| Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-268718 and 333-268718-01 |

Product Supplement No. EQUITY MPN-1

(To Prospectus dated December 30, 2022

and Series A MTN Prospectus Supplement dated December 30, 2022)

December 1, 2023

BofA Finance LLC

Market Participation Notes Linked to One or More Equity Indices or Exchange Traded Funds

Fully and Unconditionally Guaranteed by Bank of America Corporation

| • | The notes are unsecured senior notes issued by BofA Finance LLC, a consolidated finance subsidiary of Bank of America Corporation (the “Guarantor”). Any payment due on the notes is fully and unconditionally guaranteed by the Guarantor. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BofA Finance LLC, as issuer of the notes, and the credit risk of Bank of America Corporation, as guarantor of the notes. |

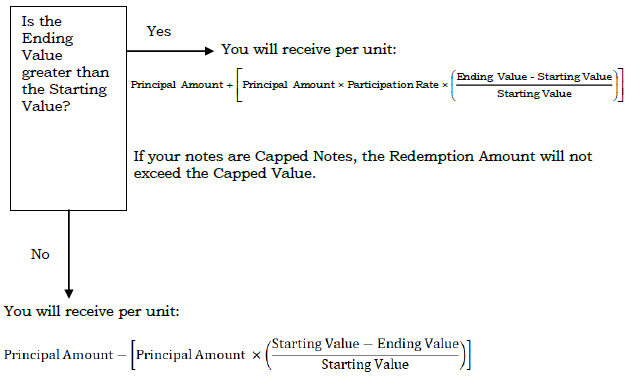

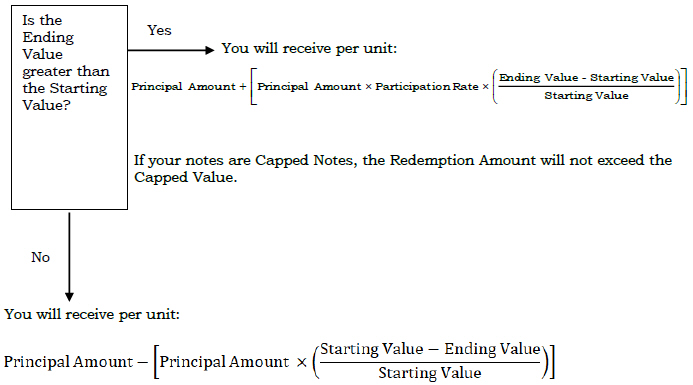

| • | The notes do not guarantee the return of principal at maturity, and we will not pay interest on the notes. Instead, the return on the notes will be based on the performance of an underlying “Market Measure,” which will be an equity index (an “Index”), an exchange traded fund (an “Underlying Fund”), a basket of the foregoing, or the worst-performing of two or more of the foregoing. |

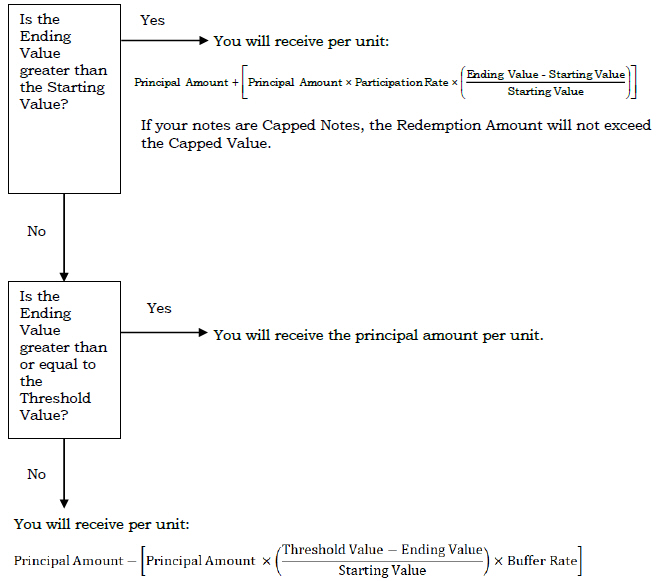

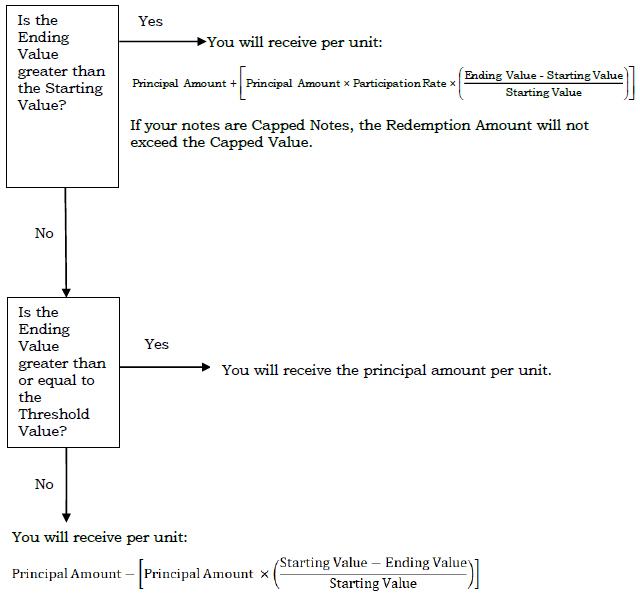

| • | The notes provide an opportunity to earn a return based on any positive performance of the Market Measure. If specified in the applicable term sheet, your notes may be “Capped Notes.” In the case of Capped Notes, the amount payable at maturity will not exceed a specified cap (the “Capped Value”). You will be exposed to any negative performance of the Market Measure on a 1-to-1 basis unless the notes provide for a “Buffer” or “Barrier” (as further described in “Summary”), in which case you will be afforded limited protection against the downside performance of the Market Measure. Such Buffer or Barrier will be indicated by a “Threshold Value”, which will be a percentage of the Starting Value (as defined in “Summary”). Additionally, if specified in the applicable term sheet, your notes may be subject to an automatic call, which will limit your return to a fixed amount if the notes are called. |

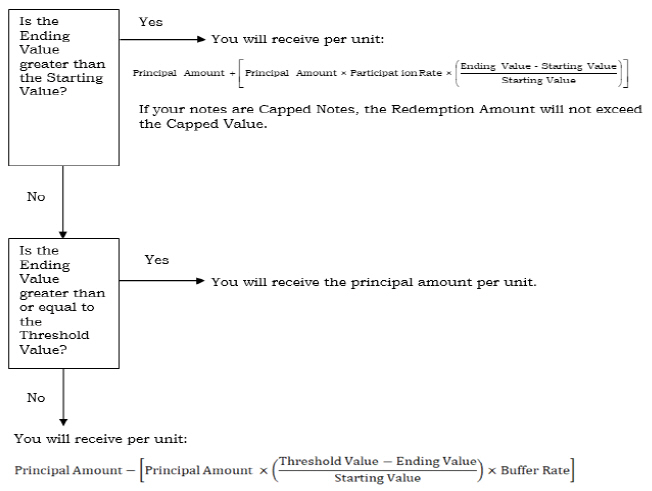

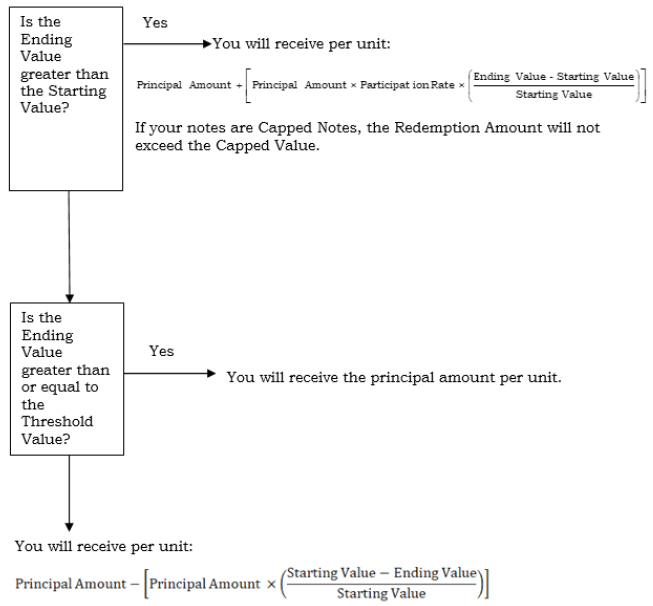

| • | If the notes are not automatically called prior to maturity, as applicable, and the value of the Market Measure increases from its Starting Value to its Ending Value (each as defined in “Summary”), you will receive at maturity a cash payment per unit (the “Redemption Amount”) that equals the principal amount of your notes plus a multiple (as measured by the “Participation Rate”, which will be greater than or equal to 100%) of that increase, and in the case of Capped Notes, up to the Capped Value. |

| • | If the notes are not automatically called prior to maturity, as applicable, and the value of the Market Measure does not change from its Starting Value to its Ending Value or, in the case of notes with a Buffer or Barrier, decreases from its Starting Value to its Ending Value but not below the Threshold Value, then the Redemption Amount will equal the principal amount. However, if the Ending Value is less than the Starting Value (or, in the case of notes with a Buffer or Barrier, the Threshold Value), you will lose all or a significant portion of the principal amount of your notes. |

| • | If specified in the applicable term sheet, your notes may be subject to an automatic call. In that case, the notes will be automatically called if the Observation Value on any Observation Date is greater than or equal to the Call Value (each as defined in “Summary”). If automatically called, you will receive a cash payment per unit (the “Call Payment”) that equals the principal amount plus the applicable Call Premium (as defined in “Summary”). |

| • | This product supplement describes the general terms of the notes, the risk factors to consider before investing, the general manner in which the notes may be offered and sold, and other relevant information. |

| • | For each offering of the notes we will provide you with a pricing supplement (which we refer to as a “term sheet”) that will describe the specific terms of that offering, including the specific Market Measure, the Threshold Value, if applicable, the Capped Value, if applicable, the Participation Rate and, if the notes are subject to an automatic call, the Call Value, the Call Payment and the Call Premium for each Observation Date, the Observation Dates and the Call Payment Dates (each as defined in “Summary”), and certain risk factors. The applicable term sheet will identify, if applicable, any additions or changes to the terms specified in this product supplement. |

| • | The notes will be issued in denominations of whole units. Unless otherwise set forth in the applicable term sheet, each unit will have a principal amount of $10.00. The applicable term sheet may also set forth a minimum number of units that you must purchase. |

| • | Unless otherwise specified in the applicable term sheet, the notes will not be listed on a securities exchange or quotation system. |

| • | One or more of our affiliates, including BofA Securities, Inc. (“BofAS”), may act as our selling agents to offer the notes and will act in a principal capacity in such role. |

The notes are unsecured and unsubordinated obligations of BofA Finance LLC and the related guarantee of the notes is an unsecured and unsubordinated obligation of Bank of America Corporation. The notes and the related guarantee are not savings accounts, deposits, or other obligations of a bank. The notes are not guaranteed by Bank of America, N.A. or any other bank, and are not insured by the Federal Deposit Insurance Corporation (the “FDIC”) or any other governmental agency and may involve investment risks, including possible loss of principal. Potential purchasers of the notes should consider the information in “Risk Factors” beginning on page PS-10 of this product supplement, page S-6 of the accompanying Series A MTN prospectus supplement, and page 7 of the accompanying prospectus. You may lose all or a significant portion of your investment in the notes.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or passed upon the adequacy or accuracy of this product supplement or the accompanying prospectus supplement or prospectus. Any representation to the contrary is a criminal offense.

BofA Securities