March 7, 2022

Letter from our Chair and

Chief Executive Officer

We are pleased to invite you to the 2022 annual meeting of shareholders to be held on April 26, 2022 at 10:00 a.m., Eastern time. For the health and safety of our shareholders, employees, and communities, our 2022 annual meeting will be held virtually by webcast.

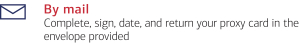

During the meeting, we will provide updates on how, by focusing on Responsible Growth, our company delivered for shareholders and all of our stakeholders in 2021.

You will also hear from Lionel Nowell, who assumed the role of Lead Independent Director following the 2021 annual meeting.

Your vote is important. We will make a $1 charitable donation for every shareholder account that votes; contributions will be made in equal parts to Feeding America and World Food Program USA. This is the sixth year Bank of America has made a $1 charitable donation for every shareholder account that votes—your participation in the 2021 annual meeting resulted in approximately $1.1 million in contributions to the National Urban League and UnidosUS.

I encourage you to read our 2022 Proxy Statement, our 2021 Annual Report, and the other proxy materials and the voting instructions on the pages that follow to ensure your shares are represented at the meeting.

|

|

BRIAN T. MOYNIHAN

Chair and Chief Executive Officer |

Letter from our Lead

Independent Director

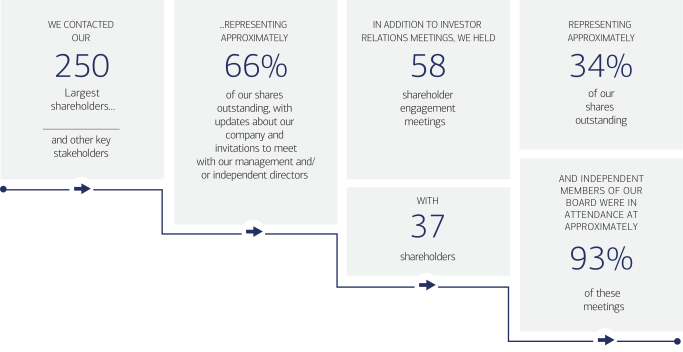

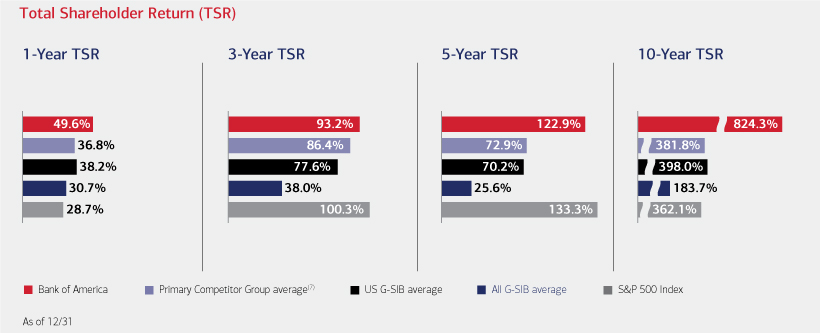

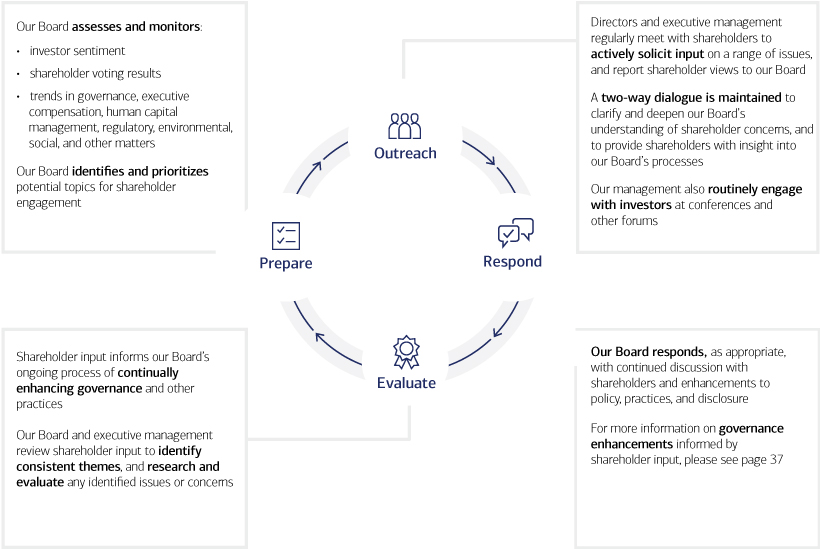

The independent directors and I join Brian in inviting you to attend our company’s 2022 annual meeting of shareholders. The Board values input from our shareholders as the company executes our long-term strategy. As the Board’s Lead Independent Director, I meet regularly with investors and have participated in more than 70 investor meetings since being named the Lead Independent Director Successor in the fall of 2020. I share investors’ viewpoints with the Board, and that input enhances our decision-making.

During 2021 and early 2022, our dialogue covered broad-ranging topics, including: the Board’s diverse composition and breadth of experience; the Board’s oversight of risk, including climate risk; the Board’s oversight of our company’s decades-long commitment to advance racial equality and economic opportunity; and how our company continues to support our employees, our clients, and the communities we serve during the health crisis.

So that all shareholders have the opportunity to hear directly from our Board members, we continue to make available video interviews of each director discussing our company’s governance practices and what Responsible Growth means to us on our annual meeting website at https://investor.bankofamerica.com/events-and-presentations/annual-shareholder-meeting.

Our Board remains committed to building long-term value in the company through our continued focus on Responsible Growth. On behalf of the directors, I join Brian and the management team in thanking you for choosing to invest in Bank of America.

|

|

LIONEL L. NOWELL III Lead Independent Director

|

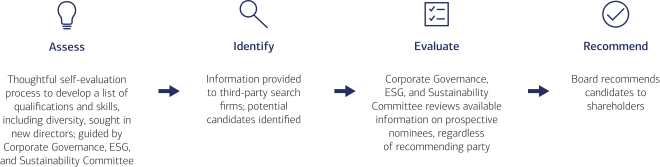

Assess. The Committee regularly reviews the mix of individual directors on our Board to assess the overall Board composition. Among other factors, the Committee

considers our company’s strategy and needs; our directors’ experiences, diversity, tenure, and age; and the attributes and qualifications our Board identifies in its self-evaluations to develop criteria for potential candidates and assess

whether these attributes and qualifications are additive to our overall Board composition.

Assess. The Committee regularly reviews the mix of individual directors on our Board to assess the overall Board composition. Among other factors, the Committee

considers our company’s strategy and needs; our directors’ experiences, diversity, tenure, and age; and the attributes and qualifications our Board identifies in its self-evaluations to develop criteria for potential candidates and assess

whether these attributes and qualifications are additive to our overall Board composition.  Identify. To drive effective Board renewal and director and Board leadership succession planning, the Committee has a regularly recurring agenda item to develop

and review a diverse group of potential director candidates. Based on the factors and criteria developed in the assessment phase, the Committee engages third-party search firms to identify potential candidates for review. It considers and provides

feedback on the then-current pool of director talent identified by search firms; the search firms periodically update the list of potential director candidates based on Committee and Board input.

Identify. To drive effective Board renewal and director and Board leadership succession planning, the Committee has a regularly recurring agenda item to develop

and review a diverse group of potential director candidates. Based on the factors and criteria developed in the assessment phase, the Committee engages third-party search firms to identify potential candidates for review. It considers and provides

feedback on the then-current pool of director talent identified by search firms; the search firms periodically update the list of potential director candidates based on Committee and Board input.  Evaluate. The Committee has an established process for evaluating director candidates that it follows regardless of who recommends the candidate for consideration. During this

process, the Committee reviews available or self-identified information regarding each candidate, including but not limited to, professional qualifications, experience, and expertise, as well as race, ethnicity, gender, nationality, national origin,

sexual orientation, military service, and other diverse characteristics. The Committee also reviews the candidate’s independence, absence of conflicts, and any reputational risks.

Evaluate. The Committee has an established process for evaluating director candidates that it follows regardless of who recommends the candidate for consideration. During this

process, the Committee reviews available or self-identified information regarding each candidate, including but not limited to, professional qualifications, experience, and expertise, as well as race, ethnicity, gender, nationality, national origin,

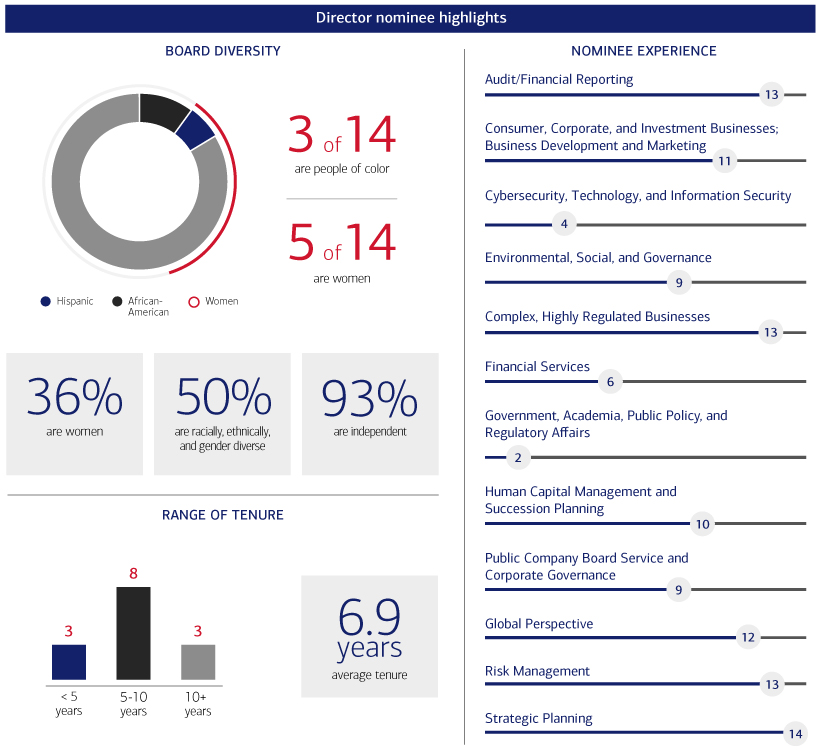

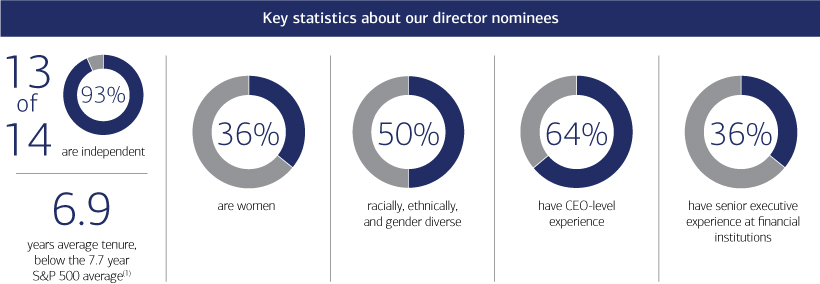

sexual orientation, military service, and other diverse characteristics. The Committee also reviews the candidate’s independence, absence of conflicts, and any reputational risks. Recommend. The Board selected our 14 director nominees based on their satisfaction of the core attributes described on page 10, and the belief that

each can continue making substantial contributions to our Board and company. Our Board believes our nominees’ breadth of experience and their diversity and mix of attributes strengthen our Board’s independent leadership and effective

oversight of management, in the context of our company’s businesses, our industry’s operating environment, and our company’s long-term strategy.

Recommend. The Board selected our 14 director nominees based on their satisfaction of the core attributes described on page 10, and the belief that

each can continue making substantial contributions to our Board and company. Our Board believes our nominees’ breadth of experience and their diversity and mix of attributes strengthen our Board’s independent leadership and effective

oversight of management, in the context of our company’s businesses, our industry’s operating environment, and our company’s long-term strategy.