Filed Pursuant to Rule 433

Registration No. 333-158663

Subject to Completion

Preliminary Term Sheet dated November 10, 2011

The notes are being offered by Bank of America Corporation (“BAC”). The notes will have the terms specified in this term sheet as supplemented by the documents indicated below under “Additional Terms” (together, the “Note Prospectus”). Investing in the notes involves a number of risks. There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk Factor” and “Additional Risk Factor” on page TS-5 of this term sheet and beginning on page S-10 of product supplement LIRN-2. The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

In connection with this offering, Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) is acting in its capacity as a principal for your account.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit |

Total |

|||||||

| Public offering price (1) |

$10.00 | $ | ||||||

| Underwriting discount (1) |

$0.20 | $ | ||||||

| Proceeds, before expenses, to BAC |

$9.80 | $ | ||||||

| (1) | The public offering price and underwriting discount for any purchase of 500,000 units or more in a single transaction by an individual investor will be $9.95 per unit and $0.15 per unit, respectively. The public offering price and underwriting discount for any purchase by certain fee-based trusts and fee-based discretionary accounts managed by U.S. Trust operating through Bank of America, N.A. will be $9.80 per unit and $0.00 per unit, respectively. |

*Depending on the date the notes are priced for initial sale to the public (the “pricing date”), any reference in this term sheet to the month in which the pricing date, settlement date, or maturity date will occur is subject to change.

| Merrill Lynch & Co.

|

| |||

| November , 2011 |

Units

Capped Leveraged Index Return Notes®

Linked to the Dow Jones U.S. Real Estate Index

due May , 2013

$10 principal amount per unit

Term Sheet No.

Pricing Date* November , 2011

Settlement Date* November , 2011

Maturity Date* May , 2013

CUSIP No.

Capped Leveraged Index Return Notes®

The notes have a maturity of approximately one and a half years

The notes provide 2-to-1 upside exposure to any increase in the level of Dow Jones U.S. Real Estate Index (the “Index”), subject to a cap of between 36% and 44%

1-to-1 downside exposure to decreases in the level of the Index below the Threshold Value, with up to 90% of the principal amount at risk

Payment of the Redemption Amount at maturity is subject to the credit risk of Bank of America Corporation

No periodic interest payments

No listing on any securities exchange

Summary

The Capped Leveraged Index Return Notes® Linked to the Dow Jones U.S. Real Estate Index, due May , 2013 (the “notes”) are our senior unsecured debt securities. The notes are not guaranteed or insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally with all of our other unsecured and unsubordinated debt, and any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BAC.

The notes provide a leveraged return for investors, subject to a cap, if the level of the Dow Jones U.S. Real Estate Index (the “Index”) increases moderately from the Starting Value to the Ending Value. Investors must be willing to forgo interest payments on the notes and be willing to accept a return that is capped or a repayment that is less, and potentially significantly less, than the Original Offering Price if the Ending Value is less than the Threshold Value.

Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement LIRN-2. Unless otherwise indicated or unless the context requires otherwise, all references in this term sheet to “we,” “us,” “our,” or similar references are to BAC.

| Capped Leveraged Index Return Notes® | TS-2 |

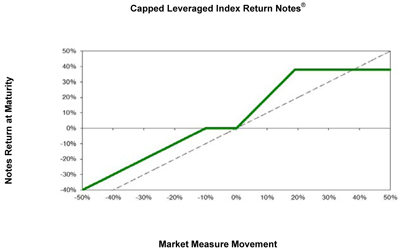

Hypothetical Payout Profile

The below graph is based on hypothetical numbers and values.

|

This graph reflects the return on the notes at maturity, based on the Participation Rate of 200%, a Threshold Value equal to 90% of the Starting Value, and a Capped Value of $13.80 (a 38% return), the midpoint of the Capped Value range of $13.60 to $14.00. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the stocks included in the Index, excluding dividends.

This graph has been prepared for purposes of illustration only. Your actual return will depend on the actual Starting Value, Threshold Value, Ending Value, Capped Value and the term of your investment. |

Hypothetical Redemption Amounts

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show a hypothetical return on the notes. The actual amount you receive and the resulting total rate of return will depend on the actual Starting Value, Threshold Value, Ending Value, Capped Value, and the term of your investment.

The following table illustrates, for a Starting Value of 100.00 and a range of Ending Values:

| § | the percentage change from the Starting Value to the Ending Value; |

| § | the Redemption Amount per unit of the notes; and |

| § | the total rate of return to holders of the notes. |

The Index is a price return index. Accordingly, the Ending Value will not include any income generated by dividends paid on the stocks included in the Index, which you would otherwise be entitled to receive if you invested in those stocks directly.

The table and examples reflect the Participation Rate of 200%, a Threshold Value equal to 90% of the Starting Value, and a Capped Value of $13.80 per unit.

| Ending Value |

Percentage Change from the Starting Value to the Ending |

Redemption Amount per Unit |

Total Rate of Return on the | |||||||||||||||

| 50.00 | -50.00 | % | $6.00 | -40.00 | % | |||||||||||||

| 60.00 | -40.00 | % | $7.00 | -30.00 | % | |||||||||||||

| 70.00 | -30.00 | % | $8.00 | -20.00 | % | |||||||||||||

| 80.00 | -20.00 | % | $9.00 | -10.00 | % | |||||||||||||

| 90.00 | (1) | -10.00 | % | $10.00 | 0.00 | % | ||||||||||||

| 95.00 | -5.00 | % | $10.00 | 0.00 | % | |||||||||||||

| 97.50 | -2.50 | % | $10.00 | 0.00 | % | |||||||||||||

| 100.00 | (2) | 0.00 | % | $10.00 | 0.00 | % | ||||||||||||

| 102.50 | 2.50 | % | $10.50 | 5.00 | % | |||||||||||||

| 105.00 | 5.00 | % | $11.00 | 10.00 | % | |||||||||||||

| 110.00 | 10.00 | % | $12.00 | 20.00 | % | |||||||||||||

| 120.00 | 20.00 | % | $13.80 | (3) | 38.00 | % | ||||||||||||

| 130.00 | 30.00 | % | $13.80 | 38.00 | % | |||||||||||||

| 140.00 | 40.00 | % | $13.80 | 38.00 | % | |||||||||||||

| 150.00 | 50.00 | % | $13.80 | 38.00 | % | |||||||||||||

| (1) | This is the hypothetical Threshold Value. |

| (2) | The hypothetical Starting Value of 100 used in these examples has been chosen for illustrative purposes only, and does not represent a likely actual Starting Value for the Index. For recent actual levels of the Index, see “The Index” section below, beginning on page TS-7. |

| (3) | The Redemption Amount cannot exceed the hypothetical Capped Value of $13.80 per unit of the notes, the midpoint of the Capped Value range of $13.60 to $14.00. |

| Capped Leveraged Index Return Notes® | TS-3 |

Example 1: The Ending Value is 70% of the Starting Value:

Starting Value: 100

Ending Value: 70

Threshold Value: 90

| Redemption Amount (per unit) = |

$10 – |

[ | $10 × | ( | 90 – 70 | ) | ] | = $8.00 | ||||||||||||||||||

| 100 |

Redemption Amount (per unit) = $8.00

Example 2: The Ending Value is 95% of the Starting Value:

Starting Value: 100

Ending Value: 95

Threshold Value: 90

Redemption Amount (per unit) = $10.00 (If the Ending Value is less than or equal to the Starting Value but is greater than or equal to the Threshold Value, the Redemption Amount will equal the Original Offering Price.)

Example 3: The Ending Value is 104% of the Starting Value:

Starting Value: 100

Ending Value: 104

| Redemption Amount (per unit) = $10 + |

[ | $10 × 200% × | ( | 104 – 100 | ) | ] | = $10.80 | |||||||||||

| 100 |

Redemption Amount (per unit) = $10.80

Example 4: The Ending Value is 150% of the Starting Value:

Starting Value: 100

Ending Value: 150

| Redemption Amount (per unit) = $10 + |

[ | $10 × 200% × | ( | 150 – 100 | ) | ] | = $20.00 | |||||||||||

| 100 |

Redemption Amount (per unit) = $13.80 (The Redemption Amount cannot be greater than the Capped Value.)

| Capped Leveraged Index Return Notes® | TS-4 |

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Additional Risk Factor” section below and the “Risk Factors” sections beginning on page S-10 of product supplement LIRN-2 and page S-4 of the MTN prospectus supplement identified below under “Additional Terms.” We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| § | Your investment may result in a loss; there is no guaranteed return of principal. |

| § | Your yield may be less than the yield on a conventional debt security of comparable maturity. |

| § | Your investment return, if any, on the notes is limited to the return represented by the Capped Value. |

| § | Your investment return, if any, may be less than a comparable investment directly in the stocks included in the Index. |

| § | You must rely on your own evaluation of the merits of an investment linked to the Index. |

| § | In seeking to provide you with what we believe to be competitive terms for the notes while providing MLPF&S with compensation for its services, we have considered the costs of developing, hedging, and distributing the notes described on page TS-6. The price at which you may sell the notes in any secondary market may be lower than the public offering price due to, among other things, the inclusion of these costs. |

| § | A trading market is not expected to develop for the notes. MLPF&S is not obligated to make a market for, or to repurchase, the notes. |

| § | The Redemption Amount will not be affected by all developments relating to the Index. |

| § | If you attempt to sell the notes prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the Original Offering Price. |

| § | Payments on the notes are subject to our credit risk, and changes in our credit ratings are expected to affect the value of the notes. |

| § | Dow Jones Trademark Holdings, LLC (“Dow Jones”), and CME Group Index Services LLC (“CME Indexes”) may adjust the Index in a way that affects its level, and Dow Jones and CME Indexes have no obligation to consider your interests. |

| § | You will have no rights of a holder of the stocks included in the Index, and you will not be entitled to receive securities or dividends or other distributions of the issuers of those securities. |

| § | While we or our affiliates may from time to time own stocks included in the Index, we do not control any company included in the Index, and are not responsible for any disclosure made by any other company. |

| § | Purchases and sales by us and our affiliates of stocks included in the Index may affect your return. |

| § | Our trading and hedging activities may create conflicts of interest with you. |

| § | Our hedging activities may affect your return on the notes and their market value. |

| § | Our business activities relating to the companies represented by the Index may create conflicts of interest with you. |

| § | There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” and “U.S. Federal Income Tax Considerations” below and “U.S. Federal Income Tax Summary” beginning on page S-35 of product supplement LIRN-2. |

Additional Risk Factor

The stocks included in the Index are concentrated in one industry.

All of the stocks included in the Index are issued by companies involved directly or indirectly in the U.S. real estate industry. As a result, the stocks that will determine the performance of the Index and hence, the value of the notes, are concentrated in one industry. Although an investment in the notes will not give you any ownership or other direct interests in these stocks, the return on an investment in the notes will be subject to certain risks associated with direct equity investments in the real estate industry.

| Capped Leveraged Index Return Notes® | TS-5 |

Investor Considerations

Supplement to the Plan of Distribution; Role of MLPF&S and Conflicts of Interest

We may deliver the notes against payment therefor in New York, New York on a date that is greater than three business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the notes occurs more than three business days from the pricing date, purchasers who wish to trade the notes more than three business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units.

MLPF&S, a broker-dealer subsidiary of BAC, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of Rule 5121 applicable to FINRA members. MLPF&S may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

Under our distribution agreement with MLPF&S, MLPF&S will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount. The public offering price includes, in addition to the underwriting discount, a charge of approximately $0.075 per unit. This charge reflects an estimated profit earned by MLPF&S from transactions through which the notes are structured and resulting obligations hedged. The fees charged reduce the economic terms of the notes. Actual profits or losses from these hedging transactions may be more or less than this amount. In entering into the hedging arrangements for the notes, we seek competitive terms and may enter into hedging transactions with a division of MLPF&S or one of our subsidiaries or affiliates. For further information regarding these charges, our trading and hedging activities and conflicts of interest, see “Risk Factors-General Risks Relating to LIRNs” beginning on page S-10 and “Use of Proceeds” on page S-21 of product supplement LIRN-2.

MLPF&S will not receive an underwriting discount for notes sold to certain fee-based trusts and fee-based discretionary accounts managed by U.S. Trust operating through Bank of America, N.A.

If you place an order to purchase the notes, you are consenting to MLPF&S acting as a principal in effecting the transaction for your account.

MLPF&S may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices. MLPF&S may act as principal or agent in these market-making transactions; however it is not obligated to engage in any such transactions.

| Capped Leveraged Index Return Notes® | TS-6 |

The Index

All disclosures contained in this term sheet regarding the Index, including, without limitation, its make-up, method of calculation, and changes in its components have been derived from publicly available sources. The information reflects the policies of Dow Jones, the marketing name of CME Indexes, and is subject to change by Dow Jones. Dow Jones has no obligation to continue to publish, and may discontinue publication of, the Index. The consequences of Dow Jones discontinuing publication of the Index are discussed in “Description of LIRNs–Discontinuance of a Market Measure” beginning on page S-30 of product supplement LIRN-2. None of us, the calculation agent, or any of the selling agents accepts any responsibility for the calculation, maintenance, or publication of the Index or any successor index.

“Dow Jones®” and “Dow Jones US Real Estate IndexSM” are service marks of Dow Jones, have been licensed to CME Indexes and have been sublicensed for use for certain purposes by us. The notes based on the Dow Jones US Real Estate IndexSM are not sponsored, endorsed, sold or promoted by Dow Jones, CME Indexes or their respective affiliates and none of them makes any representation regarding the advisability of investing in such product(s).

The Index is a float-adjusted market capitalization-weighted real-time index that provides a broad measure of the performance of the real estate sector of the U.S. securities market. Component companies consist of Real Estate Investment Trusts (“REITs”) and other companies that invest directly or indirectly in real estate through development, management, or ownership, including property agencies. Because the Index is comprised primarily of REITs, the prices of the component stocks reflect changes in lease rates, vacancies, property development and other transactions.

The Index is a subset of the Dow Jones U.S. IndexSM, a broad-based measure of the U.S. stock market, which aims to measure the performance of 95% of U.S. stocks by float-adjusted market capitalization. The index universe is defined as all stocks traded on the major U.S. stock exchanges, minus any noncommon issues and illiquid stocks. The value of the Dow Jones U.S. IndexSM was set to 100 on the base date of December 31, 1991. The Dow Jones U.S. IndexSM is part of the Dow Jones Global Indexes, which is a benchmark family of indices that currently follows stocks from 42 countries. It is a market capitalization-weighted index, adjusted for free-float shares and calculated on a price and total return basis.

Composition and Maintenance

Defining the Investable Universe: Index universe candidates must trade on a major U.S. stock exchange and must be common shares or other securities that have the characteristics of common equities. All classes of common shares, both fully and partially paid, are eligible. Fixed-dividend shares and securities such as convertible notes, warrants, rights, mutual funds, unit investment trusts, closed-end fund shares, and shares in limited partnerships are not eligible. Temporary issues arising from corporate actions, such as “when-issued shares,” are considered on a case-by-case basis when necessary to maintain continuity in a company’s index membership. REITs, listed property trusts (LPTs), and similar real-property-owning pass-through structures taxed as REITs by their domiciles are also eligible. Multiple classes of shares are included if each issue, on its own merit, meets the other eligibility criteria. Securities that have had more than ten nontrading days during the past quarter are excluded.

Stock Selection: The index universe is sorted by float-adjusted market capitalization and the stocks in the top 95% are selected as components of the Dow Jones U.S. IndexSM, excluding stocks that fall within the bottom 1% of the universe according to their free-float market capitalization and within the bottom .01% of the universe according to their turnover. To be included in the Index, the issuer of each component security must be classified in the Real Estate supersector, as defined by the proprietary classification system used by Dow Jones Indexes.

Review Process: The Index is reviewed by Dow Jones on a quarterly basis. Shares outstanding totals for component stocks are updated during each quarterly review. If the number of outstanding shares for an Index component changes by more than 10% due to a corporate action, the shares total will be adjusted immediately after the close of trading on the date of such event. If a change in float-adjusted shares reflects a combination of a share increase (or decrease) and block ownership decrease (or increase), such as a secondary offering (or block purchase), the new total of outstanding shares will be used to calculate the new share blocks. If a block ownership change is part of a float change involving a change in total shares outstanding of less than 10%, the block must increase (or decrease) by at least five percentage points to trigger the adjustment. If the impact of corporate actions during the period between quarterly share updates changes the number of a company’s float-adjusted shares outstanding by 10% or more, the company’s shares and float factor will be updated as soon as prudently possible. In the event that a component no longer meets the eligibility requirements, it will be removed from the Index.

Whenever possible, Dow Jones will announce any such change at least two business days prior to its implementation. Changes in shares outstanding due to stock dividends, splits, and other corporate actions also are adjusted immediately after the close of trading on the day they become effective. Quarterly reviews are implemented during March, June, September, and December. Both component changes and share changes become effective at the opening on the first Monday after the third Friday of the review month. Changes to the Index are implemented after the official closing levels have been established. All adjustments are made before the start of the next trading day. Constituent changes that result from a periodic review will be announced on the second Friday of the third month of each quarter.

In addition to the scheduled quarterly reviews, the Index is reviewed on an ongoing basis. Changes in Index composition and related weight adjustments are necessary whenever there are extraordinary events such as delistings, bankruptcies, mergers, or takeovers involving index components. In these cases, each event will be taken into account as soon as it is effective. Whenever possible, the changes in the Index components will be announced at least two business days prior to their implementation date.

Background on the Dow Jones Indexes Proprietary Industry Classification System

Companies are assigned to industry groups based on the revenues received in their lines of business. Mergers, takeovers, and spinoffs, as well as organic growth in a company’s business segments, can require industry and sector transfers. Stocks in the Dow Jones Global Indexes are categorized into 10 industries, 19 supersectors, 41 sectors and 114 subsectors, as defined by the proprietary classification system used by Dow Jones Indexes. These segments are designed to reflect the risk characteristics of a specific market by grouping together constituents that respond in similar ways to economic, political and environmental factors. The Real Estate supersector is composed of two sectors, the Real Estate Investment & Services sector and the Real Estate Investment Trusts sector, both of which contain subsectors. The Real Estate Investment & Services sector consists of the Real Estate Holding & Development subsector and the Real Estate Services subsector. The Real Estate Investment Trusts sector consists of the Industrial & Office REITs subsector and the Retail REITs subsector.

| Capped Leveraged Index Return Notes® | TS-7 |

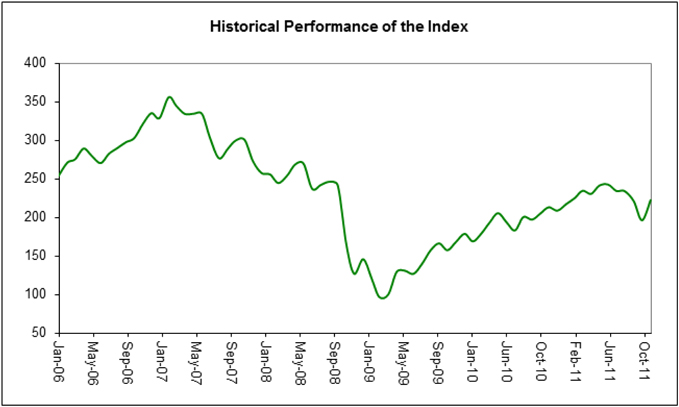

The following graph sets forth the monthly historical performance of the Index in the period from January 2006 to October 2011. This historical data on the Index is not necessarily indicative of the future performance of the Index or what the value of the notes may be. Any historical upward or downward trend in the level of the Index during any period set forth below is not an indication that the level of the Index is more or less likely to increase or decrease at any time over the term of the notes. On November 9, 2011, the closing level of the Index was 212.62.

Before investing in the notes, you should consult publicly available sources for the levels and trading pattern of the Index. The generally unsettled international environment and related uncertainties, including the risk of terrorism, may result in the Index and financial markets generally exhibiting greater volatility than in earlier periods.

License Agreement

We have entered into a non-exclusive license agreement with Dow Jones providing for the license to us and certain of our affiliated or subsidiary companies, in exchange for a fee, of the right to use indices owned and published by Dow Jones (including the Dow Jones U.S. Real Estate IndexSM) in connection with certain securities, including the notes.

The license agreement between us and Dow Jones requires that the following language be stated in this term sheet:

“Dow Jones®” and “Dow Jones US Real Estate IndexSM” are service marks of Dow Jones, have been licensed to CME Indexes and have been sublicensed for use for certain purposes by us. Dow Jones, CME Indexes and their respective affiliates have no relationship to us, other than the licensing of the Dow Jones US Real Estate IndexSM (DJUSRE) and their respective service marks for use in connection with the notes.

Dow Jones, CME Indexes and their respective affiliates do not:

| • | Sponsor, endorse, sell or promote the notes. |

| • | Recommend that any person invest in the notes. |

| • | Have any responsibility or liability for or make any decisions about the timing, amount or pricing of the notes. |

| • | Have any responsibility or liability for the administration, management or marketing of the notes. |

| • | Consider the needs of the notes or the owners of the notes in determining, composing or calculating the DJUSRE or have any obligation to do so. |

DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES WILL NOT HAVE ANY LIABILITY IN CONNECTION WITH THE NOTES. SPECIFICALLY,

| • | DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES DO NOT MAKE ANY WARRANTY, EXPRESS OR IMPLIED, AND DOW JONES, CME INDEXES AND THEIR RESPECTIVE AFFILIATES DISCLAIM ANY WARRANTY ABOUT: |

| • | THE RESULTS TO BE OBTAINED BY THE NOTES, THE OWNER OF THE NOTES OR ANY OTHER PERSON IN CONNECTION WITH THE USE OF THE DJUSRE AND THE DATA INCLUDED IN THE DJUSRE; |

| • | THE ACCURACY OR COMPLETENESS OF THE DJUSRE OR ITS DATA; |

| Capped Leveraged Index Return Notes® | TS-9 |

| • | THE MERCHANTABILITY AND THE FITNESS FOR A PARTICULAR PURPOSE OR USE OF THE DJUSRE OR ITS DATA; |

| • | DOW JONES, CME INDEXES AND/OR THEIR RESPECTIVE AFFILIATES WILL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS OR INTERRUPTIONS IN THE DJUSRE OR ITS DATA; |

| • | UNDER NO CIRCUMSTANCES WILL DOW JONES, CME INDEXES AND/OR THEIR RESPECTIVE AFFILIATES BE LIABLE FOR ANY LOST PROFITS OR INDIRECT, PUNITIVE, SPECIAL OR CONSEQUENTIAL DAMAGES OR LOSSES, EVEN IF THEY KNOW THAT THEY MIGHT OCCUR. |

THE LICENSING RELATING TO THE USE OF THE INDEXES AND TRADEMARKS REFERRED TO ABOVE BY US IS SOLELY FOR THE BENEFIT OF US, AND NOT FOR ANY OTHER THIRD PARTIES.

| Capped Leveraged Index Return Notes® | TS-10 |

Summary Tax Consequences

You should consider the U.S. federal income tax consequences of an investment in the notes, including the following:

| • | You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as single financial contracts with respect to the Index that requires you to pay us at inception an amount equal to the purchase price of the notes and that entitles you to receive at maturity an amount in cash based upon the performance of the Index. |

| • | Under this characterization and tax treatment of the notes, upon receipt of a cash payment at maturity or upon a sale or exchange of the notes prior to maturity, you generally will recognize capital gain or loss. This capital gain or loss generally will be long-term capital gain or loss if you held the notes for more than one year. |

U.S. Federal Income Tax Considerations

Set forth below is a summary of the U.S. federal income tax considerations relating to an investment in the notes. The following summary is not complete and is qualified in its entirety by the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page S-35 of product supplement LIRN-2, which you should carefully review prior to investing in the notes.

General. Although there is no statutory, judicial, or administrative authority directly addressing the characterization of the notes, we intend to treat the notes for all tax purposes as single financial contracts with respect to the Index that requires the investor to pay us at inception an amount equal to the purchase price of the notes and that entitles the investor to receive at maturity an amount in cash based upon the performance of the Index. Under the terms of the notes, we and every investor in the notes agree, in the absence of an administrative determination or judicial ruling to the contrary, to treat the notes as described in the preceding sentence. This discussion assumes that the notes constitute single financial contracts with respect to the Index for U.S. federal income tax purposes. If the notes did not constitute single financial contracts, the tax consequences described below would be materially different. The discussion in this section also assumes that there is a significant possibility of a significant loss of principal on an investment in the notes.

This characterization of the notes is not binding on the Internal Revenue Service (“IRS”) or the courts. No statutory, judicial, or administrative authority directly addresses the characterization of the notes or any similar instruments for U.S. federal income tax purposes, and no ruling is being requested from the IRS with respect to their proper characterization and treatment. Due to the absence of authorities on point, significant aspects of the U.S. federal income tax consequences of an investment in the notes are not certain, and no assurance can be given that the IRS or any court will agree with the characterization and tax treatment described in product supplement LIRN-2. Accordingly, you are urged to consult your tax advisor regarding all aspects of the U.S. federal income tax consequences of an investment in the notes, including possible alternative characterizations.

Settlement at Maturity or Sale or Exchange Prior to Maturity. Assuming that the notes are properly characterized and treated as single financial contracts with respect to the Index for U.S. federal income tax purposes, upon receipt of a cash payment at maturity or upon a sale or exchange of the notes prior to maturity, a U.S. Holder (as defined on page S-36 of product supplement LIRN-2) generally will recognize capital gain or loss equal to the difference between the amount realized and the U.S. Holder’s basis in the notes. This capital gain or loss generally will be long-term capital gain or loss if the U.S. Holder held the notes for more than one year. The deductibility of capital losses is subject to limitations.

Possible Future Tax Law Changes. From time to time, there may be legislative proposals or interpretive guidance addressing the tax treatment of financial instruments such as the notes. We cannot predict the likelihood of any such legislation or guidance being adopted, or the ultimate impact on the notes. For example, on December 7, 2007, the IRS released Notice 2008-2 (“Notice”) seeking comments from the public on the taxation of financial instruments currently taxed as “prepaid forward contracts.” This Notice addresses instruments such as the notes. According to the Notice, the IRS and Treasury are considering whether a holder of an instrument such as the notes should be required to accrue ordinary income on a current basis, regardless of whether any payments are made prior to maturity. It is not possible to determine what guidance the IRS and Treasury will ultimately issue, if any. Any such future guidance may affect the amount, timing, and character of income, gain, or loss in respect of the notes, possibly with retroactive effect. The IRS and Treasury are also considering additional issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax on any deemed income accruals, whether Section 1260 of the Internal Revenue Code of 1986, as amended, concerning certain “constructive ownership transactions,” generally applies or should generally apply to such instruments, and whether any of these determinations depend on the nature of the underlying asset. We urge you to consult your own tax advisors concerning the impact and the significance of the above considerations. We intend to continue treating the notes for U.S. federal income tax purposes in the manner described herein unless and until such time as we determine, or the IRS or Treasury determines, that some other treatment is more appropriate.

Additional Medicare Tax on Unearned Income. With respect to taxable years beginning after December 31, 2012, certain U.S. Holders, including individuals, estates, and trusts, will be subject to an additional 3.8% Medicare tax on unearned income. For individual U.S. Holders, the additional Medicare tax applies to the lesser of (i) “net investment income,” or (ii) the excess of “modified adjusted gross income” over $200,000 ($250,000 if married and filing jointly or $125,000 if married and filing separately). “Net investment income” generally equals the taxpayer’s gross investment income reduced by the deductions that are allocable to such income. Investment income generally includes passive income such as interest, dividends, annuities, royalties, rents, and capital gains. U.S. Holders are urged to consult their own tax advisors regarding the implications of the additional Medicare tax resulting from an investment in the notes.

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. See the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page S-35 of product supplement LIRN-2.

| Capped Leveraged Index Return Notes® | TS-11 |

Additional Terms

You should read this term sheet, together with the documents listed below, which together contain the terms of the notes and supersede all prior or contemporaneous oral statements as well as any other written materials. You should carefully consider, among other things, the matters set forth under “Risk Factors” and “Additional Risk Factor” in the sections indicated on the cover of this term sheet. The notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

You may access the following documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| § | Product supplement LIRN-2 dated April 21, 2009: |

http://www.sec.gov/Archives/edgar/data/70858/000095014409003415/g18702p2e424b5.htm

| § | Series L MTN prospectus supplement dated April 21, 2009 and prospectus dated April 20, 2009: |

http://www.sec.gov/Archives/edgar/data/70858/000095014409003387/g18667b5e424b5.htm

Our Central Index Key, or CIK, on the SEC Website is 70858.

We have filed a registration statement (including a product supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the product supplement, the prospectus supplement, and the prospectus in that registration statement, and the other documents relating to this offering that we have filed with the SEC for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, we, any agent, or any dealer participating in this offering will arrange to send you the Note Prospectus if you so request by calling MLPF&S toll-free at 1-866-500-5408.

MLPF&S classifies certain market-linked investments (the “Market-Linked Investments”) into categories, each with different investment characteristics. The following description is meant solely for informational purposes and is not intended to represent any particular Enhanced Return Market-Linked Investment or guarantee any performance.

Enhanced Return Market-Linked Investments are short- to medium-term investments that offer you a way to enhance exposure to a particular market view without taking on a similarly enhanced level of market downside risk. They can be especially effective in a flat to moderately positive market (or, in the case of bearish investments, a flat to moderately negative market). In exchange for the potential to receive better-than market returns on the linked asset, you must generally accept a degree of market downside risk and capped upside potential. As these investments are not market downside protected, and do not assure full repayment of principal at maturity, you need to be prepared for the possibility that you may lose all or part of your investment.

“Leveraged Index Return Notes®” and “LIRNs®” are our registered service marks.

| Capped Leveraged Index Return Notes® | TS-12 |