receive on your Notes, which could be negative, may be less than the return you could earn on other investments. Your yield may be less than the yield you would earn if you bought a traditional interest bearing debt security of ML&Co. with the same stated maturity date. Your investment may not reflect the full opportunity cost to you when you take into account factors that affect the time value of money. Unlike traditional interest bearing debt securities, the Notes do not guarantee the return of a principal amount on the maturity date.

In seeking to provide investors with what we believe to be commercially reasonable terms for the Notes while providing MLPF&S with compensation for its services, we have considered the costs of developing, hedging and distributing the Notes. If a trading market develops for the Notes (and such a market may not develop), these costs are expected to affect the market price you may receive or be quoted for your Notes on a date prior to the stated maturity date

The Notes will not be listed on any securities exchange and we do not expect a trading market for the Notes to develop. Although MLPF&S, our affiliate, has indicated that it currently expects to bid for Notes offered for sale to it by holders of the Notes, it is not required to do so and may cease making those bids at any time. The limited trading market for your Notes may affect the price that you receive for your Notes if you do not wish to hold your investment until the maturity date.

In determining the economic terms of the Notes, and consequently the potential return on the Notes to you, a number of factors are taken into account. Among these factors are certain costs associated with creating, hedging and offering the Notes. In structuring the economic terms of the Notes, we seek to provide investors with what we believe to be commercially reasonable terms and to provide MLPF&S with compensation for its services in developing the securities. If MLPF&S makes a market in the Notes, the price it quotes would reflect any changes in market conditions and other relevant factors. In addition, the price, if any, at which you could sell your Notes in a secondary market transaction is expected to be affected by the factors that we considered in setting the economic terms of the Notes, namely the underwriting discount paid in respect of the Notes and other costs associated with the Notes, including compensation for developing and hedging the product. This quoted price could be higher or lower than the principal amount. Furthermore, there is no assurance that MLPF&S or any other party will be willing to buy the Notes. MLPF&S is not obligated to make a market in the Notes.

Assuming there is no change in the level of the Index and no change in market conditions or any other relevant factors, the price, if any, at which MLPF&S or another purchaser might be willing to purchase your Notes in a secondary market transaction may be lower than the original issue price. This is due to, among other things, the fact that the original issue price included, and secondary market prices are likely to exclude, underwriting discount paid with respect to, and the developing and hedging costs associated with, the Notes.

PS-7

Ownership of the Notes does not entitle you to any rights with respect to any commodities, commodity futures or currency futures tracked by the Index

You will not own or have any beneficial or other legal interest in, and will not be entitled to any rights with respect to, any of the commodities, commodity futures or currency futures included in the Index. ML&Co. will not invest in any of the commodities, commodity futures or currency futures contracts included in the Index on behalf or for the benefit of the holders of the Notes.

The Notes are not regulated by the CFTC

Unlike an investment in the Notes, an investment in a collective investment vehicle that invests in futures contracts on behalf of its participants may be regulated as a commodity pool and its operator may be required to be registered with and regulated by the Commodity Futures Trading Commission (the “CFTC”) as a “commodity pool operator” (a “CPO”). Because the Notes are not interests in a commodity pool, the Notes will not be regulated by the CFTC as a commodity pool, ML&Co. will not be registered with the CFTC as a CPO and you will not benefit from the CFTC’s or any non-United States regulatory authority’s regulatory protections afforded to persons who trade in futures contracts or who invest in regulated commodity pools. The Notes do not constitute investments by you in futures contracts traded on regulated futures exchanges, which may only be transacted through a person registered with the CFTC as a “futures commission merchant” (“FCM”). ML&Co. is not registered with the CFTC as an FCM and you will not benefit from the CFTC’s or any other non-United States regulatory authority’s regulatory protections afforded to persons who trade in futures contracts on a regulated futures exchange through a registered FCM.

The Index is a rolling index

The Index is composed of futures contracts on physical commodities and currencies. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, commodity and currency futures contracts have a set expiration date and normally specify a certain date for delivery of the underlying physical commodities or currencies, as applicable. In the case of the Index, as the exchange-traded futures contracts that comprise the Index approach the month before expiration, they are replaced by contracts that have a later expiration. This process is referred to as “rolling”. If the market for these contracts is (putting aside other considerations) in “backwardation”, where the prices are lower in the distant delivery months than in the nearer delivery months, the sale of the nearer delivery month contract would take place at a price that is higher than the price of the distant delivery month contract, thereby creating a positive “roll yield”. There is no indication that these markets will consistently be in backwardation or that there will be roll yield in future performance. Instead, these markets may trade in “contango”. Contango markets are those in which the prices of contracts are higher in the distant delivery months than in the nearer delivery months. Certain of the commodities that may be included in the Index have historically traded in contango markets. Contango (or the absence of backwardation) in the commodity markets would result in negative “roll yields” which would adversely affect the value of the Index and the value of the Notes.

The Notes include the risk of concentrated positions in one or more commodity sectors

The exchange-traded physical commodities underlying the Commodity Index Components from time to time are heavily concentrated in a limited number of sectors, particularly energy and agriculture. An investment in the Notes may therefore carry risks similar to a concentrated securities investment in a limited number of industries or sectors.

Trading in the Index Components can be volatile based on a number of factors that we cannot control

Trading in the Index Components is speculative and can be extremely volatile. Market prices of the Index Components may fluctuate rapidly based on numerous factors, including: changes in supply and demand relationships; weather; agriculture; trade; fiscal, monetary, and exchange control programs; domestic and foreign political and economic events and policies; disease; technological developments; and changes in interest rates. These factors may affect the level of the Index and the value of the Notes in varying ways, and different factors may cause the value of the Index Components, and the volatilities of their prices, to move in inconsistent directions at inconsistent rates.

PS-8

Suspension or disruptions of market trading in the commodity and related futures markets may adversely affect the value of the Notes

The commodity markets are subject to disruptions due to various factors, including the lack of liquidity in the markets and government regulation and intervention. In addition, U.S. futures exchanges and some foreign exchanges have regulations that limit the amount of fluctuation in futures contract prices that may occur during a single business day. These limits are generally referred to as “daily price fluctuation limits” and the maximum or minimum price of a contract on any given day as a result of these limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may be made at a different price. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at disadvantageous times or prices. There can be no assurance that any such disruption or any other force majeure (such as an act of God, fire, flood, severe weather conditions, act of governmental authority, labor difficulty, etc.) will not have an adverse affect on the level of the Index or the manner in which it is calculated and therefore, the value of the Notes.

Standard & Poor’s, a Division of The McGraw-Hill Companies, Inc. may adjust the Index in a way that affects its level, and has no obligation to consider your interests

Standard & Poor’s, a division of The McGraw-Hill Companies, Inc. (“Standard & Poor’s” or “S&P”) is responsible for calculating and maintaining the Index. Standard & Poor’s can add, delete or substitute the commodities or currencies underlying the Index or make other methodological changes that could change the level of the Index. You should realize that the changing of the futures contracts included in the Index may affect the Index as a newly added futures contract may perform significantly better or worse than the futures contract or contracts it replaces. Additionally, Standard & Poor’s may alter, discontinue or suspend calculation or dissemination of the Index. Any of these actions could adversely affect the value of the Notes. Standard & Poor’s has no obligation to consider your interests in calculating or revising the Index. See “The Index.”

The return on your Notes depends on the values of the Financial Index Components, which are affected by many factors outside of our control

The value of any currency may be affected by complex political and economic factors. The exchange rate of each currency relating to a Financial Index Component is at any moment a result of the supply and demand for that currency relative to other currencies, and changes in the exchange rate result over time from the interaction of many factors directly or indirectly affecting economic and political conditions in the originating country of each currency, including economic and political developments in other countries. Of particular importance are the relative rates of inflation, interest rate levels, balance of payments and extent of governmental surpluses or deficits in those countries, all of which are in turn sensitive to the monetary, fiscal and trade policies pursued by the governments of those countries, and other countries important to international trade and finance.

Foreign exchange rates either can be fixed by governmental institutions or they may be floating. exchange rates of most economically developed nations and many developing nations are permitted to fluctuate in value relative to the United States dollar. However, governments sometimes do not allow their currencies to float freely in response to economic forces. Governments, including those issuing the currencies relating to the Financial Index Components, may use a variety of techniques, such as intervention by their central bank or imposition of regulatory controls or taxes, to affect the exchange rates of their respective currencies. They may also issue a new currency to replace an existing currency or alter the exchange rate or relative exchange characteristics by devaluation or revaluation of a currency. Thus, a special risk in purchasing the Notes is that their liquidity, trading value and amounts payable could be affected by the actions of sovereign governments which could change or interfere with theretofore freely determined currency valuation, fluctuations in response to other market forces and the movement of currencies across borders. There will be no adjustment or change in the terms of the Notes in the event that exchange rates should become fixed, or in the event of any devaluation or revaluation or imposition of exchange or other regulatory controls or taxes, or in the event of the issuance of a replacement currency or in the event of other developments affecting any of the currencies relating to the Financial Index Components specifically, or any other currency.

Even though currency trades around-the-clock, your Notes will not, and the prevailing market prices for your Notes may not reflect the underlying currency prices and rates

The interbank market in foreign currencies is a global, around-the-clock market. Therefore, the hours of trading for the Notes will not conform to the hours during which the currencies relating to the Financial Index Components are traded. Significant price and rate movements may take place in the underlying foreign exchange

PS-9

markets that will not be reflected immediately in the market price of the Notes. The possibility of these movements should be taken into account in relating the value of the Notes to those in the underlying foreign exchange markets.

There is no systematic reporting of last-sale information for foreign currencies. Reasonably current bid and offer information is available in certain brokers’ offices, in bank foreign currency trading offices and to others who wish to subscribe for this information, but this information will not necessarily be reflected in the value of the Basket used to calculate the Redemption Amount. There is no regulatory requirement that those quotations be firm or revised on a timely basis. The absence of last-sale information and the limited availability of quotations to individual investors may make it difficult for many investors to obtain timely, accurate data about the state of the underlying foreign exchange markets.

Many factors affect the trading value of the Notes; these factors interrelate in complex ways and the effect of any one factor may offset or magnify the effect of another factor

The trading value of the Notes will be affected by factors that interrelate in complex ways. The effect of one factor may offset the increase in the trading value of the Notes caused by another factor and the effect of one factor may exacerbate the decrease in the trading value of the Notes caused by another factor. The following paragraphs describe the expected impact on the trading value of the Notes given a change in a specific factor, assuming all other conditions remain constant.

The level of the Index is expected to affect the trading value of the Notes. We expect that the trading value of the Notes will depend substantially on the amount, if any, by which the level of the Index increases from the Starting Value to the Ending Value.

Changes in the volatility of the Index are expected to affect the trading value of the Notes. Volatility is the term used to describe the size and frequency of price and/or market fluctuations. If the volatility of the Index increases or decreases, the trading value of the Notes may be adversely affected.

Changes in levels of interest rates are expected to affect the trading value of the Notes. We expect that changes in interest rates will affect the trading value of the Notes. If interest rates increase or decrease in markets based on any currency relating to a Financial Index Component, the trading value of the Notes may be adversely affected. Interest rates may also affect the economies of the countries issuing the currencies underlying the Financial Index Components and, in turn, the respective exchange rates, which may affect the value of the Index and therefore, the trading value of the Notes.

As the time remaining to the stated maturity date of the Notes decreases, the “time premium” associated with the Notes is expected to decrease. We anticipate that before their stated maturity date, the Notes may trade at a value above that which would be expected based on the level of interest rates and the level of the Index. This difference will reflect a “time premium” due to expectations concerning the level of the Index during the period before the maturity date of the Notes. However, as the time remaining to the maturity date of the Notes decreases, we expect that this time premium will decrease, lowering the trading value of the Notes.

Changes in our credit ratings may affect the trading value of the Notes. Our credit ratings are an assessment of our ability to pay our obligations. Consequently, real or anticipated changes in our credit ratings may affect the trading value of the Notes. However, because the return on your Notes is dependent upon factors in addition to our ability to pay our obligations under the Notes, such as the average percentage increase, if any, in the level of the Index or a decrease in 3-Month LIBOR, an improvement in our credit ratings will not reduce the other investment risks related to the Notes.

In general, assuming all relevant factors are held constant, we expect that the effect on the trading value of the Notes of a given change in some of the factors listed above will be less if it occurs later in the term of the Notes than if it occurs earlier in the term of the Notes.

Purchases and sales by us and our affiliates may affect your return

We and our affiliates may from time to time buy or sell the currencies or commodities underlying the Index Components or futures or options contracts on the Index for our own accounts for business reasons and expect to enter into these transactions in connection with hedging our obligations under the Notes. These transactions could

PS-10

affect the price of these currencies and commodities and, in turn, the level of the Index in a manner that would be adverse to your investment in the Notes.

Potential conflicts of interest could arise

Our subsidiary Merrill Lynch International is our agent for the purposes of calculating the Final Return, Index Return, Fees and Redemption Amount. Under certain circumstances, Merrill Lynch International as our subsidiary and its responsibilities as Calculation Agent for the Notes could give rise to conflicts of interests. These conflicts could occur, for instance, in connection with its determination as to whether a level of the Index can be calculated on a particular trading day, or in connection with judgments that it would be required to make in the event of a discontinuance or unavailability of the Index. See the section entitled “Description of the Notes—Payment at Maturity, “ —Adjustments to the Index” and “—Discontinuance of the Index” in this pricing supplement. Merrill Lynch International is required to carry out its duties as Calculation Agent in good faith and using its reasonable judgment. However, because we control Merrill Lynch International, potential conflicts of interest could arise.

We expect to enter into arrangements to hedge the market risks associated with our obligation to pay interest on the Notes. We may seek competitive terms in entering into the hedging arrangements for the Notes, but are not required to do so, and we may enter into such hedging arrangements with one of our subsidiaries or affiliated companies. Such hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, but which could also result in a loss for the hedging counterparty.

ML&Co. does not make any representation to any purchasers of the Notes regarding any matters whatsoever relating to the currencies or commodities underlying the Index Components. Any prospective purchaser of the Notes should undertake an independent investigation of the Index and Index Components as in its judgment is appropriate to make an informed decision regarding an investment in the Notes. The composition of the Index does not reflect any investment recommendations of ML&Co. or its affiliates.

Amounts payable on the Notes may be limited by state law

New York State law governs the 1983 Indenture under which the Notes will be issued. New York has usury laws that limit the amount of interest that can be charged and paid on loans, which includes debt securities like the Notes. Under present New York law, the maximum rate of interest is 25% per annum on a simple interest basis. This limit may not apply to debt securities in which $2,500,000 or more has been invested.

While we believe that New York law would be given effect by a state or federal court sitting outside of New York, many other states also have laws that regulate the amount of interest that may be charged to and paid by a borrower. We will promise, for the benefit of the holders of the Notes, to the extent permitted by law, not to voluntarily claim the benefits of any laws concerning usurious rates of interest.

Uncertain tax consequences

You should consider the tax consequences of investing in the Notes, aspects of which are uncertain. See “United States Federal Income Taxation” in this pricing supplement.

PS-11

ML&Co. will issue the Notes as part of a series of senior debt securities entitled “Medium-Term Notes, Series C,” which is more fully described in the MTN prospectus supplement, under the 1983 Indenture, which is more fully described in the accompanying general prospectus supplement. The Bank of New York has succeeded JPMorgan Chase Bank, N.A. as trustee under such indenture. The Notes will mature on June , 2009. Information included in this pricing supplement supersedes information in the accompanying MTN prospectus supplement, general prospectus supplement and prospectus to the extent that it is different from that information. The CUSIP number for the Notes is .

The Notes may be subject to early redemption as described below, but are not otherwise subject to redemption by us at our option or by any holder at its option prior to the maturity date.

ML&Co. will issue the Notes in denominations of $100,000 and integral multiples of $10,000 in excess thereof. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the Notes in the form of a global certificate, which will be held by The Depository Trust Company, also known as DTC, or its nominee. Direct and indirect participants in DTC will record your ownership of the Notes. You should refer to the section entitled “Description of Debt Securities—Depositary” in the accompanying general prospectus supplement.

The Notes will not have the benefit of any sinking fund and there is no principal protection on the Notes.

Payment on the Maturity Date

On the maturity date, you will be entitled to receive a cash payment per unit equal to the Redemption Amount per unit, as provided below.

Determination of the Redemption Amount

The “Redemption Amount” per $10,000 principal amount of Notes, denominated and payable in U.S. dollars, will be determined by the Calculation Agent and will equal the $10,000 principal amount of Notes per unit multiplied by the greater of:

| (i) | 0; and |

| (ii) |

[

|

100% + |

(

|

300% × Final Return | )

|

].

|

||||||||

The “Final Return” will equal:

Index Return – Fees

The “Index Return” will equal:

| (

|

Ending Value | )

|

– 1 | |||||||

| Starting Value |

The “Starting Value” will equal the closing level of the S&P Diversified Trends Indicator Price Return Index (the “Index”) on the date the Notes are priced for initial sale to the public (the “Pricing Date”).

The “Ending Value” will equal the closing level of the Index on the Valuation Date (as defined below), provided that if a Market Disruption Event (as defined below) occurs on that date, then the Ending Value will equal the closing level of the Index determined on the next scheduled Index Business Day (or, if not determinable, estimated by the Calculation Agent in a manner which is considered commercially reasonable under the circumstances).

The “Valuation Date” will be the eighth scheduled Index Business Day prior to the maturity date.

PS-12

The “Fees” will equal:

| 1.6% × |

(

|

D | )

|

,

|

||||||||

| 365 |

where “D” equals the number of days from and including the Pricing Date to and including the Valuation Date.

Payments of Interest on Interest Payment Dates

Unless earlier redeemed, we will pay interest on the Notes in cash quarterly in arrears on September , 2008, December , 2008, March , 2009 and on the maturity date (the “Interest Payment Dates”). The Notes will accrue interest at a rate equal to the Interest Payment Rate (as defined below) from and including June , 2008, or from and including the most recent Interest Payment Date to which interest has been paid, to but excluding the next succeeding Interest Payment Date, the stated maturity date or Early Redemption Date, as the case may be (each, an “Interest Payment Period”); provided, however, that if an Interest Payment Date falls on a day that is not a Banking Business Day, other than the Interest Payment Date that is also the stated maturity date or Early Redemption Date, that Interest Payment Date will be postponed to the next Banking Business Day except that if such next Banking Business Day is in a different month, then that Interest Payment Date will be the immediately preceding day that is a Banking Business Day.

We will pay interest to the persons in whose names the Notes are registered at the close of business on the immediately preceding September , December , March , and June , respectively, whether or not a Business Day, except with respect to the final payment of interest on the maturity date, which will be paid to holders to whom the Redemption Amount is payable. Interest on the Notes will be computed on the basis of a 360-day year consisting of twelve 30-day months. Interest will accrue quarterly on the Notes, at a rate equal to:

| (3-Month LIBOR – 0.12%) |

× |

(

|

Days | )

|

; | |||||||||||

| 360 |

where “Days” equals the number of calendar days during such Interest Payment Period (the “Interest Payment Rate”). The determination of the Interest Payment Rate applicable to any Interest Payment Period will be made on the second London Banking Day immediately preceding the first day of the applicable Interest Payment Period (the “LIBOR Determination Date”).

If the maturity date or Early Redemption Date falls on a day that is not a Business Day, we will make the required payment of principal and interest on the next succeeding Business Day, and no additional interest on such payment will accrue for the period from and after the maturity date.

“Business Day” means any day on which the New York Stock Exchange (the “NYSE”) is open for trading and that is also a London Banking Day.

“Banking Business Day” means any day, other than a Saturday or Sunday, that is neither a legal holiday nor a day on which commercial banks are authorized or required by law, regulation or executive order to close in The City of New York and that is also a London Banking Day.

“Index Business Day” means any day on which the NYSE is open for trading which is also a London Banking Day, and on which the Index or any successor index is calculated and published.

“London Banking Day” means a day on which commercial banks are open for business, including dealings in U.S. dollars, in London.

“Market Disruption Event” means either of the following events as determined by the Calculation Agent:

| (A) | the suspension of or material limitation on trading, in each case, for more than two hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange or exchanges on which the Index Components trade as determined by the Calculation Agent (without taking into account any extended or after-hours trading session), in 20% or more of the Index Components which then comprise the Index or any successor index; or |

PS-13

| (B) | the suspension of or material limitation on trading, in each case, for more than two hours of trading, or during the one-half hour period preceding the close of trading, on the primary exchange or exchanges that trade options contracts or futures contracts related to the Index Components as determined by the Calculation Agent (without taking into account any extended or after-hours trading session), whether by reason of movements in price otherwise exceeding levels permitted by the relevant exchange or otherwise, in option contracts or futures contracts related to the Index, or any successor index. |

For the purpose of determining whether a Market Disruption Event has occurred:

| (1) | a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular business hours of the relevant exchange; |

| (2) | a decision to permanently discontinue trading in the relevant futures or options contracts related to the Index, or any successor index, will not constitute a Market Disruption Event; |

| (3) | a suspension in trading in a futures or options contract on the Index, or any successor index, by a major securities market by reason of (a) a price change violating limits set by that securities market, (b) an imbalance of orders relating to those contracts or (c) a disparity in bid and ask quotes relating to those contracts will constitute a suspension of or material limitation on trading in futures or options contracts related to the Index; |

| (4) | a suspension of or material limitation on trading on the relevant exchange will not include any time when that exchange is closed for trading under ordinary circumstances; and |

| (5) | for the purpose of clauses (A) and (B) above, any limitations on trading during significant market fluctuations under NYSE Rule 80B, or any applicable rule or regulation enacted or promulgated by the NYSE or any other self regulatory organization or the Securities and Exchange Commission of similar scope as determined by the Calculation Agent, will be considered “material”. |

All determinations made by the Calculation Agent, absent a determination of manifest error, will be conclusive for all purposes and binding on ML&Co. and the holders and beneficial owners of the Notes.

PS-14

Hypothetical Returns

The following table illustrates, for a hypothetical Starting Value of 1,371.49 (the closing level of the Index on May 27, 2008) and a range of hypothetical Ending Values of the Index:

| • | the percentage change from the hypothetical Starting Value to the hypothetical Ending Value; |

| • | the total amount payable on the maturity date per unit; |

| • | the total rate of return to holders of the Notes, which includes interest payments on the Notes at an assumed Interest Payment Rate of 2.25875% per annum, as more fully described below; |

| • | the pretax annualized rate of return to holders of the Notes; and |

| • | the pretax annualized rate of return of an investment in the Index Components. |

| Hypothetical Ending Value |

Percentage change from the hypothetical Starting Value to the hypothetical Ending Value |

Total amount payable on the maturity date per unit |

Interest Payments (3) |

Total rate of return on the Notes (including interest)(1)(3) |

Pretax annualized rate of return on the Notes(1)(3) |

Pretax annualized rate of return of the Index Components(1)(2) | ||||||

| 1,234.34 | –10% | $6,520.00 | $226.35 | –32.54% | –31.41% | –10% | ||||||

| 1,261.77 | –8% | $7,120.00 | $226.35 | –26.54% | –25.58% | –8% | ||||||

| 1,289.20 | –6% | $7,720.00 | $226.35 | –20.54% | –19.77% | –6% | ||||||

| 1,316.63 | –4% | $8,320.00 | $226.35 | –14.54% | –13.97% | –4% | ||||||

| 1,344.06 | –2% | $8,920.00 | $226.35 | –8.54% | –8.19% | –2% | ||||||

| 1,371.49(4) | 0% | $9,520.00 | $226.35 | –2.54% | –2.43% | 0% | ||||||

| 1,398.92 | 2% | $10,120.00 | $226.35 | 3.46% | 3.32% | 2% | ||||||

| 1,426.35 | 4% | $10,720.00 | $226.35 | 9.46% | 9.05% | 4% | ||||||

| 1,453.78 | 6% | $11,320.00 | $226.35 | 15.46% | 14.77% | 6% | ||||||

| 1,481.21 | 8% | $11,920.00 | $226.35 | 21.46% | 20.48% | 8% | ||||||

| 1,508.64 | 10% | $12,520.00 | $226.35 | 27.46% | 26.17% | 10% | ||||||

| 1,645.79 | 20% | $15,520.00 | $226.35 | 57.46% | 54.49% | 20% | ||||||

| 1,782.94 | 30% | $18,520.00 | $226.35 | 87.46% | 82.58% | 30% | ||||||

| 1,920.09 | 40% | $21,520.00 | $226.35 | 117.46% | 110.48% | 40% |

| (1) | The annualized rates of return specified in this column are calculated on an annual bond equivalent basis and assume an investment term from June 13, 2008 to June 29, 2009, a term expected to be approximately equal to that of the Notes. |

| (2) | This rate of return assumes: |

| (a) | a percentage change in the aggregate price of the Index Components that equals the percentage change in the Index from the hypothetical Starting Value to the relevant hypothetical Ending Value; and |

| (b) | no transaction fees or expenses. |

| (3) | This assumes the Interest Payment Rate at each Interest Payment Date is the current 3-Month LIBOR rate of 2.37875% minus 0.12%, or 2.25875%, and that the Notes were held until June 29, 2009. |

| (4) | This is the hypothetical Starting Value. The actual Starting Value will be determined on the Pricing Date and will be set forth in the final pricing supplement made available in connection with sales of the Notes. |

The above figures are for purposes of illustration only. The actual amount received by you and the resulting total and pretax annualized rates of return will depend on the actual Starting Value, Ending Value, the actual 3-Month LIBOR rate at each Interest Payment Date and the term of your investment.

PS-15

Determination of 3-Month LIBOR

Each 3-Month London Inter-Bank Offer Rate (“3-Month LIBOR”) used to calculate the Interest Payment Rate shall be determined as of the relevant calendar day as follows:

| • | the rate (expressed as a percentage per annum) for deposits in U.S. dollars for a three month period, that appears on Bloomberg Page “US0003M <Index>“ in the Bloomberg Professional Service (or any other page that may replace page “US0003M<Index>” on the Bloomberg Professional Service or a successor service, in each case, for the purpose of displaying London interbank offered rates of major banks), as of 11:00 A.M., London time, on the second London Banking Day immediately preceding the first day of such Interest Payment Period; |

| • | if the three-month U.S. dollar LIBOR with respect to an applicable Interest Payment Period cannot be determined as described above, we will select four major banks in the London interbank market. We will request that the principal London offices of those four selected banks provide their offered quotations to prime banks in the London interbank market at approximately 11:00 a.m., London time, on the second London Banking Day immediately preceding the first day of such Interest Payment Period. These quotations will be for deposits in U.S. dollars for a three-month period. Offered quotations must be based on a principal amount equal to an amount that is representative of a single transaction in U.S. dollars in the market at the time; |

| • | if two or more quotations are provided, three-month U.S. dollar LIBOR for the Interest Payment Period will be the arithmetic mean of the quotations. If fewer than two quotations are provided, we will select three major banks in New York City and will then determine three-month U.S. dollar LIBOR for the Interest Payment Period as the arithmetic mean of rates quoted by those three major banks in New York City to leading European banks at approximately 3:00 p.m., New York City time, on the second London Banking Day immediately preceding the first day of such Interest Payment Period. The rates quoted will be for loans in U.S. dollars, for a three-month period. Rates quoted must be based on a principal amount equal to an amount that is representative of a single transaction in U.S. dollars in the market at the time; and |

| • | if fewer than three New York City banks selected by us are quoting rates, three-month U.S. dollar LIBOR for the applicable period will be the same as for the immediately preceding Interest Payment Period. |

Adjustments to the Index

If at any time Standard & Poor’s makes a material change in the formula for or the method of calculating the Index or in any other way materially modifies the Index so that the Index does not, in the opinion of the Calculation Agent, fairly represent the level of the Index had those changes or modifications not been made, then, from and after that time, the Calculation Agent will, at the close of business in New York, New York, on each date that the closing level of the Index is to be calculated, make any adjustments as, in the good faith judgment of the Calculation Agent, may be necessary in order to arrive at a calculation of a level of an index comparable to the Index as if those changes or modifications had not been made, and calculate the closing level with reference to the Index, as so adjusted. Accordingly, if the method of calculating the Index is modified so that the level of the Index is a fraction or a multiple of what it would have been if it had not been modified, e.g., due to a split, then the Calculation Agent will adjust the Index in order to arrive at a level of the Index as if it had not been modified, e.g., as if a split had not occurred.

Discontinuance of the Index

If Standard & Poor’s discontinues publication of the Index and Standard & Poor’s or another entity publishes a successor or substitute index that the Calculation Agent determines, in its sole discretion, to be comparable to the Index (a “successor index”), then, upon the Calculation Agent’s notification of that determination to the Trustee and ML&Co., the Calculation Agent will substitute the successor index as calculated by Standard & Poor’s or any other entity for the Index. Upon any selection by the Calculation Agent of a successor index, ML&Co. will cause notice to be given to holders of the Notes.

PS-16

In the event that Standard & Poor’s discontinues publication of the Index and:

| • | the Calculation Agent does not select a successor index; or |

| • | the successor index is not published on any Business Day, |

the Calculation Agent will compute a substitute level for the Index in accordance with the procedures last used to calculate the Index before any discontinuance. If a successor index is selected or the Calculation Agent calculates a level as a substitute for the Index as described below, the successor index or level will be used as a substitute for the Index for all purposes.

If Standard & Poor’s discontinues publication of the Index and the Calculation Agent determines that no successor index is available at that time, then on each Business Day until the earlier to occur of:

| • | the maturity date or Early Redemption Date, as applicable; and |

| • | a determination by the Calculation Agent that a successor index is available, |

the Calculation Agent will determine the value that would be used in computing the interest payable on the Notes as described in the preceding paragraph as if that day were a Business Day. The Calculation Agent will cause notice of each value to be published not less often than once each month in The Wall Street Journal or another newspaper of general circulation and arrange for information with respect to these values to be made available by telephone.

Notwithstanding these alternative arrangements, discontinuance of the publication of the Index may adversely affect trading in the Notes.

Early Redemption

If on any date from and including June , 2008, the expected settlement date and to but excluding the Valuation Date, the closing level of the Index is equal to or less than 85% of the Starting Value of the Index on any Index Business Day (as such, an “Early Redemption Date”) (an “Early Redemption Event”), then the Notes will be redeemed by ML&Co. If an Early Redemption Event occurs, then ML&Co. will pay holders of Notes the Redemption Amount per unit, plus any accrued and unpaid interest on the Notes, provided, however, that the Valuation Date will be accelerated to the Index Business Day immediately following such Early Redemption Date (the “Early Redemption Valuation Date”) and the maturity date will be accelerated to the fifth scheduled Index Business Day following the Early Redemption Valuation Date. In the event of Early Redemption Event, the Redemption Amount payable on the Notes shall be calculated as if such Early Redemption Valuation Date was the Valuation Date.

Events of Default and Acceleration

In case an Event of Default with respect to any Notes has occurred and is continuing, the amount payable to a holder of a Note upon any acceleration permitted by the Notes, with respect to each $10,000 original public offering price per unit, will be equal to the Redemption Amount per unit, calculated as though the date of acceleration were the stated maturity date of the Notes.

In case of default in payment of the Notes, whether on the stated maturity date or upon acceleration, from and after that date the Notes will bear interest, payable upon demand of their holders, at the then current Federal Funds Rate, reset daily, as determined by reference to Reuters page FEDFUNDS1 under the heading “EFFECT”, to the extent that payment of such interest shall be legally enforceable, on the unpaid amount due and payable on that date in accordance with the terms of the Notes to the date payment of that amount has been made or duly provided for. “Reuters page FEDFUNDS1” means such page or any successor page, or page on a successor service, displaying such rate. If the Federal Funds Rate cannot be determined by reference to Reuters page FEDFUNDS1, such rate will be determined in accordance with the procedures set forth in the accompanying MTN prospectus supplement relating to the determination of the Federal Funds Rate in the event of the unavailability of Moneyline Telerate page 120.

PS-17

All disclosure contained in this pricing supplement regarding the Index, including, without limitation, its make-up, method of calculation and changes in its components has been derived from publicly available sources. The information reflects the policies of Standard and Poor’s as stated in these sources and these policies are subject to change at the discretion of Standard and Poor’s. ML&Co. and MLPF&S have not independently verified the accuracy or completeness of that information.

General

The Index follows a quantitative methodology to track prices of a diversified portfolio of commodities and other indicated underlyings, as reflected in the prices of certain futures contracts, representing a mixture of commodity futures contracts (the “Commodity Index Components”) and financial futures contracts (the “Financial Index Components” and, together with the Commodity Index Components, the “Index Components”). The Index Components are grouped into sectors and each sector is represented on either a “long” or “short” basis, depending on recent price trends of that particular sector. As such, the Index is designed to capture the economic benefit over long time periods derived from both rising and declining trends within a cross-section of futures markets. The Commodity Index Components and the Financial Index Components each compose 50% of the Index.

The Index includes 24 Index Components, divided by weight as listed below and grouped into 14 sectors. The sectors are divided such that there are eight Financial Index Components sectors and six Commodity Index Components sectors. The sectors are rebalanced monthly and the Index Components are rebalanced annually.

The following table lists the futures contracts, exchanges and ticker symbols of each of the Index Components currently included in the Index:

| Futures Contract | Exchange | Symbol | ||

| Wheat |

CBOT | W | ||

| Cotton |

NYBOT | CT | ||

| Corn |

CBOT | C | ||

| Copper |

NYMEX | HG | ||

| Soybeans |

CBOT | S | ||

| Cocoa |

NYBOT | CC | ||

| Sugar |

NYBOT | SB | ||

| Silver |

NYMEX | SI | ||

| Live Cattle |

CME | LC | ||

| Lean Hogs |

CME | LH | ||

| Coffee |

NYBOT | KC | ||

| British Pound |

CME | BP | ||

| Swiss Franc |

CME | SF | ||

| Gold |

NYMEX | GC | ||

| Canadian Dollar |

CME | CD | ||

| Japanese Yen |

CME | JY | ||

| US Treasury Bond |

CBOT | US | ||

| Heating Oil |

NYMEX | HO | ||

| US 10-Year Treasury Note |

CBOT | TY | ||

| Light Crude Oil |

NYMEX | CL | ||

| Unleaded Gasoline |

NYMEX | HU | ||

| Australian Dollar |

CME | AD | ||

| Natural Gas |

NYMEX | NG | ||

| European Union Euro |

CME | EC | ||

| CBOT: Chicago Board of Trade CME: Chicago Mercantile Exchange NYMEX: New York Mercantile Exchange NYBOT: New York Board of Trade |

||||

PS-18

Initial Weightings

The current Index Components and weightings are as follows:

| Market |

Market Weight |

Sector |

Sector Weight |

Component |

Component Weight | |||||

| Commodities |

50.00% | Energy | 18.75% | Heating Oil | 3.00% | |||||

| Light Crude | 8.50% | |||||||||

| Natural Gas | 4.25% | |||||||||

| Unleaded Gasoline | 3.00% | |||||||||

| Industrial Metals |

5.00% | Copper | 5.00% | |||||||

| Precious Metals |

5.25% | Gold | 3.50% | |||||||

| Silver | 1.75% | |||||||||

| Livestock |

5.00% | Lean Hogs | 2.00% | |||||||

| Live Cattle | 3.00% | |||||||||

| Grains |

11.50% | Corn | 4.00% | |||||||

| Soybeans | 5.00% | |||||||||

| Wheat | 2.50% | |||||||||

| Softs |

4.50% | Cocoa | 1.00% | |||||||

| Coffee | 1.50% | |||||||||

| Cotton | 1.00% | |||||||||

| Sugar | 1.00% | |||||||||

| Financials |

50.00% | Australian Dollar | 2.00% | Australian Dollar | 2.00% | |||||

| British Pound |

5.00% | British Pound | 5.00% | |||||||

| Canadian Dollar |

1.00% | Canadian Dollar | 1.00% | |||||||

| European Union Euro |

13.00% | Euro | 13.00% | |||||||

| Japanese Yen |

12.00% | Japanese Yen | 12.00% | |||||||

| Swiss Franc |

2.00% | Swiss Franc | 2.00% | |||||||

| U.S. Treasury Bonds |

7.50% | U.S. Treasury Bonds | 7.50% | |||||||

| U.S. Treasury Notes |

7.50% | U.S. Treasury Notes | 7.50% | |||||||

The weightings of the various Index Components are determined on the basis of several factors, including:

| • | Global production; |

| • | Gross domestic product (“GDP”) of certain relevant countries; and |

| • | The goal of maintaining an equal weighting between Financial Index Components and Commodity Index Components |

Commodity Weightings

For commodities, production is an indication of the significance of a given component to the world economy and of such component’s significance within the futures markets themselves.1 Since there is often no single recognized source for a commodity’s production figures, estimates are used in selecting and making

| 1 | In the case of the Natural Gas component included in the Energy sector, North American rather than world production has been used as the relevant factor due to constraints linked to transporting natural gas internationally. |

PS-19

allocations. GDP is an indication of economic significance of certain Index Components and is used in selecting and making allocations to financials.2 Commodity weights are based on generally known world production levels. A reasonability test is used to compare weights with established commodity-specific indices, such as the Goldman Sachs Commodity Index and Dow Jones-AIG Commodity Index.

Financial Weightings

Weightings of the financial sectors are based on, but not directly proportional to, GDP. Instead, there is a three tier system and each financial sector’s “tier” is based on relevant economic data for the particular country. The countries with a GDP of greater than $3 trillion are placed into tier 1 and countries with a GDP of less than $3 trillion are placed in tier 2. The financial sectors in tier 1 are meant to be close in weight, with slight relative tilts towards those from the larger economies. The financial sectors in tier 2 are weighted approximately proportionate to each other, but some adjustments have been made for liquidity, trading significance, and potential correlation to tier 1 markets. For example, the Canadian Dollar component receives a 1% weighting due in part to Canada’s historical economic connection with the U.S.

Gross Domestic Product, 2004

| Related Sector Weight |

Region | GDP (USD Trillion) | ||

| 15% |

United States | $11.67 | ||

| 13% |

European Union | $9.37 | ||

| 12% |

Japan | $4.62 | ||

| 5% |

United Kingdom | $2.14 | ||

| 1% |

Canada | $0.98 | ||

| 2% |

Australia | $0.63 | ||

| 2% |

Switzerland | $0.36 |

Source of GDP: World Development Indicators Database, World Bank, March 2006

Methodology and Maintenance

The methodology of the Index is designed with a focus on capturing both up and down price trends, while at the same time moderating the volatility of the Index. Index Components are chosen based on fundamental characteristics and liquidity (necessary for an investable model), as opposed to a means for achieving performance per se. Investability is another important consideration in the choosing of Index Components. Contracts are limited to those traded on U.S. exchanges in order to minimize any impact from major differences in trading hours, avoid currency exchange calculations, and allow for similar closing times and holiday schedules.

Rebalancing

Monthly Rebalancing for Sector Weights

The sectors are rebalanced monthly to maintain their fixed weights. The rebalance decision date is the second to the last business day of the month with an effective date randomly selected from any of the first five business days of the next month.

An extended move in one group or sector would overweight the Index and potentially lead to significantly higher volatility of the Index. Rebalancing monthly aims to keep the volatility low. Because the sectors are rebalanced, every month the aggregate Index Components are rebalanced to equal weighting (e.g., 50% Commodity Index Components/50% Financial Index Components). An exception to this is when the energy sector has a neutral position. The rebalance decision determines whether a future position in any Index Component is long or short in the Index. The energy sector is never in a short position in the Index methodology.

| 2 | The Swiss Franc is an exception: this currency is allocated a weighting slightly disproportionate to the Swiss GDP due to the Swiss franc’s liquidity and Switzerland’s political significance. |

PS-20

Annual Rebalancing for Index Component Weights

Each of the 24 Index Components is rebalanced annually to reflect the then current commodity or financial market conditions, as applicable. Historically, the Index Component weights have not varied significantly from year to year.

Position Determination

The rule for the Index regarding long or short positions can be summarized as follows:

| • | Long positions are tracked when an Index Component’s current price input is equal to or greater than an exponential average of the past seven price inputs; |

| • | Short positions are tracked when an Index Component’s current price input is less than an exponential average of the past seven price inputs; |

| • | Track a flat (zero weight) position for the energy sector when a short position is indicated; in this case, the 18.75% weight for energy is distributed proportionately to the other 13 sectors. |

Position is determined on the second to the last business day of the month (the “position determination date” or “PDD”) when the monthly percentage change of a sector’s price is compared to past monthly price changes exponentially weighted to greatest weight to the most recent return and least weight to the return seven months prior. The weighted sum of the percentage changes of all the sector prices equals the daily movement of the Index.

After the market closes on the trade activity date (“TAD”), active Index Components are replaced either because a new long/short signal has been generated for a particular sector or component, or in order to roll into a future dated contract as required by the roll schedule, or both. Therefore, new contracts become active as of the day following the TAD. The TAD is randomly selected and is one of the first five business days of each month. S&P acknowledges that limit3 closes which occur on the TAD in active Index Components can restrict, and in some cases eliminate, the liquidity required for perfect replication of the Index.

Sectors versus Components

Price input calculations are used to determine the relative long/short positions of the sectors. For those sectors with only one Index Component (industrial metals and the eight financial sectors), the price input calculations to determine long/short position are at the Index Component level. For the energy, precious metals, livestock, and grain sectors, the price inputs from the respective underlying Index Components are aggregated to determine the long/short position for that sector as a whole. An exception exists in the calculations of the softs sector. For that sector, since there is no fundamental tie between each of its underlying Index Components (coffee, cocoa, cotton and sugar), the long/short positions of each Index Component are determined separately, rather than in the aggregate, such that the soft sector Index Components could have different long/short positions concurrently.

Contract Maintenance

The Index is an indicator of futures contract price trends and futures contracts have limited durations. Consequently, in order for the Index to be calculated on an ongoing basis, it must change (or roll) from tracking contracts that are approaching expiration to tracking new contracts. Currently, each contract has three to four roll periods each year and its own “roll pattern” based on historical liquidity. The following rules are observed in rolling the Index futures contractors from an expiring contract to the next contract:

| • | The commodity contracts are rolled over from the current contract to the next contract beginning with the TAD for the month that is two months before the current contract matures. |

| 3 | A “limit” is a contract’s maximum price advance or decline from the previous day’s settlement price permitted in one trading session, as determined by the relevant exchange. |

PS-21

| • | The contracts are rolled over from the current contract to the next maturing futures contract four times per year as of the TAD for the month prior to the contract’s final maturity month. |

The risk of aberrational liquidity or pricing around the maturity date of a commodity futures contract is greater than in the case of other futures contracts because (among other factors) a number of market participants take delivery of the underlying commodities.

S&P Diversified Trends Indicator Oversight Committee

In order to provide for the smooth functioning of the Index, the S&P Diversified Trends Indicator Oversight Committee (the “Oversight Committee”) oversees the Index and makes decisions that cannot be systematized or that occur on an ad hoc basis, with the goal of maintaining liquidity and low volatility in the Index. The Oversight Committee implements the methodology of the Index or determines new policies if market conditions warrant change. For example, an exchange might substantially change the contract terms or even discontinue trading a component contract. In such cases, the Oversight Committee would determine any component or weighting changes. The Oversight Committee does not, however, have the power to use discretion to affect performance of the Index.

PS-22

Historical data on the Index

The following table sets forth the closing levels of the Index at the end of each month in the period from January 2004 through April 2008. This historical data on the Index is not necessarily indicative of the future performance of the Index or what the value of the Notes may be. Any historical upward or downward trend in the level of the Index during any period set forth below is not an indication that the Index is more or less likely to increase or decrease at any time during the term of the Notes. The closing level of the Index on May 27, 2008 was 1,371.49.

| 2004 | 2005 | 2006 | 2007 | 2008 | ||||||

| January |

1,016.31 | 1,133.13 | 1,177.46 | 1,208.34 | 1,282.36 | |||||

| February |

1,052.58 | 1,104.58 | 1,156.17 | 1,203.15 | 1,347.16 | |||||

| March |

1,067.25 | 1,127.62 | 1,183.55 | 1,196.62 | 1,338.13 | |||||

| April |

1,043.79 | 1,088.13 | 1,218.97 | 1,204.18 | 1,342.64 | |||||

| May |

1,047.55 | 1,100.56 | 1,220.75 | 1,190.47 | ||||||

| June |

1,045.76 | 1,127.71 | 1,191.44 | 1,207.74 | ||||||

| July |

1,084.93 | 1,136.33 | 1,211.95 | 1,197.35 | ||||||

| August |

1,058.83 | 1,157.67 | 1,211.73 | 1,181.53 | ||||||

| September |

1,117.41 | 1,182.71 | 1,189.84 | 1,192.81 | ||||||