This pricing supplement, which is not complete and may be changed, relates to an effective Registration Statement under the Securities Act of 1933. This pricing supplement and the accompanying product supplement, prospectus supplement and prospectus are not an offer to sell these Notes in any country or jurisdiction where such an offer would not be permitted.

|

•

|

The Contingent Income Issuer Callable Yield Notes Linked to the United States Oil Fund, LP, due March 17, 2028 (the “Notes”) are expected to price on March 14, 2025 and expected to issue on March 19, 2025.

|

|

•

|

Approximate 3 year term if not called prior to maturity.

|

|

•

|

Payments on the Notes will depend on the performance of the United States Oil Fund, LP (the “Underlying”).

|

|

•

|

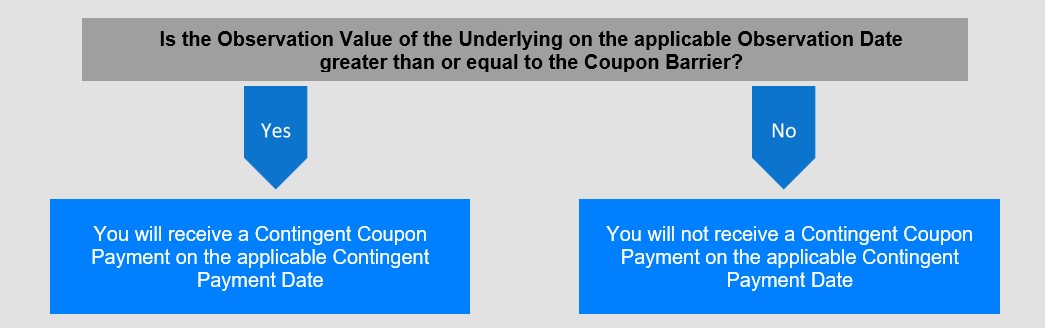

Contingent coupon rate of 8.50% per annum (0.7084% per month) payable monthly if the Observation Value of the Underlying on the applicable Observation Date is greater than or equal to 50.00% of its Starting Value, assuming the Notes have not been called.

|

|

•

|

Beginning on June 20, 2025, callable monthly at our option for an amount equal to the principal amount plus the relevant Contingent Coupon Payment, if otherwise payable.

|

|

•

|

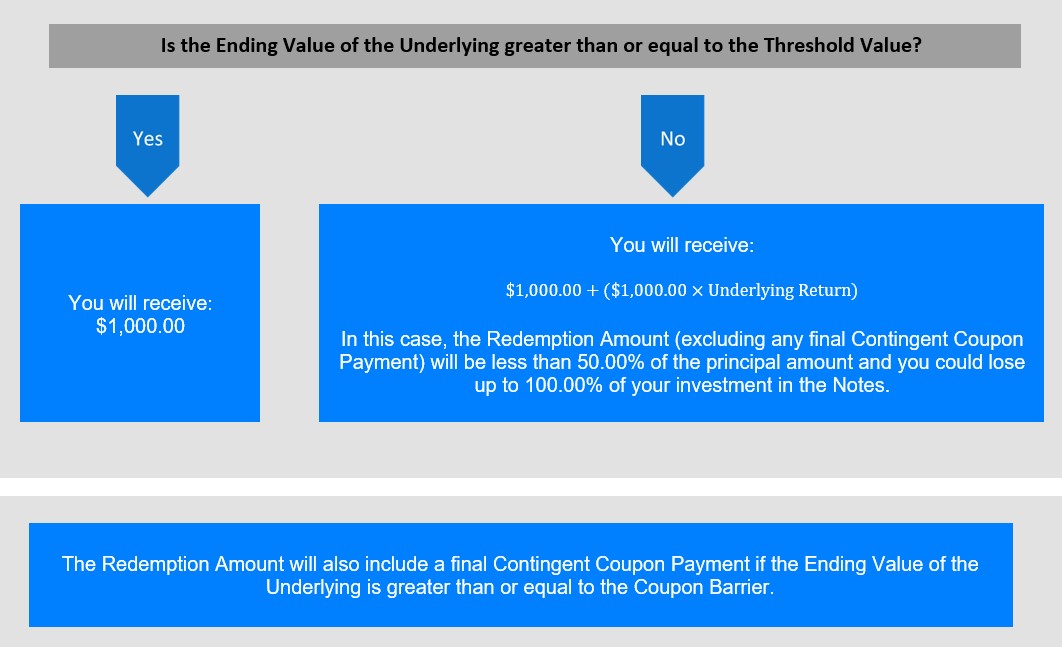

Assuming the Notes are not called prior to maturity, if the Underlying declines by more than 50% from its Starting Value, at maturity your investment will be subject to 1:1 downside exposure to decreases in the value of the Underlying, with up to 100% of the principal at risk; otherwise, at maturity, you will receive the principal amount. At maturity you will also receive a final Contingent Coupon Payment if the Observation Value of the Underlying on the final Observation Date is greater than or equal to 50.00% of its Starting Value.

|

|

•

|

All payments on the Notes are subject to the credit risk of BofA Finance LLC (“BofA Finance” or the “Issuer”), as issuer of the Notes, and Bank of America Corporation (“BAC” or the “Guarantor”), as guarantor of the Notes.

|

|

•

|

The Notes will not be listed on any securities exchange.

|

|

•

|

CUSIP No. 09711GEG6.

|

|

|

Public offering price(1)

|

Underwriting discount(1)(2)

|

Proceeds, before expenses, to BofA Finance(2)

|

|

Per Note

|

$1,000.00

|

$15.00

|

$985.00

|

|

Total

|

|

|

|

|

(1)

|

Certain dealers who purchase the Notes for sale to certain fee-based advisory accounts may forgo some or all of their selling concessions, fees or commissions. The public offering price for investors purchasing the Notes in these fee-based advisory accounts may be as low as $985.00 per $1,000.00 in principal amount of Notes.

|

|

(2)

|

The underwriting discount per $1,000.00 in principal amount of Notes may be as high as $15.00, resulting in proceeds, before expenses, to BofA Finance of as low as $985.00 per $1,000.00 in principal amount of Notes.

|

|

Are Not FDIC Insured

|

Are Not Bank Guaranteed

|

May Lose Value

|

|

|

Selling Agent

|

|

|

|

|

|

Issuer:

|

BofA Finance

|

|

Guarantor:

|

BAC

|

|

Denominations:

|

The Notes will be issued in minimum denominations of $1,000.00 and whole multiples of $1,000.00 in excess thereof.

|

|

Term:

|

Approximately 3 years, unless previously called.

|

|

Underlying:

|

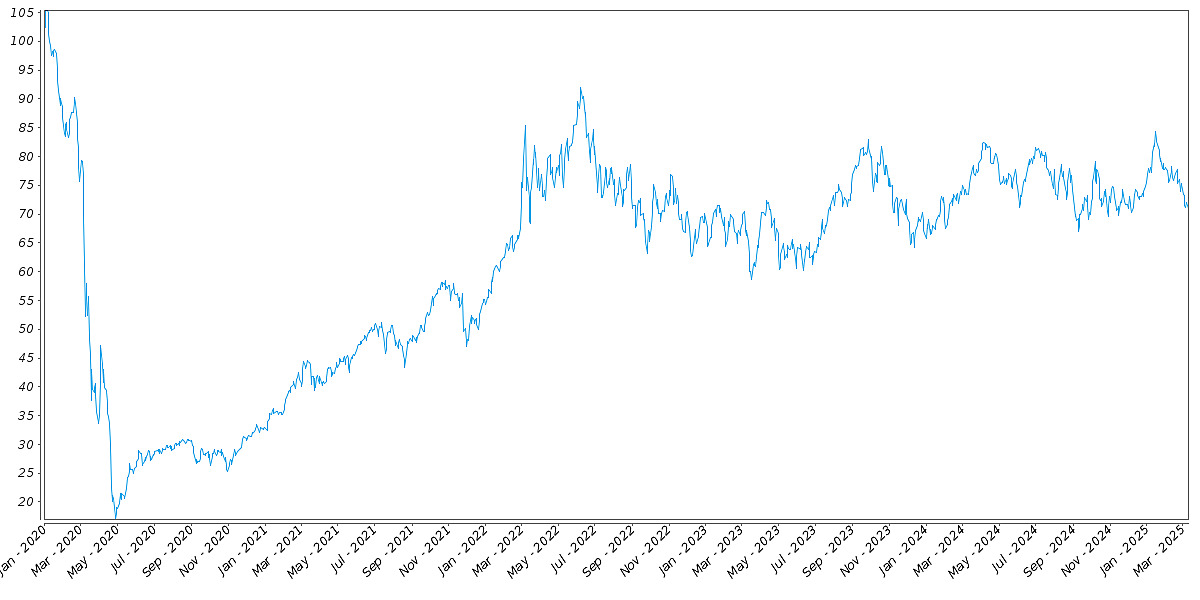

The United States Oil Fund, LP (Bloomberg symbol: “USO”).

|

|

Pricing Date*:

|

March 14, 2025

|

|

Issue Date*:

|

March 19, 2025

|

|

Valuation Date*:

|

March 14, 2028, subject to postponement as described under “Description of the Notes—Certain Terms of the Notes—Events Relating to Observation Dates” in the accompanying product supplement.

|

|

Maturity Date*:

|

March 17, 2028

|

|

Starting Value:

|

The Closing Market Price of the Underlying on the pricing date.

|

|

Observation Value:

|

The Closing Market Price of the Underlying on the applicable Observation Date, multiplied by its Price Multiplier.

|

|

Ending Value:

|

The Observation Value of the Underlying on the Valuation Date.

|

|

Price Multiplier:

|

1, subject to adjustment for certain events relating to the Underlying as described in “Description of the Notes — Anti-Dilution and Discontinuance Adjustments Relating to ETFs” beginning on page PS-28 of the accompanying product supplement.

|

|

Coupon Barrier:

|

50.00% of the Starting Value.

|

|

Threshold Value:

|

50.00% of the Starting Value.

|

|

Contingent Coupon Payment:

|

If, on any monthly Observation Date, the Observation Value of the Underlying is greater than or equal to the Coupon Barrier, we will pay a Contingent Coupon Payment of $7.084 per $1,000.00 in principal amount of Notes (equal to a rate of 0.7084% per month or 8.50% per annum) on the applicable Contingent Payment Date (including the Maturity Date).

|

|

Optional Early Redemption:

|

On any monthly Call Payment Date, we have the right to redeem all (but not less than all) of the Notes at the Early Redemption Amount. No further amounts will be payable following an Optional Early Redemption. We will give notice to the trustee at least five business days but not more than 60 calendar days before the applicable Call Payment Date.

|

|

Early Redemption Amount:

|

For each $1,000.00 in principal amount of Notes, $1,000.00, plus the applicable Contingent Coupon Payment if the Observation Value of the Underlying on the corresponding Observation Date is greater than or equal to the Coupon Barrier.

|

|

Redemption Amount:

|

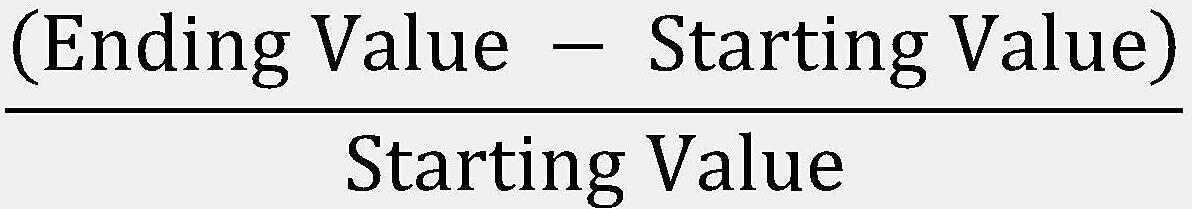

If the Notes have not been called prior to maturity, the Redemption Amount per $1,000.00 in principal amount of Notes will be:

a) If the Ending Value of the Underlying is greater than or equal to the Threshold Value:

b) If the Ending Value of the Underlying is less than the Threshold Value:

In this case, the Redemption Amount (excluding any final Contingent Coupon Payment) will be less than 50.00% of the principal amount and you could lose up to 100.00% of your investment in the Notes.

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-2

|

|

|

|

|

|

|

|

The Redemption Amount will also include a final Contingent Coupon Payment if the Ending Value of the Underlying is greater than or equal to the Coupon Barrier.

|

|

Observation Dates*:

|

As set forth beginning on page PS-4

|

|

Contingent Payment Dates*:

|

As set forth beginning on page PS-4

|

|

Call Payment Dates*:

|

As set forth beginning on page PS-6. Each Call Payment Date is also a Contingent Payment Date.

|

|

Calculation Agent:

|

BofA Securities, Inc. (“BofAS”), an affiliate of BofA Finance.

|

|

Selling Agent:

|

BofAS

|

|

CUSIP:

|

09711GEG6

|

|

Underlying Return:

|

|

|

Events of Default and Acceleration:

|

If an Event of Default, as defined in the senior indenture relating to the Notes and in the section entitled “Description of Debt Securities of BofA Finance LLC—Events of Default and Rights of Acceleration; Covenant Breaches” on page 54 of the accompanying prospectus, with respect to the Notes occurs and is continuing, the amount payable to a holder of the Notes upon any acceleration permitted under the senior indenture will be equal to the amount described under the caption “Redemption Amount” above, calculated as though the date of acceleration were the Maturity Date of the Notes and as though the Valuation Date were the third Trading Day prior to the date of acceleration. We will also determine whether a final Contingent Coupon Payment is payable based upon the price of the Underlying on the deemed Valuation Date; any such final Contingent Coupon Payment will be prorated by the calculation agent to reflect the length of the final contingent payment period. In case of a default in the payment of the Notes, whether at their maturity or upon acceleration, the Notes will not bear a default interest rate.

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-3

|

|

|

|

|

|

|

Observation Dates*

|

Contingent Payment Dates

|

|

April 14, 2025

|

April 17, 2025

|

|

May 14, 2025

|

May 19, 2025

|

|

June 16, 2025

|

June 20, 2025

|

|

July 14, 2025

|

July 17, 2025

|

|

August 14, 2025

|

August 19, 2025

|

|

September 15, 2025

|

September 18, 2025

|

|

October 14, 2025

|

October 17, 2025

|

|

November 14, 2025

|

November 19, 2025

|

|

December 15, 2025

|

December 18, 2025

|

|

January 14, 2026

|

January 20, 2026

|

|

February 17, 2026

|

February 20, 2026

|

|

March 16, 2026

|

March 19, 2026

|

|

April 14, 2026

|

April 17, 2026

|

|

May 14, 2026

|

May 19, 2026

|

|

June 15, 2026

|

June 18, 2026

|

|

July 14, 2026

|

July 17, 2026

|

|

August 14, 2026

|

August 19, 2026

|

|

September 14, 2026

|

September 17, 2026

|

|

October 14, 2026

|

October 19, 2026

|

|

November 16, 2026

|

November 19, 2026

|

|

December 14, 2026

|

December 17, 2026

|

|

January 14, 2027

|

January 20, 2027

|

|

February 16, 2027

|

February 19, 2027

|

|

March 15, 2027

|

March 18, 2027

|

|

April 14, 2027

|

April 19, 2027

|

|

May 14, 2027

|

May 19, 2027

|

|

June 14, 2027

|

June 17, 2027

|

|

July 14, 2027

|

July 19, 2027

|

|

August 16, 2027

|

August 19, 2027

|

|

September 14, 2027

|

September 17, 2027

|

|

October 14, 2027

|

October 19, 2027

|

|

November 15, 2027

|

November 18, 2027

|

|

December 14, 2027

|

December 17, 2027

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-4

|

|

|

|

|

|

|

Observation Dates*

|

Contingent Payment Dates

|

|

January 14, 2028

|

January 20, 2028

|

|

February 14, 2028

|

February 17, 2028

|

|

March 14, 2028 (the “Valuation Date”)

|

March 17, 2028 (the “Maturity Date”)

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-5

|

|

|

|

|

|

|

Call Payment Dates

|

|

June 20, 2025

|

|

July 17, 2025

|

|

August 19, 2025

|

|

September 18, 2025

|

|

October 17, 2025

|

|

November 19, 2025

|

|

December 18, 2025

|

|

January 20, 2026

|

|

February 20, 2026

|

|

March 19, 2026

|

|

April 17, 2026

|

|

May 19, 2026

|

|

June 18, 2026

|

|

July 17, 2026

|

|

August 19, 2026

|

|

September 17, 2026

|

|

October 19, 2026

|

|

November 19, 2026

|

|

December 17, 2026

|

|

January 20, 2027

|

|

February 19, 2027

|

|

March 18, 2027

|

|

April 19, 2027

|

|

May 19, 2027

|

|

June 17, 2027

|

|

July 19, 2027

|

|

August 19, 2027

|

|

September 17, 2027

|

|

October 19, 2027

|

|

November 18, 2027

|

|

December 17, 2027

|

|

January 20, 2028

|

|

February 17, 2028

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-6

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-7

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-8

|

|

|

|

|

|

|

Number of Contingent Coupon Payments

|

Total Contingent Coupon Payments

|

|

0

|

$0.000

|

|

2

|

$14.168

|

|

4

|

$28.336

|

|

6

|

$42.504

|

|

8

|

$56.672

|

|

10

|

$70.840

|

|

12

|

$85.008

|

|

14

|

$99.176

|

|

16

|

$113.344

|

|

18

|

$127.512

|

|

20

|

$141.680

|

|

22

|

$155.848

|

|

24

|

$170.016

|

|

26

|

$184.184

|

|

28

|

$198.352

|

|

30

|

$212.520

|

|

32

|

$226.688

|

|

34

|

$240.856

|

|

36

|

$255.024

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-9

|

|

|

|

|

|

|

Ending Value

|

Underlying Return

|

Redemption Amount per Note (including any final Contingent Coupon Payment)

|

Return on the Notes(1)

|

|

160.00

|

60.00%

|

$1,007.084

|

0.7084%

|

|

150.00

|

50.00%

|

$1,007.084

|

0.7084%

|

|

140.00

|

40.00%

|

$1,007.084

|

0.7084%

|

|

130.00

|

30.00%

|

$1,007.084

|

0.7084%

|

|

120.00

|

20.00%

|

$1,007.084

|

0.7084%

|

|

110.00

|

10.00%

|

$1,007.084

|

0.7084%

|

|

105.00

|

5.00%

|

$1,007.084

|

0.7084%

|

|

102.00

|

2.00%

|

$1,007.084

|

0.7084%

|

|

100.00(2)

|

0.00%

|

$1,007.084

|

0.7084%

|

|

90.00

|

-10.00%

|

$1,007.084

|

0.7084%

|

|

80.00

|

-20.00%

|

$1,007.084

|

0.7084%

|

|

70.00

|

-30.00%

|

$1,007.084

|

0.7084%

|

|

60.00

|

-40.00%

|

$1,007.084

|

0.7084%

|

|

50.00(3)

|

-50.00%

|

$1,007.084

|

0.7084%

|

|

49.99

|

-50.01%

|

$499.900

|

-50.0100%

|

|

0.00

|

-100.00%

|

$0.000

|

-100.0000%

|

|

(1)

|

The “Return on the Notes” is calculated based on the Redemption Amount and potential final Contingent Coupon Payment, not including any Contingent Coupon Payments paid prior to maturity.

|

|

(2)

|

The hypothetical Starting Value of 100 used in the table above has been chosen for illustrative purposes only and does not represent a likely Starting Value for the Underlying.

|

|

(3)

|

This is the hypothetical Coupon Barrier and Threshold Value.

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-10

|

|

|

|

|

|

|

•

|

Your investment may result in a loss; there is no guaranteed return of principal. There is no fixed principal repayment amount on the Notes at maturity. If the Notes are not called prior to maturity and the Ending Value of the Underlying is less than the Threshold Value, at maturity, your investment will be subject to 1:1 downside exposure to decreases in the value of the Underlying and you will lose 1% of the principal amount for each 1% that the Ending Value of the Underlying is less than the Starting Value. In that case, you will lose a significant portion or all of your investment in the Notes.

|

|

•

|

Your return on the Notes is limited to the return represented by the Contingent Coupon Payments, if any, over the term of the Notes. Your return on the Notes is limited to the Contingent Coupon Payments paid over the term of the Notes, regardless of the extent to which the Observation Value or Ending Value of the Underlying exceeds its Coupon Barrier or Starting Value, as applicable. Similarly, the amount payable at maturity or upon an Optional Early Redemption will never exceed the sum of the principal amount and the applicable Contingent Coupon Payment, regardless of the extent to which the Observation Value or Ending Value of the Underlying exceeds its Starting Value. In contrast, a direct investment in the Underlying or in the securities held by or included in the Underlying would allow you to receive the benefit of any appreciation in its value. Any return on the Notes will not reflect the return you would realize if you actually owned those securities and received the dividends paid or distributions made on them.

|

|

•

|

The Notes are subject to Optional Early Redemption, which would limit your ability to receive the Contingent Coupon Payments over the full term of the Notes. On each Call Payment Date, at our option, we may call your Notes in whole, but not in part. If the Notes are called prior to the Maturity Date, you will be entitled to receive the Early Redemption Amount on the applicable Call Payment Date, and no further amounts will be payable on the Notes. In this case, you will lose the opportunity to continue to receive Contingent Coupon Payments after the date of the Optional Early Redemption. If the Notes are called prior to the Maturity Date, you may be unable to invest in other securities with a similar level of risk that could provide a return that is similar to the Notes. Even if we do not exercise our option to call your Notes, our ability to do so may adversely affect the market value of your Notes. It is our sole option whether to call your Notes prior to maturity on any such Call Payment Date and we may or may not exercise this option for any reason. Because of this Optional Early Redemption potential, the term of your Notes could be anywhere between three and thirty-six months.

|

|

•

|

You may not receive any Contingent Coupon Payments. The Notes do not provide for any regular fixed coupon payments. Investors in the Notes will not necessarily receive any Contingent Coupon Payments on the Notes. If the Observation Value of the Underlying is less than its Coupon Barrier on an Observation Date, you will not receive the Contingent Coupon Payment applicable to that Observation Date. If the Observation Value of the Underlying is less than its Coupon Barrier on all the Observation Dates during the term of the Notes, you will not receive any Contingent Coupon Payments during the term of the Notes, and will not receive a positive return on the Notes.

|

|

•

|

Your return on the Notes may be less than the yield on a conventional debt security of comparable maturity. Any return that you receive on the Notes may be less than the return you would earn if you purchased a conventional debt security with the same Maturity Date. As a result, your investment in the Notes may not reflect the full opportunity cost to you when you consider factors, such as inflation, that affect the time value of money. In addition, if interest rates increase during the term of the Notes, the Contingent Coupon Payment (if any) may be less than the yield on a conventional debt security of comparable maturity.

|

|

•

|

The Contingent Coupon Payment, Early Redemption Amount or Redemption Amount, as applicable, will not reflect changes in the price of the Underlying other than on the Observation Dates. The price of the Underlying during the term of the Notes other than on the Observation Dates will not affect payments on the Notes. Notwithstanding the foregoing, investors should generally be aware of the performance of the Underlying while holding the Notes, as the performance of the Underlying may influence the market value of the Notes. The calculation agent will determine whether each Contingent Coupon Payment is payable and will calculate the Early Redemption Amount or the Redemption Amount, as applicable, by comparing only the Starting Value, the Coupon Barrier or the Threshold Value, as applicable, to the Observation Value or the Ending Value for the Underlying. No other price of the Underlying will be taken into account. As a result, if the Notes are not called prior to maturity and the Ending Value of the Underlying is less than the Threshold Value, you will receive less than the principal amount at maturity even if the price of the Underlying was always above the Threshold Value prior to the Valuation Date.

|

|

•

|

Any payments on the Notes are subject to our credit risk and the credit risk of the Guarantor, and any actual or perceived changes in our or the Guarantor’s creditworthiness are expected to affect the value of the Notes. The Notes are our senior unsecured debt securities. Any payment on the Notes will be fully and unconditionally guaranteed by the Guarantor. The Notes are not guaranteed by any entity other than the Guarantor. As a result, your receipt of any payments on the Notes will be dependent upon our ability and the ability of the Guarantor to repay our respective obligations under the Notes on the applicable payment date, regardless of the performance of the Underlying. No assurance can be given as to what our financial condition or the financial condition of the Guarantor will be at any time after the pricing date of the Notes. If we and the Guarantor become unable to meet our respective financial

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-11

|

|

|

|

|

|

|

|

obligations as they become due, you may not receive the amount(s) payable under the terms of the Notes.

In addition, our credit ratings and the credit ratings of the Guarantor are assessments by ratings agencies of our respective abilities to pay our obligations. Consequently, our or the Guarantor’s perceived creditworthiness and actual or anticipated decreases in our or the Guarantor’s credit ratings or increases in the spread between the yield on our respective securities and the yield on U.S. Treasury securities (the “credit spread”) prior to the Maturity Date may adversely affect the market value of the Notes. However, because your return on the Notes depends upon factors in addition to our ability and the ability of the Guarantor to pay our respective obligations, such as the value of the Underlying, an improvement in our or the Guarantor’s credit ratings will not reduce the other investment risks related to the Notes. |

|

•

|

We are a finance subsidiary and, as such, have no independent assets, operations, or revenues. We are a finance subsidiary of the Guarantor, have no operations other than those related to the issuance, administration and repayment of our debt securities that are guaranteed by the Guarantor, and are dependent upon the Guarantor and/or its other subsidiaries to meet our obligations under the Notes in the ordinary course. Therefore, our ability to make payments on the Notes may be limited.

|

|

•

|

The public offering price you pay for the Notes will exceed their initial estimated value. The range of initial estimated values of the Notes that is provided on the cover page of this preliminary pricing supplement, and the initial estimated value as of the pricing date that will be provided in the final pricing supplement, are each estimates only, determined as of a particular point in time by reference to our and our affiliates’ pricing models. These pricing models consider certain assumptions and variables, including our credit spreads and those of the Guarantor, the Guarantor’s internal funding rate, mid-market terms on hedging transactions, expectations on interest rates, dividends and volatility, price-sensitivity analysis, and the expected term of the Notes. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. If you attempt to sell the Notes prior to maturity, their market value may be lower than the price you paid for them and lower than their initial estimated value. This is due to, among other things, changes in the price of the Underlying, changes in the Guarantor’s internal funding rate, and the inclusion in the public offering price of the underwriting discount, if any, and the hedging related charges, all as further described in “Structuring the Notes” below. These factors, together with various credit, market and economic factors over the term of the Notes, are expected to reduce the price at which you may be able to sell the Notes in any secondary market and will affect the value of the Notes in complex and unpredictable ways.

|

|

•

|

The initial estimated value does not represent a minimum or maximum price at which we, BAC, BofAS or any of our other affiliates would be willing to purchase your Notes in any secondary market (if any exists) at any time. The value of your Notes at any time after issuance will vary based on many factors that cannot be predicted with accuracy, including the performance of the Underlying, our and BAC’s creditworthiness and changes in market conditions.

|

|

•

|

We cannot assure you that a trading market for your Notes will ever develop or be maintained. We will not list the Notes on any securities exchange. We cannot predict how the Notes will trade in any secondary market or whether that market will be liquid or illiquid.

|

|

•

|

Trading and hedging activities by us, the Guarantor and any of our other affiliates, including BofAS, may create conflicts of interest with you and may affect your return on the Notes and their market value. We, the Guarantor or one or more of our other affiliates, including BofAS, may buy or sell shares or units of the Underlying or the securities held by or included in the Underlying, as applicable, or futures or options contracts or exchange traded instruments on the Underlying or those securities, or other instruments whose value is derived from the Underlying or those securities. While we, the Guarantor or one or more of our other affiliates, including BofAS, may from time to time own shares or units of the Underlying or securities represented by the Underlying, except to the extent that BAC’s common stock may be included in the Underlying, we, the Guarantor and our other affiliates, including BofAS, do not control any company included in the Underlying, and have not verified any disclosure made by any other company. We, the Guarantor or one or more of our other affiliates, including BofAS, may execute such purchases or sales for our own or their own accounts, for business reasons, or in connection with hedging our obligations under the Notes. These transactions may present a conflict of interest between your interest in the Notes and the interests we, the Guarantor and our other affiliates, including BofAS, may have in our or their proprietary accounts, in facilitating transactions, including block trades, for our or their other customers, and in accounts under our or their management. These transactions may adversely affect the price of the Underlying in a manner that could be adverse to your investment in the Notes. On or before the pricing date, any purchases or sales by us, the Guarantor or our other affiliates, including BofAS or others on our or their behalf (including those for the purpose of hedging some or all of our anticipated exposure in connection with the Notes), may affect the price of the Underlying. Consequently, the price of the Underlying may change subsequent to the pricing date, which may adversely affect the market value of the Notes.

We, the Guarantor or one or more of our other affiliates, including BofAS, also expect to engage in hedging activities that could affect the price of the Underlying on the pricing date. In addition, these hedging activities, including the unwinding of a hedge, may decrease the market value of your Notes prior to maturity, and may affect the amounts to be paid on the Notes. We, the Guarantor or one or more of our other affiliates, including BofAS, may purchase or otherwise acquire a long or short position in the Notes and may hold or resell the Notes. For example, BofAS may enter into these transactions in connection with any market making activities in which it engages. We cannot assure you that these activities will not adversely affect the price of the Underlying, the market value of your Notes prior to |

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-12

|

|

|

|

|

|

|

|

maturity or the amounts payable on the Notes.

|

|

•

|

There may be potential conflicts of interest involving the calculation agent, which is an affiliate of ours. We have the right to appoint and remove the calculation agent. One of our affiliates will be the calculation agent for the Notes and, as such, will make a variety of determinations relating to the Notes, including the amounts that will be paid on the Notes. Under some circumstances, these duties could result in a conflict of interest between its status as our affiliate and its responsibilities as calculation agent.

|

|

•

|

The USO’s underlying assets are concentrated in one sector. The USO’s underlying assets will consist primarily of futures contracts for light, sweet crude oil and other petroleum based fuels that are traded on certain exchanges (collectively, "Oil Futures Contracts"). As a result, the underlying assets that will in part determine the performance of the Notes are concentrated in one sector. Although an investment in the Notes will not give holders any ownership or other direct interests in the Oil Futures Contracts, the return on an investment in the Notes will be subject to certain risks associated with a direct investment in a futures contract for oil. Accordingly, by investing in the Notes, you will not fully benefit from the diversification which could result from an investment linked to assets associated with multiple sectors.

|

|

•

|

Legal and regulatory changes could adversely affect the return on and value of your Notes. The value of commodities or futures contracts could be adversely affected by new laws or regulations or by the reinterpretation of existing laws or regulations (including, without limitation, those related to taxes and duties on commodities and futures contracts) by one or more governments, courts, or other official bodies. Futures contracts and options on futures contracts, including those related to the USO, are subject to extensive statutes, regulations, and margin requirements. The Commodity Futures Trading Commission, commonly referred to as the “CFTC,” and the exchanges on which such futures contracts trade, are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily limits and the suspension of trading. Furthermore, certain exchanges have regulations that limit the amount of fluctuations in futures contract prices that may occur during a single five-minute trading period. These limits could adversely affect the market prices of relevant futures and options contracts and forward contracts.

|

|

•

|

The price of crude oil is subject to swift price fluctuations. The USO’s Underlying Asset is a futures contract for crude oil. The price for crude oil is affected by supply and demand and is subject to swift fluctuations caused by events relating to international politics, energy conservation, the success of exploration projects and tax and other governmental regulatory policies. Weak demand for crude oil would adversely impact the price of the Underlying Asset, the market price of the USO, and the value of the Notes.

|

|

•

|

Single commodity prices tend to be more volatile than, and may not correlate with, the prices of commodities generally. The Notes are linked the USO, which tracks the daily price movements of light, sweet crude oil, and not to a diverse basket of commodities or a broad-based commodity index. The prices of the Underlying may not correlate to the prices of commodities generally and may diverge significantly from the prices of commodities generally. Because the Notes are linked to an Underlying which tracks the price of a single commodity, they carry greater risk and may be more volatile than securities linked to the prices of a larger number of commodities or a broad-based commodity index. In addition, the prices of many individual commodities, including crude oil, have recently been highly volatile and there can be no assurance that the volatility will lessen.

|

|

•

|

The Notes provide exposure to an ETF that tracks futures contracts on light, sweet crude oil and not direct exposure to such commodity. The price of a futures contract reflects the expected value of the underlying commodity upon delivery in the future, whereas the spot price of the commodity reflects the immediate delivery value of that commodity. A variety of factors can lead to a disparity between the expected future price of a commodity and its spot price at a given point in time, such as the cost of storing the commodity for the term of the futures contract, interest charges incurred to finance the purchase of the commodity and expectations concerning supply and demand for the commodity. The price movement of a futures contract is typically correlated with the movements of the spot price of the reference commodity, but the correlation is generally imperfect and price movements of the spot price may not be reflected in the futures market (and vice versa).

|

|

•

|

Investments linked to an underlying that tracks commodities are subject to sharp fluctuations in commodity prices. Investments, such as the Notes, linked to an underlying that tracks the prices of a commodity are subject to sharp fluctuations in the

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-13

|

|

|

|

|

|

|

|

prices of commodities and commodity futures over short periods of time for a variety of reasons, including changes in supply and demand relationships; weather; climatic events; the occurrence of natural disasters; wars; political and civil upheavals; acts of terrorism; trade, fiscal, monetary, and exchange control programs; domestic and foreign political and economic events and policies; disease; pestilence; technological developments; changes in interest rates; and trading activities in commodities and commodity futures. These factors may affect the commodity price and, in turn, the price of the of the Underlying and the value of the Notes in varying and potentially inconsistent ways. As a result of these or other factors, the commodity price and the price of the Underlying may be, and recently have been, highly volatile.

|

|

•

|

The Notes will not be regulated by the CFTC. Unlike an investment in the Notes, an investment in a collective investment vehicle that invests in futures contracts on behalf of its participants may be regulated as a commodity pool and its operator may be required to be registered with and regulated by the CFTC as a “commodity pool operator” (a “CPO”). Because the Notes will not be interests in a commodity pool, the Notes will not be regulated by the CFTC as a commodity pool, neither we nor the Guarantor will be registered with the CFTC as a CPO, and you will not benefit from the CFTC’s or any non-U.S. regulatory authority’s regulatory protections afforded to persons who trade in futures contracts or who invest in regulated commodity pools.

|

|

•

|

Crude oil prices can be volatile as a result of various factors that we cannot control, and this volatility may reduce the market value of the Notes. Historically, oil prices have been highly volatile. They are affected by numerous factors, including oil supply and demand, the level of global industrial activity, the driving habits of consumers, public health, political events and policies, regulations, weather, fiscal, monetary and exchange control programs, and, especially, direct government intervention such as embargoes, and supply disruptions in major producing or consuming regions such as the Middle East, the United States, Latin America, and Russia. The outcome of meetings of the Organization of Petroleum Exporting Countries also can affect liquidity and world oil supply and, consequently, the value of the USO. Market expectations about these events and speculative activity also may cause oil prices to fluctuate unpredictably. If the volatility of the underlying assets increase or decrease, the price of the USO and, in turn, the market value of the Notes may be adversely affected.

|

|

•

|

The performance of the USO may not correlate with the performance of its underlying assets, including the Benchmark Oil Futures Contract, as well as the net asset value per share of the USO, especially during periods of market volatility. The investment objective of the USO is for the daily changes in percentage terms of its net asset value per share to reflect the daily changes in percentage terms of the spot price of light, sweet crude oil delivered to Cushing, Oklahoma, as measured by the daily changes in the price of a specified short-term futures contract on light, sweet crude oil called the “Benchmark Oil Futures Contract,” plus interest earned on the USO’s collateral holdings, less the USO’s fees and expenses. The performance of the USO and that of its underlying assets generally will vary due to, for example, transaction costs, management fees, certain corporate actions, and timing variances. Moreover, it is also possible that the performance of the USO may not fully replicate or may, in certain circumstances, diverge significantly from the performance of its underlying assets. This could be due to, for example, differences in trading hours between the USO and the underlying assets, or due to other circumstances. This variation in performance is called the “tracking error,” and, at times, the tracking error may be significant. In addition, because the shares of the USO are traded on a securities exchange and are subject to market supply and investor demand, the market price of one share of the USO may differ from its net asset value per share; shares of the USO may trade at, above, or below its net asset value per share. During periods of market volatility, market participants may be unable to calculate accurately the net asset value per share of the USO and the liquidity of the USO may be adversely affected. Market volatility may also disrupt the ability of market participants to trade shares of the USO. Further, market volatility may adversely affect, sometimes materially, the prices at which market participants are willing to buy and sell shares of the USO. As a result, under these circumstances, the market value of shares of the USO may vary substantially from the net asset value per share of the USO.

|

|

•

|

Suspension or disruptions of market trading in the futures contracts on light, sweet crude oil may adversely affect the value of the Notes. The commodity markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators and government regulation and intervention. In addition, U.S. futures exchanges and some foreign exchanges have regulations that limit the amount of fluctuation in futures contract prices that may occur during a single business day. These limits are generally referred to as “daily price fluctuation limits,” and the maximum or minimum price of a contract on any given day as a result of these limits is referred to as a “limit price.” Once the limit price has been reached in a particular contract, no trades may be made at a different price. Limit prices have the effect of precluding trading in a particular contract or forcing the liquidation of contracts at disadvantageous times or prices. Any such distortion, disruption, or any other force majeure (such as an act of God, fire, flood, severe weather conditions, act of governmental authority, labor difficulty, etc.), may adversely affect the value of or trading in the futures contracts on light, sweet crude oil or the manner in which they are calculated, and therefore, the price of the of the USO and the value of the Notes.

|

|

•

|

The USO may include underlying assets traded on foreign exchanges that are less regulated than U.S. markets and may involve different and greater risks than trading on U.S. exchanges. The USO may track futures contracts on light, sweet crude oil that trade

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-14

|

|

|

|

|

|

|

|

on exchanges located outside the U.S. The regulations of the CFTC do not apply to trading on foreign exchanges, and trading on foreign exchanges may involve different and greater risks than trading on U.S. exchanges. Certain foreign markets may be more susceptible to disruption than U.S. exchanges due to the lack of a government-regulated clearinghouse system. Trading on foreign exchanges also involves certain other risks that are not applicable to trading on U.S. exchanges. Those risks include: (a) exchange rate risk relative to the U.S. dollar; (b) exchange controls; (c) expropriation; (d) burdensome or confiscatory taxation; and (e) moratoriums, and political or diplomatic events. It may also be more costly and difficult for participants in those markets to enforce the laws or regulations of a foreign country or exchange, and it is possible that the foreign country or exchange may not have laws or regulations which adequately protect the rights and interests of investors in the relevant contracts. These factors could reduce the value of the USO and the value of your Notes.

|

|

•

|

The anti-dilution adjustments will be limited. The calculation agent may adjust the Price Multiplier of the USO and other terms of the Notes to reflect certain actions by the USO, as described in the section “Description of the Notes—Anti-Dilution and Discontinuance Adjustments Relating to ETFs” in the accompanying product supplement. The calculation agent will not be required to make an adjustment for every event that may affect the USO and will have broad discretion to determine whether and to what extent an adjustment is required.

|

|

•

|

The publisher or the sponsor or investment advisor of the Underlying may adjust the Underlying in a way that affects its price, and the publisher or the sponsor or investment advisor has no obligation to consider your interests. The publisher or the sponsor or investment advisor of the Underlying can add, delete, or substitute the components included in the Underlying or make other methodological changes that could change its price. Any of these actions could adversely affect the value of your Notes.

|

|

•

|

The U.S. federal income tax consequences of an investment in the Notes are uncertain, and may be adverse to a holder of the Notes. No statutory, judicial, or administrative authority directly addresses the characterization of the Notes or securities similar to the Notes for U.S. federal income tax purposes. As a result, significant aspects of the U.S. federal income tax consequences of an investment in the Notes are not certain. Under the terms of the Notes, you will have agreed with us to treat the Notes as contingent income-bearing single financial contracts, as described below under “U.S. Federal Income Tax Summary—General.” If the Internal Revenue Service (the “IRS”) were successful in asserting an alternative characterization for the Notes, the timing and character of income, gain or loss with respect to the Notes may differ. No ruling will be requested from the IRS with respect to the Notes and no assurance can be given that the IRS will agree with the statements made in the section entitled “U.S. Federal Income Tax Summary.” You are urged to consult with your own tax advisor regarding all aspects of the U.S. federal income tax consequences of investing in the Notes.

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-15

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-16

|

|

|

|

|

|

|

●

|

The bankruptcy, dissolution, withdrawal, or removal of USCF, unless a majority in interest of the limited partners within 90 days after such event elects to continue the USO and appoints a successor general partner; or

|

|

●

|

The affirmative vote of a majority in interest of the limited partners, provided that prior to or concurrently with such vote, there shall have been established procedures for the assumption of the USO’s obligations arising under any agreement to which the USO is a party and which is still in force immediately prior to such vote regarding termination, and there shall have been an irrevocable appointment of an agent who shall be empowered to give and receive notices, reports and payments under such agreements, and hold and exercise such other powers as are necessary to permit all other parties to such agreements to deal with such agent as if the agent were the sole owner of the USO’s interest, which procedures are agreed to in writing by each of the other parties to such agreements.

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-17

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-18

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-19

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-20

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-21

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-22

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-23

|

|

|

|

|

|

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-24

|

|

|

|

|

|

|

•

|

Product Supplement EQUITY-1 dated December 30, 2022:

https://www.sec.gov/Archives/edgar/data/1682472/000119312522315473/d429684d424b2.htm |

|

•

|

Series A MTN prospectus supplement dated December 30, 2022 and prospectus dated December 30, 2022:

https://www.sec.gov/Archives/edgar/data/1682472/000119312522315195/d409418d424b3.htm |

|

CONTINGENT INCOME ISSUER CALLABLE YIELD NOTES | PS-25

|

|