This term sheet, which is not complete and may be changed, relates to an effective Registration Statement under the Securities Act of 1933. This term sheet and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these notes in any country or jurisdiction where such an offer would not be permitted.

|

|

Subject to Completion

Preliminary Term Sheet dated

November 13, 2024

|

Filed Pursuant to Rule 424(b)(2)

Registration Statement No. 333-268718 and 333-268718-01

(To Prospectus dated December 30, 2022,

Prospectus Supplement dated December 30, 2022 and

Product Supplement STOCK STR-1

dated November 13, 2024)

|

|

Units

$10 principal amount per unit

CUSIP No.

|

Pricing Date*

Settlement Date*

Maturity Date*

|

November , 2024

December , 2024

November , 2027

|

|

|

*Subject to change based on the actual date the notes are priced for initial sale to the public (the “pricing date”)

|

|

|

|

|

|

|

BofA Finance LLC

Autocallable Strategic Accelerated Redemption Securities® Linked to a Basket of Three Financial Sector Stocks

Fully and Unconditionally Guaranteed by Bank of America Corporation

■

Automatically callable if the value of the Basket on any Observation Date, occurring approximately one, two and three years after the pricing date, is at or above the Starting Value

■

In the event of an automatic call, the amount payable per unit will be:

■

[$10.95 to $11.05] if called on the first Observation Date

■

[$11.90 to $12.10] if called on the second Observation Date

■

[$12.85 to $13.15] if called on the final Observation Date

■

If not called on the first or second Observation Dates, a maturity of approximately three years

■

If not called, 1-to-1 downside exposure to decreases in the Basket, with up to 100% of your principal at risk

■

The Basket will be comprised of the common stocks of The Goldman Sachs Group, Inc., JPMorgan Chase & Co. and Morgan Stanley. Each Basket Stock will be given an approximately equal weight

■

All payments are subject to the credit risk of BofA Finance LLC, as issuer of the notes, and the credit risk of Bank of America Corporation, as guarantor of the notes

■

No periodic interest payments

■

In addition to the underwriting discount set forth below, the notes include a hedging-related charge of $0.05 per unit. See “Structuring the Notes”

■

Limited secondary market liquidity, with no exchange listing

|

|

|

The notes are being issued by BofA Finance LLC (“BofA Finance”) and are fully and unconditionally guaranteed by Bank of America Corporation (“BAC”). There are important differences between the notes and a conventional debt security, including different investment risks and certain additional costs. See “Risk Factors” beginning on page TS-7 of this term sheet, “Additional Risk Factors” beginning on page TS-8 of this term sheet, and “Risk Factors” beginning on page PS-7 of the accompanying product supplement, page S-6 of the accompanying Series A MTN prospectus supplement and page 7 of the accompanying prospectus.

The initial estimated value of the notes as of the pricing date is expected to be between $9.23 and $9.89 per unit, which is less than the public offering price listed below. See “Summary” on the following page, “Risk Factors” beginning on page TS-7 of this term sheet and “Structuring the Notes” on page TS-16 of this term sheet for additional information. The actual value of your notes at any time will reflect many factors and cannot be predicted with accuracy.

_________________________

None of the Securities and Exchange Commission (the “SEC”), any state securities commission, or any other regulatory body has approved or disapproved of these securities or determined if this Note Prospectus (as defined below) is truthful or complete. Any representation to the contrary is a criminal offense.

_________________________

|

|

Per Unit

|

Total

|

|

Public offering price(1)

|

$10.00

|

$

|

|

Underwriting discount(1)

|

$ 0.20

|

$

|

|

Proceeds, before expenses, to BofA Finance

|

$ 9.80

|

$

|

|

(1)

|

For any purchase of 300,000 units or more in a single transaction by an individual investor or in combined transactions with the investor's household in this offering, the public offering price and the underwriting discount will be $9.95 per unit and $0.15 per unit, respectively. See “Supplement to the Plan of Distribution; Conflicts of Interest” below.

|

The notes and the related guarantee:

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

BofA Securities

November , 2024

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Summary

The Autocallable Strategic Accelerated Redemption Securities® Linked to a Basket of Three Financial Sector Stocks, due November , 2027 (the “notes”) are our senior unsecured debt securities. Payments on the notes are fully and unconditionally guaranteed by BAC. The notes and the related guarantee are not insured by the Federal Deposit Insurance Corporation or secured by collateral. The notes will rank equally in right of payment with all of BofA Finance’s other unsecured and unsubordinated obligations, except obligations that are subject to any priorities or preferences by law. The related guarantee will rank equally in right of payment with all of BAC’s other unsecured and unsubordinated obligations, except obligations that are subject to any priorities or preferences by law, and senior to its subordinated obligations. Any payments due on the notes, including any repayment of principal, will be subject to the credit risk of BofA Finance, as issuer, and BAC, as guarantor. The notes will be automatically called at the applicable Call Amount if the Observation Level of the Market Measure, which is the basket of three financial sector stocks described below (the “Basket”), is equal to or greater than the Call Level on the applicable Observation Date. If your notes are not called, at maturity, if the Ending Value is less than the Threshold Value, you will lose all or a portion of the principal amount of your notes. Any payments on the notes, including the amount you receive at maturity or upon an automatic call, will be calculated based on the $10 principal amount per unit and will depend on the performance of the Basket, subject to our and BAC’s credit risk. See “Terms of the Notes” below.

The Basket will be comprised of the common stocks of The Goldman Sachs Group, Inc., JPMorgan Chase & Co. and Morgan Stanley (each a “Basket Stock”). On the pricing date, each Basket Stock will be given an approximately equal weight.

The economic terms of the notes (including the Call Amounts and Call Premiums) are based on BAC’s internal funding rate, which is the rate it would pay to borrow funds through the issuance of market-linked notes and the economic terms of certain related hedging arrangements. BAC’s internal funding rate is typically lower than the rate it would pay when it issues conventional fixed or floating rate debt securities. This difference in funding rate, as well as the underwriting discount and the hedging-related charge described below, will reduce the economic terms of the notes to you and the initial estimated value of the notes on the pricing date. Due to these factors, the public offering price you pay to purchase the notes will be greater than the initial estimated value of the notes.

On the cover page of this term sheet, we have provided the initial estimated value range for the notes. This initial estimated value range was determined based on our, BAC’s and our other affiliates’ pricing models, which take into consideration BAC’s internal funding rate and the market prices for the hedging arrangements related to the notes. The notes are subject to an automatic call, and the initial estimated value is based on an assumed tenor of the notes. The initial estimated value of the notes calculated on the pricing date will be set forth in the final term sheet made available to investors in the notes. For more information about the initial estimated value and the structuring of the notes, see “Structuring the Notes” on page TS-16.

|

Terms of the Notes

|

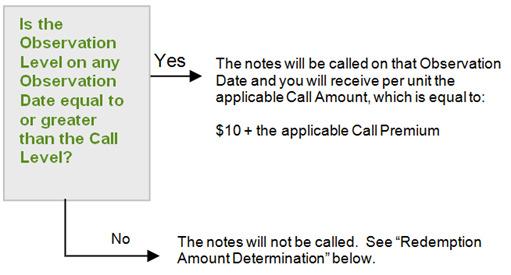

Payment Determination

|

|

Issuer:

|

BofA Finance LLC (“BofA Finance”)

|

Automatic Call Provision:

Redemption Amount Determination:

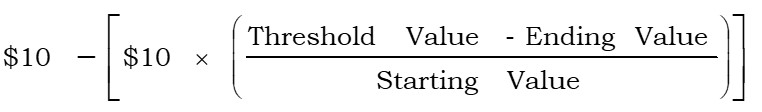

If the notes are not called you will receive the Redemption Amount per unit on the maturity date, determined as follows:

|

|

Guarantor:

|

Bank of America Corporation (“BAC”)

|

|

Principal Amount:

|

$10.00 per unit

|

|

Term:

|

Approximately three years, if not called on the first or second Observation Dates

|

|

Market Measure:

|

An approximately equally weighted basket of three financial sector stocks comprised of the common stocks of The Goldman Sachs Group, Inc. (NYSE symbol: “GS”), JPMorgan Chase & Co. (NYSE symbol: “JPM”) and Morgan Stanley (NYSE symbol: “MS”) (each a “Basket Stock”).

|

|

Starting Value:

|

The Starting Value will be set to 100.00 on the pricing date

|

|

Ending Value:

|

The Observation Level of the Market Measure on the final Observation Date

|

|

Observation Level:

|

The value of the Market Measure on the applicable Observation Date

|

|

Observation Dates:

|

On or about December , 2025, November , 2026 and November , 2027 (the final Observation Date), approximately one, two and three years after the pricing date.

The Observation Dates are subject to postponement in the event of Market Disruption Events, as described beginning on page PS-24 of the accompanying product supplement.

|

|

Call Level:

|

100% of the Starting Value

|

Because the Threshold Value for the notes is equal to the Starting Value, you will lose all or a portion of your investment if the Ending Value is less than the Starting Value.

|

|

Call Amounts (per Unit) and Call Premiums:

|

[$10.95 to $11.05], representing a Call Premium of [9.50% to 10.50%] of the principal amount, if called on the first Observation Date;

[$11.90 to $12.10], representing a Call Premium of [19.00% to 21.00%] of the principal amount, if called on the second Observation Date;

[$12.85 to $13.15], representing a Call Premium of [28.50% to 31.50%] of the principal amount, if called on the final Observation Date.

The actual Call Amounts and Call Premiums will be determined on the pricing date.

|

|

Call Settlement Dates:

|

Approximately the fifth business day following the applicable Observation Date, subject to postponement as described on page PS-22 of the accompanying product supplement; provided however, that the Call Settlement Date related to the final Observation Date will be the maturity date.

|

|

Threshold Value:

|

100% of the Starting Value.

|

|

Fees and Charges:

|

The underwriting discount of $0.20 per unit listed on the cover page and the hedging-related charge of $0.05 per unit described in “Structuring the Notes” on page TS-16.

|

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-2

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

|

Calculation Agent:

|

BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance.

|

|

|

|

|

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-3

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

The terms and risks of the notes are contained in this term sheet and in the following:

|

■

|

Product supplement STOCK STR-1 dated November 13, 2024:

|

|

■

|

Series A MTN prospectus supplement dated December 30, 2022 and prospectus dated December 30, 2022:

|

These documents (together, the “Note Prospectus”) have been filed as part of a registration statement with the SEC, which may, without cost, be accessed on the SEC website at www.sec.gov or obtained from Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”) or BofAS by calling 1-800-294-1322.

Before you invest, you should read the Note Prospectus, including this term sheet, for information about us, BAC and this offering. Any prior or contemporaneous oral statements and any other written materials you may have received are superseded by the Note Prospectus. Certain terms used but not defined in this term sheet have the meanings set forth in the accompanying product supplement. Unless otherwise indicated or unless the context requires otherwise, all references in this document to “we,” “us,” “our,” or similar references are to BofA Finance, and not to BAC.

Investor Considerations

|

You may wish to consider an investment in the notes if:

|

|

The notes may not be an appropriate investment for you if:

|

■

You anticipate that the value of the Basket on any of the Observation Dates will be equal to or greater than the Starting Value and, in that case, you accept an early exit from your investment.

■

You accept that the return on the notes will be limited to the return represented by the applicable Call Premium even if the percentage change in the value of the Basket is greater than the applicable Call Premium.

■

If the notes are not automatically called, you accept that your investment will result in a loss, which could be significant, if the Ending Value is below the Threshold Value.

■

You are willing to forgo the interest payments that are paid on conventional interest bearing debt securities.

■

You are willing to forgo dividends or other benefits of owning the Basket Stocks.

■

You are willing to accept a limited or no market for sales prior to maturity, and understand that the market prices for the notes, if any, will be affected by various factors, including our and BAC's actual and perceived creditworthiness, BAC's internal funding rate and fees and charges on the notes.

■

You are willing to assume our credit risk, as issuer of the notes, and BAC's credit risk, as guarantor of the notes, for all payments under the notes, including the Call Amounts and the Redemption Amount.

|

|

■

You wish to make an investment that cannot be automatically called prior to maturity.

■

You believe that the notes will not be automatically called and the value of the Basket will decrease from the Starting Value to the Ending Value.

■

You anticipate that the Observation Level will be less than the Call Level on each Observation Date.

■

You seek an uncapped return on your investment.

■

You seek principal repayment or preservation of capital.

■

You seek interest payments or other current income on your investment.

■

You want to receive dividends or other distributions paid on the Basket Stocks.

■

You seek an investment for which there will be a liquid secondary market.

■

You are unwilling or are unable to take market risk on the notes or to take our credit risk as issuer of the notes or to take BAC's credit risk, as guarantor of the notes.

|

We urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-4

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Examples of Hypothetical Payments

The following examples are for purposes of illustration only. They are based on hypothetical values and show hypothetical returns on the notes. They illustrate the calculation of the Call Amount or Redemption Amount, as applicable, based on the hypothetical terms set forth below. The actual amount you receive and the resulting return will depend on the actual Observation Levels, Call Premiums, and the term of your investment. The following examples do not take into account any tax consequences from investing in the notes. These examples are based on:

|

1)

|

the Starting Value of 100.00;

|

|

2)

|

the Threshold Value of 100.00;

|

|

3)

|

the Call Level of 100.00;

|

|

4)

|

an expected term of the notes of approximately three years, if the notes are not called on the first or second Observation Dates;

|

|

5)

|

a Call Premium of 10.00% of the principal amount if the notes are called on the first Observation Date; 20.00% if called on the second Observation Date; and 30.00% if called on the final Observation Date (the midpoint of the applicable Call Premium ranges); and

|

|

6)

|

Observation Dates occurring approximately one, two and three years after the pricing date.

|

For recent hypothetical values of the Basket, see “The Basket” section below. For recent actual prices of the Basket Stocks, see “The Basket Stocks” section below. The Ending Value will not include any income generated by dividends paid on the Basket Stocks, which you would otherwise be entitled to receive if you invested in those stocks directly. In addition, all payments on the notes are subject to issuer and guarantor credit risk.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-5

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Notes Are Called on an Observation Date

The notes will be called at $10.00 plus the applicable Call Premium on one of the Observation Dates if the relevant Observation Level is equal to or greater than the Call Level.

Example 1 - The Observation Level on the first Observation Date is 105.00. Therefore, the notes will be called at $10.00 plus the Call Premium of $1.00 = $11.00 per unit. After the notes are called, they will no longer remain outstanding and there will not be any further payments on the notes.

Example 2 - The Observation Level on the first Observation Date is below the Call Level, but the Observation Level on the second Observation Date is 105.00. Therefore, the notes will be called at $10.00 plus the Call Premium of $2.00 = $12.00 per unit. After the notes are called, they will no longer remain outstanding and there will not be any further payments on the notes.

Example 3 - The Observation Levels on each of the first and second Observation Dates are below the Call Level, but the Observation Level on the third Observation Date is 105.00. Therefore, the notes will be called at $10.00 plus the Call Premium of $3.00 = $13.00 per unit. After the notes are called, they will no longer remain outstanding and there will not be any further payments on the notes.

Notes Are Not Called on Any Observation Date

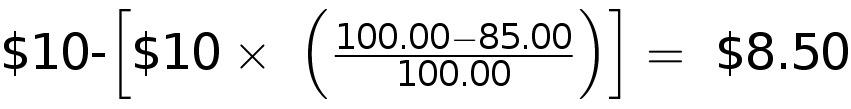

Example 4 - The notes are not called on any Observation Date and the Ending Value is less than the Threshold Value. The Redemption Amount will be less, and possibly significantly less, than the principal amount. For example, if the Ending Value is 85.00, the Redemption Amount per unit will be:

|

|

Notes Are Called on an Observation Date

|

Notes Are Not Called on Any Observation Date

|

|

|

Example 1

|

Example 2

|

Example 3

|

Example 4

|

|

Starting Value

|

100.00

|

100.00

|

100.00

|

100.00

|

|

Call level

|

100.00

|

100.00

|

100.00

|

100.00

|

|

Threshold value

|

100.00%

|

100.00%

|

100.00%

|

100.00%

|

|

Observation Level on the first Observation Date

|

110.00%

|

86.00%

|

80.00%

|

82.00%

|

|

Observation Level on the second Observation Date

|

N/A

|

105.00%

|

80.00%

|

78.00%

|

|

Observation Level on the third Observation Date

|

N/A

|

N/A

|

105.00%

|

85.00%

|

|

Return of the Basket

|

10.00%

|

5.00%

|

5.00%

|

-15.00%

|

|

Return of the Notes

|

10.00%

|

20.00%

|

30.00%

|

-15.00%

|

|

Call Amount /

Redemption Amount per Unit

|

$11.00

|

$12.00

|

$13.00

|

$8.50

|

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-6

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Risk Factors

There are important differences between the notes and a conventional debt security. An investment in the notes involves significant risks, including those listed below. You should carefully review the more detailed explanation of risks relating to the notes in the “Risk Factors” sections beginning on page PS-7 of the accompanying product supplement, page S-6 of the Series A MTN prospectus supplement, and page 7 of the prospectus identified above. We also urge you to consult your investment, legal, tax, accounting, and other advisors before you invest in the notes.

Structure-related Risks

|

■

|

If the notes are not automatically called, your investment may result in a loss; there is no guaranteed return of principal.

|

|

■

|

Your return on the notes may be less than the yield you could earn by owning a conventional fixed or floating rate debt security of comparable maturity.

|

|

■

|

Payments on the notes are subject to our credit risk, and the credit risk of BAC, and actual or perceived changes in our or BAC’s creditworthiness are expected to affect the value of the notes. If we and BAC become insolvent or are unable to pay our respective obligations, you may lose your entire investment.

|

|

■

|

Your investment return is limited to the return represented by the applicable Call Premium and may be less than a comparable investment directly in the Basket Stocks.

|

|

■

|

We are a finance subsidiary and, as such, have no independent assets, operations or revenues.

|

|

■

|

BAC’s obligations under its guarantee of the notes will be structurally subordinated to liabilities of its subsidiaries.

|

|

■

|

The notes issued by us will not have the benefit of any cross-default or cross-acceleration with other indebtedness of BofA Finance or BAC; events of bankruptcy or insolvency or resolution proceedings relating to BAC and covenant breach by BAC will not constitute an event of default with respect to the notes.

|

Valuation- and Market-related Risks

|

■

|

The initial estimated value of the notes considers certain assumptions and variables and relies in part on certain forecasts about future events, which may prove to be incorrect. The initial estimated value of the notes is an estimate only, determined as of a particular point in time by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of BAC, BAC’s internal funding rate on the pricing date, mid-market terms on hedging transactions, expectations on interest rates and volatility, price-sensitivity analysis, and the expected term of the notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect.

|

|

■

|

The public offering price you pay for the notes will exceed the initial estimated value. If you attempt to sell the notes prior to maturity, their market value may be lower than the price you paid for them and lower than the initial estimated value. This is due to, among other things, changes in the value of the Basket, changes in BAC’s internal funding rate, and the inclusion in the public offering price of the underwriting discount and the hedging-related charge, all as further described in “Structuring the Notes” on page TS-16. These factors, together with various credit, market and economic factors over the term of the notes, are expected to reduce the price at which you may be able to sell the notes in any secondary market and will affect the value of the notes in complex and unpredictable ways.

|

|

■

|

The initial estimated value does not represent a minimum or maximum price at which we, BAC, MLPF&S, BofAS or any of our other affiliates would be willing to purchase your notes in any secondary market (if any exists) at any time. The value of your notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Basket, our and BAC’s creditworthiness and changes in market conditions.

|

|

■

|

A trading market is not expected to develop for the notes. None of us, BAC, MLPF&S or BofAS is obligated to make a market for, or to repurchase, the notes. There is no assurance that any party will be willing to purchase your notes at any price in any secondary market.

|

Conflict-related Risks

|

■

|

BAC and its affiliates’ hedging and trading activities (including trades in shares of the Basket Stocks) and any hedging and trading activities BAC or its affiliates engage in that are not for your account or on your behalf, may affect the market value and return of the notes and may create conflicts of interest with you.

|

|

■

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent.

|

Market Measure-related Risks

|

■

|

The Underlying Companies will have no obligations relating to the notes, and none of us, BAC or MLPF&S will perform any due diligence procedures with respect to any Underlying Company in connection with this offering.

|

|

■

|

Changes in the price of one of the Basket Stocks may be offset by changes in the prices of the other Basket Stocks.

|

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-7

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

|

■

|

You will have no rights of a holder of the Basket Stocks, and you will not be entitled to receive shares of the Basket Stocks or dividends or other distributions by the Underlying Companies.

|

|

■

|

The payment on the notes will not be adjusted for all corporate events that could affect a Basket Stock. See “Description of The Notes—Anti-Dilution Adjustments” beginning on page PS-25 of the accompanying product supplement.

|

|

■

|

While BAC and our other affiliates may from time to time own securities of the Underlying Companies, we do not control any Underlying Company, and have not verified any disclosures made by any Underlying Company.

|

Tax-related Risks

|

■

|

The U.S. federal income tax consequences of the notes are uncertain, and may be adverse to a holder of the notes. See “Summary Tax Consequences” below and “U.S. Federal Income Tax Summary” beginning on page PS-36 of the accompanying product supplement.

|

Additional Risk Factors

The stocks included in the Basket are concentrated in one sector. All of the stocks included in the Basket are issued by companies in the financial sector. Although an investment in the notes will not give holders any ownership or other direct interests in the Basket Stocks, the return on an investment in the notes will be subject to certain risks associated with a direct equity investment in companies in the financial sector, including those discussed below. Accordingly, by investing in the notes, you will not benefit from the diversification which could result from an investment linked to companies that operate in multiple sectors.

Adverse conditions in the financial sector may reduce your return on the notes. All of the Basket Stocks are issued by companies whose primary lines of business are directly associated with the financial sector. The profitability of these companies is largely dependent on the availability and cost of capital funds, and can fluctuate significantly, particularly when market interest rates change. Credit losses resulting from financial difficulties of these companies’ customers can negatively impact the sector. In addition, adverse international economic, business, or political developments, including with respect to the insurance sector, or to real estate and loans secured by real estate, could have a major effect on the prices of the Basket Stocks. As a result of these factors, the value of the notes may be subject to greater volatility and be more adversely affected by economic, political, or regulatory events relating to the financial services sector.

Economic conditions have adversely impacted the stock prices of many companies in the financial services sector, and may do so during the term of the notes. In recent years, international economic conditions have resulted, and may continue to result, in significant losses among many companies that operate in the financial services sector. These conditions have also resulted, and may continue to result, in a high degree of volatility in the stock prices of financial institutions, and substantial fluctuations in the profitability of these companies. Numerous financial services companies have experienced substantial decreases in the value of their assets, taken action to raise capital (including the issuance of debt or equity securities), or even ceased operations. Further, companies in the financial services sector have been subject to unprecedented government actions and regulation, which may limit the scope of their operations and, in turn, result in a decrease in value of these companies. Any of these factors may have an adverse impact on the performance of the Basket Stocks. As a result, the prices of the Basket Stocks may be adversely affected by economic, political, or regulatory events affecting the financial services sector or one of the sub-sectors of the financial services sector. This in turn could adversely impact the market value of the notes and the payment on the notes.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-8

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

The Basket

The Basket is designed to allow investors to participate in the percentage changes in the prices of the Basket Stocks from the Starting Value to the Ending Value. The Basket Stocks are described in the section “The Basket Stocks” below. Each Basket Stock will be assigned an initial weight on the pricing date, as set forth in the table below.

For more information on the calculation of the value of the Basket, please see the section entitled “Description of the Notes—Basket Market Measures” beginning on page PS-31 of the accompanying product supplement.

If November 8, 2024 were the pricing date, for each Basket Stock, the Initial Component Weight, the Closing Market Price, the hypothetical Component Ratio and the initial contribution to the Basket value would be as follows:

|

Basket Stock

|

Bloomberg Symbol

|

Initial Component Weight

|

Closing Market Price(1)(2)

|

Hypothetical Component Ratio(1)(3)

|

Initial Basket Value Contribution

|

|

The Goldman Sachs Group, Inc.

|

GS

|

33.34%

|

$589.26

|

0.05657944

|

33.34

|

|

JPMorgan Chase & Co.

|

JPM

|

33.33%

|

$236.98

|

0.14064478

|

33.33

|

|

Morgan Stanley

|

MS

|

33.33%

|

$129.53

|

0.25731491

|

33.33

|

|

|

|

|

|

Starting Value

|

100.00%

|

|

(1)

|

The actual Closing Market Price of each Basket Stock and the resulting actual Component Ratios will be determined on the pricing date. The actual Closing Market Price and Component Ratio of each Basket Stock will be set forth in the final term sheet that will be made available with the sales of the notes.

|

|

(2)

|

These were the Closing Market Prices of the Basket Stocks on November 8, 2024.

|

|

(3)

|

Each hypothetical Component Ratio equals the Initial Component Weight of the relevant Basket Stock (as a percentage) multiplied by 100, and then divided by the Closing Market Price of that Basket Stock on November 8, 2024 and rounded to eight decimal places.

|

The Observation Levels and the Ending Value of the Basket will equal the value of the Basket on the applicable Observation Date. The calculation agent will calculate the value of the Basket for Observation Date by summing the products of the Closing Market Price for each Basket Stock (multiplied by its Price Multiplier) on the applicable Observation Date and the Component Ratio applicable to such Basket Stock. If a Market Disruption Event occurs as to any Basket Stock on a scheduled Observation Date, the Closing Market Price of that Basket Stock will be determined as more fully described on page PS-32 of the accompanying product supplement in the section “Description of the Notes—Basket Market Measures—Observation Level of the Basket.”

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-9

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

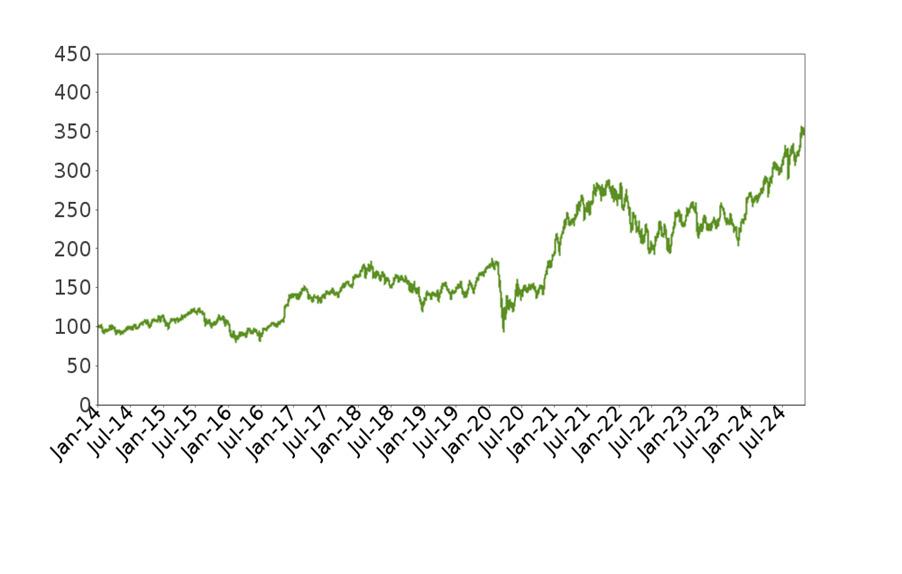

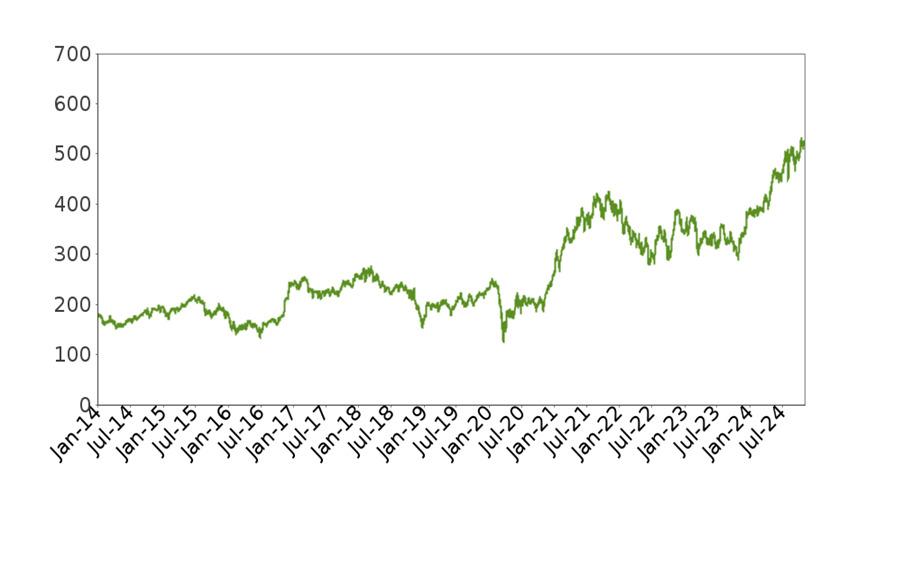

While actual historical information on the Basket will not exist before the pricing date, the following graph sets forth the hypothetical historical daily performance of the Basket from January 1, 2014 through November 8, 2024. The graph is based upon actual daily historical Closing Market Prices of the Basket Stocks, hypothetical Component Ratios based on the Closing Market Prices of the Basket Stocks as of January 1, 2014, and a Basket value of 100.00 as of that date. This hypothetical historical data on the Basket is not necessarily indicative of the future performance of the Basket or what the value of the notes may be. Any hypothetical historical upward or downward trend in the value of the Basket during any period set forth below is not an indication that the value of the Basket is more or less likely to increase or decrease at any time over the term of the notes.

Hypothetical Historical Performance of the Basket

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-10

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

The Basket Stocks

We have derived the following information from publicly available documents. We have not independently verified the accuracy or completeness of the following information.

Because each Basket Stock is registered under the Securities Exchange Act of 1934, the Underlying Companies are required to file periodically certain financial and other information specified by the SEC. Information provided to or filed with the SEC by the Underlying Companies can be located at the Public Reference Section of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549 or through the SEC’s website at http://www.sec.gov by reference to the applicable CIK number set forth below.

This term sheet relates only to the notes and does not relate to any securities of the Underlying Companies. Neither we nor any of our affiliates have participated or will participate in the preparation of the Underlying Companies’ publicly available documents. Neither we nor any of our respective affiliates has made any due diligence inquiry with respect to the Underlying Companies in connection with the offering of the notes. None of us, MLPF&S, BofAS or any of our respective affiliates makes any representation that the publicly available documents or any other publicly available information regarding the Underlying Companies are accurate or complete. Furthermore, there can be no assurance that all events occurring prior to the date of this term sheet, including events that would affect the accuracy or completeness of these publicly available documents that would affect the trading price of the Basket Stocks, have been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events concerning an Underlying Company could affect the price of its Basket Stock and therefore could affect your return on the notes. The selection of the Basket Stocks is not a recommendation to buy or sell shares of the Basket Stocks.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-11

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

The Goldman Sachs Group, Inc.

The Goldman Sachs Group, Inc. is a global investment banking and securities firm specializing in investment banking, trading, asset management and securities services to corporations, governments, financial institutions and high-net worth individuals. This Basket Stock trades on the New York Stock Exchange under the symbol “GS”. The company’s CIK number is 886982.

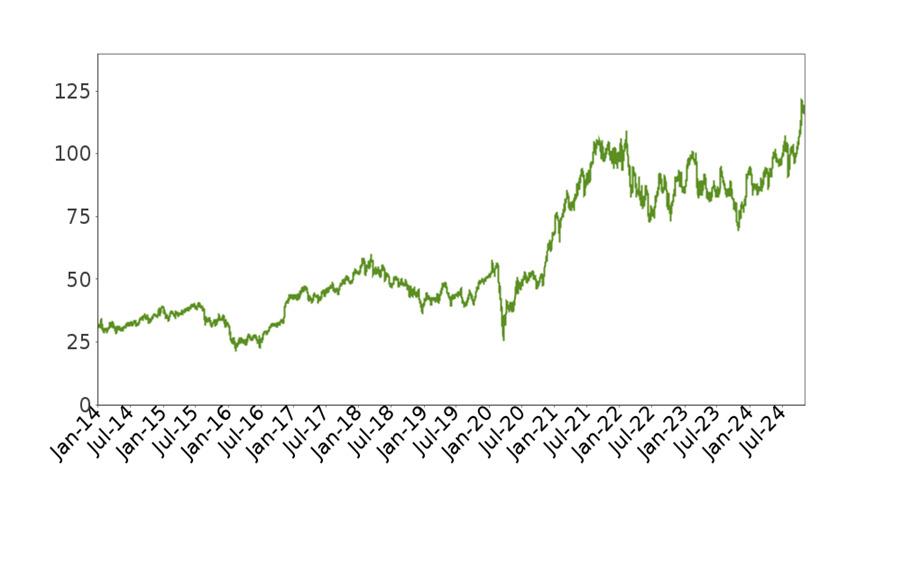

The following graph shows the daily historical performance of GS on its primary exchange in the period from January 1, 2014 through November 8, 2024. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On November 8, 2024, the Closing Market Price of GS was $589.26. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of GS

This historical data on GS is not necessarily indicative of the future performance of GS or what the value of the notes may be. Any historical upward or downward trend in the price per share of GS during any period set forth above is not an indication that the price per share of GS is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of GS.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-12

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

JPMorgan Chase & Co.

JPMorgan Chase & Co. is a financial services firm engaged in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing and asset management. This Basket Stock trades on the New York Stock Exchange under the symbol “JPM”. The company’s CIK number is 19617.

The following graph shows the daily historical performance of JPM on its primary exchange in the period from January 1, 2014 through November 8, 2024. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On November 8, 2024, the Closing Market Price of JPM was $236.98. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of JPM

This historical data on JPM is not necessarily indicative of the future performance of JPM or what the value of the notes may be. Any historical upward or downward trend in the price per share of JPM during any period set forth above is not an indication that the price per share of JPM is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of JPM.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-13

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Morgan Stanley

Morgan Stanley is a global financial services firm that advises, and originates, trades, manages and distributes capital for, governments, institutions and individuals. This Basket Stock trades on the New York Stock Exchange under the symbol “MS”. The company’s CIK number is 895421.

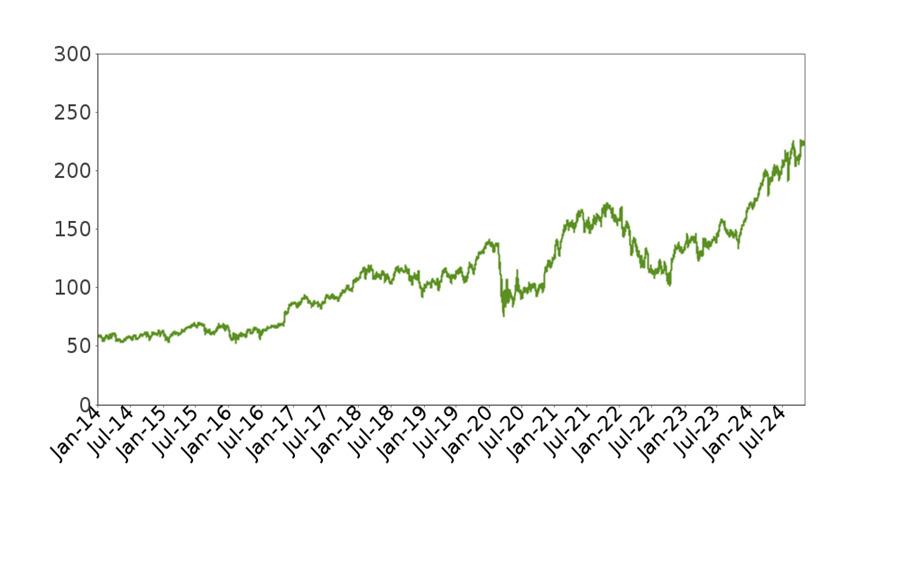

The following graph shows the daily historical performance of MS on its primary exchange in the period from January 1, 2014 through November 8, 2024. We obtained this historical data from Bloomberg L.P. We have not independently verified the accuracy or completeness of the information obtained from Bloomberg L.P. On November 8, 2024, the Closing Market Price of MS was $129.53. The graph below may have been adjusted to reflect certain corporate actions such as stock splits and reverse stock splits.

Historical Performance of MS

This historical data on MS is not necessarily indicative of the future performance of MS or what the value of the notes may be. Any historical upward or downward trend in the price per share of MS during any period set forth above is not an indication that the price per share of MS is more or less likely to increase or decrease at any time over the term of the notes.

Before investing in the notes, you should consult publicly available sources for the prices and trading pattern of MS.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-14

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Supplement to the Plan of Distribution; Conflicts of Interest

Under our distribution agreement with BofAS, BofAS will purchase the notes from us as principal at the public offering price indicated on the cover of this term sheet, less the indicated underwriting discount.

MLPF&S will purchase the notes from BofAS for resale, and will receive a selling concession in connection with the sale of the notes in an amount up to the full amount of underwriting discount set forth on the cover of this term sheet.

MLPF&S and BofAS, each a broker-dealer subsidiary of BAC, are members of the Financial Industry Regulatory Authority, Inc. (“FINRA”) and will participate as selling agent, in the case of BofAS and as dealer in the case of MLPF&S, in the distribution of the notes. Accordingly, offerings of the notes will conform to the requirements of Rule 5121 applicable to FINRA members. Neither BofAS nor MLPF&S may make sales in this offering to any of its discretionary accounts without the prior written approval of the account holder.

We may deliver the notes against payment therefor in New York, New York on a date that is greater than one business day following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in one business day, unless the parties to any such trade expressly agree otherwise. Accordingly, if the initial settlement of the notes occurs more than one business day from the pricing date, purchasers who wish to trade the notes more than one business day prior to the original issue date will be required to specify alternative settlement arrangements to prevent a failed settlement.

The notes will not be listed on any securities exchange. In the original offering of the notes, the notes will be sold in minimum investment amounts of 100 units. If you place an order to purchase the notes, you are consenting to MLPF&S and/or one of its affiliates acting as a principal in effecting the transaction for your account.

MLPF&S and BofAS may repurchase and resell the notes, with repurchases and resales being made at prices related to then-prevailing market prices or at negotiated prices, and these will include MLPF&S’s and BofAS’s trading commissions and mark-ups or mark-downs. MLPF&S and BofAS may act as principal or agent in these market-making transactions; however, neither is obligated to engage in any such transactions. At their discretion, for a short, undetermined initial period after the issuance of the notes, MLPF&S and BofAS may offer to buy the notes in the secondary market at a price that may exceed the initial estimated value of the notes. Any price offered by MLPF&S or BofAS for the notes will be based on then-prevailing market conditions and other considerations, including the performance of the Basket and the remaining term of the notes. However, neither we nor any of our affiliates is obligated to purchase your notes at any price, or at any time, and we cannot assure you that we or any of our affiliates will purchase your notes at a price that equals or exceeds the initial estimated value of the notes.

The value of the notes shown on your account statement will be based on BofAS’s estimate of the value of the notes if BofAS or another of our affiliates were to make a market in the notes, which it is not obligated to do. That estimate will be based upon the price that BofAS may pay for the notes in light of then-prevailing market conditions and other considerations, as mentioned above, and will include transaction costs. At certain times, this price may be higher than or lower than the initial estimated value of the notes.

An investor’s household, as referenced on the cover of this term sheet, will generally include accounts held by any of the following, as determined by MLPF&S in its discretion and acting in good faith based upon information then available to MLPF&S:

|

●

|

the investor’s spouse (including a domestic partner), siblings, parents, grandparents, spouse’s parents, children and grandchildren, but excluding accounts held by aunts, uncles, cousins, nieces, nephews or any other family relationship not directly above or below the individual investor;

|

|

●

|

a family investment vehicle, including foundations, limited partnerships and personal holding companies, but only if the beneficial owners of the vehicle consist solely of the investor or members of the investor’s household as described above; and

|

|

●

|

a trust where the grantors and/or beneficiaries of the trust consist solely of the investor or members of the investor’s household as described above; provided that, purchases of the notes by a trust generally cannot be aggregated together with any purchases made by a trustee’s personal account.

|

Purchases in retirement accounts will not be considered part of the same household as an individual investor’s personal or other non-retirement account, except for individual retirement accounts (“IRAs”), simplified employee pension plans (“SEPs”), savings incentive match plan for employees (“SIMPLEs”), and single-participant or owners only accounts (i.e., retirement accounts held by self-employed individuals, business owners or partners with no employees other than their spouses).

Please contact your Merrill financial advisor if you have any questions about the application of these provisions to your specific circumstances or think you are eligible.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-15

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Structuring the Notes

The notes are our debt securities, the return on which is linked to the performance of the Basket. The related guarantees are BAC’s obligations. As is the case for all of our and BAC’s respective debt securities, including our market-linked notes, the economic terms of the notes reflect our and BAC’s actual or perceived creditworthiness at the time of pricing. In addition, because market-linked notes result in increased operational, funding and liability management costs to us and BAC, BAC typically borrows the funds under these types of notes at a rate that is more favorable to BAC than the rate that it might pay for a conventional fixed or floating rate debt security. This rate, which we refer to in this term sheet as BAC’s internal funding rate, is typically lower than the rate BAC would pay when it issues conventional fixed or floating rate debt securities. This generally relatively lower internal funding rate, which is reflected in the economic terms of the notes, along with the fees and charges associated with market-linked notes, typically results in the initial estimated value of the notes on the pricing date being less than their public offering price.

Payments on the notes, including the amount you receive at maturity or upon an automatic call, will be calculated based on the $10 per unit principal amount and will depend on the performance of the Basket. In order to meet these payment obligations, at the time we issue the notes, we may choose to enter into certain hedging arrangements (which may include call options, put options or other derivatives) with BofAS or one of our other affiliates. The terms of these hedging arrangements are determined by seeking bids from market participants, including MLPF&S, BofAS and its affiliates, and take into account a number of factors, including our and BAC’s creditworthiness, interest rate movements, the volatility of the Basket Stocks, the tenor of the notes and the tenor of the hedging arrangements. The economic terms of the notes and their initial estimated value depend in part on the terms of these hedging arrangements.

BofAS has advised us that the hedging arrangements will include a hedging-related charge of approximately $0.05 per unit, reflecting an estimated profit to be credited to BofAS from these transactions. Since hedging entails risk and may be influenced by unpredictable market forces, additional profits and losses from these hedging arrangements may be realized by BofAS or any third-party hedge providers.

For further information, see “Risk Factors” beginning on page PS-7 and “Use of Proceeds” on page PS-20 of the accompanying product supplement.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-16

|

|

Autocallable Strategic Accelerated Redemption Securities®

Linked to a Basket of Three Financial Sector Stocks, due November , 2027

|

|

Summary Tax Consequences

You should consider the U.S. federal income tax consequences of an investment in the notes, including the following:

|

■

|

There is no statutory, judicial, or administrative authority directly addressing the characterization of the notes.

|

|

■

|

You agree with us (in the absence of an administrative determination, or judicial ruling to the contrary) to characterize and treat the notes for all tax purposes as a callable single financial contract with respect to the Basket.

|

|

■

|

Under this characterization and tax treatment of the notes, a U.S. Holder (as defined beginning on page 71 of the prospectus) generally will recognize capital gain or loss upon maturity or upon a sale, exchange, or redemption of the notes prior to maturity. This capital gain or loss generally will be long-term capital gain or loss if you held the notes for more than one year.

|

|

■

|

No assurance can be given that the Internal Revenue Service (“IRS”) or any court will agree with this characterization and tax treatment.

|

|

■

|

Under current IRS guidance, withholding on “dividend equivalent” payments (as discussed in the product supplement), if any, will not apply to notes that are issued as of the date of this term sheet unless such notes are “delta-one” instruments.

|

You should consult your own tax advisor concerning the U.S. federal income tax consequences to you of acquiring, owning, and disposing of the notes, as well as any tax consequences arising under the laws of any state, local, foreign, or other tax jurisdiction and the possible effects of changes in U.S. federal or other tax laws. You should review carefully the discussion under the section entitled “U.S. Federal Income Tax Summary” beginning on page PS-36 of the accompanying product supplement.

Where You Can Find More Information

We and BAC have filed a registration statement (including a product supplement, a prospectus supplement, and a prospectus) with the SEC for the offering to which this term sheet relates. Before you invest, you should read the Note Prospectus, including this term sheet, and the other documents relating to this offering that we and BAC have filed with the SEC, for more complete information about us, BAC and this offering. You may get these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, we, any agent, or any dealer participating in this offering will arrange to send you these documents if you so request by calling MLPF&S or BofAS toll-free at 1-800-294-1322.

|

Autocallable Strategic Accelerated Redemption Securities®

|

TS-17

|