CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee(1) | ||||

| 100% Principal Protected Notes Linked to the Difference between the 30-Year and the 2-Year U.S. Dollar Constant Maturity Swap Rates, due May 29, 2019 |

30,245 | $1,000.00 | $30,245,000 | $1,687.67 |

(1) Calculated in accordance with Rule 457(r) of the Securities Act of 1933.

| Pricing Supplement No. 120 (To Prospectus dated April 20, 2009 and Series L Prospectus Supplement dated April 21, 2009) May 21, 2009 |

Filed Pursuant to Rule 424(b)(2) Registration No. 333-158663 |

$30,245,000

100% Principal Protected Notes Linked to the Difference between the 30-Year and the 2-Year U.S. Dollar Constant Maturity Swap Rates, due May 29, 2019

| • | The notes are senior debt securities issued by Bank of America Corporation. The notes are 100% principal protected on the maturity date or date of early redemption, as applicable. |

| • | The notes will be issued in denominations of whole units. Each unit will have a principal amount of $1,000. |

| • | The notes are designed for investors who wish to receive quarterly interest income, where, as described below, the amount of such interest depends on the amount by which the 30-year U.S. Dollar Constant Maturity Swap Rate exceeds the 2-year U.S. Dollar Constant Maturity Swap Rate as of the applicable interest determination date (as defined below), minus the “Strike” (as defined below). |

| • | Interest will be paid quarterly on February 29 (or, in a non-leap year, March 1), May 29, August 29 and November 29 of each year, beginning August 29, 2009. |

| • | During the first four quarterly interest periods, interest on the notes will accrue at the rate of 11.00% per annum. |

| • | During each subsequent quarterly interest period beginning on May 29, 2010, interest on the notes will accrue at a rate per annum equal to the product of (a) 10 and (b) the amount by which the 30-year U.S. Dollar Constant Maturity Swap Rate exceeds the 2-year U.S. Dollar Constant Maturity Swap Rate on the applicable interest determination date, each expressed as a percentage (such amount, which may be negative, the “Spread Differential”), minus the Strike. In no event will the interest payable on the notes in any interest period be less than 0.00% per annum. |

We further describe how to determine the interest payable on the notes beginning on page PS-13.

| • | The “Strike” is 0.80%. |

| • | At maturity, if the notes have not been previously redeemed, you will receive for each unit of your notes a cash payment equal to the $1,000 principal amount, plus any accrued but unpaid interest. |

| • | We may redeem all of the notes on any quarterly interest payment date on or after May 29, 2010 (an “Early Redemption Date”). If redeemed early, you will receive for each unit of your notes a cash payment equal to the $1,000 principal amount, plus any accrued but unpaid interest to but excluding the Early Redemption Date. |

| • | The notes will not be listed on any securities exchange. |

| • | Each of Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), its broker-dealer affiliate First Republic Securities Company, LLC (“First Republic”), and Banc of America Investment Services, Inc. (“BAI”) is acting as our selling agent. Each of MLPF&S and First Republic is acting in its capacity as principal, and BAI will use its best efforts to sell the notes. |

| • | The CUSIP number for the notes is 06048WAB6. |

| Per Note | Total | ||||

| Public offering price |

100.00 | % | $30,245,000 | ||

| Selling discount |

1.50 | % | $453,675 | ||

| Proceeds (before expenses) |

98.50 | % | $29,791,325 |

Our notes are unsecured and are not savings accounts, deposits, or other obligations of a bank. Our notes are not guaranteed by Bank of America, N.A. (“BANA”) or any other bank, are not insured by the Federal Deposit Insurance Corporation (the “FDIC”) or any other governmental agency and involve investment risks. The notes are not guaranteed under the FDIC’s Temporary Liquidity Guarantee Program. Potential purchasers of the notes should consider the information in “Risk Factors” beginning on page PS-8.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these notes or passed upon the adequacy or accuracy of this pricing supplement, the accompanying prospectus supplement, or the accompanying prospectus. Any representation to the contrary is a criminal offense.

We will deliver the notes in book-entry form only through The Depository Trust Company on or about May 29, 2009 against payment in immediately available funds.

| Merrill Lynch & Co. | Banc of America Investment Services, Inc. | |

| Selling Agents | ||

| Page | ||

| PS-3 | ||

| PS-8 | ||

| PS-12 | ||

| PS-13 | ||

| PS-16 | ||

| PS-19 | ||

| PS-20 | ||

| PS-26 | ||

PS-2

This summary includes questions and answers that highlight selected information from this pricing supplement and the accompanying prospectus supplement and prospectus to help you understand these notes. You should read carefully the entire pricing supplement, prospectus supplement, and prospectus to understand fully the terms of the notes, as well as the tax and other considerations important to you in making a decision about whether to invest in the notes. In particular, you should review carefully the section in this pricing supplement entitled “Risk Factors,” which highlights a number of risks, to determine whether an investment in the notes is appropriate for you. If information in this pricing supplement is inconsistent with the prospectus supplement or prospectus, this pricing supplement will supersede those documents.

Certain capitalized terms used and not defined in this pricing supplement have the meanings ascribed to them in the prospectus supplement and prospectus.

In light of the complexity of the transaction described in this pricing supplement, you are urged to consult with your own attorneys and business and tax advisors before making a decision to purchase any of the notes.

The information in this “Summary” section is qualified in its entirety by the more detailed explanation set forth elsewhere in this pricing supplement and the accompanying prospectus supplement and prospectus. You should rely only on the information contained in this pricing supplement and the accompanying prospectus supplement and prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor either of the selling agents is making an offer to sell these notes in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this pricing supplement, the accompanying prospectus supplement, and prospectus is accurate only as of the date on their respective front covers.

Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to Bank of America Corporation.

What are the notes?

The notes are senior debt securities issued by Bank of America Corporation, and are not secured by collateral. The notes will rank equally with all of our other unsecured senior indebtedness from time to time outstanding, and any payments due on the notes, including any repayment of principal, will be subject to our credit risk. The notes will mature on May 29, 2019.

The notes differ from traditional debt securities in that their return is linked to the performance of the 30-year and 2-year U.S. Dollar Constant Maturity Swap Rates. The notes are designed for investors who wish to receive quarterly interest income, and are willing to accept that after the first four quarterly interest periods, the amount of interest payable depends on the amount by which the 30-year U.S. Dollar Constant Maturity Swap Rate exceeds the 2-year U.S. Dollar Constant Maturity Swap Rate as of the applicable interest determination date, minus the Strike, as described below. Interest payable on the notes after May 29, 2010 may be more or less than the rate that we would pay on a conventional fixed-rate or floating-rate debt security with the same maturity, and may be 0.00%.

Investors in the notes should have a view as to U.S. Dollar Constant Maturity Swap Rates and related interest rate movements, and must be willing to forgo guaranteed market rates of interest for most of the term of their investment in the notes. Investors must also be prepared to have their notes redeemed by us at our option on any interest payment date on or after May 29, 2010.

Will you receive interest on the notes?

Yes. During the first four quarterly interest periods, interest on the notes will accrue at 11% per annum; and during subsequent quarterly interest periods, the amount of interest will depend on the amount by which the Spread Differential exceeds the Strike as of the applicable interest determination

PS-3

date, as described in this pricing supplement. However, in no event will the annualized interest rate applicable to any interest period be less than 0.00%.

Will you receive your principal at maturity?

Yes. If you hold the notes until maturity, you will receive your principal amount and any accrued but unpaid interest on the notes, subject to our credit risk. However, if you sell the notes prior to maturity, you may find that the market value of the notes may be less than the principal amount of the notes.

How will the quarterly rate of interest on the notes be determined?

For each quarterly interest period, the calculation agent will determine the applicable annualized interest rate as follows:

| (a) | From and including May 29, 2009 to but excluding May 29, 2010, interest on the notes will accrue at the rate of 11.00% per annum. |

| (b) | During each subsequent quarterly interest period beginning on May 29, 2010, interest will accrue at a rate per annum equal to: |

10 × (CMS30 - CMS2 - Strike)

In no event will the interest rate applicable to any interest period be less than 0.00% per annum.

The Strike is 0.80%.

Each quarterly interest period (other than the first quarterly interest period) will commence on, and will include, an interest payment date, and will extend to, but will exclude, the next succeeding interest payment date. The first quarterly interest period will commence on, and will include, May 29, 2009, and will extend to, but will exclude, August 29, 2009.

The interest due for each quarterly interest period will be paid on the following interest payment dates: February 29 (or, in a non-leap year, March 1), May 29, August 29, and November 29 of each year, beginning August 29, 2009.

“CMS30” means the 30-year U.S. Dollar Constant Maturity Swap Rate, expressed as a percentage, as quoted on the Reuters Screen ISDAFIX3 Page, at 11:00 a.m., New York City time, on the applicable interest determination date.

“CMS2” means the 2-year U.S. Dollar Constant Maturity Swap Rate, expressed as a percentage, as quoted on the Reuters Screen ISDAFIX3 Page, at 11:00 a.m., New York City time, on the applicable interest determination date.

The “interest determination date” for each quarterly interest period after the first four quarterly interest periods will be the second U.S. Government Securities Business Day (as defined below) prior to the beginning of the applicable quarterly interest period.

A “U.S. Government Securities Business Day” means any day, other than a Saturday, Sunday, or a day on which the Securities Industry and Financial Markets Association (or any successor thereto) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

PS-4

Examples: Below are four examples of the calculation of the annualized interest rate payable on a quarterly interest payment date after May 29, 2010 for the notes, based on the Strike of 0.80%. These examples are for purposes of illustration only. The actual annualized interest rate to be applied in calculating the interest payable on the notes for any interest period after the first four quarterly interest periods will depend on the actual levels of CMS30 and CMS2 and the actual Spread Differential (i.e., CMS30 - CMS2) on the applicable interest determination date.

Example 1: The hypothetical CMS30 is less than the hypothetical CMS2 on the interest determination date:

Hypothetical CMS30: 4.75%

Hypothetical CMS2: 5.00%

Strike: 0.80%

10 × (4.75% - 5.00% - 0.80%) = -10.50%

Annualized interest rate = 0.00% per annum (the interest rate cannot be less than 0.00%)

Example 2: The hypothetical CMS30 is greater than the hypothetical CMS2 on the interest determination date, but the hypothetical Spread Differential is less than the Strike:

Hypothetical CMS30: 5.65%

Hypothetical CMS2: 5.00%

Strike: 0.80%

10 × (5.65% - 5.00% - 0.80%) = -1.50%

Annualized interest rate = 0.00% per annum (the interest rate cannot be less than 0.00%)

Example 3: The hypothetical CMS30 is greater than the hypothetical CMS2 on the interest determination date, and the hypothetical Spread Differential is greater than the Strike:

Hypothetical CMS30: 6.00%

Hypothetical CMS2: 5.00%

Strike: 0.80%

10 × (6.00% - 5.00% - 0.80%) = 2.00%

Annualized interest rate = 2.00% per annum (the interest rate cannot be less than 0.00%)

Example 4: The hypothetical CMS30 is substantially greater than the hypothetical CMS2 on the interest determination date:

Hypothetical CMS30: 8.00%

Hypothetical CMS2: 5.00%

Strike: 0.80%

10 × (8.00% - 5.00% - 0.80%) = 22.00%

Annualized interest rate = 22.00% per annum

PS-5

Is it possible that I will not receive any interest for any quarterly interest period after the first four quarterly interest periods?

Yes. After the first four quarterly interest periods, if the Spread Differential is less than or equal to the Strike on the applicable interest determination date, you will not receive any interest for that period. This will be the case even if the Spread Differential exceeds the Strike during other days in a quarterly interest period after the applicable interest determination date.

After the first four quarterly interest periods, is the interest rate on the notes limited in any way?

No. The interest rate payable on the notes in all quarterly interest periods other than the first four quarterly interest periods is not limited. Until the notes are redeemed or mature, you will benefit from any amount by which the Spread Differential exceeds the Strike on each applicable interest determination date. However, there can be no assurance that the interest rate payable on the notes during these quarterly interest periods will be similar to, or greater than, the interest that is payable on a conventional debt security.

Can we redeem your notes before the maturity date?

Yes. We may redeem all of the notes on any quarterly interest payment date on or after May 29, 2010. See the section entitled “Description of the Notes—Early Redemption at Our Option.”

Who will determine the interest rate applicable to each interest amount?

A calculation agent will make all the calculations associated with determining each interest payment. We have appointed our subsidiary, Merrill Lynch Capital Services, Inc. (“MLCS”), to act as calculation agent. See the section entitled “Description of the Notes—Role of the Calculation Agent.”

What do CMS30 and CMS2 measure?

CMS30 and CMS2 are “constant maturity swap rates” that measure the fixed rate of interest payable on a hypothetical fixed-for-floating U.S. dollar interest rate swap transaction with a maturity of 30 years and two years, respectively. In such a hypothetical swap transaction, the fixed rate of interest, payable semi-annually on the basis of a 360-day year consisting of twelve 30-day months, is exchangeable for a floating 3-month LIBOR-based payment stream that is payable quarterly on the basis of the actual number of days elapsed during a quarterly period in a 360-day year. “LIBOR” is the London interbank offered rate and is a common rate of interest used in the swaps industry. See the section entitled “The 30-Year U.S. Dollar Constant Maturity Swap Rate (CMS30) and The 2-Year U.S. Dollar Constant Maturity Swap Rate (CMS30).” The Spread Differential measures the steepness of the swap rate curve from the two-year maturity point to the 30-year maturity point on the curve.

What have been the historic levels of CMS30 and CMS2?

We have included a table and a graph showing the historical month-end and daily spread, respectively, between CMS30 and CMS2 from January 2004 through April 2009, in the section entitled “The 30-Year U.S. Dollar Constant Maturity Swap Rate (CMS30) and The 2-Year U.S. Dollar Constant Maturity Swap Rate (CMS30).” We have provided this historical information to help you evaluate the behavior of these rates in various periods. However, past behavior of these rates is not necessarily indicative of how they will perform in the future.

Who are the selling agents for the notes?

MLPF&S, First Republic, and BAI are acting as our selling agents in connection with this offering and will be compensated based on the total principal amount of notes sold. In this capacity, none of the selling agents is your fiduciary or advisor, and you should not rely upon any communication from them in connection with the notes as investment advice or a recommendation to purchase the notes. You should make your own investment decision regarding the notes after consulting with your legal, tax, and other advisors.

PS-6

How are the notes being offered?

We have registered the notes with the SEC in the United States. However, we are not registering the notes for public distribution in any jurisdiction other than the United States. The selling agents may solicit offers to purchase the notes from non-U.S. investors in reliance on available private placement exemptions. See the section entitled “Supplemental Plan of Distribution—Selling Restrictions” in the prospectus supplement.

How are the notes treated for U.S. federal income tax purposes?

We intend to treat the notes, for U.S. federal income tax purposes, as debt instruments that will be subject to Treasury (as defined below) regulations governing contingent payment debt instruments. As a result, you will be required to include income on the notes over their term based upon a comparable yield. We will determine this comparable yield for the notes in accordance with the Treasury regulations, solely in order for you to determine the amount of income that you will be required to include each year as a result of your ownership of the notes. The comparable yield is neither a prediction nor a guarantee of the actual payments on the notes.

Additionally, you generally will be required to recognize ordinary income on any gain realized on a sale, upon maturity, or upon another disposition of a note.

If you are a Non-U.S. Holder, payments on the notes generally will not be subject to U.S. federal income or withholding tax, as long as you provide us with the required completed tax forms.

See the section entitled “U.S. Federal Income Tax Summary.”

Will the notes be listed on an exchange?

No. The notes will not be listed on any securities exchange, and a market for them may never develop.

Does ERISA impose any limitations on purchases of the notes?

Yes. An employee benefit plan subject to the fiduciary responsibility provisions of the Employee Retirement Income Security Act of 1974 (commonly referred to as “ERISA”) or a plan that is subject to Section 4975 of the Internal Revenue Code of 1986, as amended, or the “Code,” including individual retirement accounts, individual retirement annuities or Keogh plans, or any entity the assets of which are deemed to be “plan assets” under the ERISA regulations, should not purchase, hold, or dispose of the notes unless that plan or entity has determined that its purchase, holding, or disposition of the notes will not constitute a prohibited transaction under ERISA or Section 4975 of the Code.

Any plan or entity purchasing the notes will be deemed to be representing that it has made such determination, or that a prohibited transaction class exemption (“PTCE”) or other statutory or administrative exemption exists and can be relied upon by such plan or entity. See the section entitled “ERISA Considerations.”

Are there any risks associated with your investment?

Yes. An investment in the notes is subject to risk. Please refer to the section entitled “Risk Factors” on the next page of this pricing supplement and page S-4 of the prospectus supplement.

PS-7

Your investment in the notes entails significant risks. Your decision to purchase the notes should be made only after carefully considering the risks of an investment in the notes, including those discussed below, with your advisors in light of your particular circumstances. The notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the notes or financial matters in general.

It is possible that after the first four quarterly interest periods, you may not earn a return on your investment. The interest payable on the notes during any quarterly interest period, except for the first four quarterly interest periods, will depend on the amount by which the Spread Differential exceeds the Strike as of the relevant interest determination date. As a result, you could receive little or no payment of interest on one or more of the interest payment dates (except for the first four interest payment dates) during the term of the notes. If the Spread Differential is constantly less than or equal to the Strike on each interest determination date over the term of the notes, even if the Spread Differential exceeds the Strike during other days during each quarterly interest period, your return on the notes would be limited to the first four quarterly fixed interest payments.

We have no control over various matters, including economic, financial and political events, which may affect the levels of CMS30 and CMS2, and thus the Spread Differential. In recent years, the Spread Differential has been volatile, and such volatility may be expected in the future. However, historical performance is not necessarily indicative of what may occur in the future. You should have a view as to U.S. Dollar Constant Maturity Swap Rates and related interest rate movements, and must be willing to forgo guaranteed market rates of interest for most of the term of the notes, before investing.

Your yield may be less than the yield on a conventional debt security of comparable maturity. The yield that you receive on the notes may be less than the return you would earn if you purchased a conventional debt security with the same maturity date. As a result, your investment in the notes may not reflect the full opportunity cost to you when you consider factors that affect the time value of money.

The notes are subject to our early redemption. We may redeem all of the notes on any interest payment date on or after May 29, 2010. You should expect to receive less than five business days’ notice of that redemption, and if you intend to purchase the notes, you must be willing to have your notes redeemed as early as that date. We are generally more likely to elect to redeem the notes during periods when interest on the notes is expected to accrue at an average rate that is greater than that which we would pay on our traditional interest bearing debt securities having a maturity equal to the remaining term of the notes. In contrast, we are generally less likely to elect to redeem the notes during periods when interest is accruing on the notes at a rate that is less than that which we would pay on our traditional interest bearing debt securities having a maturity equal to the remaining term of the notes. In general, the more that CMS30 exceeds CMS2—that is, the higher the expected quarterly interest payments—the more likely it will be that we will elect to redeem the notes.

If we redeem the notes prior to the maturity date, you will receive for each unit of your notes a cash payment equal to the $1,000 principal amount per unit, plus any accrued and unpaid interest to but excluding the Early Redemption Date (as defined below), and you will not receive the benefit of any future interest payments. In the case of an early redemption, you will not benefit from the fact that the Spread Differential is greater than the Strike after the Early Redemption Date and prior to the maturity date. You may be unable to reinvest your proceeds from the redemption in an investment with a return that is as high as the return on the notes would have been if they had not been redeemed.

You must rely on your own evaluation of the merits of an investment linked to U.S. Dollar Constant Maturity Swap Rates. In the ordinary course of their businesses, our affiliates may have expressed views on expected movements in the U.S. Dollar Constant Maturity Swap Rates and related interest rates, and may do so in the future. These views or reports may be communicated to our clients and clients of our affiliates. However, these views are subject to change from time to time. Moreover, other professionals who deal in markets relating to U.S. Dollar Constant Maturity Swap Rates may at any time have significantly different views from those of our affiliates. For these reasons, you are encouraged to derive information concerning the U.S. Dollar Constant Maturity Swap Rates and related interest rates from multiple sources, and you should not rely on the views expressed by our affiliates.

PS-8

Neither the offering of the notes nor any views which our affiliates from time to time may express in the ordinary course of their businesses constitutes a recommendation as to the merits of an investment in the notes.

In seeking to provide you with what we believe to be commercially reasonable terms for the notes, we have considered the costs of developing, hedging, and distributing the notes. In determining the economic terms of the notes, and consequently the potential return on the notes to you, a number of factors are taken into account. Among these factors are certain costs associated with creating, hedging, and offering the notes. In structuring the economic terms of the notes, we seek to provide you with what we believe to be commercially reasonable terms. The price, if any, at which you could sell your notes in a secondary market transaction is expected to be affected by the factors that we considered in setting the economic terms of the notes, namely the costs associated with the notes, and compensation for developing and hedging the notes. The quoted price of any of our affiliates for the notes could be higher or lower than the original offering price.

Assuming there is no change in the difference between CMS30 and CMS2 after the pricing date and no change in market conditions or any other relevant factors, the price, if any, at which the selling agents or another purchaser might be willing to purchase your notes in a secondary market transaction is expected to be lower than the original offering price. This is due to, among other things, the fact that the original offering price includes, and secondary market prices are likely to exclude, the developing and hedging costs associated with the notes.

We cannot assure you that a trading market for your notes will ever develop or be maintained. We will not list the notes on any securities exchange. We cannot predict how the notes will trade in any secondary market or whether that market will be liquid or illiquid.

The development of a trading market for the notes will depend on our financial performance and other factors, including changes in levels of the Spread Differential. The number of potential buyers of your notes in any secondary market may be limited. We anticipate that one or more of the selling agents will act as a market-maker for the notes, but it is not required to do so. Any such selling agent may discontinue its market-making activities as to the notes at any time. To the extent that a selling agent engages in any market-making activities, it may bid for or offer the notes. Any price at which the selling agent may bid for, offer, purchase, or sell any notes may differ from the values determined by pricing models that it may use, whether as a result of dealer discounts, mark-ups, or other transaction costs. These bids, offers, or completed transactions may affect the prices, if any, at which the notes might otherwise trade in the market.

In addition, if at any time the applicable selling agent were to cease acting as a market-maker as to the notes, it is likely that there would be significantly less liquidity in the secondary market. In such a case, the price at which the notes could be sold likely would be lower than if an active market existed.

If you attempt to sell the notes prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the principal amount of the notes. Unlike savings accounts, certificates of deposit, and other similar investment products, you have no right to have your notes redeemed prior to maturity. If you wish to liquidate your investment in the notes prior to maturity, your only option would be to sell them. At that time, there may be an illiquid market for your notes or no market at all. Even if you were able to sell your notes, there are many factors outside of our control that may affect their market value, some of which, but not all, are stated below. Some of these factors are interrelated in complex ways. As a result, the effect of any one factor may be offset or magnified by the effect of another factor. The following paragraphs describe the expected impact on the market value of the notes from a change in a specific factor, assuming all other conditions remain constant.

| • | The difference between CMS30 and CMS2 is expected to affect the market value of the notes. We expect that the market value of the notes will depend substantially on the amount by which CMS30 exceeds CMS2, and expectations of the amount by which CMS30 will exceed CMS2 in the future, if at all. In general, the value of the notes will increase when the difference between CMS30 and CMS2 increases, and the value of the notes will decrease when the difference between CMS30 and CMS2 decreases. The levels of the CMS30 and CMS2 may change at rates that are different from one another. If you sell your notes when the annual interest payable on the notes is less than, or expected to be less than, market interest rates (as compared to traditional |

PS-9

| interest-bearing debt securities), you may receive less than the principal amount that would be payable at maturity. |

| • | Changes in the levels of interest rates may affect the market value of the notes. The level of interest rates in the United States may affect the U.S. economy and, in turn, the magnitude of the difference between CMS30 and CMS2. Changes in prevailing interest rates may decrease the difference between CMS30 and CMS2 relative to previous periods, which would decrease the interest rate on the notes after the first four quarterly interest periods. This, in turn, may decrease the market value of the notes. |

| • | Volatility of the difference between CMS30 and CMS2. Volatility is the term used to describe the size and frequency of market fluctuations. During recent periods, the difference between CMS30 and CMS2 has had periods of volatility, and this volatility may vary during the term of the notes. In addition, an unsettled international environment and related uncertainties may result in greater market volatility, which may continue over the term of the notes. Increases or decreases in the volatility of the difference between CMS30 and CMS2 may have an adverse impact on the market value of the notes. |

| • | Economic and Other Conditions Generally. Interest payable on the notes after the first four quarterly interest periods is expected to be correlated to the difference between long-term interest rates (as represented by CMS30) and short-term interest rates (as represented by CMS2). Prevailing interest rates may be influenced by a number of factors, including general economic conditions in the United States, U.S. monetary and fiscal policies, inflation, and other financial, political, regulatory, and judicial events. These factors interrelate in complex ways, and may disproportionately affect short-term interest rates relative to long-term interest rates, thereby potentially lowering the difference between CMS30 and CMS2, and consequently adversely affecting the market value of your notes. |

| • | Time to Maturity. We anticipate that the notes may have a market value that may be different from that which would be expected based on the levels of interest rates and the difference between CMS30 and CMS2. This difference will reflect a time premium due to expectations concerning the difference between CMS30 and CMS2 during the period before the maturity date. In general, as the time remaining to maturity decreases, the value of notes will approach a value that reflects the remaining interest payments on the notes based on the then-current difference between CMS30 and CMS2. |

In general, assuming all relevant factors are held constant, we anticipate that the effect on the market value of the notes based on a given change in most of the factors listed above will be less if it occurs later in the term of the notes than if it occurs earlier in their term.

Payments on the notes are subject to our credit risk, and changes in our credit ratings are expected to affect the value of the notes. The notes are our senior unsecured debt securities. As a result, your receipt of all payments of interest and principal on the notes is dependent upon our ability to repay our obligations on the applicable payment date. This will be the case even if the difference between CMS30 and CMS2 increases after the pricing date. No assurance can be given as to what our financial condition will be at any time during the term of the notes or on the maturity date.

In addition, our credit ratings are an assessment by ratings agencies of our ability to pay our obligations. Consequently, our perceived creditworthiness and actual or anticipated changes in our credit ratings prior to the maturity date of the notes may affect the market value of the notes. However, because your return on the notes depends upon factors in addition to our ability to pay our obligations, such as the difference between CMS30 and CMS2 during the term of the notes, an improvement in our credit ratings will not reduce the other investment risks related to the notes.

Our trading and hedging activities may create conflicts of interest with you. We or one or more of our affiliates, including the selling agents, may engage in trading activities related to one or both of CMS30 and CMS2 that are not for your account or on your behalf. We or one or more of our affiliates, including the selling agents, also may issue, or our affiliates may underwrite, other financial instruments with returns linked to CMS30 and/or CMS2. We expect to enter into arrangements to hedge the market risks associated with our obligation to pay the amounts due under the notes. We may seek competitive

PS-10

terms in entering into the hedging arrangements for the notes, but are not required to do so, and we may enter into such hedging arrangements with one of our subsidiaries or affiliates. Such hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, but which could also result in a loss for the hedging counterparty. These trading and hedging activities may present a conflict of interest between your interest in the notes and the interests we and our affiliates may have in our proprietary accounts, in facilitating transactions for our other customers, and in accounts under our management.

There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. Our subsidiary, MLCS, will be the calculation agent for the notes and, as such, will determine the amount of interest to be paid on the notes. Under some circumstances, these duties could result in a conflict of interest between MLCS’s status as our subsidiary and its responsibilities as calculation agent. These conflicts could occur, for instance, in connection with judgments that it would be required to make if one or both of CMS30 and CMS2 are unavailable. See the section entitled “Description of the Notes—Unavailability of CMS30 and/or CMS2.” The calculation agent will be required to carry out its duties in good faith and using its reasonable judgment. However, because we expect to control the calculation agent, potential conflicts of interest could arise.

PS-11

We will use the net proceeds we receive from the sale of the notes for the purposes described in the accompanying prospectus under “Use of Proceeds.” In addition, we expect that we or our affiliates will use a portion of the net proceeds to hedge our obligations under the notes.

PS-12

General

The notes are part of a series of medium-term notes entitled “Medium-Term Notes, Series L” issued under the Senior Indenture, as amended and supplemented from time to time. The Senior Indenture is described more fully in the accompanying prospectus supplement and prospectus. The following description of the notes supplements the description of the general terms and provisions of the notes and debt securities set forth under the headings “Description of the Notes” in the prospectus supplement and “Description of Debt Securities” in the prospectus. These documents should be read in connection with this pricing supplement.

The notes are issued in denominations of whole units, and each unit will have a principal amount $1,000. The notes will mature on May 29, 2019.

We may redeem all of the notes on any quarterly interest payment date on or after May 29, 2010. Prior to maturity, the notes are not repayable at your option. The notes are not subject to any sinking fund.

The notes will be issued in book-entry form only. The CUSIP number for the notes is 06048WAB6.

Interest

Each interest payment due for a quarterly interest period will be paid on February 29 (or, in a non-leap year, March 1), May 29, August 29, and November 29 of each year, beginning August 29, 2009. Each quarterly interest period (other than the first quarterly interest period from, and including, the original date of issuance of the notes to, but excluding, August 29, 2009) will commence on, and will include, an interest payment date, and will extend to, but will exclude, the next succeeding interest payment date or the maturity date, as applicable. If any interest payment date, including the maturity date of the notes, falls on a day that is not a business day, no adjustment will be made to the length of the corresponding quarterly interest period; however, we will make the required payment on the next business day and no additional interest will accrue in respect of the payment made on the next business day.

A “business day” means any day other than a day on which banking institutions in New York, New York are authorized or required by law, regulation, or executive order to close or a day on which transactions in U.S. dollars are not conducted.

Interest is computed on the basis of a 360-day year of twelve 30-day months. For as long as the notes are held in book-entry only form, the record date for each payment of interest will be the business day prior to the payment date. If the notes are issued at any time in a form that is other than book-entry only, the regular record date for an interest payment date will be the last day of the calendar month preceding the interest payment date.

For each quarterly interest period, the calculation agent will determine the applicable annualized interest rate as follows:

| (a) | From and including May 29, 2009 to but excluding May 29, 2010, interest on the notes will accrue at the rate of 11.00% per annum. |

| (b) | During each subsequent quarterly interest period beginning on May 29, 2010, interest will accrue at a rate per annum equal to: |

10 × (CMS30 - CMS2 - Strike)

In no event will the interest rate applicable to any interest period be less than 0.00% per annum.

The Strike is 0.80%.

PS-13

“CMS30” means the 30-year U.S. Dollar Constant Maturity Swap Rate, expressed as a percentage, as quoted on the Reuters Screen ISDAFIX3 Page, at 11:00 a.m., New York City time, on the applicable interest determination date.

“CMS2” means the 2-year U.S. Dollar Constant Maturity Swap Rate, expressed as a percentage, as quoted on the Reuters Screen ISDAFIX3 Page, at 11:00 a.m., New York City time, on the applicable interest determination date.

The “interest determination date” for each quarterly interest period after the first four quarterly interest periods will be the second U.S. Government Securities Business Day prior to the beginning of the applicable quarterly interest period.

A “U.S. Government Securities Business Day” means any day, other than a Saturday, Sunday, or a day on which the Securities Industry and Financial Markets Association (or any successor thereto) recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

Payment at Maturity

Unless earlier redeemed, on the maturity date, you will be paid the principal amount of the notes and any accrued and unpaid interest on the notes, subject to our credit risk.

The notes are principal protected at maturity. Regardless of the amounts of the interest payable during each interest period over the term of the notes, you will receive your principal amount at maturity, assuming that we are otherwise able to pay our debts on the maturity date.

Early Redemption at Our Option

We may redeem all of the notes on any interest payment date on or after May 29, 2010 (each, an “Early Redemption Date”). We must provide the trustee with notice of redemption at least five business days prior to the applicable Early Redemption Date. The trustee will deliver the notice to The Depository Trust Company (“DTC”), as the record holder of the notes. Beneficial holders of the notes will receive such notice from the direct or indirect DTC participant through which they hold their notes. Accordingly, you should expect to receive less than five business days’ notice of an early redemption.

If we redeem the notes prior to the maturity date, you will receive for each unit of your notes a cash payment equal to the $1,000 principal amount per unit, plus any accrued and unpaid interest to but excluding the Early Redemption Date, and you will not receive the benefit of any future interest payments.

Unavailability of CMS30 and/or CMS2

If, on any interest determination date, CMS30 and/or CMS2 are not quoted on the Reuters Screen ISDAFIX3 Page, or any page substituted for that page, then CMS30 and CMS2 will be a percentage determined on the basis of the mid-market semi-annual swap rate quotations provided by three banks chosen by the calculation agent at approximately 11:00 a.m., New York City time, on that date. For this purpose, the semi-annual swap rate means the mean of the bid and offered rates for the semi-annual fixed leg, calculated on the basis of a 360-day year consisting of twelve 30-day months, of a fixed-for-floating U.S. dollar interest rate swap transaction with a term equal to 30 years or two years, as applicable, commencing on the applicable date and in a representative amount with an acknowledged dealer of good credit in the swap market, where the floating leg, calculated on the actual number of days in a 360-day year, is equivalent to USD-LIBOR-BBA, as quoted on the Reuters Screen LIBOR01 Page at 11:00 a.m., New York City time, with a designated maturity of three months. The calculation agent will request the principal New York City office of each of the three banks chosen by it to provide a quotation of its rate. If at least three quotations are provided, the rate for the relevant interest determination date will be the arithmetic mean of the quotations. If two quotations are provided, the rate for the relevant interest determination date will be the arithmetic mean of the two quotations. If only one quotation is provided,

PS-14

the rate for the relevant interest determination date will equal that one quotation. If no quotations are available, then CMS30 and/or CMS2 will be the rates the calculation agent, in its sole discretion, determines to be fair and reasonable under the circumstances at approximately 11:00 a.m., New York City time, on the relevant interest determination date.

Role of the Calculation Agent

The calculation agent has the sole discretion to make all determinations regarding the notes, including determinations regarding CMS30, CMS2, the amount of each interest payment, U.S. Government Securities Business Days, and business days. Absent manifest error, all determinations of the calculation agent will be final and binding on you and us, without any liability on the part of the calculation agent.

We have initially appointed our subsidiary, MLCS, as the calculation agent, but we may change the calculation agent at any time without notifying you.

Same-Day Settlement and Payment

The notes will be delivered in book-entry form only through DTC against payment by purchasers of the notes in immediately available funds. We will make payments of the principal amount and each interest payment in immediately available funds so long as the notes are maintained in book-entry form.

Events of Default and Rights of Acceleration

If an event of default (as defined in the Senior Indenture) occurs and is continuing, holders of the notes may accelerate the maturity of the notes, as described under “Description of Debt Securities – Events of Default and Rights of Acceleration” in the prospectus. Upon an event of default, you will be entitled to receive only your principal amount, and accrued and unpaid interest, if any, through the acceleration date. In case of an event of default, the notes will not bear a default interest rate. If a bankruptcy proceeding is commenced in respect of us, your claim may be limited, under the United States Bankruptcy Code, to the original public offering price of the notes.

Listing

The notes will not be listed on any securities exchange.

PS-15

THE 30-YEAR U.S. DOLLAR CONSTANT MATURITY SWAP RATE (CMS30) AND

THE 2-YEAR U.S. DOLLAR CONSTANT MATURITY SWAP RATE (CMS2)

General

CMS30 and CMS2 are “constant maturity swap rates” that measure the fixed rate of interest payable on a hypothetical fixed-for-floating U.S. dollar interest rate swap transaction with a maturity of 30 years and two years, respectively. In such a hypothetical swap transaction, the fixed rate of interest, payable semi-annually on the basis of a 360-day year consisting of twelve 30-day months, is exchangeable for a floating 3-month LIBOR-based payment stream that is payable quarterly on the basis of the actual number of days elapsed during a quarterly period in a 360-day year. “LIBOR” is the London interbank offered rate and is a common rate of interest used in the swaps industry.

Historical Levels of CMS30 and CMS2

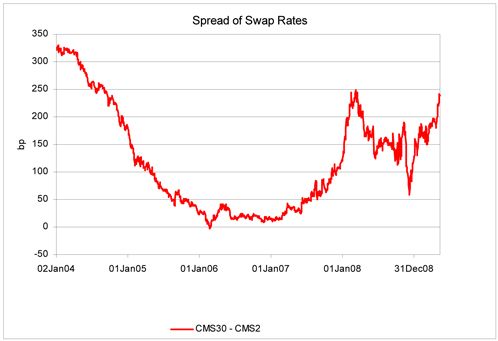

The following table sets forth the historical month-end spread (expressed as a percentage) between CMS30 and CMS2 from January 2004 through April 2009. The following graph sets forth the historical daily spread (expressed as a percentage) between CMS30 and CMS2 over the same time period. This data is not intended to be indicative of the future performance of the difference between CMS30 and CMS2 or what the value of or return on the notes may be. Any historical upward or downward trend in the difference between CMS30 and CMS2 during any period set forth below is not an indication that such difference is more or less likely to increase or decrease in value at any time over the term of the notes or that these represent what the difference would have been on any hypothetical interest determination date. Further, investors in the notes may not realize a return consistent with the historical data presented even if equally favorable historical spreads continue during the term of the notes, since the notes are subject to early redemption. See “Risk Factors—The notes are subject to our early redemption” above.

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | |||||||

| January |

311.361 | 134.611 | 21.752 | 15.985 | 196.119 | 196.119 | ||||||

| February |

319.932 | 119.420 | -1.307 | 21.296 | 227.654 | 178.581 | ||||||

| March |

321.965 | 106.687 | 21.322 | 38.950 | 221.903 | 186.480 | ||||||

| April |

295.621 | 97.721 | 41.672 | 36.212 | 171.254 | 216.204 | ||||||

| May |

278.822 | 81.744 | 31.257 | 26.230 | 163.184 | |||||||

| June |

256.552 | 65.086 | 17.523 | 44.863 | 142.621 | |||||||

| July |

249.772 | 55.841 | 23.886 | 59.856 | 159.146 | |||||||

| August |

251.810 | 50.736 | 20.518 | 57.659 | 148.627 | |||||||

| September |

229.382 | 44.868 | 18.316 | 80.464 | 122.803 | |||||||

| October |

222.863 | 46.292 | 17.928 | 80.001 | 165.959 | |||||||

| November |

199.270 | 39.237 | 11.457 | 101.307 | 96.750 | |||||||

| December |

178.404 | 22.761 | 14.655 | 119.482 | 128.932 |

PS-16

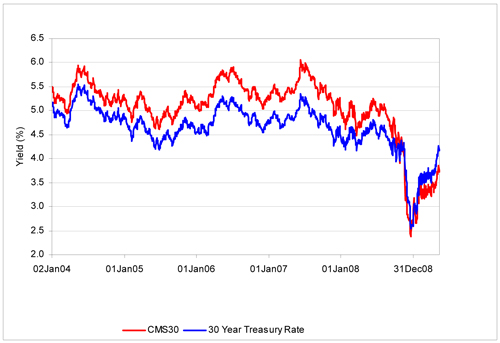

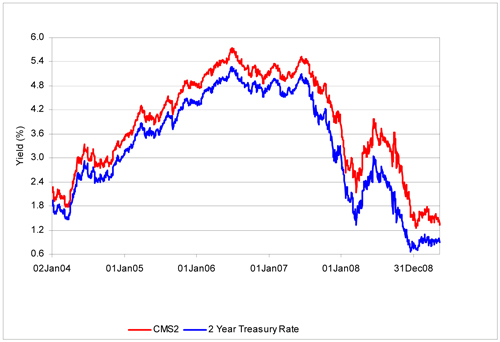

Movements in CMS30 and CMS2 are imperfectly correlated to movements in the 30-year Treasury Rate and 2-year Treasury Rate, respectively. The first graph below reflects the correlation between the daily CMS30 relative to the daily 30-year Treasury Rate during the period from January 2004 through April 2009; the second graph reflects the correlation between the daily CMS2 relative to the daily 2-year Treasury Rate during the same period.

PS-17

Interest payable on the notes after the first four quarterly interest periods will be imperfectly correlated to the difference between long-term interest rates (as measured by CMS30) and short-term interest rates (as measured by CMS2). Although long-term interest rates directionally follow short-term interest rates, movements in long-term interest rates generally tend to be smaller than movements in short-term interest rates. As such, when short-term interest rates rise, the difference between CMS30 and CMS2 tends to narrow (the curve of the spread flattens); conversely, when short-term interest rates fall, the spread widens (the curve of the spread becomes steeper). After the first four quarterly interest periods, interest payable on the notes will be greater the wider the spread between CMS30 and CMS2 (assuming the spread is greater than the Strike), and the steeper the curve of the spread, as of each interest determination date.

The difference between long-term interest rates and short-term interest rates is influenced by a number of factors, including (but not limited to) monetary policy, fiscal policy, inflation, and fundamental demand conditions. These factors interrelate in complex, and sometimes ambiguous, ways. Any factor which reduces the supply of or increases the demand for money available for borrowing will generally disproportionately affect short-term interest rates relative to long-term interest rates, thereby potentially lowering the difference between CMS30 and CMS2. For example, monetary policy tightening by the Federal Reserve Bank through open market operations initially generates high nominal short-term interest rates, while long-term rates typically rise by a smaller amount. As a result, the difference between short-term interest rates and long-term interest rates typically decreases when contractionary monetary policy shocks occur.

PS-18

SUPPLEMENTAL PLAN OF DISTRIBUTION

Our broker-dealer subsidiaries, MLPF&S, First Republic, and BAI, will act as our selling agents in connection with the offering of the notes. The selling agents are parties to the Distribution Agreement described in the “Supplemental Plan of Distribution” on page S-12 of the accompanying prospectus supplement.

Each selling agent will receive the compensation set forth on the cover of this pricing supplement as to the notes sold through its efforts. You must have an account with one of the selling agents to purchase the notes.

The selling agents are members of the Financial Industry Regulatory Authority, Inc. (formerly the National Association of Securities Dealers, Inc. (the “NASD”)). Accordingly, offerings of the notes will conform to the requirements of NASD Rule 2720.

No selling agent is acting as your fiduciary or advisor, and you should not rely upon any communication from any selling agent in connection with the notes as investment advice or a recommendation to purchase notes. You should make your own investment decision regarding the notes after consulting with your legal, tax, and other advisors.

We will deliver the notes against payment therefor in New York, New York on a date that is greater than three business days following the pricing date. Purchasers who wish to trade the notes more than three business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement. See “Supplemental Plan of Distribution” on page S-12 of the accompanying prospectus supplement.

If you place an order to purchase these offered securities, you are consenting to each of MLPF&S and its broker-dealer affiliate First Republic acting as a principal in effecting the transaction for your account. MLPF&S is acting as an underwriter in connection with this offering and will receive underwriting compensation from us.

The selling agents and any of our other broker-dealer affiliates, may use this pricing supplement, and the accompanying prospectus supplement and prospectus for offers and sales in secondary market transactions and market-making transactions in the notes. However, they are not obligated to engage in such secondary market transactions and/or market-making transactions. The selling agents may act as principal or agent in these transactions, and any such sales will be made at prices related to prevailing market prices at the time of the sale.

PS-19

U.S. FEDERAL INCOME TAX SUMMARY

The following summary of the material U.S. federal income tax considerations of the acquisition, ownership, and disposition of the notes is based upon the advice of Morrison & Foerster LLP, our tax counsel. The following discussion is not exhaustive of all possible tax considerations. This summary is based upon the Code, regulations promulgated under the Code by the U.S. Treasury Department (“Treasury”) (including proposed and temporary regulations), rulings, current administrative interpretations and official pronouncements of the Internal Revenue Service (“IRS”), and judicial decisions, all as currently in effect and all of which are subject to differing interpretations or to change, possibly with retroactive effect. No assurance can be given that the IRS would not assert, or that a court would not sustain, a position contrary to any of the tax consequences described below.

This summary is for general information only, and does not purport to discuss all aspects of U.S. federal income taxation that may be important to a particular holder in light of its investment or tax circumstances or to holders subject to special tax rules, such as partnerships, subchapter S corporations, or other pass-through entities, banks, financial institutions, tax-exempt entities, insurance companies, regulated investment companies, real estate investment trusts, trusts and estates, dealers in securities or currencies, traders in securities that have elected to use the mark-to-market method of accounting for their securities, persons holding notes as part of an integrated investment, including a “straddle,” “hedge,” “constructive sale,” or “conversion transaction,” persons (other than Non-U.S. Holders, as defined below) whose functional currency for tax purposes is not the U.S. dollar, persons holding notes in a tax-deferred or tax-advantaged account, and persons subject to the alternative minimum tax provisions of the Code. This summary does not include any description of the tax laws of any state or local governments, or of any foreign government, that may be applicable to a particular holder.

This summary is directed solely to holders that, except as otherwise specifically noted, will purchase the notes upon original issuance and will hold the notes as capital assets within the meaning of Section 1221 of the Code, which generally means property held for investment. This summary assumes that the issue price of the notes, as determined for U.S. federal income tax purposes, equals the principal amount thereof.

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws.

As used in this product supplement, the term “U.S. Holder” means a beneficial owner of a note that is for U.S. federal income tax purposes:

| • | a citizen or resident of the United States; |

| • | a corporation (including an entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or of any state of the United States or the District of Columbia; |

| • | an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| • | any trust if a court within the United States is able to exercise primary supervision over the administration of the trust and one or more United States persons have the authority to control all substantial decisions of the trust. |

Notwithstanding the preceding paragraph, to the extent provided in Treasury regulations, some trusts in existence on August 20, 1996, and treated as United States persons prior to that date, that elect to continue to be treated as United States persons also are U.S. Holders. As used in this product supplement, the term “Non-U.S. Holder” means a holder that is not a U.S. Holder.

If an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds a note, the U.S. federal income tax treatment of a partner generally will depend upon the status of the partner and the activities of the partnership and, accordingly, this summary does not apply to

PS-20

partnerships. A partner of a partnership holding a note should consult its own tax advisor regarding the U.S. federal income tax consequences to the partner of the acquisition, ownership, and disposition by the partnership of a note.

Tax Characterization of the Notes

There are no statutory provisions, regulations, published rulings, or judicial decisions addressing the characterization, for U.S. federal income tax purposes, of the notes or other instruments with terms substantially the same as the notes. However, although the matter is not free from doubt, under current law, each note should be treated as a debt instrument for U.S. federal income tax purposes and this summary assumes such treatment is proper and will be respected. We currently intend to treat the notes as debt instruments for U.S. federal income tax purposes and, where required, intend to file information returns with the IRS in accordance with such treatment, in the absence of any change or clarification in the law, by regulation or otherwise, requiring a different characterization of the notes. You should be aware, however, that the IRS is not bound by our characterization of the notes as indebtedness and the IRS could possibly take a different position as to the proper characterization of the notes for U.S. federal income tax purposes. If the notes are not in fact treated as debt instruments for U.S. federal income tax purposes, then the U.S. federal income tax treatment of the purchase, ownership, and disposition of the notes could differ materially from the treatment discussed below with the result that the timing and character of income, gain, or loss recognized in respect of the notes could differ materially from the timing and character of income, gain, or loss recognized in respect of the notes had the notes in fact been treated as debt instruments for U.S. federal income tax purposes.

U.S. Holders—Income Tax Considerations

Interest and Original Issue Discount. We intend to take the position that the notes will be treated as “contingent payment debt instruments” for U.S. federal income tax purposes subject to taxation under the “noncontingent bond method,” and the balance of this discussion assumes that this characterization is proper and will be respected. Under this characterization, the notes generally will be subject to the Treasury regulations governing contingent payment debt instruments. Under those regulations, a U.S. Holder will be required to report original issue discount (“OID”) or interest income based on a “comparable yield” and a “projected payment schedule,” both as described below, established by us for determining interest accruals and adjustments with respect to a note. A U.S. Holder which does not use the “comparable yield” and follow the “projected payment schedule” to calculate its OID and interest income on a note must timely disclose and justify the use of other estimates to the IRS.

A “comparable yield” with respect to a note generally is the yield at which we could issue a fixed-rate debt instrument with terms similar to those of the note (taking into account for this purpose the level of subordination, term, timing of payments, and general market conditions, but ignoring any adjustments for liquidity or the riskiness of the contingencies with respect to the note). Notwithstanding the foregoing, a comparable yield must not be less than the applicable U.S. federal rate based on the overall maturity of the note.

A “projected payment schedule” with respect to a note generally is a series of projected payments, the amount and timing of which would produce a yield to maturity on that note equal to the comparable yield. This projected payment schedule will consist of the principal amount, the fixed payments for the initial four quarterly interest periods and a projection for tax purposes of each “contingent payment,” i.e., each interest payment other than the fixed payments for the initial four quarterly interest periods.

Based on the comparable yield and the projected payment schedule of the notes, a U.S. Holder of a note (regardless of accounting method) generally will be required to accrue as OID the sum of the daily portions of interest on the note for each day in the taxable year on which the holder held the note, adjusted upward or downward to reflect the difference, if any, between the actual and projected amount of any contingent payments on the note, as set forth below. The daily portions of interest for a note are determined by allocating to each day in an accrual period the ratable portion of interest on the note that accrues in the accrual period. The amount of interest on the note that accrues in an accrual period is the product of the comparable yield on the note (adjusted to reflect the length of the accrual period) and the adjusted issue price of the note at the beginning of the accrual period. The adjusted issue price of a note at the beginning of the first accrual period will equal its issue price. The issue price of each note in an issue of notes is the first price at which a substantial amount of those notes has been sold (including any premium paid for those notes and ignoring sales to bond houses, brokers, or similar persons or

PS-21

organizations acting in the capacity of underwriters, placement agents, or wholesalers). For any subsequent accrual period, the adjusted issue price will be (1) the sum of the issue price of the note and any interest previously accrued on the note by a holder (without regard to any positive or negative adjustments, described below) minus (2) the amount of any projected payments on the note for previous accrual periods. A U.S. Holder of a note generally will be required to include in income OID in excess of actual cash payments received for certain taxable years.

A U.S. Holder will be required to recognize interest income equal to the amount of any positive adjustment for a note for the taxable year in which a contingent payment is paid (including a payment of interest at maturity). A positive adjustment is the excess of actual payments in respect of contingent payments over the projected amount of contingent payments. A U.S. Holder also will be required to account for any “negative adjustment” for a taxable year in which a contingent payment is paid. A negative adjustment is the excess of the projected amounts of contingent payments over actual payments in respect of the contingent payments. A net negative adjustment is the amount by which total negative adjustments in a taxable year exceed total positive adjustments in such taxable year. A net negative adjustment (1) will first reduce the amount of interest for the note that a U.S. Holder would otherwise be required to include in income in the taxable year, and (2) to the extent of any excess, will result in an ordinary loss equal to that portion of the excess as does not exceed the excess of (A) the amount of all previous interest inclusions under the note over (B) the total amount of the U.S. Holder’s net negative adjustments treated as ordinary loss on the note in prior taxable years. A net negative adjustment is not subject to the 2% floor limitation imposed on miscellaneous deductions under Section 67 of the Code. Any net negative adjustment in excess of the amounts described above in (1) and (2) will be carried forward to offset future interest income on the note or to reduce the amount realized on a sale, exchange, or retirement of the note and, in the case of a payment at maturity, should result in a capital loss. The deductibility of capital losses by a U.S. Holder is subject to limitations.

The following table is based upon a projected payment schedule and a comparable yield equal to 6.35% per annum (compounded quarterly), that we established for the notes, and shows the amounts of ordinary income from a note that an initial U.S. Holder that holds the note until maturity and pays taxes on a calendar year basis should be required to report each calendar year.

| Accrual Period | Interest Deemed to Accrue During Accrual Period (per $1,000 principal amount per unit of the Notes) |

Total Interest Deemed to Have Accrued from Original Issue Date (per $1,000 principal amount per unit of the Notes) | ||

| May 29, 2009 through December 31, 2009 |

$36.91 | $36.91 | ||

| January 1, 2010 through December 31, 2010 |

$60.94 | $97.85 | ||

| January 1, 2011 through December 31, 2011 |

$60.72 | $158.57 | ||

| January 1, 2012 through December 31, 2012 |

$61.01 | $219.58 | ||

| January 1, 2013 through December 31, 2013 |

$61.30 | $280.88 | ||

| January 1, 2014 through December 31, 2014 |

$61.63 | $342.51 | ||

| January 1, 2015 through December 31, 2015 |

$61.95 | $404.46 | ||

| January 1, 2016 through December 31, 2016 |

$62.30 | $466.76 | ||

| January 1, 2017 through December 31, 2017 |

$62.68 | $529.44 | ||

| January 1, 2018 through December 31, 2018 |

$63.08 | $592.52 | ||

| January 1, 2019 through May 29, 2019 |

$25.80 | $618.32 |

PS-22

In addition, we have determined the projected payment schedule for the notes as follows:

| Taxable Year |

Payment on February 29 or |

Payment on May 29 |

Payment on August 29 |

Payment on November 29 | ||||

| 2009 |

N/A | N/A | $27.50 | $27.50 | ||||

| 2010 |

$27.50 | $27.50 | $14.12 | $14.12 | ||||

| 2011 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2012 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2013 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2014 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2015 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2016 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2017 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2018 |

$14.12 | $14.12 | $14.12 | $14.12 | ||||

| 2019 |

$14.12 | $1,014.12 | N/A | N/A |

You should be aware that these amounts are not calculated or provided for any purposes other than the determination of a U.S. Holder’s interest accruals and adjustments with respect to the notes for U.S. federal income tax purposes. By providing the projected payment schedule, we make no representations regarding the actual amounts of interest payments on the notes after the first four quarterly interest periods.

Sale, Exchange, or Retirement. Upon a sale, exchange, or retirement of a note prior to maturity, a U.S. Holder generally will recognize taxable gain or loss equal to the difference between the amount realized on the sale, exchange, or retirement and that holder’s tax basis in the note. A U.S. Holder’s tax basis in a note generally will equal the cost of that note, increased by the amount of OID previously accrued by the holder for that note (without regard to any positive or negative adjustments). A U.S. Holder generally will treat any gain as interest income, and will treat any loss as ordinary loss to the extent of the excess of previous interest inclusions over the total negative adjustments previously taken into account as ordinary losses, and the balance as long-term or short-term capital loss depending upon the U.S. Holder’s holding period for the note. The deductibility of capital losses by a U.S. Holder is subject to limitations.

Unrelated Business Taxable Income

Section 511 of the Code generally imposes a tax, at regular corporate or trust income tax rates, on the “unrelated business taxable income” of certain tax-exempt organizations, including qualified pension and profit sharing plan trusts and individual retirement accounts. In general, if the notes are held for investment purposes, the amount of income or gain realized with respect to a note should not constitute unrelated business taxable income. However, if a note constitutes debt-financed property (as defined in Section 514(b) of the Code) by reason of indebtedness incurred by a holder of a note to purchase or carry the note, all or a portion of any income or gain realized with respect to such note may be classified as unrelated business taxable income pursuant to Section 514 of the Code. Moreover, prospective investors in the notes should be aware that whether or not any income or gain realized with respect to a note which is owned by an organization that is generally exempt from U.S. federal income taxation constitutes unrelated business taxable income will depend upon the specific facts and circumstances applicable to such organization. Accordingly, any potential investors in the notes that are generally exempt from U.S. federal income taxation should consult with their own tax advisors concerning the U.S. federal income tax consequences to them of investing in the notes.

Non-U.S. Holders—Income Tax Considerations

U.S. Federal Income and Withholding Tax

Under current U.S. federal income tax law and subject to the discussion below concerning backup withholding, principal and interest payments, including any OID, that are received from us or our agent and that are not effectively connected with the conduct by the Non-U.S. Holder of a trade or business within the United States, or a permanent establishment maintained in the United States if

PS-23

certain tax treaties apply, generally will not be subject to U.S. federal income or withholding tax except as provided below. Interest, including any OID and any gain realized on the sale, exchange, or retirement of a note, may be subject to a 30% withholding tax (or less under an applicable treaty, if any) if:

| • | a Non-U.S. Holder actually or constructively owns 10% or more of the total combined voting power of all classes of our stock entitled to vote; |

| • | a Non-U.S. Holder is a “controlled foreign corporation” for U.S. federal income tax purposes that is related to us (directly or indirectly) through stock ownership; |

| • | a Non-U.S. Holder is a bank extending credit under a loan agreement in the ordinary course of its trade or business; |

| • | the payments on the notes are determined by reference to the income, profits, changes in the value of property or other attributes of the debtor or a related party (other than payments that are based on the value of a security or index of securities that are, and will continue to be, actively traded within the meaning of Section 1092(d) of the Code, and that are not nor will be a “United States real property interest” as described in Section 897(c)(1) or 897(g) of the Code); or |

| • | the Non-U.S. Holder does not satisfy the certification requirements described below. |

A Non-U.S. Holder generally will satisfy the certification requirements if either: (A) the Non-U.S. Holder certifies to us or our agent, under penalties of perjury, that it is a non-United States person and provides its name and address (which certification may generally be made on an IRS Form W-8BEN, or a successor form), or (B) a securities clearing organization, bank, or other financial institution that holds customer securities in the ordinary course of its trade or business (a “financial institution”) and holds the notes certifies to us or our agent under penalties of perjury that either it or another financial institution has received the required statement from the Non-U.S. Holder certifying that it is a non-United States person and furnishes us with a copy of the statement.

Payments not meeting the requirements set forth above and thus subject to withholding of U.S. federal income tax may nevertheless be exempt from withholding (or subject to withholding at a reduced rate) if the Non-U.S. Holder provides us with a properly executed IRS Form W-8BEN (or successor form) claiming an exemption from, or reduction in, withholding under the benefit of a tax treaty, or IRS Form W-8ECI (or other applicable form) stating that income on the notes is not subject to withholding tax because it is effectively connected with the conduct of a trade or business within the United States as discussed below. To claim benefits under an income tax treaty, a Non-U.S. Holder must obtain a taxpayer identification number and certify as to its eligibility under the appropriate treaty’s limitations on benefits article, if applicable. In addition, special rules may apply to claims for treaty benefits made by Non-U.S. Holders that are entities rather than individuals. A Non-U.S. Holder that is eligible for a reduced rate of U.S. federal withholding tax pursuant to an income tax treaty may obtain a refund of any excess amounts withheld by filing an appropriate claim for refund with the IRS.

If a Non-U.S. Holder of a note is engaged in the conduct of a trade or business within the United States and if interest (including any OID) on the note, or gain realized on the sale, exchange, or other disposition of the note, is effectively connected with the conduct of such trade or business (and, if certain tax treaties apply, is attributable to a permanent establishment maintained by the Non-U.S. Holder in the United States), the Non-U.S. Holder, although exempt from U.S. federal withholding tax (provided that the applicable certification requirements are satisfied), generally will be subject to U.S. federal income tax on such interest (including any OID) or gain on a net income basis in the same manner as if it were a U.S. Holder. Non-U.S. Holders should read the material under the heading “—U.S. Holders—Income Tax Considerations,” for a description of the U.S. federal income tax consequences of acquiring, owning, and disposing of notes. In addition, if such Non-U.S. Holder is a foreign corporation, it may also be subject to a branch profits tax equal to 30% (or such lower rate provided by an applicable U.S. income tax treaty) of a portion of its earnings and profits for the taxable year that are effectively connected with its conduct of a trade or business in the United States, subject to certain adjustments.

PS-24

U.S. Federal Estate Tax

Under current law, a note should generally not be includible in the estate of a Non-U.S. Holder unless the individual actually or constructively owns 10% or more of the total combined voting power of all classes of our stock entitled to vote or, at the time of the individual’s death, payments in respect of that note would have been effectively connected with the conduct by the individual of a trade or business in the United States.

Backup Withholding and Reporting