This pricing supplement, which is not complete and may be changed, relates to an effective Registration Statement under the Securities Act of 1933. This pricing supplement and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these notes in any country or jurisdiction where such an offer would not be permitted.

SUBJECT TO COMPLETION, DATED March 19, 2024

|

Preliminary Pricing Supplement - Subject to Completion

(To Prospectus dated December 30, 2022,

Prospectus Supplement dated December 30, 2022 and

Product Supplement EQUITY-1 dated December 30, 2022)

Dated March , 2024

|

Filed Pursuant to Rule 424(b)(2)

Series A Registration Statement Nos. 333-268718 and 333-268718-01

|

| |

|

| |

|

|

BofA Finance LLC $---- Capped GEARS

|

|

Linked to an Unequally Weighted Basket of Five Indices Due May 30, 2025

Fully and Unconditionally Guaranteed by Bank of America Corporation

|

|

Investment Description

|

|

The Capped GEARS (the “Notes”) linked to an unequally weighted basket of five indices due May 30, 2025 are senior unsecured obligations issued by BofA Finance LLC (“BofA Finance”), a consolidated finance subsidiary of Bank of America Corporation (“BAC” or the “Guarantor”), which are fully and unconditionally guaranteed by the Guarantor. The return on the Notes is linked to the performance of an unequally weighted basket of five indices (the “Basket”) comprised of the EURO STOXX 50® Index, the Nikkei Stock Average Index, the FTSE® 100 Index, the Swiss Market Index® and the S&P®/ASX 200 Index (each, a “Basket Component”). If the Basket Return is positive, BofA Finance will repay the Stated Principal Amount of the Notes at maturity plus a return equal to the Basket Return multiplied by the Upside Gearing of 3.0, but no more than the Maximum Gain of between [22.85% and 24.85%] (to be set on the Trade Date). If the Basket Return is zero, BofA Finance will repay the Stated Principal Amount of the Notes at maturity. However, if the Basket Return is negative, you will be fully exposed to the negative Basket Return and you will receive less than the Stated Principal Amount at maturity, resulting in a loss that is proportionate to the decline in the value of the Basket. In this case, you will have full downside exposure to the Basket from the Initial Basket Value to the Final Basket Value, and you could lose all of your initial investment.

Investing in the Notes involves significant risks. You will not receive coupon payments during the 14 month term of the Notes. You may lose a substantial portion or all of your initial investment. You will not receive dividends or other distributions paid on any stocks included in the Basket Components. Any payment on the Notes, including any repayment of the Stated Principal Amount, is subject to the creditworthiness of BofA Finance and the Guarantor and is not, either directly or indirectly, an obligation of any third party.

|

|

Features

|

|

Key Dates1

|

|

❑ Enhanced Growth Potential, subject to Maximum Gain— If the Basket Return is positive, BofA Finance will repay the Stated Principal Amount of the Notes at maturity plus a return equal to the Basket Return multiplied by the Upside Gearing, but no more than the Maximum Gain. The Upside Gearing feature will provide leveraged exposure to a limited range of positive performance of the Basket.

❑ Downside Exposure— If the Basket Return is zero, you will receive the Stated Principal Amount of the Notes at maturity. However, if the Basket Return is negative, you will receive less than the Stated Principal Amount of your Notes at maturity, resulting in a loss that is proportionate to the decline in the value of the Basket from the Trade Date to the Valuation Date, up to a 100% loss of your investment.

Any payment on the Notes is subject to the creditworthiness of BofA Finance and the Guarantor.

|

|

Trade Date

Issue Date

Valuation Date2

Maturity Date

|

March 26, 2024

March 28, 2024

May 28, 2025

May 30, 2025

|

|

1 Subject to change and will be set forth in the final pricing supplement relating to the Notes.

2 See page PS-4 for additional details.

|

|

NOTICE TO INVESTORS: THE NOTES ARE SIGNIFICANTLY RISKIER THAN CONVENTIONAL DEBT INSTRUMENTS. BOFA FINANCE IS NOT NECESSARILY OBLIGATED TO REPAY THE STATED PRINCIPAL AMOUNT AT MATURITY, AND THE NOTES CAN HAVE DOWNSIDE MARKET RISK SIMILAR TO THE BASKET. THIS MARKET RISK IS IN ADDITION TO THE CREDIT RISK INHERENT IN PURCHASING A DEBT OBLIGATION OF BOFA FINANCE THAT IS GUARANTEED BY BAC. YOU SHOULD NOT PURCHASE THE NOTES IF YOU DO NOT UNDERSTAND OR ARE NOT COMFORTABLE WITH THE SIGNIFICANT RISKS INVOLVED IN INVESTING IN THE NOTES.

YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER “RISK FACTORS’’ BEGINNING ON PAGE PS-6 OF THIS PRICING SUPPLEMENT, PAGE PS-5 OF THE ACCOMPANYING PRODUCT SUPPLEMENT, PAGE S-6 OF THE ACCOMPANYING PROSPECTUS SUPPLEMENT AND PAGE 7 OF THE ACCOMPANYING PROSPECTUS BEFORE PURCHASING ANY NOTES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR NOTES. YOU MAY LOSE SOME OR ALL OF YOUR INITIAL INVESTMENT IN THE NOTES. THE NOTES WILL NOT BE LISTED ON ANY SECURITIES EXCHANGE AND MAY HAVE LIMITED OR NO LIQUIDITY.

|

|

Notes Offering

|

|

We are offering Capped GEARS linked to an unequally weighted basket of five indices due May 30, 2025. The Basket Components are listed below and described in more detail beginning on page PS-12 of this pricing supplement. Any payment on the Notes will be based on the performance of the Basket. The Maximum Gain and the Initial Index Value of each Basket Component will be determined on the Trade Date. The Notes are our senior unsecured obligations, guaranteed by BAC, and are offered for a minimum investment of 100 Notes (each Note corresponding to $10.00 in Stated Principal Amount) at the Public Offering Price described below.

|

| Basket Components |

Basket Weighting |

Initial Index Value |

Initial Basket Value |

Upside Gearing |

Maximum Gain |

CUSIP / ISIN |

| EURO STOXX 50® Index (Bloomberg ticker: SX5E) |

40.00% |

|

100.00 |

3.0 |

[22.85% to 24.85%] |

09710M889 / US09710M8890 |

| Nikkei Stock Average Index (Bloomberg ticker: NKY) |

25.00% |

|

| FTSE® 100 Index (Bloomberg ticker: UKX) |

17.50% |

|

| Swiss Market Index® (Bloomberg ticker: SMI) |

10.00% |

|

| S&P®/ASX 200 Index (Bloomberg ticker: AS51) |

7.50% |

|

See “Summary” in this pricing supplement. The Notes will have the terms specified in the accompanying product supplement, prospectus supplement and prospectus, as supplemented by this pricing supplement.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these Notes or the guarantee, or passed upon the adequacy or accuracy of this pricing supplement, or the accompanying product supplement, prospectus supplement or prospectus. Any representation to the contrary is a criminal offense. The Notes and the related guarantee of the Notes by the Guarantor are unsecured and are not savings accounts, deposits, or other obligations of a bank. The Notes are not guaranteed by Bank of America, N.A. or any other bank, are not insured by the Federal Deposit Insurance Corporation or any other governmental agency and involve investment risks.

|

|

Public Offering Price

|

Underwriting Discount(1)

|

Proceeds (before expenses) to BofA Finance

|

|

Per Note

|

$10.00

|

$0.20

|

$9.80

|

|

Total

|

$

|

$

|

$

|

(1) The underwriting discount is $0.20 per Note. BofA Securities, Inc. (“BofAS”), acting as principal, expects to purchase from BofA Finance, and BofA Finance expects to sell to BofAS, the aggregate principal amount of the Notes set forth above for $9.80 per Note. UBS Financial Services Inc. (“UBS”), acting as a selling agent for sales of the Notes, expects to purchase from BofAS, and BofAS expects to sell to UBS, all of the Notes for $9.80 per Note. UBS will receive an underwriting discount of $0.20 per Note for each Note it sells in this offering. UBS proposes to offer the Notes to the public at a price of $10.00 per Note. For additional information on the distribution of the Notes, see “Supplement to the Plan of Distribution; Role of BofAS and Conflicts of Interest” in this pricing supplement.

The initial estimated value of the Notes will be less than the public offering price. The initial estimated value of the Notes as of the Trade Date is expected to be between $9.20 and $9.70 per $10 in Stated Principal Amount. See “Summary” on page PS-4 of this pricing supplement, “Risk Factors” beginning on page PS-6 of this pricing supplement and “Structuring the Notes” on page PS-26 of this pricing supplement for additional information. The actual value of your Notes at any time will reflect many factors and cannot be predicted with accuracy.

UBS Financial Services Inc. |

BofA Securities |

|

Additional Information about BofA Finance LLC, Bank of America Corporation and the Notes

|

|

You should read carefully this entire pricing supplement and the accompanying product supplement, prospectus supplement and prospectus to understand fully the terms of the Notes, as well as the tax and other considerations important to you in making a decision about whether to invest in the Notes. In particular, you should review carefully the section in this pricing supplement entitled “Risk Factors,” which highlights a number of risks of an investment in the Notes, to determine whether an investment in the Notes is appropriate for you. If information in this pricing supplement is inconsistent with the product supplement, prospectus supplement or prospectus, this pricing supplement will supersede those documents. You are urged to consult with your own attorneys and business and tax advisors before making a decision to purchase any of the Notes.

The information in the “Summary” section is qualified in its entirety by the more detailed explanation set forth elsewhere in this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus. You should rely only on the information contained in this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. None of us, the Guarantor, BofAS or UBS is making an offer to sell these Notes in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this pricing supplement and the accompanying product supplement, prospectus supplement, and prospectus is accurate only as of the date on their respective front covers.

Certain terms used but not defined in this pricing supplement have the meanings set forth in the accompanying product supplement, prospectus supplement and prospectus. Unless otherwise indicated or unless the context requires otherwise, all references in this pricing supplement to “we,” “us,” “our,” or similar references are to BofA Finance, and not to BAC (or any other affiliate of BofA Finance).

The above-referenced accompanying documents may be accessed at the following links:

♦

Product supplement EQUITY-1 dated December 30, 2022:

♦

Series A MTN prospectus supplement dated December 30, 2022 and prospectus dated December 30, 2022:

The Notes are our senior debt securities. Any payments on the Notes are fully and unconditionally guaranteed by BAC. The Notes and the related guarantee are not insured by the Federal Deposit Insurance Corporation or secured by collateral. The Notes will rank equally in right of payment with all of our other unsecured and unsubordinated obligations, except obligations that are subject to any priorities or preferences by law. The related guarantee will rank equally in right of payment with all of BAC’s other unsecured and unsubordinated obligations, except obligations that are subject to any priorities or preferences by law, and senior to its subordinated obligations. Any payments due on the Notes, including any repayment of the principal amount, will be subject to the credit risk of BofA Finance, as issuer, and BAC, as Guarantor.

|

PS-2

|

The Notes may be suitable for you if, among other considerations:

♦

You fully understand the risks inherent in an investment in the Notes, including the risk of loss of your entire investment.

♦

You do not seek current income from your investment and are willing to forgo dividends or any other distributions paid on the stocks included in the Basket Components.

♦

You can tolerate a loss of all or a substantial portion of your investment and are willing to make an investment that will have the full downside market risk of an investment in the Basket.

♦

You understand and accept the risks associated with the Basket Components.

♦

You believe that the value of the Basket will increase over the term of the Notes and that the Final Basket Value is likely to close above the Initial Basket Value, and you are willing to give up any appreciation in excess of the Maximum Gain (the actual Maximum Gain will be determined on the Trade Date).

♦

You understand and accept that your potential return is limited by the Maximum Gain and you would be willing to invest in the Notes if the Maximum Gain was set equal to the lower end of the range indicated on the cover page of this pricing supplement (the actual Maximum Gain will be determined on the Trade Date).

♦

You can tolerate fluctuations in the value of the Notes prior to maturity that may be similar to or exceed the downside fluctuations in the value of the Basket.

♦

You are willing and able to hold the Notes to maturity, and accept that there may be little or no secondary market for the Notes.

♦

You are willing to assume the credit risk of BofA Finance and BAC for all payments under the Notes, and understand that if BofA Finance and BAC default on their obligations, you might not receive any amounts due to you, including any repayment of the Stated Principal Amount.

|

The Notes may not be suitable for you if, among other considerations:

♦

You do not fully understand the risks inherent in an investment in the Notes, including the risk of loss of your entire investment.

♦

You seek current income from this investment or prefer to receive the dividends and any other distributions paid on the stocks included in the Basket Components.

♦

You cannot tolerate the loss of all or a substantial portion of your initial investment, or you are not willing to make an investment that will have the full downside market risk of an investment in the Basket.

♦

You require an investment designed to guarantee a full return of the Stated Principal Amount at maturity.

♦

You do not understand or are not willing to accept the risks associated with the Basket Components.

♦

You believe that the value of the Basket will decline during the term of the Notes and the Final Basket Value is likely to close below the Initial Basket Value on the Valuation Date, exposing you to full downside performance of the Basket, or you believe the Basket will appreciate over the term of the Notes by more than the Maximum Gain (the actual Maximum Gain will be determined on the Trade Date).

♦

You seek an investment that participates in the full appreciation in the value of the Basket or that has unlimited return potential, or you would be unwilling to invest in the Notes if the Maximum Gain was set equal to the lower end of the range indicated on the cover page of this pricing supplement (the actual Maximum Gain will be determined on the Trade Date).

♦

You cannot tolerate fluctuations in the value of the Notes prior to maturity that may be similar to or exceed the downside fluctuations in the value of the Basket.

♦

You seek an investment for which there will be an active secondary market.

♦

You prefer the lower risk of conventional fixed income investments with comparable maturities and credit ratings.

♦

You are not willing to assume the credit risk of BofA Finance and BAC for all payments under the Notes, including any repayment of the Stated Principal Amount.

|

|

The suitability considerations identified above are not exhaustive. Whether or not the Notes are a suitable investment for you will depend on your individual circumstances and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the Notes in light of your particular circumstances. You should review “The Basket and the Basket Components” herein for more information on the Basket Components. You should also review carefully the “Risk Factors” section herein for risks related to an investment in the Notes.

|

PS-3

|

Summary

|

|

Issuer

|

BofA Finance

|

|

Guarantor

|

BAC

|

|

Public Offering Price

|

100% of the Stated Principal Amount

|

|

Stated Principal Amount

|

$10.00 per Note

|

|

Minimum Investment

|

$1,000 (100 Notes)

|

|

Term

|

Approximately fourteen months

|

|

Trade Date1

|

March 26, 2024

|

|

Issue Date1

|

March 28, 2024

|

|

Valuation Date1

|

May 28, 2025, subject to postponement as set forth in “Description of the Notes—Certain Terms of the Notes—Events Relating to Calculation Days” beginning on page PS-22 of the accompanying product supplement.

|

|

Maturity Date1

|

May 30, 2025

|

|

Basket

|

The Notes are linked to an unequally weighted basket consisting of the following indices and their respective weightings:

EURO STOXX 50® Index (Bloomberg ticker: SX5E)

Nikkei Stock Average Index (Bloomberg ticker: NKY)

FTSE® 100 Index (Bloomberg ticker: UKX)

Swiss Market Index® (Bloomberg ticker: SMI)

S&P®/ASX 200 Index (Bloomberg ticker: AS51)

|

|

Payment At Maturity (per $10.00 Stated Principal Amount)

|

If the Basket Return is positive, we will repay the Stated Principal Amount of the Notes at maturity plus a return equal to the Basket Return multiplied by the Upside Gearing, but no more than the Maximum Gain, calculated as follows:

$10.00 × (1 + the lesser of (i) Basket Return x Upside Gearing and (ii) Maximum Gain)

If the Basket Return is zero, we will repay the Stated Principal Amount of the Notes at maturity.

If the Basket Return is negative, we will repay less than the Stated Principal Amount of your Notes at maturity, resulting in a loss that is proportionate to the decline in the value of the Basket from the Trade Date to the Valuation Date, calculated as follows:

$10.00 × (1 + Basket Return)

Accordingly, you may lose all or a substantial portion of your Stated Principal Amount at maturity, depending on how significantly the Basket declines.

|

|

Basket Return

|

Final Basket Value – Initial Basket Value

Initial Basket Value

|

|

Upside Gearing

|

3.0

|

|

Maximum Gain

|

[22.85% to 24.85%], which corresponds to a maximum Payment at Maturity of between [$12.285 to $12.485]. The actual Maximum Gain will be determined on the Trade Date.

|

|

Initial Basket Value

|

100.00

|

|

Final Basket Value

|

100.00 × (1 + the sum of the Weighted Basket Component Returns)

|

|

Weighted Basket Component Return

|

For each Basket Component, its weighting multiplied by its Basket Component Return

|

|

Basket Component Return

|

For each Basket Component,

Final Index Value – Initial Index Value

Initial Index Value

|

|

Initial Index Value

|

For each Basket Component, the closing level of that Basket Component on the Trade Date, as specified on the cover page of this pricing supplement.

|

|

Final Index Value

|

For each Basket Component, the closing level of that Basket Component on the Valuation Date.

|

|

Calculation Agent

|

BofAS, an affiliate of BofA Finance.

|

|

Selling Agents

|

BofAS and UBS.

|

|

Events of Default and Acceleration

|

If an Event of Default, as defined in the senior indenture relating to the Notes and in the section entitled “Description of Debt Securities of BofA Finance LLC—Events of Default and Rights of Acceleration; Covenant Breaches” on page 54 of the accompanying prospectus, with respect to the Notes occurs and is continuing, the amount payable to a holder of the Notes upon any acceleration permitted under the senior indenture will be equal to the amount described under the caption “—Payment at Maturity” above, calculated as though the date of acceleration were the Maturity Date of the Notes and as though the Valuation Date were the third trading day prior to the date of acceleration. In case of a default in the payment of the Notes, whether at their maturity or upon acceleration, the Notes will not bear a default interest rate.

|

1 Subject to change and will be set forth in the final pricing supplement relating to the Notes.

PS-4

|

Investment Timeline

|

|

|

|

|

|

|

|

Trade Date

|

|

The closing level of each Basket Component (its Initial Index Value) is observed and the Maximum Gain is set.

|

|

|

|

|

|

|

|

Maturity Date

|

|

The Final Basket Value is determined on the Valuation Date and the Basket Return is calculated.

If the Basket Return is positive, we will repay the Stated Principal Amount of the Notes at maturity plus a return equal to the Basket Return multiplied by the Upside Gearing but no more than the Maximum Gain, calculated as follows:

$10.00 × (1 + the lesser of (i) Basket Return x Upside Gearing and (ii) Maximum Gain)

If the Basket Return is zero, we will repay the Stated Principal Amount of the Notes at maturity.

If the Basket Return is negative, we will repay less than the Stated Principal Amount of your Notes at maturity, resulting in a loss that is proportionate to the decline in the value of the Basket from the Trade Date to the Valuation Date, calculated as follows:

$10.00 × (1 + Basket Return)

Accordingly, you may lose all or a substantial portion of your Stated Principal Amount at maturity, depending on how significantly the Basket declines.

|

INVESTING IN THE NOTES INVOLVES SIGNIFICANT RISKS. YOU MAY LOSE A SUBSTANTIAL PORTION OR ALL OF YOUR INITIAL INVESTMENT. YOU WILL BE EXPOSED TO THE MARKET RISK OF THE BASKET COMPONENTS. ANY PAYMENT ON THE NOTES IS SUBJECT TO THE CREDITWORTHINESS OF BOFA FINANCE AND THE GUARANTOR.

PS-5

Your investment in the Notes entails significant risks, many of which differ from those of a conventional debt security. Your decision to purchase the Notes should be made only after carefully considering the risks of an investment in the Notes, including those discussed below, with your advisors in light of your particular circumstances. The Notes are not an appropriate investment for you if you are not knowledgeable about significant elements of the Notes or financial matters in general. You should carefully review the more detailed explanation of risks relating to the Notes in the “Risk Factors” sections beginning on page PS-5 of the accompanying product supplement, page S-6 of the accompanying prospectus supplement and page 7 of the accompanying prospectus identified on page PS-2 above.

Structure-related Risks

|

♦

|

Your investment may result in a loss; there is no guaranteed return of principal. There is no fixed principal repayment amount on the Notes at maturity. If the Final Basket Value is less than the Initial Basket Value, at maturity, you will lose 1% of the Stated Principal Amount for each 1% that the Final Basket Value is less than the Initial Basket Value. In that case, you will lose a significant portion or all of your investment in the Notes.

|

|

♦

|

The return on the Notes will be limited to the Maximum Gain. The return on the Notes will not exceed the Maximum Gain, regardless of the performance of the Basket. Your return on the Notes may be less than the return that you could have realized if you invested directly in the securities held by or included in the Basket Components, and you will not receive the full benefit of any appreciation in the value of the Basket beyond that Maximum Gain.

|

|

♦

|

The Notes do not bear interest. Unlike a conventional debt security, no interest payments will be paid over the term of the Notes, regardless of the extent to which the Final Basket Value exceeds the Initial Basket Value.

|

|

♦

|

The Upside Gearing applies only at maturity. You should be willing to hold your Notes to maturity. If you are able to sell your Notes in the secondary market prior to maturity, the price you receive will likely not reflect the full economic value of the Upside Gearing, and the return you realize may be less than the then-current basket return multiplied by the Upside Gearing, even if such return is positive. You can receive the full benefit of the Upside Gearing only if you hold your Notes to maturity. Any payment on the Notes is subject to the credit risk of BofA Finance, as issuer, and BAC, as guarantor.

|

|

♦

|

Your return on the Notes may be less than the yield on a conventional debt security of comparable maturity. Any return that you receive on the Notes may be less than the return you would earn if you purchased a conventional debt security with the same Maturity Date. As a result, your investment in the Notes may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money.

|

|

♦

|

Any payment on the Notes is subject to our credit risk and the credit risk of the Guarantor, and actual or perceived changes in our or the Guarantor’s creditworthiness are expected to affect the value of the Notes. The Notes are our senior unsecured debt securities. Any payment on the Notes will be fully and unconditionally guaranteed by the Guarantor. The Notes are not guaranteed by any entity other than the Guarantor. As a result, your receipt of any payment on the Notes will be dependent upon our ability and the ability of the Guarantor to repay our respective obligations under the Notes on the Maturity Date, regardless of the Final Basket Value as compared to the Initial Basket Value. No assurance can be given as to what our financial condition or the financial condition of the Guarantor will be on the Maturity Date. If we and the Guarantor become unable to meet our respective financial obligations as they become due, you may not receive the amount payable under the terms of the Notes and you could lose all of your initial investment.

|

In addition, our credit ratings and the credit ratings of the Guarantor are assessments by ratings agencies of our respective abilities to pay our obligations. Consequently, our or the Guarantor’s perceived creditworthiness and actual or anticipated decreases in our or the Guarantor’s credit ratings or increases in the spread between the yield on our respective securities and the yield on U.S. Treasury securities (the “credit spread”) prior to the Maturity Date of your Notes may adversely affect the market value of the Notes. However, because your return on the Notes depends upon factors in addition to our ability and the ability of the Guarantor to pay our respective obligations, such as the values of the Basket Components, an improvement in our or the Guarantor’s credit ratings will not reduce the other investment risks related to the Notes.

|

♦

|

We are a finance subsidiary and, as such, have no independent assets, operations or revenues. We are a finance subsidiary of the Guarantor, have no operations other than those related to the issuance, administration and repayment of our debt securities that are guaranteed by the Guarantor, and are dependent upon the Guarantor and/or its other subsidiaries to meet our obligations under the Notes in the ordinary course. Therefore, our ability to make payment on the Notes may be limited.

|

|

♦

|

The Payment at Maturity will not reflect the value of the Basket other than on the Valuation Date. The value of the Basket during the term of the Notes other than on the Valuation Date will not affect payment on the Notes. Notwithstanding the foregoing, investors should generally be aware of the performance of the Basket and the Basket Components while holding the Notes, as the performance of the Basket and the Basket Components may influence the market value of the Notes. The calculation agent will calculate the Payment at Maturity by comparing only the Initial Basket Value to the Final Basket Value for the Basket. No other value of the Basket will be taken into account. As a result, if the Final Basket Value of the Basket is less than the Initial Basket Value, you will receive less than the Stated Principal Amount at maturity, even if the value of the Basket was always above the Initial Basket Value prior to the Valuation Date.

|

|

♦

|

Changes in the level of one of the Basket Components may be offset by changes in the level of the other Basket Components. The Notes are linked to a Basket. Changes in the levels of one or more of the Basket Components may not correlate with changes in the levels of one or more

|

PS-6

of the other Basket Components. The levels of one or more Basket Components may increase, while the levels of one or more of the other Basket Components may decrease or not increase as much. Therefore, in calculating the value of the Basket, increases in the level of one Basket Component may be moderated or wholly offset by decreases or lesser increases in the level of one or more of the other Basket Components. Due to the different weightings of the Basket Components, adverse changes in the level of the Basket Components which are more heavily weighted will have a greater impact upon the value of your Notes at any time or the Payment at Maturity than changes in the level of lower weighted Basket Components.

Valuation and Market-related Risks

|

♦

|

The public offering price you pay for the Notes will exceed their initial estimated value. The range of initial estimated values of the Notes that is provided on the cover page of this preliminary pricing supplement, and the initial estimated value as of the Trade Date that will be provided in the final pricing supplement, are each estimates only, determined as of a particular point in time by reference to our and our affiliates' pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of the Guarantor, the Guarantor’s internal funding rate, mid-market terms on hedging transactions, expectations on interest rates, dividends and volatility, price-sensitivity analysis, and the expected term of the Notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and lower than their initial estimated value. This is due to, among other things, changes in the levels of the Basket Components, changes in the Guarantor’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging related charges, all as further described in "Structuring the Notes" below. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways.

|

|

♦

|

The initial estimated value does not represent a minimum or maximum price at which we, BAC, BofAS or any of our other affiliates would be willing to purchase your Notes in any secondary market (if any exists) at any time. The value of your Notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket Components, our and BAC’s creditworthiness and changes in market conditions.

|

|

♦

|

The price of the Notes that may be paid by BofAS in any secondary market (if BofAS makes a market, which it is not required to do), as well as the price which may be reflected on customer account statements, will be higher than the then-current estimated value of the Notes for a limited time period after the Trade Date. As agreed by BofAS and UBS, for approximately a seven-month period after the Trade Date, to the extent BofAS offers to buy the Notes in the secondary market, it will do so at a price that will exceed the estimated value of the Notes at that time. The amount of this excess, which represents a portion of the hedging-related charges expected to be realized by BofAS and UBS over the term of the Notes, will decline to zero on a straight line basis over that seven-month period. Accordingly, the estimated value of your Notes during this initial seven-month period may be lower than the value shown on your customer account statements. Thereafter, if BofAS buys or sells your Notes, it will do so at prices that reflect the estimated value determined by reference to its pricing models at that time. Any price at any time after the Trade Date will be based on then-prevailing market conditions and other considerations, including the performance of the Basket Components and the remaining term of the Notes. However, none of us, the Guarantor, BofAS or any other party is obligated to purchase your Notes at any price or at any time, and we cannot assure you that any party will purchase your Notes at a price that equals or exceeds the initial estimated value of the Notes.

|

|

♦

|

We cannot assure you that a trading market for your Notes will ever develop or be maintained. We will not list the Notes on any securities exchange. We cannot predict how the Notes will trade in any secondary market or whether that market will be liquid or illiquid.

|

The development of a trading market for the Notes will depend on the Guarantor’s financial performance and other factors, including changes in the levels of the Basket Components. The number of potential buyers of your Notes in any secondary market may be limited. We anticipate that BofAS will act as a market-maker for the Notes, but none of us, the Guarantor or BofAS is required to do so. There is no assurance that any party will be willing to purchase your Notes at any price in any secondary market. BofAS may discontinue its market-making activities as to the Notes at any time. To the extent that BofAS engages in any market-making activities, it may bid for or offer the Notes. Any price at which BofAS may bid for, offer, purchase, or sell any Notes may differ from the values determined by pricing models that it may use, whether as a result of dealer discounts, mark-ups, or other transaction costs. These bids, offers, or completed transactions may affect the prices, if any, at which the Notes might otherwise trade in the market. In addition, if at any time BofAS were to cease acting as a market-maker as to the Notes, it is likely that there would be significantly less liquidity in the secondary market. In such a case, the price at which the Notes could be sold likely would be lower than if an active market existed.

|

♦

|

Economic and market factors have affected the terms of the Notes and may affect the market value of the Notes prior to maturity. Because market-linked notes, including the Notes, can be thought of as having a debt component and a derivative component, factors that influence the values of debt instruments and options and other derivatives will also affect the terms and features of the Notes at issuance and the market price of the Notes prior to maturity. These factors include the levels of the Basket Components and the values of the securities included in the Basket Components; the volatility of the Basket Components and the securities included in the Basket Components; the dividend rate paid on the securities included in the Basket Components, if applicable; the time remaining to the maturity of the Notes; interest rates in the markets; geopolitical conditions and economic, financial, political, force majeure and regulatory or judicial events; whether the value of the Basket is currently or has been less than the Initial Basket Value; the availability of comparable instruments; the creditworthiness of BofA Finance, as issuer, and BAC, as guarantor; and the then current bid-ask spread for the Notes and the factors discussed under “— Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, and UBS and its affiliates, may create conflicts of interest with you

|

PS-7

and may affect your return on the Notes and their market value” below. These factors are unpredictable and interrelated and may offset or magnify each other.

|

♦

|

Greater expected volatility generally indicates an increased risk of loss at maturity. Volatility is a measure of the degree of variation in the level of the Basket Components over a period of time. The greater the expected volatility of the Basket Components at the time the terms of the Notes are set, the greater the expectation is at that time that you may lose a significant portion or all of the Stated Principal Amount at maturity. However, the Basket Components' volatility can change significantly over the term of the Notes. You should be willing to accept the downside market risk of each Basket Component and the potential to lose a significant portion or all of your initial investment.

|

Conflict-related Risks

|

♦

|

Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, and UBS and its affiliates, may create conflicts of interest with you and may affect your return on the Notes and their market value. We, the Guarantor or one or more of our other affiliates, including BofAS, and UBS and its affiliates, may buy or sell the securities held by or included in the Basket Components, or futures or options contracts on the Basket Components or those securities, or other listed or over-the-counter derivative instruments linked to the Basket Components or those securities. We, the Guarantor or one or more of our other affiliates, including BofAS, and UBS and its affiliates also may issue or underwrite other financial instruments with returns based upon the Basket Components and the securities held by or included in the Basket Components. We expect to enter into arrangements or adjust or close out existing transactions to hedge our obligations under the Notes. We, the Guarantor or our other affiliates, including BofAS, and UBS and its affiliates also may enter into hedging transactions relating to other notes or instruments, some of which may have returns calculated in a manner related to that of the Notes offered hereby. We or UBS may enter into such hedging arrangements with one of our or their affiliates. Our affiliates or their affiliates may enter into additional hedging transactions with other parties relating to the Notes and the Basket Components. This hedging activity is expected to result in a profit to those engaging in the hedging activity, which could be more or less than initially expected, or the hedging activity could also result in a loss. We and our affiliates and UBS and its affiliates will price these hedging transactions with the intent to realize a profit, regardless of whether the value of the Notes increases or decreases. Any profit in connection with such hedging activities will be in addition to any other compensation that we, the Guarantor and our other affiliates, including BofAS, and UBS and its affiliates receive for the sale of the Notes, which creates an additional incentive to sell the Notes to you. While we, the Guarantor or one or more of our other affiliates, including BofAS, and UBS and its affiliates may from time to time own securities represented by the Basket Components, except to the extent that BAC’s or UBS Group AG’s (the parent company of UBS) common stock may be included in the Basket Components, as applicable, we, the Guarantor and our other affiliates, including BofAS, and UBS and its affiliates do not control any company included in the Basket Components, and have not verified any disclosure made by any other company. We, the Guarantor or one or more of our other affiliates, including BofAS, and UBS and its affiliates may execute such purchases or sales for our own or their own accounts, for business reasons, or in connection with hedging our obligations under the Notes. The transactions described above may present a conflict of interest between your interest in the Notes and the interests we, the Guarantor and our other affiliates, including BofAS, and UBS and its affiliates may have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management.

|

The transactions described above may affect the value of the Basket Components in a manner that could be adverse to your investment in the Notes. On or before the Trade Date, any purchases or sales by us, the Guarantor or our other affiliates, including BofAS or others on its behalf, and UBS and its affiliates (including for the purpose of hedging some or all of our anticipated exposure in connection with the Notes) may affect the value of the Basket Components. Consequently, the value of the Basket Components may change subsequent to the Trade Date, which may adversely affect the market value of the Notes. In addition, these activities may decrease the market value of your Notes prior to maturity, and may affect the amounts to be paid on the Notes. We, the Guarantor or one or more of our other affiliates, including BofAS, and UBS and its affiliates may purchase or otherwise acquire a long or short position in the Notes and may hold or resell the Notes. For example, BofAS may enter into these transactions in connection with any market making activities in which it engages. We cannot assure you that these activities will not adversely affect the value of the Basket Components, the market value of your Notes prior to maturity or the amounts payable on the Notes.

|

♦;

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the Notes and, as such, will make a variety of determinations relating to the Notes, including the amounts that will be paid on the Notes. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent.

|

Basket-related Risks

|

♦

|

The Notes are subject to the market risk of the Basket Components. The return on the Notes, which may be negative, is directly linked to the performance of the Basket Components and indirectly linked to the value of the securities included in the Basket Components. The levels of the Basket Components can rise or fall sharply due to factors specific to the Basket Components and the securities included in the Basket Components and the issuers of such securities, such as stock price volatility, earnings and financial conditions, corporate, industry and regulatory developments, management changes and decisions and other events, as well as general market factors, such as general stock market or commodity market volatility and levels, interest rates and economic and political conditions.

|

|

♦

|

Your return on the Notes and the value of the Notes may be affected by exchange rate movements and factors affecting the international securities markets, specifically changes in the countries represented by the Basket Components. The Basket Components include certain foreign equity securities. You should be aware that investments in securities linked to the value of foreign equity securities involve particular risks. The foreign securities markets comprising the Basket Components may have less liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets. Direct or indirect

|

PS-8

government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information about foreign companies than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange Commission, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies. Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors, which could negatively affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural disaster or adverse public health developments in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. In addition, you will not obtain the benefit of any increase in the value of the currencies in which the securities included in the Basket Components trade against the U.S. dollar, which you would have received if you had owned the securities represented by the Basket Components during the term of your Notes, although the level of the Basket Components may be adversely affected by general exchange rate movements in the market.

|

♦

|

The publisher of each Basket Component may adjust the applicable Basket Component in a way that affects its level, and the publisher has no obligation to consider your interests. The publisher of each Basket Component can add, delete, or substitute the components included in the applicable Basket Component or make other methodological changes that could change its level. Any of these actions could adversely affect the value of your Notes.

|

|

♦

|

Governmental regulatory actions could result in material changes to the composition of the Basket Components and could negatively affect your return on the Notes. Governmental regulatory actions, including but not limited to sanctions-related actions by the U.S. or foreign governments, could make it necessary or advisable for there to be material changes to the composition of the Basket Components, depending on the nature of such governmental regulatory actions and the Basket Component constituent stocks that are affected. For instance, pursuant to recent executive orders, U.S. persons are prohibited from engaging in transactions in publicly traded securities of certain companies that are determined to be linked to the People’s Republic of China (the “PRC”) military, intelligence and security apparatus, or securities that are derivative of, or are designed to provide investment exposure to such securities. If any governmental regulatory action results in the removal of Basket Component constituent stocks that have (or historically have had) significant weights within the applicable Basket Component, such removal, or even any uncertainty relating to a possible removal, could have a material and negative effect on the level of the applicable Basket Component and, therefore, your return on the Notes.

|

Tax-related Risks

|

◆

|

The U.S. federal income tax consequences of an investment in the Notes are uncertain, and may be adverse to a holder of the Notes. No statutory, judicial, or administrative authority directly addresses the characterization of the Notes or securities similar to the Notes for U.S. federal income tax purposes. As a result, significant aspects of the U.S. federal income tax consequences of an investment in the Notes are not certain. Under the terms of the Notes, you will have agreed with us to treat the Notes as single financial contracts, as described below under “U.S. Federal Income Tax Summary—General.” If the Internal Revenue Service (the “IRS”) were successful in asserting an alternative characterization for the Notes, the timing and character of gain or loss with respect to the Notes may differ. No ruling will be requested from the IRS with respect to the Notes and no assurance can be given that the IRS will agree with the statements made in the section entitled “U.S. Federal Income Tax Summary.” You are urged to consult with your own tax advisor regarding all aspects of the U.S. federal income tax consequences of investing in the Notes.

|

PS-9

Hypothetical terms only. Actual terms may vary. See the cover page for actual offering terms.

The examples below illustrate the hypothetical Payment at Maturity for a $10.00 Stated Principal Amount Note for a range of hypothetical Basket Returns for the Basket with the following assumptions* (the actual terms of the Notes will be determined on the Trade Date; amounts may have been rounded for ease of reference and do not take into account any tax consequences from investing in the Notes):

|

◆

|

Stated Principal Amount: $10

|

|

◆

|

Term: Approximately 14 months

|

|

◆

|

Initial Basket Value: 100.00

|

|

◆

|

Hypothetical Maximum Gain: 22.85% (the lower end of the range for the Maximum Gain)

|

|

◆

|

Hypothetical Maximum Payment at Maturity: $12.285 (corresponding to the lower end of the range for the Maximum Gain)

|

*The hypothetical Maximum Gain and Maximum Payment at Maturity may not represent the actual Maximum Gain and Maximum Payment at Maturity. The actual Maximum Gain and Maximum Payment at Maturity will be determined on the Trade Date. Any payment on the Notes is subject to issuer and Guarantor credit risk.

|

Final Basket Value

|

Basket Return

|

Payment at Maturity

|

Return on the Notes

|

|

160.00

|

60.00%

|

$12.285

|

22.85%

|

|

150.00

|

50.00%

|

$12.285

|

22.85%

|

|

140.00

|

40.00%

|

$12.285

|

22.85%

|

|

130.00

|

30.00%

|

$12.285

|

22.85%

|

|

120.00

|

20.00%

|

$12.285

|

22.85%

|

|

110.00

|

10.00%

|

$12.285

|

22.85%

|

|

107.62

|

7.62%

|

$12.285

|

22.85%(1)

|

|

102.00

|

2.00%

|

$10.60

|

6.00%

|

|

100.00(2)

|

0.00%

|

$10.00

|

0.00%

|

|

90.00

|

-10.00%

|

$9.00

|

-10.00%

|

|

80.00

|

-20.00%

|

$8.00

|

-20.00%

|

|

75.00

|

-25.00%

|

$7.50

|

-25.00%

|

|

60.00

|

-40.00%

|

$6.00

|

-40.00%

|

|

50.00

|

-50.00%

|

$5.00

|

-50.00%

|

|

0.00

|

-100.00%

|

$0.00

|

-100.00%

|

|

(1) The “Return on the Notes” cannot exceed the hypothetical Maximum Gain and is calculated based on the Public Offering Price of $10 per Note.

|

|

(2) This is the Initial Basket Value.

|

|

|

PS-10

Example 1 — The Final Basket Value of 150.00 is greater than the Initial Basket Value of 100.00, resulting in a Basket Return of 50.00%.

Since the Basket Return is positive, we will repay the Stated Principal Amount of the Notes at maturity plus a return equal to the Basket Return multiplied by the Upside Gearing, but no more than the Maximum Gain, calculated as follows:

$10.00 × (1 + the lesser of (i) 50.00% x 3.0 and (ii) 22.85%) = $12.285.

In this example, an investment in the Notes would underperform a direct investment in the securities held by or included in the Basket Components.

Example 2 — The Final Basket Value of 102.00 is greater than the Initial Basket Value of 100.00, resulting in a Basket Return of 2.00%.

Since the Basket Return is positive, we will repay the Stated Principal Amount of the Notes at maturity plus a return equal to the Basket Return multiplied by the Upside Gearing, but no more than the Maximum Gain, calculated as follows:

$10.00 × (1 + the lesser of (i) 2.00% x 3.0 and (ii) 22.85%) = $10.60.

Example 3 — The Final Basket Value of 50.00 is less than the Initial Basket Value of 100.00 (resulting in a Basket Return of -50.00%).

Since the Basket Return is negative, we will repay less than the Stated Principal Amount of your Notes at maturity, resulting in a loss that is proportionate to the decline in the value of the Basket from the Trade Date to the Valuation Date, calculated as follows:

$10.00 × (1 + -50.00%) = $5.00

PS-11

The Basket and the Basket Components

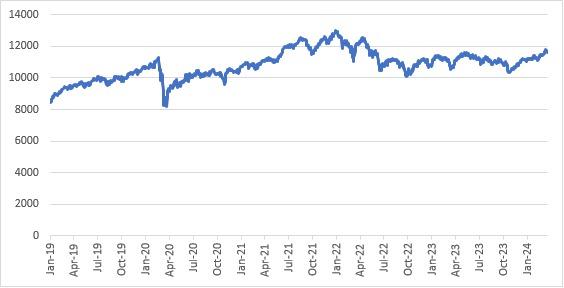

Because the Basket exists solely for purposes of these Notes, historical information on the performance of the Basket does not exist for dates prior to the Trade Date for these Notes. The graph below sets forth the hypothetical historical daily levels of the Basket for the period from January 2, 2019 to March 18, 2024, assuming that the Basket was created on January 2, 2019 with the same Basket Components and corresponding weights in the Basket and with an Initial Basket Value of 100 on that date. The hypothetical performance of the Basket is based on the actual closing levels of the Basket Components on the applicable dates. We obtained these closing levels from Bloomberg L.P., without independent verification. Any historical trend in the level of the Basket during the period shown below is not an indication of the performance of the Basket during the term of the Notes.

All disclosures contained in this pricing supplement regarding the Basket Components, including, without limitation, their make-up, method of calculation, and changes in their components, have been derived from publicly available sources. The information reflects the policies of, and is subject to change by, each of STOXX Limited (“STOXX”) with respect to the EURO STOXX 50® Index (the “SX5E”), Nikkei Inc. (“Nikkei”) with respect to Nikkei Stock Average Index (the “NKY”), FTSE International Limited (“FTSE”) with respect to the FTSE® 100 Index (the “UKX”), the Geneva, Zurich, SIX Group Ltd., certain of its subsidiaries, and the Management Committee of the SIX Swiss Exchange (collectively, the “SIX Exchange”), with respect to the Swiss Market Index (the “SMI”) , and S&P Dow Jones Indices LLC (“S&P”) with respect to the S&P®/ASX 200 Index (the “AS51”) (STOXX, Nikkei, FTSE, S&P, SMI and Six Exchange together, the “Underlying Sponsors”) The Underlying Sponsors, which license the copyright and all other rights to the respective Basket Components, have no obligation to continue to publish, and may discontinue publication of, any Basket Component. The consequences of an Underlying Sponsor discontinuing publication of the applicable Basket Component are discussed in “Description of the Notes—Discontinuance of an Index” in the accompanying product supplement. None of us, the Guarantor, the calculation agent, or either Selling Agent accepts any responsibility for the calculation, maintenance or publication of any Basket Component or any successor index.

None of us, the Guarantor, the Selling Agents or any of our or their respective affiliates makes any representation to you as to the future performance of any Basket Component.

You should make your own investigation into the Basket Components.

The EURO STOXX 50® Index

The SX5E is composed of 50 stocks from 11 Eurozone countries (Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain) of the STOXX Europe 600 Supersector indices. The STOXX 600 Supersector indices contain the 600 largest stocks traded on the major exchanges of 18 European countries and are organized into the following 20 Supersectors: Technology; Telecommunications; Health Care; Banks; Financial Services; Insurance; Real Estate; Automobiles and Parts; Consumer Products and Services; Media; Retail; Travel and Leisure; Food, Beverage and Tobacco; Personal Care, Drug and Grocery Stores; Construction and Materials; Industrial Goods and Services; Basic Resources; Chemicals; Energy; and Utilities.

The SX5E was created by STOXX, which is part of the Deutsche Börse Group. Publication of the SX5E began in February 1998, based on an initial SX5E level of 1,000 at December 31, 1991. On March 1, 2010, STOXX announced the removal of the “Dow Jones” prefix from all of its indices, including the SX5E.

SX5E Composition and Maintenance

For each of the 20 EURO STOXX regional supersector indices, the stocks are ranked in terms of free-float market capitalization. The largest stocks are added to the selection list until the coverage is close to, but still less than, 60% of the free-float market capitalization of the corresponding supersector index. If the next highest-ranked stock brings the coverage closer to 60% in absolute terms, then it is also added to the selection list. All

PS-12

current stocks in the SX5E are then added to the selection list. All of the stocks on the selection list are then ranked in terms of free-float market capitalization to produce the final index selection list. The largest 40 stocks on the selection list are selected; the remaining 10 stocks are selected from the largest remaining current stocks ranked between 41 and 60; if the number of stocks selected is still below 50, then the largest remaining stocks are selected until there are 50 stocks. In exceptional cases, STOXX’s management board can add stocks to and remove them from the selection list.

The SX5E components are subject to a capped maximum index weight of 10%, which is applied on a quarterly basis.

The composition of the SX5E is reviewed annually, based on the closing stock data on the last trading day in August. Changes in the composition of the SX5E are made to ensure that the SX5E includes the 50 market sector leaders from within the SX5E.

The free float factors for each component stock used to calculate the SX5E, as described below, are reviewed, calculated, and implemented on a quarterly basis and are fixed until the next quarterly review.

The SX5E is subject to a “fast exit rule.” The SX5E components are monitored for any changes based on the monthly selection list ranking. A stock is deleted from the SX5E if: (a) it ranks 75 or below on the monthly selection list and (b) it has been ranked 75 or below for a consecutive period of two months in the monthly selection list. The highest-ranked stock that is not an index component will replace it. Changes will be implemented on the close of the fifth trading day of the month, and are effective the next trading day.

The SX5E is also subject to a “fast entry rule.” All stocks on the latest selection lists and initial public offering (IPO) stocks are reviewed for a fast-track addition on a quarterly basis. A stock is added, if (a) it qualifies for the latest STOXX blue-chip selection list generated end of February, May, August or November and (b) it ranks within the “lower buffer” on this selection list.

The SX5E is also reviewed on an ongoing monthly basis. Corporate actions (including initial public offerings, mergers and takeovers, spin-offs, delistings, and bankruptcy) that affect the SX5E composition are announced immediately, implemented two trading days later and become effective on the next trading day after implementation.

SX5E Calculation

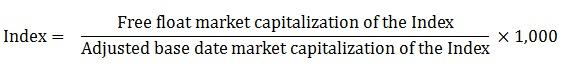

The SX5E is calculated with the “Laspeyres formula,” which measures the aggregate price changes in the component stocks against a fixed base quantity weight. The formula for calculating the SX5E value can be expressed as follows:

The “free float market capitalization of the SX5E” is equal to the sum of the product of the price, the number of shares and the free float factor and the weighting cap factor for each component stock as of the time the SX5E is being calculated.

The SX5E is also subject to a divisor, which is adjusted to maintain the continuity of the SX5E values across changes due to corporate actions, such as the deletion and addition of stocks, the substitution of stocks, stock dividends, and stock splits.

Neither we nor any of our affiliates, including the selling agent, accepts any responsibility for the calculation, maintenance, or publication of, or for any error, omission, or disruption in, the SX5E or any successor to the SX5E. STOXX does not guarantee the accuracy or the completeness of the SX5E or any data included in the SX5E. STOXX assumes no liability for any errors, omissions, or disruption in the calculation and dissemination of the SX5E. STOXX disclaims all responsibility for any errors or omissions in the calculation and dissemination of the SX5E or the manner in which the SX5E is applied in determining the amount payable on the notes at maturity.

Historical Performance of the SX5E

The following graph sets forth the daily historical performance of the SX5E in the period from January 2, 2019 through March 18, 2024. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On March 18, 2024 the closing level of the SX5E was 4,982.76.

PS-13

This historical data on the SX5E is not necessarily indicative of the future performance of the SX5E or what the value of the Notes may be. Any historical upward or downward trend in the level of the SX5E during any period set forth above is not an indication that the level of the SX5E is more or less likely to increase or decrease at any time over the term of the Notes.

Before investing in the Notes, you should consult publicly available sources for the levels of the SX5E.

License Agreement

One of our affiliates has entered into a non-exclusive license agreement with STOXX providing for the license to it and certain of its affiliated companies, including us, in exchange for a fee, of the right to use indices owned and published by STOXX (including the SX5E) in connection with certain securities, including the notes offered hereby.

The license agreement requires that the following language be stated in this document:

STOXX and its licensors (the “Licensors”) have no relationship to us, other than the licensing of the SX5E and the related trademarks for use in connection with the notes. STOXX and its Licensors do not:

|

■

|

sponsor, endorse, sell, or promote the notes;

|

|

■

|

recommend that any person invest in the notes offered hereby or any other securities;

|

|

■

|

have any responsibility or liability for or make any decisions about the timing, amount, or pricing of the notes;

|

|

■

|

have any responsibility or liability for the administration, management, or marketing of the notes; or

|

|

■

|

consider the needs of the notes or the holders of the notes in determining, composing, or calculating the SX5E, or have any obligation to do so.

|

STOXX and its Licensors will not have any liability in connection with the notes. Specifically:

|

■

|

STOXX and its Licensors do not make any warranty, express or implied, and disclaims any and all warranty concerning:

|

|

■

|

the results to be obtained by the notes, the holders of the notes or any other person in connection with the use of the SX5E and the data included in the SX5E;

|

|

■

|

the accuracy or completeness of the SX5E and its data;

|

|

■

|

the merchantability and the fitness for a particular purpose or use of the SX5E and its data;

|

|

■

|

STOXX and its Licensors will have no liability for any errors, omissions, or interruptions in the SX5E or its data; and

|

|

■

|

Under no circumstances will STOXX be liable for any lost profits or indirect, punitive, special, or consequential damages or losses, even if STOXX or its Licensors know that they might occur.

|

The licensing agreement discussed above is solely for our benefit and that of STOXX, and not for the benefit of the holders of the notes or any other third parties.

The Nikkei Stock Average Index

The NKY, also known as the Nikki 225 Index, is an equity index calculated, published, and disseminated by Nikkei Inc. The NKY measures the composite price performance of selected Japanese stocks. The NKY is currently based on 225 stocks (each, an “Index Stock”) trading on the Tokyo Stock Exchange (“TSE”) and represents a broad cross-section of Japanese industry. All 225 of the Index Stocks are listed in the First Section of the TSE. Index Stocks listed in the First Section are among the most actively traded stocks on the TSE. The NKY started on September 7, 1950. However, it was retroactively calculated back to May 16, 1949, when the TSE reopened for the first time after World War II.

Calculation of the NKY

The NKY is a modified, price-weighted index. Each Index Stock’s weight is based on its price per share rather than the total market capitalization of the issuer. Nikkei Inc. calculates the NKY by multiplying the per share price of each Index Stock by the corresponding weighting factor for that Index Stock (a “Weight Factor”), calculating the sum of all these products and dividing that sum by a divisor. The divisor is subject to periodic adjustments as set forth below. Each Weight Factor is computed by dividing 50 by the presumed par value of the relevant Index Stock, so that the share price of each Index Stock when multiplied by its Weight Factor corresponds to a share price based on a uniform par value of 50. Each Weight Factor represents the number of shares of the related Index Stock which are included in one trading unit of the NKY. The stock prices used in the calculation of the NKY are those reported by a primary market for the Index Stocks, currently the TSE. The level of the NKY is currently calculated once per 15 seconds during TSE trading hours.

In order to maintain continuity in the level of the NKY in the event of certain changes due to non-market factors affecting the Index Stocks, such as the addition or deletion of stocks, stock splits, or increase in paid-in capital, the divisor used in calculating the NKY is adjusted in a manner designed to prevent any instantaneous change or discontinuity in the level of the NKY. The divisor remains at the new value until a further adjustment is necessary as the result of another change. In the event of a change affecting any Index Stock, the divisor is adjusted in such a way that the sum of all share prices immediately after the change multiplied by the applicable Weight Factor and divided by the new divisor, i.e., the level of the NKY immediately after the change, will equal the level of the NKY immediately prior to the change.

Index Maintenance

PS-14

The NKY is reviewed annually at the beginning of October. The purpose of the review is to maintain the representative nature of the Index Stocks. Stocks with high market liquidity are added and those with low liquidity are deleted. At the same time, to take changes in industry structure into account, the balance of the sectors, in terms of the number of constituents, is considered. Liquidity of a stock is assessed by the two measures: “trading value” and “magnitude of price fluctuation by volume,” which is calculated as (high price/low price) / volume. Among stocks on the TSE First Section, the top 450 stocks in terms of liquidity are selected to form the “high liquidity group”. Those constituents that are not in the high liquidity group are deleted. Those non-constituent stocks which are in the top 75 of the high liquidity group are added.

After the liquidity deletions and additions, constituents are deleted and added to balance the number of constituents among sectors, and to make the total number of the constituents equal 225. Among the 450 “high liquidity” stocks, half of those that belong to a sector are designated as the “appropriate number of stocks” for that sector. The actual number of constituents in a sector is then compared with its “appropriate number,” and if the actual number is larger or smaller than the “appropriate number,” then components are deleted or added, as necessary. Stocks to be deleted are selected from stocks with lower liquidity and stocks to be added are selected from stocks with higher liquidity. Stocks selected according to the foregoing procedures are candidates for addition or deletion, as applicable, and the final determinations will be made by Nikkei Inc.

The NKY is also reviewed on an ongoing basis in response to extraordinary developments, such as bankruptcies or mergers. Any stock becoming ineligible for listing in the TSE First Section due to any of the following reasons will be removed from the NKY: (i) bankruptcy and liquidation events; (ii) corporate restructurings, such as mergers, share exchanges or share transfers; (iii) excess debt or other reasons; or (iv) transfer to the TSE Second Section. In addition, a component stock designated as “security under supervision” becomes a deletion candidate. However, the decision to delete such a candidate will be made by examining the sustainability and the probability of delisting for each individual case. Upon deletion of a stock from the NKY, Nikkei Inc. will generally select as a replacement the most liquid stock that is both in the “high liquidity group” and in the same sector as the deleted stock. When deletions are known in advance, replacements may be selected as part of the periodic review process or by using similar procedures.

The Tokyo Stock Exchange

The TSE is one of the world’s largest securities exchanges in terms of market capitalization. Trading hours for most products listed on the TSE are currently from 9:00 A.M. to 11:00 A.M. and from 12:30 P.M. to 3:00 P.M., Tokyo time, Monday through Friday.

Due to the time zone difference, on any normal trading day, the TSE will close prior to the opening of business in New York City on the same calendar day. Therefore, the closing level of the NKY on a trading day will generally be available in the U.S. by the opening of business on the same calendar day.

The TSE has adopted certain measures, including daily price floors and ceilings on individual stocks, intended to prevent any extreme short-term price fluctuations resulting from order imbalances. In general, any stock listed on the TSE cannot be traded at a price lower than the applicable price floor or higher than the applicable price ceiling. These price floors and ceilings are expressed in absolute Japanese yen, rather than percentage limits based on the closing price of the stock on the previous trading day. In addition, when there is a major order imbalance in a listed stock, the TSE posts a “special bid quote” or a “special asked quote” for that stock at a specified higher or lower price level than the stock’s last sale price in order to solicit counter-orders and balance supply and demand for the stock. The TSE may also suspend the trading of individual stocks in certain limited and extraordinary circumstances, including, for example, unusual trading activity in that stock. As a result, changes in the NKY may be limited by price limitations or special quotes, or by suspension of trading, on individual stocks that make up the NKY, and these limitations, in turn, may adversely affect the market value of the notes.

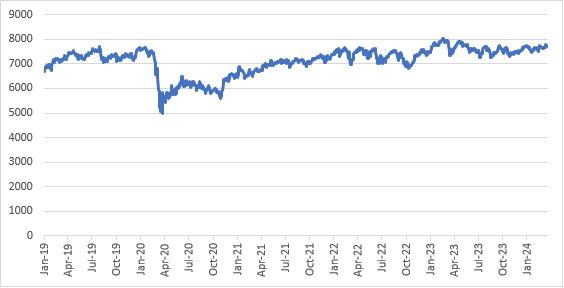

Historical Performance of the NKY

The following graph sets forth the daily historical performance of the NKY in the period from January 2, 2019 through March 18, 2024. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On March 18, 2024 the closing level of the NKY was 39,740.44.

This historical data on the NKY is not necessarily indicative of the future performance of the NKY or what the value of the Notes may be. Any historical upward or downward trend in the level of the NKY during any period set forth above is not an indication that the level of the NKY is more or less likely to increase or decrease at any time over the term of the Notes.

PS-15

Before investing in the Notes, you should consult publicly available sources for the levels of the NKY.

License Agreement

One of our affiliates has entered into an agreement with Nikkei Inc. providing us with a non-exclusive license with the right to use the NKY in exchange for a fee. The NKY is the intellectual property of Nikkei Inc. (the “index sponsor”), formerly known as Nihon Keizai Shimbum, Inc. “Nikkei”, “Nikkei Stock Average”, and “Nikkei 225” are the service marks of Nikkei Inc. Nikkei Inc. reserves all the rights, including copyright, to the NKY.

The Notes are not in any way sponsored, endorsed or promoted by the index sponsor. The index sponsor does not make any warranty or representation whatsoever, express or implied, either as to the results to be obtained as to the use of the NKY or the figure at which the NKY stands at any particular day or otherwise. The NKY is compiled and calculated solely by the index sponsor. However, the index sponsor shall not be liable to any person for any error in the NKY and the index sponsor shall not be under any obligation to advise any person, including a purchaser or seller of the Notes, of any error therein.

In addition, the index sponsor gives no assurance regarding any modification or change in any methodology used in calculating the NKY and is under no obligation to continue the calculation, publication and dissemination of the NKY.

The FTSE® 100 Index

The UKX is a market capitalization-weighted index of the 100 most highly capitalized U.K.-listed blue chip companies traded on the London Stock Exchange. The UKX was developed with a base level of 1,000 as of December 30, 1983. It is calculated, published and disseminated by FTSE, a company owned by The London Stock Exchange Plc.

Additional information on the UKX is available from the following website: ftse.com/uk. We are not incorporating by reference that website or any material it includes in this document.

Index Composition and Selection Criteria

The UKX consists of the 100 largest U.K.-listed blue chip companies, based on full market capitalization, that pass screening tests for price and liquidity. The UKX is reviewed on a quarterly basis in March, June, September and December based on data from the close of business on the Tuesday before the first Friday of the review month. The FTSE Europe, Middle East & Africa Regional Advisory Committee (the “Committee”), meets quarterly to approve the constituents of the UKX. These meetings are held on the Wednesday before the first Friday in March, June, September and December. Any constituent changes are implemented after the close of business on the third Friday of the review month (i.e., effective Monday), following the expiration of the London International Financial Futures and Options Exchange futures and options contracts.

Eligibility Standards

Only “premium listed” equity shares, as defined by the Financial Conduct Authority in its Listing Rules Sourcebook, are eligible for inclusion in the UKX. Eligible stocks must pass price and liquidity screens before being included in the UKX. Additionally, a stock must have a free float (as described below) of greater than 5%.

Price Screen — With regard to the price screen, the Committee must be satisfied that an accurate and reliable price exists for purposes of determining the market value of a company. To be eligible for inclusion in the UKX, a stock must have a full listing on the London Stock Exchange with a Sterling-denominated price on SETS (the London Stock Exchange’s trading service for UK blue chip securities).