April 2015

2015 Corporate Governance

and Compensation Practices

Highlights |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| ¨ | Definitive Proxy Statement | |||

| x | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to §240.14a-12 | |||

Bank of America Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

April 2015

2015 Corporate Governance

and Compensation Practices

Highlights |

•

Serves

48M

consumer and small business relationships

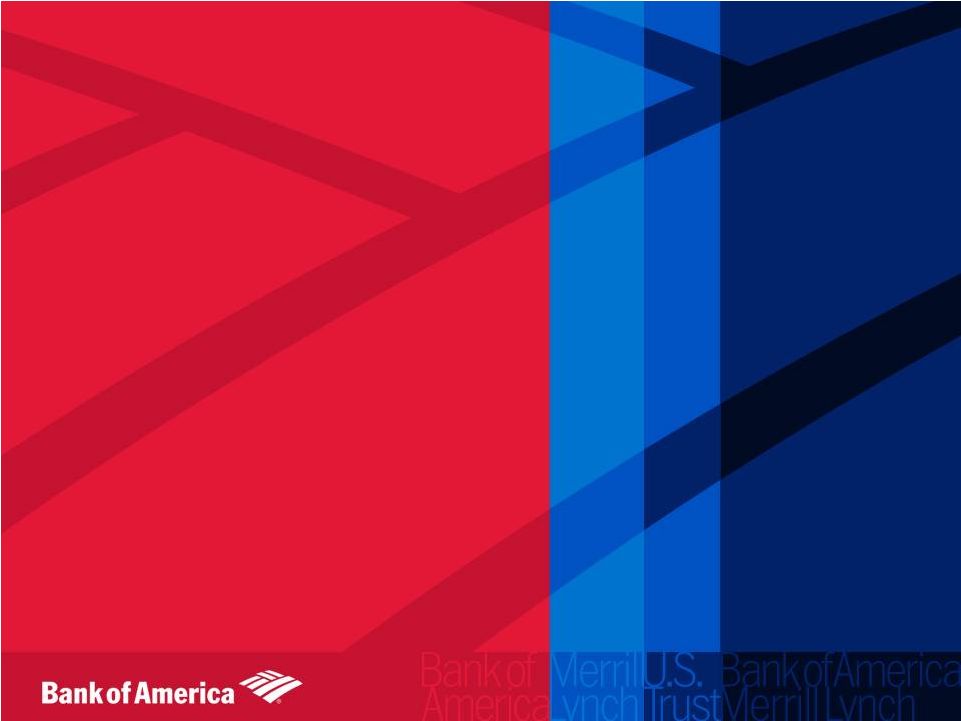

Business Overview & Performance Highlights

2

Premier Financial Institution Focused

on

Three Groups of Customers

2014

Revenue

Across

Our

Five

Reported

Segments

($B)

1

Reflects

reclassification

of

reporting

segments

as

of

January

1,

2015

2

Primary competitor group includes Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley and

Wells Fargo 2014 Performance Highlights

Achieved “Project New BAC”

cost savings goal

Reduced costs by $2B per quarter nine months ahead of original plan

Improved levels of capital and liquidity

Tier 1 capital increased more than 7% from 12/31/13 to $169B;

achieved record Global Excess Liquidity Sources of $439B

Improved / increased client and customer activity

4M business referrals in 2014

Increased quarterly common stock dividend

From $0.01 to $0.05 per share

15.7% total return to investors in 2014

Surpassed both peer and S&P average

Strong One-Year TSR Performance Relative to Peers

2

Institutional

Investors.

Support

research

processes,

risk

management and portfolio performance goals

Companies.

Expertise

and

customized

products

and

services

delivered through our global banking platform

Consumer

Banking

$30.8

Global Wealth

& Investment

Mgmt

$18.4

Global

Banking

$17.7

Global

Markets

$16.1

Legacy Assets

& Servicing

$2.7

15.7%

14.8%

14.4%

13.7%

3.8%

BAC

Primary

Competitor

Group Average

USG-SIFI Average

S&P 500 Index

AIIG-SIFI Average

People.

Banking

and

wealth

management

solutions

•

Serve

1

in

3

companies

with

$50M

-

$2B

in

annual

sales

•

More than

200,000

unique institutional and retail clients access our

research and analysis

1 |

Governance

Enhancements Informed by Shareholder Feedback 3

Board implemented special meeting right at 10% ownership threshold

Annual election of directors

Majority vote standard for director elections

•

Business Standards report

1

•

Political activities disclosure

•

Sustainability and greenhouse gas emission disclosure

Shareholder

Rights

Reporting

& Disclosure

Director

Accountability

1

Expected to be produced by March 31, 2016.

Our Board has implemented market-leading governance practices in direct response to our

shareholders’

feedback, including proxy access with 3%/3 year threshold

Board proactively adopted proxy access right at a 3% / 3 year ownership threshold with

market-leading aggregation terms

•

At time of adoption, Bank of America was one of only 10 US companies to establish

proxy access at 3%/3 year threshold

•

Demonstrates Bank of America’s commitment to constructive engagement with investors

and the evolving landscape of shareholder rights

Proxy Access

Enhanced business and sustainability reporting, including: |

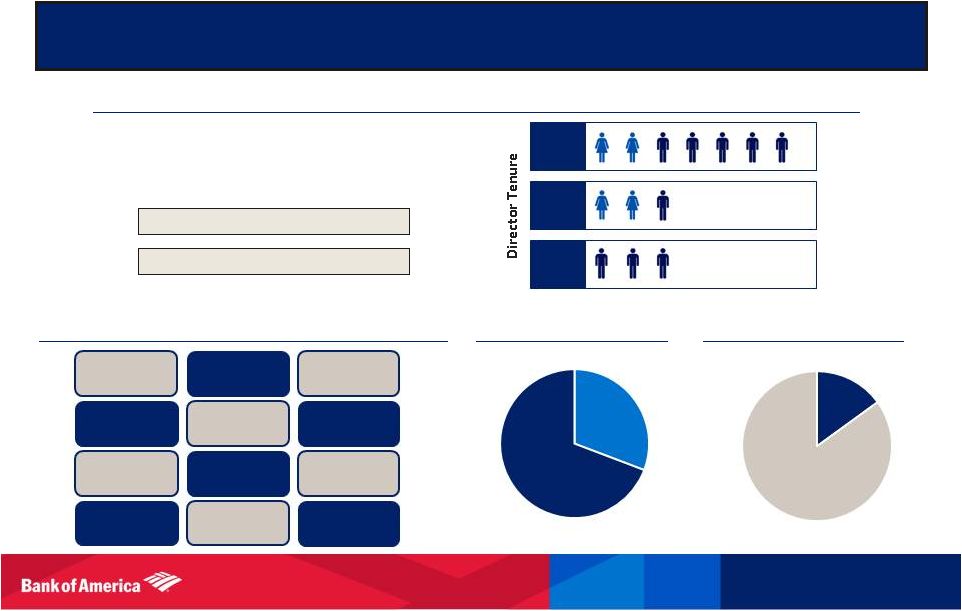

Highly Engaged,

Independent Board with Deep Expertise •

Our 13 member Board includes 11 independent directors,

8 of whom have been elected since 2009, including 7 in the

last 3 years

4

We maintain strong board evaluation and succession planning practices to ensure we have the

right skills and experiences on the Board to oversee our business and strategy

2013:

De

Weck,

Donald

&

Nowell

2012:

Allen,

Bovender,

Hudson

&

Yost

Independent

85%

Risk Management

Cybersecurity

Risk

Consumer Banking

International

Perspective

Audit / Financial

Reporting

Corporate

Governance

Financial Services

Industry Experience

Strategic Planning

Business

Development

Regulated Business

Expertise

Operational Risk

Social Responsibility

and Diversity

1 –

4

years

5 –

8

years

9 –

12

years

Balance of Institutional Knowledge and Fresh Perspectives

Directors Contribute Valuable Range of Expertise

Gender Diversity

Director Independence

Female

31%

Male

69%

Inside

15% |

Commitment to

Strong, Independent Board Leadership •

Bank of America has evolved significantly since 2009, when separate Chairman and CEO roles

were established. We have made significant changes to our Board

composition and Executive Management Team, and our shareholder base has evolved

considerably •

Decision to appoint Mr. Moynihan as Chairman reflected his demonstrated leadership, management

capability, knowledge of our business and industry, and the long-term, strategic

perspective he has demonstrated as CEO over the last 5 years •

Under Mr. Moynihan’s leadership, we have rebuilt capital, streamlined operations,

stabilized performance, increased capital return to shareholders, and made key

governance changes to enhance disclosure and shareholder engagement •

Creation of a Lead Independent Director role with robust and transparent duties comparable to

that of an Independent Chair was a critical component of the Board’s decision to

change the independent leadership structure •

Shareholder feedback from prior engagement and investor voting policies was also an important

factor in our decision 5

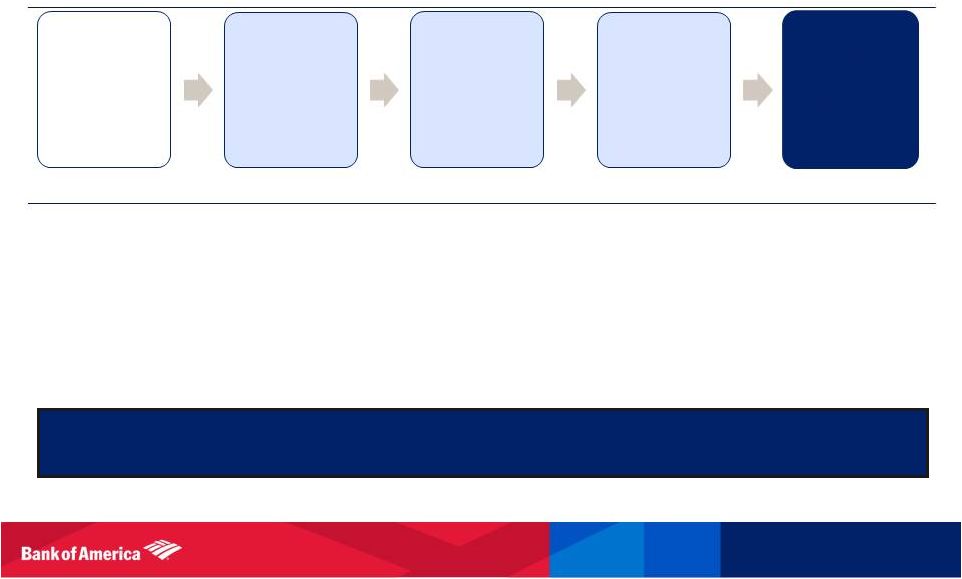

Key Elements of 2014 Board Leadership Review

Key Considerations in Board Leadership Decision

When Mr. Holliday

advised the Board of

his intention to step

out of Independent

Chairman role,

formal succession

review commenced

Board conducted

external review

of

board leadership

structures including

investor voting

policies and past

feedback, benchmark

data, and peer data

Board conducted

internal

review

of

current governance

structure, needs of

the business, and

Board leadership

candidates

Board appointed CEO

Brian Moynihan as

Chairman of the

Board, and elected

Jack Bovender to

newly established

Lead Independent

Director role

Our Board believes that an executive Chairman, working in tandem with a Lead Independent

Director with meaningful leadership responsibilities, provides the right Board

leadership structure at this time Corporate

Governance

Committee

deliberates annually

on Board leadership

structure,

in part by questions

on topic in annual

shareholder

engagement

informed |

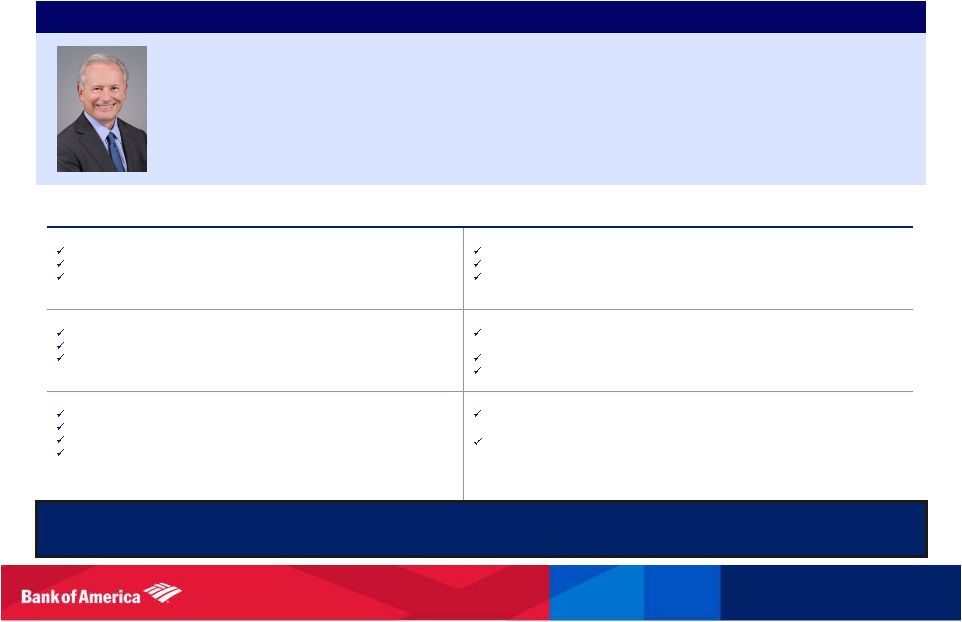

Lead Independent

Director with Significant Board Leadership Responsibilities

Jack Bovender, Lead Independent Director

•

Respected

among

the

directors

and

has

the

qualities

and

experience

desired

for

the

role

–

high

personal

integrity,

a

breadth

of

knowledge

in

management,

operations

and

corporate

governance

a

willingness

to

listen

and

to

engage

with

substance

and

impact,

and

a

readiness

to

challenge

management

•

Brings

strategic

insights

and

relevant

knowledge

as

former

Chairman,

CEO

and

COO

of

HCA

Inc.,

a

highly regulated company

Duties of the Lead Independent Director Establish Strong Independent Leadership in the

Boardroom Board Leadership

Presides at all meetings when Chairman is not present

Calls meetings of independent directors

Provides leadership if CEO / Chairman’s role may be in conflict

Board Culture

Serves as a liaison between CEO and independent directors

Establishes relationship with CEO, providing support, advice and feedback

Board Focus

Helps ensure Board focuses on key issues facing Bank of America

Assists in promoting corporate governance best practices

Board Meetings

Advises CEO of Board information needs, and approves information sent to Board

Develops discussion topics for Board executive sessions

Board Performance & Development

Helps ensure efficient and effective Board performance and functioning

Consults with Governance Committee on annual Board self assessment

Provides guidance on ongoing director development

Consults in identification and evaluation of director candidates, committee

members and committee chairs

Shareholders & Other Stakeholders

Available for consultation and direct communication, to the extent requested by

major shareholders

6

Our

Governance

Committee

will

continue

to

regularly

review

and

assess

the

best

Board

leadership

structure

for

Bank of America’s evolving needs

Acts as a “sounding board”and advisor to CEO

Plans, reviews and approves Board meeting agendas and schedules in coordination

with CEO

Contributes to annual performance review of CEO and participates in CEO

succession planning

,

,

Board’s oversight of management and company Regularly

communicates with primary bank regulators to discuss appropriateness of

|

Effective,

Independent Corporate Governance Committee 7

•

Committee takes a proactive, disciplined approach to Board refreshment and director

self-assessments as well as CEO evaluation and succession planning

•

Track record of promoting market-leading corporate governance best practices, including

proxy access adoption and enhanced reporting disclosure

Our Corporate Governance Committee is made up of experienced, skilled Board members who

contribute crucial strategic perspectives and drive independent oversight of management

Thomas May, Committee Chair

Sharon Allen, Committee Member

Other Committees: Enterprise Risk

Frank Bramble, Sr., Committee Member

Other Committees: Enterprise Risk (Chair)

•

Brings broad-ranging financial services experience and

historical insight from leadership positions at two

•

Experience on a wide range of issues including risk management, credit

cycles, consumer sales and marketing, and audit and financial reporting

Other Committees: Audit (Chair)

•

Prior positions give broad management experience of large, complex

businesses and an international perspective on risk management and

strategic planning

•

Public company board service gives further perspective into large,

complex, regulated organizations and financial reporting and

accounting

•

Strong accounting and financial skills from experience as a Certified

Public Accountant, as well as a professional perspective on financial

reporting and enterprise and operational risk management

Other Committees: Audit

•

Experience with regulated businesses, operations, risk

management, business development, strategic planning

and corporate governance matters as Chairman and CEO

of Northeast Utilities dba Eversource Energy

Lionel Nowell, III, Committee Member

•

Audit committee financial expert

•

Extensive experience in risk management and strategic

planning as well as strong financial skills as former

Treasurer of PepsiCo, Inc.

•

Audit committee financial expert

•

Extensive audit, financial reporting and corporate

governance experience from audit and consulting

services responsibilities as former Chairman at Deloitte

financial services companies acquired by BAC |

Best-in-Class Corporate Governance Practices

Substantial majority of independent directors; 11 of 13 members are independent

Annual election of directors with a majority vote standard

Robust Lead Independent Director role with clearly defined leadership responsibilities

Proxy access right at a 3% / 3 year ownership threshold

Special meeting right at a 10% ownership threshold

No supermajority provisions

Strong board oversight of risk management

Detailed business and sustainability reporting

Robust, proactive management succession planning

Annual Board and Committee self-evaluations

Corporate Governance Committee considers director candidates recommended by shareholders

Directors

may

not

sell

restricted

stock

received

as

compensation

(except

as

necessary

to

pay

taxes

upon

vesting)

until

termination of service

Regular engagement with shareholders and consideration of shareholder feedback

8 |

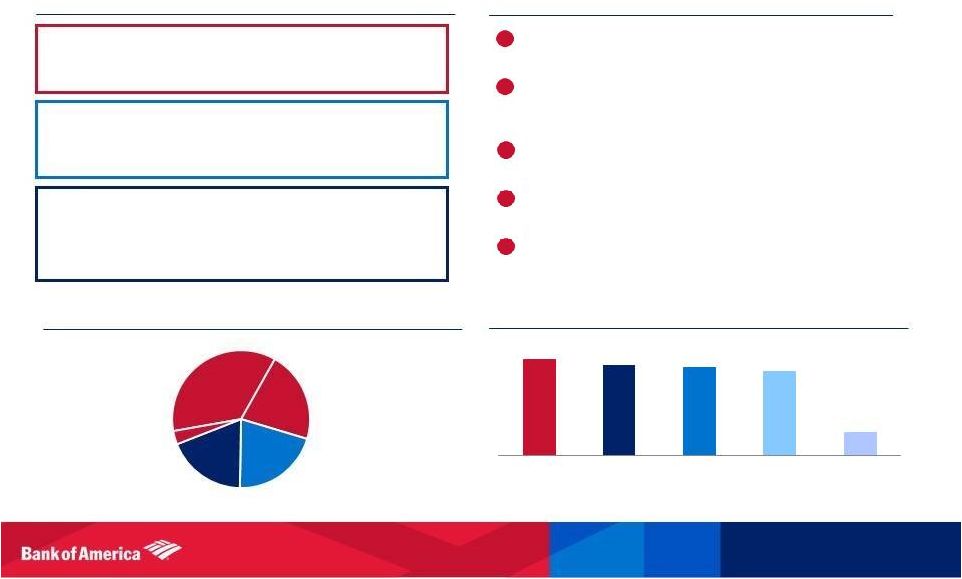

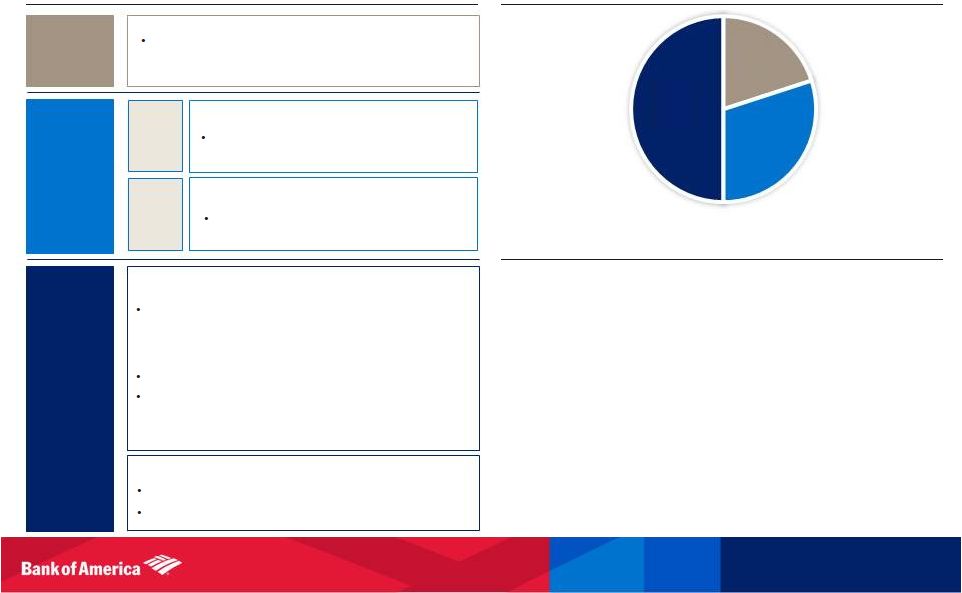

Executive

Compensation Program Strongly Aligns Pay and Performance

9

•

Our Board believes equity-based awards are the most direct way

to align employee and investor interests

•

We are requesting authorization for 125 million additional shares

this year, for a total pool of 450 million shares

-

We expect this pool to last three to four years, assuming we

settle awards in stock

•

We carefully manage potential dilution and with the additional

shares, our overhang will total 5.1%

•

Our plan has features that protect investor interests, including

double-trigger vesting, prohibition of re-pricing and no liberal

share recycling

CEO Variable Pay Mix for 2014

2014 Compensation Elements

Equity Plan Aligns Employee and Investor Interests

PRSUs

50%

TRSUs

20%

CRSUs

30%

Long-

Term

Incentive

Short-

Term

Incentive

For

CEO

For all

other

NEOs

Base

Salary

Cash-Settled Restricted Stock Units (CRSUs)

Stock price performance measured over 1-

year vesting period

Annual Cash Incentive

Provides short-term variable pay for

applicable performance year

Performance Restricted Stock Units (PRSUs)

Fully performance based. Measures Return on Assets and

adjusted Tangible Book Value growth, with full payout at

3-year Average ROA of 100bps and 3-year adjusted TBV

growth of 11.5%

3-year

performance

measurement

period

PRSUs are forfeited if results are below minimum goals

(minimum set at 3-year average ROA at 50bps and 3-year

average adjusted TBV growth of 5.25%)

Time-Based Restricted Stock Units (TRSUs)

Vest ratably over three years

Aligned with long-term stock price performance

Reflects job scope, experience and market comparable

positions |

Effective

Compensation Practices Aligned with Investor Interests What We Do

What We Don’t Do

Pay

for

performance

and

allocate

individual

awards

based

on

actual results and how results were achieved

Use balanced,

risk-adjusted performance measures

Review feedback

from independent control functions in performance evaluations and

compensation decisions Provide appropriate mix of fixed and variable pay to reward

company, line of business and individual performance

Defer

a

significant

portion

of

variable

pay

as

equity-based

awards

Strong

risk

management

practices

including

multiple

clawback

and

cancellation

features

for

equity

awards

including

detrimental conduct clawback and performance-based clawback

Require stock

ownership and retention of a portion of equity- based awards

•

500,000 shares for CEO

•

300,000 shares for other NEOs

Prohibit

hedging

and

speculative

trading

of

company

stock,

including short sales and trading in options and derivatives

x

No severance or change in control agreements for executive

officers

x

No

severance

benefits

to

our

executive

officers

>

2x

base

salary

and bonus without shareholder approval (per our policy limiting

future severance agreements)

x

No accrual of additional retirement benefits under supplemental

executive retirement plans (SERPs)

x

No excise tax gross-ups upon change in control

x

No discounting, reloading or re-pricing stock options without

shareholder approval

x

No single-trigger vesting of equity based awards upon change in

control

x

No multi-year guaranteed incentive awards

x

No fixed-duration employment contracts with executive officers

10

, |

Robust

Sustainability Initiatives and Reporting Our Board believes management is best suited to

address potential climate change impacts by supporting key environmental initiatives, continuing to

develop innovative solutions, and regularly communicating progress to our shareholders

1.

Bank of America Has Robust Disclosure Currently in Place

•

We are an industry leader in publicly disclosing the greenhouse gas emissions related to

operations and business activities •

We report publicly on 10 of 11 categories of Scope 3 emissions relevant to our business, and

provide detailed disclosure relating to the emissions profile of the U.S. electric

power utilities to which we extend credit •

In 2014, the Carbon Disclosure Project gave our Company a perfect disclosure score, and

ranked us in Performance Band A (the highest possible)

2.

We Continue to Develop Innovative Environmental Solutions

•

In 2012, we exceeded our original 10-year, $20B environmental business initiative to

address climate change through lending, investments, capital markets activity,

philanthropy and our Company’s own operations •

We renewed our commitment by embarking on a new 10-year, $50B initiative, bringing our

goal to $70 billion, and have delivered more than $39B under the combined goals to

date Proposal 5 is a shareholder proposal requesting a report on greenhouse gas emissions;

the report is unnecessary given our current strong practices in environmental

projects and disclosure 11

The

Board

encourages

a

vote

AGAINST

Proposal

5

•

The requested additional report would focus on greenhouse gas emissions of our customers and

climate change risk exposure in all of our lending, investing and financing

activities, and would require considerable resources without conveying useful information

•

In 2014, we announced a Catalytic Finance Initiative designed to stimulate at least $10B of

new investment into high-impact, clean energy projects |

Robust Disclosure

of Political Activities, and No Company Grassroots Lobbying

12

Proposal 6 is a shareholder proposal that requests a report on lobbying; the report is

unnecessary due to Company’s current disclosure on political activities and

contributions, and on trade associations The

Board

encourages

a

vote

AGAINST

Proposal

6

•

Our company does not engage in grassroots lobbying communications, or advocate with respect

to specific legislation with the general public

•

When we engage with policymakers or monitor legislative activities, we comply with all

federal and state laws and reporting requirements, and our feedback is readily

available to the public

2.

No Grassroots Lobbying

•

Our Company currently discloses policies and procedures on political activities and

contributions on our website •

Our Board Corporate Governance Committee has oversight of political activities, and Public

Policy Executive reports at least annually to the Committee on significant policies

and practices •

Further, we currently disclose our trade association memberships

on our website, and restrict organizations from

using any payments (including membership fees and dues) for any election-related

activity 1.

Robust Disclosure Currently in Place |

1.

Shareholders Have Multiple Avenues for Voicing Concerns

•

Annually elected board, with a majority voting standard

•

Holders of 3% of shares continuously for 3 years can nominate up

to 20% of the board, on the company’s proxy

card, through market-leading proxy access rights

•

No supermajority voting provisions

•

No shareholder rights plan

2.

Matters Requiring Vote Should be Presented to and Voted on by All Shareholders

13

Proposal 7 is a shareholder proposal that requests written consent rights; the proposal is

unnecessary in light of existing strong shareholder rights

The Board encourages a vote AGAINST

Proposal 7

Written Consent Rights are Unnecessary In Light of Strong Special

Meeting and Proxy Access Provisions

•

Our shareholders can call a special meeting at a 10% ownership threshold

•

Shareholder meeting process provides procedural safeguards and advantages over action taken

by a limited number of shareholders by written consent |

Our Integrated

Business Approach Benefits our Customers and Shareholders

Divestment of operations along the lines the proposal appears to

contemplate (i.e., divestiture of businesses conducted

outside of Bank of America, N.A.) would not enhance shareholder value and would negatively

impact our shareholders 1.

Customers Benefit from Our Integrated Approach

2.

We Already Have Narrowed the Company’s Focus and Streamlined Operations

3.

Our Board is Actively Involved in Oversight of Initiatives

Proposal 8 is a shareholder proposal requesting a Board committee to develop a plan to divest

what the proposal refers

to

as

“non-core

banking

operations”;

the

proposal

is

not

in

the

best

interest

of

shareholders

14

The Board encourages a vote AGAINST Proposal 8

•

We serve our customers (individuals, companies and institutional

investors) on an integrated basis, which we

believe is a competitive advantage. Many customers are served by

entities in addition to Bank of America, N.A.

Implementing the proposal would disrupt the flow of credit and services

•

We see continued improvement in our customer scores, market rankings, and penetration of

products per customer as a result of our approach

•

At the core of our integrated strategy are the combined competencies of Bank of America and

Merrill Lynch •

Since 2010, we have reduced our size, scope of activity and risk, trimming hundreds of

billions of dollars in assets from our balance sheet and eliminating dozens of

non-core businesses, while increasing our capital and liquidity

•

Our entire Board, as part of its regular process, is engaged in development and

implementation of our strategic plan,

which considers dispositions and other initiatives, including streamlining our operations,

and has active oversight of strategic initiatives |

|