☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material Pursuant to § 240.14a-12 | |

☒ |

No fee required. | ||||

☐ |

Fee paid previously with preliminary materials. | ||||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||

March 11, 2024

Letter from our Chair and Chief Executive Officer

We are pleased to invite you to the 2024 annual meeting of shareholders to be held on April 24, 2024 at 10:00 a.m., Eastern time. Our 2024 annual meeting will be held virtually by webcast.

During the meeting, we will provide updates on how Responsible Growth helped enable us to deliver for our shareholders and stakeholders in 2023—and how it positions us to deliver for shareholders and stakeholders in the future. You will also hear from Lionel Nowell, our Lead Independent Director.

Your vote is important. We will make a $1 charitable donation for every shareholder account that votes. Contributions this year will be made in equal parts to Every Mother Counts, (RED), St. Jude Children’s Research Hospital, The Steve Fund, and World Central Kitchen, as part of our ongoing focus on health equity, including mental, maternal, and overall health access. This is the eighth year Bank of America will make a $1 charitable donation for every shareholder account that votes—shareholder participation has led to more than $7.7 million in aggregate charitable donations.

I encourage you to read our 2024 Proxy Statement, our 2023 Annual Report to shareholders, and the other proxy materials and the voting instructions on the pages that follow so your shares are represented at the meeting. These materials are also available on our annual meeting website at https://investor.bankofamerica.com/events-and-

presentations/annual-shareholder-meeting.

Letter from our Lead Independent Director

The independent directors and I join Brian in inviting you to attend our company’s 2024 annual meeting of shareholders.

Bank of America’s Board of Directors is committed to building long-term value in the company through our continued focus on Responsible Growth, and values input from our shareholders as the company executes our strategy.

As the Board’s Lead Independent Director, I meet with shareholders throughout the year to discuss the Board’s focus on governance practices and our oversight of the company’s drive for Responsible Growth. During these meetings, I also hear from shareholders on the things that matter to them most and share these viewpoints with the Board to enhance our oversight.

During 2023 and early 2024, I was joined by Monica Lozano, Chair of the Board’s Compensation and Human Capital Committee, in dialogue with shareholders. Together with management, we met with holders of approximately 47% of our institutionally held shares. We discussed the Board’s composition and our oversight of the company’s progress toward its commitment to net zero greenhouse gas emissions by 2050 in its financing activities, operations, and supply chain. In response to the results of our 2023 “Say on Pay” vote, our dialogue also focused on Board and Committee oversight of Bank of America’s executive compensation practices and disclosures. I greatly appreciate the time taken by our investors to provide the Board with valuable insight on how they believe our company can improve, and I look forward to our continued dialogue.

On behalf of the Board, thank you for choosing to invest in Bank of America.

On behalf of our Board, we would like to share a tribute to our friend and colleague, Frank Bramble, a 17-year member of the Board who passed away last year. Frank was a deeply committed member of our Board. We are grateful to Frank for his years of service and contributions as Chair of the Board’s Corporate Governance, ESG, and Sustainability Committee, and prior to that, as Chair of our Board’s Enterprise Risk Committee. We have greatly benefited from his judgment and counsel.

|

|

BRIAN T. MOYNIHAN Chair and Chief Executive Officer

|

|

|

LIONEL L. NOWELL III Lead Independent Director |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

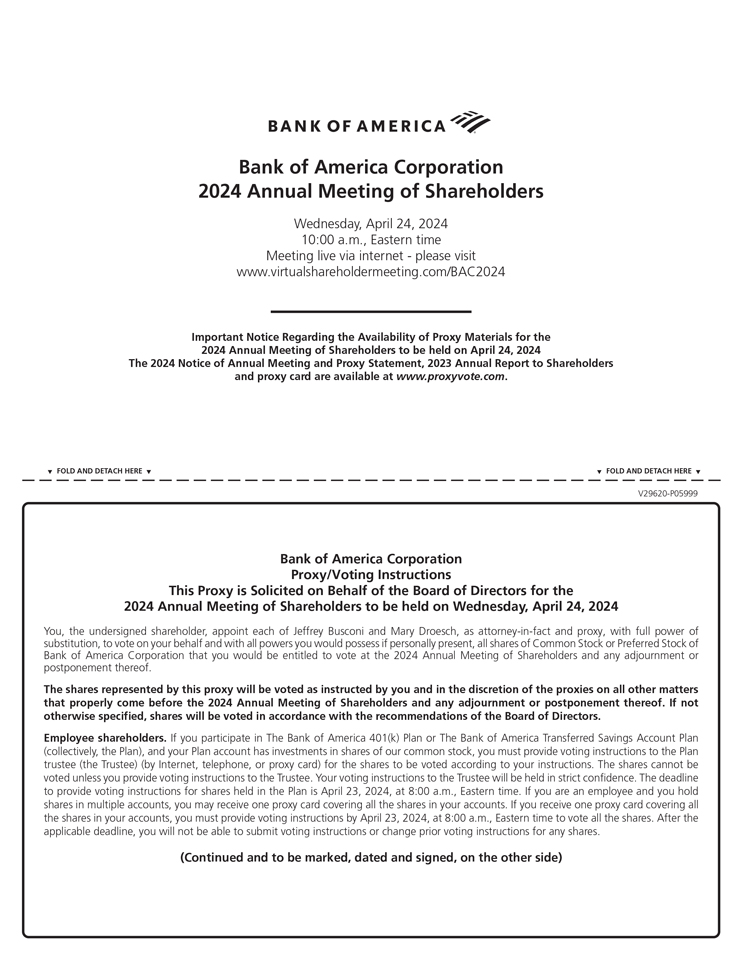

Notice of 2024 annual meeting of shareholders

| Date and time:

| ||

|

|

April 24, 2024 | 10:00 a.m., Eastern time

| |

|

Live audio webcast:

| ||

|

|

www.virtualshareholdermeeting.com/BAC2024

| |

|

Matters to be voted on: | ||

|

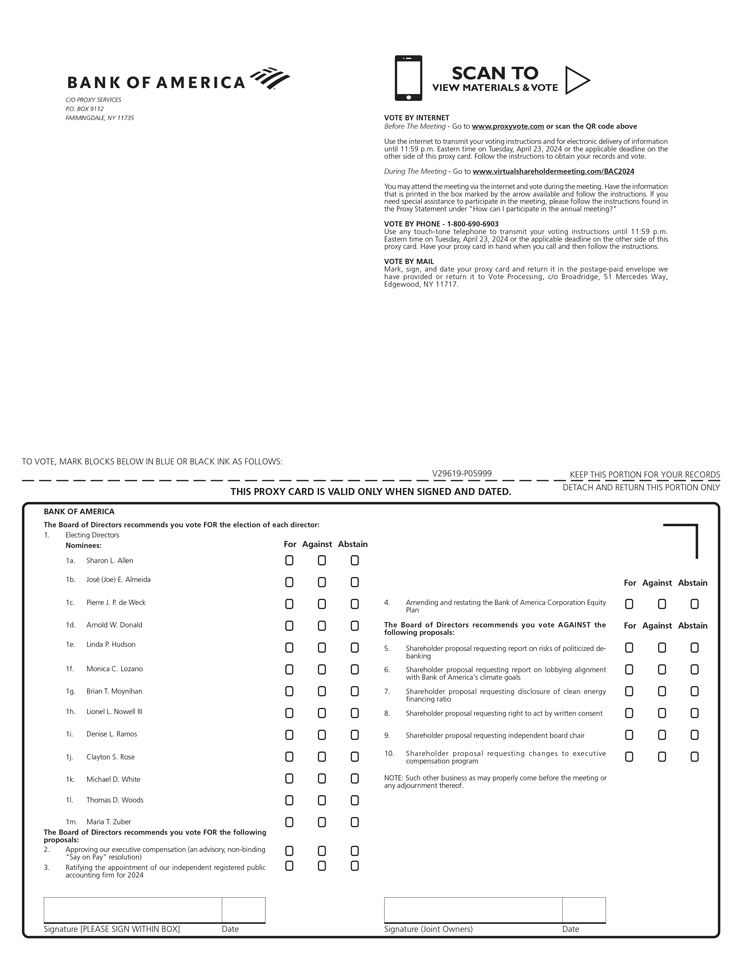

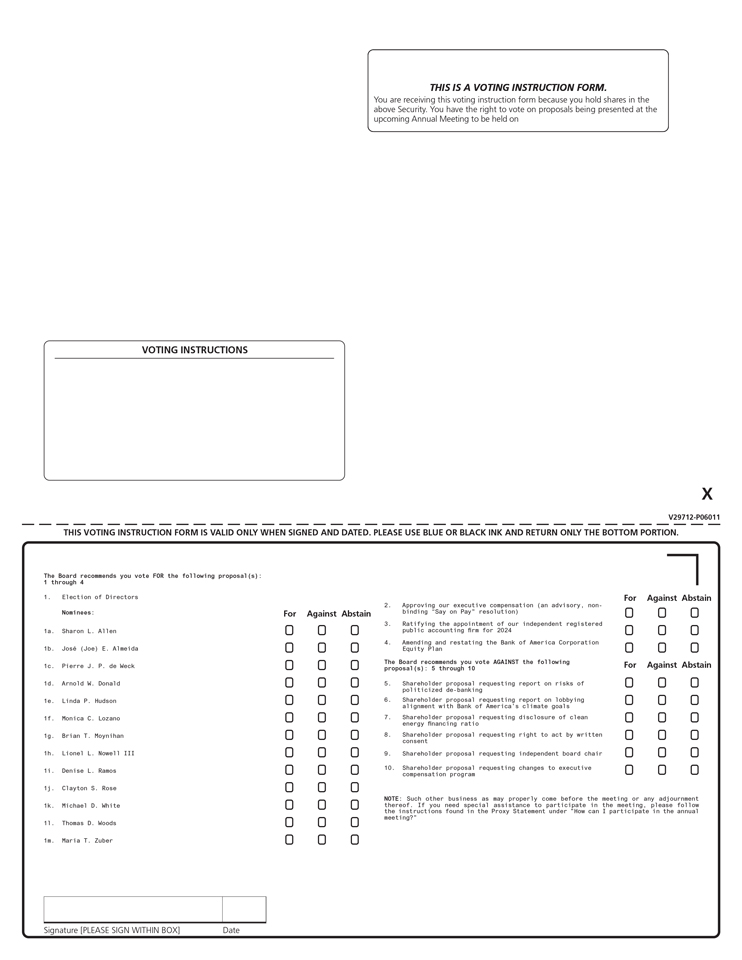

• Electing the 13 directors named in the

• A proposal approving our executive

• A proposal ratifying the appointment of

• A proposal to amend and restate the Bank

• Shareholder proposals, if they are properly

• Any other business that may properly come

| ||

Your vote is important

Please submit your proxy as soon as possible online, by telephone, or by mail. Submitting your proxy by one of these methods will ensure your representation at the annual meeting, regardless of whether you attend the meeting.

Your vote is important—we want to hear from you and all of our other shareholders. For every shareholder account that votes, Bank of America will make a $1 charitable donation in equal parts to five nonprofit organizations: Every Mother Counts, (RED), St. Jude Children’s Research Hospital, The Steve Fund, and World Central Kitchen, as part of our ongoing focus on health equity, including mental, maternal, and overall health access.

Please refer to page 110 of this proxy statement for additional information on how to vote your shares and attend our annual meeting virtually.

Record date

Bank of America shareholders as of the close of business on March 1, 2024 will be entitled to vote at our annual meeting and any adjournments or postponements of the meeting.

|

We will hold our annual meeting this year solely by means of remote communication via audio webcast at www.virtualshareholdermeeting.com/BAC2024. You will be able to participate in the virtual annual meeting online, vote your shares electronically, and submit questions during the meeting. You will not be able to attend the annual meeting in person.

|

By order of the Board of Directors,

|

ROSS E. JEFFRIES, JR.

Deputy General Counsel and Corporate Secretary

March 11, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON APRIL 24, 2024: We commenced providing and making available our 2024 Proxy Statement on March 11, 2024. Our 2024 Proxy Statement and 2023 Annual Report to shareholders are available at https://investor.bankofamerica.com/events-and-presentations/annual-shareholder-meeting.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table of contents

Cautionary information and forward-looking statements. This proxy statement contains certain statements regarding Responsible Growth and environmental, social, and governance information and opinions, including metrics, aspirations, targets, goals, commitments, cumulative values and sustainability objectives (collectively, the Sustainability Information). Such statements regarding Sustainability Information may be based on current or historic aspirations, goals, targets, commitments, estimates, assumptions, standards, metrics, methodologies and internal control frameworks, and currently available data, which continue to evolve and develop, and any statements made in connection with Bank of America Corporation’s aspirations, goals, targets or commitments are not guarantees or promises that they will be met.

Additionally, certain statements contained in this proxy statement may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our future financial performance and business and sustainability-related statements regarding our aspirations, goals, targets and commitments, such as our commitment to achieve net zero greenhouse gas emissions before 2050 in our financing activities, operations and supply chain, interim 2030 net zero greenhouse gas emissions targets, including financed emissions targets, and sustainable finance commitments, which may evolve over time. We use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could” to identify forward-looking statements. Forward-looking statements are not based on historical facts, but reflect management’s current expectations, plans or forecasts, are not guarantees of future results or performance, involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and often beyond our control and are inherently uncertain. You should not place undue reliance on any forward-looking statement. Actual outcomes and results may differ materially from those expressed in, or implied by, any of these forward-looking statements due to a variety of factors, including global socio-demographic and economic trends, energy prices, technological innovations and advances, climate-related conditions and weather events, legislative and regulatory changes, public policies, engagement with clients, suppliers, investors, government officials, and other stakeholders, our ability to successfully implement sustainability-related initiatives under expected time frames, third-party compliance with our expectations, policies and procedures and other unforeseen events or conditions. Discussion of additional factors, including uncertainties and risks, can be found in Bank of America Corporation’s 2023 Annual Report on Form 10-K (2023 Form 10-K) and subsequent Securities and Exchange Commission (SEC) filings. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise any forward-looking statements.

References to our 2023 Annual Report to shareholders (2023 Annual Report), 2023 Task Force on Climate-Related Financial Disclosures (TCFD) Report and Environmental and Social Risk Policy Framework, and website references (including any hyperlinks) throughout this proxy statement are provided for convenience only, and the content of which is not incorporated by reference into this proxy statement.

| Proxy statement summary |

Proxy statement summary

Your vote is important

How to vote your shares

You may vote if you were a shareholder as of the close of business on March 1, 2024.

|

|

Online before the meeting www.proxyvote.com or at the website indicated on the materials provided to you by your broker | |

|

|

By mail Complete, sign, date, and return your proxy card in the envelope provided | |

|

|

By phone Call the phone number located on the top of your proxy card | |

|

|

Online during the meeting Attend our annual meeting virtually by logging into the virtual annual meeting website and vote by following the instructions provided on the website | |

We encourage you to vote your shares prior to the meeting.

| Proposals for your vote |

Board voting recommendation |

Page | ||

|

|

8 | |||

| 2. Approving our executive compensation (an advisory, non-binding “Say on Pay” resolution) |

|

53 | ||

| 3. Ratifying the appointment of our independent registered public accounting firm for 2024 |

|

88 | ||

|

4. Amending and restating the Bank of America Corporation Equity Plan |

|

90 | ||

|

|

97 |

Your vote is important—we want to hear from you and all our other shareholders. For every shareholder account that votes, Bank of America will make a $1 charitable donation. This year, as part of our ongoing focus on health equity, including mental, maternal, and overall health access, contributions will be made in equal parts to Every Mother Counts, (RED), St. Jude Children’s Research Hospital, The Steve Fund, and World Central Kitchen.

Every Mother Counts is dedicated to making pregnancy and childbirth safe, respectful, and equitable for mothers everywhere. (RED) works to make preventable and treatable diseases preventable and treatable for everyone. St. Jude Children’s Research Hospital is committed to advancing cures and means of prevention for catastrophic pediatric diseases. The Steve Fund is dedicated to promoting the mental health and emotional well-being of young people of color. World Central Kitchen provides meals in response to humanitarian, climate, and community crises.

As a part of our marathon sponsorships in Boston and Chicago, Bank of America has enabled these organizations to activate charity runners to raise funds. Your vote will help amplify fundraising for our partners and the good they do in our communities.

For more information on how to attend our 2024 annual meeting, see “Attending the annual meeting” on page 112. To review our 2024 Proxy Statement, 2023 Annual Report, and other information relating to our 2024 annual meeting online, go to https://investor.bankofamerica.com/events-and-presentations/annual-shareholder-meeting.

| 2024 PROXY STATEMENT |

1 |

| Proxy statement summary |

Strategic objectives

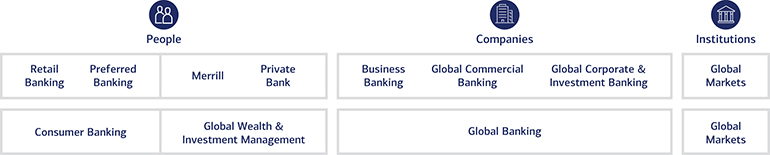

Bank of America is one of the world’s largest financial institutions, serving people, companies, and institutions with a diversified range of banking and non-banking services and products. The way we serve our stakeholders begins with one straightforward question:

| What would you like the power to do?®

At Bank of America, we ask this question every day of all those we serve. It is at the core of how we live our values, deliver our

| ||||||

|

Our values

• Deliver together

• Act responsibly

• Realize the power of

• Trust the team |

Our purpose

To help make financial lives |

Responsible Growth

• We must grow and win in the market — no excuses

• We must grow with our customer-focused strategy

• We must grow within our risk framework

• We must grow in a sustainable manner |

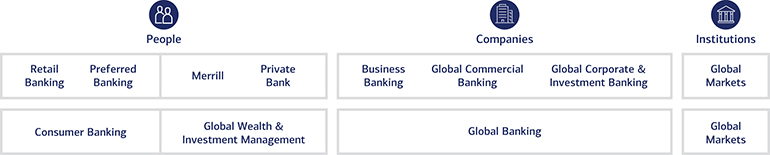

Eight lines of business

Serving the core financial needs of people, companies and institutional investors through eight lines of business | |||

Eight lines of business

By delivering capabilities through eight lines of business, we provide a unique advantage to each customer and client: the powerful expertise of one team, working together to deliver on our purpose to help make financial lives better through our focus on Responsible Growth.

Responsible Growth

At Bank of America, the work we do to deliver for our shareholders, our teammates, and our communities is embedded in all of our operations and is integral to how we run our company—we call it Responsible Growth.

| Responsible Growth has four tenets:

• We must grow and win in the market — no excuses

• We must grow with our customer-focused strategy

• We must grow within our risk framework

• We must grow in a sustainable manner

|

Responsible Growth requires us to grow in a sustainable manner, with a simultaneous focus on three components. The first is our appetite for enhancing Operational Excellence (OpEx) at every opportunity. OpEx is at the heart of how we reduce costs by eliminating inefficiencies in our processes across our company and reinvest the savings into the people and things that are core to it: our client experience; our team; our capabilities; our communities; and our shareholders. Second, we aspire to be a great place to work for our teammates. Third, we know that when the communities in which we live and do business are strong, Bank of America is strong, too. So we share our success to help communities address their biggest challenges. |

| 2 |

BANK OF AMERICA |

| Proxy statement summary |

2023 Company Performance — Responsible Growth

| WE MUST GROW AND WIN IN THE MARKET — NO EXCUSES |

WE MUST GROW WITH OUR CUSTOMER-FOCUSED STRATEGY | |||||

|

$98.6B Revenue

$1.9T in Deposits

|

$26.5B Net Income

$1.1T in Loans |

Added approx. 2M active digital banking users

40K+ net new relationships across Merrill and The Private Bank

Added approx. 2,500 new Global Banking

|

Experienced 12.8B digital logins, up 11% vs. 2022

Added over 600K net new Consumer

$17.4B Sales & Trading

| |||

|

WE MUST GROW WITHIN OUR RISK FRAMEWORK | ||||||

|

11.8% CET1 regulatory capital ratio, in |

0.36% net charge-offs as a | |||||

|

$12B distributed to

$897B Average Global |

Lowest stressed

10 of the past 11 Federal Reserve Comprehensive Capital Analysis and Review exams

|

|||||

| WE MUST GROW IN A SUSTAINABLE MANNER | ||||||

|

Nearly $290M

in philanthropic

Operational Excellence is how we create the means |

More than $2B in annual spend

Recognized approx. 97% of teammates with | |||||

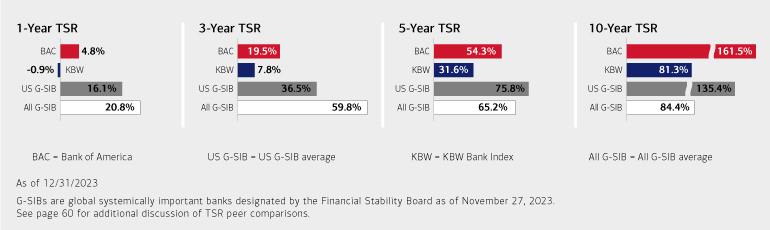

Total Shareholder Return (TSR)

| (1) | As of fourth quarter of 2023. Global Liquidity Sources comprise assets that are readily available to the company and its subsidiaries. For more information, see “Global Liquidity Sources and Other Unencumbered Assets” in the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of our 2023 Form 10-K. |

| 2024 PROXY STATEMENT |

3 |

| Proxy statement summary |

Governance objectives

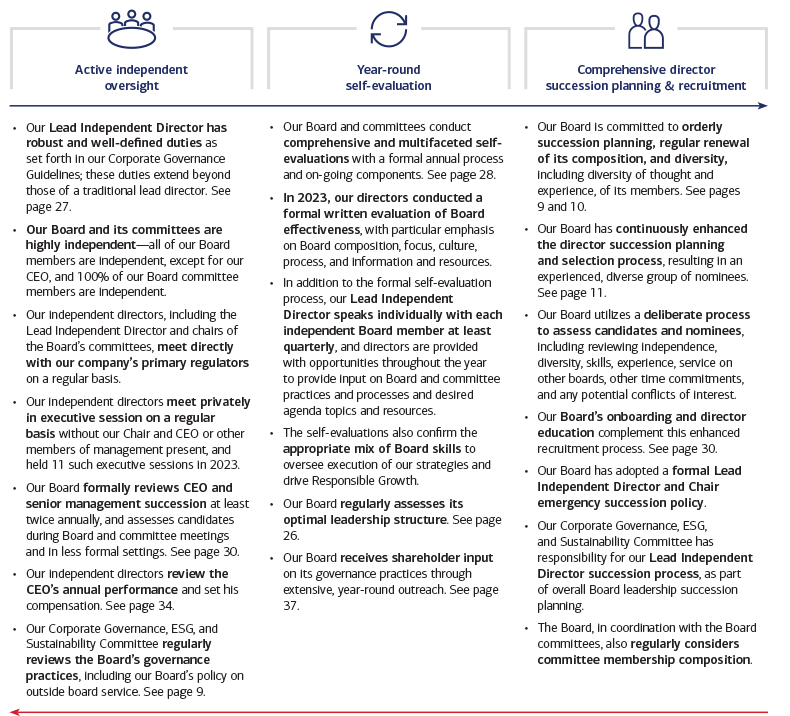

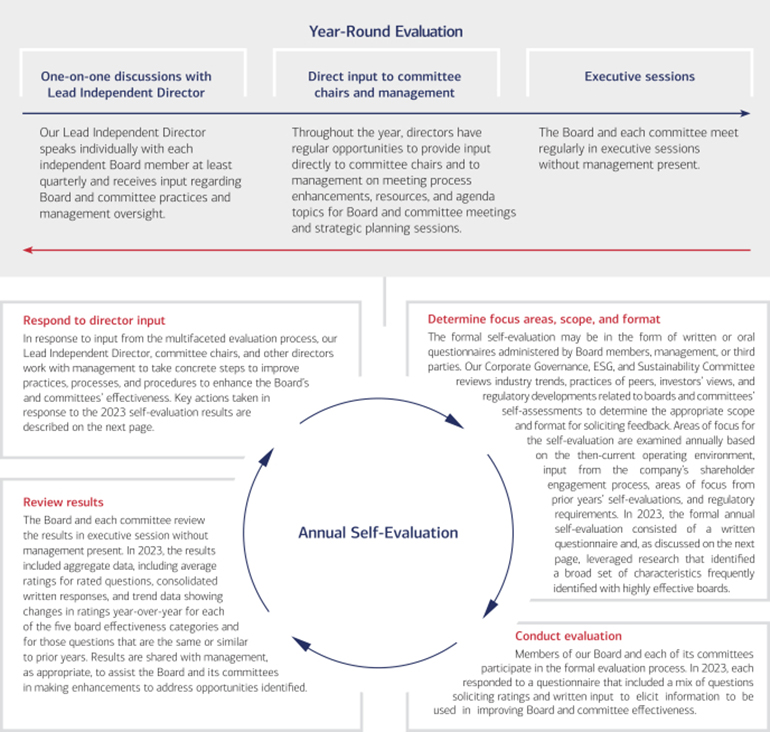

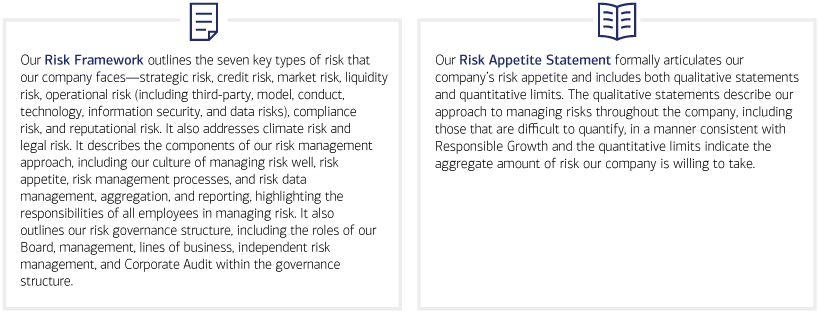

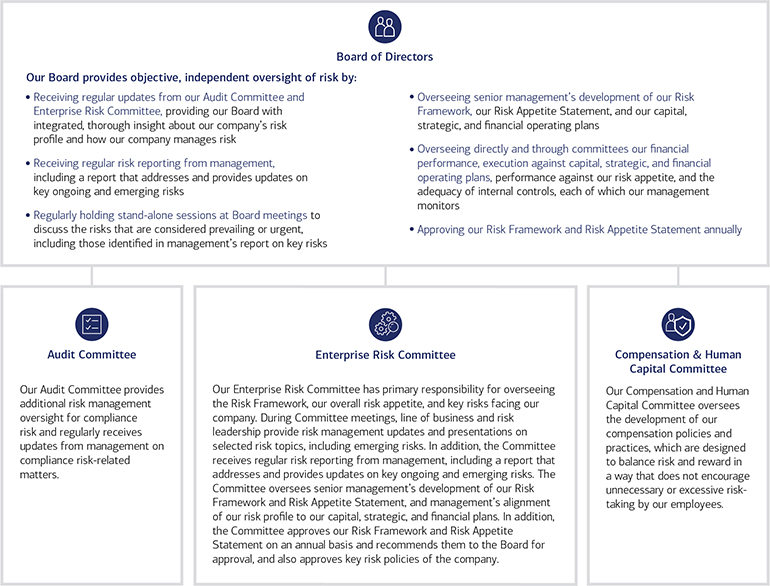

Our Board of Directors oversees the development and execution of our strategy. The Board has adopted thoughtful governance practices and processes consistent with our drive for Responsible Growth and implemented a number of measures to enrich its composition, enhance independent oversight, and increase its effectiveness. These measures align our corporate governance structure with achieving our strategic objectives, and facilitate our Board’s independent oversight of our culture of compliance and rigorous risk management.

Thoughtful, interconnected governance processes

| 4 |

BANK OF AMERICA |

| Proxy statement summary |

Compensation highlights

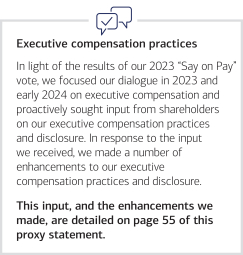

Shareholder engagement and “Say on Pay”

We have a long history of strong shareholder support for our Board’s pay-for-performance philosophy, as accomplished through our executive compensation design and decisions. From 2011 to 2022, support for our “Say on Pay” proposal averaged 94.2%, with the lowest level of support being 92.9% in 2011 and 2012. In recognition of this continued support as well as input from engagement with institutional shareholders, for 2022, our Board maintained a consistent executive compensation design and in applying its pay-for-performance philosophy, decreased the overall pay to Mr. Moynihan by approximately 6%. Compensation for that year’s other named executive officers also decreased between approximately 5% and 7% based on 2022 performance.

Leading up to our 2023 annual meeting, two U.S. proxy advisory firms recommended—for the first time ever—that their subscribers vote “against” our “Say on Pay” proposal. We believe these recommendations contributed significantly to the lower support received in 2023, as some of our institutional investors follow the voting recommendations of these firms and some others are influenced by their analyses and recommendations. In total, of the approximately 5.7 billion votes cast at the meeting, 69.1% favored our “Say on Pay” proposal.

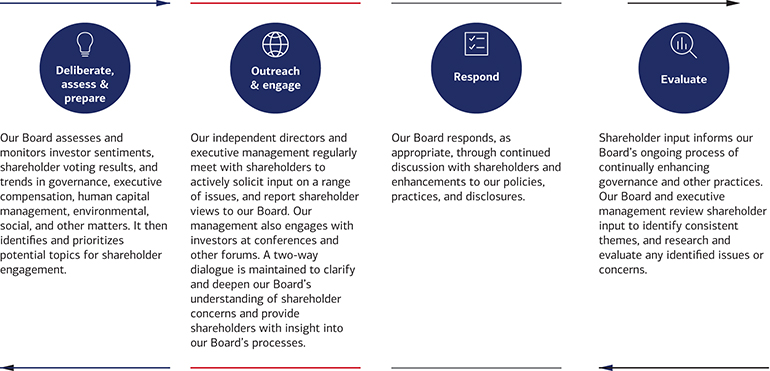

In light of the result of our 2023 “Say on Pay” vote, which differed significantly from our prior history, and in order to ascertain the reasons for the decline, we intentionally refocused our 2023 and early 2024 shareholder engagements more directly on our executive compensation program and disclosures than in prior years. We specifically solicited input on our executive compensation program as part of our engagement agenda, welcoming dialogue from those who both supported and did not support our “Say on Pay” proposal last year. Our Lead Independent Director and our Compensation and Human Capital Committee Chair played a central role in these discussions. For more information about our shareholder engagement, see ”Shareholder engagement” on page 37 and “Compensation discussion and analysis—Executive summary” on page 54.

Overall, investors expressed their understanding and support for our compensation program and structure and its alignment with the tenets of Responsible Growth. We focused on listening to shareholders to understand why they voted against “Say on Pay” last year, and to confirm their expectations of an appropriate response to regain support.

We received specific input on two key areas that contributed to a lower “Say on Pay” vote result in 2023: 1) one-time awards and 2) transparency in the pay decision process. This input, along with a range of perspectives and suggestions received during our shareholder engagement, informed the Committee as it implemented enhancements to our 2023 compensation program and disclosures. For details on our responsive actions, see “Compensation discussion and analysis—What we heard and how we responded” on page 55.

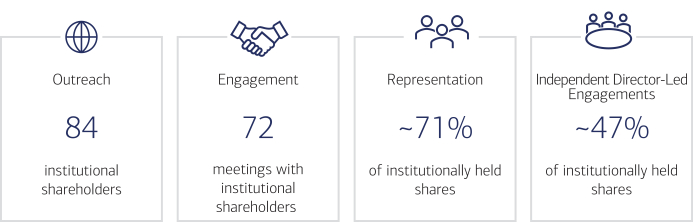

|

Highlights

from our year-round, Board-driven shareholder engagement process in 2023 and early 2024(1) |

Independent director participation

Lionel Nowell, Lead Independent Director, and Monica Lozano, Chair of the Compensation and Human Capital Committee, led engagements with shareholders representing ~47% of institutionally held shares

| |||||||||

|

Outreach to holders of ~79% of institutionally held shares

|

Met with holders of ~71% of institutionally held shares

|

Since being named Lead Independent Director, Lionel Nowell has participated in over 130 meetings with our institutional shareholders | ||||||||

| (1) | Based on stock ownership as of December 31, 2023. |

| 2024 PROXY STATEMENT |

5 |

| Proxy statement summary |

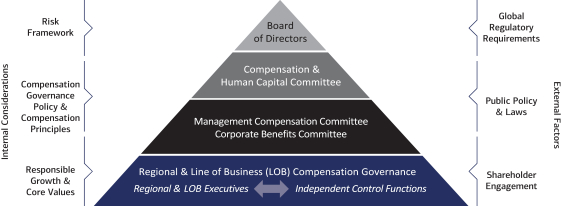

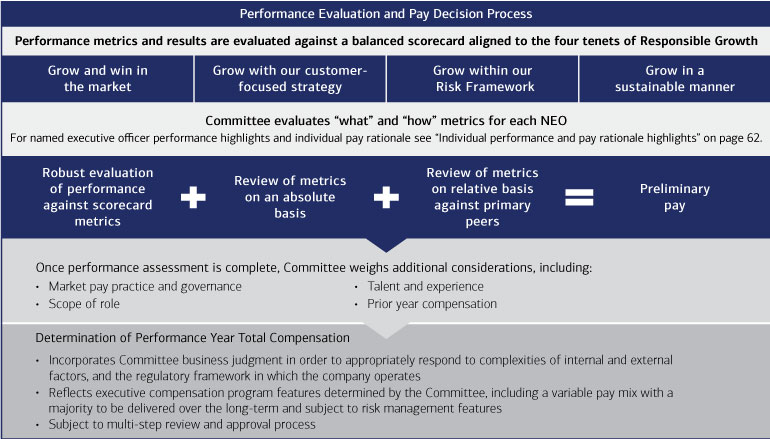

Pay-for-performance compensation philosophy

Our compensation philosophy is to pay for performance over the long term, as well as on an annual basis. Our performance considerations include both financial and non-financial measures—including the manner in which results are achieved. These considerations are designed to reinforce and promote Responsible Growth and maintain alignment with our Risk Framework.

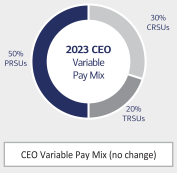

Our executive compensation program provides a mix of salary, incentives, and benefits paid over time to align executive officer and shareholder interests. A majority of variable compensation granted to named executive officers is in deferred equity-based awards, further encouraging long-term focus on generating sustainable growth.

|

In recognition of strong company performance in delivering Responsible Growth, and the CEO’s individual performance, the Compensation and Human Capital Committee and the Board’s independent directors determined the following 2023 compensation for our CEO:

| ||

| • Total compensation, inclusive of base salary and equity-based incentives, of $29.0 million, down 3% compared to 2022

• The Compensation and Human Capital Committee and Board undertook a robust performance evaluation and decision process, which included a detailed review of performance results under the four tenets of Responsible Growth

• The performance evaluation considered the “What,” which includes a thorough evaluation of performance against scorecard metrics, and the “How,” which includes the manner in which results, both financial and non-financial, were achieved

• 94.8% of Mr. Moynihan’s total compensation is variable and directly linked to company performance. All CEO variable compensation was delivered in equity-based awards (as it has been since 2010)

• Half of Mr. Moynihan’s variable compensation is performance restricted stock units (PRSUs) that must be re-earned based on sustained three-year average performance of key metrics (return on assets (tax-normalized) and growth in adjusted tangible book value) |

| |

|

• The remainder of the CEO’s variable pay is 30% cash-settled restricted stock units (CRSUs) and 20% time-based restricted stock units (TRSUs) settled in stock; TRSUs will vest over four years

• Mr. Moynihan must hold 50% of net after-tax shares received from equity-based awards until one year after retirement

| ||

See “Compensation discussion and analysis” on page 53.

| 6 |

BANK OF AMERICA |

| Proxy statement summary |

| Responsible Growth: Grow in a Sustainable Manner(1)

To grow in a sustainable manner, we share our success with our communities, make our company a great place to work for our teammates, and drive Operational Excellence(2) so that we can eliminate inefficiencies, reduce costs, and continue to invest in our capabilities, our teammates, our communities, and our shareholders. Learn more at http://bankofamerica.com/responsiblegrowth.

Our Board actively oversees our focus on growing in a sustainable manner

Our Board, together with its committees, actively oversees our drive for Responsible Growth through comprehensive governance and risk oversight practices that further the independent examination of our activities, processes, and strategies. The Board and its committees engage with management on our: product and service offerings; operational excellence and process excellence; diversity, equity and inclusion; human capital management; sustainability; and climate topics, including climate risk and the company’s progress toward its commitment to achieve net zero greenhouse gas emissions in its operations, supply chain, and financing activities before 2050 and its sustainable finance commitment. See “Board oversight of our drive for Responsible Growth” on page 39 for more information.

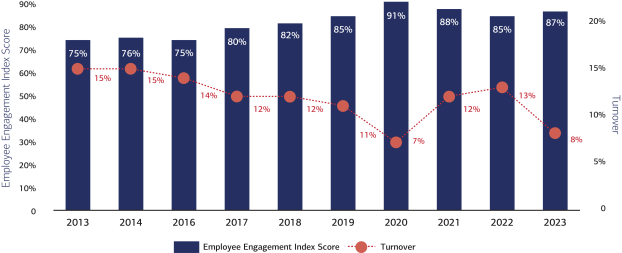

Our commitment to being a great place to work

Central to Responsible Growth is being a great place to work for our teammates. We deliver on this commitment by: fostering a diverse and inclusive workplace so our workforce reflects the communities we serve; attracting and developing exceptional talent; expanding our benefits and resources to support the physical, emotional, and financial wellness of our teammates and their families; recognizing and rewarding performance; and providing a competitive starting wage. To promote transparency, accountability, and continued progress, we hold ourselves accountable each year by using third parties to validate equal pay for equal work and asking our workforce to tell us how we are doing in our Employee Satisfaction Survey, which includes a diversity and inclusion component.

Our focus on being a great place to work is highlighted in “Being a great place to work,” starting on page 42, and is described in further detail in the Human Capital Management update in our 2023 Annual Report, which accompanies this proxy statement.

Our commitment to sharing our success

Sharing success in our communities. For Responsible Growth to be sustainable, we must share our success with the communities in which we work and live. See examples to the right of how we shared success with our communities.

For more information about our community impact, see page 40 of this proxy statement and our 2023 Annual Report.

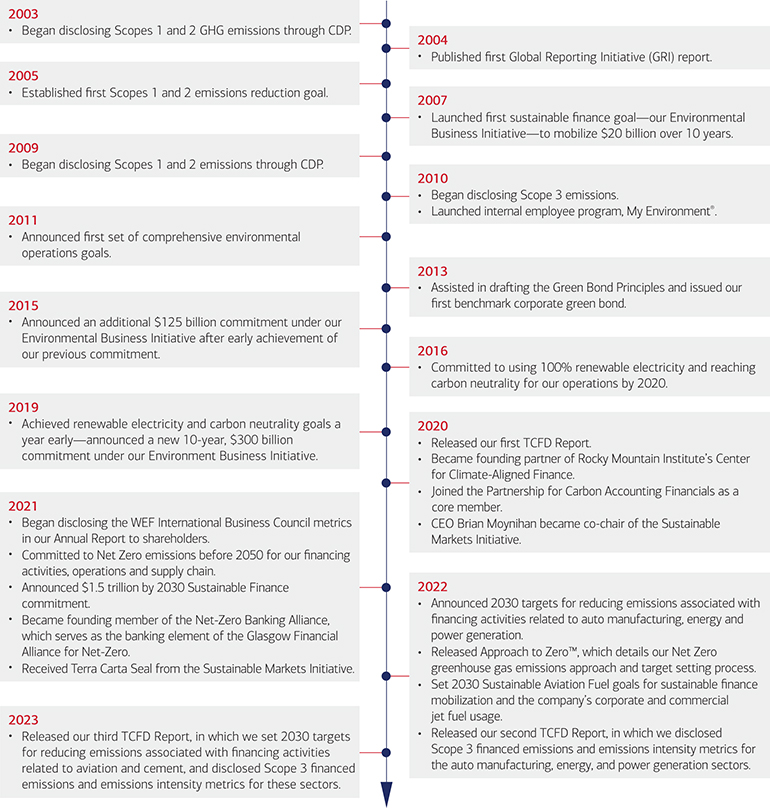

Helping reach a clean energy future. Consistent with our drive for Responsible Growth, we continue to make progress on our strategy to support and finance the transition to a low-carbon economy.

For more information on how we work with our clients toward a secure energy future, see page 40 of this proxy statement, our 2023 Annual Report, and our 2023 Task Force on Climate-Related Financial Disclosures Report. |

Empowering often under-resourced entrepreneurs $10M additional financing to support veteran-owned businesses through the Veteran Loan Fund

28K+ employed by portfolio companies

| ||||||

|

Supporting economic opportunity for people and communities

Committed $1.2B against our $1.25B commitment to advance economic opportunity

Nearly 45,000 individuals and families purchased a home under our $15B Community Homeownership Commitment

| |||||||

|

Investing in arts, culture, and heritage

$32M+ to support the arts and promote cultural sustainability

| |||||||

|

Financing a sustainable future

Mobilized and deployed $560B in sustainable finance since 2021

| |||||||

| Issued nearly $15B in ESG Bonds since 2013

|

Underwrote more than $30B in ESG Bonds in 2023

| ||||||

| (1) | For cautionary information and forward-looking statements regarding Sustainability Information, see the “Table of contents” page to this proxy statement. |

| (2) | See our 2023 Annual Report for additional information. |

| 2024 PROXY STATEMENT |

7 |

| Proposal 1: Electing directors |

Proposal 1: Electing directors

Our Board is presenting 13 nominees for election as directors at our annual meeting. All nominees currently serve as directors on our Board and were elected by shareholders at our 2023 annual meeting. Each director elected at the meeting will serve until our 2025 annual meeting or until a successor is duly elected and qualified. Each director nominee has consented to being named in this proxy statement and to serving as a director if elected. If any nominee is unable to stand for election for any reason, the shares represented at our annual meeting may be voted for another candidate proposed by our Board, or our Board may choose to reduce its size. See “Our director nominees” on page 11 for more information about the nominees and our Board’s composition.

| Nominee/Age(1) |

Independent |

Director since |

Other U.S.-listed |

Committee membership (C=chair) |

Key skills/ qualifications |

Race/ ethnicity/ gender(2) | ||||||||||||

|

Sharon Allen, 72 Former Chairman, Deloitte LLP |

Yes |

2012 |

1 |

AC (C) CGESC |

• Financial Expertise; Audit/Financial Reporting • Risk Management • Strategic Planning |

White Female | ||||||||||||

|

Joe Almeida, 61 Chairman, President, and CEO, |

Yes |

2022 |

1 |

AC CHCC |

• Active Chief Executive Officer • Complex, Highly Regulated Businesses • Strategic Planning; Global Operations |

Hispanic- Latino Male | ||||||||||||

|

Pierre de Weck, 73 Former Chairman and Global Head of Private Wealth Management, Deutsche Bank AG |

Yes |

2013 |

None |

CHCC ERC |

• Financial Services Experience; Consumer, Corporate, and Investment Businesses • Global Perspective • Risk Management |

White Male | ||||||||||||

|

Arnold Donald, 69 Former President and CEO, |

Yes |

2013 |

2 |

AC CHCC |

• Retired Chief Executive Officer • Strategic Planning; Global Operations • Consumer Businesses; Business Development and Marketing |

Black/ African American Male | ||||||||||||

|

Linda Hudson, 73 Former Chairman and CEO, The Cardea Group, LLC; Former President and CEO, BAE Systems, Inc. |

Yes |

2012 |

2 |

CGESC ERC |

• Retired Chief Executive Officer • Cybersecurity, Technology, and Information Security • Strategic Planning; Global Operations |

White Female | ||||||||||||

|

Monica Lozano, 67 Former CEO, College Futures Foundation; Former Chairman, US Hispanic Media Inc.; |

Yes |

2006 |

2 |

CHCC (C) ERC |

• Public Policy • Human Capital • Bank of America Institutional Knowledge; Public Company Board Leadership |

Hispanic- Latina Female | ||||||||||||

|

Brian Moynihan, 64 Chair and CEO, |

No |

2010 |

None |

None |

• Complex, Highly Regulated Businesses • Strategic Planning; Global Operations • Financial Services; Risk Management |

White Male | ||||||||||||

|

Lionel Nowell, 69 Lead Independent Director, Bank of America Corporation; Former SVP and Treasurer, PepsiCo, Inc. |

Yes |

2013 |

2 |

None |

• Public Company Board Leadership • Financial Expertise; Audit/Financial Reporting • Strategic Planning |

Black/ African American Male | ||||||||||||

|

Denise Ramos, 67 Former CEO and President, ITT Inc. |

Yes |

2019 |

2 |

AC CHCC |

• Retired Chief Executive Officer • Financial Expertise; Audit/Financial Reporting • Human Capital |

White Female | ||||||||||||

|

Clayton Rose, 65 Baker Foundation Professor of Management Practice at |

Yes |

2018(3) |

None |

CHCC ERC (C) |

• Financial Services Experience; Consumer, Corporate, and Investment Businesses • Risk Expert • Public Policy |

White Male | ||||||||||||

|

Michael White, 72 Former Chairman, President, and CEO, DIRECTV |

Yes |

2016 |

2 |

AC CGESC (C) |

• Public Company Board Leadership • Retired Chief Executive Officer • Strategic Planning; Global Operations |

White Male | ||||||||||||

|

Thomas Woods, 71 Former Vice Chairman and SEVP, Canadian Imperial Bank of Commerce |

Yes |

2016 |

None |

CGESC ERC |

• Financial Services Experience • Risk Management • Financial Expertise; Audit/Financial Reporting |

White Male | ||||||||||||

|

Maria Zuber, 65 VP for Research and E.A. Griswold Professor of Geophysics, Massachusetts Institute of Technology |

Yes |

2017 |

1 |

CGESC ERC |

• Cybersecurity, Technology, and Information Security • Risk Management • Strategic Planning |

White Female | ||||||||||||

| (1) Age as of annual meeting date.

(2) Based on information from director nominees.

(3) Dr. Rose previously served as a member of our Board from 2013 to 2015. |

AC = Audit Committee CGESC = Corporate Governance, ESG, and Sustainability Committee CHCC = Compensation and Human Capital Committee ERC = Enterprise Risk Committee |

| 8 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

Identifying and evaluating director candidates

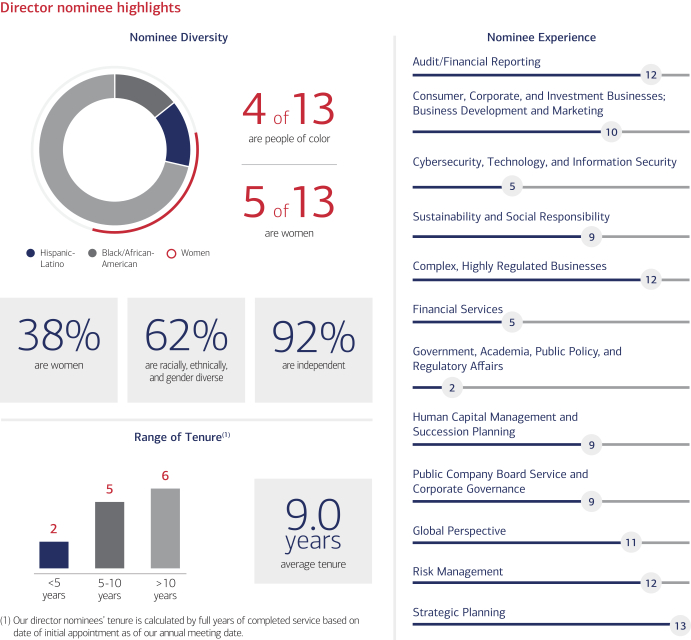

Our Board oversees the business and affairs of the company through active and independent oversight of management. To carry out its responsibilities and set the tone at the top, our Board is keenly focused on its composition, its leadership structure, and succession planning. The Board regularly reviews its composition, and through its Corporate Governance, ESG, and Sustainability Committee identifies and recommends director candidates for nomination using a director selection process that has been reviewed with our primary bank regulators. The Board, in coordination with its committees, also regularly considers Board leadership succession planning and committee membership composition.

Board composition

Our Board believes directors should possess high personal integrity and character, demonstrated management and leadership ability, extensive experience within our industry and across sectors, and the ability to exercise sound and independent judgment in a collegial manner. Our Board:

| • | seeks directors whose complementary knowledge, experience, and skills provide a broad range of perspectives and leadership expertise in areas important to our company’s strategy and oversight. |

| • | assesses directors’ age and tenure to provide for continuity in the boardroom and to achieve a balance between the perspectives of newer directors and those of longer-serving directors. |

| • | evaluates whether directors are able to devote the time necessary to discharge their duties. |

In addition, the Corporate Governance, ESG, and Sustainability Committee follows applicable regulations in confirming that our Board includes members who are independent, possess financial literacy and expertise, understand risk management principles, policies, and practices, and have experience in identifying, assessing, and managing risk exposures.

Key considerations informing the Board’s approach

Director experience, skills, and expertise. When evaluating and identifying director candidates, the Corporate Governance, ESG, and Sustainability Committee considers the experiences, skills, and expertise that are critical to the Board’s ability to provide effective oversight of the company and are directly relevant to our business, strategy, and operations. The Committee seeks candidates with experiences, skills, and expertise in financial services and other global, highly complex and regulated industries, strategic planning and business development, business operations, marketing and distribution, technology, cybersecurity, risk management and financial controls, human capital management, corporate governance, and public policy.

Director diversity. Our Board views diversity, including diversity of thought, perspective, and experience, as a priority. Through the Corporate Governance, ESG, and Sustainability Committee, the Board regularly assesses its diversity and seeks representation across a range of attributes when identifying and evaluating director candidates. The Committee demonstrates this commitment to diversity by requesting the inclusion of diverse candidates in its consideration of potential directors in its work with third-party search firms. (See information on the next page for the Committee’s engagement with external search firms.) When evaluating director candidates, the Committee reviews available or self-identified information regarding each candidate, including, but not limited to, professional qualifications, experience, and expertise as well as race, ethnicity, gender, nationality, national origin, sexual orientation, military service, and other diverse characteristics.

Director time commitment. Our Board understands the time commitment involved in serving on the Board and its committees. Through the Committee, the Board evaluates whether candidates and serving directors are able to devote the time necessary to discharge their duties as directors, taking into account their primary occupations, memberships on other boards, and other responsibilities.

In 2022, at the Committee’s recommendation, our Board amended its policy on outside board service set forth in the Corporate Governance Guidelines. The revised policy limits the maximum number of public company boards on which a director on our Board may serve to four public companies (including our Board) and specifies that any public company chief executive officer who serves as a director on our Board may not serve on the boards of more than two public companies (including our Board).

| The Committee assesses directors’ time commitment to the Board throughout the year, including through the annual formal self-evaluation process and prior to the annual renomination of currently serving directors. Under our Corporate Governance Guidelines, directors are expected to seek Committee approval prior to joining the board of another public company, and directors who change principal occupations must offer to resign from the Board, subject to further evaluation by the Committee and the Lead Independent Director.

The Committee regularly reviews and closely monitors external perspectives and trends on the appropriate number of public company boards on which directors may serve, including the proxy voting guidelines of our major shareholders and input from shareholder engagement discussions, voting policies of the major proxy advisory firms, corporate governance guidelines adopted by other public companies, board trends at peers and other significant public companies, and advice from outside advisors. |

Outside board service policy

|

|||||||

|

All directors 4 total public company boards |

CEO directors 2 total public company boards |

|||||||

| (including our Board)

|

(including our Board)

|

|||||||

|

Aligns with majority of institutional shareholders’ policies. All directors and nominees comply with our outside board service policy.

|

||||||||

| 2024 PROXY STATEMENT |

9 |

| Proposal 1: Electing directors |

| Director retirement policy. Our Corporate Governance Guidelines provide that a director who would be age 75 as of the time of election shall not be nominated for initial election to the Board, provided that the Board may approve the nomination for reelection of a director who would be age 75 at the time of the election, if, in light of all the circumstances, the Board determines that it is in the best interests of our company and shareholders. |

Succession planning and the director recruitment process

|

| ||||||

| 10 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

Our director nominees

Our director nominees bring diverse backgrounds and viewpoints, and a broad range of skills and experiences that are critical to the Board’s ability to provide effective oversight of the company and directly relevant to our business, strategy, and operations. They are seasoned leaders from research academia, government service, private organizations, and global public companies that are subject to extensive regulations and operate in highly competitive environments. They serve or have served as chief executive officers or C-suite executives leading business innovation and transformation, and they have expertise managing risk, operations, finance, technology, human capital, and other areas important to our business, strategy, and operations. Their varying tenure on the Board strengthens our Board’s oversight with a balance of historical insights about our company and new perspectives.

| 2024 PROXY STATEMENT |

11 |

| Proposal 1: Electing directors |

|

Our Board recommends a vote “FOR” each of the 13 nominees listed below for election as a |

Set forth below are each nominee’s name, age as of our annual meeting date, principal occupation, business experience, and U.S.-listed public company directorships held during the past five years. We also discuss the qualifications, attributes, and skills that led our Board to nominate each for election as a Bank of America director.

|

Age: 72 Director since: August 2012

Ms. Allen is an experienced director

As a corporate leader, Ms. Allen has broad experience leading and working with large, complex businesses and brings an international perspective on risk management and strategic planning. During her nearly 40-year career with Deloitte, the largest professional services organization in the U.S. and member firm of Deloitte Touche Tohmatsu Limited (DTTL), she became the first woman elected to serve as Chairman of the Board and also served as a member of DTTL’s Global Board of Directors, the chair of its Global Risk Committee, and the U.S. representative of its Global Governance Committee. During her tenure at Deloitte, Ms. Allen oversaw relationships with major multinational corporations and provided oversight and guidance to management.

|

Sharon L. Allen

Former Chairman, Deloitte LLP (Deloitte)

Committee membership:

• Audit Committee (chair) • Corporate Governance, ESG, and Sustainability Committee

Professional highlights: • Served as Chairman of Deloitte, a firm that provides audit, consulting, financial advisory, risk management, and tax services, as the U.S. member firm of DTTL from 2003 to 2011 • Employed at Deloitte for nearly 40 years in various leadership roles, including Partner and Regional Managing Partner, responsible for audit and consulting services for a number of Fortune 500 and large private companies • Former member of the Board of Directors of First Solar, Inc. and its Technology Committee, and Chair of its Audit Committee • Member of the Board of Directors of Albertsons Companies, Inc. and its Audit & Risk Committee, and Chair of its Governance, Compliance & ESG Committee • Member of the Global Board of Directors, Chair of the Global Risk Committee, and U.S. Representative on the Global Governance Committee of DTTL from 2003 to 2011

Other leadership experience and service: • Former Director and Chair of the National Board of Directors of the YMCA of the USA, a leading nonprofit organization for youth development, healthy living, and social responsibility • Former Vice Chair of the Board of Trustees of the Autry National Center, the governing body of the Autry Museum of the American West • Appointed by President George W. Bush to the President’s Export Council, which advised the President on export enhancement

Other U.S.-listed company boards: • Albertsons Companies, Inc. • First Solar, Inc. (past five years) |

| 12 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

|

Age: 61 Director since: September 2022

Mr. Almeida is an active chief executive officer and public company director with experience leading large, global companies subject to regulatory oversight. His service as a board member in a variety of industries also brings additional perspective to our Board.

As Chairman, President, and Chief Executive Officer of Baxter, Mr. Almeida is leading the company through a period of transformation driven by innovation, operational excellence, and strategic execution. Prior to joining Baxter, Mr. Almeida served as chairman, president and chief executive officer of Covidien plc and served in leadership roles at Tyco Healthcare (Covidien’s predecessor), Wilson Greatbatch Technologies Inc., American Home Products’ Acufex Microsurgical division, and Johnson & Johnson’s Professional Products division. He began his career as a management consultant at Andersen Consulting (Accenture) and previously served on the boards of Walgreens Boots Alliance, Inc., Analog Devices, Inc., EMC Corporation, State Street Corporation and Covidien plc.

|

José (Joe) E. Almeida

Chairman, President, and Chief Executive Officer,

Committee membership:

• Audit Committee • Compensation and Human Capital Committee

Professional highlights: • Chairman of the Board, President and CEO of Baxter, a global medtech leader, effective January 1, 2016. Began serving as an executive officer of Baxter in October 2015 • Served as Senior Advisor with The Carlyle Group, a multinational private equity, alternative asset management and financial services corporation, from May 2015 to October 2015 • Served as the Chairman, President and Chief Executive Officer of Covidien, a global healthcare products company, from March 2012 through January 2015, prior to the acquisition of Covidien by Medtronic plc, and President and Chief Executive Officer of Covidien from July 2011 to March 2012 • Prior to becoming Covidien’s President and Chief Executive officer, served in several leadership roles at Covidien, including President of its Worldwide Medical Devices business; also served as President of International and Vice President of Global Manufacturing for Covidien’s predecessor, Tyco Healthcare • Served on the boards of directors of: Walgreens Boots Alliance, Inc. from 2017 to 2022, including on its Compensation Committee; State Street Corporation from 2013 to 2015, including on its Executive Compensation Committee; Analog Devices, Inc. during 2015; and EMC Corporation from 2014 to 2015 • Served on the Board of Trustees of Partners in Health from 2013 to 2021

Other leadership experience and service: • Serves on the Board of Trustees of Northwestern University

Other U.S.-listed company boards: • Baxter • Walgreens Boots Alliance, Inc. (past five years) |

| 2024 PROXY STATEMENT |

13 |

| Proposal 1: Electing directors |

|

Age: 73 Director since: July 2013

Mr. de Weck is a Swiss national

As a senior executive with a tenure of more than three decades in global financial services, including as a member of the Group Executive Committee and Global Head of Private Wealth Management of Deutsche Bank AG in London, and as Chief Executive Officer of North America, Chief Executive Officer of Europe, and a member of the Group Executive Board at UBS AG, and as Chief Executive Officer of UBS Capital, Mr. de Weck has extensive experience in risk management, including credit risk management. He brings valuable international perspective to our company’s business activities, including to our European subsidiaries through his service on the Boards of Directors of Merrill Lynch International (MLI), our U.K. broker-dealer subsidiary, and BofA Securities Europe S.A. (BofASE), our French broker-dealer subsidiary.

|

Pierre J.P. de Weck

Former Chairman and Global Head of Private Wealth Management, Deutsche Bank AG

Committee membership:

• Compensation and Human Capital Committee • Enterprise Risk Committee

Professional highlights: • Served as the Chairman and Global Head of Private Wealth Management and as a member of the Group Executive Committee of Deutsche Bank AG from 2002 to May 2012 • Served on the Management Board of UBS from 1994 to 2001; as Head of Institutional Banking from 1994 to 1997; as Chief Credit Officer and Head of Private Equity from 1998 to 1999; and as Head of Private Equity from 2000 to 2001 • Held various senior management positions at Union Bank of Switzerland, a predecessor firm of UBS, from 1985 to 1994 • Chair of the Board of Directors of MLI (and previously chair of the MLI Board’s Risk Committee), and Chair of the Board of Directors of BofASE

Other U.S.-listed company boards: • N/A |

| 14 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

|

Age: 69 Director since: January 2013

Mr. Donald has more than three decades of strategic planning, global operations, and risk management experience in regulated, consumer, retail, and distribution businesses.

He brings expertise in business transformation through his service as President and Chief Executive Officer of Carnival, one of the world’s largest leisure travel companies with operations worldwide, his leadership roles with global responsibilities at Monsanto, and his experience as a public company director. Through his leadership of nonprofit organizations, including The Executive Leadership Council and the Juvenile Diabetes Research Foundation International, Mr. Donald also brings focus and perspective on our work to promote equality, diversity, and inclusion, and advance economic opportunity for our employees and the communities we serve.

|

Arnold W. Donald

Former President and Chief Executive Officer, Carnival Corporation and Carnival plc (Carnival)

Committee membership:

• Audit Committee • Compensation and Human Capital Committee

Professional highlights: • President, Chief Executive Officer, and Chief Climate Officer of Carnival, a cruise and vacation company from July 2013 to November 2022; began serving on Carnival’s Board of Directors in 2001 • Served as President and Chief Executive Officer from November 2010 to June 2012 of The Executive Leadership Council, a nonprofit organization providing a professional network and business forum to African-American executives at major U.S. companies • President and Chief Executive Officer of the Juvenile Diabetes Research Foundation International from January 2006 to February 2008 • Served as Chairman and Chief Executive Officer of Merisant from 2000 to 2003, a privately held global manufacturer of tabletop sweeteners, and remained as Chairman until 2005 • Joined Monsanto in 1977 and held several senior leadership positions with global responsibilities, including President of its Agricultural Group and President of its Nutrition and Consumer Sector, over a more than 20-year tenure • Served as a member of the Board of Directors of Crown Holdings, Inc. and member of its Compensation Committee; served as a member of the Board of Directors of Carnival and member of its Executive Committee • Member of the Board of Directors of Salesforce, Inc. and a member of its Audit & Finance and Nominating & Corporate Governance Committees • Member of the Board of Directors of MP Materials Corp. and a member of its Compensation Committee • Member of the Board of Directors of GE Vernova, effective upon expected completion of GE Vernova’s spin-off from General Electric Company as a U.S.-listed public company

Other leadership experience and service: • Appointed by President Clinton and re-appointed by President George W. Bush to the President’s Export Council

Other U.S.-listed company boards: • MP Materials Corp. • Salesforce, Inc. • Carnival; Crown Holdings, Inc. (past five years) | |||||||

| 2024 PROXY STATEMENT |

15 |

| Proposal 1: Electing directors |

|

Age: 73 Director since: August 2012

Ms. Hudson has extensive executive leadership experience, with a focus on risk management.

She brings international perspective, geopolitical insights, and broad knowledge in strategic planning, technology, global operations, and risk management to our Board through a career in the defense, aerospace, and security industries that spanned more than 40 years. As the former President and Chief Executive Officer of BAE and the first woman to lead a major national security corporation, Ms. Hudson oversaw a global, highly regulated, and complex U.S.-based defense, aerospace, and security company, wholly owned by London-based BAE Systems plc (BAE Systems), where she also served as an executive director. Through her leadership positions, including with General Dynamics Corporation and its armament and technical products division, Ms. Hudson also brings focus and perspective to the Board’s oversight of technology and related risks, including cybersecurity risks.

|

Linda P. Hudson

Former Chairman and Chief Executive Officer,

Former President and Chief Executive Officer,

Committee membership:

• Corporate Governance, ESG, and Sustainability Committee • Enterprise Risk Committee

Professional highlights: • Chairman and Chief Executive Officer of The Cardea Group, LLC, a management consulting business, from May 2014 to January 2020 • Served as CEO Emeritus of BAE, a U.S.-based subsidiary of BAE Systems, a global defense, aerospace, and security company headquartered in London, from February 2014 to May 2014, and as President and Chief Executive Officer of BAE from October 2009 until January 2014 • Served as President of BAE Systems’ Land and Armaments operating group, the world’s largest military vehicle and equipment business, from October 2006 to October 2009 • Prior to joining BAE, served as Vice President of General Dynamics Corporation and President of its Armament and Technical Products business; held various positions in engineering, production operations, program management, and business development for defense and aerospace companies • Served as a member of the Executive Committee and as an executive director of BAE Systems from 2009 until January 2014 and as a member of the Board of Directors of BAE from 2009 to April 2015 • Served as a member of the Board of Directors of The Southern Company and its Nominating, Governance and Corporate Responsibility Committee and Operations, Environmental and Safety Committee from 2014 to July 2018 • Member of the Board of Directors of Trane Technologies plc (formerly Ingersoll-Rand plc) and its Compensation Committee, Sustainability, Corporate Governance and Nominating Committee, and Technology and Innovation Committee • Member of the Board of Directors of TPI Composites, Inc. and its Nominating and Corporate Governance Committee and Technology Committee

Other leadership experience and service: • Elected member to the National Academy of Engineering, one of the highest professional honors accorded an engineer • Member of the Board of Directors of the University of Florida Foundation, Inc. and the advisory board of the University of Florida Engineering Leadership Institute • Former member of the Charlotte Center Executive Board for the Wake Forest University School of Business • Former member of the Board of Trustees of Discovery Place, a nonprofit education organization dedicated to inspiring exploration of the natural and social world • Member of the Board of Directors of UF Health, the health care system affiliated with the University of Florida College of Medicine

Other U.S.-listed company boards: • Trane Technologies plc (formerly Ingersoll-Rand plc) • TPI Composites, Inc. | |||||||

| 16 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

|

Age: 67 Director since: April 2006

Ms. Lozano has a broad range of leadership experience in public and private sectors and a track record as a champion for equality, opportunity, and representation.

As Chief Executive Officer of College Futures Foundation, a charitable foundation focused on increasing the rate of bachelor’s degree completion among California student populations who are low-income and have had a historically low college success rate, she worked to increase the rate of college graduation and improve opportunity for low-income students and students of color in California. With 30 years at La Opinión, the largest Spanish-language newspaper in the U.S., including as editor and publisher, as Chairman and Chief Executive Officer of its parent company, ImpreMedia LLC, and as co-founder of the Aspen Institute Latinos and Society Program, Ms. Lozano possesses deep insights into the issues that impact the Hispanic-Latino community. As a director serving on the boards of large organizations with diversified international operations, including Apple Inc. and Target Corporation, and previously The Walt Disney Company, Ms. Lozano has long-standing experience overseeing matters ranging from corporate governance, human capital management, and executive compensation, to risk management and financial reporting. In addition, as a member of California’s Task Force on Jobs and Business Recovery, Ms. Lozano provides valuable perspective on important public policy, societal, and economic issues relevant to our company.

|

Monica C. Lozano

Former Chief Executive Officer, College Futures Foundation

Former Chairman, US Hispanic Media Inc.

Lead Independent Director, Target Corporation

Committee membership:

• Compensation and Human Capital Committee (chair) • Enterprise Risk Committee

Professional highlights: • Chief Executive Officer of College Futures Foundation from December 2017 to July 2022 and member of the Board of Directors from December 2019 to July 2022 • Served as Chair of the Board of Directors of U.S. Hispanic Media Inc., the parent company of ImpreMedia, a leading Hispanic news and information company, from June 2014 to January 2016 • Served as Chairman of ImpreMedia from July 2012 to January 2016, Chief Executive Officer from May 2010 to May 2014, and Senior Vice President from January 2004 to May 2010 • Served as Publisher of La Opinión, a subsidiary of ImpreMedia and the leading Spanish-language daily print and online newspaper in the U.S., from 2004 to May 2014, and Chief Executive Officer from 2004 to July 2012 • Currently serves as a strategic advisor to multiple media companies • Lead Independent Director of the Board of Directors of Target Corporation and member of its Governance & Sustainability Committee, Chair of its Compensation & Human Capital Management Committee • Member of the Board of Directors of Apple Inc. and its Audit and Finance Committee

Other leadership experience and service: • Member of California’s Task Force on Jobs and Business Recovery • Served as a member of President Obama’s Council on Jobs and Competitiveness from 2011 to 2012 and served on President Obama’s Economic Recovery Advisory Board from 2009 to 2011 • Appointed by the U.S. Ambassador to Mexico to serve on COMEXUS, a binational commission dedicated to strengthening ties between the two countries through business, education, and cultural collaboration • Chair of the Board of Directors of the Weingart Foundation • Served as the Chair of the Board of Regents of the University of California, as a member of the Board of Trustees of The Rockefeller Foundation, as a member of the Board of Trustees of the University of Southern California, and as a member of the State of California Commission on the 21st Century Economy

Other U.S.-listed company boards: • Apple Inc. • Target Corporation |

| 2024 PROXY STATEMENT |

17 |

| Proposal 1: Electing directors |

|

Age: 64 Director since: January 2010

As our Chief Executive Officer, Mr. Moynihan leads a team of more than 200,000 employees focused on driving Responsible Growth for our teammates, clients, communities, and shareholders.

Under his leadership, the company provides core financial services to three client groups through our eight lines of business. This has delivered record earnings and significant capital return to shareholders. Mr. Moynihan has demonstrated leadership qualities, management capability, knowledge of our business and industry, and a long-term strategic perspective. In addition, he has many years of international and domestic financial services experience, including wholesale and retail businesses.

|

Brian T. Moynihan

Chair of the Board and Chief Executive Officer,

Committee membership:

Attends meetings of all of the Board committees

Professional highlights: • Appointed Chair of the Board of Directors of Bank of America Corporation in October 2014 and President and Chief Executive Officer in January 2010. Prior to becoming Chief Executive Officer, Mr. Moynihan led each of the company’s operating units • Member (and prior Chair) of the Board of Directors of Bank Policy Institute (Chair of the Global Regulatory Policy Committee) • Member (and prior Chair) of Financial Services Forum • Chair of the Supervisory Board of The Clearing House Association L.L.C. • Member of Business Roundtable • Member (and prior Chairman) of the World Economic Forum’s International Business Council (Chair of Stakeholder Capitalism Metrics Initiative) • Chair of the Board of The U.S. Council on Competitiveness • Chair of the Sustainable Markets Initiative

Other leadership experience and service: • Incoming Chancellor and current member of Board of Fellows of Brown University • Member of Advisory Council of Smithsonian’s National Museum of African American History and Culture • Member of Charlotte Executive Leadership Council • Chair of Massachusetts Competitive Partnership

Other U.S.-listed company boards: • N/A |

| 18 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

|

Age: 69 Director since: January 2013

Mr. Nowell is an active board leader

During his more than 30-year career with multinational consumer products conglomerates, he oversaw the worldwide corporate treasury functions, including debt and investment activities, capital markets strategies, and foreign exchange as Senior Vice President and Treasurer of Pepsi, finance functions as Chief Financial Officer of Pepsi Bottling Group, and held responsibilities for strategy and business development as a Senior Vice President at RJR Nabisco. Mr. Nowell brings a robust corporate governance and board leadership perspective through his current and prior service on public company boards across varying industries and through his ongoing dialogue with institutional shareholders as our Board’s Lead Independent Director.

|

Lionel L. Nowell III

Lead Independent Director, Bank of America Corporation

Former Senior Vice President and Treasurer, PepsiCo, Inc. (Pepsi)

Committee membership:

Attends meetings of all of the Board committees

Professional highlights: • Served as Senior Vice President and Treasurer of Pepsi, a leading global food, snack, and beverage company, from 2001 to May 2009, and as Chief Financial Officer of The Pepsi Bottling Group and Controller of Pepsi • Served as Senior Vice President, Strategy and Business Development at RJR Nabisco, Inc. from 1998 to 1999 • Held various senior financial roles at the Pillsbury division of Diageo plc, including Chief Financial Officer of its Pillsbury North America, Pillsbury Foodservice, and Häagen-Dazs divisions, and also served as Controller and Vice President of Internal Audit of the Pillsbury Company • Served as Lead Director of the Board of Directors of Reynolds American, Inc. from January 2017 to July 2017 and as a Board member from September 2007 to July 2017 • Served as a member of the Board of Directors of American Electric Power Company, Inc., from July 2004 to April 2020, chair of its Audit Committee, member of its Directors and Corporate Governance, Policy, Executive, and Finance Committees • Member of the Board of Directors of Ecolab Inc., Chair of its Audit Committee, and member of its Finance Committee • Member of the Board of Directors of Textron Inc. and Chair of its Audit Committee • As our Board’s Lead Independent Director Mr. Nowell has an extensive set of responsibilities that brings him into frequent communications with our primary regulators, institutional shareholders, other stakeholders, and our employees and customers. See page 27 • In 2022, Mr. Nowell was named “Independent Director of the Year” by Corporate Board Member

Other leadership experience and service: • Emeritus member of the Dean’s Advisory Council at The Ohio State University Max M. Fisher College of Business

Other U.S.-listed company boards: • Ecolab Inc. • Textron Inc. • American Electric Power Company, Inc. (past five years) | |||||||

| 2024 PROXY STATEMENT |

19 |

| Proposal 1: Electing directors |

|

Age: 67 Director since: July 2019

Ms. Ramos is an experienced public company executive who brings global business leadership, financial expertise, and strategic planning experience to our Board.

Ms. Ramos served as Chief Executive Officer of ITT, a diversified manufacturer of engineered components and customized technology solutions for the transportation, industrial, and energy markets, focusing on innovation and technology. She was Chief Financial Officer at ITT, Furniture Brands International, and the U.S. KFC division of Yum! Brands, and served as the corporate treasurer at Yum! Brands. Through her public company board service on the Boards of Phillips 66 and RTX Corporation, Ms. Ramos brings board-level insights into issues facing complex, regulated global public companies and oversight experience in finance, audit, corporate governance, public policy, and sustainability.

|

Denise L. Ramos

Former Chief Executive Officer and President, ITT Inc. (ITT)

Committee membership:

• Audit Committee • Compensation and Human Capital Committee

Professional highlights: • Chief Executive Officer and President of ITT, a diversified manufacturer of critical components and customized technology solutions, from 2011 to 2019; Senior Vice President and Chief Financial Officer of ITT from 2007 to 2011 • Served as Chief Financial Officer for Furniture Brands International, a former home furnishings company, from 2005 to 2007 • Served in various roles at Yum! Brands Inc., an American fast-food company, from 2000 to 2005, including Chief Financial Officer of the U.S. Division of KFC Corporation and as Senior Vice President and Treasurer • Began her career at Atlantic Richfield Company, where she spent more than 20 years in a number of finance positions • Member of the Board of Directors of Phillips 66 and its Audit and Finance, Nominating and Governance, and Executive Committees, and Chair of its Public Policy and Sustainability Committee • Member of the Board of Directors of RTX Corporation and its Audit, and Governance and Public Policy Committees

Other U.S.-listed company boards: • Phillips 66 • RTX Corporation |

| 20 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

|

Age: 65 Director since: October 2018

Dr. Rose is an executive leader in academics and the private sector who brings risk management experience, public policy and social thought leadership, broad global financial services industry knowledge, and strategic planning experience to our Board.

As former President of Bowdoin College, Dr. Rose has a legacy of promoting intellectual engagement; advancing diversity, equity, and inclusion; increasing access and opportunity for students; addressing mental health challenges facing youth; and promoting sustainability. As a Harvard Business School faculty member, Dr. Rose has taught and written on issues of leadership, ethics, the financial crisis, and the role of business in society. Dr. Rose spent the first 20 years of his career with JPMorgan Chase & Co. and its predecessor company, where he retired as Vice Chairman after holding leadership positions in investment banking, equities, securities, derivatives, and corporate finance divisions and leading the company’s diversity, equity, and inclusion initiatives. Following retirement from JPMorgan Chase, Dr. Rose received a master’s degree and PhD with distinction in sociology from the University of Pennsylvania focusing on issues of race in America. Dr. Rose also holds an MBA from the University of Chicago. Dr. Rose has served on several financial institutions boards and currently serves as Chair of the Board of Trustees of the Howard Hughes Medical Institute, the U.S.’s largest private supporter of academic biomedical research.

|

Clayton S. Rose

Baker Foundation Professor of Management Practice at Harvard Business School

Committee membership:

• Compensation and Human Capital Committee • Enterprise Risk Committee (chair)

Professional highlights: • Baker Foundation Professor of Management Practice at Harvard Business School • Former President of Bowdoin College • Served as a professor at Harvard Business School prior to his appointment as President of Bowdoin College • Served as Vice Chairman, headed two lines of business–Global Investment Banking and Global Equities–and was a member of JPMorgan Chase’s senior management team during his approximately 20-year tenure at JPMorgan Chase • Served as a member of the Boards of Directors of XL Group, plc, Federal Home Loan Mortgage Corporation (Freddie Mac), and Mercantile Bankshares Corp.

Other leadership experience and service: • Trustee and Chair of the Board of Trustees for Howard Hughes Medical Institute and formerly Chair of the Audit and Compensation Committee • Served on the company’s Board of Directors from 2013 to 2015

Other U.S.-listed company boards: • N/A |

| 2024 PROXY STATEMENT |

21 |

| Proposal 1: Electing directors |

|

Age: 72 Director since: June 2016

Mr. White is a seasoned executive and public company director with experience leading the global operations and strategic direction of complex and highly regulated multinational consumer retail and distribution businesses.

He possesses executive and board leadership experience and provides broad ranging operational and strategic insights, an international perspective, and financial expertise to our Board. Mr. White was President, Chief Executive Officer, and Chairman of the board of directors of DIRECTV, where he oversaw the operations and strategic direction of the company in the U.S. and in Latin America. Prior to joining DIRECTV, he served as the Chief Executive Officer of PepsiCo International; Frito-Lay’s Europe, Africa, and Middle East division; and Snack Ventures Europe, PepsiCo’s partnership with General Mills International. He also served as Chief Financial Officer of PepsiCo., Inc., Pepsi-Cola Company worldwide, and Frito-Lay International. Mr. White began his career as a management consultant at Bain & Company and Arthur Andersen & Co.

|

Michael D. White

Former Chairman, President, and Chief Executive Officer, DIRECTV

Committee membership:

• Audit Committee • Corporate Governance, ESG, and Sustainability Committee (chair)

Professional highlights: • Served as Chairman, President, and Chief Executive Officer of DIRECTV, a leading provider of digital television entertainment services, from January 2010 to August 2015, and as a Director of the company from November 2009 until August 2015 • Chief Executive Officer of PepsiCo International from February 2003 until November 2009; and served as Vice Chairman and director of PepsiCo from March 2006 to November 2009, after holding positions of increasing importance with PepsiCo since 1990 • Served as Senior Vice President at Avon Products, Inc. • Served as a Management Consultant at Bain & Company and Arthur Andersen & Co. • Lead Director of the Board of Directors of Kimberly-Clark Corporation, Chair of its Executive Committee (retiring in May 2024) • Member of the Board of Directors of Whirlpool Corporation, Chair of its Audit Committee, and member of its Corporate Governance and Nominating Committee (retiring in April 2024)

Other leadership experience and service: • Vice Chair of The Partnership to End Addiction

Other U.S.-listed company boards: • Kimberly-Clark Corporation (retiring in May 2024) • Whirlpool Corporation (retiring in April 2024) |

| 22 |

BANK OF AMERICA |

| Proposal 1: Electing directors |

|

Age: 71 Director since: April 2016

Mr. Woods is a veteran financial

Mr. Woods began his nearly 40-year tenure at CIBC and its predecessor firms in its investment banking department and later served as Head of Canadian Corporate Banking, Chief Financial Officer, and Chief Risk Officer, before retiring as Vice Chairman. As Senior Executive Vice President and Chief Risk Officer of CIBC during the financial crisis, Mr. Woods focused on risk management and CIBC’s risk culture. He chaired CIBC’s Asset Liability Committee, served as CIBC’s lead liaison with regulators, and was an active member of CIBC’s business strategy group. He brings international perspective, including to our European subsidiaries through his service on the Boards of Directors of MLI and BofASE.

|

Thomas D. Woods

Former Vice Chairman and Senior Executive Vice President, Canadian Imperial Bank of Commerce (CIBC)

Committee membership:

• Corporate Governance, ESG, and Sustainability Committee • Enterprise Risk Committee

Professional highlights: • Served as Vice Chairman and Senior Executive Vice President of CIBC, a leading Canada-based global financial institution, from July 2013 until his retirement in December 2014 • Served as Senior Executive Vice President and Chief Risk Officer of CIBC from 2008 to July 2013, and Senior Executive Vice President and Chief Financial Officer of CIBC from 2000 to 2008 • Began his career at CIBC in 1977 through Wood Gundy, a predecessor firm; served in various senior leadership positions, including as Controller of CIBC, as Chief Financial Officer of CIBC World Markets (CIBC’s investment banking division), and as the Head of CIBC’s Canadian Corporate Banking division • Served as Chair of the Board of Directors of Hydro One Limited, an electricity transmission and distribution company serving the Canadian province of Ontario, and publicly traded and listed on the Toronto Stock Exchange, from August 2018 to July 2019 • Member of the Board of Directors of MLI, chair of its Risk Committee, and member of its Governance Committee • Member of the Board of Directors of BofASE

Other leadership experience and service: • Member of the Board of Directors of Alberta Investment Management Corporation, a Canadian institutional investment fund manager, and on the advisory committee of Cordiant Capital Inc., a global infrastructure and real assets manager • Member of the University of Toronto College of Electors • Member of Board of Directors of Institute of Corporate Directors (Institut des Administrateurs de Sociétés) • Former member of the Board of Directors of Jarislowsky Fraser Limited, a global investment management firm, from 2016 to 2018, former member of the Boards of Directors of DBRS Limited and DBRS, Inc., an international credit rating agency, from 2015 to 2016, and former member of the Board of Directors of TMX Group Inc., a Canada-based financial services company, from 2012 to 2014

Other U.S.-listed company boards: • N/A | |||||||

| 2024 PROXY STATEMENT |

23 |

| Proposal 1: Electing directors |

|

Age: 65 Director since: December 2017

Dr. Zuber is a distinguished research scientist and academic leader who

Dr. Zuber is the first woman to lead a science department at MIT and the first woman to lead a NASA planetary mission. In her role as Vice President for Research at MIT, Dr. Zuber oversees multiple interdisciplinary research laboratories and centers focusing on cancer research, energy and environmental solutions initiatives, plasma science and fusion, electronics, nanotechnology, and radio science and technology. She also led the development of MIT’s initial Climate Action Plan, and is responsible for intellectual property, research integrity and compliance, and research relationships with the federal government. Dr. Zuber has held leadership roles on 10 space exploratory missions with NASA. She also served on the National Science Board under President Obama and President Trump and is currently Co-Chair of President Biden’s Council of Advisors on Science and Technology.

|

Maria T. Zuber

Vice President for Research and E. A. Griswold Professor of Geophysics, Massachusetts Institute of Technology (MIT)

Committee membership:

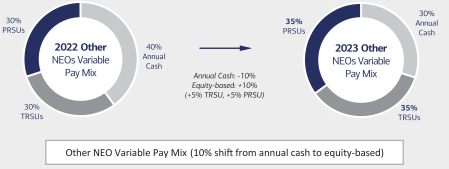

• Corporate Governance, ESG, and Sustainability Committee • Enterprise Risk Committee