Filed Pursuant to Rule 433

Registration No. 333-158663

Subject to Completion

Preliminary Term Sheet dated July 29, 2009

The notes are being offered by Bank of America Corporation (“BAC”). The notes will have the terms specified in this term sheet as supplemented by the documents indicated herein under “Additional Terms” (together, the “Note Prospectus”). Investing in the notes involves a number of risks. There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk Factors” on page TS-6 of this term sheet and beginning on page S-10 of product supplement STEPS-3. The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

In connection with this offering, each of Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) and its broker-dealer affiliate First Republic Securities Company, LLC (“First Republic”) is acting in its capacity as a principal for your account.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit |

Total | |||

| Public offering price (1) |

$10.000 | $ | ||

| Selling discount (1) |

$0.175 | $ | ||

| Proceeds, before expenses, to Bank of America Corporation |

$9.825 | $ |

| (1) | The public offering price and selling discount for any purchase of 500,000 or more units in a single transaction by an individual investor will be $9.950 per unit and $0.125 per unit, respectively. |

*Depending on the date the notes are priced for initial sale to the public (the “pricing date”), which may be in August or September 2009, the settlement date may occur in August or September 2009, the maturity date may occur in August or September 2010 and the interest payment dates and Valuation Date may be adjusted accordingly. Any reference in this term sheet to the month in which the pricing date, settlement date, maturity date, interest payment dates, or Valuation Date will occur is subject to change as specified above.

Merrill Lynch & Co.

August , 2009

Units

STEP Income Securities®

Linked to the common stock of JPMorgan Chase & Co.,

due September , 2010

$10 principal offering amount per unit

Term Sheet No.

Expected Pricing Date* August , 2009

Settlement Date* September , 2009

Maturity Date* September , 2010

CUSIP No.

STEP Income Securities®

Interest payable quarterly at the rate of 10% per year

Potential Step Payment of 3% to 7% at maturity per unit if the closing price of the common stock of JPMorgan Chase & Co. (the “Underlying Stock”) on the Valuation Date is greater than or equal to the Step Level, which will be 110% of the Starting Value

A maturity of approximately one year and one week

1-for-1 downside exposure to decrease in the price of the Underlying Stock in excess of a Threshold Value, with up to 95% of the principal amount at risk at maturity due to such decreases

Payments on the notes, including the payment of the Redemption Amount at maturity, are subject to the credit risk of Bank of America Corporation

No listing on any securities exchange

This debt is not guaranteed under the Federal Deposit Insurance Corporation’s Temporary Liquidity Guarantee Program

Structured investments

Principal protection

Enhanced income

Enhanced participation

Market participation

Summary

The STEP Income Securities® Linked to the common stock of JPMorgan Chase & Co., due September , 2010 (the “notes”), are our senior unsecured debt securities and are not guaranteed or insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally with all of our other unsecured and unsubordinated debt, and any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BAC. The notes provide quarterly interest payments and, if the Ending Value of the Underlying Stock (as defined below) on the Valuation Date is at or above the Step Level, an additional payment per unit at maturity (the “Step Payment”). If the Ending Value of the Underlying Stock on the Valuation Date is less than the Step Level, the amount you will receive on the maturity date (the “Redemption Amount”) will not be greater than the Original Offering Price per unit and will be based on the direction of and percentage change in the price of the Underlying Stock from the Starting Value, as determined on the pricing date, to the Ending Value, as determined on the Valuation Date. Investors must be willing to accept a repayment that may be less, and potentially significantly less, than the Original Offering Price of the notes. Investors also must be willing to accept that no Step Payment will be payable on the maturity date if the closing price of the Underlying Stock is below the Step Level and be willing to lose all or a portion of their principal if the Ending Value is below the Threshold Value.

Capitalized terms used but not defined in this term sheet have the meanings set forth in the product supplement STEPS-3. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BAC.

TS-2

Hypothetical Payments

Set forth below are three hypothetical examples of payment calculations related to the notes. These examples have been prepared for purposes of illustration only. Your actual return will depend on the actual Starting Value, Threshold Value, Ending Value, Step Payment, and the term of your investment. These examples are based on:

| 1) | a hypothetical Starting Value of 36.94, which was the volume weighted average price of the Underlying Stock on July 21, 2009; |

| 2) | a hypothetical Threshold Value of 35.09, which is 95% of the hypothetical Starting Value; |

| 3) | a hypothetical Step Level of 40.63 (equal to 110% of the hypothetical Starting Value, rounded to two decimal places); |

| 4) | a hypothetical Step Payment equal to 5% of the $10 Original Offering Price per unit (the midpoint of the range of 3% and 7%) if the hypothetical Ending Value is greater than or equal to the hypothetical Step Level; |

| 5) | a term of the notes from July 28, 2009 to August 4, 2010, a term expected to be similar to that of the notes; and |

| 6) | interest payable quarterly in arrears at the rate of 10% of the $10 Original Offering Price per unit per annum. |

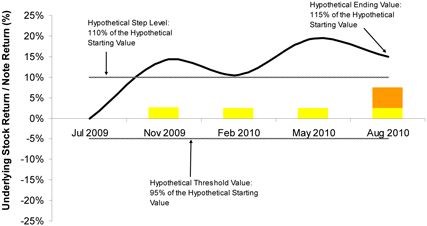

Example 1

The hypothetical Ending Value is 42.48 (115% of the hypothetical Starting Value)

The hypothetical Ending Value of the Underlying Stock is greater than the hypothetical Step Level. Consequently, in addition to the quarterly interest payments (represented in yellow below), you will receive on the maturity date the 5% Step Payment (represented in orange below). The Redemption Amount per unit on the maturity date will therefore be equal to $10.50 ($10.00 plus the Step Payment).

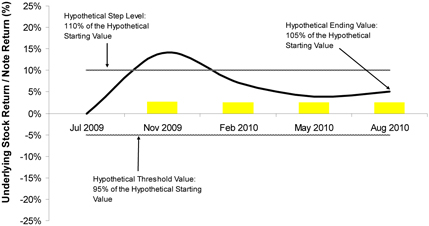

Example 2

The hypothetical Ending Value is 38.79 (105% of the hypothetical Starting Value)

The hypothetical Ending Value of the Underlying Stock is greater than the hypothetical Starting Value but below the hypothetical Step Level. Consequently, you will receive the quarterly interest payments (represented in yellow below), but not the Step Payment. The Redemption Amount per unit on the maturity date will therefore be equal to $10.00.

TS-3

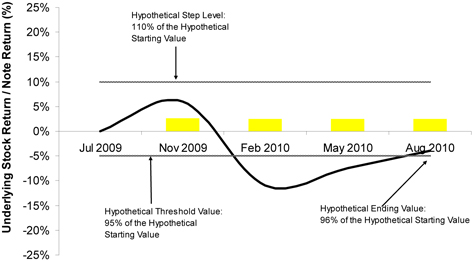

Example 3

The hypothetical Ending Value is 35.46 (96% of the hypothetical Starting Value)

The hypothetical Ending Value of the Underlying Stock is less than the hypothetical Starting Value and the hypothetical Step Level, but is above the hypothetical Threshold Value. Consequently, you will receive the quarterly interest payments (represented in yellow below), but not the Step Payment. Because the Ending Value is not less than the Threshold Value, the Redemption Amount per unit on the maturity date will therefore be equal to $10.00.

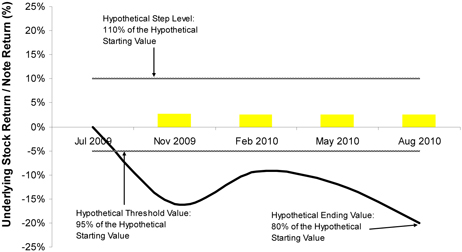

Example 4

The hypothetical Ending Value is 29.55 (80% of the hypothetical Starting Value)

The hypothetical Ending Value of the Underlying Stock is less than the hypothetical Threshold Value. Consequently, you will receive only the quarterly interest payments (represented in yellow below). You will not receive the Step Payment, and you will participate in the decrease of the Underlying Stock in excess of the hypothetical Threshold Value. The Redemption Amount per unit will equal:

| $10 – |

[ | $10 × | ( | 35.09 - 29.55

|

) | x 100% | ] | = $8.50 | ||||||||||

|

36.94 |

On the maturity date, you will receive the Redemption Amount per unit of $8.50.

TS-4

| Summary of the Hypothetical Examples | Example 1 | Example 2 | ||

| The hypothetical Ending Value is greater than or equal to the hypothetical Starting Value and... |

...the hypothetical Ending Value is greater than or equal to the hypothetical Step Level |

...the hypothetical Ending Value is less than the hypothetical Step Level | ||

| Hypothetical Starting Value |

36.94 | 36.94 | ||

| Hypothetical Ending Value |

42.48 | 38.79 | ||

| Hypothetical Step Level |

40.63 | 40.63 | ||

| Hypothetical Threshold Value |

35.09 | 35.09 | ||

| Interest Rate (per annum) |

10.00% | 10.00% | ||

| Step Payment |

5.00% | 0.00% | ||

| Redemption Amount per Unit |

10.50 | 10.00 | ||

| Total Return of the Underlying Stock(1) |

15.55% | 5.55% | ||

| Total Return on the Notes(2) |

15.17% | 10.17% | ||

| Summary of the Hypothetical Examples | Example 3 | Example 4 | ||

| The hypothetical Ending Value is less than the hypothetical Starting Value and... |

...the hypothetical Ending Value is greater than or equal to the hypothetical Threshold Value |

...the hypothetical Ending Value is less than the hypothetical Threshold Value | ||

| Hypothetical Starting Value |

36.94 | 36.94 | ||

| Hypothetical Ending Value |

35.46 | 29.55 | ||

| Hypothetical Step Level |

40.63 | 40.63 | ||

| Hypothetical Threshold Value |

35.09 | 35.09 | ||

| Interest Rate (per annum) |

10.00% | 10.00% | ||

| Step Payment |

0.00% | 0.00% | ||

| Redemption Amount per Unit |

10.00 | 8.50 | ||

| Total Return of the Underlying Stock(1) |

-3.45% | -19.45% | ||

| Total Return on the Notes(2) |

10.17% | -4.83% | ||

| (1) | The total return of the Underlying Stock assumes: |

| (a) | a percentage change in the price of the Underlying Stock that equals the percentage change in the price of the Underlying Stock from the hypothetical Starting Value to the hypothetical Ending Value; |

| (b) | a constant dividend yield of 0.54% per annum, the dividend yield as reported by Bloomberg L.P. on July 21, 2009; and |

| (c) | no transaction fees or expenses. |

| (2) | The total return on the notes includes interest paid on the notes and assumes a term of the notes from July 28, 2009 to August 4, 2010, a term expected to be similar to that of the notes. |

TS-5

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections included in product supplement STEPS-3 and MTN prospectus supplement identified below under “Additional Terms.” We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| § | Your investment will result in a loss if the Ending Value is less than the Threshold Value; there is no guaranteed return of principal. |

| § | You will not receive a Step Payment at maturity unless the Ending Value is greater than or equal to the Step Level on the Valuation Date. |

| § | Your return, if any, is limited to the return represented by the periodic interest payments over the term of the notes and the Step Payment, if any. |

| § | Your yield may be less than the yield on a conventional debt security of comparable maturity. |

| § | Your investment return may be less than a comparable investment directly in the Underlying Stock. |

| § | You must rely on your own evaluation of the merits of an investment linked to the Underlying Stock. |

| § | In seeking to provide you with what we believe to be commercially reasonable terms for the notes while providing the selling agents with compensation for their services, we have considered the costs of developing, hedging, and distributing the notes. |

| § | A trading market is not expected to develop for your notes. |

| § | The Redemption Amount will not be affected by all developments relating to the Underlying Stock. |

| § | The Underlying Company will have no obligations relating to the notes, and neither we nor any selling agent will perform any due diligence procedures with respect to the Underlying Company in connection with this offering. |

| § | You will have no rights as a holder of the Underlying Stock, and you will not be entitled to receive any shares of the Underlying Stock or dividends or other distributions by the Underlying Company. |

| § | We do not control the Underlying Company, and are not responsible for any disclosure made by the Underlying Company. |

| § | If you attempt to sell notes prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than their Original Offering Price. |

| § | Payments on the notes are subject to our credit risk, and changes in our credit ratings are expected to affect the value of the notes. |

| § | Purchases and sales by us and our affiliates of the Underlying Stock may affect your return. |

| § | Our trading and hedging activities may create conflicts of interest with you. |

| § | Our hedging activities may affect your return on the notes and their market value. |

| § | Our business activities relating to the Underlying Company may create conflicts of interest with you. |

| § | There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” and “Certain U.S. Federal Income Taxation Considerations” below and “U.S. Federal Income Tax Summary” in product supplement STEPS-3. |

Investor Considerations

TS-6

Other Provisions

We may deliver the notes against payment therefor in New York, New York on a date that is more than three business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement on the notes occurs more than three business days from the pricing date, purchasers who wish to trade notes more than three business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

If you place an order to purchase the notes, you are consenting to each of MLPF&S and its broker-dealer affiliate First Republic acting as a principal in effecting the transaction for your account.

Supplement to the Plan of Distribution

MLPF&S and First Republic, each a broker-dealer subsidiary of BAC, are members of the Financial Industry Regulatory Authority, Inc. (formerly the National Association of Securities Dealers, Inc. (the “NASD”)) and will participate as selling agents in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of NASD Rule 2720. Under our distribution agreement with the selling agents, MLPF&S will purchase the notes from us on the issue date as principal at the purchase price indicated on the cover of this term sheet, less the indicated selling discount. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units.

MLPF&S and First Republic may use this Note Prospectus for offers and sales in secondary market transactions and market-making transactions in the notes but are not obligated to engage in such secondary market transactions and/or market-making transactions. MLPF&S and First Republic may act as principal or agent in these transactions, and any such sales will be made at prices related to prevailing market prices at the time of the sale.

TS-7

The Underlying Stock

We have derived the following information from publicly available documents published by the Underlying Company. We make no representation or warranty as to the accuracy or completeness of the following information. The Underlying Company provides global financial services and retail banking. The Underlying Company provides services such as investment banking, treasury and securities services, asset management, private banking, card member services, commercial banking, and home finance.

Because the Underlying Stock is registered under the Securities Exchange Act of 1934, the Underlying Company is required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Underlying Company can be located at the SEC's facilities or through the SEC's web site by reference to SEC CIK number 0000019617. We make no representation or warranty as to the accuracy or completeness of the Underlying Company’s information or reports.

We are not affiliated with the Underlying Company. The Underlying Company will have no obligations with respect to the notes. This term sheet relates only to the notes and does not relate to the Underlying Stock or to any other securities of the Underlying Company. Neither we nor any of our affiliates have participated nor will participate in the preparation of the Underlying Company’s publicly available documents. Neither we nor any of our affiliates have made any due diligence inquiry with respect to the Underlying Company in connection with the offering of the notes. Neither we nor any of our affiliates make any representation that the publicly available documents or any other publicly available information regarding the Underlying Company are accurate or complete. Furthermore, there can be no assurance that all events occurring prior to the date of this term sheet, including events that would affect the accuracy or completeness of these publicly available documents that would affect the trading price of the Underlying Stock, have been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events concerning the Underlying Company could affect the value of the Underlying Stock on the Valuation Date and therefore could affect your return on the notes.

The selection of the Underlying Stock is not a recommendation to buy or sell the Underlying Stock. Neither we nor any of our affiliates make any representation to you as to the performance of the Underlying Stock.

The Underlying Stock trades on the New York Stock Exchange (the “NYSE”) under the symbol “JPM”.

Historical Data

The following table sets forth the high and low closing prices of the shares of the Underlying Stock in the calendar quarters from the first quarter of 2004 to July 22, 2009. The closing prices listed below were obtained from publicly available information at Bloomberg Financial Market, rounded to two decimal places. The historical closing prices of shares of the Underlying Stock should not be taken as an indication of its future performance, and we cannot assure you that the price per share of the Underlying Stock will not decrease to a level that is less than the Threshold Value. In addition, we cannot assure you that the price per share of the Underlying Stock will increase to a level that is greater than the Step Level so that you will receive the Step Payment on the maturity date.

| High |

Low | |||||

| 2004 |

||||||

| First Quarter |

43.01 | 36.55 | ||||

| Second Quarter |

42.26 | 35.19 | ||||

| Third Quarter |

40.10 | 35.87 | ||||

| Fourth Quarter |

40.34 | 37.02 | ||||

| 2005 |

||||||

| First Quarter |

39.15 | 34.58 | ||||

| Second Quarter |

36.26 | 33.77 | ||||

| Third Quarter |

35.86 | 33.58 | ||||

| Fourth Quarter |

40.20 | 33.27 | ||||

| 2006 |

||||||

| First Quarter |

42.11 | 38.05 | ||||

| Second Quarter |

46.65 | 39.95 | ||||

| Third Quarter |

47.22 | 40.71 | ||||

| Fourth Quarter |

48.95 | 46.01 | ||||

| 2007 |

||||||

| First Quarter |

51.65 | 46.70 | ||||

| Second Quarter |

53.20 | 48.24 | ||||

| Third Quarter |

50.05 | 43.00 | ||||

| Fourth Quarter |

47.58 | 40.46 | ||||

| 2008 |

||||||

| First Quarter |

48.25 | 36.48 | ||||

| Second Quarter |

49.25 | 34.31 | ||||

| Third Quarter |

48.24 | 31.02 | ||||

| Fourth Quarter |

49.85 | 22.72 | ||||

| 2009 |

||||||

| First Quarter |

31.35 | 15.90 | ||||

| Second Quarter |

38.94 | 27.25 | ||||

| Third Quarter (through July 22, 2009) |

37.10 | 32.27 |

Before investing in the notes, you should consult publicly available sources for the levels and trading pattern of the Underlying Stock. The generally unsettled international environment and related uncertainties, including the risk of terrorism, may result in the Underlying Stock and financial markets generally exhibiting greater volatility than in earlier periods.

TS-8

Summary Tax Consequences

You should consider the U.S. federal income tax consequences of an investment in the notes, including the following:

| • | You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as an income-bearing single financial contract linked to the Underlying Stock that requires you to pay us at inception an amount equal to the purchase price of the notes and that entitles you to receive the stated periodic interest payments as well as, at maturity, an amount in cash linked to the value of the Underlying Stock. |

| • | Under this characterization and tax treatment of the notes, we intend to take the position that the stated periodic interest payments constitute taxable ordinary income to you, and, upon receipt of a cash payment at maturity or upon a sale or exchange of the notes prior to maturity (other than amounts representing accrued stated periodic interest payments), you generally will recognize capital gain or loss. This capital gain or loss generally will be long-term capital gain or loss if you hold the notes for more than one year. |

Certain U.S. Federal Income Taxation Considerations

Set forth below is a summary of certain U.S. federal income tax considerations relating to an investment in the notes. The following summary is not complete and is qualified in its entirety by the discussion under the section entitled “U.S. Federal Income Tax Summary” in product supplement STEPS-3, which you should carefully review prior to investing in the notes.

General. Although there is no statutory, judicial, or administrative authority directly addressing the characterization of the notes, we intend to treat the notes for all tax purposes as an income-bearing single financial contract linked to the Underlying Stock that requires you to pay us at inception an amount equal to the purchase price of the notes and that entitles you to receive the stated periodic interest payments as well as, at maturity, an amount in cash linked to the value of the Underlying Stock. Under the terms of the notes, we and every investor in the notes agree, in the absence of an administrative determination or judicial ruling to the contrary, to treat the notes as described in the preceding sentence. This discussion assumes that the notes constitute an income-bearing single financial contract linked to the Underlying Stock for U.S. federal income tax purposes. If the notes did not constitute an income-bearing single financial contract, the tax consequences described below would be materially different.

This characterization of the notes is not binding on the Internal Revenue Service (“IRS”) or the courts. No statutory, judicial, or administrative authority directly addresses the characterization of the notes or any similar instruments for U.S. federal income tax purposes, and no ruling is being requested from the IRS with respect to their proper characterization and treatment. Due to the absence of authorities on point, significant aspects of the U.S. federal income tax consequences of an investment in the notes are not certain, and no assurance can be given that the IRS or any court will agree with the characterization and tax treatment described in product supplement STEPS-3. Accordingly, you are urged to consult your tax advisor regarding all aspects of the U.S. federal income tax consequences of an investment in the notes, including possible alternative characterizations. The discussion in this section and in the section entitled “U.S. Federal Income Tax Summary” in product supplement STEPS-3 assume that there is a significant possibility of a significant loss of principal on an investment in the notes.

Stated Periodic Interest Payments. Although the U.S. federal income tax treatment of the stated periodic interest payments on the notes is uncertain, we intend to take the position, and this discussion assumes, that the stated periodic interest payments constitute taxable ordinary income to a U.S. Holder (as defined in product supplement STEPS-3) at the time received or accrued in accordance with the U.S. Holder’s regular method of accounting.

Settlement at Maturity or Sale or Exchange Prior to Maturity. Assuming that the notes are properly characterized and treated as income-bearing single financial contracts linked to the Underlying Stock for U.S. federal income tax purposes, upon receipt of a cash payment at maturity or upon a sale or exchange of the notes prior to maturity, a U.S. Holder generally will recognize capital gain or loss equal to the difference between the amount realized (other than amounts representing accrued stated periodic interest payments, which would be taxed as described above under “– Stated Periodic Interest Payments”) and the U.S. Holder’s basis in the notes. This capital gain or loss generally will be long-term capital gain or loss if the U.S. Holder holds the notes for more than one year. The deductibility of capital losses is subject to limitations.

Possible Future Tax Law Changes. On December 7, 2007, the IRS released Notice 2008-2 (“Notice”) seeking comments from the public on the taxation of financial instruments currently taxed as “prepaid forward contracts.” The scope of the Notice may extend to instruments similar to the notes. According to the Notice, the IRS and Treasury are considering whether a holder of such instruments should be required to accrue ordinary income on a current basis, regardless of whether any payments are made prior to maturity. It is not possible to determine what guidance the IRS and Treasury will ultimately issue, if any. Any such future guidance may affect the amount, timing, and character of income, gain, or loss in respect of the notes, possibly with retroactive effect. The IRS and Treasury are also considering additional issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax on any deemed income accruals, whether Section 1260 of the Internal Revenue Code of 1986, as amended, concerning certain “constructive ownership transactions,” generally applies or should generally apply to such instruments, and whether any of these determinations depend on the nature of the underlying asset. We urge you to consult your own tax advisors concerning the impact and the significance of the above considerations. We intend to continue treating the notes for U.S. federal income tax purposes in the manner described herein unless and until such time as we determine, or the IRS or Treasury determines, that some other treatment is more appropriate.

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. See the discussion under the section entitled “U.S. Federal Income Tax Summary” in product supplement STEPS-3.

TS-9

Additional Terms

You should read this term sheet, together with the documents listed below, which together contain the terms of the notes and supersede all prior or contemporaneous oral statements as well as any other written materials. You should carefully consider, among other things, the matters set forth under “Risk Factors” in the section indicated on the cover of this term sheet. The notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

You may access the following documents on the SEC Website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC Website):

| § | Product supplement STEPS-3 dated July 29, 2009: |

http://www.sec.gov/Archives/edgar/data/70858/000095012309026925/g19932e424b5.htm

| § | Series L MTN prospectus supplement dated April 21, 2009 and prospectus dated April 20, 2009: |

http://www.sec.gov/Archives/edgar/data/70858/000095014409003387/g18667b5e424b5.htm

Our Central Index Key, or CIK, on the SEC Website is 70858.

We have filed a registration statement (including a product supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the product supplement, the prospectus supplement, and the prospectus in that registration statement, and the other documents relating to this offering that we have filed with the SEC for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, we, any agent, or any dealer participating in this offering will arrange to send you the Note Prospectus if you so request by calling MLPF&S toll-free at 1-866-500-5408.

Structured Investments Classification

MLPF&S classifies certain structured investments (the “Structured Investments”), including the notes, into four categories, each with different investment characteristics. The description below is intended to briefly describe the four categories of Structured Investments offered: Principal Protection, Enhanced Income, Market Participation, and Enhanced Participation. A Structured Investment may, however, combine characteristics that are relevant to one or more of the other categories. As such, a category should not be relied upon as a description of any particular Structured Investment.

Principal Protection: Principal Protected Structured Investments offer full or partial principal protection against decreases in the value of the underlying market measure (or increases in the value of an underlying market measure for bearish Structured Investments), while offering market exposure and the opportunity for a better return than may be available from comparable fixed income securities. Principal protection may not be achieved if the investment is sold prior to maturity.

Enhanced Income: Structured Investments offering enhanced income may offer an enhanced income stream through interim fixed or variable coupon payments. However, in exchange for receiving current income, investors may forfeit upside potential on the underlying asset. These investments generally do not include the principal protection feature.

Market Participation: Market Participation Structured Investments can offer investors exposure to specific market sectors, asset classes, and/or strategies that may not be readily available through traditional investment alternatives. Returns obtained from these investments are tied to the performance of the underlying asset. As such, subject to certain fees, the returns will generally reflect any increases or decreases in the value of such assets. These investments generally do not include the principal protection feature.

Enhanced Participation: Enhanced Participation Structured Investments may offer investors the potential to receive better than market returns on the performance of the underlying asset. Some structures may offer leverage in exchange for a capped or limited upside potential and also in exchange for downside risk. These investments generally do not include the principal protection feature.

The classification of Structured Investments is meant solely for informational purposes and is not intended to fully describe any particular Structured Investment nor guarantee any particular performance.

“STEP Income Securities®” and “STEPS®” are registered service marks of our subsidiary, Merrill Lynch & Co., Inc.

TS-10