|

|

|

Filed Pursuant to Rule 424(b)(2)

Registration Nos. 333-268718 and 333-268718-01

This pricing supplement, which is not complete and may be changed, relates to an effective Registration Statement under the Securities Act of 1933. This pricing supplement and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these Securities in any country or jurisdiction where such an offer would not be permitted.

|

Preliminary Pricing Supplement

Subject To Completion, dated June 21, 2024

(To Prospectus dated December 30, 2022,

Series A Prospectus Supplement dated December 30, 2022 and

Product Supplement No. WF-1 dated March 8, 2023) |

|

|

|

|

BofA Finance LLC

Medium-Term Notes, Series A

Fully and Unconditionally Guaranteed by Bank of America Corporation |

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

■ Linked to the NASDAQ-100 Index® (the “Underlying”)

■ Unlike ordinary debt securities, the Securities do not pay interest, do not repay a fixed amount of principal at maturity and are subject to potential automatic call upon the terms described below. Whether the Securities are automatically called for a fixed call premium or, if not automatically called, the Maturity Payment Amount, will depend, in each case, on the closing level of the Underlying on the applicable Call Date

■ Automatic Call. If the closing level of the Underlying on any Call Date is greater than or equal to the Starting Value, the Securities will be automatically called for the principal amount plus the Call Premium applicable to that Call Date. The Call Premium applicable to each Call Date will be a percentage of the principal amount that increases for each Call Date based on a simple (non-compounding) return of at least approximately 8.00% per annum (to be determined on the Pricing Date)

At least 8.00% of the principal amount

At least 16.00% of the principal amount

At least 24.00% of the principal amount

June 27, 2028 (the “Final Calculation Day”)

At least 32.00% of the principal amount

* The actual Call Premium applicable to each Call Date will be determined on the Pricing Date

■ Maturity Payment Amount. If the Securities are not automatically called, you will receive a Maturity Payment Amount that could be equal to or less than the principal amount per Security depending on the closing level of the Underlying on the Final Calculation Day as follows:

■

If the closing level of the Underlying on the Final Calculation Day is less than the Starting Value, but not by more than the buffer amount of 10.00%, you will receive the principal amount of your Securities

■

If the closing level of the Underlying on the Final Calculation Day is less than the Starting Value by more than the buffer amount, you will receive less than the principal amount and have 1-to-1 downside exposure to the decrease in the level of the Underlying in excess of the buffer amount

■ Investors may lose up to 90.00% of the principal amount

■ Any positive return on the Securities will be limited to the applicable Call Premium, even if the closing level of the Underlying on the applicable Call Date significantly exceeds the Starting Value. You will not participate in any appreciation of the Underlying beyond the applicable fixed Call Premium

■ All payments on the Securities are subject to the credit risk of BofA Finance LLC (“BofA Finance”), as issuer of the Securities, and Bank of America Corporation (“BAC” or the “Guarantor”), as guarantor of the Securities

■ Securities will not be listed on any securities exchange

■ No periodic interest payments |

The initial estimated value of the Securities as of the Pricing Date is expected to be between $914.25 and $964.25 per Security, which is less than the public offering price listed below. The actual value of your Securities at any time will reflect many factors and cannot be predicted with accuracy. See “Selected Risk Considerations” beginning on page PS-8 of this pricing supplement and “Structuring the Securities” on page PS-19 of this pricing supplement for additional information.

The Securities have complex features and investing in the Securities involves risks not associated with an investment in conventional debt securities. Potential purchasers of the Securities should consider the information in “Selected Risk Considerations” beginning on page PS-8 herein and “Risk Factors” beginning on page PS-5 of the accompanying product supplement, page S-6 of the accompanying prospectus supplement, and page 7 of the accompanying prospectus.

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these Securities or determined if this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Public offering price |

Underwriting Discount(1)(2) |

Proceeds, before expenses, to BofA Finance |

Per Security |

$1,000.00 |

$25.75 |

$974.25 |

Total |

|

|

|

(1) Wells Fargo Securities, LLC and BofA Securities, Inc. are the selling agents for the distribution of the Securities and are acting as principal. See “Terms of the Securities—Selling Agents” in this pricing supplement for further information.

(2) In addition, in respect of certain Securities sold in this offering, BofA Securities, Inc. or one of its affiliates may pay a fee of up to $4.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers.

Wells Fargo Securities |

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Issuer: |

BofA Finance LLC. |

Guarantor: |

BAC. |

Underlying: |

The NASDAQ-100 Index® (Bloomberg symbol: “NDX”), a price return index. |

Pricing Date*: |

June 27, 2024. |

Issue Date*: |

July 2, 2024. |

Maturity Date*: |

June 30, 2028, subject to postponement as described below in “—Market Disruption Events and Postponement Provisions”. The Securities are not subject to repayment at the option of any holder of the Securities prior to the Maturity Date. |

Denominations: |

$1,000 and any integral multiple of $1,000. References in this pricing supplement to a “Security” are to a Security with a principal amount of $1,000. |

Automatic Call: |

If the closing level of the Underlying on any Call Date is greater than or equal to the Starting Value, the Securities will be automatically called, and on the related Call Settlement Date you will be entitled to receive a cash payment per Security in U.S. dollars equal to the principal amount per Security plus the Call Premium applicable to the relevant Call Date. The last Call Date is the Final Calculation Day, and payment upon an automatic call on the Final Calculation Day, if applicable, will be made on the Maturity Date.

Any positive return on the Securities will be limited to the applicable Call Premium, even if the closing level of the Underlying on the applicable Call Date significantly exceeds the Starting Value. You will not participate in any appreciation of the Underlying beyond the applicable Call Premium.

If the Securities are automatically called, they will cease to be outstanding on the related Call Settlement Date and you will have no further rights under the Securities after such Call Settlement Date. You will not receive any notice from us if the Securities are automatically called. |

Call Dates* and Call Premiums: |

The Call Premium applicable to each Call Date will be a percentage of the principal amount that increases for each Call Date based on a simple (non-compounding) return of at least approximately 8.00% per annum (to be determined on the Pricing Date).

The actual Call Premium and payment per Security upon an automatic call that is applicable to each Call Date will be determined on the Pricing Date and will be at least the amounts specified in the table below.

Payment per Security upon an Automatic Call

At least 8.00% of the principal amount

At least 16.00% of the principal amount

At least 24.00% of the principal amount

At least 32.00% of the principal amount

We refer to June 27, 2028 as the “Final Calculation Day.”

The Call Dates are subject to postponement as described below in “—Market Disruption Events and Postponement Provisions”. |

Call Settlement Date: |

Three business days after the applicable Call Date (as each such Call Date may be postponed as described below in “—Market Disruption Events and Postponement Provisions”, if applicable); provided that the Call Settlement Date for the last Call Date is the Maturity Date. |

Maturity Payment Amount: |

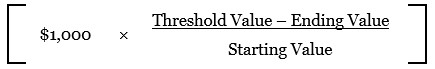

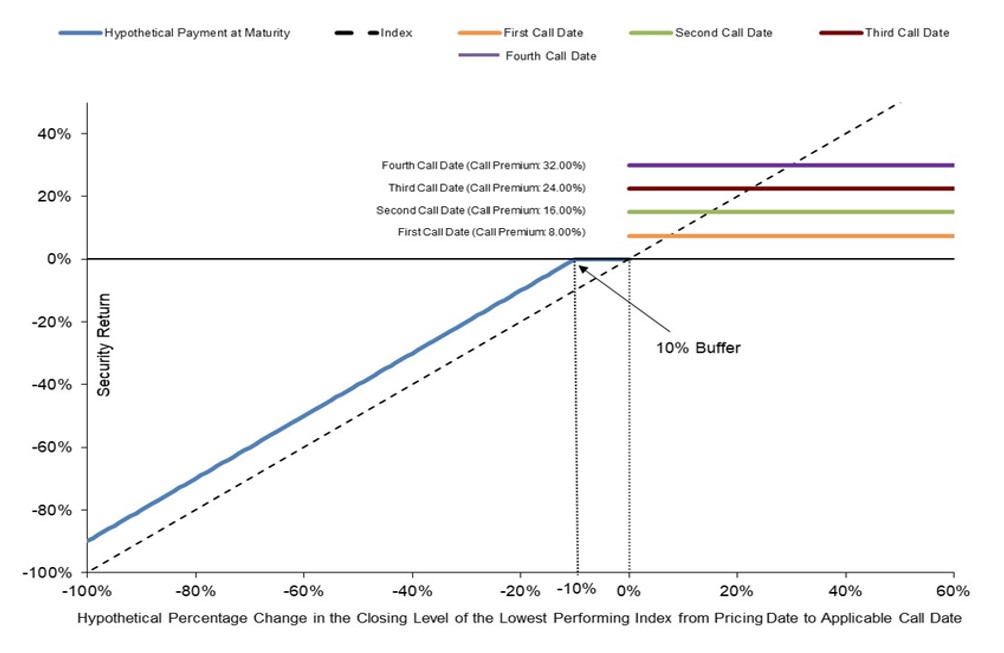

If the Securities are not automatically called, then on the Maturity Date, you will be entitled to receive a cash payment per Security in U.S. dollars equal to the Maturity Payment Amount. The “Maturity Payment Amount” per Security will be calculated as follows:

• if the Ending Value is less than the Starting Value but greater than or equal to the Threshold Value: $1,000; or

• if the Ending Value is less than the Threshold Value: $1,000 minus:

|

PS-2

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

|

If the Securities are not automatically called and the Ending Value is less than the Threshold Value, you will receive less, and possibly 90.00% less, than the principal amount of your Securities at maturity.

|

Closing Level: |

Closing level has the meaning set forth under “General Terms of the Securities—Certain Terms for Securities Linked to an Index—Certain Definitions” in the accompanying product supplement. |

Starting Value: |

, which is the closing level of the Underlying on the Pricing Date. |

Ending Value: |

The “Ending Value” will be the closing level of the Underlying on the Final Calculation Day. |

Threshold Value: |

, which is equal to 90.00% of the Starting Value. |

Market Disruption Events and Postponement Provisions: |

Each Call Date (including the Final Calculation Day) is subject to postponement due to non-trading days and the occurrence of a market disruption event. In addition, the Maturity Date will be postponed if the Final Calculation Day is postponed and will be adjusted for non-business days. For more information regarding adjustments to the Call Dates and the Maturity Date, see “General Terms of the Securities—Consequences of a Market Disruption Event; Postponement of a Calculation Day—Securities Linked to Multiple Market Measures” and “—Payment Dates” in the accompanying product supplement. For purposes of the accompanying product supplement, each Call Date (including the Final Calculation Day) is a “calculation day” and each Call Settlement Date (including the Maturity Date) is a “payment date.” In addition, for information regarding the circumstances that may result in a market disruption event, see “General Terms of the Securities—Certain Terms for Securities Linked to an Index—Market Disruption Events” in the accompanying product supplement. |

Calculation Agent: |

BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance. |

Selling Agents: |

BofAS and Wells Fargo Securities, LLC (“WFS”)

Under our distribution agreement with BofAS, BofAS will purchase the Securities from us as principal at the public offering price indicated on the cover of this pricing supplement, less the indicated underwriting discount. BofAS will sell the Securities to WFS at the public offering price of the Securities less a concession of up to $25.75 per Security. WFS may provide dealers, which may include Wells Fargo Advisors (“WFA”) (the trade name of the retail brokerage business of WFS’s affiliates, Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC), with a selling concession of up to $20.00 per Security. In addition to the concession allowed to WFA, WFS may pay up to $0.75 per Security to WFA as a distribution expense fee for each Security sold by WFA.

In addition, in respect of certain Securities sold in this offering, BofAS or its affiliates may pay a fee of up to $4.00 per Security to selected securities dealers in consideration for marketing and other services in connection with the distribution of the Securities to other securities dealers.

WFS has advised us that if it, WFA or any of their affiliates makes a secondary market in the Securities at any time up to the Issue Date or during the four-month period following the Issue Date, the secondary market price offered by it, WFA or any of their affiliates will be increased by an amount reflecting a portion of the costs associated with selling, structuring and hedging the Securities that are included in the public offering price of the Securities. Because this portion of the costs is not fully deducted upon issuance, WFS has advised us that any secondary market price it, WFA or any of their affiliates offers during this period will be higher than it otherwise would be outside of this period, as any secondary market price offered outside of this period will reflect the full deduction of the costs as described above. WFS has advised us that the amount of this increase in the secondary market price will decline steadily to zero over this four-month period. If you hold the Securities through an account at WFS, WFA or any of their affiliates, WFS has advised us that it expects that this increase will also be reflected in the value indicated for the Securities on your brokerage account statement. If you hold your Securities through an account at a broker-dealer other than WFS, WFA or any of their affiliates, the value of the Securities on your brokerage account statement may be different than if you held your Securities at WFS, WFA or any of their affiliates.

|

PS-3

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Events of Default

and Acceleration: |

If an Event of Default, as defined in the senior indenture relating to the Securities and in the section entitled “Description of Debt Securities of BofA Finance LLC—Events of Default and Rights of Acceleration; Covenant Breaches” on page 54 of the accompanying prospectus, with respect to the Securities occurs and is continuing, the amount payable to a holder of the Securities upon any acceleration permitted under the senior indenture will be equal to the amount described under the caption “Terms of the Securities—Maturity Payment Amount” above, calculated as though the date of acceleration were the Final Calculation Day of the Securities; provided that if the closing level of the Underlying on the date of acceleration is equal to or greater than the Starting Value, then the Maturity Payment Amount will be calculated using a call premium that is prorated to the date of acceleration. In case of a default in the payment of the Securities, whether at their maturity or upon acceleration, the Securities will not bear a default interest rate. |

Material Tax

Consequences: |

For a discussion of the material U.S. federal income and estate tax consequences of the ownership and disposition of the Securities, see “U.S. Federal Income Tax Summary.” |

CUSIP: |

09711DVM1 |

* Subject to change

|

|

PS-4

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Additional Information about BofA Finance, the Guarantor and the Securities |

The terms and risks of the Securities are contained in this pricing supplement and in the following related product supplement, prospectus supplement and prospectus. Information included in this pricing supplement supersedes information in the product supplement, prospectus supplement and prospectus to the extent that it is different from that information. These documents can be accessed at the following links:

• |

Product Supplement No. WF-1 dated March 8, 2023: |

These documents have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website at www.sec.gov or obtained from BofAS by calling 1-800-294-1322. Before you invest, you should read this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus for information about us, BAC and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by this pricing supplement and the accompanying product supplement, prospectus supplement and prospectus. Certain terms used but not defined in this pricing supplement have the meanings set forth in the accompanying product supplement or prospectus supplement. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BofA Finance, and not to BAC.

The Securities are our senior debt securities. Any payments on the Securities are fully and unconditionally guaranteed by BAC. The Securities and the related guarantee are not insured by the Federal Deposit Insurance Corporation or secured by collateral. The Securities will rank equally in right of payment with all of our other unsecured and unsubordinated obligations, except obligations that are subject to any priorities or preferences by law. The related guarantee will rank equally in right of payment with all of BAC’s other unsecured and unsubordinated obligations, except obligations that are subject to any priorities or preferences by law, and senior to its subordinated obligations. Any payments due on the Securities, including any repayment of the principal amount, will be subject to the credit risk of BofA Finance, as issuer, and BAC, as guarantor.

PS-5

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

The Securities are not appropriate for all investors. The Securities may be an appropriate investment for investors who:

■ believe that the closing level of the Underlying will be greater than or equal to the Starting Value on one of the Call Dates;

■ seek the potential for a fixed return if the Underlying has appreciated at all as of any of the Call Dates in lieu of full participation in any potential appreciation of the Underlying;

■ are willing to accept the risk that, if the closing level of the Underlying is less than the Starting Value on each Call Date, they will not receive any positive return on their investment in the Securities;

■ are willing to accept the risk that, if the Securities are not automatically called and the Ending Value the Underlying on the Final Calculation Day is less than the Starting Value by more than the buffer amount of 10.00%, they will receive less, and possibly 90.00% less, than the principal amount of their Securities at maturity; |

■ understand that the term of the Securities may be as short as approximately one year and that they will not receive a higher Call Premium payable with respect to a later Call Date if the Securities are called on an earlier Call Date;

■ are willing to forgo interest payments on the Securities and dividends on securities included in the Underlying; and

■ are willing to hold the Securities until maturity.

The Securities may not be an appropriate investment for investors who:

■ seek a liquid investment or are unable or unwilling to hold the Securities to maturity;

■ require full payment of the principal amount of the Securities at maturity;

■ believe that the closing level of the Underlying will be less than the Starting Value on each Call Date;

■ seek a security with a fixed term;

■ are unwilling to accept the risk that, if the closing level of the Underlying is less than the Starting Value on each Call Date, they will not receive any positive return on their investment in the Securities;

■ are unwilling to accept the risk that the closing level of the Underlying may decrease by more than the buffer amount of 10.00% from the Starting Value to the Ending Value;

■ are unwilling to purchase securities with an estimated value as of the Pricing Date that is lower than the public offering price and that may be as low as the lower estimated value set forth on the cover page;

■ seek current income;

■ are unwilling to accept the risk of exposure to the Underlying;

■ seek exposure to the upside performance of the Underlying beyond the applicable Call Premiums;

■ are unwilling to accept the credit risk of BofA Finance, as issuer, and BAC, as guarantor, to obtain exposure to the Underlying generally, or to obtain exposure to the Underlying that the Securities provide specifically; or

■ prefer the lower risk of conventional fixed income investments with comparable maturities issued by companies with comparable credit ratings.

The considerations identified above are not exhaustive. Whether or not the Securities are an appropriate investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the appropriateness of an investment in the Securities in light of your particular circumstances. You should also review carefully “Selected Risk Considerations” herein and “Risk Factors” in each of the accompanying product supplement, prospectus supplement and prospectus for risks related to an investment in the Securities. For more information about the Underlying, please see the section titled “The NASDAQ-100 Index®” below.

PS-6

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Determining Timing and Amount of Payment on the Securities |

The timing and amount of the payment you will receive will be determined as follows:

PS-7

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Selected Risk Considerations |

The Securities have complex features and investing in the Securities will involve risks not associated with an investment in conventional debt securities. Your decision to purchase the Securities should be made only after carefully considering the risks of an investment in the Securities, including those discussed below, with your advisors in light of your particular circumstances. The Securities are not an appropriate investment for you if you are not knowledgeable about significant elements of the Securities or financial matters in general. You should carefully review the more detailed explanation of risks relating to the Securities in the “Risk Factors” sections beginning on page PS-5 of the accompanying product supplement, page S-6 of the accompanying prospectus supplement and page 7 of the accompanying prospectus.

Structure-related Risks

Your investment may result in a loss; there is no guaranteed return of principal. There is no fixed principal repayment amount on the Securities at maturity. If the Securities are not automatically called and the Ending Value of the Underlying is less than the Threshold Value, at maturity, you will lose 1% of the principal amount for each 1% that the Ending Value of the Underlying is less than the Threshold Value. In that case, you will lose some or a significant portion of your investment in the Securities.

Any positive investment return on the Securities is limited. You will not participate in any increase in the level of the Underlying. Any positive investment return is limited to the applicable Call Premium, if any, regardless of the extent to which the closing level of the Underlying on any Call Date exceeds the Starting Value. In contrast, a direct investment in the securities included in the Underlying would allow you to receive the benefit of any appreciation in their values. Thus, any return on the Securities will not reflect the return you would realize if you actually owned those securities and received the dividends paid or distributions made on them. The return on the Securities may be less than a comparable investment directly in the securities included in or held by the Underlying. There is no guarantee that the Securities will be called for more than the principal amount, and it is possible you will not receive any positive return on the Securities.

The Securities do not bear interest. Unlike a conventional debt security, no interest payments will be paid over the term of the Securities, regardless of the extent to which the closing level of the Underlying exceeds the Starting Value or Threshold Value on any Call Date.

The Call Premium or Maturity Payment Amount, as applicable, will not reflect the level of the Underlying other than on the Call Dates. The levels of the Underlying during the term of the Securities other than on the Call Dates will not affect payments on the Securities. Notwithstanding the foregoing, investors should generally be aware of the performance of the Underlying while holding the Securities, as the performance of the Underlying may influence the market value of the Securities. The calculation agent will determine whether the Securities will be automatically called, and will calculate the Call Premium or the Maturity Payment Amount, as applicable, by comparing only the Starting Value or Threshold Value, as applicable, to the closing level of the Underlying on the applicable Call Date. No other levels of the Underlying will be taken into account. As a result, if the Securities are not automatically called, and the Ending Value of the Underlying is less than the Threshold Value, you will receive less than the principal amount at maturity even if the level of the Underlying was always above the Threshold Value prior to the Final Calculation Day.

The Securities are subject to a potential automatic call, which would limit your ability to receive further payment on the Securities. The Securities are subject to a potential automatic call. The Securities will be automatically called if, on any Call Date, the closing level of the Underlying is greater than or equal to the Starting Value. If the Securities are automatically called, you will be entitled to receive the principal amount and the applicable Call Premium with respect to the applicable Call Date, and no further amounts will be payable with respect to the Securities. In this case, you will lose the opportunity to receive payment of any higher call premium that otherwise would be payable after the date of the automatic call. If the Securities are called, you may be unable to invest in other securities with a similar level of risk that could provide a return that is similar to the Securities.

Your return on the Securities may be less than the yield on a conventional debt security of comparable maturity. Any return that you receive on the Securities may be less than the return you would earn if you purchased a conventional debt security with the same Maturity Date. As a result, your investment in the Securities may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money.

A Call Settlement Date and the Maturity Date may be postponed if a Call Date is postponed. A Call Date (including the Final Calculation Day) with respect to the Underlying will be postponed if the applicable originally scheduled Call Date is not a trading day with respect to the Underlying or if the calculation agent determines that a market disruption event has occurred or is continuing with respect to the Underlying on that Call Date. If such a postponement occurs with respect to a Call Date other than the Final Calculation Day, then the related Call Settlement Date will be postponed. If such a postponement occurs with respect to the Final Calculation Day, the Maturity Date will be the later of (i) the initial Maturity Date and (ii) three business days after the Final Calculation Day as postponed.

Any payment on the Securities is subject to our credit risk and the credit risk of the Guarantor, and actual or perceived changes in our or the Guarantor’s creditworthiness are expected to affect the value of the Securities. The Securities are our senior unsecured debt securities. Any payment on the Securities will be fully and unconditionally guaranteed by the Guarantor. The Securities are not guaranteed by any entity other than the Guarantor. As a result, your receipt of the payment on an automatic call or the Maturity Payment Amount at maturity will be dependent upon our ability and the ability of the Guarantor to repay our respective obligations under the Securities on the applicable payment date, regardless of the closing level of the Underlying as compared to the

PS-8

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Starting Value or Threshold Value, as applicable. No assurance can be given as to what our financial condition or the financial condition of the Guarantor will be at any time after the Pricing Date of the Securities. If we and the Guarantor become unable to meet our respective financial obligations as they become due, you may not receive the amount(s) payable under the terms of the Securities.

In addition, our credit ratings and the credit ratings of the Guarantor are assessments by ratings agencies of our respective abilities to pay our obligations. Consequently, our or the Guarantor’s perceived creditworthiness and actual or anticipated decreases in our or the Guarantor’s credit ratings or increases in the spread between the yield on our respective securities and the yield on U.S. Treasury securities (the “credit spread”) prior to the Maturity Date of your Securities may adversely affect the market value of the Securities. However, because your return on the Securities depends upon factors in addition to our ability and the ability of the Guarantor to pay our respective obligations, such as the level of the Underlying, an improvement in our or the Guarantor’s credit ratings will not reduce the other investment risks related to the Securities.

We are a finance subsidiary and, as such, have no independent assets, operations or revenues. We are a finance subsidiary of the Guarantor, have no operations other than those related to the issuance, administration and repayment of our debt securities that are guaranteed by the Guarantor, and are dependent upon the Guarantor and/or its other subsidiaries to meet our obligations under the Securities in the ordinary course. Therefore, our ability to make payments on the Securities may be limited.

Valuation- and Market-related Risks

The public offering price you pay for the Securities will exceed their initial estimated value. The range of initial estimated values of the Securities that is provided on the cover page of this preliminary pricing supplement, and the initial estimated value as of the Pricing Date that will be provided in the final pricing supplement, are each estimates only, determined as of a particular point in time by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of the Guarantor, the Guarantor’s internal funding rate, mid-market terms on hedging transactions, expectations on interest rates, dividends and volatility, price-sensitivity analysis, and the expected term of the Securities. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. If you attempt to sell the Securities prior to maturity, their market value may be lower than the price you paid for them and lower than their initial estimated value. This is due to, among other things, changes in the level of the Underlying, changes in the Guarantor’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging related charges, all as further described in "Structuring the Securities" below. These factors, together with various credit, market and economic factors over the term of the Securities, are expected to reduce the price at which you may be able to sell the Securities in any secondary market and will affect the value of the Securities in complex and unpredictable ways.

The initial estimated value does not represent a minimum or maximum price at which we, BAC, BofAS or any of our other affiliates or WFS or its affiliates would be willing to purchase your Securities in any secondary market (if any exists) at any time. The value of your Securities at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Underlying, our and BAC’s creditworthiness and changes in market conditions.

We cannot assure you that a trading market for your Securities will ever develop or be maintained. We will not list the Securities on any securities exchange. We cannot predict how the Securities will trade in any secondary market or whether that market will be liquid or illiquid.

The Securities are not designed to be short-term trading instruments, and if you attempt to sell the Securities prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the principal amount. The following factors are expected to affect the value of the Securities: level of the Underlying at such time; volatility of the Underlying; economic and other conditions generally; interest rates; dividend yields; exchange rate movements and volatility; our and the Guarantor’s financial condition and creditworthiness; and time to maturity.

Conflict-related Risks

Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, and WFS and its affiliates, may create conflicts of interest with you and may affect your return on the Securities and their market value. We, the Guarantor or one or more of our other affiliates, including BofAS, and WFS and its affiliates, may buy or sell the securities held by or included in the Underlying, or futures or options contracts on the Underlying or those securities, or other listed or over-the-counter derivative instruments linked to the Underlying or those securities. While we, the Guarantor or one or more of our other affiliates, including BofAS, and WFS and its affiliates, may from time to time own securities represented by the Underlying, except to the extent that BAC’s or Wells Fargo & Company’s (the parent company of WFS) common stock may be included in the Underlying, as applicable, we, the Guarantor and our other affiliates, including BofAS, and WFS and its affiliates, do not control any company included in the Underlying, and have not verified any disclosure made by any other company. We, the Guarantor or one or more of our other affiliates, including BofAS, or WFS and its affiliates, may execute such purchases or sales for our own or their own accounts, for business reasons, or in connection with hedging our obligations under the Securities. These transactions may present a conflict of interest between your interest in the Securities and the interests we, the Guarantor and our other affiliates, including BofAS, and WFS and its affiliates, may have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These transactions may adversely affect the level of the Underlying in a manner that could be adverse to your investment in the Securities. On or before the Pricing Date, any purchases or sales by us, the Guarantor or our other affiliates, including BofAS or others on its behalf, and WFS and its affiliates (including for the purpose of hedging some or all of our anticipated exposure in connection with the Securities), may affect the level of the Underlying. Consequently, the level of the Underlying may change subsequent to the Pricing Date, which may adversely affect the market value of the Securities.

PS-9

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

We, the Guarantor or one or more of our other affiliates, including BofAS, and WFS and its affiliates, also expect to engage in hedging activities that could affect the level of the Underlying on the Pricing Date. In addition, these hedging activities, including the unwinding of a hedge, may decrease the market value of your Securities prior to maturity, and may affect the amounts to be paid on the Securities. We, the Guarantor or one or more of our other affiliates, including BofAS, and WFS and its affiliates, may purchase or otherwise acquire a long or short position in the Securities and may hold or resell the Securities. For example, BofAS may enter into these transactions in connection with any market making activities in which it engages. We cannot assure you that these activities will not adversely affect the level of the Underlying, the market value of your Securities prior to maturity or the amounts payable on the Securities.

If WFS, BofAS or an affiliate of either selling agent participating as a dealer in the distribution of the Securities conducts hedging activities for us in connection with the Securities, such selling agent or participating dealer will expect to realize a projected profit from such hedging activities, and this projected profit will be in addition to any discount, concession or fee received in connection with the sale of the Securities to you. This additional projected profit may create a further incentive for the selling agents or participating dealers to sell the Securities to you.

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the Securities and, as such, will make a variety of determinations relating to the Securities, including the amounts that will be paid on the Securities. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent.

Underlying-related Risks

Any payments on the Securities and whether the Securities are automatically called will depend upon the performance of the Underlying, and therefore the Securities are subject to the following risks, each as discussed in more detail in the accompanying product supplement.

● |

Changes that affect the Index may adversely affect the value of the Securities and any payments on the Securities. |

● |

We and our affiliates have no affiliation with the index sponsor and have not independently verified its public disclosure of information. |

The Securities are subject to risks associated with foreign securities markets. The NDX includes certain foreign equity securities. You should be aware that investments in securities linked to the value of foreign equity securities involve particular risks. The foreign securities markets comprising the NDX may have less liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information about foreign companies than about those U.S. companies that are subject to the reporting requirements of the SEC, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies. Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors, which could negatively affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural disaster or adverse public health developments in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency.

Tax-related Risks

The U.S. federal income and estate tax consequences of the Securities are uncertain, and may be adverse to a holder of the Securities. See “U.S. Federal Income Tax Summary” below and “U.S. Federal Income Tax Summary” beginning on page PS-36 of the accompanying product supplement.

PS-10

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

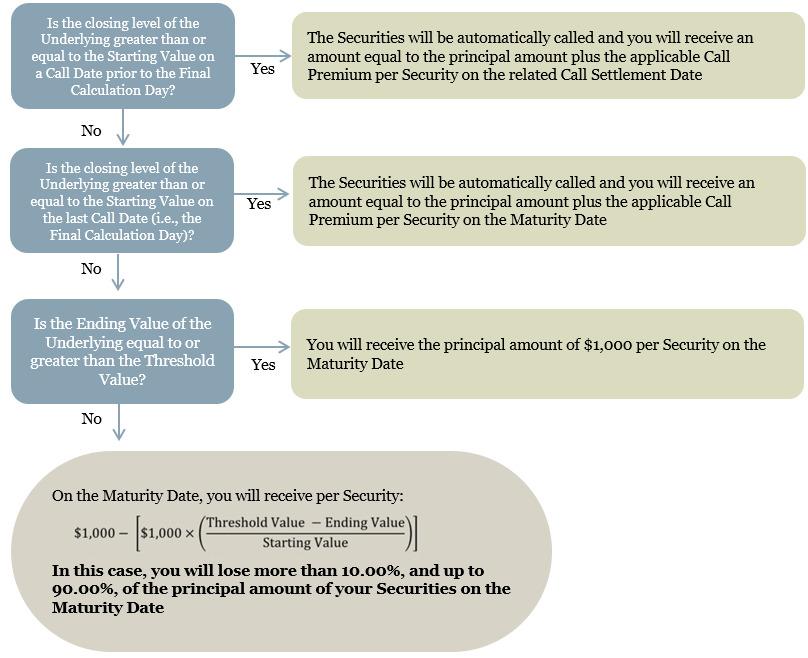

Hypothetical Examples and Returns |

The payout profile, hypothetical returns and examples below illustrate hypothetical payments upon an automatic call or at maturity for a $1,000 principal amount security on a hypothetical offering of securities under various scenarios, with the assumptions set forth in the table below. The terms used for purposes of these hypothetical examples do not represent the actual Starting Value or Threshold Value of the Underlying. The hypothetical Starting Value of 100.00 for the Underlying has been chosen for illustrative purposes only and does not represent the actual Starting Value of the Underlying. The actual Starting Value and Threshold Value for the Underlying will be determined on the Pricing Date and will be set forth under “Terms of the Securities” above. For historical data regarding the actual closing levels of the Underlying, see the historical information set forth herein. The payout profile, return table and examples below assume that an investor purchases the Securities for $1,000 per Security. These examples are for purposes of illustration only and the values used in the examples may have been rounded for ease of analysis. The actual amount you receive at stated maturity or upon automatic call and the resulting pre-tax total rate of return will depend on the actual terms of the Securities.

Hypothetical Call Premiums: |

8.00% for the first Call Date, 16.00% for the second Call Date, 24.00% for the third Call Date and 32.00% for the fourth Call Date (assuming that a Call Premium is equal to the lowest possible Call Premium that will be determined on the Pricing Date) |

Hypothetical Starting Value: |

100.00 |

Hypothetical Threshold Value: |

90.00 (90% of the hypothetical Starting Value) |

Hypothetical Payout Profile

PS-11

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

Hypothetical Returns

If the Securities are automatically called:

|

|

|

Hypothetical Call Date on which Securities are automatically called |

Hypothetical payment per Security on related Call Settlement Date |

Hypothetical pre-tax total rate of return |

1st Call Date |

$1,080.00 |

8.00% |

2nd Call Date |

$1,160.00 |

16.00% |

3rd Call Date |

$1,240.00 |

24.00% |

4th Call Date |

$1,320.00 |

32.00% |

If the Securities are not automatically called:

|

|

|

|

Hypothetical

Ending Value |

Hypothetical percentage change from the hypothetical Starting Value to the hypothetical Ending Value |

Hypothetical Maturity Payment Amount per Security |

Hypothetical pre-tax total rate of return |

95.00 |

-5.00% |

$1,000.00 |

0.00% |

90.00 |

-10.00% |

$1,000.00 |

0.00% |

85.00 |

-15.00% |

$950.00 |

-5.00% |

80.00 |

-20.00% |

$900.00 |

-10.00% |

75.00 |

-25.00% |

$850.00 |

-15.00% |

50.00 |

-50.00% |

$600.00 |

-40.00% |

25.00 |

-75.00% |

$350.00 |

-65.00% |

0.00 |

-100.00% |

$100.00 |

-90.00% |

Hypothetical Examples Of Payment Upon An Automatic Call Or At Maturity

Example 1. The closing level of the Underlying on the first Call Date is greater than the Starting Value, and the Securities are automatically called on the first Call Date:

|

NASDAQ-100 Index® |

Hypothetical Starting Value: |

100.00 |

Hypothetical closing level on first Call Date: |

125.00 |

Because the hypothetical closing level of the Underlying on the first Call Date is greater than the hypothetical Starting Value, the Securities are automatically called on the first Call Date and you will receive on the related Call Settlement Date the principal amount of your Securities plus a Call Premium of 8.00% of the principal amount. Even though the Underlying appreciated by 25.00% from the Starting Value to its closing level on the first Call Date in this example, your return is limited to the Call Premium of 8.00% that is applicable to such Call Date.

On the Call Settlement Date, you would receive $1,080.00 per Security.

Example 2. The Securities are not automatically called prior to the last Call Date (the Final Calculation Day). The closing level of the Underlying on the Final Calculation Day is greater than the Starting Value, and the Securities are automatically called:

|

NASDAQ-100 Index® |

Hypothetical Starting Value: |

100.00 |

Hypothetical closing level on Call Dates prior to the Final Calculation Day: |

Various (all below Starting Value) |

Hypothetical closing level on Final Calculation Day: |

120.00 |

Because the hypothetical closing level of the Underlying on each Call Date prior to the last Call Date (which is the Final Calculation Day) is less than the hypothetical Starting Value, the Securities are not called prior to the Final Calculation Day. Because the hypothetical closing level of the Underlying on the Final Calculation Day is greater than the hypothetical Starting Value, the Securities are automatically called and you will receive on the related Call Settlement Date (which is the Maturity Date) the principal amount of your Securities plus a Call Premium of 32.00% of the principal amount.

On the Call Settlement Date (which is the Maturity Date), you would receive $1,320.00 per Security

PS-12

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

|

|

Hypothetical Payments at Stated Maturity (Continued) |

Example 3. The Securities are not automatically called. The Ending Value is less than the Starting Value but greater than the Threshold Value and the Maturity Payment Amount is equal to the principal amount:

|

NASDAQ-100 Index® |

Hypothetical Starting Value: |

100.00 |

Hypothetical closing levels on Call Dates prior to the Final Calculation Day: |

Various (all below Starting Value) |

Hypothetical Ending Value: |

95.00 |

Hypothetical Threshold Value: |

90.00, which is 90.00% of the hypothetical Starting Value |

Because the hypothetical closing level of the Underlying on each Call Date (including the Final Calculation Day) is less than the hypothetical Starting Value, the Securities are not automatically called. Because the hypothetical Ending Value is less than the hypothetical Starting Value, but not by more than the buffer amount of 10.00%, you would receive the principal amount of your Securities at maturity.

On the Maturity Date, you would receive $1,000.00 per Security.

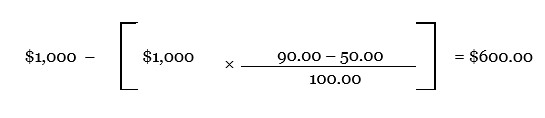

Example 4. The Securities are not automatically called. The Ending Value is less than the Threshold Value and the Maturity Payment Amount is less than the principal amount:

|

NASDAQ-100 Index® |

Hypothetical Starting Value: |

100.00 |

Hypothetical closing levels on Call Dates prior to the Final Calculation Day: |

Various (all below Starting Value) |

Hypothetical Ending Value: |

50.00 |

Hypothetical Threshold Value: |

90.00, which is 90.00% of the hypothetical Starting Value |

Because the hypothetical closing level of the Underlying on each Call Date (including the Final Calculation Day) is less than the hypothetical Starting Value, the Securities are not automatically called. Because the hypothetical Ending Value is less than the hypothetical Starting Value by more than the buffer amount of 10.00%, you would lose a portion of the principal amount of your Securities and would be paid a Maturity Payment Amount equal to:

On the Maturity Date, you would receive $600.00 per Security, resulting in a loss of 40.00%.

PS-13

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

The NDX is intended to measure the performance of the 100 largest domestic and international non-financial securities listed on The Nasdaq Stock Market (“NASDAQ”) based on market capitalization. The NDX reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

The NDX began trading on January 31, 1985 at a base value of 125.00. The NDX is calculated and published by Nasdaq, Inc. In administering the NDX, Nasdaq, Inc. will exercise reasonable discretion as it deems appropriate.

Underlying Stock Eligibility Criteria

NDX eligibility is limited to specific security types only. The security types eligible for the NDX include foreign or domestic common stocks, ordinary shares, ADRs and tracking stocks. Security types not included in the NDX are closed-end funds, convertible debt securities, exchange traded funds, limited liability companies, limited partnership interests, preferred stocks, rights, shares or units of beneficial interest, warrants, units, and other derivative securities. The NDX does not contain securities of investment companies. For purposes of the NDX eligibility criteria, if the security is a depositary receipt representing a security of a non-U.S. issuer, then references to the “issuer” are references to the issuer of the underlying security.

Initial Eligibility Criteria

To be eligible for initial inclusion in the NDX, a security must be listed on NASDAQ and meet the following criteria:

● |

the security’s U.S. listing must be exclusively on the Nasdaq Global Select Market or the Nasdaq Global Market (unless the security was dually listed on another U.S. market prior to January 1, 2004 and has continuously maintained such listing); |

● |

the security must be of a non-financial company; |

● |

the security may not be issued by an issuer currently in bankruptcy proceedings; |

● |

the security must have a minimum three-month average daily trading volume of at least 200,000 shares; |

● |

if the issuer of the security is organized under the laws of a jurisdiction outside the U.S., then such security must have listed options on a recognized options market in the U.S. or be eligible for listed-options trading on a recognized options market in the U.S.; |

● |

the issuer of the security may not have entered into a definitive agreement or other arrangement which would likely result in the security no longer being eligible for inclusion in the NDX; |

● |

the issuer of the security may not have annual financial statements with an audit opinion that is currently withdrawn; and |

● |

the issuer of the security must have “seasoned” on NASDAQ, the New York Stock Exchange or NYSE Amex. Generally, a company is considered to be seasoned if it has been listed on a market for at least three full months (excluding the first month of initial listing). |

Continued Eligibility Criteria

In addition, to be eligible for continued inclusion in the NDX, the following criteria apply:

● |

the security’s U.S. listing must be exclusively on the Nasdaq Global Select Market or the Nasdaq Global Market; |

● |

the security must be of a non-financial company; |

● |

the security may not be issued by an issuer currently in bankruptcy proceedings; |

● |

the security must have a minimum three-month average daily trading volume of at least 200,000 shares; |

● |

if the issuer of the security is organized under the laws of a jurisdiction outside the U.S., then such security must have listed options on a recognized options market in the U.S. or be eligible for listed-options trading on a recognized options market in the U.S. (measured annually during the ranking review process); |

● |

the security must have an adjusted market capitalization equal to or exceeding 0.10% of the aggregate adjusted market capitalization of the NDX at each month-end. In the event a company does not meet this criterion for two consecutive month-ends, it will be removed from the NDX effective after the close of trading on the third Friday of the following month; and |

PS-14

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

● |

the issuer of the security may not have annual financial statements with an audit opinion that is currently withdrawn. |

Computation of the NDX

The value of the NDX equals the aggregate value of the NDX share weights (the “NDX Shares”) of each of the NDX securities multiplied by each such security’s last sale price (last sale price refers to the last sale price on NASDAQ), and divided by the divisor of the NDX. If trading in an NDX security is halted while the market is open, the last traded price for that security is used for all NDX computations until trading resumes. If trading is halted before the market is open, the previous day’s last sale price is used. The formula for determining the NDX value is as follows:

The NDX is ordinarily calculated without regard to cash dividends on NDX securities. The NDX is calculated during the trading day and is disseminated once per second from 09:30:01 to 17:16:00 ET. The closing level of the NDX may change up until 17:15:00 ET due to corrections to the last sale price of the NDX securities. The official closing value of the NDX is ordinarily disseminated at 17:16:00 ET.

NDX Maintenance

Changes to NDX Constituents

Changes to the NDX constituents may be made during the annual ranking review. In addition, if at any time during the year other than the annual review, it is determined that an NDX security issuer no longer meets the criteria for continued inclusion in the NDX, or is otherwise determined to have become ineligible for continued inclusion in the NDX, it is replaced with the largest market capitalization issuer not currently in the NDX that meets the applicable eligibility criteria for initial inclusion in the NDX.

Ordinarily, a security will be removed from the NDX at its last sale price. However, if at the time of its removal the NDX security is halted from trading on its primary listing market and an official closing price cannot readily be determined, the NDX security may, in Nasdaq, Inc.’s discretion, be removed at a price of $0.00000001 (“zero price”). This zero price will be applied to the NDX security after the close of the market but prior to the time the official closing value of the NDX is disseminated.

Divisor Adjustments

The divisor is adjusted to ensure that changes in the NDX constituents either by corporate actions (that adjust either the price or shares of an NDX security) or NDX participation outside of trading hours do not affect the value of the NDX. All divisor changes occur after the close of the applicable index security markets.

Quarterly NDX Rebalancing

The NDX will be rebalanced on a quarterly basis if it is determined that (1) the current weight of the single NDX security with the largest market capitalization is greater than 24.0% of the NDX or (2) the collective weight of those securities whose individual current weights are in excess of 4.5% exceeds 48.0% of the NDX. In addition, a “special rebalancing” of the NDX may be conducted at any time if Nasdaq, Inc. determines it necessary to maintain the integrity and continuity of the NDX. If either one or both of the above weight distribution conditions are met upon quarterly review, or Nasdaq, Inc. determines that a special rebalancing is necessary, a weight rebalancing will be performed.

If the first weight distribution condition is met and the current weight of the single NDX security with the largest market capitalization is greater than 24.0%, then the weights of all securities with current weights greater than 1.0% (“large securities”) will be scaled down proportionately toward 1.0% until the adjusted weight of the single largest NDX security reaches 20.0%.

If the second weight distribution condition is met and the collective weight of those securities whose individual current weights are in excess of 4.5% (or adjusted weights in accordance with the previous step, if applicable) exceeds 48.0% of the NDX, then the weights of all such large securities in that group will be scaled down proportionately toward 1.0% until their collective weight, so adjusted, is equal to 40.0%.

The aggregate weight reduction among the large securities resulting from either or both of the rebalancing steps above will then be redistributed to those securities with weightings of less than 1.0% (“small securities”) in the following manner. In the first iteration, the weight of the largest small security will be scaled upwards by a factor which sets it equal to the average NDX weight of 1.0%. The weights of each of the smaller remaining small securities will be scaled up by the same factor reduced in relation to each security’s relative ranking among the small securities such that the smaller the NDX security in the ranking, the less its weight will be scaled upward. This is intended to reduce the market impact of the weight rebalancing on the smallest component securities in the NDX.

PS-15

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

In the second iteration of the small security rebalancing, the weight of the second largest small security, already adjusted in the first iteration, will be scaled upwards by a factor which sets it equal to the average NDX weight of 1.0%. The weights of each of the smaller remaining small securities will be scaled up by this same factor reduced in relation to each security’s relative ranking among the small securities such that, once again, the smaller the security in the ranking, the less its weight will be scaled upward. Additional iterations will be performed until the accumulated increase in weight among the small securities equals the aggregate weight reduction among the large securities that resulted from the rebalancing in accordance with the two weight distribution conditions discussed above.

Finally, to complete the rebalancing process, once the final weighting percentages for each NDX security have been set, the NDX Shares will be determined anew based upon the last sale prices and aggregate capitalization of the NDX at the close of trading on the last calendar day in February, May, August and November. Changes to the NDX Shares will be made effective after the close of trading on the third Friday in March, June, September and December, and an adjustment to the divisor is made to ensure continuity of the NDX. Ordinarily, new rebalanced NDX Shares will be determined by applying the above procedures to the current NDX Shares. However, Nasdaq, Inc. may, from time to time, determine rebalanced weights, if necessary, by applying the above procedure to the actual current market capitalization of the NDX components. In such instances, Nasdaq, Inc. would announce the different basis for rebalancing prior to its implementation.

During the quarterly rebalancing, data is cutoff as of the previous month end and no changes are made to the NDX from that cutoff until the quarterly index share change effective date, except in the case of changes due to corporate actions with an ex-date.

Adjustments for Corporate Actions

Changes in the price and/or NDX Shares driven by corporate events such as stock dividends, splits, and certain spin-offs and rights issuances will be adjusted on the ex-date. If the change in total shares outstanding arising from other corporate actions is greater than or equal to 10.0%, the change will be made as soon as practicable. Otherwise, if the change in total shares outstanding is less than 10.0%, then all such changes are accumulated and made effective at one time on a quarterly basis after the close of trading on the third Friday in each of March, June, September, and December. The NDX Shares are derived from the security’s total shares outstanding. The NDX Shares are adjusted by the same percentage amount by which the total shares outstanding have changed.

PS-16

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

Historical Performance of the NDX

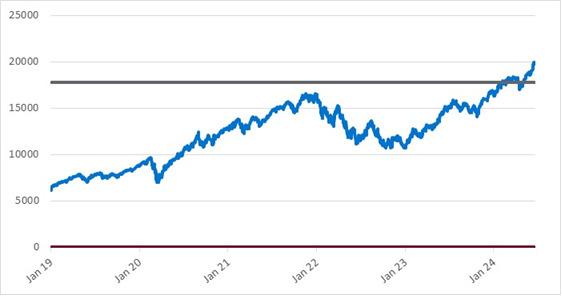

The following graph sets forth the daily historical performance of the NDX in the period from January 2, 2018 through June 20, 2024. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. The horizontal line in the graph represents the NDX’s hypothetical Threshold Value of 17,777.07, which is 90.00% of the NDX’s hypothetical Starting Value of 19,752.30, which was its closing level on June 20, 2024. The actual Starting Value and Threshold Value will be determined on the Pricing Date.

This historical data on the NDX is not necessarily indicative of the future performance of the NDX or what the value of the Securities may be. Any historical upward or downward trend in the level of the NDX during any period set forth above is not an indication that the level of the NDX is more or less likely to increase or decrease at any time over the term of the Securities.

Before investing in the Securities, you should consult publicly available sources for the levels of the NDX.

PS-17

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

License Agreement

The Securities are not sponsored, endorsed, sold or promoted by Nasdaq, Inc. or its affiliates (Nasdaq, Inc., with its affiliates, are referred to as the “Corporations”). The Corporations have not passed on the legality or suitability of, or the accuracy or adequacy of descriptions and disclosures relating to, the Securities. The Corporations make no representation or warranty, express or implied, to the owners of the Securities or any member of the public regarding the advisability of investing in securities generally or in the Securities particularly, or the ability of the NDX to track general stock market performance. The Corporations’ only relationship to our affiliate, Merrill Lynch, Pierce, Fenner & Smith Incorporated (“Licensee”) is in the licensing of the NASDAQ®, OMX®, NASDAQ OMX®, and NDX registered trademarks, and certain trade names of the Corporations or their licensor and the use of the NDX which is determined, composed and calculated by Nasdaq, Inc. without regard to Licensee or the Securities. Nasdaq, Inc. has no obligation to take the needs of the Licensee or the owners of the Securities into consideration in determining, composing or calculating the NDX. The Corporations are not responsible for and have not participated in the determination of the timing of, prices at, or quantities of the Securities to be issued or in the determination or calculation of the equation by which the Securities are to be converted into cash. The Corporations have no liability in connection with the administration, marketing or trading of the Securities.

THE CORPORATIONS DO NOT GUARANTEE THE ACCURACY AND/OR UNINTERRUPTED CALCULATION OF THE NDX OR ANY DATA INCLUDED THEREIN. THE CORPORATIONS MAKE NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE NDX OR ANY DATA INCLUDED THEREIN. THE CORPORATIONS MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE NDX OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THE CORPORATIONS HAVE ANY LIABILITY FOR ANY LOST PROFITS OR SPECIAL, INCIDENTAL, PUNITIVE, INDIRECT, OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.

PS-18

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

Structuring the Securities |

The Securities are our debt securities, the return on which is linked to the performance of the Underlying. The related guarantee is BAC’s obligation. Any payments on the Securities, including payment of the Maturity Payment Amount, depend on the credit risk of BofA Finance and BAC and on the performance of the Underlying. As is the case for all of our and BAC’s respective debt securities, including our market-linked securities, the economic terms of the Securities reflect our and BAC’s actual or perceived creditworthiness at the time of pricing. In addition, because market-linked securities result in increased operational, funding and liability management costs to us and BAC, BAC typically borrows the funds under these types of securities at a rate, which we refer to in this pricing supplement as BAC’s internal funding rate, that is more favorable to BAC than the rate that it might pay for a conventional fixed or floating rate debt security. This generally relatively lower internal funding rate, which is reflected in the economic terms of the Securities, along with the fees and charges associated with market-linked securities, typically results in the initial estimated value of the Securities on the Pricing Date being less than their public offering price.

The initial estimated value range of the Securities is set forth on the cover page of this preliminary pricing supplement. The final pricing supplement will set forth the initial estimated value of the Securities as of the Pricing Date.

In order to meet our payment obligations on the Securities, at the time we issue the Securities, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with BofAS or one of our other affiliates. The terms of these hedging arrangements are determined based upon terms provided by BofAS and its affiliates, and take into account a number of factors, including our and BAC’s creditworthiness, interest rate movements, the volatility of the Underlying, the tenor of the Securities and the hedging arrangements. The economic terms of the Securities and their initial estimated value depend in part on the terms of these hedging arrangements.

BofAS has advised us that the hedging arrangements will include hedging related charges, reflecting the costs associated with, and our affiliates’ profit earned from, these hedging arrangements. Since hedging entails risk and may be influenced by unpredictable market forces, actual profits or losses from these hedging transactions may be more or less than any expected amounts.

For further information, see “Selected Risk Considerations” beginning on page PS-8 above and “Use of Proceeds” on page PS-17 of the accompanying prospectus.

PS-19

|

|

Market Linked Securities—Auto-Callable with Fixed Percentage Buffered Downside

Principal at Risk Securities Linked to the NASDAQ-100 Index® due June 30, 2028 |

U.S. Federal Income Tax Summary |

You should consider the U.S. federal income and estate tax consequences of an investment in the Securities, including the following:

• |

There is no statutory, judicial, or administrative authority directly addressing the characterization of the Securities. |

• |

You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the Securities for all tax purposes as single financial contracts with respect to the Underlying. In the opinion of Sidley Austin LLP, our tax counsel, the U.S. federal income tax characterization and treatment of the Securities described herein is a reasonable interpretation of current law. |

• |

Under this characterization and tax treatment of the Securities, a U.S. Holder (as defined beginning on page 71 of the accompanying prospectus) generally will recognize capital gain or loss upon maturity or upon a sale, exchange or redemption of the Securities. This capital gain or loss generally will be long-term capital gain or loss if you held the Securities for more than one year. |

• |

No assurance can be given that the Internal Revenue Service (“IRS”) or any court will agree with this characterization and tax treatment. |

• |

Under current IRS guidance, withholding on “dividend equivalent” payments (as discussed in the accompanying product supplement), if any, will not apply to Securities that are issued as of the date of this pricing supplement unless such Securities are “delta-one” instruments. Based on our determination that the Securities are not delta-one instruments, Non-U.S. Holders should not be subject to withholding on dividend equivalent payments, if any, under the Securities. |

• |

Under current law, while the matter is not entirely clear, individual Non-U.S. Holders, and entities whose property is potentially includible in those individuals’ gross estates for U.S. federal estate tax purposes (for example, a trust funded by such an individual and with respect to which the individual has retained certain interests or powers), should note that, absent an applicable treaty benefit, the Securities are likely to be treated as U.S. situs property, subject to U.S. federal estate tax. These individuals and entities should consult their own tax advisors regarding the U.S. federal estate tax consequences of investing in the Securities. |

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the Securities, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. You should review carefully the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page PS-36 of the accompanying product supplement.

PS-20