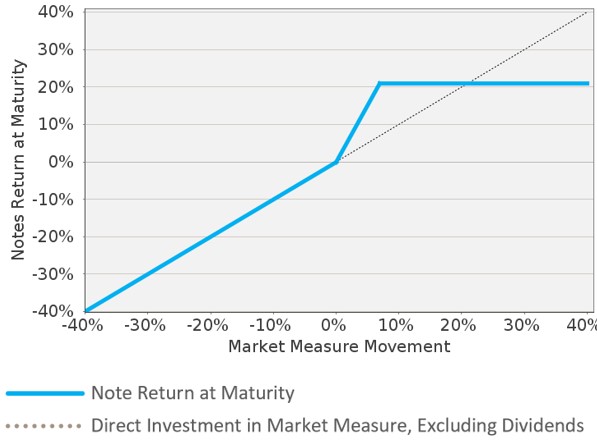

The graph above and the table below reflect the hypothetical return on the notes, based on the terms contained in the table to the left (using the mid-point for any range(s)). The graph and table have been prepared for purposes of illustration only and do not take into account any tax consequences from investing in the notes.

Hypothetical Percentage Change from the Starting Value to the Ending Value

Hypothetical Redemption Amount per Unit

Hypothetical Total Rate of Return on the Notes

-100.00%

$0.00

-100.00%

-50.00%

$5.00

-50.00%

-20.00%

$8.00

-20.00%

-10.00%

$9.00

-10.00%

-6.00%

$9.40

-6.00%

-3.00%

$9.70

-3.00%

0.00%

$10.00

0.00%

2.00%

$10.60

6.00%

5.00%

$11.50

15.00%

7.00%

$12.10(1)

21.00%

10.00%

$12.10

21.00%

20.00%

$12.10

21.00%

30.00%

$12.10

21.00%

40.00%

$12.10

21.00%

50.00%

$12.10

21.00%

60.00%

$12.10

21.00%

(1)

The Redemption Amount per unit cannot exceed the hypothetical Capped Value.