|

|

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement Nos. 333-268718 and 333-268718-01

(To Prospectus dated December 30, 2022,

Prospectus Supplement dated December 30, 2022 and

Product Supplement STOCK ARN-1 dated February 2, 2023)

|

465,200 Units

$10 principal amount per unit

CUSIP No. 09710N564

|

Pricing Date

Settlement Date

Maturity Date

|

March 27, 2024

April 4, 2024

May 30, 2025

|

|

|

|

|

|

|

|

|

BofA Finance LLC

Accelerated Return Notes® Linked to a Basket of 20 Cross-Sector Stocks

Fully and Unconditionally Guaranteed by Bank of America Corporation

■

Maturity of approximately 14 months

■

3-to-1 upside exposure to increases in the Basket, subject to a capped return of 17.90%

■

1-to-1 downside exposure to decreases in the Basket, with 100% of your investment at risk

■

The Basket is comprised of an equally-weighted basket of common stocks (each, a “Basket Stock”) of entities that are not affiliated with us. The Basket Stocks were selected by us by reference to a BofA Global Research screen. The BofA Global Research screen identifies companies that may be impacted by the moving of manufacturing operations of companies from outside of the U.S. to the U.S., referred to as “re-shoring”. There is no guarantee that the Basket Stocks will provide any exposure to companies that may be positively impacted by re-shoring, or that will undergo re-shoring, during the term of the notes. If potential exposure to companies that may be impacted by re-shoring is a factor in your decision to invest in the notes, you should consult with your legal or other advisors before making an investment in the notes. See the “Summary”, “The Basket” and “The Basket Stock” sections for more information.

■

All payments occur at maturity and are subject to the credit risk of BofA Finance LLC, as issuer of the notes, and the credit risk of Bank of America Corporation, as guarantor of the notes

■

No periodic interest payments

■

In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.05 per unit. See “Structuring the Notes”

■

Limited secondary market liquidity, with no exchange listing

|

|

|

The notes are being issued by BofA Finance LLC (“BofA Finance”) and are fully and unconditionally guaranteed by Bank of America Corporation (“BAC”). There are important differences between the notes and a conventional debt security, including different investment risks and certain additional costs. See “Risk Factors” beginning on page TS-6 of this term sheet, “Additional Risk Factors” on page TS-7 of this term sheet and “Risk Factors” beginning on page PS-6 of the accompanying product supplement, page S-6 of the accompanying Series A MTN prospectus supplement and page 7 of the accompanying prospectus.

The initial estimated value of the notes as of the pricing date is $9.798 per unit, which is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” beginning on page TS-6 of this term sheet and “Structuring the Notes” on page TS-34 of this term sheet for additional information. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

_________________________

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

|

|

Per Unit

|

Total

|

|

Public offering price

|

$ 10.00

|

$4,652,000

|

|

Underwriting discount

|

$ 0.175

|

$ 81,410

|

|

Proceeds, before expenses, to BofA Finance

|

$ 9.825

|

$4,570,590

|

The notes and the related guarantee:

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

BofA Securities

March 27, 2024

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Summary

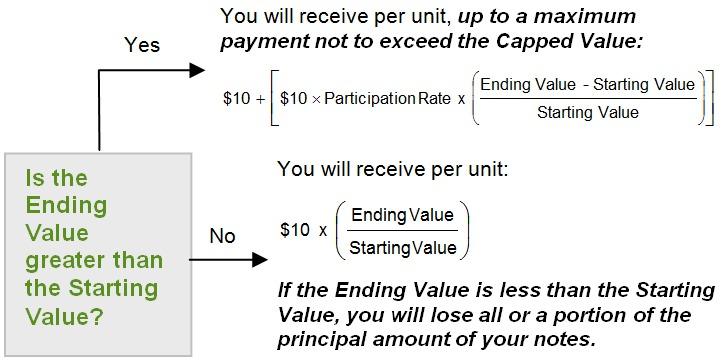

The Accelerated Return Notes® Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025 (the “notes”) are our senior unsecured debt securities. Payments on the notes are fully and unconditionally guaranteed by BAC. The notes and the related guarantee are not insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally in right of payment with all of BofA Finance’s other unsecured and unsubordinated obligations, and the related guarantee will rank equally in right of payment with all of BAC’s other unsecured and unsubordinated obligations, in each case except obligations that are subject to any priorities or preferences by law. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BofA Finance, as issuer, and BAC, as guarantor. The notes provide you a leveraged return, subject to a cap, if the Ending Value of the Market Measure, which is the basket of 20 cross-sector common stocks described below (the “Basket”), is greater than its Starting Value. If the Ending Value is less than the Starting Value, you will lose all or a portion of the principal amount of your notes. Any payments on the notes will be calculated based on the $10 principal amount per unit and will depend on the performance of the Basket, subject to our and BAC’s credit risk. See “Terms of the Notes” below.

The Basket is comprised of 20 cross-sector common stocks that we selected by reference to a screen that BofA Global Research published in the ordinary course of its research activities (each a “Basket Stock”). The screen, which is based on certain quantitative factors, is intended to identify domestically-oriented companies (i.e., those with 85% or more in U.S. sales) included in the S&P 500® Index with at least 10 years of data that may be impacted by the “re-shoring” of manufacturing chains to the U.S. “Re-shoring” in this context generally refers to the process of moving the manufacture of a company’s goods/products/services to the U.S. after having conducted such manufacturing operations outside of the U.S. Despite how the Basket Stocks were selected, there is no guarantee that the Basket will actually provide exposure to companies that may be impacted by re-shoring. See the sections “Additional Risk Factors”, “The Basket—Basket Stock Selection” and “The Basket Stocks” for more information. On the pricing date, each of the 20 Basket Stocks will be assigned a weighting of 5% in the Basket. The Basket Stocks, their ticker symbols, and weightings are listed below under “The Basket”.

The economic terms of the notes (including the Capped Value) are based on BAC’s internal funding rate, which is the rate it would pay to borrow funds through the issuance of market-linked notes and the economic terms of certain related hedging arrangements. BAC’s internal funding rate is typically lower than the rate it would pay when it issues conventional fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount and the hedging-related charge described below, reduced the economic terms of the notes to you and the initial estimated value of the notes on the pricing date. Due to these factors, the public offering price you pay to purchase the notes is greater than the initial estimated value of the notes.

On the cover page of this term sheet, we have provided the initial estimated value for the notes. This initial estimated value was determined based on our, BAC’s and our other affiliates’ pricing models, which take into consideration BAC’s internal funding rate and the market prices for the hedging arrangements related to the notes. For more information about the initial estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-34.

|

Terms of the Notes

|

Redemption Amount Determination

|

|

Issuer:

|

BofA Finance LLC (“BofA Finance”)

|

On the maturity date, you will receive a cash payment per unit determined as follows:

|

|

Guarantor:

|

Bank of America Corporation (“BAC”)

|

|

|

Principal Amount:

|

$10.00 per unit

|

|

|

Term:

|

Approximately 14 months

|

|

Market Measure:

|

An equally-weighted basket of 20 cross-sector common stocks, selected by us (by reference to a BofA Global Research screen). See “The Basket” starting on page TS-9 for information about the Basket Stocks, including ticker symbols and weightings on the pricing date. BofA Global Research is a division of BofA Securities, Inc.

|

|

Starting Value:

|

100.00

|

|

Ending Value:

|

The value of the Market Measure on the scheduled calculation day. The scheduled calculation day is subject to postponement in the event of Market Disruption Events, as described on page PS-22 of the accompanying product supplement.

|

|

Participation Rate:

|

300%

|

|

Capped Value:

|

$11.79 per unit, which represents a return of 17.90% over the principal amount.

|

|

Calculation Day:

|

May 22, 2025

|

|

Price Multiplier:

|

1 for each Basket Stock, subject to adjustment for certain corporate events relating to the Basket Stocks described beginning on PS-22 of the accompanying product supplement.

|

|

Fees and Charges:

|

The underwriting discount of $0.175 per unit listed on the cover page and the hedging-related charge of $0.05 per unit described in “Structuring the Notes” on page TS-34.

|

|

Calculation Agent:

|

BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance

|

|

Accelerated Return Notes®

|

TS-2

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

The terms and risks of the notes are contained in this term sheet and in the following:

These documents (together, the “Note Prospectus”) have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website at www.sec.gov or obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322. Before you invest, you should read the Note Prospectus, including this term sheet, for information about us, BAC and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Certain terms used but not defined in this term sheet have the meanings set forth in the accompanying product supplement. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BofA Finance, and not to BAC.

Investor Considerations

|

You may wish to consider an investment in the notes if:

|

|

The notes may not be an appropriate investment for you if:

|

■

You anticipate that the value of the Basket will increase moderately from the Starting Value to the Ending Value.

■

You accept that the Basket consists of a static selection of Basket Stocks with fixed weightings.

■

You are willing to risk a loss of principal and return if the value of the Basket decreases from the Starting Value to the Ending Value.

■

You accept that the return on the notes will be capped.

■

You are willing to forgo the interest payments that are paid on conventional interest-bearing debt securities.

■

You are willing to forgo dividends or other benefits of owning the Basket Stocks.

■

You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our and BAC’s actual and perceived creditworthiness, BAC’s internal funding rate and fees and charges on the notes.

■

You are willing to assume our credit risk, as issuer of the notes, and BAC’s credit risk, as guarantor of the notes, for all payments under the notes, including the Redemption Amount.

|

|

■

You believe that the value of the Basket will decrease from the Starting Value to the Ending Value or that it will not increase sufficiently over the term of the notes to provide you with your desired return.

■

You seek a Basket that is dynamic in nature (meaning, that the Basket Stocks and their weightings can change over the term of the notes).

■

You seek principal repayment or preservation of capital.

■

You seek an uncapped return on your investment.

■

You seek interest payments or other current-income on your investment.

■

You want to receive dividends or other distributions paid on the Basket Stocks.

■

You seek an investment for which there will be a liquid secondary market.

■

You are unwilling or are unable to take market risk on the notes, to take our credit risk, as issuer of the notes, or to take BAC’s credit risk, as guarantor of the notes.

|

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

|

Accelerated Return Notes®

|

TS-3

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Hypothetical Payout Profile and Examples of Payments at Maturity

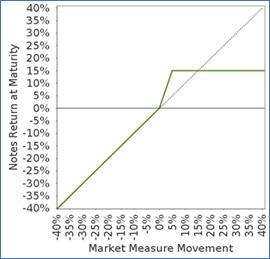

The below graph is based on hypothetical numbers and values.

|

Accelerated Return Notes®

|

This graph reflects the returns on the notes, based on the Participation Rate of 300% and the Capped Value of $11.79 per unit. The green line reflects the returns on the notes, while the dotted gray line reflects the returns of a direct investment in the Basket Stocks, excluding dividends.

This graph has been prepared for purposes of illustration only.

|

The following table and examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the Redemption Amount and total rate of return based on the Starting Value of 100, the Participation Rate of 300%, the Capped Value of $11.79 per unit and a range of hypothetical Ending Values. The actual amount you receive and the resulting total rate of return will depend on the actual Ending Value and whether you hold the notes to maturity. The following examples do not take into account any tax consequences from investing in the notes.

For hypothetical historical values of the Basket, see “The Basket” section below. For recent actual prices of the Basket Stocks, see “The Basket Stocks” section below. The Ending Value will not include any income generated by dividends paid on the Basket Stocks, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer and guarantor credit risk.

|

Ending Value

|

Percentage Change from the Starting Value to the Ending Value

|

Redemption Amount per Unit

|

Total Rate of Return on the Notes

|

|

0.00

|

-100.00%

|

$0.00

|

-100.00%

|

|

50.00

|

-50.00%

|

$5.00

|

-50.00%

|

|

80.00

|

-20.00%

|

$8.00

|

-20.00%

|

|

90.00

|

-10.00%

|

$9.00

|

-10.00%

|

|

94.00

|

-6.00%

|

$9.40

|

-6.00%

|

|

97.00

|

-3.00%

|

$9.70

|

-3.00%

|

|

100.00(1)

|

0.00%

|

$10.00

|

0.00%

|

|

102.00

|

2.00%

|

$10.60

|

6.00%

|

|

103.00

|

3.00%

|

$10.90

|

9.00%

|

|

105.00

|

5.00%

|

$11.50

|

15.00%

|

|

105.97

|

5.97%

|

$11.79(2)

|

17.90%

|

|

110.00

|

10.00%

|

$11.79

|

17.90%

|

|

115.00

|

15.00%

|

$11.79

|

17.90%

|

|

120.00

|

20.00%

|

$11.79

|

17.90%

|

|

130.00

|

30.00%

|

$11.79

|

17.90%

|

|

140.00

|

40.00%

|

$11.79

|

17.90%

|

|

150.00

|

50.00%

|

$11.79

|

17.90%

|

|

160.00

|

60.00%

|

$11.79

|

17.90%

|

|

(1)

|

The Starting Value was set to 100.00 on the pricing date.

|

|

(2)

|

The Redemption Amount per unit cannot exceed the Capped Value.

|

|

Accelerated Return Notes®

|

TS-4

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Redemption Amount Calculation Examples

|

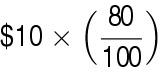

Example 1

|

|

The Ending Value is 80.00, or 80.00% of the Starting Value:

|

|

Starting Value: 100.00

|

|

Ending Value: 80.00

|

|

|

= $8.00 Redemption Amount per unit

|

|

Example 2

|

|

The Ending Value is 103.00, or 103.00% of the Starting Value:

|

|

Starting Value: 100.00

|

|

Ending Value: 103.00

|

|

|

= $10.90 Redemption Amount per unit

|

|

Example 3

|

|

The Ending Value is 130.00, or 130.00% of the Starting Value:

|

|

Starting Value: 100.00

|

|

Ending Value: 130.00

|

|

|

= $19.00, however, because the Redemption Amount for the notes cannot exceed the Capped Value, the Redemption Amount will be $11.79 per unit

|

|

Accelerated Return Notes®

|

TS-5

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-6 of the accompanying product supplement, page S-6 of the Series A MTN prospectus supplement, and page 7 of the prospectus identified above. We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

|

■

|

Depending on the performance of the Basket as measured shortly before the maturity date, your investment may result in a loss; there is no guaranteed return of principal.

|

|

■

|

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity.

|

|

■

|

Payments on the notes are subject to our credit risk, and the credit risk of BAC, and any actual or perceived changes in our or BAC’s creditworthiness are expected to affect the value of the notes. If we and BAC become insolvent or are unable to pay our respective obligations, you may lose your entire investment.

|

|

■

|

Your investment return is limited to the return represented by the Capped Value and may be less than a comparable investment directly in the Basket Stocks.

|

|

■

|

We are a finance subsidiary and, as such, have no independent assets, operations or revenues.

|

|

■

|

BAC’s obligations under its guarantee of the notes will be structurally subordinated to liabilities of its subsidiaries.

|

|

■

|

The notes issued by us will not have the benefit of any cross-default or cross-acceleration with other indebtedness of BofA Finance or BAC; events of bankruptcy or insolvency or resolution proceedings relating to BAC and covenant breach by BAC will not constitute an event of default with respect to the notes.

|

Valuation- and Market-related Risks

|

■

|

The initial estimated value of the notes considers certain assumptions and variables and relies in part on certain forecasts about future events, which may prove to be incorrect. The initial estimated value of the notes is an estimate only, determined as of the pricing date by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of BAC, BAC’s internal funding rate on the pricing date, mid-market terms on hedging transactions, expectations on interest rates and volatility, price-sensitivity analysis, and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect.

|

|

■

|

The public offering price you pay for the notes exceeds the initial estimated value. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, changes in the value of the Basket, changes in BAC’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging-related charge, all as further described in “Structuring the Notes” on page TS-34. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways.

|

|

■

|

The initial estimated value does not represent a minimum or maximum price at which we, BAC, MLPF&S, BofAS or any of our other affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket, our and BAC’s creditworthiness and changes in market conditions.

|

|

■

|

A trading market is not expected to develop for the notes. None of us, BAC, MLPF&S or BofAS is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market.

|

Conflict-related Risks

|

■

|

BAC and its affiliates’ hedging and trading activities (including trades in the Basket Stocks) and any hedging and trading activities BAC or its affiliates engage in that are not for your account or on your behalf, may affect the market value and return of the notes and may create conflicts of interest with you.

|

|

■

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent.

|

Market Measure-related Risks

|

■

|

The Underlying Companies will have no obligations relating to the notes, and none of us, BAC, MLPF&S or BofAS will perform any due diligence procedures with respect to any Underlying Company in connection with this offering.

|

|

■

|

Changes in the price of one of the Basket Stocks may be offset by changes in the prices of the other Basket Stocks.

|

|

■

|

You will have no rights of a holder of the Basket Stocks, and you will not be entitled to receive shares of the Basket Stocks or dividends or other distributions by the Underlying Companies.

|

|

Accelerated Return Notes®

|

TS-6

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

|

■

|

The payment on the notes will not be adjusted for all corporate events that could affect a Basket Stock. See “Description of ARNs—Anti-Dilution Adjustments” beginning on page PS-22 of the accompanying product supplement.

|

|

■

|

While BAC and our other affiliates may from time to time own securities of the Underlying Companies, we, BAC and our other affiliates do not control any Underlying Company, and have not verified any disclosures made by any Underlying Company.

|

Tax-related Risks

|

■

|

The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page PS-32 of the accompanying product supplement.

|

Additional Risk Factors

The Basket Stocks were determined by us, and not by BofA Global Research. BofA Global Research publishes its reports (including any related stock screens) solely in connection with its ordinary course research activities and without regard to the issuer, the notes or the holders of the notes. Any views that BofA Global Research has at the time that it creates its reports are separate and apart from the offering of these notes, do not constitute investment advice, and such views may have changed and /or may change (and may change significantly) prior to the pricing date or settlement date of the notes or during the term of the notes. BofA Global Research’s views also may differ from that of other investment research analysts. No BofA Global Research report is incorporated by reference into this term sheet and you should not view any BofA Global Research report as an offer or solicitation to buy the notes. The notes are being offered to you only on the basis of the information contained in this term sheet and the Note Prospectus.

The inclusion of the Basket Stocks in the Basket does not guarantee a positive return on the notes. There can be no assurance that any Basket Stock which we determine to include in the Basket by reference to a BofA Global Research screen, or the Basket in its entirety, will perform positively. The Basket Stocks may underperform the equities markets generally, may underperform the economic sectors represented by the Basket Stocks, and may underperform other securities in which you may choose to invest and other U.S.-listed companies that may be impacted by the re-shoring of manufacturing chains to the United States. BofA Global Research makes no assurances as to the performance of any securities included in its reports, and makes no assurances as to the performance of the notes. In addition, it is possible that any quantitative criteria that BofA Global Research chose to screen for companies that may be impacted by a particular theme (e.g., re-shoring) will not result in positive performance for any particular company, and such criteria may not be an accurate predictor of which companies may be impacted by the theme. You should undertake your own investigation into each Basket Stock and its issuer, and you should make your own determination as to the potential effect of re-shoring on each Basket Stock during the term of the note.

The Basket Stocks may be selected from a limited number of companies. BofA Global Research, in its ordinary course research activities and without regard to the notes or the holders of the notes, may publish screens based on or, in the case of the re-shoring screen, that include (but are not limited to) stocks that it covers. We and the dealer’s selection of stocks for the Basket includes stocks that are not covered by BofA Global Research. It is possible that a broader or different selection of stocks for the notes could outperform the Basket Stocks.

The Basket does not include all of the stocks in BofA Research’s report (including any related screens). The Basket does not include all of the stocks in BofA Research’s re-shoring screen. Instead, we have selected to include only the top 20 stocks (based on their market capitalization as of February 22, 2024) from BofA Global Research’s screen to include in the Basket. As such, the notes do not reflect the performance of all the constituent stocks included in BofA Global Research’s screen, but only a subset of those stocks. It is possible that if we had included a broader or different selection of stocks, based on market capitalization or other factors, such stocks could have outperformed the Basket Stocks.

The notes are linked to a static basket and, as such, the Basket will not be adjusted during the term of the note due to the poor performance of any Basket Stock or any other reason (other than certain corporate events). The Basket is not dynamic and, subject to adjustments for certain corporate events, its constituents will not change during the term of the notes. If BofA Global Research’s views of a Basket Stock for this note have changed or change at some point in the future, that change will not result in any deletion or addition of Basket Stocks to the Basket. It is possible that, if you invested in a portfolio of stocks that rebalanced periodically, your return would have been different, and perhaps higher, than any return on the notes. In addition, a Basket Stock will remain in the Basket even if such Basket Stock is performing poorly or its issuer experiences financial difficulty. The negative performance of such a Basket Stock will reduce, perhaps significantly, the return on the Basket and, therefore, the return on your notes. See the sections entitled “Descriptions of the ARNS—Market Disruption Events” and “—Anti-Dilution Adjustments” in the accompanying product supplement for information on how certain corporate events may affect the Basket.

Re-shoring of manufacturing to the U.S. may not occur and, even if it does, the Basket Stocks may not benefit. While it is possible that manufacturing chains that were outside of the U.S. will be moved to the U.S. (known as the “re-shoring” of U.S. manufacturing) in light of disruptions that occurred with the global COVID-19 pandemic, trade tensions, geopolitical conflicts and ESG considerations, re-shoring may not occur for a variety of reasons or may take longer to occur than anticipated. Additionally, if re-shoring does occur, it is possible that the Basket Stocks will not be impacted or may be adversely impacted due to, among other things, domestically-oriented companies (based on percentage of the company’s U.S. sales) not being an accurate predictor of or contributor to the impacts that can occur from the re-shoring of manufacturing to the U.S., future events leading to manufacturing being moved

|

Accelerated Return Notes®

|

TS-7

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

outside of the U.S. again, difficulties sourcing workers at economical costs in the U.S., or the Basket Stock companies having an increased focus on non-U.S. sales/investment. If the Basket Stocks don’t benefit, the value of your notes could be adversely affected.

|

Accelerated Return Notes®

|

TS-8

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

The Basket

The Basket is designed to allow investors to participate in the percentage changes of the Basket from the Starting Value to the Ending Value. The Basket Stocks are described in the section “The Basket Stocks” below. Each Basket Stock will be assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of ARNs—Basket Market Measures” beginning on page PS-28 of the accompanying product supplement.

Basket Stock Selection

The notes provide market exposure to an equally-weighted basket of 20 cross-sector common stocks (each, a “Basket Stock”). The Basket Stocks were determined by us by reference to BofA Global Research’s screen intended to identify domestically-oriented companies (i.e., those with 85% or more in U.S. sales) included in the S&P 500® Index with at least 10 years of data that may be impacted by the re-shoring (described more below) of manufacturing chains to the United States. We then selected only the top 20 stocks (based on their market capitalization as of February 22, 2024) from BofA Global Research’s screen to include in the Basket. BofA Global Research publishes its reports, solely in connection with its ordinary course research activities and without regard to the issuer, the notes or the holders of the notes. See “—BofA Global Research Disclaimers” at the end of this section.

“Re-shoring” in this context generally refers to the process of moving the manufacture of a company’s goods/products/services to the U.S. after having conducted such manufacturing operations outside of the U.S. There is no guarantee that any particular company, including any Underlying Company, will realize any benefits associated with re-shoring.

Basket Stock Weights, Closing Market Prices, Component Ratio and Initial Basket Value Contribution

As of the pricing date, for each Basket Stock, the Initial Component Weight, the Closing Market Price, the Component Ratio and the initial contribution to the Basket value would be as follows:

|

Basket Stock

|

|

Bloomberg Symbol

|

|

Initial Component Weight

|

|

Closing Market Price(1)

|

|

Component Ratio(2)

|

|

Initial Basket Value Contribution

|

|

Union Pacific Corporation

|

|

UNP

|

|

5.00%

|

|

$244.63

|

|

0.02043903

|

|

5.00

|

|

AT&T Inc.

|

|

T

|

|

5.00%

|

|

$17.55

|

|

0.28490028

|

|

5.00

|

|

The Charles Schwab Corporation

|

|

SCHW

|

|

5.00%

|

|

$72.38

|

|

0.06907986

|

|

5.00

|

|

Automatic Data Processing, Inc.

|

|

ADP

|

|

5.00%

|

|

$248.33

|

|

0.02013450

|

|

5.00

|

|

Duke Energy Corporation

|

|

DUK

|

|

5.00%

|

|

$96.09

|

|

0.05203455

|

|

5.00

|

|

U.S. Bancorp

|

|

USB

|

|

5.00%

|

|

$44.00

|

|

0.11363636

|

|

5.00

|

|

Humana Inc.

|

|

HUM

|

|

5.00%

|

|

$349.50

|

|

0.01430615

|

|

5.00

|

|

Sempra Energy

|

|

SRE

|

|

5.00%

|

|

$71.25

|

|

0.07017544

|

|

5.00

|

|

American Electric Power Co Inc.

|

|

AEP

|

|

5.00%

|

|

$84.80

|

|

0.05896226

|

|

5.00

|

|

Kinder Morgan, Inc.

|

|

KMI

|

|

5.00%

|

|

$18.15

|

|

0.27548209

|

|

5.00

|

|

Martin Marietta Materials, Inc.

|

|

MLM

|

|

5.00%

|

|

$611.86

|

|

0.00817180

|

|

5.00

|

|

Vulcan Materials Company

|

|

VMC

|

|

5.00%

|

|

$272.79

|

|

0.01832912

|

|

5.00

|

|

Quanta Services, Inc.

|

|

PWR

|

|

5.00%

|

|

$259.75

|

|

0.01924928

|

|

5.00

|

|

Avalonbay Communities, Inc.

|

|

AVB

|

|

5.00%

|

|

$183.69

|

|

0.02721977

|

|

5.00

|

|

T. Rowe Price Group, Inc.

|

|

TROW

|

|

5.00%

|

|

$120.86

|

|

0.04137018

|

|

5.00

|

|

Raymond James Financial, Inc.

|

|

RJF

|

|

5.00%

|

|

$127.40

|

|

0.03924647

|

|

5.00

|

|

Equity Residential

|

|

EQR

|

|

5.00%

|

|

$62.57

|

|

0.07991050

|

|

5.00

|

|

Entergy Corporation

|

|

ETR

|

|

5.00%

|

|

$104.88

|

|

0.04767353

|

|

5.00

|

|

Alexandria Real Estate Equities, Inc.

|

|

ARE

|

|

5.00%

|

|

$127.68

|

|

0.03916040

|

|

5.00

|

|

Ventas, Inc.

|

|

VTR

|

|

5.00%

|

|

$43.63

|

|

0.11460005

|

|

5.00

|

|

|

|

|

|

|

|

|

|

Starting Value

|

|

100.00

|

(1) These were the Closing Market Prices of the Basket Stocks on the pricing date.

(2) Each Component Ratio equals the Initial Component Weight of the relevant Basket Stock (as a percentage) multiplied by 100, and then divided by the Closing Market Price of that Basket Stock on the pricing date and rounded to eight decimal places.

|

Accelerated Return Notes®

|

TS-9

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

The calculation agent will calculate the Ending Value of the Basket by summing the products of the Closing Market Price for each Basket Stock (multiplied by its Price Multiplier) on the calculation day and the Component Ratio applicable to that Basket Stock. The Price Multiplier for each Basket Stock will initially be 1, and is subject to adjustment as described in the product supplement. If a Market Disruption Event or non-trading day occurs as to any Basket Stock on the scheduled calculation day, the Closing Market Price of that Basket Stock will be determined as more fully described in the section entitled “Description of ARNs—Ending Value of the Basket” beginning on page PS-29 of the accompanying product supplement.

|

Accelerated Return Notes®

|

TS-10

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

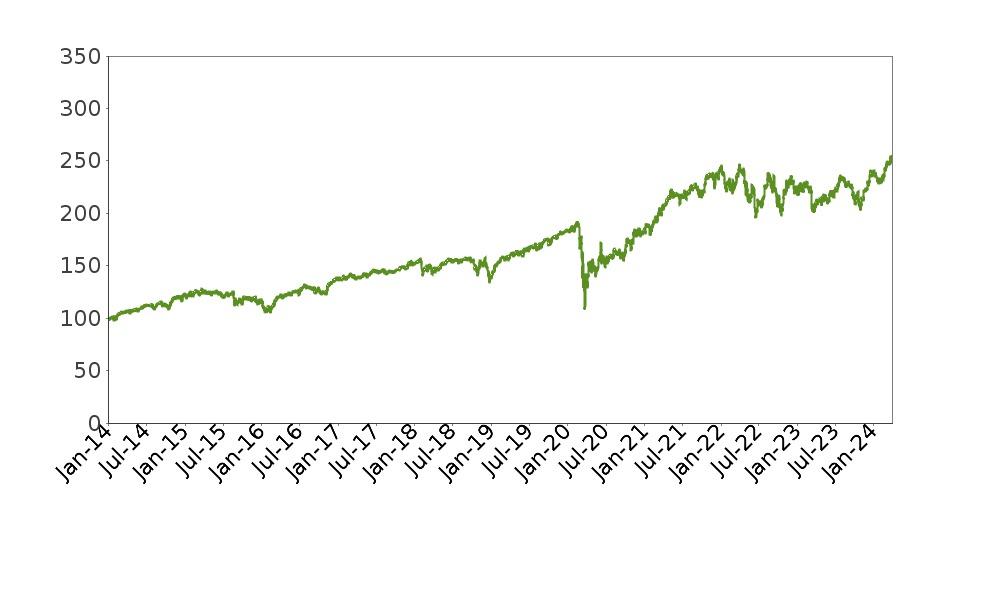

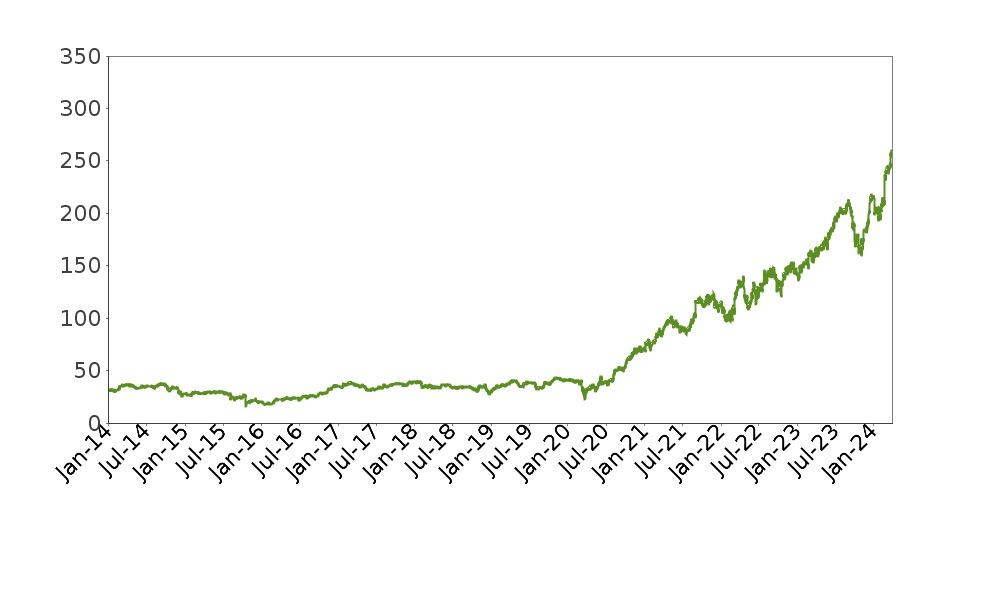

While actual historical information on the Basket did not exist before the pricing date, the following graph sets forth the hypothetical historical daily performance of the Basket from January 1, 2014 through the pricing date. The graph is based upon actual daily historical prices of the Basket Stocks, hypothetical Component Ratios based on the closing prices of the Basket Stocks as of December 31, 2013, and a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any hypothetical historical upward or downward trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

BofA Global Research Disclaimers

The notes are not sponsored or endorsed by BofA Global Research and BofA Global Research makes no representation or warranty, express or implied, to the holders of the notes or any member of the public regarding the advisability of investing in the notes. While we referenced BofA Global Research’s views in determining which Basket Stocks to include in the Basket, BofA Global Research’s views are published solely in connection with its ordinary course research activities and without regard to the issuer of the notes, BofAS, MLPF&S or any holders of the notes. BofA Global Research is not responsible for any decision to include any Basket Stock in the Basket. BofA Global Research has no obligation to (and does not) take the needs of holders of the note into consideration in any determinations it may make in its ordinary course research activities regarding any stocks, whether included in the Basket or not. BofA Global Research is not responsible for and has not participated (and will not participate) in any determination or calculation made with respect to the issuance or any other determination with respect to the notes. BofA Global Research’s research activities are not intended, nor shall they be construed, as a solicitation or offer to buy or sell any security or financial instrument. BofA Global Research has no obligation or liability in connection with the notes.

BofA Global Research shall have no liability whatsoever for any investment decision made by any person in connection with the notes or the use of the Basket Stocks. BofA Global Research makes no warranty, express or implied, as to results, including any losses, to be obtained by the holders of the notes or any other person or entity from the determination by the issuer of the notes or its affiliates to use the Basket Stocks. BofA Global Research makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the Basket Stocks or the notes. Without limiting any of the foregoing, in no event shall BofA Global Research have any liability for any special, punitive, indirect, or consequential damages (including lost profits) arising from the inclusion of the Basket Stocks in the Basket or any decision to invest in the notes, even if notified of the possibility of such damages.

|

Accelerated Return Notes®

|

TS-11

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

The Basket Stocks

We have derived the following information from publicly available documents. We have not independently verified the accuracy or completeness of the following information.

Because each Basket Stock is registered under the Securities Exchange Act of 1934, the Underlying Companies are required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Underlying Companies can be located at the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549 or through the SEC’s website at http://www.sec.gov by reference to the applicable CIK number set forth below.

This term sheet relates only to the notes and does not relate to any securities of the Underlying Companies. Neither we nor any of our affiliates have participated or will participate in the preparation of the Underlying Companies’ publicly available documents. Neither we nor any of our respective affiliates has made any due diligence inquiry with respect to the Underlying Companies in connection with the offering of the notes. None of us, MLPF&S, BofAS or any of our respective affiliates makes any representation that the publicly available documents or any other publicly available information regarding the Underlying Companies are accurate or complete. Furthermore, there can be no assurance that all events occurring prior to the date of this term sheet, including events that would affect the accuracy or completeness of these publicly available documents that would affect the trading price of the Basket Stocks, have been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events concerning an Underlying Company could affect the price of its Basket Stock and therefore could affect your return on the notes. The selection of the Basket Stocks is not a recommendation to buy or sell shares of the Basket Stocks.

|

Accelerated Return Notes®

|

TS-12

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Union Pacific Corporation

Union Pacific Corporation, through its principal operating company, Union Pacific Railroad Company, connects 23 states in the western two-thirds of the United States by rail, providing a link in the global supply chain.. This Basket Stock trades on the NYSE under the symbol “UNP”. The company’s CIK number is 0000100885.

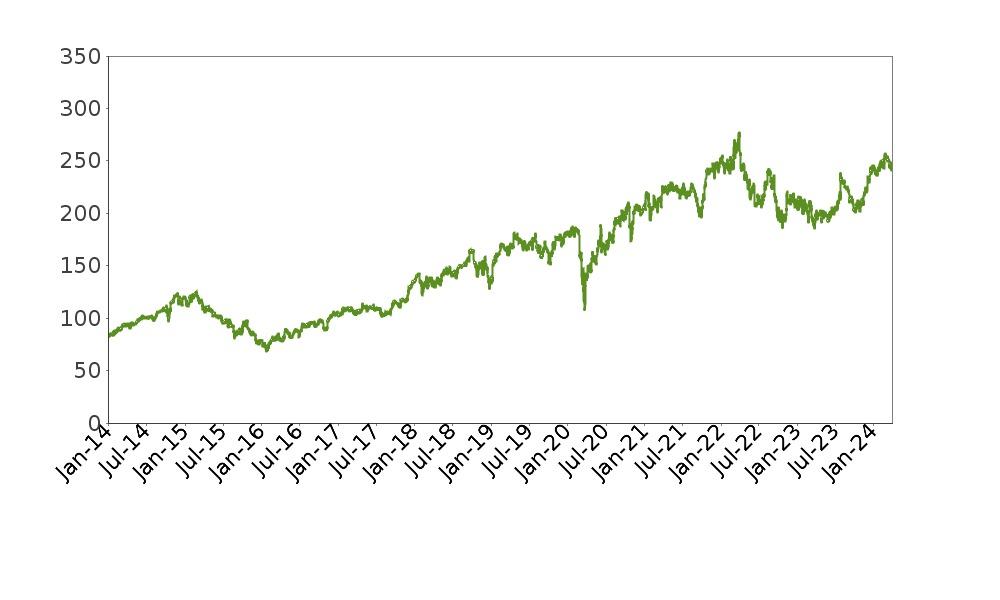

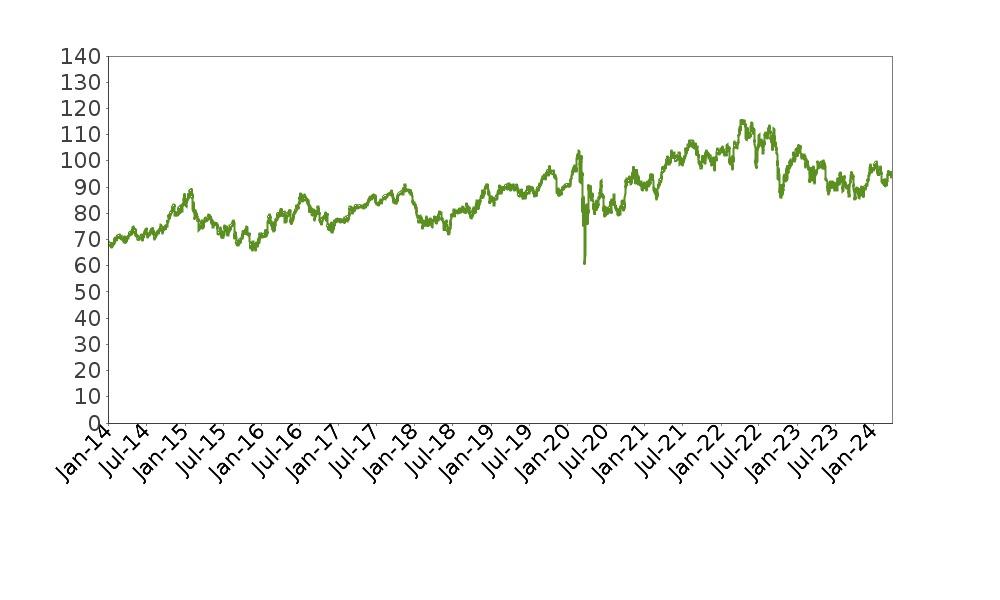

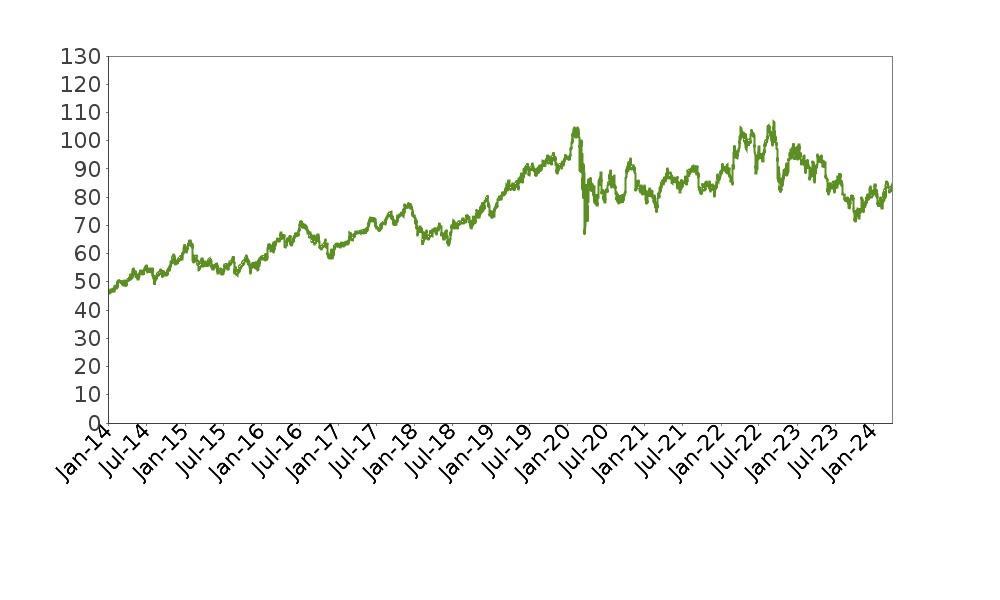

The following graph shows the daily historical performance of UNP on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of UNP was $244.63. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of UNP

This historical data on UNP is not necessarily indicative of the future performance of UNP or what the value of the notes may be. Any historical upward or downward trend in the price per share of the UNP during any period set forth above is not an indication that the price per share of the UNP is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of UNP.

|

Accelerated Return Notes®

|

TS-13

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

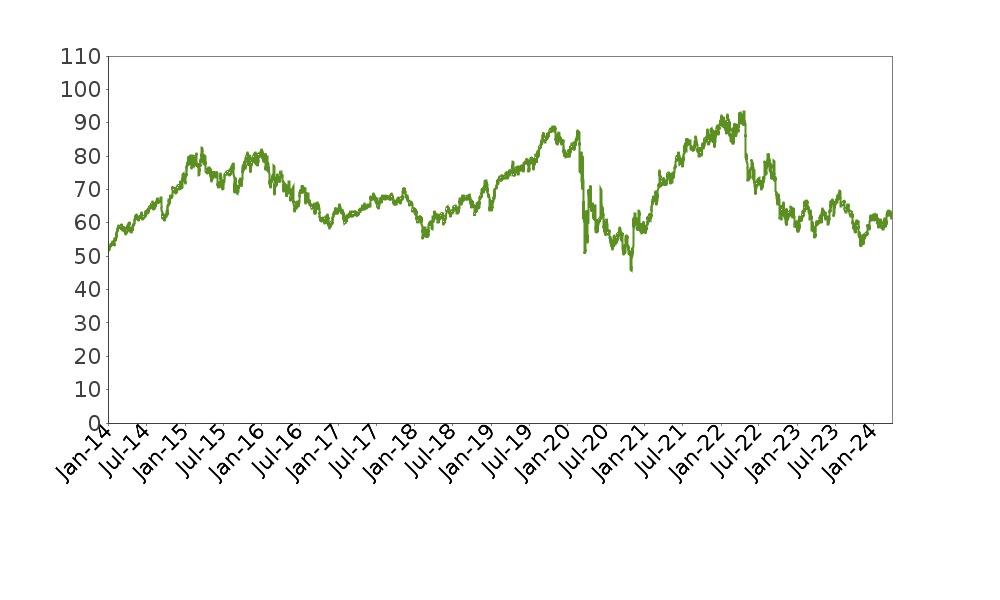

AT&T Inc.

AT&T Inc. is a communications holding company. The company, through its subsidiaries and affiliates, provides local and long-distance phone service, wireless and data communications, Internet access and messaging, IP-based and satellite television, security services, telecommunications equipment, and directory advertising and publishing. This Basket Stock trades on the NYSE under the symbol “T”. The company’s CIK number is 0000732717.

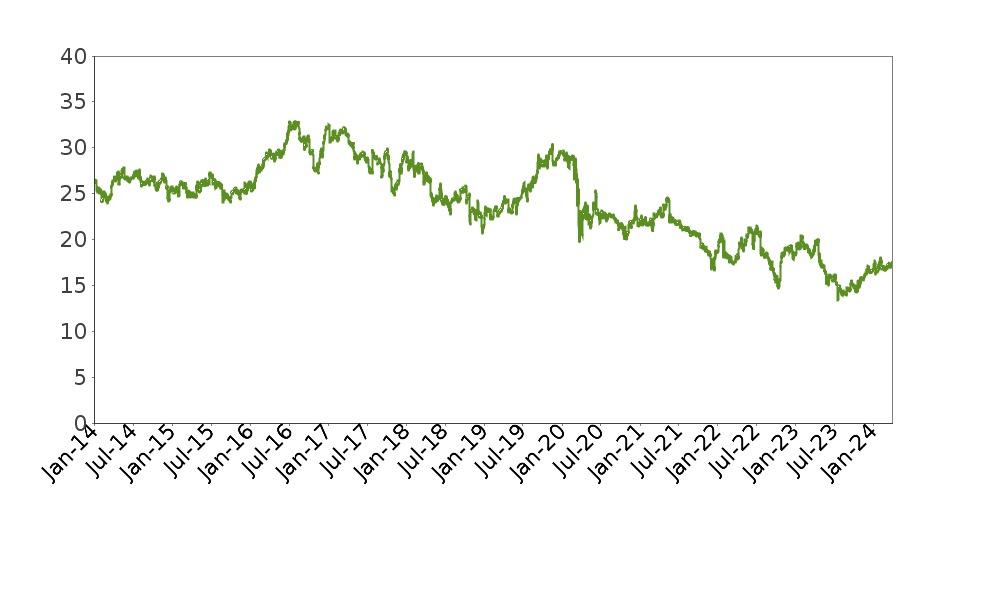

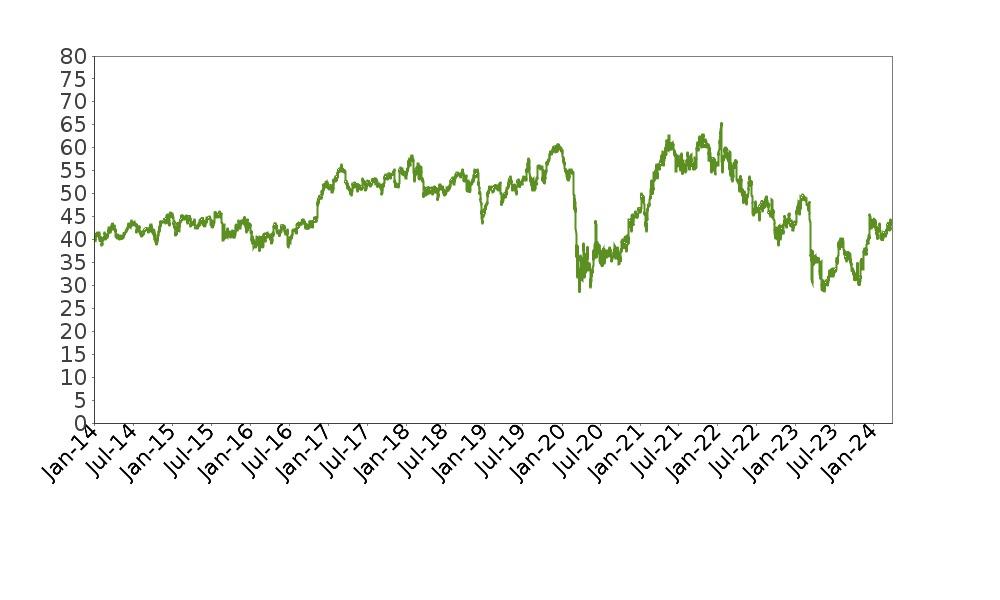

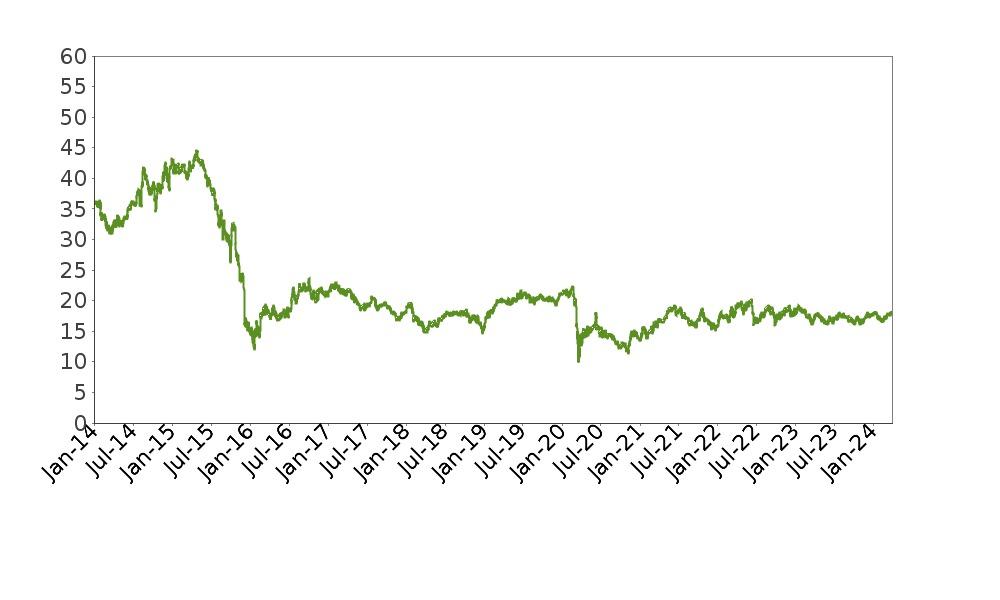

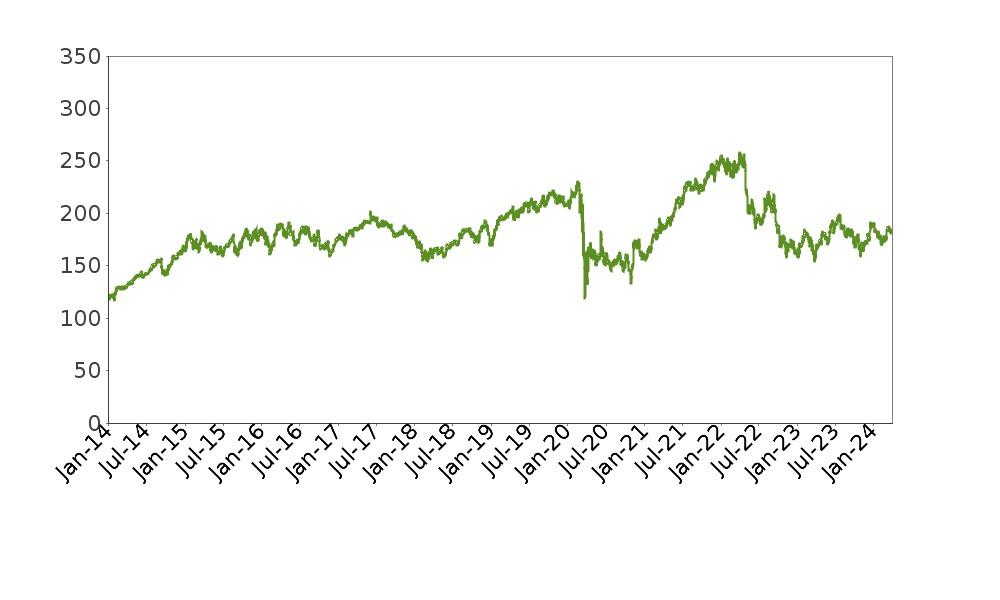

The following graph shows the daily historical performance of T on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of T was $17.55. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of T

This historical data on T is not necessarily indicative of the future performance of T or what the value of the notes may be. Any historical upward or downward trend in the price per share of the T during any period set forth above is not an indication that the price per share of the T is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of T.

|

Accelerated Return Notes®

|

TS-14

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

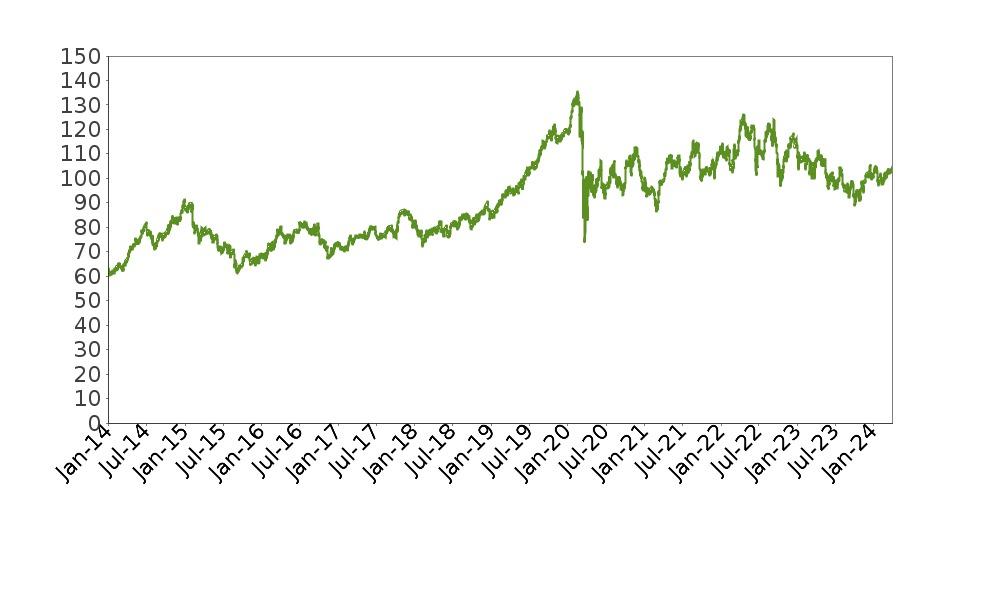

The Charles Schwab Corporation

The Charles Schwab Corporation provides a variety of financial services to individual investors, independent investment managers, retirement plans, and institutions. The company provides its clients with securities brokerage, banking, and related financial services through offices in the United States, Puerto Rico, and the United Kingdom. This Basket Stock trades on the NYSE under the symbol “SCHW”. The company’s CIK number is 0000316709.

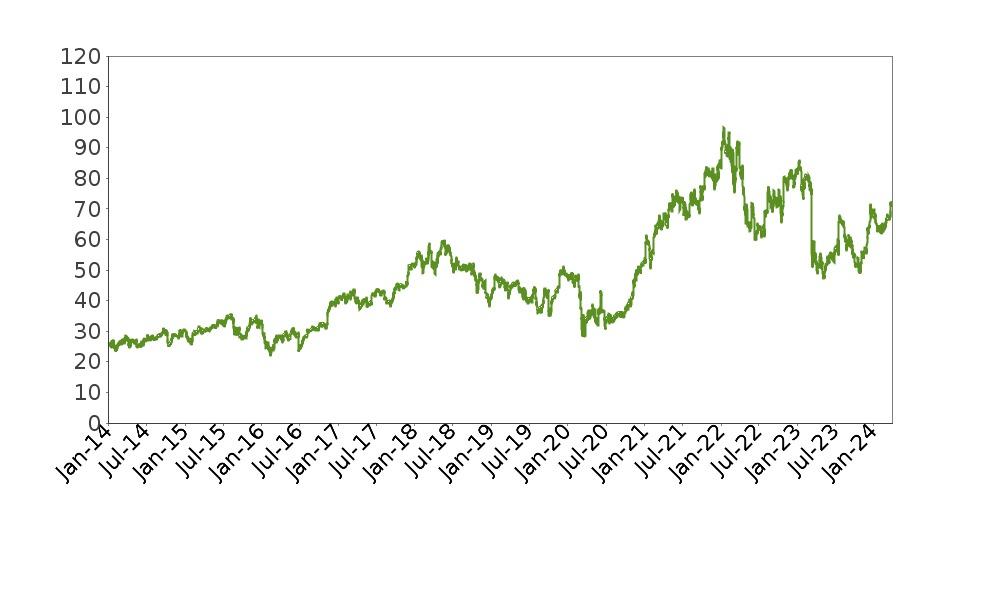

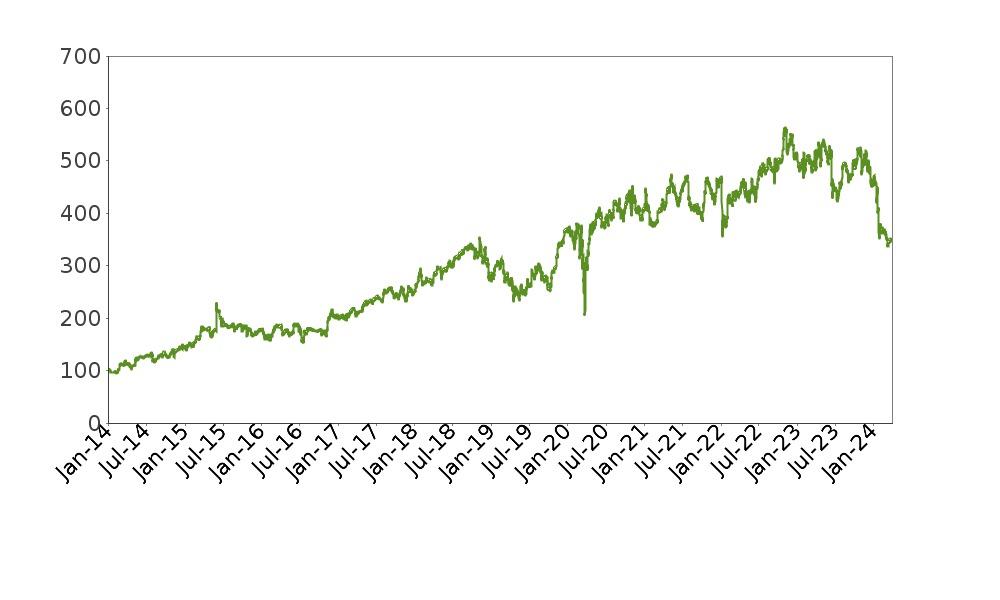

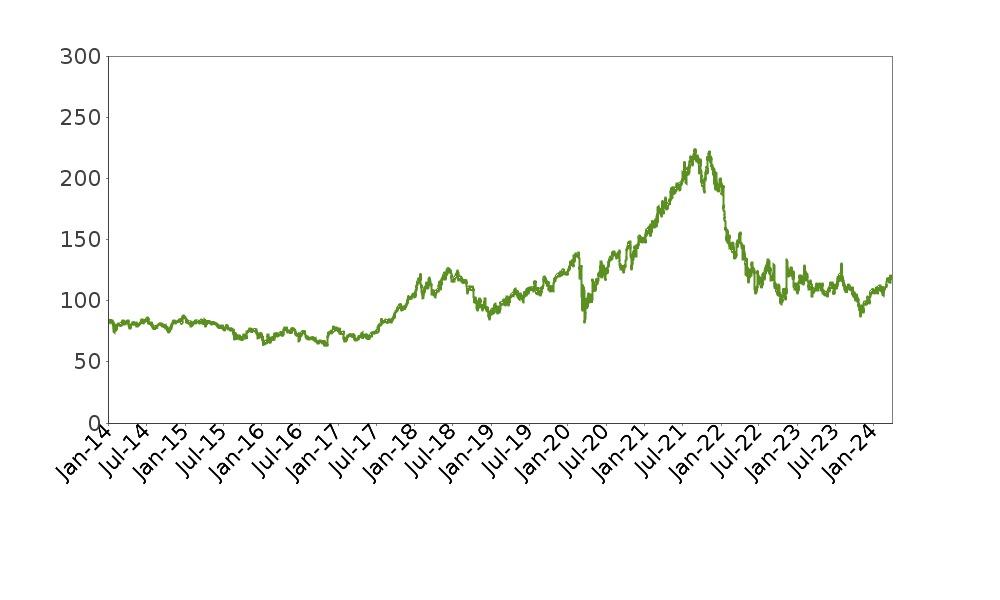

The following graph shows the daily historical performance of SCHW on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of SCHW was $72.38. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of SCHW

This historical data on SCHW is not necessarily indicative of the future performance of SCHW or what the value of the notes may be. Any historical upward or downward trend in the price per share of the SCHW during any period set forth above is not an indication that the price per share of the SCHW is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of SCHW.

|

Accelerated Return Notes®

|

TS-15

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

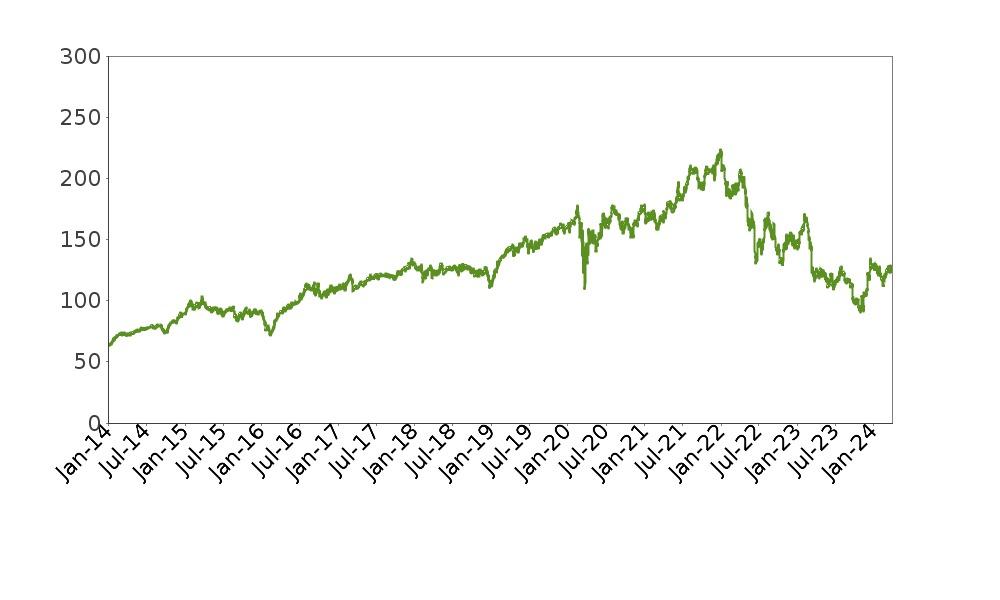

Automatic Data Processing, Inc.

Automatic Data Processing, Inc. is a human resources and payroll company. This Basket Stock trades on the Nasdaq under the symbol “ADP”. The company’s CIK number is 0000008670.

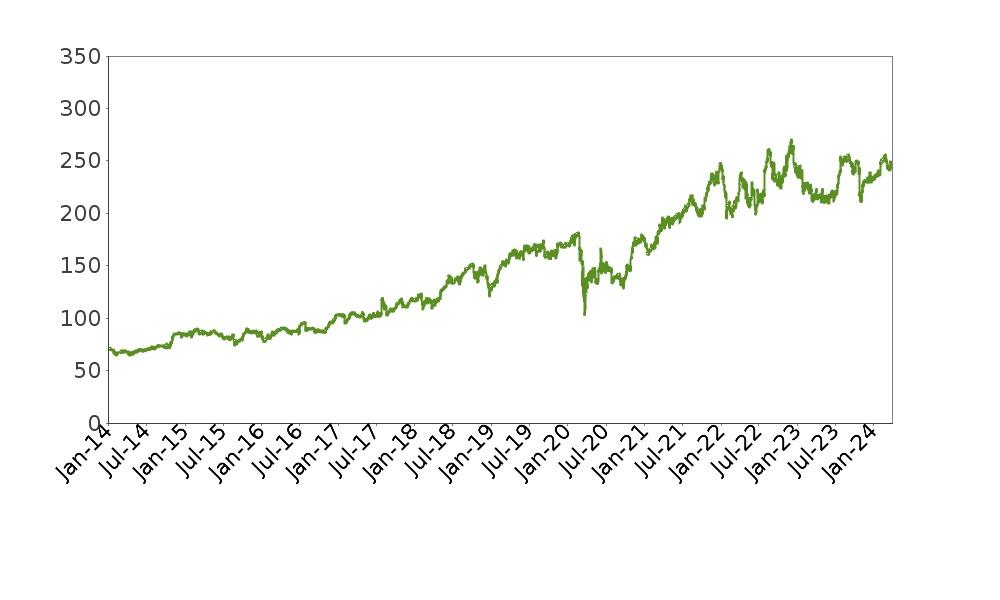

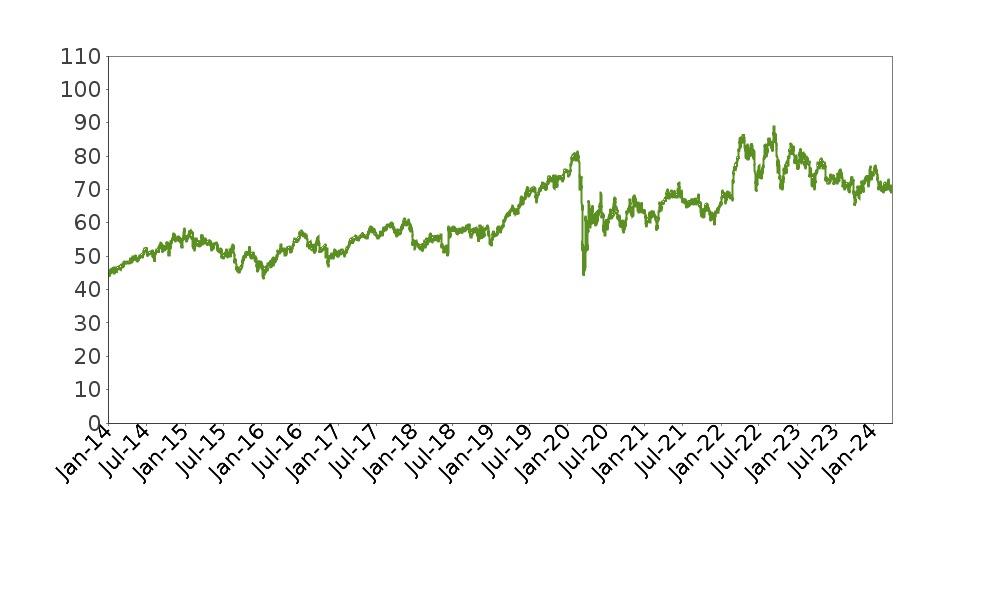

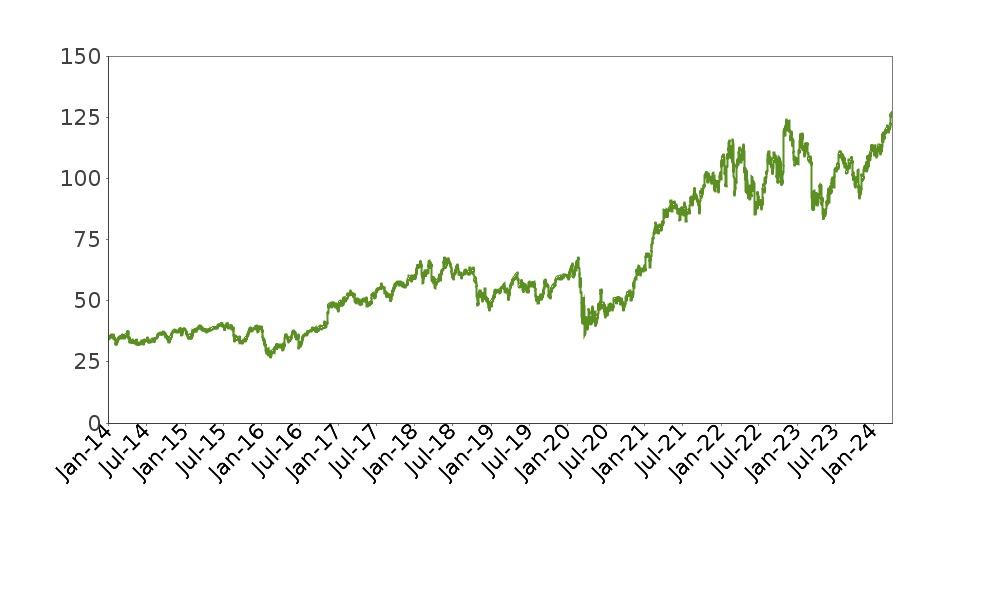

The following graph shows the daily historical performance of ADP on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of ADP was $248.33. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of ADP

This historical data on ADP is not necessarily indicative of the future performance of ADP or what the value of the notes may be. Any historical upward or downward trend in the price per share of the ADP during any period set forth above is not an indication that the price per share of the ADP is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of ADP.

|

Accelerated Return Notes®

|

TS-16

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

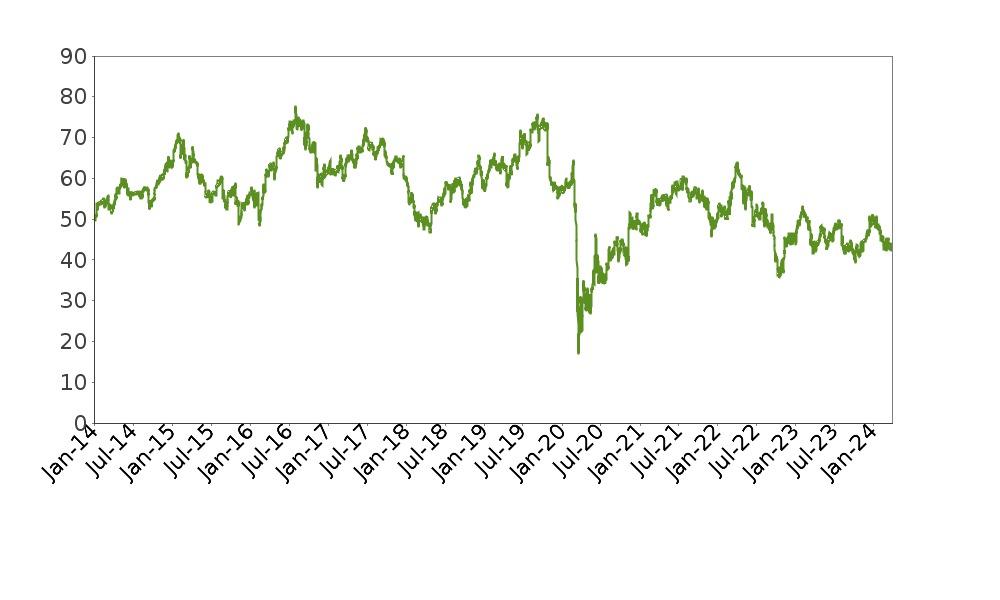

Duke Energy Corporation

Duke Energy Corporation is an energy company that owns a network of energy assets. The company manages a portfolio of natural gas and electric supply, delivery, and trading businesses in the United States and Latin America. This Basket Stock trades on the NYSE under the symbol “DUK”. The company’s CIK number is 0001326160.

The following graph shows the daily historical performance of DUK on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of DUK was $96.09. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of DUK

This historical data on DUK is not necessarily indicative of the future performance of DUK or what the value of the notes may be. Any historical upward or downward trend in the price per share of the DUK during any period set forth above is not an indication that the price per share of the DUK is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of DUK.

|

Accelerated Return Notes®

|

TS-17

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

U.S. Bancorp

U.S. Bancorp provides a range of financial services, including lending and depository services, cash management, capital markets and trust and investment management services. U.S. Bancorp also engages in credit card services, merchant and ATM processing, mortgage banking, insurance, brokerage and leasing. This Basket Stock trades on the NYSE under the symbol “USB”. The company’s CIK number is 0000036104.

The following graph shows the daily historical performance of USB on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of USB was $44.00. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of USB

This historical data on USB is not necessarily indicative of the future performance of USB or what the value of the notes may be. Any historical upward or downward trend in the price per share of the USB during any period set forth above is not an indication that the price per share of the USB is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of USB.

|

Accelerated Return Notes®

|

TS-18

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Humana Inc.

Humana Inc. is a managed health care company with medical members located in the United States and Puerto Rico. The company offers coordinated health care through health maintenance organizations, preferred provider organizations, point-of-service plans, and administrative services products. Humana offers its products to employer groups, government-sponsored plans, and individuals. This Basket Stock trades on the NYSE under the symbol “HUM”. The company’s CIK number is 0000049071.

The following graph shows the daily historical performance of HUM on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of HUM was $349.50. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of HUM

This historical data on HUM is not necessarily indicative of the future performance of HUM or what the value of the notes may be. Any historical upward or downward trend in the price per share of the HUM during any period set forth above is not an indication that the price per share of the HUM is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of HUM.

|

Accelerated Return Notes®

|

TS-19

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Sempra Energy

Sempra Energy operates as an energy infrastructure company. The company focuses on delivering sustainable energy to consumers, and also invests in, develops, and operates transmission and distribution infrastructure and the LNG export market. This Basket Stock trades on the NYSE under the symbol “SRE”. The company’s CIK number is 0001032208.

The following graph shows the daily historical performance of SRE on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of SRE was $71.25. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of SRE

This historical data on SRE is not necessarily indicative of the future performance of SRE or what the value of the notes may be. Any historical upward or downward trend in the price per share of the SRE during any period set forth above is not an indication that the price per share of the SRE is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of SRE.

|

Accelerated Return Notes®

|

TS-20

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

American Electric Power Co Inc.

American Electric Power Co Inc. operates as a public utility holding company. The company generates, transmits, distributes, and sells electricity to residential and commercial customers. This Basket Stock trades on the Nasdaq under the symbol “AEP”. The company’s CIK number is 0000004904.

The following graph shows the daily historical performance of AEP on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of AEP was $84.80. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of AEP

This historical data on AEP is not necessarily indicative of the future performance of AEP or what the value of the notes may be. Any historical upward or downward trend in the price per share of the AEP during any period set forth above is not an indication that the price per share of the AEP is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of AEP.

|

Accelerated Return Notes®

|

TS-21

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Kinder Morgan, Inc.

Kinder Morgan, Inc. is an energy infrastructure company that owns an interest in and operates pipelines, which transport natural gas, refined petroleum products, crude oil, condensate, CO2 and other products, and terminals which store and handle commodities including gasoline, diesel fuel, chemicals, ethanol, metals and petroleum coke. This Basket Stock trades on the NYSE under the symbol “KMI”. The company’s CIK number is 0001506307.

The following graph shows the daily historical performance of KMI on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of KMI was $18.15. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of KMI

This historical data on KMI is not necessarily indicative of the future performance of KMI or what the value of the notes may be. Any historical upward or downward trend in the price per share of the KMI during any period set forth above is not an indication that the price per share of the KMI is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of KMI.

|

Accelerated Return Notes®

|

TS-22

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Martin Marietta Materials, Inc.

Martin Marietta Materials, Inc. is a natural resource-based building materials company. The company supplies aggregates, such as crushed stone, sand and gravel; and cement and downstream products, such as ready mixed concrete, asphalt and paving services. The company also operates a magnesia specialties business that produces magnesia-based chemical products and dolomitic lime. This Basket Stock trades on the NYSE under the symbol “MLM”. The company’s CIK number is 0000916076.

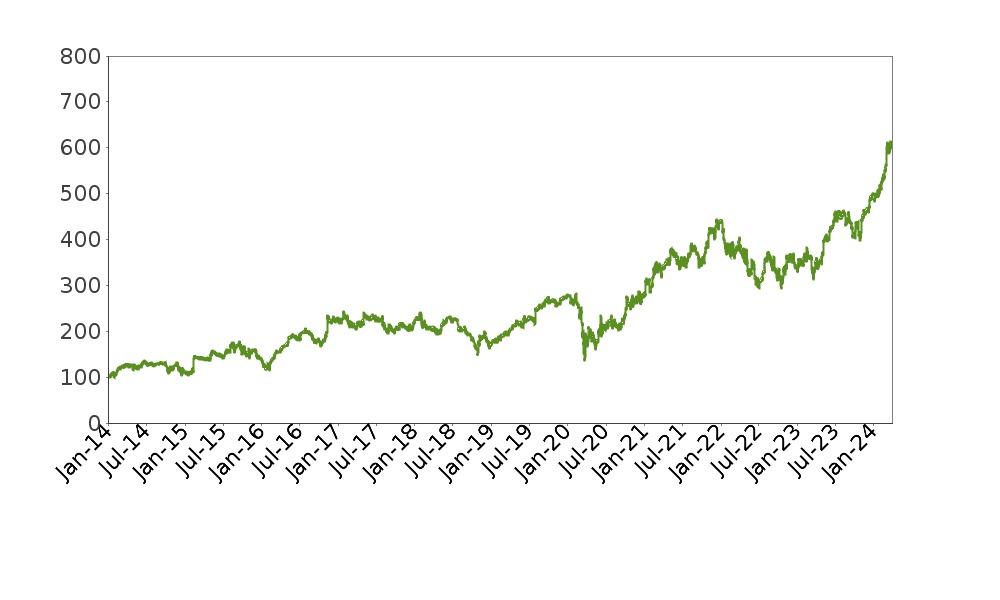

The following graph shows the daily historical performance of MLM on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of MLM was $611.86. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of MLM

This historical data on MLM is not necessarily indicative of the future performance of MLM or what the value of the notes may be. Any historical upward or downward trend in the price per share of the MLM during any period set forth above is not an indication that the price per share of the MLM is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of MLM.

|

Accelerated Return Notes®

|

TS-23

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Vulcan Materials Company

Vulcan Materials Company is a supplier of construction aggregates, a producer of asphalt mix and ready-mixed concrete, and a supplier of construction paving services. This Basket Stock trades on the NYSE under the symbol “VMC”. The company’s CIK number is 0001396009.

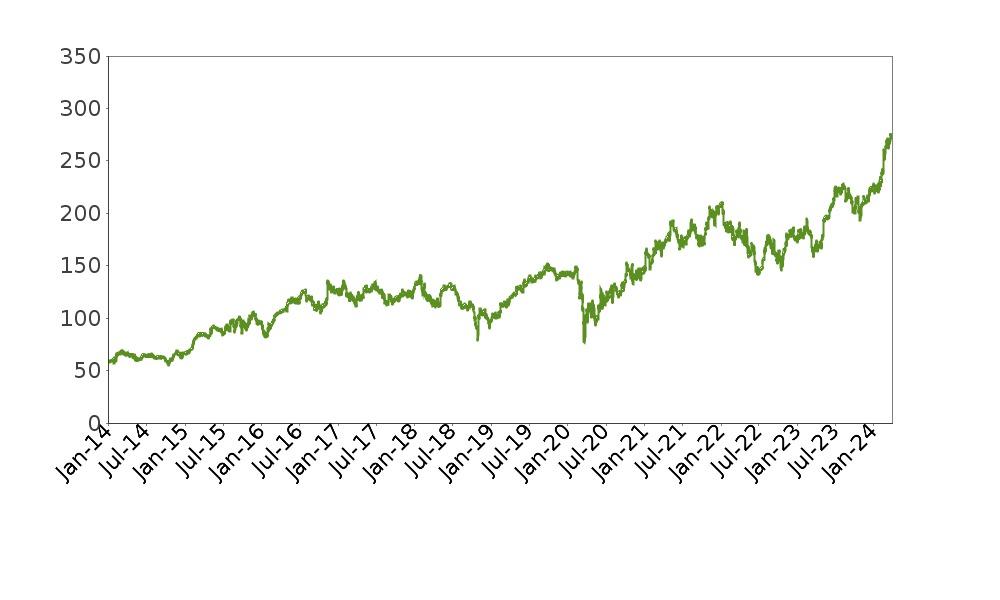

The following graph shows the daily historical performance of VMC on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of VMC was $272.79. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of VMC

This historical data on VMC is not necessarily indicative of the future performance of VMC or what the value of the notes may be. Any historical upward or downward trend in the price per share of the VMC during any period set forth above is not an indication that the price per share of the VMC is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of VMC.

|

Accelerated Return Notes®

|

TS-24

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Quanta Services, Inc.

Quanta Services, Inc. provides infrastructure solutions for the electric and gas utility, renewable energy, communications, pipeline and energy industries. This Basket Stock trades on the NYSE under the symbol “PWR”. The company’s CIK number is 0001050915.

The following graph shows the daily historical performance of PWR on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of PWR was $259.75. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of PWR

This historical data on PWR is not necessarily indicative of the future performance of PWR or what the value of the notes may be. Any historical upward or downward trend in the price per share of the PWR during any period set forth above is not an indication that the price per share of the PWR is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of PWR.

|

Accelerated Return Notes®

|

TS-25

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Avalonbay Communities, Inc.

Avalonbay Communities, Inc. develops, redevelops, acquires, owns and operates multifamily apartment communities in New England, the New York/New Jersey metro area, the Mid-Atlantic, the Pacific Northwest, and Northern and Southern California, as well as in expansion regions of Raleigh-Durham and Charlotte, North Carolina, Southeast Florida, Dallas and Austin, Texas, and Denver, Colorado. This Basket Stock trades on the NYSE under the symbol “AVB”. The company’s CIK number is 0000915912.

The following graph shows the daily historical performance of AVB on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of AVB was $183.69. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of AVB

This historical data on AVB is not necessarily indicative of the future performance of AVB or what the value of the notes may be. Any historical upward or downward trend in the price per share of the AVB during any period set forth above is not an indication that the price per share of the AVB is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of AVB.

|

Accelerated Return Notes®

|

TS-26

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

T. Rowe Price Group, Inc.

T. Rowe Price Group, Inc. is a financial services holding company. This Basket Stock trades on the Nasdaq under the symbol “TROW”. The company’s CIK number is 0001113169.

The following graph shows the daily historical performance of TROW on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of TROW was $120.86. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of TROW

This historical data on TROW is not necessarily indicative of the future performance of TROW or what the value of the notes may be. Any historical upward or downward trend in the price per share of the TROW during any period set forth above is not an indication that the price per share of the TROW is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of TROW.

|

Accelerated Return Notes®

|

TS-27

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Raymond James Financial, Inc.

Raymond James Financial, Inc. provides financial services to individuals, corporations, and municipalities through its subsidiary investment firms. This Basket Stock trades on the NYSE under the symbol “RJF”. The company’s CIK number is 0000720005.

The following graph shows the daily historical performance of RJF on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of RJF was $127.40. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of RJF

This historical data on RJF is not necessarily indicative of the future performance of RJF or what the value of the notes may be. Any historical upward or downward trend in the price per share of the RJF during any period set forth above is not an indication that the price per share of the RJF is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of RJF.

|

Accelerated Return Notes®

|

TS-28

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Equity Residential

Equity Residential is a real estate investment trust. This Basket Stock trades on the NYSE under the symbol “EQR”. The company’s CIK number is 0000906107.

The following graph shows the daily historical performance of EQR on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of EQR was $62.57. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of EQR

This historical data on EQR is not necessarily indicative of the future performance of EQR or what the value of the notes may be. Any historical upward or downward trend in the price per share of the EQR during any period set forth above is not an indication that the price per share of the EQR is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of EQR.

|

Accelerated Return Notes®

|

TS-29

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Entergy Corporation

Entergy Corporation is an energy company primarily engaged in electric power production and retail distribution operations. This Basket Stock trades on the NYSE under the symbol “ETR”. The company’s CIK number is 0000065984.

The following graph shows the daily historical performance of ETR on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of ETR was $104.88. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of ETR

This historical data on ETR is not necessarily indicative of the future performance of ETR or what the value of the notes may be. Any historical upward or downward trend in the price per share of the ETR during any period set forth above is not an indication that the price per share of the ETR is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of ETR.

|

Accelerated Return Notes®

|

TS-30

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Alexandria Real Estate Equities, Inc.

Alexandria Real Estate Equities, Inc. is an owner, operator and developer of collaborative life science, agtech, and technology campuses. This Basket Stock trades on the NYSE under the symbol “ARE”. The company’s CIK number is 0001035443.

The following graph shows the daily historical performance of ARE on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of ARE was $127.68. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of ARE

This historical data on ARE is not necessarily indicative of the future performance of ARE or what the value of the notes may be. Any historical upward or downward trend in the price per share of the ARE during any period set forth above is not an indication that the price per share of the ARE is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of ARE.

|

Accelerated Return Notes®

|

TS-31

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Ventas, Inc.

Ventas, Inc. is a real estate investment trust. This Basket Stock trades on the NYSE under the symbol “VTR”. The company’s CIK number is 0000740260.

The following graph shows the daily historical performance of VTR on its primary exchange in the period from January 1, 2014 through the pricing date. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On the pricing date, the Closing Market Price of VTR was $43.63. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of VTR

This historical data on VTR is not necessarily indicative of the future performance of VTR or what the value of the notes may be. Any historical upward or downward trend in the price per share of the VTR during any period set forth above is not an indication that the price per share of the VTR is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of VTR.

|

Accelerated Return Notes®

|

TS-32

|

|

Accelerated Return Notes®

Linked to a Basket of 20 Cross-Sector Stocks, due May 30, 2025

|

|

Supplement to the Plan of Distribution; Conflicts of Interest

Under our distribution agreement with BofAS, BofAS will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

MLPF&S will purchase the notes from BofAS for resale, and will receive a selling concession in connection with the sale of the notes in an amount up to the full amount of underwriting discount set forth on the cover of this term sheet.

We will pay a fee to LFT Securities, LLC for providing certain electronic platform services with respect to this offering, which will reduce the economic terms of the notes to you. An affiliate of BofAS has an ownership interest in LFT Securities, LLC.