CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Offering Price |

Amount of Fee(1) | ||||

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, Due October 24, 2014 |

560,000 | $10.00 | $5,600,000 | $763.84 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Calculated in accordance with Rule 457(r) of the Securities Act of 1933. |

| Filed Pursuant to Rule 424(b)(2) Registration No. 333-180488 (To Prospectus dated March 30, 2012, Prospectus Supplement dated March 30, 2012 and Product Supplement ARN-4 dated April 2, 2012) |

The notes are being issued by Bank of America Corporation (“BAC”). There are important differences between the notes and a conventional debt security, including different investment risks and certain additional costs. See “Risk Factors” on page TS-7 of this term sheet and beginning on page S-10 of product supplement ARN-4.

The initial estimated value of the notes as of the pricing date is $9.71 per unit, which is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” on page TS-7 of this term sheet and “Structuring the Notes” on page TS-18 of this term sheet for additional information. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit |

Total |

|||||||||

| Public offering price |

$10.00 | $5,600,000.00 | ||||||||

| Underwriting discount |

$0.20 | $112,000.00 | ||||||||

| Proceeds, before expenses, to BAC |

$9.80 | $5,488,000.00 | ||||||||

The notes:

| Are Not FDIC Insured | Are Not Bank Guaranteed | May Lose Value |

Merrill Lynch & Co.

August 9, 2013

560,000 Units

$10 principal amount per unit

CUSIP No. 06053F463

Pricing Date August 9, 2013

Settlement Date August 16, 2013

Maturity Date October 24, 2014

Bank of America

Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities

Maturity of approximately 14 months

3-to-1 upside exposure to increases in the Basket, subject to a capped return of 18.18%

The Basket is comprised of Accenture PLC, Applied Materials Inc., CSX Corporation, Eastman Chemical Company, Eaton Corporation plc, Fluor Corporation, Ingersoll-Rand PLC, International Paper Company, LyondellBasell Industries NV, Masco Corporation, Nucor Corporation, Occidental Petroleum Corporation, Oracle Corporation, Red Hat Inc., Teradata Corporation, and VMware Inc. (the “Basket Components”)

1-to-1 downside exposure to decreases in the Basket, with 100% of your investment at risk

All payments occur at maturity and are subject to the credit risk of Bank of America Corporation

No periodic interest payments

Limited secondary market liquidity, with no exchange listing

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Summary

The Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 (the “notes”) are our senior unsecured debt securities. The notes are not guaranteed or insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally with all of our other unsecured and unsubordinated debt. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BAC. The notes provide you a leveraged return, subject to a cap, if the Ending Value of the Market Measure, which is the basket of 16 Common Equity Securities described below (the “Basket”), is greater than its Starting Value. If the Ending Value is less than the Starting Value, you will lose all or a portion of the principal amount of your notes. Payments on the notes, including the amount you receive at maturity, will be calculated based on the $10 Original Offering Price per unit and will depend on our credit risk and the performance of the Basket. See “Terms of the Notes” below.

The economic terms of the notes (including the Capped Value) are based on the rate we would pay to borrow funds through the issuance of market-linked notes and the economic terms of certain related hedging arrangements. The implied borrowing rate for market-linked notes is typically lower than the rate we would pay when we issue conventional fixed or floating rate debt securities. This difference in borrowing rate, as well as the underwriting discount and the hedging related charge described below, reduced the economic terms of the notes to you and the initial estimated value of the notes on the pricing date. Due to these factors, the public offering price you pay to purchase the notes will be greater than the initial estimated value of the notes.

On the cover page of this term sheet, we have provided the initial estimated value for the notes. This initial estimated value was determined based on our and our affiliates’ pricing models, which take into consideration our implied borrowing costs and the market prices for the hedging arrangements related to the notes. For more information about the initial estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-18.

| Accelerated Return Notes® | TS-2 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

The terms and risks of the notes are contained in this term sheet and in the following:

| § | Product supplement ARN-4 dated April 2, 2012: |

http://www.sec.gov/Archives/edgar/data/70858/000119312512146655/d326526d424b5.htm

| § | Series L MTN prospectus supplement dated March 30, 2012 and prospectus dated March 30, 2012: |

http://www.sec.gov/Archives/edgar/data/70858/000119312512143855/d323958d424b5.htm

These documents (together, the “Note Prospectus”) have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website as indicated above or obtained from MLPF&S by calling 1-866-500-5408.

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Capitalized terms used but not defined in this term sheet have the meanings set forth in product supplement ARN-4. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BAC.

Investor Considerations

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| Accelerated Return Notes® | TS-3 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

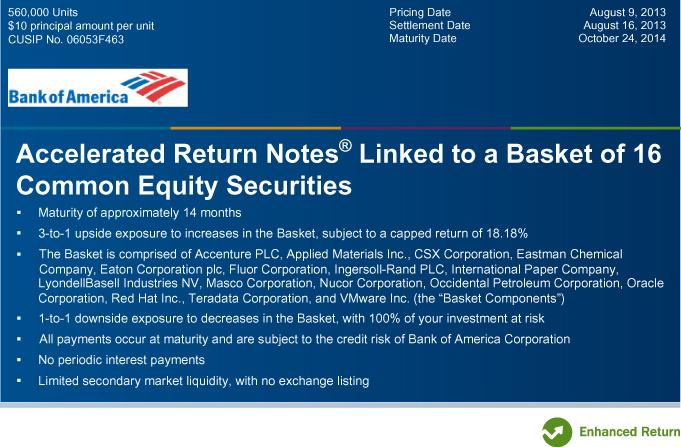

Hypothetical Payout Profile and Examples of Payments at Maturity

|

This graph reflects the returns on the notes, based on the Participation Rate of 300% and the Capped Value of $11.818. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the Basket Components, excluding dividends.

This graph has been prepared for purposes of illustration only. |

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the Redemption Amount and total rate of return based on the Starting Value of 100, the Participation Rate of 300%, the Capped Value of $11.818 per unit and a range of hypothetical Ending Values. The actual amount you receive and the resulting total rate of return will depend on the actual Ending Value and whether you hold the notes to maturity. The following examples do not take into account any tax consequences from investing in the notes.

For recent actual levels of the Market Measure, see “The Basket Components” section below. The Ending Value will not include any income generated by dividends paid on the Basket Components, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer credit risk.

| Ending Value |

Percentage Change from the Starting Value to the Ending Value |

Redemption Amount per Unit |

Total Rate of Return on the Notes | |||||||||||||||

| 60.00 | -40.00 | % | $6.000 | -40.00 | % | |||||||||||||

| 70.00 | -30.00 | % | $7.000 | -30.00 | % | |||||||||||||

| 80.00 | -20.00 | % | $8.000 | -20.00 | % | |||||||||||||

| 90.00 | -10.00 | % | $9.000 | -10.00 | % | |||||||||||||

| 94.00 | -6.00 | % | $9.400 | -6.00 | % | |||||||||||||

| 97.00 | -3.00 | % | $9.700 | -3.00 | % | |||||||||||||

| 100.00 | (1) | 0.00 | % | $10.000 | 0.00 | % | ||||||||||||

| 103.00 | 3.00 | % | $10.900 | 9.00 | % | |||||||||||||

| 105.00 | 5.00 | % | $11.500 | 15.00 | % | |||||||||||||

| 110.00 | 10.00 | % | $11.818 | (2) | 18.18 | % | ||||||||||||

| 120.00 | 20.00 | % | $11.818 | 18.18 | % | |||||||||||||

| 130.00 | 30.00 | % | $11.818 | 18.18 | % | |||||||||||||

| 140.00 | 40.00 | % | $11.818 | 18.18 | % | |||||||||||||

| 150.00 | 50.00 | % | $11.818 | 18.18 | % | |||||||||||||

| 160.00 | 60.00 | % | $11.818 | 18.18 | % | |||||||||||||

| (1) | The Starting Value was set to 100.00 on the pricing date. |

| (2) | The Redemption Amount per unit cannot exceed the Capped Value. |

| Accelerated Return Notes® | TS-4 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Redemption Amount Calculation Examples

Example 1

The Ending Value is 80.00, or 80.00% of the Starting Value:

| Starting Value: |

100.00 |

|||

| Ending Value: |

80.00 |

| $10 × |

( | 80 | ) | = $8.000 Redemption Amount per unit | ||||||||||||

| 100 |

Example 2

The Ending Value is 103.00, or 103.00% of the Starting Value:

| Starting Value: |

100.00 |

|||

| Ending Value: |

103.00 |

| $10 + |

[ | $10 × 300% × | ( | 103 – 100 | ) | ] | = $10.900 Redemption Amount per unit | |||||||||||

| 100 |

Example 3

The Ending Value is 130.00, or 130.00% of the Starting Value:

| Starting Value: |

100.00 | |||

| Ending Value: |

130.00 |

| $10 + |

[ | $10 × 300% × | ( | 130 – 100 | ) | ] | = $19.000, however, because the Redemption Amount for the notes cannot exceed the Capped Value, the Redemption Amount will be $11.818 per unit | |||||||||||

| 100 |

| Accelerated Return Notes® | TS-5 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page S-10 of product supplement ARN-4, page S-5 of the MTN prospectus supplement, and page 8 of the prospectus identified above. We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

| § | Depending on the performance of the Basket as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal. |

| § | Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity. |

| § | Payments on the notes are subject to our credit risk, and actual or perceived changes in our creditworthiness are expected to affect the value of the notes. If we become insolvent or are unable to pay our obligations, you may lose your entire investment. |

| § | Your investment return, if any, is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the Basket Components. |

| § | The initial estimated value of the notes is an estimate only, determined as of a particular point in time by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads, our implied borrowing rate on the pricing date, mid-market terms on hedging transactions, expectations on interest rates and volatility, price-sensitivity analysis, and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. |

| § | The public offering price you pay for the notes will exceed the initial estimated value. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, changes in the level of the Basket, the implied borrowing rate we pay to issue market-linked notes, and the inclusion in the public offering price of the underwriting discount and the hedging related charge, all as further described in “Structuring the Notes” on page TS-18. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways. |

| § | The initial estimated value does not represent a minimum or maximum price at which we, MLPF&S or any of our affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket, our creditworthiness and changes in market conditions. |

| § | A trading market is not expected to develop for the notes. Neither we nor MLPF&S is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market. |

| § | Our business activities as a full service financial institution, including our commercial and investment banking activities, our hedging and trading activities (including trades in shares of the Basket Components) and any hedging and trading activities we engage in for our clients’ accounts, may affect the market value and return of the notes and may create conflicts of interest with you. |

| § | Changes in the prices of the Basket Components may offset each other. |

| § | You will have no rights of a holder of the Basket Components, and you will not be entitled to receive shares of the Basket Components or dividends or other distributions by the issuers of the Basket Components. |

| § | While we or our affiliates may from time to time own shares of the Basket Components, we do not control any company included in the Basket, and are not responsible for any disclosure made by any other company. |

| § | The Redemption Amount will not be adjusted for all corporate events that could affect a Basket Component. See “Description of ARNs — Anti-Dilution Adjustments for ARNs Linked to Underlying Stocks” beginning on page S-32 of product supplement ARN-4. |

| § | There may be potential conflicts of interest involving the calculation agent. We have the right to appoint and remove the calculation agent. |

| § | The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page S-45 of product supplement ARN-4. |

| Accelerated Return Notes® | TS-6 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

The Basket

The Basket is designed to allow investors to participate in the percentage changes of the Basket from the Starting Value to the Ending Value. The Basket Components are described in the section “The Basket Components” below. Each Basket Component was assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of ARNs — Basket Market Measures” on page S-39 of product supplement ARN-4.

On the pricing date, for each Basket Component, the Initial Component Weight, the Closing Market Price, the Component Ratio and the initial contribution to the Basket value were set as follows:

| Basket Component |

Bloomberg Symbol |

Initial Component Weight |

Closing Market Price(1) |

Component Ratio(2) |

Initial Basket Value Contribution | |||||

| Accenture PLC |

ACN | 6.25 | 73.53 | 0.08499932 | 6.25 | |||||

| Applied Materials Inc. |

AMAT | 6.25 | 15.67 | 0.39885131 | 6.25 | |||||

| CSX Corporation |

CSX | 6.25 | 25.70 | 0.24319066 | 6.25 | |||||

| Eastman Chemical Company |

EMN | 6.25 | 80.07 | 0.07805670 | 6.25 | |||||

| Eaton Corporation plc |

ETN | 6.25 | 65.62 | 0.09524535 | 6.25 | |||||

| Fluor Corporation |

FLR | 6.25 | 65.98 | 0.09472567 | 6.25 | |||||

| Ingersoll-Rand PLC |

IR | 6.25 | 61.01 | 0.10244222 | 6.25 | |||||

| International Paper Company |

IP | 6.25 | 48.02 | 0.13015410 | 6.25 | |||||

| LyondellBasell Industries NV |

LYB | 6.25 | 68.70 | 0.09097525 | 6.25 | |||||

| Masco Corporation |

MAS | 6.25 | 19.90 | 0.31407035 | 6.25 | |||||

| Nucor Corporation |

NUE | 6.25 | 49.22 | 0.12698090 | 6.25 | |||||

| Occidental Petroleum Corporation |

OXY | 6.25 | 88.28 | 0.07079746 | 6.25 | |||||

| Oracle Corporation |

ORCL | 6.25 | 32.92 | 0.18985419 | 6.25 | |||||

| Red Hat Inc. |

RHT | 6.25 | 52.46 | 0.11913839 | 6.25 | |||||

| Teradata Corporation |

TDC | 6.25 | 63.76 | 0.09802384 | 6.25 | |||||

| VMware Inc. |

VMW | 6.25 | 84.99 | 0.07353806 | 6.25 | |||||

| Starting Value | 100.00 |

| (1) | These were the Closing Market Prices of the Basket Components on the pricing date. |

| (2) | Each Component Ratio equals the Initial Component Weight of the relevant Basket Component (as a percentage) multiplied by 100, and then divided by the Closing Market Price of that Basket Component on the pricing date and rounded to eight decimal places. |

The calculation agent will calculate the Ending Value of the Basket by summing the products of the Closing Market Price for each Basket Component (multiplied by its Price Multiplier) on the calculation day and the Component Ratio applicable to that Basket Component. The Price Multiplier for each Basket Component will initially be 1, and is subject to adjustment as described in the product supplement.

If, for any Basket Component (an “Affected Basket Component”), (i) a Market Disruption Event occurs on the scheduled calculation day or (ii) that day is determined by the calculation agent not to be a trading day by reason of an extraordinary event, occurrence, declaration, or otherwise (any such day in either (i) or (ii) being a “non-calculation day”), the calculation agent will determine the Closing Market Price of each Basket Component for such non-calculation day, and as a result, the Ending Value, as follows:

| § | The Closing Market Price of each Basket Component that is not an Affected Basket Component will be its Closing Market Price on that non-calculation day. |

| § | The Closing Market Price of each Basket Component that is an Affected Basket Component for the applicable non-calculation day will be deemed to be the Closing Market Price of the Basket Component on the immediately succeeding trading day during which no Market Disruption Event shall have occurred or is continuing to occur; provided that the Ending Value of the Market Measure will be determined (or, if not determinable, estimated) by the calculation agent in a manner which the calculation agent considers commercially reasonable under the circumstances on a date no later than the second scheduled trading day prior to the maturity date, regardless of the occurrence of a Market Disruption Event on that schedule trading day. |

| Accelerated Return Notes® | TS-7 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

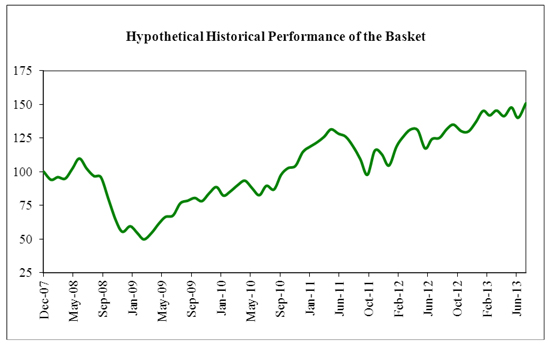

While actual historical information on the Basket did not exist before the pricing date, the following graph sets forth the hypothetical historical monthly performance of the Basket from January 2008 through July 2013. The graph is based upon actual month-end historical levels of the Basket Components, hypothetical Component Ratios based on the Closing Market Prices of the Basket Components as of December 31, 2007, and a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any historical upward or downward trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

The shares of LyondellBasell Industries NV were not publicly traded prior to October 14, 2010. As a result, instead of using Closing Market Prices of this Basket Component, the Basket values represented by the following graph from December 31, 2007 to October 14, 2010 include a fixed Initial Basket Value Contribution of 6.25.

| Accelerated Return Notes® | TS-8 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

The Basket Components

We have derived the following information about the Underlying Companies from publicly available documents that they have published. We have not independently verified the following information.

Because each Basket Component is registered under the Securities Exchange Act of 1934, the Underlying Companies are required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Underlying Companies can be located at the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549 or through the SEC’s web site at http://www.sec.gov by reference to the applicable CIK number set forth below.

This term sheet relates only to the notes and does not relate to any securities of the Underlying Companies. Neither we nor any of our affiliates have participated or will participate in the preparation of the Underlying Companies’ publicly available documents. Neither we nor any of our affiliates have made any due diligence inquiry with respect to the Underlying Companies in connection with the offering of the notes. Neither we nor any of our affiliates make any representation that the publicly available documents or any other publicly available information regarding the Underlying Companies are accurate or complete. Furthermore, there can be no assurance that all events occurring prior to the date of this term sheet, including events that would affect the accuracy or completeness of these publicly available documents that would affect the trading price of the Basket Components, have been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events concerning the Underlying Companies could affect the value of the Basket Components and therefore could affect your return on the notes. The selection of the Basket Components is not a recommendation to buy or sell shares of the Basket Components.

The tables set forth below shows the quarterly high and low Closing Market Prices of the shares of the Basket Components on their primary exchange from the first quarter of 2008 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. These historical trading prices may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Accenture PLC

Accenture PLC provides management and technology consulting services and solutions. The company delivers a range of specialized capabilities and solutions to clients across all industries on a worldwide basis, and its network of businesses provides consulting, technology, outsourcing, and alliances This Basket Component trades on the New York Stock Exchange (the “NYSE”) under the symbol “ACN”. The company’s CIK number is 0001467373.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 37.05 | 32.79 | |||||||||

| Second Quarter | 41.34 | 35.76 | ||||||||||

| Third Quarter | 41.96 | 35.27 | ||||||||||

| Fourth Quarter | 37.06 | 26.71 | ||||||||||

| 2009 |

First Quarter | 34.07 | 27.09 | |||||||||

| Second Quarter | 33.72 | 26.67 | ||||||||||

| Third Quarter | 37.89 | 32.39 | ||||||||||

| Fourth Quarter | 42.87 | 36.53 | ||||||||||

| 2010 |

First Quarter | 43.75 | 39.75 | |||||||||

| Second Quarter | 44.67 | 36.44 | ||||||||||

| Third Quarter | 42.49 | 38.13 | ||||||||||

| Fourth Quarter | 50.32 | 43.32 | ||||||||||

| 2011 |

First Quarter | 54.97 | 48.11 | |||||||||

| Second Quarter | 60.42 | 53.95 | ||||||||||

| Third Quarter | 63.44 | 47.44 | ||||||||||

| Fourth Quarter | 61.76 | 51.62 | ||||||||||

| 2012 |

First Quarter | 65.89 | 51.74 | |||||||||

| Second Quarter | 65.49 | 55.28 | ||||||||||

| Third Quarter | 70.03 | 56.98 | ||||||||||

| Fourth Quarter | 71.39 | 64.59 | ||||||||||

| 2013 |

First Quarter | 78.35 | 68.81 | |||||||||

| Second Quarter | 83.09 | 71.96 | ||||||||||

| Third Quarter (through the pricing date) | 76.25 | 72.10 | ||||||||||

| Accelerated Return Notes® | TS-9 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Applied Materials Inc.

Applied Materials Inc. develops, manufactures, markets, and services semiconductor wafer fabrication equipment and related spare parts for the worldwide semiconductor industry. The company’s customers include semiconductor wafer and integrated circuit manufacturers, flat panel liquid crystal displays, solar photovoltaic cells and modules and other electronic devices manufacturers. This Basket Component trades on the NASDAQ Global Select Market (“Nasdaq”) under the symbol “AMAT”. The company’s CIK number is 0000006951.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

21.59 | 16.32 | |||||||||

| Second Quarter |

20.89 | 18.40 | ||||||||||

| Third Quarter |

19.33 | 14.63 | ||||||||||

| Fourth Quarter |

14.96 | 8.14 | ||||||||||

| 2009 |

First Quarter |

11.62 | 8.34 | |||||||||

| Second Quarter |

12.78 | 10.50 | ||||||||||

| Third Quarter |

14.01 | 10.72 | ||||||||||

| Fourth Quarter |

14.07 | 11.89 | ||||||||||

| 2010 |

First Quarter |

14.87 | 11.77 | |||||||||

| Second Quarter |

14.47 | 12.02 | ||||||||||

| Third Quarter |

12.61 | 10.39 | ||||||||||

| Fourth Quarter |

14.13 | 11.49 | ||||||||||

| 2011 |

First Quarter |

16.85 | 13.76 | |||||||||

| Second Quarter |

15.92 | 12.40 | ||||||||||

| Third Quarter |

13.44 | 10.35 | ||||||||||

| Fourth Quarter |

12.73 | 9.85 | ||||||||||

| 2012 |

First Quarter |

13.21 | 10.70 | |||||||||

| Second Quarter |

12.50 | 10.00 | ||||||||||

| Third Quarter |

12.05 | 10.37 | ||||||||||

| Fourth Quarter |

11.50 | 10.15 | ||||||||||

| 2013 |

First Quarter |

13.89 | 11.50 | |||||||||

| Second Quarter |

15.97 | 12.92 | ||||||||||

| Third Quarter (through the pricing date) |

16.69 | 14.82 | ||||||||||

CSX Corporation

CSX Corporation is an international freight transportation company, and provides rail, intermodal, domestic container-shipping, barging, and contract logistics services globally. This Basket Component trades on the NYSE under the symbol “CSX”. The company’s CIK number is 0000277948.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

19.14 | 13.44 | |||||||||

| Second Quarter |

23.02 | 18.77 | ||||||||||

| Third Quarter |

22.89 | 17.67 | ||||||||||

| Fourth Quarter |

17.69 | 10.18 | ||||||||||

| 2009 |

First Quarter |

12.23 | 6.97 | |||||||||

| Second Quarter |

12.17 | 8.85 | ||||||||||

| Third Quarter |

16.06 | 10.42 | ||||||||||

| Fourth Quarter |

16.80 | 13.88 | ||||||||||

| 2010 |

First Quarter |

17.46 | 14.11 | |||||||||

| Second Quarter |

19.17 | 16.22 | ||||||||||

| Third Quarter |

18.71 | 15.82 | ||||||||||

| Fourth Quarter |

21.54 | 18.15 | ||||||||||

| 2011 |

First Quarter |

26.67 | 21.80 | |||||||||

| Second Quarter |

26.46 | 24.30 | ||||||||||

| Third Quarter |

27.01 | 18.59 | ||||||||||

| Fourth Quarter |

23.11 | 18.39 | ||||||||||

| 2012 |

First Quarter |

23.68 | 20.16 | |||||||||

| Second Quarter |

22.69 | 20.32 | ||||||||||

| Third Quarter |

23.39 | 20.75 | ||||||||||

| Fourth Quarter |

21.63 | 19.01 | ||||||||||

| 2013 |

First Quarter |

24.63 | 20.17 | |||||||||

| Second Quarter |

26.14 | 22.65 | ||||||||||

| Third Quarter (through the pricing date) |

26.05 | 23.03 | ||||||||||

| Accelerated Return Notes® | TS-10 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Eastman Chemical Company

Eastman Chemical Company is an international chemical company which produces chemicals, fibers, and plastics. The company’s operations include coatings, adhesives, specialty polymers, and inks, fibers, performance chemicals and intermediates, performance polymers, and specialty plastics. This Basket Component trades on the NYSE under the symbol “EMN”. The company’s CIK number is 0000915389.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

33.74 | 29.00 | |||||||||

| Second Quarter |

38.76 | 32.16 | ||||||||||

| Third Quarter |

34.40 | 26.64 | ||||||||||

| Fourth Quarter |

27.33 | 13.42 | ||||||||||

| 2009 |

First Quarter |

16.84 | 9.00 | |||||||||

| Second Quarter |

22.52 | 14.18 | ||||||||||

| Third Quarter |

27.58 | 17.61 | ||||||||||

| Fourth Quarter |

30.70 | 25.11 | ||||||||||

| 2010 |

First Quarter |

32.17 | 28.27 | |||||||||

| Second Quarter |

35.56 | 26.68 | ||||||||||

| Third Quarter |

37.00 | 25.82 | ||||||||||

| Fourth Quarter |

42.04 | 37.04 | ||||||||||

| 2011 |

First Quarter |

49.66 | 42.68 | |||||||||

| Second Quarter |

54.08 | 47.51 | ||||||||||

| Third Quarter |

52.84 | 33.31 | ||||||||||

| Fourth Quarter |

41.92 | 34.23 | ||||||||||

| 2012 |

First Quarter |

54.96 | 40.09 | |||||||||

| Second Quarter |

54.39 | 43.26 | ||||||||||

| Third Quarter |

58.64 | 47.47 | ||||||||||

| Fourth Quarter |

68.05 | 53.65 | ||||||||||

| 2013 |

First Quarter |

74.78 | 68.00 | |||||||||

| Second Quarter |

73.95 | 64.06 | ||||||||||

| Third Quarter (through the pricing date) |

82.49 | 70.71 | ||||||||||

Eaton Corporation plc

Eaton Corporation plc manufactures engineered products for the industrial, vehicle, construction, commercial, and aerospace markets. The company offers products including hydraulic products and fluid connectors, electrical power distribution and control equipment, truck drivetrain systems, engine components, and a wide variety of controls. This Basket Component trades on the NYSE under the symbol “ETN”. The company’s CIK number is 0001551182.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

48.09 | 38.78 | |||||||||

| Second Quarter |

48.35 | 42.10 | ||||||||||

| Third Quarter |

42.17 | 26.89 | ||||||||||

| Fourth Quarter |

27.29 | 19.39 | ||||||||||

| 2009 |

First Quarter |

26.16 | 15.14 | |||||||||

| Second Quarter |

24.59 | 18.75 | ||||||||||

| Third Quarter |

30.04 | 20.41 | ||||||||||

| Fourth Quarter |

33.10 | 27.03 | ||||||||||

| 2010 |

First Quarter |

38.21 | 30.62 | |||||||||

| Second Quarter |

40.16 | 32.72 | ||||||||||

| Third Quarter |

41.34 | 31.79 | ||||||||||

| Fourth Quarter |

51.09 | 40.65 | ||||||||||

| 2011 |

First Quarter |

56.22 | 50.11 | |||||||||

| Second Quarter |

55.91 | 45.81 | ||||||||||

| Third Quarter |

52.88 | 34.73 | ||||||||||

| Fourth Quarter |

46.97 | 34.16 | ||||||||||

| 2012 |

First Quarter |

52.51 | 45.29 | |||||||||

| Second Quarter |

50.09 | 37.09 | ||||||||||

| Third Quarter |

48.52 | 37.04 | ||||||||||

| Fourth Quarter |

54.66 | 44.65 | ||||||||||

| 2013 |

First Quarter |

63.42 | 55.02 | |||||||||

| Second Quarter |

68.88 | 55.80 | ||||||||||

| Third Quarter (through the pricing date) |

69.93 | 64.55 | ||||||||||

| Accelerated Return Notes® | TS-11 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Fluor Corporation

Fluor Corporation provides engineering, procurement, construction and maintenance as well as project management services on a global basis. The company also provides outsourcing of maintenance services and asset operations, equipment rental and sales, business support services, and other services. This Basket Component trades on the NYSE under the symbol “FLR”. The company’s CIK number is 0001124198.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

75.78 | 53.50 | |||||||||

| Second Quarter |

98.64 | 74.15 | ||||||||||

| Third Quarter |

95.71 | 48.72 | ||||||||||

| Fourth Quarter |

52.22 | 29.56 | ||||||||||

| 2009 |

First Quarter |

49.79 | 30.46 | |||||||||

| Second Quarter |

54.76 | 35.01 | ||||||||||

| Third Quarter |

58.21 | 46.16 | ||||||||||

| Fourth Quarter |

51.54 | 39.86 | ||||||||||

| 2010 |

First Quarter |

50.20 | 42.44 | |||||||||

| Second Quarter |

55.13 | 42.22 | ||||||||||

| Third Quarter |

50.46 | 41.76 | ||||||||||

| Fourth Quarter |

66.63 | 48.19 | ||||||||||

| 2011 |

First Quarter |

75.63 | 64.55 | |||||||||

| Second Quarter |

73.56 | 60.48 | ||||||||||

| Third Quarter |

67.60 | 46.55 | ||||||||||

| Fourth Quarter |

60.02 | 45.49 | ||||||||||

| 2012 |

First Quarter |

63.99 | 51.53 | |||||||||

| Second Quarter |

61.17 | 45.12 | ||||||||||

| Third Quarter |

60.15 | 46.09 | ||||||||||

| Fourth Quarter |

59.53 | 51.39 | ||||||||||

| 2013 |

First Quarter |

66.33 | 59.98 | |||||||||

| Second Quarter |

66.28 | 54.16 | ||||||||||

| Third Quarter (through the pricing date) |

66.70 | 57.75 | ||||||||||

Ingersoll-Rand PLC

Ingersoll-Rand PLC is a diversified, global company that provides a diverse range of products and services for a wide range of industries. The company’s operations include consist of air conditioning systems and services, climate control technologies, industrial technologies and security technologies. This Basket Component trades on the NYSE under the symbol “IR”. The company’s CIK number is 0001466258.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

45.07 | 36.77 | |||||||||

| Second Quarter |

46.58 | 36.87 | ||||||||||

| Third Quarter |

40.17 | 29.86 | ||||||||||

| Fourth Quarter |

29.46 | 12.08 | ||||||||||

| 2009 |

First Quarter |

20.02 | 11.84 | |||||||||

| Second Quarter |

23.55 | 14.52 | ||||||||||

| Third Quarter |

32.74 | 19.76 | ||||||||||

| Fourth Quarter |

37.23 | 29.70 | ||||||||||

| 2010 |

First Quarter |

37.51 | 31.26 | |||||||||

| Second Quarter |

40.01 | 34.49 | ||||||||||

| Third Quarter |

38.15 | 32.53 | ||||||||||

| Fourth Quarter |

47.36 | 35.91 | ||||||||||

| 2011 |

First Quarter |

49.03 | 44.48 | |||||||||

| Second Quarter |

52.08 | 42.81 | ||||||||||

| Third Quarter |

47.06 | 27.37 | ||||||||||

| Fourth Quarter |

34.18 | 26.48 | ||||||||||

| 2012 |

First Quarter |

41.63 | 31.86 | |||||||||

| Second Quarter |

44.54 | 38.64 | ||||||||||

| Third Quarter |

46.92 | 39.54 | ||||||||||

| Fourth Quarter |

48.87 | 44.30 | ||||||||||

| 2013 |

First Quarter |

56.47 | 48.96 | |||||||||

| Second Quarter |

58.52 | 52.23 | ||||||||||

| Third Quarter (through the pricing date) |

62.95 | 55.69 | ||||||||||

| Accelerated Return Notes® | TS-12 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

International Paper Company

International Paper Company produces and distributes printing paper, packaging, forest products, and chemical products. The company operates specialty businesses in global markets as well as a broadly based distribution network. This Basket Component trades on the NYSE under the symbol “IP”. The company’s CIK number is 0000051434.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 33.50 | 26.68 | |||||||||

| Second Quarter | 29.10 | 23.30 | ||||||||||

| Third Quarter | 30.59 | 22.00 | ||||||||||

| Fourth Quarter | 26.06 | 10.36 | ||||||||||

| 2009 |

First Quarter | 12.52 | 4.09 | |||||||||

| Second Quarter | 15.81 | 6.86 | ||||||||||

| Third Quarter | 25.12 | 13.99 | ||||||||||

| Fourth Quarter | 27.66 | 21.35 | ||||||||||

| 2010 |

First Quarter | 28.14 | 22.15 | |||||||||

| Second Quarter | 28.63 | 21.08 | ||||||||||

| Third Quarter | 25.50 | 19.88 | ||||||||||

| Fourth Quarter | 27.24 | 21.52 | ||||||||||

| 2011 |

First Quarter | 30.29 | 25.63 | |||||||||

| Second Quarter | 32.86 | 26.57 | ||||||||||

| Third Quarter | 30.95 | 23.23 | ||||||||||

| Fourth Quarter | 29.64 | 22.65 | ||||||||||

| 2012 |

First Quarter | 36.29 | 29.97 | |||||||||

| Second Quarter | 35.17 | 27.81 | ||||||||||

| Third Quarter | 36.78 | 28.56 | ||||||||||

| Fourth Quarter | 39.84 | 33.62 | ||||||||||

| 2013 |

First Quarter | 47.00 | 40.01 | |||||||||

| Second Quarter | 48.68 | 42.89 | ||||||||||

| Third Quarter (through the pricing date) | 50.19 | 45.13 | ||||||||||

LyondellBasell Industries NV

LyondellBasell Industries NV manufactures plastic, chemical, and fuel products. The company offers products used for packaging, clean fuels, durable textiles, medical applications, construction materials, and automotive parts. This Basket Component trades on the NYSE under the symbol “LYB”. The company’s CIK number is 0001489393. The shares of LyondellBasell Industries NV were not publicly traded prior to October 14, 2010.

| High ($) | Low ($) | |||||||||||

| 2010 |

Fourth Quarter | 34.40 | 29.21 | |||||||||

| 2011 |

First Quarter | 40.90 | 34.56 | |||||||||

| Second Quarter | 45.62 | 36.56 | ||||||||||

| Third Quarter | 41.23 | 24.43 | ||||||||||

| Fourth Quarter | 36.08 | 24.10 | ||||||||||

| 2012 |

First Quarter | 46.01 | 33.47 | |||||||||

| Second Quarter | 45.73 | 36.76 | ||||||||||

| Third Quarter | 53.42 | 39.62 | ||||||||||

| Fourth Quarter | 57.09 | 45.41 | ||||||||||

| 2013 |

First Quarter | 65.42 | 56.84 | |||||||||

| Second Quarter | 68.81 | 55.51 | ||||||||||

| Third Quarter (through the pricing date) | 70.89 | 65.41 | ||||||||||

| Accelerated Return Notes® | TS-13 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Masco Corporation

Masco Corporation manufactures, and sells home improvement and building products. The company’s products include faucets, kitchen and bath cabinets, architectural coatings, and builders’ hardware products. This Basket Component trades on the NYSE under the symbol “MAS”. The company’s CIK number is 0000062996.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 23.33 | 18.22 | |||||||||

| Second Quarter | 20.80 | 15.73 | ||||||||||

| Third Quarter | 19.79 | 13.92 | ||||||||||

| Fourth Quarter | 17.86 | 7.44 | ||||||||||

| 2009 |

First Quarter | 11.91 | 3.67 | |||||||||

| Second Quarter | 11.29 | 6.99 | ||||||||||

| Third Quarter | 15.13 | 8.24 | ||||||||||

| Fourth Quarter | 14.68 | 11.65 | ||||||||||

| 2010 |

First Quarter | 15.58 | 13.16 | |||||||||

| Second Quarter | 18.35 | 10.76 | ||||||||||

| Third Quarter | 11.93 | 10.05 | ||||||||||

| Fourth Quarter | 13.53 | 10.60 | ||||||||||

| 2011 |

First Quarter | 14.77 | 12.72 | |||||||||

| Second Quarter | 14.29 | 11.81 | ||||||||||

| Third Quarter | 12.46 | 6.96 | ||||||||||

| Fourth Quarter | 10.70 | 6.91 | ||||||||||

| 2012 |

First Quarter | 14.10 | 10.98 | |||||||||

| Second Quarter | 14.55 | 11.73 | ||||||||||

| Third Quarter | 16.25 | 11.94 | ||||||||||

| Fourth Quarter | 17.08 | 14.30 | ||||||||||

| 2013 |

First Quarter | 20.94 | 17.07 | |||||||||

| Second Quarter | 22.74 | 18.65 | ||||||||||

| Third Quarter (through the pricing date) | 21.55 | 19.31 | ||||||||||

Nucor Corporation

Nucor Corporation manufactures steel products. The company’s products include carbon and alloy steel, steel joists, steel deck, cold finished steel, steel grinding balls, steel bearing products, and metal building systems, and brokers ferrous and nonferrous metals, pig iron, supplies ferro-alloys, and processes ferrous and nonferrous scrap. This Basket Component trades on the NYSE under the symbol “NUE”. The company’s CIK number is 0000073309.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 74.45 | 50.30 | |||||||||

| Second Quarter | 82.07 | 68.11 | ||||||||||

| Third Quarter | 72.23 | 36.98 | ||||||||||

| Fourth Quarter | 47.26 | 25.52 | ||||||||||

| 2009 |

First Quarter | 48.30 | 30.74 | |||||||||

| Second Quarter | 48.97 | 37.50 | ||||||||||

| Third Quarter | 49.84 | 40.40 | ||||||||||

| Fourth Quarter | 47.10 | 38.67 | ||||||||||

| 2010 |

First Quarter | 49.93 | 39.50 | |||||||||

| Second Quarter | 47.67 | 38.28 | ||||||||||

| Third Quarter | 40.66 | 36.38 | ||||||||||

| Fourth Quarter | 44.58 | 37.50 | ||||||||||

| 2011 |

First Quarter | 48.88 | 43.75 | |||||||||

| Second Quarter | 47.64 | 39.45 | ||||||||||

| Third Quarter | 41.57 | 31.25 | ||||||||||

| Fourth Quarter | 41.17 | 30.91 | ||||||||||

| 2012 |

First Quarter | 45.41 | 40.52 | |||||||||

| Second Quarter | 43.49 | 34.39 | ||||||||||

| Third Quarter | 40.76 | 36.82 | ||||||||||

| Fourth Quarter | 43.97 | 37.82 | ||||||||||

| 2013 |

First Quarter | 48.23 | 43.71 | |||||||||

| Second Quarter | 47.10 | 42.23 | ||||||||||

| Third Quarter (through the pricing date) | 49.22 | 43.55 | ||||||||||

| Accelerated Return Notes® | TS-14 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Occidental Petroleum Corporation

Occidental Petroleum Corporation explores, develops, produces, and markets crude oil and natural gas. The company manufactures and markets a variety of basic chemicals, vinyls and performance chemicals. The company gathers, treats, processes, transports, stores, trades and markets crude oil, natural gas, NGLs, condensate and carbon dioxide, and generates and markets power This Basket Component trades on the NYSE under the symbol “OXY”. The company’s CIK number is 0000797468.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 80.51 | 64.53 | |||||||||

| Second Quarter | 97.85 | 74.88 | ||||||||||

| Third Quarter | 91.44 | 65.00 | ||||||||||

| Fourth Quarter | 67.42 | 40.72 | ||||||||||

| 2009 |

First Quarter | 62.16 | 47.56 | |||||||||

| Second Quarter | 70.63 | 54.77 | ||||||||||

| Third Quarter | 79.15 | 59.57 | ||||||||||

| Fourth Quarter | 84.48 | 74.33 | ||||||||||

| 2010 |

First Quarter | 84.54 | 76.01 | |||||||||

| Second Quarter | 89.99 | 77.15 | ||||||||||

| Third Quarter | 82.92 | 72.23 | ||||||||||

| Fourth Quarter | 99.03 | 78.63 | ||||||||||

| 2011 |

First Quarter | 107.37 | 93.81 | |||||||||

| Second Quarter | 115.74 | 96.89 | ||||||||||

| Third Quarter | 108.08 | 71.50 | ||||||||||

| Fourth Quarter | 101.29 | 68.58 | ||||||||||

| 2012 |

First Quarter | 105.46 | 94.43 | |||||||||

| Second Quarter | 97.48 | 77.33 | ||||||||||

| Third Quarter | 91.95 | 82.65 | ||||||||||

| Fourth Quarter | 86.38 | 73.59 | ||||||||||

| 2013 |

First Quarter | 88.68 | 78.01 | |||||||||

| Second Quarter | 94.75 | 78.95 | ||||||||||

| Third Quarter (through the pricing date) | 92.09 | 87.88 | ||||||||||

Oracle Corporation

Oracle Corporation supplies software for enterprise information management. The company offers databases and relational servers, application development and decision support tools, and enterprise business applications. The company’s software runs on network computers, personal digital assistants, set-top devices, PCs, workstations, minicomputers, mainframes, and massively parallel computers. This Basket Component trades on the NYSE under the symbol “ORCL”. The company’s CIK number is 0001341439.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 23.07 | 18.44 | |||||||||

| Second Quarter | 23.18 | 19.84 | ||||||||||

| Third Quarter | 23.52 | 18.10 | ||||||||||

| Fourth Quarter | 19.86 | 15.40 | ||||||||||

| 2009 |

First Quarter | 18.68 | 13.85 | |||||||||

| Second Quarter | 21.63 | 18.07 | ||||||||||

| Third Quarter | 22.86 | 20.18 | ||||||||||

| Fourth Quarter | 25.01 | 20.34 | ||||||||||

| 2010 |

First Quarter | 26.04 | 23.06 | |||||||||

| Second Quarter | 26.51 | 21.46 | ||||||||||

| Third Quarter | 27.50 | 21.55 | ||||||||||

| Fourth Quarter | 31.76 | 26.90 | ||||||||||

| 2011 |

First Quarter | 33.69 | 30.14 | |||||||||

| Second Quarter | 36.37 | 30.81 | ||||||||||

| Third Quarter | 34.09 | 24.78 | ||||||||||

| Fourth Quarter | 33.69 | 25.52 | ||||||||||

| 2012 |

First Quarter | 30.24 | 25.92 | |||||||||

| Second Quarter | 29.71 | 25.58 | ||||||||||

| Third Quarter | 33.10 | 28.82 | ||||||||||

| Fourth Quarter | 34.09 | 29.57 | ||||||||||

| 2013 |

First Quarter | 36.34 | 31.25 | |||||||||

| Second Quarter | 35.10 | 29.95 | ||||||||||

| Third Quarter (through the pricing date) | 33.02 | 30.10 | ||||||||||

| Accelerated Return Notes® | TS-15 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Red Hat Inc.

Red Hat Inc. develops and provides open source software and services, including the Red Hat Linux operating system. The company’s website offers information and news about open source software and provides an online community of open source software users and developers. This Basket Component trades on the NYSE under the symbol “RHT”. The company’s CIK number is 0001087423.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter | 20.71 | 16.58 | |||||||||

| Second Quarter | 24.36 | 18.96 | ||||||||||

| Third Quarter | 23.23 | 15.07 | ||||||||||

| Fourth Quarter | 15.59 | 7.89 | ||||||||||

| 2009 |

First Quarter | 17.84 | 13.20 | |||||||||

| Second Quarter | 20.79 | 17.12 | ||||||||||

| Third Quarter | 27.95 | 19.04 | ||||||||||

| Fourth Quarter | 31.43 | 25.76 | ||||||||||

| 2010 |

First Quarter | 31.12 | 27.00 | |||||||||

| Second Quarter | 32.23 | 27.49 | ||||||||||

| Third Quarter | 41.27 | 28.91 | ||||||||||

| Fourth Quarter | 48.45 | 38.17 | ||||||||||

| 2011 |

First Quarter | 47.26 | 39.11 | |||||||||

| Second Quarter |

47.71 | 40.94 | ||||||||||

| Third Quarter |

46.67 | 31.87 | ||||||||||

| Fourth Quarter |

52.72 | 39.89 | ||||||||||

| 2012 |

First Quarter |

61.43 | 41.65 | |||||||||

| Second Quarter |

61.95 | 49.90 | ||||||||||

| Third Quarter |

60.00 | 50.48 | ||||||||||

| Fourth Quarter |

55.80 | 47.41 | ||||||||||

| 2013 |

First Quarter |

56.90 | 48.99 | |||||||||

| Second Quarter |

54.99 | 45.48 | ||||||||||

| Third Quarter (through the pricing date) |

52.48 | 47.41 | ||||||||||

Teradata Corporation

Teradata Corporation operates as a database management company in the technology industry. The company offers analytic data solutions through integrated data warehousing, big data analytics, and business applications, and collaborates with leading innovators in software, technology, and integration services. This Basket Component trades on the NYSE under the symbol “TDC”. The company’s CIK number is 0000816761.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

26.99 | 21.75 | |||||||||

| Second Quarter |

27.01 | 20.61 | ||||||||||

| Third Quarter |

25.18 | 18.41 | ||||||||||

| Fourth Quarter |

18.85 | 11.46 | ||||||||||

| 2009 |

First Quarter |

17.12 | 13.02 | |||||||||

| Second Quarter |

24.10 | 15.28 | ||||||||||

| Third Quarter |

27.90 | 21.82 | ||||||||||

| Fourth Quarter |

32.08 | 26.35 | ||||||||||

| 2010 |

First Quarter |

31.04 | 27.66 | |||||||||

| Second Quarter |

33.98 | 28.25 | ||||||||||

| Third Quarter |

38.96 | 29.62 | ||||||||||

| Fourth Quarter |

43.50 | 37.31 | ||||||||||

| 2011 |

First Quarter |

51.14 | 42.00 | |||||||||

| Second Quarter |

60.20 | 49.49 | ||||||||||

| Third Quarter |

62.33 | 43.35 | ||||||||||

| Fourth Quarter |

62.18 | 47.70 | ||||||||||

| 2012 |

First Quarter |

69.38 | 47.37 | |||||||||

| Second Quarter |

77.14 | 64.64 | ||||||||||

| Third Quarter |

80.62 | 62.79 | ||||||||||

| Fourth Quarter |

76.06 | 57.94 | ||||||||||

| 2013 |

First Quarter |

69.34 | 56.28 | |||||||||

| Second Quarter |

58.24 | 48.34 | ||||||||||

| Third Quarter (through the pricing date) |

64.70 | 50.02 | ||||||||||

| Accelerated Return Notes® | TS-16 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

VMware Inc.

VMware Inc. provides virtualization solutions from the desktop to the data center. The company’s solution products address a range of IT problems, which include cost and operational inefficiencies, business continuity, software lifecycle management and desktop management. This Basket Component trades on the NYSE under the symbol “VMW”. The company’s CIK number is 0001124610.

| High ($) | Low ($) | |||||||||||

| 2008 |

First Quarter |

84.60 | 42.77 | |||||||||

| Second Quarter |

72.08 | 43.68 | ||||||||||

| Third Quarter |

55.01 | 26.00 | ||||||||||

| Fourth Quarter |

31.81 | 17.88 | ||||||||||

| 2009 |

First Quarter |

26.33 | 19.89 | |||||||||

| Second Quarter |

32.81 | 25.40 | ||||||||||

| Third Quarter |

41.09 | 26.12 | ||||||||||

| Fourth Quarter |

45.57 | 37.75 | ||||||||||

| 2010 |

First Quarter |

54.49 | 41.58 | |||||||||

| Second Quarter |

72.52 | 52.47 | ||||||||||

| Third Quarter |

87.80 | 63.28 | ||||||||||

| Fourth Quarter |

91.02 | 73.12 | ||||||||||

| 2011 |

First Quarter |

97.00 | 74.81 | |||||||||

| Second Quarter |

100.23 | 78.54 | ||||||||||

| Third Quarter |

107.75 | 76.76 | ||||||||||

| Fourth Quarter |

103.25 | 76.85 | ||||||||||

| 2012 |

First Quarter |

112.46 | 81.67 | |||||||||

| Second Quarter |

114.62 | 84.06 | ||||||||||

| Third Quarter |

102.27 | 80.29 | ||||||||||

| Fourth Quarter |

97.33 | 83.36 | ||||||||||

| 2013 |

First Quarter |

99.00 | 70.37 | |||||||||

| Second Quarter |

78.95 | 65.53 | ||||||||||

| Third Quarter (through the pricing date) |

84.99 | 65.58 | ||||||||||

| Accelerated Return Notes® | TS-17 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Supplement to the Plan of Distribution; Conflicts of Interest

Under our distribution agreement with MLPF&S, MLPF&S will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

MLPF&S, a broker-dealer subsidiary of BAC, is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of Rule 5121 applicable to FINRA members. MLPF&S may not make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

We will deliver the notes against payment therefor in New York, New York on a date that is greater than three business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, trades in the secondary market generally are required to settle in three business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes more than three business days prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units. If you place an order to purchase the notes, you are consenting to MLPF&S acting as a principal in effecting the transaction for your account.

MLPF&S may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices, and these will include MLPF&S’s trading commissions and mark-ups. MLPF&S may act as principal or agent in these market-making transactions; however, it is not obligated to engage in any such transactions. At MLPF&S’s discretion, for a short, undetermined initial period after the issuance of the notes, any purchase price paid by MLPF&S in the secondary market may be, in certain circumstances, closer to the amount that you paid for the notes than to the initial estimated value. However, neither we nor any of our affiliates is obligated to purchase your notes at any price, or at a price that exceeds the initial estimated value.

The value of the notes shown on your account statement will be based on MLPF&S’s estimate of the value of the notes if MLPF&S or another of our affiliates were to make a market in the notes, which it is not obligated to do. That estimate will be based upon the price that MLPF&S may pay for the notes in light of then-prevailing market conditions, our creditworthiness and transaction costs. At certain times, this price may be higher than or lower than the initial estimated value of the notes.

Structuring the Notes

The notes are our debt securities, the return on which is linked to the level of the Basket. As is the case for all of our debt securities, including our market-linked notes, the economic terms of the notes reflect our actual or perceived creditworthiness at the time of pricing. In addition, because market-linked notes result in increased operational, funding and liability management costs to us, we typically borrow the funds under these notes at a rate that is more favorable to us than the rate that we might pay for a conventional fixed or floating rate debt security. This rate is generally lower by an amount that we do not expect to exceed 0.50% per annum (equivalent to not more than $0.06 per unit). This generally relatively lower implied borrowing rate, which is reflected in the economic terms of the notes, along with the fees and charges associated with market-linked notes, resulted in the initial estimated value of the notes on the pricing date being less than their public offering price.

At maturity, we are required to pay the Redemption Amount to holders of the notes, which will be calculated based on the level of the Basket and the $10 per unit Original Offering Price. In order to meet these payment obligations, at the time we issue the notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with MLPF&S or one of its affiliates. The terms of these hedging arrangements are determined by seeking bids from market participants, including MLPF&S and its affiliates, and take into account a number of factors, including our creditworthiness, interest rate movements, the volatility of the Basket, the tenor of the note and the tenor of the hedging arrangements. The economic terms of the notes and their initial estimated value depend in part on the terms of these hedging arrangements.

MLPF&S has advised us that the hedging arrangements will include a hedging related charge of approximately $0.075 per unit, reflecting an estimated profit to be credited to MLPF&S from these transactions. Since hedging entails risk and may be influenced by unpredictable market forces, additional profits and losses from these hedging arrangements may be realized by MLPF&S or any third party hedge providers.

For further information, see “Risk Factors — General Risks Relating to ARNs” beginning on page S-10 and “Use of Proceeds” on page S-22 of product supplement ARN-4.

| Accelerated Return Notes® | TS-18 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Summary Tax Consequences

You should consider the U.S. federal income tax consequences of an investment in the notes, including the following:

| • | There is no statutory, judicial, or administrative authority directly addressing the characterization of the notes. |

| • | You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as a single financial contract with respect to the Basket. |

| • | Under this characterization and tax treatment of the notes, a U.S. Holder (as defined beginning on page 62 of the prospectus) generally will recognize capital gain or loss upon maturity or upon a sale or exchange of the notes prior to maturity. This capital gain or loss generally will be long-term capital gain or loss if you held the notes for more than one year. |

| • | No assurance can be given that the IRS or any court will agree with this characterization and tax treatment. |

| • | Withholding and reporting requirements under the legislation enacted on March 18, 2010 (as discussed beginning on page 85 of the prospectus), will generally apply to payments made after June 30, 2014. However, this withholding tax will not be imposed on payments pursuant to obligations outstanding on July 1, 2014. Additionally, withholding due to any payment being treated as a “dividend equivalent” (as discussed beginning on page S-48 of product supplement ARN-4) will begin no earlier than January 1, 2014. Holders are urged to consult with their own tax advisors regarding the possible implications of this recently enacted legislation on their investment in the notes. |

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. You should review carefully the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page S-45 of product supplement ARN-4.

Validity of the Notes

In the opinion of McGuireWoods LLP, as counsel to BAC, when the trustee has made an appropriate entry on Schedule 1 to the Master Registered Global Senior Note, dated March 30, 2012 (the “Master Note”) identifying the notes offered hereby as supplemental obligations thereunder in accordance with the instructions of BAC, and the notes have been delivered against payment therefor as contemplated in this Note Prospectus, all in accordance with the provisions of the Senior Indenture, such notes will be legal, valid and binding obligations of BAC, subject to applicable bankruptcy, reorganization, insolvency, moratorium, fraudulent conveyance or other similar laws affecting the rights of creditors now or hereafter in effect, and to equitable principles that may limit the right to specific enforcement of remedies, and further subject to 12 U.S.C. §1818(b)(6)(D) (or any successor statute) and any bank regulatory powers now or hereafter in effect and to the application of principles of public policy. This opinion is given as of the date hereof and is limited to the federal laws of the United States, the laws of the State of New York and the Delaware General Corporation Law (including the statutory provisions, all applicable provisions of the Delaware Constitution and reported judicial decisions interpreting the foregoing). In addition, this opinion is subject to the assumption that the trustee’s certificate of authentication of the Master Note has been manually signed by one of the trustee’s authorized officers and to customary assumptions about the trustee’s authorization, execution and delivery of the Senior Indenture, the validity, binding nature and enforceability of the Senior Indenture with respect to the trustee, the legal capacity of natural persons, the genuineness of signatures, the authenticity of all documents submitted to McGuireWoods LLP as originals, the conformity to original documents of all documents submitted to McGuireWoods LLP as photocopies thereof, the authenticity of the originals of such copies and certain factual matters, all as stated in the letter of McGuireWoods LLP dated March 30, 2012, which has been filed as an exhibit to BAC’s Registration Statement relating to the notes filed with the SEC on March 30, 2012.

| Accelerated Return Notes® | TS-19 |

| Accelerated Return Notes® Linked to a Basket of 16 Common Equity Securities, due October 24, 2014 |

|

Where You Can Find More Information

We have filed a registration statement (including a product supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the Note Prospectus, including this term sheet, and the other documents that we have filed with the SEC, for more complete information about us and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, we, any agent, or any dealer participating in this offering will arrange to send you these documents if you so request by calling MLPF&S toll-free at 1-866-500-5408.

Market-Linked Investments Classification

MLPF&S classifies certain market-linked investments (the “Market-Linked Investments”) into categories, each with different investment characteristics. The following description is meant solely for informational purposes and is not intended to represent any particular Enhanced Return Market-Linked Investment or guarantee any performance.

Enhanced Return Market-Linked Investments are short- to medium-term investments that offer you a way to enhance exposure to a particular market view without taking on a similarly enhanced level of market downside risk. They can be especially effective in a flat to moderately positive market (or, in the case of bearish investments, a flat to moderately negative market). In exchange for the potential to receive better-than market returns on the linked asset, you must generally accept market downside risk and capped upside potential. As these investments are not market downside protected, and do not assure full repayment of principal at maturity, you need to be prepared for the possibility that you may lose all or part of your investment.

“Accelerated Return Notes®” and “ARNs®” are our registered service marks.

| Accelerated Return Notes® | TS-20 |