UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 | |

Bank of America Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

PAYMENT OF FILING FEE (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

5) Total fee paid:

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

| March 15, 2017 |

| Dear Fellow Stockholders: |

| We are pleased to invite you to the 2017 annual meeting of stockholders, to be held April 26, 2017 at 10:00 a.m., Eastern time, at the Hilton Charlotte Center City, 222 East Third Street, Charlotte, North Carolina. |

| We will provide an update on the company and how we are executing our responsible growth strategy. It’s also a good opportunity for us to hear directly from you. |

| Please read the proxy materials and follow the voting instructions to ensure your shares are represented at the meeting. Your vote is important. |

| Sincerely, |

| Brian Moynihan |

| Chairman and Chief Executive Officer |

| March 15, 2017 |

| To Our Stockholders: |

| The independent directors and I join Brian in inviting you to attend our company’s 2017 annual meeting of stockholders. |

| Our company continues to execute on our long-term, responsible growth strategy. Our 2016 results demonstrated significant progress in executing the strategy. |

| As the Board’s Lead Independent Director, I meet regularly with investors. Other directors also meet with investors from time to time. Our dialogue covers broad-ranging topics, including the Board’s governance practices, the Board’s role in providing strategic planning oversight and in affirming the company’s strategy, the company’s ESG activities, the company’s performance, and my role as Lead Independent Director. I share information from our discussions with my fellow directors; we value this engagement and take action where appropriate. |

| I encourage you to carefully review our 2017 proxy statement, our Annual Report and the other materials the company makes available to stockholders. Our Board remains committed to building long-term value in the company and returning value to our stockholders. On behalf of the directors of your company, I join Brian and the management team in thanking you for choosing to invest in Bank of America. |

| Sincerely, |

| Jack O. Bovender, Jr. |

| Lead Independent Director |

Notice of 2017 Annual Meeting of Stockholders

| Date and Time: | Place: | |||||

| April 26, 2017 10:00 a.m., Eastern time |

Hilton Charlotte Center City 222 East Third Street Charlotte, North Carolina 28202 | |||||

Matters to be voted on:

| ● | Electing the 14 directors named in the proxy statement |

| ● | A proposal approving our executive compensation (an advisory, non-binding “Say on Pay” resolution) |

| ● | A proposal on the frequency of future “Say on Pay” resolutions (an advisory, non-binding “Say on Frequency” resolution) |

| ● | A proposal ratifying the appointment of our independent registered public accounting firm for 2017 |

| ● | Stockholder proposals, if they are properly presented at our annual meeting |

| ● | Any other business that may properly come before our annual meeting |

Record date: Bank of America stockholders as of the close of business on March 2, 2017 will be entitled to vote at our annual meeting and any adjournments or postponements of the meeting.

Your vote is very important. Please submit your proxy as soon as possible by the Internet, telephone, or mail. Submitting your proxy by one of these methods will ensure your representation at the annual meeting regardless of whether you attend the meeting.

| How to Vote Your Shares | ||||||

|

|

Online Registered holders – www.envisionreports.com/BAC Beneficial owners – www.proxyvote.com |

|

By Phone Call the phone number located on the top of your proxy card | |||

|

|

By Mail Complete, sign, date, and return your proxy card in the envelope provided

|

|

In Person Attend our annual meeting and vote by ballot | |||

To express our appreciation for your participation, Bank of America will make a $1 donation to Special Olympics on behalf of every stockholder account that votes. Our long-standing support of Special Olympics reflects our belief that diverse and inclusive communities are stronger communities.

Please refer to page 73 for additional information on how to vote your shares and attend our annual meeting.

By order of the Board of Directors,

Ross E. Jeffries, Jr.

Deputy General Counsel and Corporate Secretary

March 15, 2017

Important notice regarding the availability of proxy materials for the annual meeting of stockholders to be held on April 26, 2017: Our Proxy Statement and 2016 Annual Report to stockholders are available at www.bankofamerica.com/annualmeeting

Proxy Statement Summary

Proxy Statement Summary

|

Our Eight Lines Of Business

| ||||||||||||||

|

People |

Companies |

Institutions | ||||||||||||

|

Retail |

Preferred & Small Business |

Merrill Lynch |

U.S. Trust |

Business Banking |

Commercial Banking |

Global Corporate & Investment Banking

|

Global Markets | |||||||

|

Consumer

|

GWIM

|

Global Banking

|

Global Markets

| |||||||||||

| Bank of America Corporation 2017 Proxy Statement | i |

Proxy Statement Summary

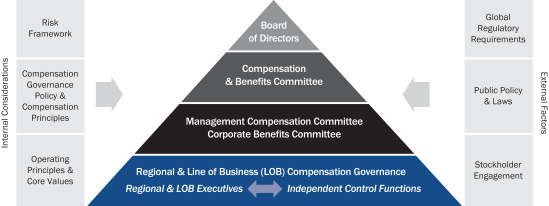

Governance Objectives

| Our Board of Directors oversees the development and execution of our strategy. We have robust governance practices and procedures focused on our responsible growth strategy. To maintain and enhance independent oversight, our Board is focused on its composition and effectiveness.

Our Board has implemented a number of measures to improve Board composition, oversight, and effectiveness. These measures further align our corporate governance structure with achieving our strategic objectives, and enable our Board to effectively communicate and implement our culture of compliance and rigorous risk management. |

Thoughtful, Interconnected Governance Practices

|

|

Our Board is committed to regular renewal and refreshment; our Board has continuously enhanced the director recruitment and selection process, giving us an experienced and diverse group of nominees. See page 3.

Our Board’s rigorous on-boarding and director education processes complement this enhanced recruitment process. See page 17. | |

|

Our Lead Independent Director’s robust and well-defined duties are set forth in our Corporate Governance Guidelines; they extend beyond those of a traditional lead director. See page 14.

Our independent directors meet privately in executive session at each regularly scheduled Board meeting and held 13 such sessions in 2016. See page 17.

Our Board reviews CEO and senior management succession and development plans at least annually, and assesses candidates during Board and committee meetings and in less formal settings. See page 23. | ||

|

Our Board and committees conduct intensive and thoughtful annual self-assessments. Our directors provide feedback on Board effectiveness, with particular emphasis on areas such as Board composition, focus, culture, and process. See page 16.

Our Board regularly assesses its optimal leadership structure. See page 14.

Our Board is informed by input from stockholders. See page 19. |

|

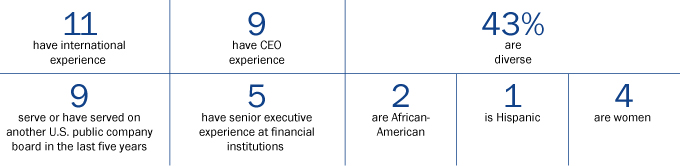

Key Statistics about Our Director Nominees

| ||||||||||

| 5.6

years average tenure, below the 8.3-year S&P 500 average(1) |

9

new independent director nominees since 2012 |

13 of 14

are |

4

are women |

64%

have CEO experience |

36%

have senior executive experience at financial institutions | |||||

| (1) | Our director nominees’ average tenure is calculated as of our annual meeting date; source for S&P 500 average: 2016 Spencer Stuart Board Index. |

| ii | Bank of America Corporation 2017 Proxy Statement |

Proxy Statement Summary

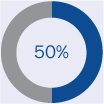

Our Stockholders Inform and Guide Achievement of these Governance Objectives

Our Board and management are committed to engaging with and listening to our stockholders. Throughout 2016 and into 2017, our Board and management met with many of our major stockholders, soliciting their input on important performance, governance, executive compensation, human capital management, regulatory, environmental, social, and other matters. We contacted our major stockholders and key stakeholders representing over 50% of shares outstanding. This continued dialogue has informed our Board’s meeting agendas, and led to governance enhancements that help us address the issues that matter most to our major stockholders and key stakeholders. This engagement process will assist us in achieving our strategic objectives, creating long-term value, maintaining our culture of compliance, and contributing to our environmental, social, and governance (ESG) activities.

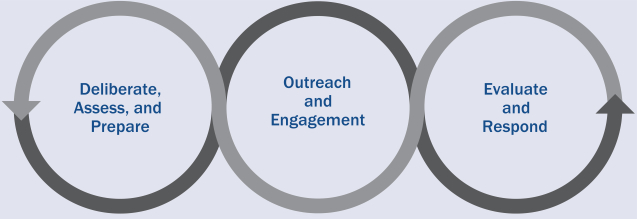

The Board-Driven Stockholder Engagement Process

See “Stockholder Engagement” on page 19.

| Bank of America Corporation 2017 Proxy Statement | iii |

Proxy Statement Summary

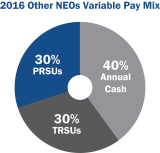

Compensation Highlights

Pay-for-Performance Compensation Philosophy

Our compensation philosophy ties our executive officers’ pay to company, line of business, and individual performance over the short and long term. Our executive compensation program provides a mix of salary, incentives, and benefits paid over time that we believe aligns executive officer and stockholder interests. A majority of total variable compensation granted to named executive officers is deferred equity-based awards, further encouraging long-term focus on generating sustainable results for our stockholders.

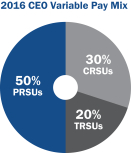

2016 Compensation Decisions for the CEO

In 2016, the company’s responsible growth strategy produced earnings of $17.9 billion, 13% higher than 2015 and the second highest earnings in company history. In recognition of this progress, overall company performance, and the CEO’s individual performance, the Compensation and Benefits Committee and the Board’s independent directors determined the following compensation for our CEO:

|

● Total compensation, inclusive of base salary and equity-based incentives, of $20 million

● 92.5% of Mr. Moynihan’s total compensation is variable and directly linked to company performance. All CEO variable compensation was awarded in equity (as it has been since 2010)

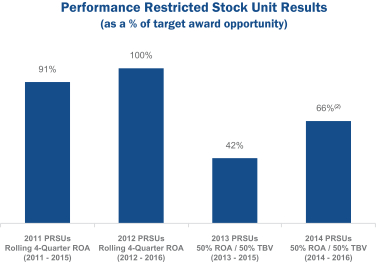

● 46.3% of Mr. Moynihan’s total compensation was awarded in the form of performance restricted stock units (PRSUs) that must be re-earned based on sustained three-year average performance of key metrics (return on assets and growth in adjusted tangible book value)

● The remainder of the CEO’s variable pay was awarded as cash-settled restricted stock units (CRSUs) and time-based restricted stock units (TRSUs)

● Based on stockholder input and our Board’s assessment, this overall pay structure is consistent with prior years |

|

|

Compensation Risk Management Features

|

Historical Say on Pay Votes

| |||

| ● Mix of fixed and variable pay

● Balanced, risk-adjusted performance measures

● Pay-for-performance process that bases individual awards on actual results and how results were achieved

● Review of independent control function feedback in performance evaluations and compensation decisions

● Deferral of a majority of variable pay through equity-based awards

● Robust stock ownership and retention requirements for executive officers

●

Use of multiple cancellation and clawback features for

|

Our Compensation and Benefits Committee believes the results of last year’s Say on Pay vote affirmed our stockholders’ support of our company’s executive compensation program. This informed our decision to maintain a consistent overall approach in setting executive compensation for 2016.

| |||

See “Compensation Discussion and Analysis” on page 33 and “Executive Compensation” on page 48.

| (1) | Total compensation pay components exceed 100% due to rounding. |

| iv | Bank of America Corporation 2017 Proxy Statement |

Proxy Statement Summary

Growing In a Sustainable Manner: Environmental, Social, and Governance Highlights

We deliver on our purpose – to help make financial lives better through the power of every connection – through a strategy of responsible growth and a focus on our environmental, social, and governance (ESG) leadership. Our approach in these areas is an important way we demonstrate the kind of company we are and how we deliver stockholder value. It reflects how we build and maintain trust and credibility as a company that people want to work for, invest in, and do business with.

Our ESG approach is fully-integrated into each of our eight lines of business. Our management-level ESG Committee is made up of senior executives across every line of business and support function who help to guide the company’s efforts and enable progress. The committee identifies and discusses issues central to our ESG focus across the company – including our human capital management practices, products and service offerings, and investments in creating a sustainable global economy. The committee also helps to set and monitor the company’s goals in these areas, and reports on progress regularly to the Board, to our investors and to the public through our annual ESG reporting on our website.

In line with this focus, we strive to make Bank of America a great place to work by listening to our employees so that our programs and resources enhance their experience, help them deepen their skill sets, and further their careers with us. We focus our human capital management efforts on key areas including growing our diverse and inclusive workforce, rewarding performance that balances risk and reward, empowering professional growth and development, and investing in health, emotional and financial wellness.

As a result of these efforts, we are helping to drive the global economy in sustainable ways, creating jobs, developing infrastructure and addressing societal challenges, while managing risk, developing talent, and providing a return to our clients and for our business. To learn more, visit http://about.bankofamerica.com.

Many recognize our focus on ESG and our commitment to promoting diversity in our workforce, including:

| ● | No. 16 out of 50 companies on Fortune Magazine’s Change the World List. This annual list honors companies that are driving social change as part of their core business strategy |

| ● | Euromoney’s World’s Best Bank for Diversity |

| ● | Black Enterprise Magazine’s 50 Best Companies for Diversity |

| ● | LATINA Style’s Top 50 Best Companies for Latinas to Work |

| ● | Fatherly.com’s 50 Best Places to Work for New Dads |

| ● | Diversity MBA Magazine’s Best Places for Women & Diverse Managers to Work |

| ● | Working Mother Magazine’s 100 Best Companies |

We benchmark our ESG performance across a number of industry measures. In each of these ratings, our company outperforms or is in line with industry peers.

|

ESG Ratings and Indices

| ||||||||

| A- |

World & North America Indices

|

92nd percentile |

92.5 out of 100 |

BBh | ||||

| CDP

|

Dow Jones Sustainability Index

|

Sustainalytics

|

Bloomberg Financial Services Gender Equality Index

|

MSCI

| ||||

See “ESG Initiatives: Focus on Responsible, Sustainable Growth” on page 20.

| Bank of America Corporation 2017 Proxy Statement | v |

Table of Contents

Internet Availability of Proxy Materials

We mailed or emailed to most of our stockholders a Notice of Internet Availability of our proxy materials with instructions on how to access our proxy materials online and how to vote. If you are a registered holder and would like to change the method of delivery of your proxy materials, please contact our transfer agent, Computershare Trust Company, N.A., P.O. Box 43078, Providence, Rhode Island 02940-3078; Toll free: 800-642-9855; or at www.computershare.com/bac. You may do the same as a beneficial owner by contacting the bank, broker, or other nominee where your shares are held.

Proxy Statement Availability

We are providing or making available this proxy statement to solicit your proxy to vote on the matters presented at our annual meeting. We commenced providing and making available this proxy statement on March 15, 2017. Our Board requests that you submit your proxy by the Internet, telephone, or mail so that your shares will be represented and voted at our annual meeting.

| 1 | Bank of America Corporation 2017 Proxy Statement |

Proposal 1: Electing Directors

Proposal 1: Electing Directors

Our Board is presenting 14 nominees for election as directors at our annual meeting. All nominees currently serve as directors on our Board. Other than Mr. White, who was appointed to our Board in June 2016, all nominees were elected by you at our 2016 annual meeting. Each director elected at the meeting will serve until our 2018 annual meeting or until a successor is duly elected and qualified. Each director nominee has consented to being named in this proxy statement and to serving as a director if elected. If any nominee is unable to stand for election for any reason, the shares represented at our annual meeting may be voted for another candidate proposed by our Board, or our Board may choose to reduce its size.

| Nominee/Age(1) |

Principal Occupation | Director Since |

Inde- pendent |

Other Company

|

Committee Membership (C = Chair) | |||||

| Sharon L. Allen, 65 |

Former Chairman, Deloitte LLP | 2012 | Yes | 1 | Audit (C) Corporate Governance | |||||

| Susan S. Bies, 69 |

Former Member, Board of Governors of the Federal Reserve System |

2009 | Yes | None | Corporate Governance Enterprise Risk | |||||

| Jack O. Bovender, Jr., 71 |

Lead Independent Director, Bank of America Corporation; Former Chairman and CEO, HCA Inc. |

2012 | Yes | None | None | |||||

| Frank P. Bramble, Sr., 68 |

Former Executive Vice Chairman, MBNA Corporation | 2006 | Yes | None | Corporate Governance Enterprise Risk (C) | |||||

| Pierre J.P. de Weck, 66 |

Former Chairman and Global Head of Private Wealth Management, Deutsche Bank AG |

2013 | Yes | None | Audit Compensation and Benefits | |||||

| Arnold W. Donald, 62 |

President and CEO, Carnival Corporation and Carnival plc | 2013 | Yes | 2 | Audit Compensation and Benefits | |||||

| Linda P. Hudson, 66 |

Chairman and CEO, The Cardea Group, LLC; Former President and CEO, BAE Systems, Inc. |

2012 | Yes | 2 | Compensation and Benefits Enterprise Risk | |||||

| Monica C. Lozano, 60 |

Former Chairman, US Hispanic Media Inc. |

2006 | Yes | 1 | Compensation and Benefits (C) Enterprise Risk | |||||

| Thomas J. May, 70 |

Chairman and Former CEO, Eversource Energy; Chairman, Viacom Inc. |

2004 | Yes | 2 | Corporate Governance (C) Enterprise Risk | |||||

| Brian T. Moynihan, 57 |

Chairman and CEO, Bank of America Corporation |

2010 | No | None | None | |||||

| Lionel L. Nowell, III, 62 |

Lead Director, Reynolds American, Inc.; Former SVP and Treasurer, PepsiCo, Inc. | 2013 | Yes | 2 | Audit Corporate Governance | |||||

| Michael D. White, 65 |

Former Chairman, President and CEO, DIRECTV | 2016 | Yes | 2 | Audit Compensation and Benefits | |||||

| Thomas D. Woods, 64 |

Former Vice Chairman and SEVP, Canadian Imperial Bank of Commerce |

2016 | Yes | None | Corporate Governance Enterprise Risk | |||||

| R. David Yost, 69 |

Former CEO, AmerisourceBergen Corporation | 2012 | Yes | 2 | Audit Compensation and Benefits | |||||

| Number of Meetings Held in 2016(2)

|

Board |

21 | (3) | |||

| Audit | 14 | |||||

| Compensation and Benefits | 7 | |||||

| Corporate Governance | 8 | |||||

| Credit | 4 | (4) | ||||

| Enterprise Risk

|

|

14

|

|

| (1) | Age as of April 26, 2017. |

| (2) | In addition to the number of formal meetings reflected above, from time to time the Board and/or its committees also held educational and/or informational sessions. |

| (3) | Includes the Board’s stand-alone risk oversight sessions. |

| (4) | Our Credit Committee was dissolved in April 2016; its responsibilities were assumed by the Enterprise Risk Committee. |

| Bank of America Corporation 2017 Proxy Statement | 2 |

Proposal 1: Electing Directors

Identifying and Evaluating Director Candidates

Board Composition

Our Board seeks directors whose complementary knowledge, experience, and skills provide a broad range of perspectives and leadership expertise in financial services and other highly complex and regulated industries, strategic planning and business development, business operations, marketing and distribution, risk management and financial controls, corporate governance and public policy, and other areas important to our company’s strategy and oversight. Our Board also assesses director age and tenure and Board continuity, and strives to achieve a proper balance between the perspectives of new directors and those of longer-serving directors with industry and institutional insights.

Our Board views diversity as a priority and seeks representation across a range of attributes, including race, gender, ethnicity, and professional experience, and regularly assesses our Board’s diversity when identifying and evaluating director candidates. In addition, our Corporate Governance Committee follows applicable regulations in confirming that our Board includes members who are independent, possess financial literacy and expertise, and an understanding of risk management principles, policies, and practices, and have experience in identifying, assessing, and managing risk exposures.

Our current Board, comprised of the 14 director nominees, reflects the Board’s commitment to identify, evaluate and nominate candidates who possess personal qualities, qualifications, skills, and diversity of backgrounds, and provide a mix of tenure that, when taken together, best serve our company and our stockholders. See “Our Director Nominees” on page 5.

|

|

Succession Planning and the Director Recruitment Process Our Board regularly reviews and renews its composition. Our Corporate Governance Committee is responsible for identifying and recommending director candidates to our Board for nomination using a director selection process that has been reviewed and acknowledged by our primary bank regulators.

Assess. The Committee regularly reviews our mix of directors on the Board to assess the overall Board composition. Among other factors, the Committee considers our company’s strategy and needs; our directors’ experiences, gender, race, ethnicity, tenure and age; and the attributes our Board identifies annually in its self-assessments to develop criteria for potential candidates and evaluate whether their attributes and qualifications are additive to our overall Board composition.

Identify. To drive effective Board renewal and Board leadership succession planning, the Committee has developed and regularly reviews a “pipeline” of potential director talent. Based on the factors and criteria developed in the assessment phase, the Committee requests the third-party search firms to identify potential candidates for review. The Committee considers and provides feedback on the then-current pool of director talent identified by search firms; the pipeline is periodically updated by the search firms and further shaped by Committee and Board review.

In 2016, the Committee continued to develop the director candidate pipeline using two external search firms. The candidates in the pipeline possess professional experiences and the gender, racial, and ethnic diversity aligned with the Committee-specified criteria and with the qualities identified by our Board in its 2015 and 2016 annual self-assessments. |

| 3 | Bank of America Corporation 2017 Proxy Statement |

Proposal 1: Electing Directors

See “Board Evaluation” on page 16 for additional information on our Board’s self-assessment process. Mr. White was identified by an external search firm for inclusion in the pipeline of director candidates and appointed to the Board following Committee evaluation and nomination. The Committee also considers candidates proposed by directors, management, and our stockholders.

Evaluate. The Committee has an established process for evaluating director candidates that it follows regardless of who recommends a candidate for consideration. Through this process, the Committee reviews available information regarding each candidate, including qualifications, experience, skills, and integrity, as well as race, gender, and ethnicity. The Committee also reviews the candidate’s independence, absence of conflicts and reputational risks.

Our Board understands the significant time commitment involved in serving on the Board and its committees. The Committee assesses whether candidates and serving directors are able to devote the time necessary to discharge their duties as directors, taking into account primary occupations, memberships on other boards and other responsibilities. Prior to annual renomination, the Committee also assesses these factors. Once elected, directors are expected to seek Committee approval prior to joining the board of another public company; directors who change principal occupations must offer to resign from the Board, subject to further evaluation by the Committee and the Lead Independent Director. See “Director Commitment” on page 16.

Our Corporate Governance Guidelines provide that a director who has reached the age of 72 shall not be nominated for initial election to our Board. However, our Board may approve the nomination for re-election of a director at or after the age of 72 if, in light of the circumstances, it is in the best interests of our company and its stockholders. The Board has previously approved such nominations for re-election in limited circumstances.

Mr. Bovender, who is currently 71, has been a director on our Board since 2012. He was unanimously appointed by the independent directors to serve as the Board’s Lead Independent Director in 2014. Since that time, he has continued to enhance the Board’s objective and independent oversight of management through his active engagement with our stockholders, our primary regulators, and with the independent directors. As part of the Board’s ongoing director succession planning review, including for the role of the Lead Independent Director, and in anticipation of Mr. Bovender’s successful re-election at the 2017 annual meeting and reaching age 72 prior to our 2018 annual stockholders’ meeting, the Board has requested that Mr. Bovender stand for nomination for re-election to our Board at our 2018 annual meeting, and Mr. Bovender has accepted this request.

In addition, the Committee periodically reviews the appropriate retirement age and related tenure limitations. In 2016, the Committee reviewed the advisability of increasing the retirement age based on peer analysis, demographic trends, further expanding the pool of available director talent, and the value of maintaining a vibrant mixture of perspectives brought by new directors and the industry insights of directors having longer experience on our Board. Although the Committee did not recommend changing the retirement age as part of its review in 2016, the Committee plans to reconsider the appropriate retirement age as it prepares for our 2018 annual stockholders’ meeting. To augment its analysis, the Committee determined to seek investors’ perspectives on this topic as part of our 2017 stockholder engagement process.

Any stockholder who wishes to recommend a director candidate for consideration by our Corporate Governance Committee must submit a written recommendation to the Corporate Secretary at Bank of America Corporation, Hearst Tower, 214 North Tryon Street, NC1-027-18-05, Charlotte, North Carolina 28255. For our 2018 annual meeting of stockholders, the Committee will consider recommendations received by October 15, 2017. The recommendation must include the information set forth in our Corporate Governance Guidelines, which are published on our website at http://investor.bankofamerica.com.

| Bank of America Corporation 2017 Proxy Statement | 4 |

Proposal 1: Electing Directors

Our Board selected our 14 director nominees based on their satisfaction of the core attributes described on page 3, and the belief that each can make substantial contributions to our Board and company. Our Board believes our nominees’ breadth of experience and their mix of attributes strengthen our Board’s independent leadership and effective oversight of management, in the context of our company’s businesses, our industry’s operating environment, and our company’s long-term strategy.

Of Our 14 Nominees

Our nominees:

| ● | are seasoned leaders who have held a diverse array of leadership positions in complex, highly regulated businesses (including banks and other financial services organizations), and with our primary regulator |

| ● | have served as chief executives and in senior positions in the areas of risk, operations, finance, technology, and human resources |

| ● | bring deep and diverse experience in public and private companies, financial services, the public sector, nonprofit organizations, and other domestic and international businesses |

| ● | are experienced in regulated, non-financial services industries, adding to our Board’s understanding of overseeing a business subject to governmental oversight, and enhancing the diversity of our Board with valuable insights and fresh perspectives that complement those of our directors with specific experience in banking or financial services |

| ● | represent diverse backgrounds and viewpoints |

| ● | strengthen our Board’s oversight capabilities by having varied lengths of tenure that provide historical and new perspectives about our company |

| Diverse Range of Qualifications and Skills Represented by Our Nominees | ||||||

| Strategic Planning

|

Marketing and Retail

|

Environmental, Social, and

|

Business Development

| |||

| Financial Services Experience

|

Leadership of Complex,

|

Human Capital

|

Global Perspective

| |||

| Audit/Financial Reporting

|

Consumer, Corporate, and

|

Cybersecurity, Technology

|

Public Company Board

| |||

| Risk Management, including Credit, Operational and Reputational Risk

|

Corporate Governance |

Succession Planning |

Government, Public Policy, | |||

Our Board recommends a vote “FOR” each of the 14 nominees listed on the

following pages for election as a director (Proposal 1).

Set forth on the following pages are each nominee’s name, age as of our annual meeting date, principal occupation, business experience, and U.S. public company directorships held during the past five years. We also discuss the qualifications, attributes, and skills that led our Board to nominate each for election as a Bank of America director.

| 5 | Bank of America Corporation 2017 Proxy Statement |

Proposal 1: Electing Directors

|

Sharon L. Allen

|

Age: 65 Director since: August 2012

| |||

|

|

Other U.S. Public Company Directorships First Solar, Inc. |

| ||

Professional Highlights:

| ● | From 2003 until her retirement in 2011, Ms. Allen served as Chairman of Deloitte, a firm that provides audit, consulting, financial advisory, risk management, and tax services as the U.S. member firm of Deloitte Touche Tohmatsu Limited |

| ● | She worked at Deloitte for nearly 40 years in various leadership roles, including partner and regional managing partner |

| ● | She was responsible for audit and consulting services for a number of Fortune 500 and large private companies |

| ● | She was also a member of the Global Board of Directors, Chair of the Global Risk Committee, and U.S. representative on the Global Governance Committee of Deloitte Touche Tohmatsu Limited from 2003 to 2011 |

| ● | Ms. Allen serves on the Board of Directors of a food and drug retailer seeking to become a public company under the name Albertsons Companies, Inc. |

Other Leadership Experience and Service:

| ● | Ms. Allen is a former director and Chair of the National Board of Directors of the YMCA of the USA, a leading nonprofit organization for youth development, healthy living, and social responsibility |

| ● | She served as Chair of the Audit Committee and as a member of the Board of Directors of Catalyst Inc., a leading nonprofit organization dedicated to expanding opportunities for women and business |

| ● | She was appointed by President George W. Bush to the President’s Export Council |

|

Susan S. Bies

|

Age: 69 Director since: June 2009

| |||

|

|

Federal Reserve Board |

| ||

Professional Highlights:

| ● | Ms. Bies has served as a Senior Advisory Board Member to Oliver Wyman Group, a management consulting subsidiary of Marsh & McLennan Companies, Inc., since February 2009 |

| ● | She served as a member of the Federal Reserve Board from 2001 to 2007. During her service, Ms. Bies was Chairwoman of the Committee on Supervisory and Regulatory Affairs; she also represented the Federal Reserve Board on the Financial Stability Board and led the Federal Reserve Board’s efforts to modernize the Basel capital accord |

| ● | Ms. Bies served as a member of the FASB’s Emerging Issues Task Force from 1996 to 2001 |

| ● | Ms. Bies held various leadership roles, including Executive Vice President of Risk Management, Auditor, and Chief Financial Officer at First Tennessee, a regional bank holding company where she was employed from 1979 to 2001. At First Tennessee, she also served as Chair of the Asset Liability Management and the Executive Risk Management Committees |

| ● | Ms. Bies currently serves as a director of Zurich Insurance, where she chairs the Risk Committee |

| ● | Ms. Bies chairs the Board of Directors of our U.K. broker-dealer, MLI |

| ● | She began her career as a regional and banking structure economist at the Federal Reserve Bank of St. Louis |

| Bank of America Corporation 2017 Proxy Statement | 6 |

Proposal 1: Electing Directors

|

Jack O. Bovender, Jr.

|

Age: 71 Director since: August 2012

| |||

|

|

Lead Independent Director, Bank of America Corporation; Former Chairman and Chief Executive Officer, HCA |

| ||

Professional Highlights:

| ● | Mr. Bovender served as Chairman of HCA, the largest investor-owned hospital operator in the U.S., and a Fortune 100 company owning and operating hospitals and surgery centers, from January 2002 to December 2009, and was Chief Executive Officer from January 2001 to January 2009. During his tenure at HCA, he also served as President and Chief Operating Officer |

| ● | Mr. Bovender began his career in hospital administration in the U.S. Navy |

Other Leadership Experience and Service:

| ● | Mr. Bovender is Vice Chair of the Duke University Board of Trustees and previously served as Chair of its Audit Committee. In 2016 Mr. Bovender served as the Chair of Duke University’s Search Committee for its next president |

| ● | He also serves on the Duke University Healthcare System’s Board of Directors |

|

Frank P. Bramble, Sr.

|

Age: 68 Director since: January 2006

| |||

|

|

|

| ||

Professional Highlights:

| ● | Mr. Bramble served as Chairman of the Board of Trustees, from July 2014 to June 2016, and Interim President, from July 2013 to June 2014, of Calvert Hall College High School in Baltimore, Maryland |

| ● | Mr. Bramble served as Executive Vice Chairman, from July 2002 to April 2005, and advisor to the Executive Committee, from April 2005 to December 2005, of MBNA Corporation, a financial services company acquired by Bank of America in January 2006 |

| ● | He previously served as the Chairman, President, and Chief Executive Officer at Allfirst Financial, Inc., MNC Financial Inc., Maryland National Bank, American Security Bank, and Virginia Federal Savings Bank |

| ● | Mr. Bramble also served as a director, from April 1994 to May 2002, and Chairman, from December 1999 to May 2002, of Allfirst Financial, Inc. and Allfirst Bank, U.S. subsidiaries of Allied Irish Banks, p.l.c. |

| ● | He began his career as an audit clerk at the First National Bank of Maryland |

Other Leadership Experience and Service:

| ● | He is an emeritus member of the Board of Visitors of Towson University, where he was also a lecturer in business strategy and accounting from 2006 to 2008 |

| 7 | Bank of America Corporation 2017 Proxy Statement |

Proposal 1: Electing Directors

|

Pierre J.P. de Weck

|

Age: 66 Director since: July 2013

| |||

|

|

Former Chairman and Global Head of Private Wealth Management, Deutsche Bank |

| ||

Professional Highlights:

| ● | Mr. de Weck served as the Chairman and Global Head of Private Wealth Management and as a member of the Group Executive Committee of Deutsche Bank from 2002 to May 2012 |

| ● | Prior to joining Deutsche Bank, Mr. de Weck served on the Management Board of UBS from 1994 to 2001, as Head of Institutional Banking from 1994 to 1997, as Chief Credit Officer and Head of Private Equity from 1998 to 1999, and as Head of Private Equity from 2000 to 2001 |

| ● | He also held various senior management positions at Union Bank of Switzerland, a predecessor firm of UBS, from 1985 to 1994 |

| ● | Mr. de Weck serves on the Board of Directors of our U.K. banking entity, Bank of America Merrill Lynch International |

|

Arnold W. Donald

|

Age: 62 Director since: January 2013

| |||

|

|

Other U.S. Public Company Directorships Carnival; Crown Holdings, Inc. Past Five Years: Oil-Dri Corporation of America; The Laclede Group, Inc.

|

| ||

Professional Highlights:

| ● | Mr. Donald has been President and Chief Executive Officer of Carnival, a cruise and vacation company, since July 2013 |

| ● | Mr. Donald previously served as President and Chief Executive Officer from November 2010 to June 2012 of The Executive Leadership Council, a nonprofit organization providing a professional network and business forum to African-American executives at major U.S. companies |

| ● | Mr. Donald was President and Chief Executive Officer of the Juvenile Diabetes Research Foundation International from January 2006 to February 2008 |

| ● | From 2000 to 2003, Mr. Donald served as Chairman and Chief Executive Officer of Merisant, a privately held global manufacturer of tabletop sweeteners, and he remained Chairman until 2005 |

| ● | He joined Monsanto in 1977, where over his 20-year tenure he held several senior leadership positions with global responsibilities including President of its Agricultural Group and President of its Nutrition and Consumer Sector |

Other Leadership Experience and Service:

| ● | Mr. Donald was appointed by President Clinton and re-appointed by President George W. Bush to the President’s Export Council |

| Bank of America Corporation 2017 Proxy Statement | 8 |

Proposal 1: Electing Directors

|

Linda P. Hudson

|

Age: 66 Director since: August 2012

| |||

|

|

Other U.S. Public Company Directorships Ingersoll-Rand plc;

|

| ||

Professional Highlights:

| ● | Ms. Hudson has served as Chairman and Chief Executive Officer of The Cardea Group, LLC, a management consulting business, since May 2014 |

| ● | Ms. Hudson served as CEO Emeritus of BAE, a U.S.-based subsidiary of BAE Systems plc, a global defense, aerospace, and security company headquartered in London, from February 2014 to May 2014, and as President and Chief Executive Officer of BAE from October 2009 until January 2014 |

| ● | Ms. Hudson served as President of BAE Systems’ Land and Armaments operating group, the world’s largest military vehicle and equipment business, from October 2006 to October 2009 |

| ● | Prior to joining BAE, Ms. Hudson worked at General Dynamics Corporation and was President of its Armament and Technical Products business. During her career, she has held various positions in engineering, production operations, program management, and business development for defense and aerospace companies |

| ● | She served as a member of the Executive Committee and as an executive director of BAE Systems from 2009 until January 2014. She also served as a member of the Board of Directors of BAE from 2009 to April 2015 |

| ● | As a director of The Southern Company, Ms. Hudson is a member of the Governance Committee and the Nuclear/Operations Committee and is Chairman of its Business Security Subcommittee |

Other Leadership Experience and Service:

| ● | Ms. Hudson is a member of the Board of Directors of the University of Florida Foundation, Inc. and the University of Florida Engineering Leadership Institute, and a member of the Charlotte Center Executive Board for the Wake Forest University School of Business |

| ● | She serves on the Board of Trustees of Discovery Place, a not-for-profit education organization dedicated to inspiring exploration of the natural and social world |

|

Monica C. Lozano

|

Age: 60 Director since: April 2006

| |||

|

|

Other U.S. Public Company Directorships Target Corporation Past Five Years: The Walt Disney Company

|

| ||

Professional Highlights:

| ● | Ms. Lozano served as Chair of the Board of Directors of US Hispanic Media Inc., the parent company of ImpreMedia, a leading Hispanic news and information company, from June 2014 to January 2016. For ImpreMedia, she served as Chairman from July 2012 to January 2016 and served as Chief Executive Officer from May 2010 to May 2014. She was also Senior Vice President of ImpreMedia from January 2004 to May 2010 |

| ● | She served as Publisher of La Opinion, a subsidiary of ImpreMedia and the leading Spanish-language daily newspaper in the country, reaching 2 million readers monthly in print and online, from 2004 to May 2014, and was Chief Executive Officer from 2004 to July 2012 |

Other Leadership Experience and Service:

| ● | Ms. Lozano served as a member of President Obama’s Council on Jobs and Competitiveness from 2011 to 2012 and served on President Obama’s Economic Recovery Advisory Board from 2009 to 2011 |

| ● | She serves as the Chair of the Board of Regents of the University of California, as a member of the Board of Trustees of the Rockefeller Foundation, as Chair of the Board of Directors the Weingart Foundation, and served as a member of the Board of Trustees of the University of Southern California and as a member of the State of California Commission on the 21st Century Economy |

| 9 | Bank of America Corporation 2017 Proxy Statement |

Proposal 1: Electing Directors

|

Thomas J. May

|

Age: 70 Director since: April 2004

| |||

|

|

Other U.S. Public Company Directorships Eversource Energy; Viacom Inc. Past Five Years: NSTAR

|

| ||

Professional Highlights:

| ● | Mr. May is Chairman of the Board of Trustees of Eversource Energy, one of the nation’s largest utilities, serving 3.7 million customers in three states. He served as President and Chief Executive Officer of Eversource Energy from April 2012 until his retirement in May 2016, and has been Chairman since October 2013 |

| ● | He was the Chairman and Chief Executive Officer of NSTAR, which merged with Northeast Utilities (now Eversource Energy), from 1999 to April 2012, and was President from 2002 to April 2012. He also served as Chief Financial Officer and Chief Operating Officer during his tenure at NSTAR |

| ● | Mr. May currently serves on the Board of Directors of Liberty Mutual Holding Company, Inc. and as the non-executive Chairman of the Board of Directors of Viacom Inc. |

|

Brian T. Moynihan

|

Age: 57 Director since: January 2010

| |||

|

|

America Corporation

Other U.S. Public Company Directorships Past Five Years: Merrill Lynch & Co., Inc. (former subsidiary; merged into Bank of America Corporation in 2013)

|

| ||

Professional Highlights:

| ● | Mr. Moynihan was appointed Chairman of the Board of Directors of Bank of America Corporation in October 2014 and President and Chief Executive Officer in January 2010. Prior to becoming Chief Executive Officer, Mr. Moynihan ran each of our company’s operating units |

| ● | Mr. Moynihan currently serves as Chairman of the Board of Directors of the Financial Services Roundtable |

| ● | Mr. Moynihan currently serves on the Supervisory Board of The Clearing House Association L.L.C. |

| Bank of America Corporation 2017 Proxy Statement | 10 |

Proposal 1: Electing Directors

|

Lionel L. Nowell, III

|

Age: 62 Director since: January 2013

| |||

|

|

Former Senior Vice President and Treasurer, PepsiCo, Inc.

Other U.S. Public Company Directorships American Electric Power Company, Inc.; Reynolds American, Inc. Past Five Years: Darden Restaurants, Inc.

|

| ||

Professional Highlights:

| ● | Mr. Nowell served as Senior Vice President and Treasurer of Pepsi, a leading global food, snack, and beverage company, from 2001 to May 2009. He previously served as Chief Financial Officer of The Pepsi Bottling Group and as Controller of Pepsi |

| ● | Prior to joining Pepsi, Mr. Nowell served as Senior Vice President, Strategy and Business Development at RJR Nabisco, Inc. from 1998 to 1999 |

| ● | He held various senior financial roles at the Pillsbury division of Diageo plc, including Chief Financial Officer of its Pillsbury North America, Pillsbury Foodservice, and Haagen-Dazs divisions, and also served as Controller and Vice President of Internal Audit of the Pillsbury Company |

Other Leadership Experience and Service:

| ● | Mr. Nowell serves on the Dean’s Advisory Council at The Ohio State University Fisher College of Business |

| ● | Mr. Nowell serves as lead director of the Board of Directors of Reynolds American, Inc. |

|

Michael D. White

|

Age: 65 Director since: June 2016

| |||

|

|

Other U.S. Public Company Directorships Kimberly-Clark Corporation; Whirlpool Corporation Past Five Years: DIRECTV

|

| ||

Professional Highlights:

| ● | Mr. White served as Chairman, President and Chief Executive Officer of DIRECTV, a leading provider of digital television entertainment services, from 2010 to August 2015. He was also a director of the company from November 2009 until August 2015 |

| ● | From February 2003 until November 2009, Mr. White was Chief Executive Officer of PepsiCo International and served as Vice Chairman and director of PepsiCo from March 2006 to November 2009, after holding positions of increasing importance with PepsiCo since 1990 |

| ● | Before joining PepsiCo, Mr. White was a Senior Vice President at Avon Products, Inc., and a management consultant at Bain & Company and Arthur Andersen & Co. |

Other Leadership Experience and Service:

| ● | Mr. White is an Advisory Partner for Trian Fund Management, L.P., a hedge fund, a position he has held since January 2016 |

| ● | Mr. White is a member of the Boston College Board of Trustees |

| ● | He also serves as Chairman of the Partnership for Drug-Free Kids and Vice-Chairman of the Mariinsky Foundation of America |

| 11 | Bank of America Corporation 2017 Proxy Statement |

Proposal 1: Electing Directors

|

Thomas D. Woods

|

Age: 64 Director since: April 2016

| |||

|

|

|

| ||

Professional Highlights:

| ● | Mr. Woods served as a Vice Chairman and Senior Executive Vice President of CIBC, a leading Canada-based global financial institution, from July 2013 until his retirement in December 2014 |

| ● | He served as Senior Executive Vice President and Chief Risk Officer of CIBC from 2008 to July 2013, and Senior Executive Vice President and Chief Financial Officer of CIBC from 2000 to 2008 |

| ● | Mr. Woods joined Wood Gundy, a CIBC predecessor firm, in 1977. During his tenure, Mr. Woods served in various senior leadership positions, including as Controller of CIBC, as CFO of CIBC World Markets (CIBC’s investment banking division), and as the Head of CIBC’s Canadian Corporate Banking division |

Other Leadership Experience and Service:

| ● | Mr. Woods serves as a member of the Board of Directors of Jarislowsky Fraser Limited, a global investment management firm |

| ● | Mr. Woods served as a member of the Boards of Directors of DBRS Limited and DBRS, Inc., an international credit rating agency, from 2015 to 2016, and as a member of the Board of Directors of TMX Group Inc., a Canada-based financial services company, from 2012 to 2014 |

| ● | He serves on the board of advisors of the University of Toronto’s Department of Mechanical and Industrial Engineering |

| ● | Mr. Woods also serves as a member of the Board of Directors of Alberta Investment Management Corporation (AIMCo), a Canadian institutional investment fund manager, and on the investment committee of Cordiant Capital Inc., a fund manager specializing in emerging markets |

|

R. David Yost

|

Age: 69 Director since: August 2012

| |||

|

|

Other U.S. Public Company Directorships Johnson Controls International plc (formerly, Tyco International plc); Marsh & McLennan Companies, Inc. Past Five Years: AmerisourceBergen; Exelis Inc.

|

| ||

Professional Highlights:

| ● | Mr. Yost served as Chief Executive Officer of AmerisourceBergen, a pharmaceutical services company providing drug distribution and related services to healthcare providers and pharmaceutical manufacturers, from 2001 until his retirement in July 2011, and as President from 2001 to 2002 and again from September 2007 to November 2010 |

| ● | He has held various positions at AmerisourceBergen and its predecessor companies during a nearly 40-year career, including Chief Executive Officer from 1997 to 2001 and Chairman from 2000 to 2001 of Amerisource Health Corporation |

| Bank of America Corporation 2017 Proxy Statement | 12 |

Corporate Governance

Our Board is responsible for overseeing our company’s management. Our Board and its committees oversee:

| ● | management’s development and implementation of a multi-year strategic business plan and an annual financial operating plan, and our progress meeting these financial and strategic plans |

| ● | management’s identification, measurement, monitoring, and control of our company’s material risks, including operational, credit, market, liquidity, compliance, strategic, and reputational risks |

| ● | our company’s maintenance of high ethical standards and effective policies and practices to protect our reputation, assets, and business |

| ● | our corporate audit function, our independent registered public accounting firm, and the integrity of our consolidated financial statements |

| ● | our company’s establishment, maintenance, and administration of appropriately designed compensation programs and plans |

Our Board and its committees are also responsible for:

| ● | reviewing, monitoring, and approving succession plans for its Chairman and Lead Independent Director, and for our CEO and other key executives to promote senior management continuity |

| ● | conducting an annual self-evaluation of our Board and its committees |

| ● | identifying and evaluating director candidates and nominating qualified individuals for election to serve on our Board |

| ● | reviewing our CEO’s performance and approving the total annual compensation for our CEO and other executive officers |

| ● | overseeing and participating in our stockholder engagement activities to ascertain perspectives and topics of interest from our stockholders |

The New York Stock Exchange (NYSE) listing standards require a majority of our directors and each member of our Audit, Compensation and Benefits, and Corporate Governance Committees to be independent. The Federal Reserve Board’s Enhanced Prudential Standards require the chair of our Enterprise Risk Committee to be independent. In addition, our Corporate Governance Guidelines require a substantial majority of our directors to be independent. Our Board has adopted Director Independence Categorical Standards (Categorical Standards), published on our website at http://investor.bankofamerica.com, to assist it in determining each director’s independence. Our Board considers a director or director nominee “independent” if he or she meets the criteria for independence in both the NYSE listing standards and our Categorical Standards.

In early 2017, our Board, in coordination with our Corporate Governance Committee, evaluated the relevant relationships between each director/director nominee (and his or her immediate family members and affiliates) and Bank of America Corporation and its subsidiaries and affirmatively determined that all of our directors/director nominees are independent, except for Mr. Moynihan due to his employment by our company. Specifically, the following 13 of our 14 directors/director nominees are independent under the NYSE listing standards and our Categorical Standards: Ms. Allen, Ms. Bies, Mr. Bovender, Mr. Bramble, Mr. de Weck, Mr. Donald, Ms. Hudson, Ms. Lozano, Mr. May, Mr. Nowell, Mr. White, Mr. Woods, and Mr. Yost.

In making its independence determinations, our Board considered the following ordinary course, non-preferential relationships that existed during the preceding three years and determined that none of the relationships constituted a material relationship between the director/director nominee and our company:

| ● | Our company or its subsidiaries provided ordinary course financial products and services to all of our directors/director nominees. Our company or its subsidiaries also provided ordinary course financial products and services to some of these directors’/director nominees’ immediate family members and entities affiliated with some of our directors/director nominees or their immediate family members (Mr. Donald and Mr. May). In each case, the fees we received for these products and services were below the thresholds of the NYSE listing standards and our |

| 13 | Bank of America Corporation 2017 Proxy Statement |

Corporate Governance

| Categorical Standards, and, where applicable, were less than 2% of the consolidated gross annual revenues of our company and of the other entity. |

| ● | Our company or its subsidiaries purchased products or services in the ordinary course from entities where some of our directors/director nominees are executive officers or employees or their immediate family members serve as executive officers (Mr. Donald, Mr. May, and Mr. Woods). In each case, the fees paid to each of these entities were below the thresholds of the NYSE listing standards and our Categorical Standards. |

Under our Board’s current leadership structure, we have an executive Chairman and a Lead Independent Director. Our Lead Independent Director is empowered with robust, well-defined duties. Our Board is composed of experienced and committed independent directors (with all non-management nominees being independent), and our Board committees have objective, experienced chairs and members. Our Board believes that these factors, taken together, provide for objective, independent Board leadership, and effective engagement with and oversight of management.

Our Board is committed to objective, independent leadership for our Board and each of its committees. Our Board views the objective, independent oversight of management as central to effective Board governance, to serving the best interests of our company and our stockholders, and to executing our strategic objectives and creating long-term value. This commitment is reflected in our company’s governing documents, our Bylaws, our Corporate Governance Guidelines, and the governing documents of each of the Board’s committees.

Our Board believes that its optimal leadership structure may change over time to reflect our company’s evolving needs, strategy, and operating environment; changes in our Board’s composition and leadership needs; and other factors, including the perspectives of stockholders and other stakeholders. In accordance with a 2014 amendment to our Bylaws, which our stockholders ratified at a special meeting in 2015, our Board has the flexibility to determine the Board leadership structure best suited to the needs and circumstances of our company and our Board.

At least annually, our Board, in coordination with our Corporate Governance Committee, deliberates on and discusses the appropriate Board leadership structure, including the considerations described above. Based on that assessment and on input from stockholders, our Board believes that the existing structure, with Mr. Moynihan as executive Chairman and Mr. Bovender as Lead Independent Director, is the optimal leadership framework at this time. As a highly regulated global financial services company, we and our stockholders benefit from an executive Chairman with deep experience in and knowledge of the financial services industry, our company, and its businesses, and a strong Lead Independent Director with robust, well-defined duties. Our Lead Independent Director, together with the other independent directors, instills objective independent Board leadership, and effectively engages and oversees management.

The Board believes in having a Lead Independent Director who is empowered with robust, well-defined duties. The Lead Independent Director is joined by experienced, independent Board members and a Chairman who, as CEO, serves as the primary voice to articulate our strategy of long-term responsible growth. The independent directors provide objective oversight of management, help to establish the long-term strategy and regularly assess its effectiveness, and serve the best interests of our company and our stockholders by creating long-term value.

Robust and Well-defined Lead Independent Director Duties

Our Corporate Governance Guidelines establish robust and well-defined duties for the independent leader of our Board. Our Board’s support of the current leadership structure is premised on these duties being transparently disclosed and comprehensive in nature.

The list of duties of the Lead Independent Director does not fully capture Mr. Bovender’s active role in serving as our Board’s independent leader. Among other things, Mr. Bovender holds monthly calls with our primary bank regulators to discuss any issues of concern. He regularly speaks with our CEO and holds bi-weekly calls to discuss Board meeting agendas and discussion topics, schedules, and other Board governance matters. He attends meetings of all of the Board committees. He speaks with each Board member at least quarterly to receive input on Board agendas, Board planning matters, and other related topics of management oversight. He also meets at least quarterly with management members, including the Chief Administrative Officer, Chief Financial Officer, Chief Risk Officer, Global Compliance Executive, and Global Human Resources Executive. Mr. Bovender also plays a leading role in our stockholder engagement process, representing our Board and independent directors in investor meetings. In 2016 and in early 2017, he met with many of our largest stockholders, often in person, and in aggregate, personally met with investors who own more than 20% of our outstanding shares.

| Bank of America Corporation 2017 Proxy Statement | 14 |

Corporate Governance

Duties of the Lead Independent Director or Independent Chairman

| Board Leadership |

● In the case of the Chairman, presiding at all meetings of our Board and, in the case of the Lead Independent Director, presiding at all meetings of our Board at which the Chairman is not present, including at executive sessions of the independent directors |

● Calling meetings of the independent directors, as appropriate

● In the case of the Lead Independent Director, if our CEO is also Chairman, providing Board leadership if the CEO/Chairman’s role may be (or may be perceived to be) in conflict | ||

| Board Culture |

● Serving as a liaison between the CEO and the independent directors

● Establishing a close relationship and trust with the CEO, providing support, advice, and feedback from our Board while respecting executive responsibility |

● Acting as a “sounding board” and advisor to the CEO | ||

| Board Focus |

● Board Focus: In consultation with our Board and executive management, providing that our Board focuses on key issues and tasks facing our company, and on topics of interest to our Board

● Corporate Governance: Assisting our Board, our Corporate Governance Committee, and management in complying with our Corporate Governance Guidelines and promoting corporate governance best practices |

● CEO Performance Review and Succession Planning: Working with our Corporate Governance Committee, our Compensation and Benefits Committee, and members of our Board, contributing to the annual performance review of the CEO and participating in CEO succession planning | ||

| Board Meetings |

● In coordination with the CEO and the other members of our Board, planning, reviewing, and approving meeting agendas for our Board

● In coordination with the CEO and the other members of our Board, approving meeting schedules to assure there is sufficient time for discussion of all agenda items |

● Advising the CEO of the information needs of our Board and approving information sent to our Board

● Developing topics of discussion for executive sessions of our Board | ||

| Board Performance and Development |

● Board Performance: Together with the CEO and the other members of our Board, providing the efficient and effective performance and functioning of our Board

● Board Assessment: Consulting with our Corporate Governance Committee on our Board’s annual self-assessment

● Director Development: Providing guidance on the ongoing development of directors |

● Director Assessment/Nomination: With our Corporate Governance Committee and the CEO, consulting in the identification and evaluation of director candidates’ qualifications (including candidates recommended by directors, management, third-party search firms, and stockholders) and consulting on committee membership and committee chairs | ||

| Stockholders and Other Stakeholders |

● Being available for consultation and direct communication, to the extent requested by major stockholders |

● Having regular communication with primary bank regulators (with or without management present) to discuss the appropriateness of our Board’s oversight of management and our company | ||

| 15 | Bank of America Corporation 2017 Proxy Statement |

Corporate Governance

Our Board understands the significant time commitment involved with serving on the Board and its committees, and takes steps to assess that all directors and director nominees have the time necessary to discharge their duties. Our Corporate Governance Committee and Board nominate only candidates who they believe are capable of devoting the necessary time to discharge their duties, taking into account principal occupations, memberships on other boards and other responsibilities. Our Corporate Governance Committee assesses directors’ time commitment to the Board throughout the year, including through the annual self-assessment process. In addition, directors seek approval from the Committee prior to joining the board of another public company, and offer to resign from the Board as a result of changes to their principal occupation for further consideration by the Committee and the Lead Independent Director.

Our Corporate Governance Committee regularly assesses and closely monitors stockholders’ views on the appropriate number of public company boards on which directors may serve. In connection with this review in 2016, the Committee considered: the proxy voting guidelines of our major stockholders; input from our stockholders during our engagement discussion; voting policies of the major proxy advisory firms; corporate governance guidelines adopted by other public companies; board trends at peer and other significant public companies; and advice from outside advisors. In September 2016, based on the Committee’s review and at its recommendation, our Board amended the Corporate Governance Guidelines to reduce the maximum number of public company boards on which a director on our Board may serve from six to four public companies (including our Board), and to specify that any public company chief executive officer who serves as a director on our Board may not serve on the boards of more than three public companies (including our Board). All of our directors and director nominees comply with this revised policy.

Each year, our Board and our Board’s Audit, Compensation and Benefits, Corporate Governance, and Enterprise Risk Committees perform a thorough evaluation of their own effectiveness. This self-assessment may be in the form of written or oral questionnaires, administered by Board members, management, or third parties. Directors respond to questions designed to elicit information to be used in improving Board and committee effectiveness. Director feedback solicited from the self-assessment process is discussed during Board and committee executive sessions and, where appropriate, addressed with management.

In response to director self-assessments on improving Board and committee effectiveness, our Board and committees have devoted time to examining their structure and the effectiveness of their meetings. For example, in April 2016, after multiple discussions among the Board and committees and with regulators, the Enterprise Risk Committee assumed credit risk oversight responsibilities that were formerly the purview of the Credit Committee to efficiently address the requirements of certain federal regulations, and the Board dissolved our Credit Committee. Directors participate in the agenda setting and the strategic planning process through active and regular feedback to the Lead Independent Director and management. Materials for each Board and committee meeting include the proposed agenda topics for the remainder of the year; these topics are updated over time to reflect director input and care is taken to develop Board and committee agendas that are sufficiently flexible to promptly address time-sensitive matters as they arise.

In addition, our Board understands that clear and comprehensive information is critical for its effective oversight. In response to director self-assessments, management considers and implements enhancements to further improve the reporting and materials provided to directors. Significant effort has been devoted to clear, timely, and regular communication between directors and management:

| ● | Lead Independent Director. Our Lead Independent Director regularly speaks with other directors, our CEO and with management members. See “Robust and Well-defined Lead Independent Director Duties” on page 14. |

| ● | Committee Chairs and Other Directors. Our committee chairs regularly communicate with management to discuss the development of meeting agendas and presentations. The Chair of our Audit Committee communicates regularly with the Corporate General Auditor, Chief Financial Officer, and Chief Accounting Officer; the Chair of the Enterprise Risk Committee communicates regularly with our Chief Risk Officer, Chief Administrative Officer, and Chief Operations and Technology Officer; the Chair of our Corporate Governance Committee communicates regularly with our Chief Administrative Officer, Vice Chairman (chair of our management ESG committee), and Corporate Secretary; and the Chair of the Compensation and Benefits Committee communicates regularly with our Global Human Resources Executive. |

| ● | Strategic Planning and Agenda Topic Development. Each Board member regularly meets with our Global Strategy Executive, both in-person and by phone, to provide input regarding our company’s strategic planning and review process, as well as related agenda topics of interest. Agenda items added in response to the directors’ input are reflected in the “Topical Agendas” for the year and included in the Board’s meeting materials for each meeting. |

| Bank of America Corporation 2017 Proxy Statement | 16 |

Corporate Governance

| ● | Chairman and CEO Memos. Our Board receives a memo from our Chairman and CEO in advance of every Board meeting, with updates on the upcoming meeting, background information on the discussion topics, and information on other relevant developments. |

| ● | Other Communications to the Board, Committees, Committee Chairs, and Other Directors. In between Board and committee meetings, directors receive prompt updates from management on developing matters. |

| ● | Reference Materials. Directors also regularly receive quarterly strategy updates, securities analysts’ reports, investor communications, company publications, regulator publications, law firm memoranda, news articles and video clips, and other reference materials. |

Our Board believes that director education is vital to the ability of directors to fulfill their roles and supports Board members in their continuous learning. The Board encourages directors to participate annually in external continuing director education programs, and our company reimburses directors for their expenses associated with this participation. Continuing director education is also provided during Board meetings and other Board discussions as part of the formal meetings, and as stand-alone information sessions outside of meetings. Among other topics, during 2016, our Board heard from our key banking regulators on regulatory developments; from third-party analysts, advisors and experts on topics ranging from issues and opportunities for the financial services industry, public policy and education, artificial intelligence, and innovations in digital design; and from management on payments systems, mobile technology, and cybersecurity.

Our Board regularly reviews developments in corporate governance to continue enhancing our Board’s effectiveness. For example, in 2016, our Board reviewed and discussed “The New Paradigm: A Roadmap for an Implicit Corporate Governance Partnership Between Corporations and Investors to Achieve Sustainable Long-Term Investment” and “Growth and the Commonsense Principles of Corporate Governance.”

All new directors also participate in our director orientation program during their first six months on our Board. New directors have a series of meetings over time with management representatives from all of our business and staff areas to review and discuss, with increasing detail, information about our company, industry, and regulatory framework. Based on input from our directors, we believe this graduated on-boarding approach over the first six months of Board service, coupled with participation in regular Board and committee meetings, provides new directors with a strong foundation in our company’s businesses, connects directors with members of management with whom they will interact, and accelerates their effectiveness to engage fully in Board deliberations. Directors have access to additional orientation and educational opportunities upon acceptance of new or additional responsibilities on the Board and in committees.

Board Meetings, Committee Membership, and Attendance

Directors are expected to attend our annual meetings of stockholders and our Board and committee meetings. Each of our incumbent directors attended at least 75% of the aggregate meetings of our Board and the committees on which they served during 2016. In addition, all of the directors serving on our Board at the time of our 2016 annual meeting attended the meeting, except for Mr. Gifford, who did not stand for election at that meeting.

Our independent directors meet privately in executive session without management present at each regularly scheduled Board meeting and held 13 such executive sessions in 2016. Our Lead Independent Director leads these Board executive sessions.

Our Board has five committees. Charters describing the responsibilities of each of the Audit, Compensation and Benefits, Corporate Governance, and Enterprise Risk Committees can be found at http://investor.bankofamerica.com, and their membership is set forth on page 2. Our Board’s fifth committee, the Corporate Development Committee, was formed by our Board in 2013 as the result of a litigation settlement to oversee certain transactions. The terms of the settlement are set to expire in May 2017.

Our committees regularly make recommendations and report on their activities to the entire Board. Each committee may obtain advice from internal or external financial, legal, accounting, or other advisors at their discretion. Our Board, considering the recommendations of our Corporate Governance Committee, reviews committee membership at least annually. The duties of each of the five committees are summarized below.

| 17 | Bank of America Corporation 2017 Proxy Statement |

Corporate Governance

| Committee | Key Responsibilities | Independence / Qualifications | ||

| Audit |

● Oversees qualifications, performance, and independence of our company’s independent registered public accounting firm ● Oversees performance of our company’s corporate audit function ● Oversees integrity of our company’s consolidated financial statements ● Oversees our compliance with legal and regulatory requirements ● Makes inquiries of management or the Corporate General Auditor to assess the scope and resources necessary for the corporate audit function to execute its responsibilities

|

● All Committee members are independent under: ● NYSE listing standards and our Categorical Standards ● Heightened independence requirements applicable to audit committee members under Securities and Exchange Commission (SEC) rules ● All Committee members are financially literate in accordance with NYSE listing standards ● All Committee members qualify as audit committee financial experts under SEC rules | ||

| Compensation and Benefits |

● Oversees establishing, maintaining, and administering our compensation programs and employee benefit plans, including: ● approving and recommending our CEO’s compensation to our Board for further approval by all independent directors ● reviewing and approving all of our other executive officers’ compensation ● Recommends director compensation for Board approval |

● All Committee members are independent under: ● NYSE listing standards and our Categorical Standards ● Independence requirements applicable to compensation committee members under NYSE rules and Internal Revenue Service regulations ● Heightened independence requirements (same as heightened independence requirements applicable to Audit Committee members under SEC rules)

| ||

| Corporate Governance |

● Oversees our Board’s governance processes ● Identifies and reviews the qualifications of potential Board members; recommends nominees for election to our Board ● Leads our Board and its committees in their annual self-assessments ● Reviews and reports to our Board on our ESG activities ● Reviews and assesses stockholder input and our stockholder engagement process

|

● All Committee members are independent under the NYSE listing standards and our Categorical Standards | ||

| Enterprise Risk |