Filed Pursuant to Rule 433

Registration No. 333-158663

Subject to Completion

Preliminary Term Sheet dated January 27, 2012

The notes are being issued by Bank of America Corporation (“BAC”). There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk Factors” and “Additional Risk Factors” on page TS-5 of this term sheet and beginning on page S-10 of product supplement ARN-3.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit |

Total |

|||||||||

| Public offering price (1)(2) |

$10.00 | $ | ||||||||

| Underwriting discount (1)(2) |

$0.20 | $ | ||||||||

| Proceeds, before expenses, to BAC |

$9.80 | $ | ||||||||

| (1) | For any purchase of 500,000 units or more in a single transaction by an individual investor, the public offering price and the underwriting discount will be $9.95 per unit and $0.15 per unit, respectively. |

| (2) | For any purchase by certain fee-based trusts and discretionary accounts managed by U.S. Trust operating through Bank of America, N.A., the public offering price and underwriting discount will be $9.80 per unit and $0.00 per unit, respectively. |

The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

Merrill Lynch & Co.

February , 2012

Units $10 principal amount per unit CUSIP No. Pricing Date* February , 2012 Settlement Date* March , 2012 Maturity Date* May , 2013 *Subject to change based on the actual date the notes are priced for initial sale to the public (the “pricing date”) Accelerated Return Notes® Linked to the Silver Spot Price Maturity of approximately 14 months 3-to-1 upside exposure to increases in the Silver Spot Price, subject to a capped return of 18% to 22% 1-to-1 downside exposure to decreases in the Silver Spot Price, with 100% of your investment at risk All payments at maturity subject to the credit risk of Bank of America Corporation No periodic interest payments Limited secondary market liquidity, with no exchange listing

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

Summary

The Accelerated Return Notes® Linked to the Silver Spot Price due May , 2013 (the “notes”) are our senior unsecured debt securities. The notes are not guaranteed or insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally with all of our other unsecured and unsubordinated debt. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BAC. The notes provide you with a leveraged return, subject to a cap, if the Ending Value (as determined below) of the Silver Spot Price is greater than the Starting Value. If the Ending Value is less than the Starting Value, you will lose all or a portion of the principal amount of your notes.

The terms and risks of the notes are contained in this term sheet and the documents listed below (together, the “Note Prospectus”). The documents have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated below or obtained from MLPF&S by calling 1-866-500-5408:

| § | Product supplement ARN-3 dated April 1, 2010: |

http://www.sec.gov/Archives/edgar/data/70858/000119312510075888/d424b5.htm

| § | Series L MTN prospectus supplement dated April 21, 2009 and prospectus dated April 20, 2009: |

http://www.sec.gov/Archives/edgar/data/70858/000095014409003387/g18667b5e424b5.htm

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set forth in ARN-3. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BAC.

| Accelerated Return Notes® | TS-2 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

Investor Considerations

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

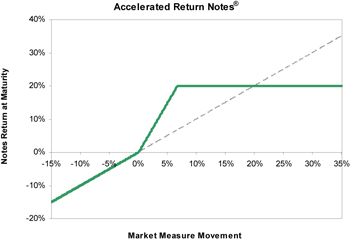

Hypothetical Payout Profile

The below graph is based on hypothetical numbers and values.

|

This graph reflects the returns on the notes, based on the Participation Rate of 300% and a Capped Value of $12.00, the midpoint of the Capped Value range of $11.80 to $12.20. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in silver, as measured by the Silver Spot Price.

This graph has been prepared for purposes of illustration only. |

| Accelerated Return Notes® | TS-3 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

Hypothetical Payments at Maturity

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. The actual amount you receive and the resulting total rate of return will depend on the actual Starting Value, Ending Value, Capped Value and the term of your investment.

The following table is based on a Starting Value of 100, the Participation Rate of 300% and a Capped Value of $12.00 per unit. It illustrates the effect of a range of Ending Values on the Redemption Amount per unit of the notes and the total rate of return to holders of notes. The following examples do not take into account any tax consequences from investing in the notes.

| Ending Value |

Percentage Change from Value to the Ending Value |

Redemption |

Total Rate | |||||||||||||||

| 50.00 | -50.00 | % | $5.00 | -50.00 | % | |||||||||||||

| 60.00 | -40.00 | % | $6.00 | -40.00 | % | |||||||||||||

| 70.00 | -30.00 | % | $7.00 | -30.00 | % | |||||||||||||

| 80.00 | -20.00 | % | $8.00 | -20.00 | % | |||||||||||||

| 90.00 | -10.00 | % | $9.00 | -10.00 | % | |||||||||||||

| 95.00 | -5.00 | % | $9.50 | -5.00 | % | |||||||||||||

| 97.50 | -2.50 | % | $9.75 | -2.50 | % | |||||||||||||

| 100.00 | (1) | 0.00 | % | $10.00 | 0.00 | % | ||||||||||||

| 102.00 | 2.00 | % | $10.60 | 6.00 | % | |||||||||||||

| 105.00 | 5.00 | % | $11.50 | 15.00 | % | |||||||||||||

| 107.00 | 7.00 | % | $12.00 | (2) | 20.00 | % | ||||||||||||

| 110.00 | 10.00 | % | $12.00 | 20.00 | % | |||||||||||||

| 120.00 | 20.00 | % | $12.00 | 20.00 | % | |||||||||||||

| 130.00 | 30.00 | % | $12.00 | 20.00 | % | |||||||||||||

| 137.00 | 37.00 | % | $12.00 | 20.00 | % | |||||||||||||

| 140.00 | 40.00 | % | $12.00 | 20.00 | % | |||||||||||||

| 150.00 | 50.00 | % | $12.00 | 20.00 | % | |||||||||||||

| (1) | The hypothetical Starting Value of 100 used in these examples has been chosen for illustrative purposes only, and does not represent a likely Starting Value for the Market Measure. The actual Starting Value will be determined after the expiration of the Starting Value Determination Period. |

| (2) | The Redemption Amount per unit cannot exceed the hypothetical Capped Value. |

For recent actual levels of the Silver Spot Price, see “The Silver Spot Price” section below. In addition, all payments on the notes are subject to issuer credit risk.

Redemption Amount Calculation Examples

Example 1

The Ending Value is 80, or 80% of the Starting Value:

Starting Value: 100

Ending Value: 80

| $10 × |

( | 80 | ) | = $8.00 Redemption Amount per unit | ||||||||||||

| 100 |

Example 2

The Ending Value is 103, or 103% of the Starting Value:

Starting Value: 100

Ending Value: 103

| $10 + |

[ | $10 × 300% × | ( | 103 – 100 | ) | ] | = $10.90 Redemption Amount per unit | |||||||||||

| 100 |

Example 3

The Ending Value is 130, or 130% of the Starting Value:

Starting Value: 100

Ending Value: 130

| $10 + |

[ | $10 × 300% × | ( | 130 – 100 | ) | ] | = $19.00, however, because the Redemption Amount for the notes cannot exceed the Capped Value, the Redemption Amount will be $12.00 | |||||||||||

| 100 |

| Accelerated Return Notes® | TS-4 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Additional Risk Factors” section below and the “Risk Factors” sections beginning on page S-10 of product supplement ARN-3 and page S-4 of the MTN prospectus supplement, and page 8 of the prospectus identified above under “Summary.” We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| § | Depending on the performance of the Silver Spot Price measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

| § | Your yield may be less than the yield on a conventional debt security of comparable maturity. |

| § | Payments on the notes are subject to our credit risk, and actual or perceived changes in our credit worthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. |

| § | Your investment return, if any, is limited to the return represented by the Capped Value and may be less than a comparable investment directly in silver, as measured by the Silver Spot Price. |

| § | The price at which you may sell the notes in any secondary market may be lower than the price you paid for the notes due to, among other things, the inclusion of fees charged for developing, hedging and distributing of the notes, as described on page TS-8 and various credit, market and economic factors that interrelate in complex and unpredictable ways. |

| § | A trading market is not expected to develop for the notes. MLPF&S is not obligated to make a market for, or to repurchase, the notes. |

| § | Our business activities as a full service financial institution, including our commercial and investment banking activities, our hedging and trading activities (including trades in silver or related futures contracts) and any hedging and trading activities we engage in for our clients’ accounts, may affect the market value of the notes and their return and may create conflicts of interest with you. |

| § | Ownership of the notes will not entitle you to any rights with respect to silver or any related futures contracts. |

| § | Suspensions or disruptions of trading in silver and related futures contracts may adversely affect the value of the notes. |

| § | The notes will not be regulated by the U.S. Commodity Futures Trading Commission. |

| § | There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page S-43 of product supplement ARN-3. |

Additional Risk Factors

The Starting Value will be determined after the pricing date of the notes.

The Starting Value of the Market Measure will be determined based on the lowest level of the Silver Spot Price during the Starting Value Determination Period. As a result, the Starting Value will not be determined, and neither you nor we can be certain of what the Starting Value will be until after the pricing date.

There are risks with investing in silver or silver-linked notes.

The Silver Spot Price is derived from a principals’ market which operates as an over-the-counter physical commodity market. Certain features of U.S. futures markets are not present in the context of trading on such principals’ markets. For example, there are no daily price limits, which would otherwise restrict the extent of daily fluctuations in the prices of the commodities in such markets. In a declining market, therefore, it is possible that prices would continue to decline without limitation within a trading day or over a period of trading days.

Silver prices are subject to volatile price movements over short periods of time and are affected by numerous factors. These include economic factors, including the structure of and confidence in the global monetary system, expectations of the future rate of inflation, the relative strength of, and confidence in, the U.S. dollar (the currency in which the price of silver is generally quoted), interest rates, and global or regional economic, financial, political, regulatory, judicial, or other events. Silver prices may also be affected by industry factors such as industrial and jewelry demand, sales and purchases of silver by the official sector, including central banks and other governmental agencies and multilateral institutions which hold silver, levels of silver production and production costs in countries where silver is mined, such as Mexico and Peru, and short-term changes in supply and demand because of trading activities in the silver market. It is not possible to predict the aggregate effect of all or any combination of these factors.

The market value of the notes may be affected by price movements in distant-delivery futures contracts associated with the Silver Spot Price.

The price movements in the Silver Spot Price may not be reflected in the market value of the notes. If you are able to sell your notes, the price you receive could be affected by changes in the values of futures contracts for silver which have more distant delivery dates than the Silver Spot Price. The prices for these distant-delivery futures contracts may not increase to the same extent as the Silver Spot Price, or may decrease to a greater extent, which may adversely affect the value of the notes.

Changes in the methodology used to calculate the Silver Spot Price or changes in laws or regulations may affect the value of the notes.

Members of the London Bullion Market Association (the “LBMA”) set the Silver Spot Price and may adjust the determination of the Silver Spot Price in a way that adversely affects the value of the notes. In setting the Silver Spot Price, these members have no obligation to consider your interests. The LBMA may from time to time change any rule or bylaw or take emergency action under its rules, any of which could affect the Silver Spot Price. Any change of this kind could cause a decrease in the Silver Spot Price, which would adversely affect the value of the notes.

| Accelerated Return Notes® | TS-5 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

In addition, the price of silver could be adversely affected by the promulgation of new laws or regulations or by the reinterpretation of existing laws or regulations (including, without limitation, those relating to taxes and duties on commodities or commodity components) by one or more governments, governmental agencies or instrumentalities, courts, or other official bodies. Any event of this kind could adversely affect the Silver Spot Price and, as a result, could adversely affect the value of the notes.

Other Terms of the Notes

Occurrence of a Market Disruption Event during the Starting Value Determination Period

If a Market Disruption Event occurs on any Market Measure Business Day during the Starting Value Determination Period (any such day being a “Market Disruption Day”), the calculation agent will establish the Silver Spot Price for such Market Disruption Day as follows:

| § | The closing level of the Silver Spot Price for the applicable Market Disruption Day will be disregarded, except as set forth below. |

| § | Notwithstanding the foregoing, if a Market Disruption Event occurs for three consecutive scheduled Market Measure Business Days during the Starting Value Determination Period, then the Silver Spot Price on the first such Market Disruption Day will be determined (or, if not determinable, estimated) by the calculation agent in a manner which the calculation agent considers commercially reasonable under the circumstances on the third of those Market Disruption Days. |

| § | If a Market Disruption Event occurs on the final date of the Starting Value Determination Period, then the Silver Spot Price for that day will be the Silver Spot Price on the first scheduled Market Measure Business Day thereafter, provided that no Market Disruption Event occurs or is continuing on that day. If a market Disruption Event occurs on the final date of the Starting Value Determination Period and on the first two scheduled Market Measure Business Days thereafter, the calculation agent will determine or, if not determinable, estimate the Silver Spot Price as of that final date on the second scheduled Market Measure Business Day after that final date. |

The provisions of this section supersede and replace the definitions of “Market Measure Business Day” and “Market Disruption Event” set forth in product supplement ARN-3.

Market Measure Business Day

A “Market Measure Business Day” means a day on which the Silver Spot Price or any successor thereto is determined and published.

Market Disruption Event

A “Market Disruption Event” means any of the following events, as determined by the calculation agent:

(A) the suspension of or material limitation on trading in silver, or futures contracts or options related to silver, on the Relevant Market (as defined below);

(B) the failure of trading to commence, or permanent discontinuance of trading, in silver, or futures contracts or options related to silver, on the Relevant Market;

(C) the failure of the LBMA (as defined above) to calculate or publish the official fixing price of silver for that day (or the information necessary for determining the official fixing prices); or

(D) any other event, if the calculation agent determines in its sole discretion that the event materially interferes with our ability or the ability of any of our affiliates to unwind all or a material portion of a hedge that we or our affiliates have effected or may effect as to the notes.

For the purpose of determining whether a Market Disruption Event has occurred:

(A) a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular trading hours of the Relevant Market; and

(B) a suspension of or material limitation on trading in the Relevant Market will not include any time when trading is not conducted or prices are not quoted by the LBMA in the Relevant Market under ordinary circumstances.

Relevant Market

“Relevant Market” means the market in London on which members of the LBMA, or any successor thereto, quote prices for the buying and selling of silver, or if such market is no longer the principal trading market for silver or options or futures contracts for silver, such other exchange or principal trading market for silver as determined in good faith by the calculation agent which serves as the source of prices for silver, and any principal exchanges where options or futures contracts on silver are traded.

| Accelerated Return Notes® | TS-6 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

The Silver Spot Price

The Silver Spot Price is a benchmark price used in the markets where silver is sold. The Silver Spot Price is the official silver U.S. cents fixing per troy ounce of silver determined by three market-making members of the LBMA. The three current members meet by telephone each London business day at 12:00 P.M. London time to determine the Silver Spot Price. Currently, the three members are The Bank of Nova Scotia — ScotiaMocatta, Deutsche Bank AG, London branch, and HSBC Bank USA, N.A., London branch. The Silver Spot Price is published by Bloomberg, L.P. (“Bloomberg”) under the symbol SLVRLN.

The London bullion market is an OTC market, as opposed to an exchange-traded environment. Members of the London bullion market typically trade with each other and with their clients on a principal-to-principal basis. All risks, including those of credit, are between the two parties to a transaction.

An investment in the notes does not entitle you to any ownership interest, either directly or indirectly, in silver or in any silver transaction traded on the London bullion market.

The notes are not sponsored, endorsed, sold, or promoted by the LBMA. The LBMA takes no responsibility for the accuracy and/or the completeness of information provided in this term sheet, the accompanying product supplement, the accompanying prospectus supplement, or the prospectus. In addition, the LBMA is not responsible for and has not participated in the determination of the timing of the sale of the notes, prices at which the notes are to initially be sold, or the quantities of the notes to be issued or in the determination or calculation of the amount payable on maturity. The LBMA has no obligation in connection with the administration, marketing, or trading of the notes.

The following graph sets forth the monthly historical performance of the Silver Spot Price in the period from January 2007 through December 2011. We obtained this historical data from Bloomberg L.P. We make no representation or warranty as to the accuracy or completeness of the information from Bloomberg L.P. On January 23, 2012, the Silver Spot Price was 3,245.00.

This historical data on the Silver Spot Price is not necessarily indicative of the future performance of the Silver Spot Price or what the value of the notes may be. Any historical upward or downward trend in the Silver Spot Price during any period set forth above is not an indication that the Silver Spot Price is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels and trading pattern of the Silver Spot Price.

| Accelerated Return Notes® | TS-7 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

Supplement to the Plan of Distribution

We may deliver the notes against payment therefor in New York, New York on a date that is greater than three business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the notes occurs more than three business days from the pricing date, purchasers who wish to trade the notes more than three business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units.

MLPF&S will not receive an underwriting discount for notes sold to certain fee-based trusts and fee-based discretionary accounts managed by U.S. Trust operating through Bank of America, N.A.

If you place an order to purchase the notes, you are consenting to MLPF&S acting as a principal in effecting the transaction for your account.

MLPF&S may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices. MLPF&S may act as principal or agent in these market-making transactions; however it is not obligated to engage in any such transactions.

Role of MLPF&S and Conflicts of Interest

MLPF&S, a broker-dealer subsidiary of BAC, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of Rule 5121 applicable to FINRA members. MLPF&S may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

Under our distribution agreement with MLPF&S, MLPF&S will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount. The public offering price includes, in addition to the underwriting discount, a charge of approximately $0.075 per unit. This charge reflects an estimated profit earned by MLPF&S from transactions through which the notes are structured and resulting obligations hedged. The fees charged reduce the economic terms of the notes. Actual profits or losses from these hedging transactions may be more or less than this amount. In entering into the hedging arrangements for the notes, we seek competitive terms and may enter into hedging transactions with a division of MLPF&S or one of our subsidiaries or affiliates. For further information regarding these charges, our trading and hedging activities and conflicts of interest, see “Risk Factors – General Risks Relating to ARNs,” beginning on page S-10 and “Use of Proceeds” on page S-21 in product supplement ARN-3.

| Accelerated Return Notes® | TS-8 |

| Accelerated Return Notes® Linked to the Silver Spot Price, due May , 2013 |

|

Summary Tax Consequences

You should consider the U.S. federal income tax consequences of an investment in the notes, including the following:

| • | There is no statutory, judicial, or administrative authority directly addressing the characterization of the notes. |

| • | You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as a single financial contract with respect to the Silver Spot Price. |

| • | Under this characterization and tax treatment of the notes, a U.S. Holder (as defined on page S-44 of product supplement ARN-3) generally will recognize capital gain or loss upon maturity or upon a sale or exchange of the notes prior to maturity. This capital gain or loss generally will be long-term capital gain or loss if you held the notes for more than one year. |

| • | No assurance can be given that the IRS or any court will agree with this characterization and tax treatment. |

| • | With respect to taxable years beginning after December 31, 2012, certain U.S. Holders, including individuals, estates and trusts, will be subject to an additional 3.8% Medicare tax on unearned income. For individual U.S. Holders, the additional Medicare tax applies to the lesser of (i) “net investment income,” or (ii) the excess of “modified adjusted gross income” over $200,000 ($250,000 if married and filing jointly or $125,000 if married and filing separately). “Net investment income” generally equals the taxpayer’s gross investment income reduced by the deductions that are allocable to such income. Investment income generally includes passive income such as interest, dividends, annuities, royalties, rents, and capital gains. |

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. See the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page S-43 of product supplement ARN-3.

Where You Can Find More Information

We have filed a registration statement (including a product supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the Note Prospectus, including this term sheet, and the other documents that we have filed with the SEC, for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, we, any agent, or any dealer participating in this offering will arrange to send you these documents if you so request by calling MLPF&S toll-free at 1-866-500-5408.

MLPF&S classifies certain market-linked investments (the “Market-Linked Investments”) into categories, each with different investment characteristics. The following description is meant solely for informational purposes and is not intended to represent any particular Enhanced Return Market-Linked Investment or guarantee any performance.

Enhanced Return Market-Linked Investments are short- to medium-term investments that offer you a way to enhance exposure to a particular market view without taking on a similarly enhanced level of market downside risk. They can be especially effective in a flat to moderately positive market (or, in the case of bearish investments, a flat to moderately negative market). In exchange for the potential to receive better-than market returns on the linked asset, you must generally accept market downside risk and capped upside potential. As these investments are not market downside protected, and do not assure full repayment of principal at maturity, you need to be prepared for the possibility that you may lose all or part of your investment.

“Accelerated Return Notes®” and “ARNs®” are our registered service marks.

| Accelerated Return Notes® | TS-9 |