Filed Pursuant to Rule 433

Registration No. 333-180488

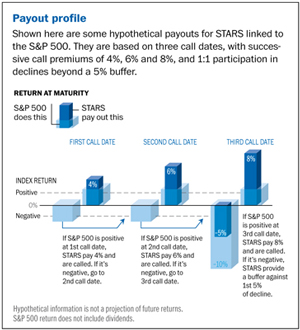

Strategic Accelerated Redemption Securities® (STARS) are Market-Linked Investments that provide an opportunity for above-market returns while usually offering some market downside protection, or buffer,

against the risk of loss. STARS are unsecured debt securities of an issuing company that are linked to a market measure or asset, such as the S&P 500, stocks or commodities. STARS include “automatic-call” dates (typically three) when

the STARS may be automatically redeemed prior to or at maturity. If on a call date the level of the linked market measure meets or exceeds the call level (generally the same as the starting value), the issuer must buy back the STARS at a premium.

You will receive back your principal plus the applicable call premium. This call premium amount increases with each successive call date. However, STARS will not yield any positive return if they’re not called and may result in a loss. Although

STARS may include a buffer against a certain percentage of losses, beyond the buffer you will bear one-to-one downside exposure to declines in the linked market measure. STARS also do not pay interest. Any returns on STARS, including any repayment

of principal, are subject to the credit risk of the issuer.

STARS are available in $10 increments (a minimum purchase of $1,000 required), with maturities of generally

one year. They can be purchased in new issue offerings or in the secondary market. They are registered with the Securities and Exchange Commission and may not be listed on any securities exchange.

How can STARS play a role in my investment strategy?

STARS may be especially useful in moderately positive, or “sideways,” markets, because even just a flat or moderately positive performance by

the linked market measure can result in the STARS being called at a premium. While most STARS are structured for investors with moderately bullish views of a market, bearish STARS that deliver a premium if the underlying market measure decreases

below the applicable call level are also available.

What advantages do STARS provide?

| § |

|

Opportunity for enhanced return. You have the opportunity to earn a premium over the principal amount invested if at the call date the

linked market measure is flat or higher than its call level. |

| § |

|

Limited market downside exposure. If the particular STARS has a buffer, regardless of how the linked market measure performs, it will

return at least a portion of your principal at maturity, subject to the credit risk of the issuer. For example, if your STARS have a 5% buffer, the linked market measure would have to decline by 6% for you to experience a 1% loss, with up to 95% of

your principal at risk. |

| § |

|

Diversification. STARS provide an alternative means of getting exposure to a wide variety of asset classes. |

| § |

|

Simplification. Because Market-Linked Investments such as STARS offer investors a single packaged solution, they may reduce the

complicated financial, tax, legal and operational issues surrounding the execution of sophisticated investment strategies.

|

|

|

|

|

|

|

|

|

|

|

|

Merrill Lynch Wealth Management makes available products and services offered by Merrill Lynch, Pierce, Fenner & Smith Incorporated, a registered

broker-dealer and member SIPC, and other subsidiaries of Bank of America Corporation. |

| |

Investment products: |

| |

|

|

Are Not FDIC Insured |

|

Are Not Bank Guaranteed |

|

May Lose

Value |

| § |

|

Complement to core portfolio strategies. STARS can be used alongside other investments as a diversification tool and as a way to enhance

returns and potentially preserve a portion of your principal. |

What risks do STARS carry?

| § |

|

Lower returns and loss of principal. If the linked market measure does not perform well and your STARS are not called, you will receive

no positive return and may lose some or all of your principal. Your return is limited to the specified call premium, even if the linked market measure increases beyond the call premium, and you could experience lower returns than you anticipated or

than could have been received from an investment in a conventional bond or in a direct investment in the linked market measure. |

| § |

|

Credit risk. Any payments due on STARS are subject to the credit risk of the particular issuer. If the issuer goes bankrupt or is unable

to pay its debts, you could lose all of your investment, even if the underlying market measure performs well. STARS are unsecured and are not backed by FDIC insurance or other governmental support. |

| § |

|

Secondary market risks. You may not be able to sell your STARS in the secondary market, and Merrill Lynch is not obligated to purchase

them from you. The price at which you may be able to sell your STARS may be lower than the price you paid for them due to a number of factors, including changes in the linked market measure’s performance, the creditworthiness of the issuer, the

cost of developing, hedging and distributing the STARS, as well as the issuer’s borrowing rate for issuing Market-Linked Investments.

|

| § |

|

Specific risks of the linked market measure. There are specific risks associated with the linked market measure. You should be familiar

with these risks before investing. |

| § |

|

Tax consequences. The appreciation on STARS will generally be taxed as capital gains. The U.S. federal tax treatment is uncertain, and

you should consult your own tax advisor before investing. |

What charges do I pay when purchasing STARS, and how

does Merrill Lynch benefit?

The $10 per unit you pay for newly issued STARS includes compensation to Merrill Lynch for distributing STARS

and may include an estimated profit credited to Merrill Lynch from related hedging arrangements associated with STARS. These fees and charges, as well as the rate at which the issuer borrows funds under STARS, reduce the economic terms of STARS to

you and result in their estimated initial value being less than the offering price. This is discussed in more detail in the offering documents. If you buy or sell STARS on the secondary market, you may pay trading commissions and markups.

The trading, hedging and investment activities conducted by Merrill Lynch and its affiliated companies in the ordinary course of business may

affect the return on the STARS. When STARS are issued by Bank of America Corporation (the parent company of Merrill Lynch), the proceeds will be used for the company’s operating or funding needs.

Merrill Lynch offers a

variety of Market-Linked Investments in four basic categories…

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Offer exposure to the upside performance of the linked market measure with no or limited exposure to declines in the value of that market measure at maturity.

Payments remain subject to issuer credit risk. |

|

May offer access to less readily available markets that may not be available through the other categories. Usually have one-to-one upside and downside exposure similar to a direct

investment in the linked market measure. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Offer periodic, variable or fixed interest payments with, in some instances, an added payout at maturity based on the

performance of the linked market measure. Generally offer no or limited market downside protection. |

|

Offer the potential to receive better-than-market returns if the linked market measure performs well, often up to a cap. Generally offer no or limited market downside protection. |

|

|

IMPORTANT NOTICE: This fact sheet provides an overview of STARS only and does not provide the terms of any specific security

proposed to be sold. Merrill Lynch will furnish you with a prospectus that contains the terms of the relevant offering. Prior to making any decision to invest, you should read that prospectus for a detailed explanation of the terms, risks, tax

treatment and other relevant information. Additionally, you should consult your accounting, legal or tax advisors before investing.

Prior to

selling any particular STARS, the issuer will have filed with the Securities and Exchange Commission (SEC) a registration statement, including a prospectus, containing more complete information about the potential offerings described in this

fact sheet. Before investing, you should carefully read the relevant prospectus and the other documents filed by the issuer with the SEC. You may obtain these documents without cost by visiting EDGAR on the SEC Web site at www.sec.gov.

Alternatively, the issuer or Merrill Lynch will arrange to have the documents sent to you; call Merrill Lynch toll-free at 1-866-500-5408.

Merrill Lynch Wealth Management is a registered trademark of Bank of America Corporation.

© 2012 Bank of America Corporation. All rights reserved. | ARB17AF4 | Code 365338PM-1212