Filed Pursuant to Rule 433

Registration No. 333-180488

Subject to Completion

Preliminary Term Sheet dated April 4, 2012

The notes are being offered by Bank of America Corporation (“BAC”). The notes will have the terms specified in this term sheet as supplemented by the documents indicated below under “Additional Terms” (together, the “Note Prospectus”). Investing in the notes involves a number of risks. There are important differences between the notes and a conventional debt security, including different investment risks. See “Risk Factors” and “Additional Risk Factors” beginning on page TS-4 of this term sheet and “Risk Factors” beginning on page S-10 of product supplement STR-3. The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

In connection with this offering, Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) is acting in its capacity as principal for your account.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit |

Total |

|||||||||

| Public offering price (1) |

$10.000 | $ | ||||||||

| Underwriting discount (1) |

$0.125 | $ | ||||||||

| Proceeds, before expenses, to BAC |

$9.875 | $ | ||||||||

| (1) | The public offering price and underwriting discount for any purchase of 500,000 or more units in a single transaction by an individual investor will be $9.975 per unit and $0.10 per unit, respectively. The public offering price and underwriting discount for any purchase by certain fee-based trusts and fee-based discretionary accounts managed by U.S. Trust operating through Bank of America, N.A. will be $9.875 per unit and $0.00 per unit, respectively. |

*Depending on the date the notes are priced for initial sale to the public (the “pricing date”), any reference in this term sheet to the month in which the pricing date, settlement date, the Observation Date, or the maturity date will occur is subject to change.

| Merrill Lynch & Co.

|

| |||

| April , 2012 |

Units

Strategic Accelerated Redemption Securities®

Linked to the Platinum Futures Contract,

due December , 2012

$10 principal amount per unit

Term Sheet No.

Pricing Date* April , 2012 Settlement Date* May , 2012 Maturity Date* December , 2012 CUSIP No.

Strategic Accelerated Redemption Securities®

The notes have a maturity of approximately eight months

The notes will be called at $10 per unit plus a Call Premium of between 7% and 11% if the price of the Platinum Futures Contract on the Observation Date is equal to or greater than 100% of its Starting Value

1-to-1 downside exposure to decreases in the price of the Platinum Futures Contract

Payments on the notes are subject to the credit risk of Bank of America Corporation

No periodic interest payments

No listing on any securities exchange

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

Summary

The Strategic Accelerated Redemption Securities® Linked to the Platinum Futures Contract, due December , 2012 (the “notes”), are our senior unsecured debt securities. The notes are not guaranteed or insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally with all of our other unsecured and unsubordinated debt, and any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BAC.

The notes have only one Observation Date, which will occur approximately eight months after the pricing date. The notes provide for an automatic call if the Observation Level of the Platinum Futures Contract (as defined and described below) on the Observation Date is equal to or greater than the Call Level. If the notes are called on the Observation Date, you will receive on the Call Settlement Date an amount per unit (the “Call Amount”) equal to the Original Offering Price of the notes plus the Call Premium. The Call Settlement Date for the Observation Date will be the maturity date. If your notes are not called, the amount you receive on the maturity date (the “Redemption Amount”) will be less than the Original Offering Price per unit and will be based on the percentage decrease in the price of the Platinum Futures Contract from the Starting Value to the Ending Value. Investors must be willing to forgo interest payments on the notes and be willing to accept a repayment that may be less, and potentially significantly less, than the Original Offering Price of the notes.

Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement STR-3. Unless otherwise indicated or unless the context requires otherwise, all references in this term sheet to “we,” “us,” “our,” or similar references are to BAC.

| Strategic Accelerated Redemption Securities® | TS-2 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

Hypothetical Payments

Set forth below are two hypothetical examples of payment calculations (rounded to two decimal places). These examples have been prepared for purposes of illustration only. Your actual return will depend on the actual Starting Value and Threshold Value, Call Level, Observation Level, Call Premium, and term of your investment. These hypothetical examples are based on:

| 1) | a Starting Value and Threshold Value of 100.00; |

| 2) | a Call Level of 100.00, or 100% of the Starting Value; |

| 3) | a term of the notes of approximately eight months; |

| 4) | a Call Premium of 9% of the Original Offering Price per unit, the midpoint of the Call Premium range of 7% to 11%; and |

| 5) | an Observation Date occurring approximately eight months after the pricing date. |

The hypothetical Starting Value of 100 used in these examples has been chosen for illustrative purposes only, and does not represent a likely actual Starting Value of the Platinum Futures Contract. For recent actual values of the Platinum Futures Contract, see “The Platinum Futures Contract” section below, beginning on page TS-7.

Notes Are Called on the Observation Date

The notes will be called at $10.00 plus the Call Premium on the Observation Date if the Observation Level is equal to or greater than the Call Level.

Example 1 — The Observation Level on the Observation Date is 115.00. Therefore, the notes will be called at $10.00 plus the Call Premium of $0.90, or $10.90 per unit.

Notes Are Not Called on the Observation Date

Example 2 — The notes are not called on the Observation Date and the Ending Value is less than the Threshold Value. The Redemption Amount will be less, and possibly significantly less, than the Original Offering Price per unit. For example, if the Ending Value is 85.00, the Redemption Amount will be:

| $10 + |

[ | $10 × | ( | 85.00 – 100.00 | ) | ] | = $8.50 per unit | |||||||||||||

| 100.00 |

| Summary of the Hypothetical Examples |

Notes Are Called on the Observation Date |

Notes Are Not Called on the Observation Date | ||

| Example 1 | Example 2 | |||

| Starting Value | 100.00 | 100.00 | ||

| Call Level | 100.00 | 100.00 | ||

| Threshold Value | 100.00 | 100.00 | ||

| Observation Level/Ending Value | 115.00 | 85.00 | ||

| Return of the Platinum Futures Contract | 15.00% | -15.00% | ||

| Return of the Notes | 9.00% | -15.00% | ||

| Redemption Amount per Unit | $10.90 | $8.50 | ||

| Strategic Accelerated Redemption Securities® | TS-3 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. The following is a list of certain of the risks involved in investing in the notes. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page S-10 of product supplement STR-3, page S-5 of the MTN prospectus supplement, and page 8 of the prospectus identified below under “Additional Terms.” We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| § | If the notes are not called, your investment will result in a loss; there is no guaranteed return of principal. |

| § | Your return, if any, is limited to the return represented by the Call Premium. |

| § | Your yield may be less than the yield on a conventional debt security of comparable maturity. |

| § | Your investment return may be less than the return on a comparable investment directly in the Platinum Futures Contract. |

| § | You must rely on your own evaluation of the merits of an investment linked to the price of the Platinum Futures Contract. |

| § | Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. |

| § | If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for the notes due to, among other things, the inclusion of fees charged for developing, hedging and distributing the notes, as described on page TS-6 and various credit, market and economic factors that interrelate in complex and unpredictable ways. |

| § | A trading market is not expected to develop for the notes. MLPF&S is not obligated to make a market for, or to repurchase, the notes. |

| § | The amount that you receive at maturity will not reflect changes in the price of the Platinum Futures Contract other than on the Observation Date. |

| § | Ownership of the notes will not entitle you to any rights with respect to platinum or any related futures contracts. |

| § | If you attempt to sell the notes prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the Original Offering Price. |

| § | The price of the Platinum Futures Contract may change unpredictably, affecting the value of the notes in unforeseeable ways. |

| § | Suspensions or disruptions of trading in platinum and related futures contracts may adversely affect the value of the notes. |

| § | The notes will not be regulated by the U.S. Commodity Futures Trading Commission. |

| § | Trading by us and our affiliates in related futures and options contracts may affect your return. |

| § | Our trading and hedging activities may create conflicts of interest with you. |

| § | Our hedging activities may affect your return on the notes and their market value. |

| § | There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” and “Material U.S. Federal Income Tax Considerations” below and “U.S. Federal Income Tax Summary” beginning on page S-45 of product supplement STR-3. |

Additional Risk Factors

The price movements in the Platinum Futures Contract may not correlate with changes in platinum’s spot price.

The Platinum Futures Contract is a futures contract for platinum that trades on the NYMEX. Unlike equities, which typically entitle the holder to a continuing stake in a corporation, a commodity futures contract is typically an agreement to buy a set amount of an underlying physical commodity at a predetermined price during a stated delivery period. A futures contract reflects the expected value of the underlying physical commodity upon delivery in the future. In contrast, the underlying physical commodity’s current or “spot” price reflects the immediate delivery value of the commodity.

The notes are linked to the Platinum Futures Contract and not to the spot price of platinum, and an investment in the notes is not the same as buying and holding platinum. While price movements in the Platinum Futures Contract may correlate with changes in platinum’s spot price, the correlation will not be perfect and price movements in the spot market for platinum may not be reflected in the futures market (and vice versa). Accordingly, an increase in the spot price of platinum may not result in an increase in the price of the Platinum Futures Contract. The Platinum Futures Contract price may decrease while the spot price for platinum remains stable or increases, or does not decrease to the same extent.

There are risks associated with investing in platinum or platinum-linked notes.

Platinum prices are primarily responsive to global supply and demand. Key factors that may influence prices are the policies in or political stability of the most important producing countries, in particular, Russia and South Africa (which together account for over 85% of mine production), the size and availability platinum stockpiles, as well as economic conditions in the countries that are the principal consumers of platinum, including the United States and China. Demand for platinum from the automotive industry, which uses platinum in catalytic converters, accounts for the majority of the industrial use of platinum. The primary non-industrial demand for platinum comes from jewelry. Accordingly, reduced demand in these and other industries in which platinum is used could reduce the value of the notes.

| Strategic Accelerated Redemption Securities® | TS-4 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

The market value of the notes may be affected by price movements in distant-delivery futures contracts associated with the Platinum Futures Contract.

The price movements in the Platinum Futures Contract may not be reflected in the market value of the notes. If you are able to sell your notes, the price you receive could be affected by changes in the values of futures contracts on platinum or similar underlying commodities that have more distant delivery dates than the Platinum Futures Contract. The prices for these distant-delivery futures contracts may not increase to the same extent as the prices of the Platinum Futures Contract, or may decrease to a greater extent, which may adversely affect the value of the notes.

The policies of the NYMEX are subject to change, in a manner which may reduce the value of the notes.

The policies of the NYMEX concerning the manner in which the price of platinum is calculated may change in the future. The NYMEX is not our affiliate, and we have no ability to control or predict the actions of the NYMEX. The NYMEX may also from time to time change its rules or bylaws or take emergency action under its rules. The NYMEX may discontinue or suspend calculation or dissemination of information relating to the Platinum Futures Contract. Any such actions could affect the price of the Platinum Futures Contract, and therefore, the value of the notes.

Investor Considerations

Other Terms of the Notes

The provisions of this section supersede and replace the definition of “Market Disruption Event” set forth in product supplement STR-3.

Market Disruption Event

A “Market Disruption Event” means any of the following events, as determined in good faith by the calculation agent:

| (A) | the suspension of or material limitation on trading in platinum, or futures contracts or options related to platinum, on the Relevant Market (as defined below); |

| (B) | the failure of trading to commence, or permanent discontinuance of trading, in platinum, or futures contracts or options related to platinum, on the Relevant Market; |

| (C) | the failure of the NYMEX (as defined above) to calculate or publish the official settlement price of platinum for that day (or the information necessary for determining the official settlement prices); or |

| (D) | any other event, if the calculation agent determines in its sole discretion that the event materially interferes with our ability or the ability of any of our affiliates to unwind all or a material portion of a hedge that we or our affiliates have effected or may effect as to the notes. |

| Strategic Accelerated Redemption Securities® | TS-5 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

For the purpose of determining whether a Market Disruption Event has occurred:

| (A) | a limitation on the hours in a trading day and/or number of days of trading will not constitute a Market Disruption Event if it results from an announced change in the regular trading hours of the Relevant Market; and |

| (B) | a suspension of or material limitation on trading in the Relevant Market will not include any time when trading is not conducted or prices are not quoted by NYMEX in the Relevant Market under ordinary circumstances. |

Relevant Market

As used herein, “Relevant Market” means the market on which members of the NYMEX, or any successor thereto, quote prices for the buying and selling of platinum, or if such market is no longer the principal trading market for platinum or options or futures contracts for platinum, such other exchange or principal trading market for platinum as determined in good faith by the calculation agent which serves as the source of prices for platinum, and any principal exchanges where options or futures contracts on platinum are traded.

Supplement to the Plan of Distribution; Role of MLPF&S and Conflicts of Interest

We may deliver the notes against payment therefor in New York, New York on a date that is greater than three business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the notes occurs more than three business days from the pricing date, purchasers who wish to trade the notes more than three business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering, the notes will be sold in minimum investment amounts of 100 units.

MLPF&S, a broker-dealer subsidiary of BAC, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of Rule 5121 applicable to FINRA members. MLPF&S may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

Under our distribution agreement with MLPF&S, MLPF&S will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount. The public offering price includes, in addition to the underwriting discount, a charge of approximately $0.075 per unit, reflecting an estimated profit earned by MLPF&S from transactions through which the notes are structured and resulting obligations hedged. Actual profits or losses from these hedging transactions may be more or less than this amount. In entering into the hedging arrangements for the notes, we seek competitive terms and may enter into hedging transactions with MLPF&S or another of our affiliates.

All charges related to the notes, including the underwriting discount and the hedging related costs and charges, reduce the economic terms of the notes. For further information regarding these charges, our trading and hedging activities and conflicts of interest, see “Risk Factors — General Risks Relating to the Notes” beginning on page S-10 and “Use of Proceeds” on page S-23 in product supplement STR-3.

MLPF&S will not receive an underwriting discount for notes sold to certain fee-based trusts and fee-based discretionary accounts managed by U.S. Trust operating through Bank of America, N.A.

If you place an order to purchase the notes, you are consenting to MLPF&S acting as a principal in effecting the transaction for your account.

MLPF&S may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices. MLPF&S may act as principal or agent in these market-making transactions; however it is not obligated to engage in any such transactions.

| Strategic Accelerated Redemption Securities® | TS-6 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

The Platinum Futures Contract

We have derived all information regarding the Platinum Futures Contract and the NYMEX from publicly available sources. This information reflects the policies of, and is subject to change without notice by, NYMEX. The consequences of NYMEX discontinuing trading in the Platinum Futures Contract are discussed in the section of product supplement STR-3 beginning on page S-37 entitled “Description of the Notes — Discontinuance of a Non-Exchange Traded Fund Market Measure.” None of us, the calculation agent, or the selling agent accepts any responsibility for the calculation or dissemination of information relating to the Platinum Futures Contract.

The Futures Market

An exchange-traded futures contract, such as the Platinum Futures Contract, provides for the future purchase and sale of a specified type and quantity of a commodity at a particular price and on a specific date. Futures contracts are standardized so that each investor trades contracts with the same requirements as to quality, quantity, and delivery terms. Rather than settlement by physical delivery of the commodity, futures contracts may be settled for the cash value of the right to receive or sell the specified commodity on the specified date. Exchange-traded futures contracts are traded on organized exchanges such as NYMEX, known as “contract markets,” through the facilities of a centralized clearing house and a brokerage firm which is a member of the clearing house.

The New York Mercantile Exchange

NYMEX, located in New York City, is the world’s largest physical commodities futures exchange and one of four “Designated Contract Markets” (each, a self regulatory exchange) comprising the CME Group Inc. (the “CME Group”). It offers futures contracts and options on futures contracts based on energy and metals commodities and clearing services for privately negotiated energy transactions. NYMEX uses an open outcry trading facility during the day and has an electronic trading system after hours. NYMEX began commodities trading in 1872, organized as the Butter and Cheese Exchange of New York, and has since traded a variety of commodity products. The establishment of energy futures trading on NYMEX occurred in 1978, with the introduction of heating oil futures contracts. NYMEX opened trading in leaded gasoline futures in 1981, followed by crude oil futures contracts in 1983 and unleaded gasoline futures contracts in 1984. In August 2008, NYMEX was acquired by CME Group.

NYMEX members include individual traders, as well as most of the world’s largest banks, hedge funds, and brokerage and investment houses. Members can execute trades for their own accounts, for clearing firm accounts, for the accounts of other members, or for the accounts of customers of clearing firms. NYMEX memberships can be bought, sold, and leased. Applicants for membership must meet certain business integrity and financial requirements. They must also comply with the provisions of the Commodity Exchange Act and the rules and regulations issued by the CFTC, and register with the National Futures Association either as a floor trader or floor broker if they intend to access the trading floors. NYMEX’s board of directors adopts rules and regulations governing the trading on the exchange, as well as to maintain appropriate business conduct and to provide protection to the public in its dealings with NYMEX and its members.

The Platinum Futures Contract

The Platinum Futures Contract is the front-month platinum futures contract traded on NYMEX. The Platinum Futures Contract trades in units of 50 troy ounces of minimum 99.95% pure platinum. The settlement price of the Platinum Futures Contract is reported by Bloomberg under the symbol PL1 <Cmdty>.

The following summarizes selected specifications relating to the Platinum Futures Contract:

| • | Price Quotation: U.S. dollars and cents per troy ounce. |

| • | Minimum Daily Price Fluctuation (Tick Size): $0.05 per troy ounce. |

The value of the Platinum Futures Contract on any trading day will be the official settlement price of the front-month platinum futures contract on NYMEX, expressed in dollars and cents per troy ounce, as determined by NYMEX.

| Strategic Accelerated Redemption Securities® | TS-7 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

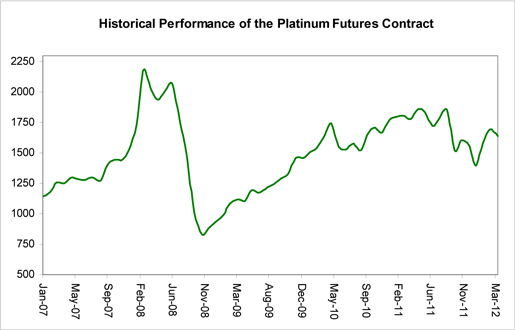

Historical Data on the Platinum Futures Contract

The following graph shows the monthly historical performance of the Platinum Futures Contract in the period from January 2007 through March 2012. We obtained this historical data from Bloomberg L.P. We make no representation or warranty as to the accuracy or completeness of the information from Bloomberg L.P. On March 30, 2012, the official settlement price of the Platinum Futures Contract was 1,638.30.

This historical data on the Platinum Futures Contract is not necessarily indicative of the future performance of the Platinum

Futures Contract or what the value of the notes may be. Any historical upward or downward trend in the price of the Platinum

Futures Contract during any period set forth above is not an indication that the price of the Platinum Futures Contract is more

or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the levels and trading pattern of the Platinum Futures Contract.

| Strategic Accelerated Redemption Securities® | TS-8 |

| Strategic Accelerated Redemption Securities ® Linked to the Platinum Futures Contract, due December , 2012 |

|

Summary Tax Consequences

You should consider the U.S. federal income tax consequences of an investment in the notes, including the following:

| • | You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as a callable single financial contract with respect to the Platinum Futures Contract. |

| • | Under this characterization and tax treatment of the notes, upon receipt of a cash payment at maturity or upon a sale or exchange of the notes prior to maturity, you generally will recognize short-term capital gain or loss. |

Material U.S. Federal Income Tax Considerations

Set forth below is a summary of the material U.S. federal income tax considerations relating to an investment in the notes. The following summary is not complete and is qualified in its entirety by the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page S-45 of product supplement STR-3, which you should carefully review prior to investing in the notes.

General. Although there is no statutory, judicial, or administrative authority directly addressing the characterization of the notes, we intend to treat the notes for all tax purposes as a callable single financial contract with respect to the Platinum Futures Contract. Under the terms of the notes, we and every investor in the notes agree, in the absence of an administrative determination or judicial ruling to the contrary, to treat the notes as described in the preceding sentence. This discussion assumes that the notes constitute a callable single financial contract with respect to the Platinum Futures Contract for U.S. federal income tax purposes. If the notes did not constitute a callable single financial contract, the tax consequences described below would be materially different.

This characterization of the notes is not binding on the Internal Revenue Service (“IRS”) or the courts. No statutory, judicial, or administrative authority directly addresses the characterization of the notes or any similar instruments for U.S. federal income tax purposes, and no ruling is being requested from the IRS with respect to their proper characterization and treatment. Due to the absence of authorities on point, significant aspects of the U.S. federal income tax consequences of an investment in the notes are not certain, and no assurance can be given that the IRS or any court will agree with the characterization and tax treatment described in product supplement STR-3. Accordingly, you are urged to consult your tax advisor regarding all aspects of the U.S. federal income tax consequences of an investment in the notes, including possible alternative characterizations. The discussion in this section and in the section entitled “U.S. Federal Income Tax Summary” in product supplement STR-3 assume that there is a significant possibility of a significant loss of principal on an investment in the notes.

Settlement at Maturity or Sale or Exchange Prior to Maturity. Assuming that the notes are properly characterized and treated as callable single financial contracts with respect to the Platinum Futures Contract for U.S. federal income tax purposes, upon receipt of a cash payment at maturity or upon a sale or exchange of the notes prior to maturity, a U.S. Holder (as defined beginning on page 62 of the prospectus) generally will recognize short-term capital gain or loss equal to the difference between the amount realized and the U.S. Holder’s basis in the notes. The deductibility of capital losses is subject to limitations.

Possible Future Tax Law Changes. From time to time, there may be legislative proposals or interpretive guidance addressing the tax treatment of financial instruments such as the notes. We cannot predict the likelihood of any such legislation or guidance being adopted, or the ultimate impact on the notes. For example, on December 7, 2007, the IRS released Notice 2008-2 (“Notice”) seeking comments from the public on the taxation of financial instruments currently taxed as “prepaid forward contracts.” This Notice addresses instruments such as the notes. According to the Notice, the IRS and Treasury are considering whether a holder of an instrument such as the notes should be required to accrue ordinary income on a current basis, regardless of whether any payments are made prior to maturity. It is not possible to determine what guidance the IRS and Treasury will ultimately issue, if any. Any such future guidance may affect the amount, timing, and character of income, gain, or loss in respect of the notes, possibly with retroactive effect. The IRS and Treasury are also considering additional issues, including whether additional gain or loss from such instruments should be treated as ordinary or capital, whether foreign holders of such instruments should be subject to withholding tax on any deemed income accruals, whether Section 1260 of the Internal Revenue Code of 1986, as amended, concerning certain “constructive ownership transactions,” generally applies or should generally apply to such instruments, and whether any of these determinations depend on the nature of the underlying asset. We urge you to consult your own tax advisors concerning the impact and the significance of the above considerations. We intend to continue treating the notes for U.S. federal income tax purposes in the manner described herein unless and until such time as we determine, or the IRS or Treasury determines, that some other treatment is more appropriate.

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. You should review carefully the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page S-45 of product supplement STR-3.

| Strategic Accelerated Redemption Securities® | TS-9 |

| Strategic Accelerated Redemption Securities® Linked to the Platinum Futures Contract, due December , 2012 |

|

Additional Terms

You should read this term sheet, together with the documents listed below, which together contain the terms of the notes and supersede all prior or contemporaneous oral statements as well as any other written materials. You should carefully consider, among other things, the matters set forth under “Risk Factors” and “Additional Risk Factors” in the sections indicated on the cover of this term sheet. The notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

You may access the following documents on the SEC Website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC Website):

| § | Product supplement STR-3 dated April 2, 2012: |

http://www.sec.gov/Archives/edgar/data/70858/000119312512146587/d324780d424b5.htm

| § | Series L MTN prospectus supplement dated March 30, 2012 and prospectus dated March 30, 2012: |

http://www.sec.gov/Archives/edgar/data/70858/000119312512143855/d323958d424b5.htm

Our Central Index Key, or CIK, on the SEC Website is 70858.

We have filed a registration statement (including a product supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the product supplement, the prospectus supplement, and the prospectus in that registration statement, and the other documents relating to this offering that we have filed with the SEC for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, we, any agent or any dealer participating in this offering will arrange to send you the Note Prospectus if you so request by calling MLPF&S toll-free at 1-866-500-5408.

MLPF&S classifies certain market-linked investments (the “Market-Linked Investments”) into categories, each with different investment characteristics. The following description is meant solely for informational purposes and is not intended to represent any particular Enhanced Return Market-Linked Investment or guarantee any performance.

Enhanced Return Market-Linked Investments are short- to medium-term investments that offer you a way to enhance exposure to a particular market view without taking on a similarly enhanced level of market downside risk. They can be especially effective in a flat to moderately positive market (or, in the case of bearish investments, a flat to moderately negative market). In exchange for the potential to receive better-than market returns on the linked asset, you must generally accept a degree of market downside risk and capped upside potential. As these investments are not market downside protected, and do not assure full repayment of principal at maturity, you need to be prepared for the possibility that you may lose all or part of your investment.

“Strategic Accelerated Redemption Securities®” is our registered service mark.

| Strategic Accelerated Redemption Securities® | TS-10 |