BofA Finance LLC

Fully and Unconditionally Guaranteed by Bank of America Corporation

Market Linked Securities

BofA Finance LLC

Fully and Unconditionally Guaranteed by Bank of America Corporation

Market Linked Securities |

|

Market Linked Securities—Auto-Callable with Contingent Downside

Principal at Risk Securities Linked to the Lowest Performing of the Russell 2000® Index, the S&P MidCap 400® Index and the S&P 500® Equal Weight Index due November 30, 2029

Term Sheet to Preliminary Pricing Supplement dated November 21, 2024 |

Issuer and Guarantor: |

BofA Finance LLC (“BofA Finance” or “Issuer”) and Bank of America Corporation (“BAC” or the “Guarantor”) |

Underlyings: |

The Russell 2000® Index, the S&P MidCap 400® Index and the S&P 500® Equal Weight Index |

Pricing Date*: |

November 27, 2024 |

Issue Date*: |

December 3, 2024 |

Maturity Date*: |

November 30, 2029 |

Denominations: |

$1,000 and any integral multiple of $1,000. |

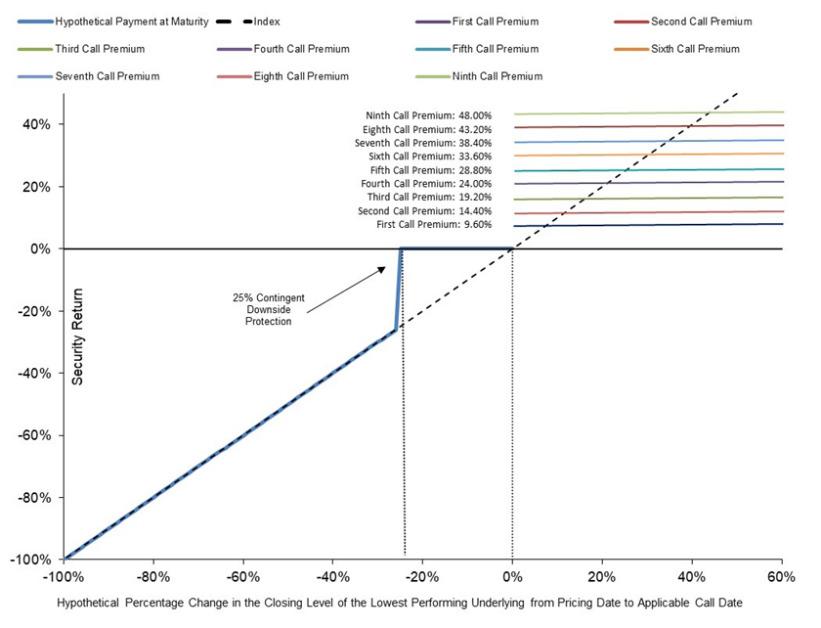

Automatic Call: |

If the closing level of the Lowest Performing Underlying on any Call Date is greater than or equal to its applicable Call Value, the Securities will be automatically called for the principal amount plus the Call Premium applicable to that Call Date. |

Call Dates* and Call Premiums: |

Call Date

Call Premium†

December 3, 2025

At least 9.60% of the principal amount

June 3, 2026

At least 14.40% of the principal amount

December 3, 2026

At least 19.20% of the principal amount

June 3, 2027

At least 24.00% of the principal amount

December 3, 2027

At least 28.80% of the principal amount

June 5, 2028

At least 33.60% of the principal amount

December 4, 2028

At least 38.40% of the principal amount

June 4, 2029

At least 43.20% of the principal amount

November 27, 2029 (the “Final Calculation Day”)

At least 48.00% of the principal amount

† to be determined on the Pricing Date.

|

Lowest Performing Underlying: |

The Lowest Performing Underlying on any Call Date is the Underlying with the lowest Performance Factor on that Call Date. |

Performance Factor: |

With respect to an Underlying on any Call Date, its closing level on such Call Date divided by its Starting Value (expressed as a percentage). |

Call Settlement Date: |

Three business days after the applicable Call Date. |

Maturity Payment Amount (per Security): |

If the Securities are not automatically called, you will receive a Maturity Payment Amount that will be less than the principal amount per Security. In these circumstances, you will have full downside exposure to the decrease in the level of the Lowest Performing Underlying from its Starting Value, and you will lose more than 30%, and possibly all, of the principal amount of your Securities |

Starting Value: |

For each Underlying, its closing level on the Pricing Date |

Ending Value: |

For each Underlying, its closing level on the Final Calculation Day |

Call Value: |

With respect to each Underlying on the first through third Call Dates, 100.00% of its Starting Value; and

with respect to each Underlying on the final Call Date (which is also the Final Calculation Day), 75.00% of its Starting Value. |

Calculation Agent: |

BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance |

Underwriting Discount**: |

Up to 1.075%; dealers, including those using the trade name Wells Fargo Advisors (WFA), may receive a selling concession of 0.25% and WFA may receive a distribution expense fee of 0.075%. |

CUSIP: |

09711FNW3 |

Material Tax Consequences: |

See the preliminary pricing supplement. |

*Subject to change.

** In addition, selected dealers may receive a fee of up to 0.25% for marketing and other services. |

|

●

Your investment may result in a loss; there is no guaranteed return of principal.

●

Any positive investment return on the Securities is limited.

●

The Securities do not bear interest.

●

The Call Premium or Maturity Payment Amount, as applicable, will not reflect the levels of the Underlyings other than on the Call Dates.

●

The Securities are subject to a potential automatic call, which would limit your ability to receive further payment on the Securities.

●

Because the Securities are linked to the lowest performing (and not the average performance) of the Underlyings, you may not receive any return on the Securities and may lose a significant portion or all of your principal amount even if the closing level of one Underlying is always greater than or equal to its applicable Call Value.

●

Your return on the Securities may be less than the yield on a conventional debt security of comparable maturity.

●

A Call Settlement Date and the Maturity Date may be postponed if a Call Date is postponed.

●

Any payment on the Securities is subject to the credit risk of BofA Finance, as issuer, and BAC, as Guarantor, and actual or perceived changes in BofA Finance’s or the Guarantor’s creditworthiness are expected to affect the value of the Securities.

●

We are a finance subsidiary and, as such, have no independent assets, operations or revenues.

●

The public offering price you pay for the Securities will exceed their initial estimated value.

●

The initial estimated value does not represent a minimum or maximum price at which BofA Finance, BAC, BofAS or any of our other affiliates or WFS or its affiliates would be willing to purchase your Securities in any secondary market (if any exists) at any time.

|

●

BofA Finance cannot assure you that a trading market for your Securities will ever develop or be maintained.

●

The Securities are not designed to be short-term trading instruments, and if you attempt to sell the Securities prior to maturity, their market value, if any, will be affected by various factors that interrelate in complex ways, and their market value may be less than the principal amount.

●

Trading and hedging activities by BofA Finance, the Guarantor and any of our other affiliates, including BofAS, and WFS and its affiliates, may create conflicts of interest with you and may affect your return on the Securities and their market value.

●

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours.

●

Changes that affect the Underlyings may adversely affect the value of the Securities and any payments on the Securities.

●

We and our affiliates have no affiliation with any index sponsor and have not independently verified their public disclosure of information.

●

The Securities are subject to risks associated with small-size capitalization companies.

●

The Securities are subject to risks associated with mid-size capitalization companies.

●

The U.S. federal income and estate tax consequences of the Securities are uncertain, and may be adverse to a holder of the Securities.

|